Global Cold Chain Data Loggers Market Size, Share, Trends Analysis Report By Type (Offline Data Loggers, Cellular Connected Data Loggers, Wireless Connected Data Loggers), By Application (Food & Beverages, Pharma & Healthcare, Chemical, Agriculture, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132428

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

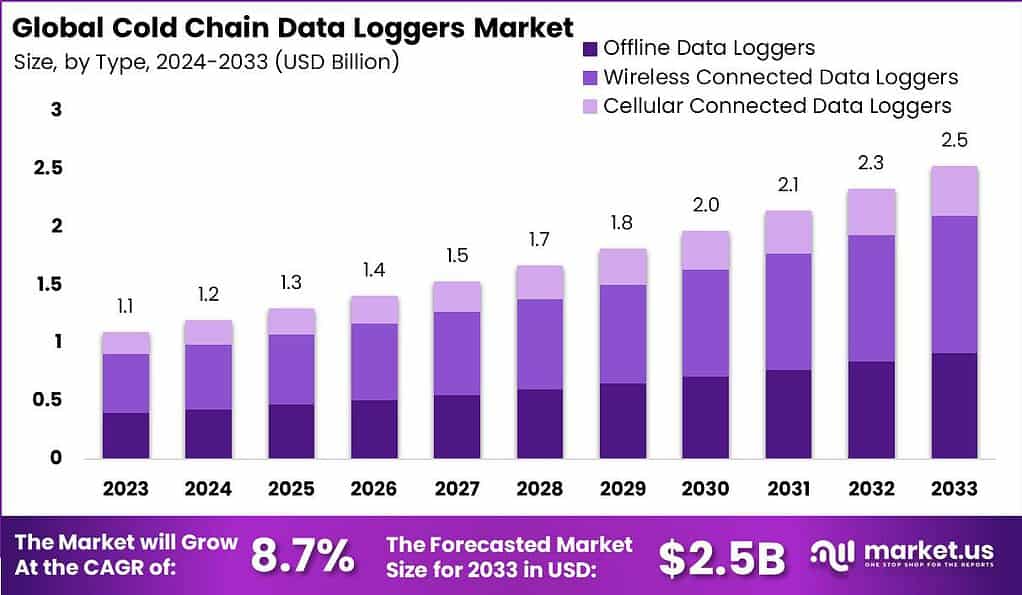

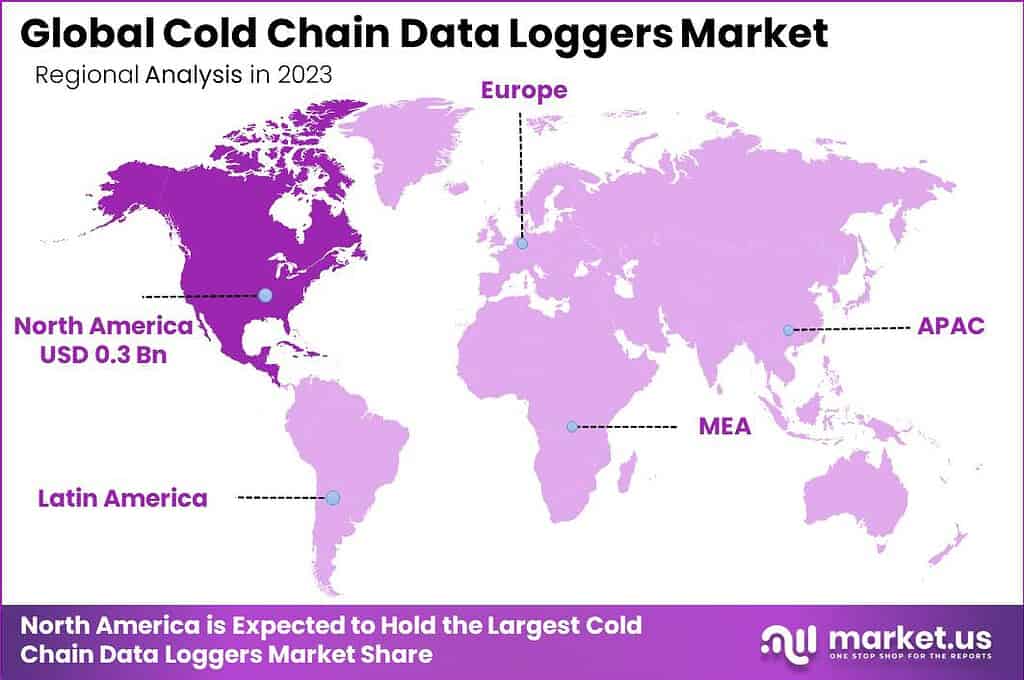

The Global Cold Chain Data Loggers Market size is expected to be worth around USD 2.5 Billion By 2033, from USD 1.10 Billion in 2023, growing at a CAGR of 8.70% during the forecast period from 2024 to 2033. In 2023, North America held the largest market share in the Cold Chain Data Loggers Market, accounting for over 34%, with revenues totaling USD 0.3 billion.

Cold chain data loggers are devices used to monitor and record temperature and other environmental parameters during the transportation and storage of temperature-sensitive products. These loggers play a crucial role in ensuring the integrity of pharmaceuticals, food and beverages, chemicals, and other products that require controlled temperature environments.

The cold chain data loggers market is driven by the growing need for quality assurance and safety in the transportation and storage of perishable goods. The market has expanded significantly due to the increasing demand for pharmaceuticals and processed food products that require strict temperature control. The market is further supported by technological advancements in IoT and wireless technology, which have enhanced the capabilities of data loggers, making them more efficient and easier to use.

Several factors are propelling the growth of the cold chain data loggers market. The surge in the pharmaceutical sector, especially with the distribution of vaccines which require stringent temperature settings, is a primary driver. Furthermore, the global increase in food safety regulations necessitates the adoption of advanced monitoring solutions.

The expansion of international trade in perishable goods also demands more robust cold chain solutions to ensure product integrity across global supply chains. The demand for cold chain data loggers is rising as industries seek more sophisticated data monitoring to prevent spoilage and ensure compliance with safety standards. This demand is particularly strong in sectors such as pharmaceuticals, where the cