Global Cold Chain Logistics Market Size, Share, Growth Analysis By Service Type (Warehousing/Cold Storage – Public Warehousing, Private Warehousing; Transportation – Railways, Airways, Roadways, Waterways; Value-Added Cold Chain Services), By Temperature Range (Chilled (0°C to 10°C), Frozen (Below 0°C), Deep Frozen (Below –20°C)), By Destination (Domestic, International), By Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, Ready-to-Eat Meals, Pharmaceuticals & Biologics, Vaccines & Clinical Trial Materials, Chemicals & Specialty Materials, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175649

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

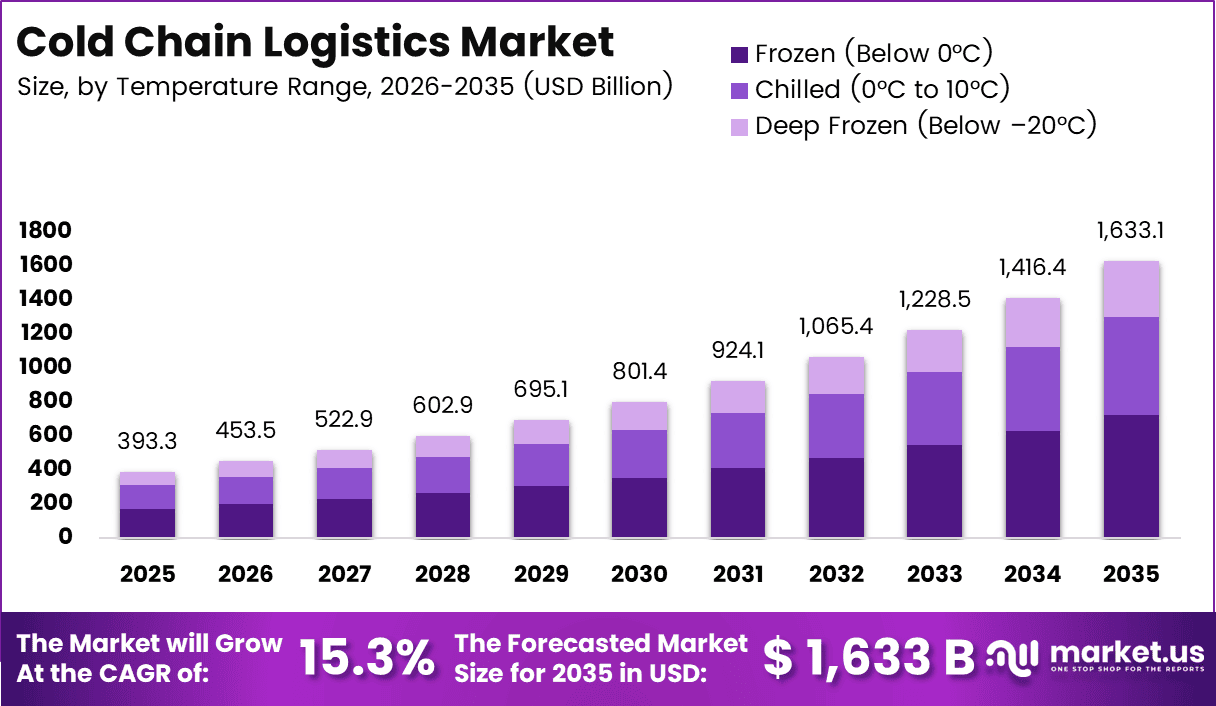

The Global Cold Chain Logistics Market size is expected to be worth around USD 1633 Billion by 2035, from USD 393.3 Billion in 2025, growing at a CAGR of 15.3% during the forecast period from 2026 to 2035.

I define the Cold Chain Logistics market as an ecosystem enabling temperature-controlled storage and transportation. It supports perishables, pharmaceuticals, and specialty materials. Consequently, businesses rely on cold chain logistics to protect product integrity, ensure regulatory compliance, and reduce financial losses across supply chains.

Cold Chain Logistics refers to coordinated refrigerated warehousing, transport, and monitoring systems that maintain precise temperature ranges. Therefore, the Cold Chain Logistics market focuses on infrastructure, technology, and services supporting sensitive goods movement. This market plays a strategic role in healthcare access, food security, and cross-border trade efficiency.

From a growth perspective, the Cold Chain Logistics market expands steadily due to rising pharmaceutical distribution and fresh food consumption. Moreover, urbanization and organized retail strengthen demand for cold storage and reefer transport. As a result, logistics providers increasingly invest in scalable cold chain logistics solutions with digital visibility.

Opportunities continue emerging through automation, energy-efficient refrigeration, and real-time monitoring technologies. Accordingly, transactional demand grows for value-added cold chain logistics services supporting compliance-driven industries. Pharmaceutical companies, food processors, and exporters prefer integrated cold chain partners to minimize risk and support long-term operational continuity.

Government investment and regulations significantly shape market development. Food safety authorities mandate controlled temperature handling, while healthcare regulators enforce strict pharmaceutical logistics standards. Therefore, public funding supports cold storage infrastructure, vaccine distribution networks, and sustainable refrigeration systems, strengthening national cold chain logistics capabilities.

According to the World Health Organization, certain pharmaceuticals lose effectiveness when exposed to temperature deviations briefly. Some vaccines require storage below -40 degrees Celsius. Fresh foods typically need 2 to 8 degrees Celsius, while frozen goods require around -20 degrees Celsius for safety and quality assurance.

According to industry facility and automation reports, pharmaceutical logistics increasingly demand ultra-low temperatures of -60 to -70 degrees Celsius, notably for mRNA COVID-19 vaccines. Large cold centers store 160,000 pallets at -25 degrees, while automated warehouses accommodate 3,800 and over 6,900 pallets under controlled environments.

Key Takeaways

- The Global Cold Chain Logistics Market was valued at USD 393.3 Billion in 2025 and is projected to grow at a 15.3% CAGR through 2035.

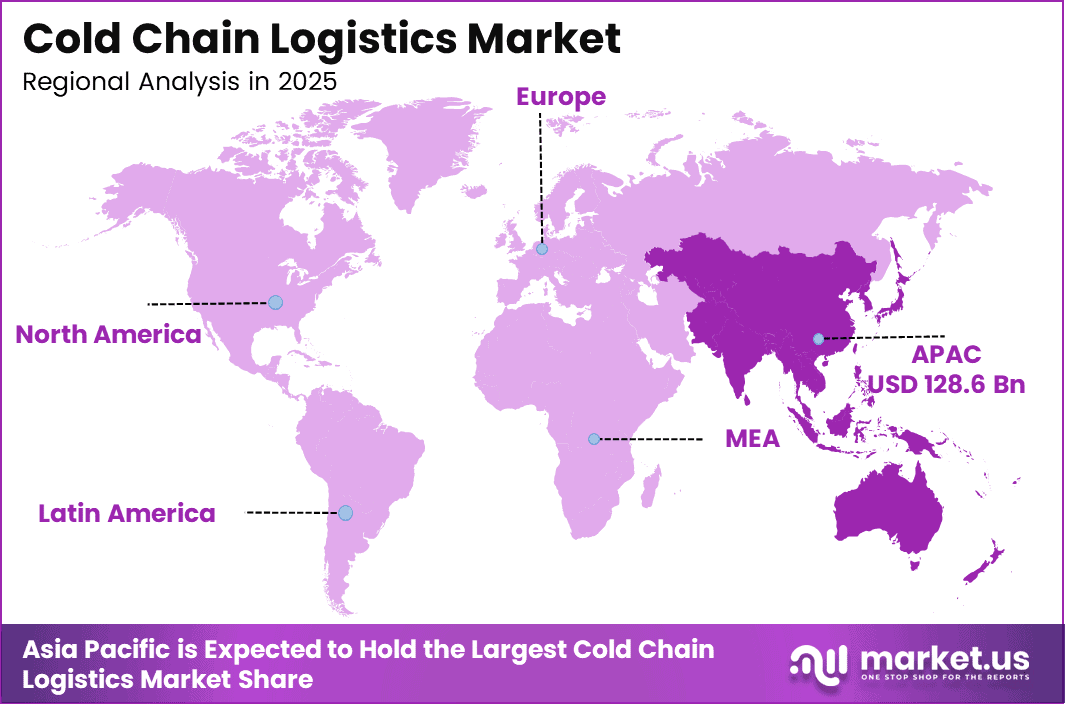

- Asia Pacific emerged as the dominating region with a market share of 32.7%, generating revenues of USD 128.6 Billion in 2025.

- Freight Transportation Cost Management led the solution segment, accounting for 60.4% of the market in 2025.

- Railways dominated the mode of transport segment with a share of 45.9% in 2025.

- Retail & E-commerce was the largest end-use industry segment, holding 20.5% of the market in 2025.

- Pharmaceutical and healthcare logistics growth is driven by temperature requirements ranging from -70°C to -40°C for advanced therapies.

- Large automated cold storage facilities now support capacities exceeding 160,000 pallets at temperatures near -25°C.

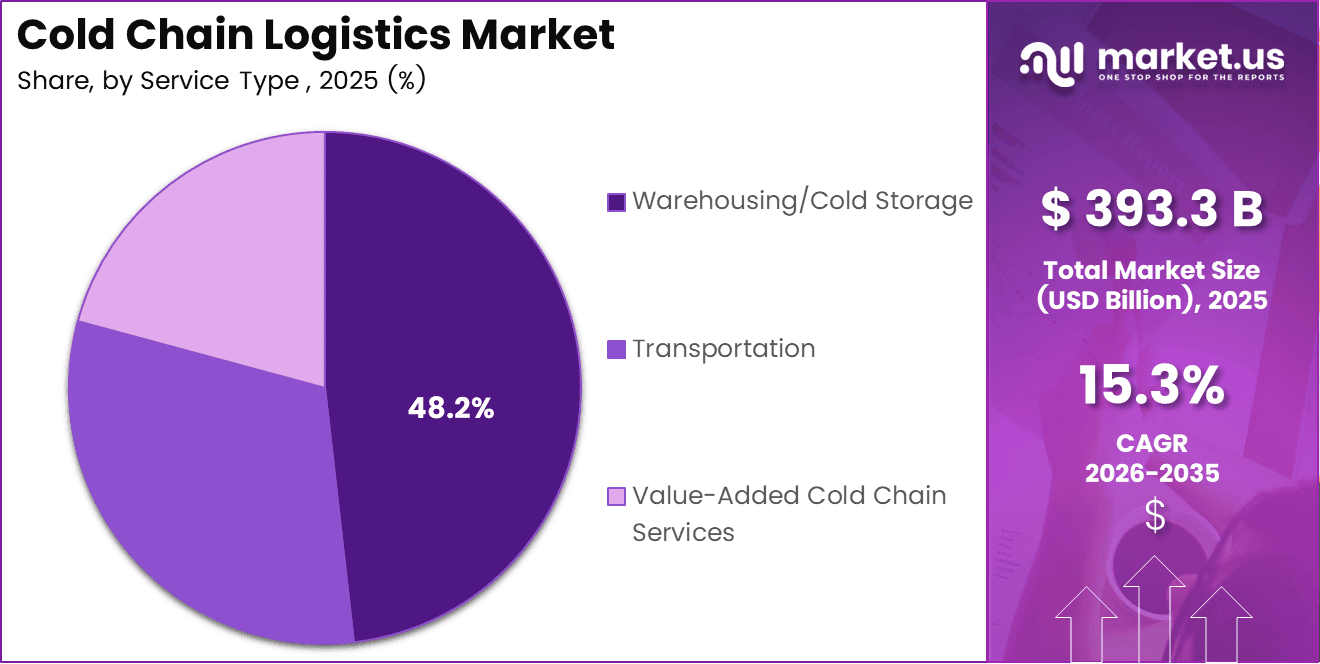

Service Type Analysis

Warehousing/Cold Storage dominates with 48.2% due to rising demand for controlled storage infrastructure.

Warehousing/Cold Storage held a dominant market position in the By Main Segment Analysis segment of Cold Chain Logistics Market, with a 48.2% share. Growing pharmaceutical inventories and frozen food volumes increase reliance on temperature-controlled storage facilities. Consequently, centralized cold warehouses support inventory stability and regulatory compliance.

Public Warehousing held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. It offers shared infrastructure for multiple users. Therefore, small and mid-sized enterprises prefer public cold storage to reduce capital investment.

Private Warehousing held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. Large producers use private facilities for operational control. As a result, dedicated cold storage supports customized handling and long-term scalability.

Transportation held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. Refrigerated transport enables movement between storage points. Consequently, it ensures uninterrupted temperature control across supply chains.

Railways supported long-distance cold transport efficiently. Airways ensured rapid delivery for urgent shipments. Roadways enabled last-mile distribution. Waterways supported bulk international movement. Value-Added Cold Chain Services improved monitoring, packaging, and compliance across logistics operations.

Temperature Range Analysis

Chilled (0°C to 10°C) dominates with 44.6% due to high usage across food and healthcare segments.

Chilled (0°C to 10°C) held a dominant market position in the By Main Segment Analysis segment of Cold Chain Logistics Market, with a 44.6% share. This range supports fresh produce, dairy, and pharmaceuticals. Therefore, it remains the most widely applied temperature category.

Frozen (Below 0°C) held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. It supports meat, Poultry, seafood, and processed foods. Consequently, frozen logistics extends shelf life and supports international trade.

Deep Frozen (Below –20°C) held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. It supports vaccines and specialty pharmaceuticals. As a result, deep frozen logistics gains importance with advanced medical therapies.

Destination Analysis

Domestic dominates with 62.8% due to strong internal distribution demand.

Domestic held a dominant market position in the By Main Segment Analysis segment of Cold Chain Logistics Market, with a 62.8% share. Rising urban consumption drives domestic cold distribution. Therefore, local cold chains expand rapidly.

International held a market position in the By Main Segment Analysis segment of Cold Chain Logistics Market. Cross-border food and pharmaceutical trade supports growth. Consequently, exporters rely on compliant cold logistics networks.

Application Analysis

Fruits & Vegetables dominate with 18.9% due to high perishability and volume.

Fruits & Vegetables held a dominant market position in the By Main Segment Analysis segment of Cold Chain Logistics Market, with a 18.9% share. Fresh produce requires strict temperature control. Therefore, cold logistics reduces post-harvest losses.

Meat & Poultry and Fish & Seafood held market positions. These segments require frozen logistics. Consequently, cold chains preserve quality and safety.

Dairy & Frozen Desserts and Bakery & Confectionery relied on chilled storage. Ready-to-Eat Meals increased demand for fast cold distribution. As a result, urban cold logistics expanded.

Pharmaceuticals & Biologics and Vaccines & Clinical Trial Materials required precision handling. Chemicals & Specialty Materials and Others used controlled logistics. Therefore, application diversity strengthens overall market demand.

Key Market Segments

By Service Type

- Warehousing/Cold Storage

- Public Warehousing

- Private Warehousing

- Transportation

- Railways

- Airways

- Roadways

- Waterways

- Value-Added Cold Chain Services

By Temperature Range

- Chilled (0°C to 10°C)

- Frozen (Below 0°C)

- Deep Frozen (Below –20°C)

By Destination

- Domestic

- International

By Application

- Fruits & Vegetables

- Meat & Poultry

- Fish & Seafood

- Dairy & Frozen Desserts

- Bakery & Confectionery

- Ready-to-Eat Meals

- Pharmaceuticals & Biologics

- Vaccines & Clinical Trial Materials

- Chemicals & Specialty Materials

- Others

Drivers

Rising Global Demand for Temperature-Sensitive Pharmaceuticals Drives Cold Chain Logistics Market Growth

The growing use of temperature-sensitive pharmaceuticals, vaccines, and biologics is a major driver of the Cold Chain Logistics Market. Many medicines require strict temperature control to remain effective. As healthcare access expands globally, demand for reliable cold logistics solutions continues to increase steadily.

At the same time, rising consumption of frozen and chilled foods in urban areas supports market growth. Busy lifestyles and preference for convenience foods increase dependence on refrigerated storage and transport. Consequently, food producers and retailers invest more in cold chain logistics networks.

International trade of perishable agricultural products and seafood further drives the market. Fresh fruits, vegetables, meat, and seafood must be transported across long distances. Therefore, exporters rely on cold chain logistics to maintain quality and reduce spoilage during cross-border shipments.

Stricter food safety and quality regulations also accelerate market demand. Governments enforce compliance standards for storage and transportation. As a result, companies adopt advanced cold chain systems to meet regulatory requirements and protect consumer health.

Restraints

High Capital Investment Requirements Restrain Cold Chain Logistics Market Expansion

High capital costs remain a key restraint in the Cold Chain Logistics Market. Refrigerated warehouses, vehicles, and monitoring systems require significant upfront investment. Consequently, small and mid-sized logistics providers face challenges entering or expanding within the market.

Operating costs also remain high due to energy consumption and maintenance needs. Refrigeration systems must run continuously to maintain temperature stability. Therefore, rising energy prices increase operational expenses and reduce profit margins for service providers.

Limited cold storage infrastructure in developing regions further restricts market growth. Many areas lack adequate facilities to handle temperature-sensitive goods. As a result, product losses remain high and cold chain coverage remains uneven.

Power reliability issues in emerging markets also pose challenges. Frequent power outages disrupt refrigeration systems. Consequently, maintaining consistent temperature control becomes difficult, impacting service quality and customer confidence.

Growth Factors

Expansion of E-commerce Grocery Platforms Creates Growth Opportunities in Cold Chain Logistics

The expansion of e-commerce grocery and meal delivery platforms creates strong growth opportunities. Online food sales require efficient cold storage and last-mile refrigerated delivery. Therefore, logistics providers can expand services to support fast and reliable home deliveries.

Growing adoption of cold chain solutions for cell and gene therapy distribution also supports market opportunity. These therapies require ultra-low temperature handling. As a result, specialized cold logistics services are increasingly in demand.

Investments in energy-efficient and sustainable refrigeration technologies open new opportunities. Companies aim to reduce energy costs and emissions. Consequently, modern cold chain systems attract environmentally conscious customers and regulatory support.

Emerging markets offer untapped potential for integrated cold logistics services. Growing food exports and healthcare demand increase the need for end-to-end solutions. Therefore, providers can expand by offering combined storage, transport, and monitoring services.

Emerging Trends

Adoption of IoT-Based Monitoring Systems Shapes Cold Chain Logistics Market Trends

The deployment of IoT-enabled temperature monitoring systems is a key market trend. These systems provide real-time data and alerts. As a result, companies improve visibility, reduce losses, and ensure compliance across the cold chain.

Automation in cold storage warehouses is also increasing. Smart warehouses improve space utilization and operational efficiency. Therefore, logistics providers benefit from faster handling and reduced labor dependency.

The shift toward eco-friendly refrigerants and low-carbon operations is gaining momentum. Companies aim to meet sustainability goals. Consequently, greener cold chain solutions become more attractive to customers and regulators.

Integration of AI-based demand forecasting and optimization tools further enhances efficiency. These tools help predict demand and manage inventory. As a result, cold chain logistics operations become more responsive and cost-effective.

Regional Analysis

Asia Pacific Dominates the Cold Chain Logistics Market with a Market Share of 32.7%, Valued at USD 128.6 Billion

Asia Pacific leads the Cold Chain Logistics Market due to rapid urbanization, expanding pharmaceutical manufacturing, and rising frozen food consumption. In 2025, the region accounted for 32.7% of the global market, valued at USD 128.6 billion. Strong government focus on food security and healthcare infrastructure further supports sustained cold chain investments.

North America Cold Chain Logistics Market Trends

North America represents a mature and technologically advanced cold chain logistics market. High adoption of automation, strict food safety regulations, and strong pharmaceutical distribution networks drive steady demand. The region benefits from established cold storage infrastructure and consistent investments in temperature-controlled transportation solutions.

Europe Cold Chain Logistics Market Trends

Europe’s cold chain logistics market is driven by stringent regulatory frameworks and cross-border food trade. The region emphasizes sustainability and energy-efficient refrigeration systems. Growing demand for biologics and fresh food exports continues to support market stability and infrastructure modernization.

Middle East and Africa Cold Chain Logistics Market Trends

The Middle East and Africa region shows gradual growth in cold chain logistics adoption. Increasing food imports and healthcare investments support demand for temperature-controlled storage. However, infrastructure gaps and power reliability challenges continue to shape cautious but improving market development.

Latin America Cold Chain Logistics Market Trends

Latin America’s cold chain logistics market is expanding due to rising agricultural exports and growing pharmaceutical distribution. Improvements in cold storage capacity and transportation networks support export-oriented growth. Government initiatives aimed at reducing food waste further encourage cold chain adoption.

U.S. Cold Chain Logistics Market Trends

The U.S. remains a key contributor within the global cold chain logistics market. Strong demand from food retail, healthcare, and e-commerce drives continued infrastructure investment. Advanced monitoring technologies and regulatory compliance requirements further strengthen the market outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cold Chain Logistics Company Insights

In 2025, Lineage Logistics continues to solidify its position as a dominant global player by expanding its network of temperature-controlled facilities and deploying advanced automation technology to enhance operational efficiency. The company’s commitment to sustainability and digital integration places it at the forefront of meeting growing demand from food and pharmaceutical sectors.

With its extensive footprint across North America and strategic investments into cutting-edge cold storage solutions, Americold Logistics remains a cornerstone of the industry’s infrastructure. In 2025, Americold’s focus on scalable capacity and partnered logistics services enables customers to reduce supply chain risks while improving delivery reliability and real-time visibility.

The rapid rise of NewCold Advanced Cold Logistics demonstrates the disruptive potential of next-generation cold chain platforms that prioritize automation and energy efficiency. NewCold’s facility designs and modular expansion strategy allow it to rapidly respond to spikes in demand, particularly for e-commerce and global food imports, making it a key competitor in both established and emerging markets.

As a major Asia-Pacific and global integrator, Nichirei Logistics Group Inc. leverages decades of expertise to deliver comprehensive cold chain services spanning storage, transport, and value-added processing. In 2025, Nichirei’s investments in data-driven temperature monitoring and cross-border distribution networks help multinational clients maintain compliance and quality for sensitive products in an increasingly complex regulatory environment.

Together, these four players exemplify the blend of scale, technology, and strategic growth shaping the global cold chain logistics landscape in 2025.

Top Key Players in the Market

- Lineage Logistics

- Americold Logistics

- NewCold Advanced Cold Logistics

- Nichirei Logistics Group Inc.

- Constellation Cold Logistics

- United States Cold Storage, Inc

- Frigolanda Cold Logistics Group

- Emergent Cold Latin America

- Snowman Logistics Ltd.

- Conestoga Cold Storage

- Interstate Cold Storage, Inc.

- SuperFrio Logística Frigorificada

- Vertical Cold Storage

- Magnavale Ltd

- Swire Cold Storage

- Other Key Players

Recent Developments

- In December 2025, Stonepeak announced the launch of Peregrine Cold Logistics, a dedicated cold chain logistics platform focused on Asia Pacific and the GCC, aimed at addressing the rapidly rising demand for temperature-controlled storage and distribution infrastructure across high-growth regions.

- In January 2025, UPS successfully completed the acquisition of Frigo-Trans and BPL, strengthening its healthcare cold-chain capabilities in Europe by enhancing specialized logistics services for pharmaceuticals, biotech products, and complex medical supply chains.

- In October 2025, Peli BioThermal announced a strategic acquisition to expand its cold chain logistics portfolio, with a strong focus on advancing cryogenic transport solutions for cell and gene therapies requiring ultra-low temperature control.

Report Scope

Report Features Description Market Value (2025) USD 393.3 Billion Forecast Revenue (2035) USD 1633 Billion CAGR (2026-2035) 15.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Warehousing/Cold Storage – Public Warehousing, Private Warehousing; Transportation – Railways, Airways, Roadways, Waterways; Value-Added Cold Chain Services), By Temperature Range (Chilled (0°C to 10°C), Frozen (Below 0°C), Deep Frozen (Below –20°C)), By Destination (Domestic, International), By Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, Ready-to-Eat Meals, Pharmaceuticals & Biologics, Vaccines & Clinical Trial Materials, Chemicals & Specialty Materials, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lineage Logistics, Americold Logistics, NewCold Advanced Cold Logistics, Nichirei Logistics Group Inc., Constellation Cold Logistics, United States Cold Storage, Inc, Frigolanda Cold Logistics Group, Emergent Cold Latin America, Snowman Logistics Ltd., Conestoga Cold Storage, Interstate Cold Storage, Inc., SuperFrio Logística Frigorificada, Vertical Cold Storage, Magnavale Ltd, Swire Cold Storage, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Chain Logistics MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cold Chain Logistics MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Lineage Logistics

- Americold Logistics

- NewCold Advanced Cold Logistics

- Nichirei Logistics Group Inc.

- Constellation Cold Logistics

- United States Cold Storage, Inc

- Frigolanda Cold Logistics Group

- Emergent Cold Latin America

- Snowman Logistics Ltd.

- Conestoga Cold Storage

- Interstate Cold Storage, Inc.

- SuperFrio Logística Frigorificada

- Vertical Cold Storage

- Magnavale Ltd

- Swire Cold Storage

- Other Key Players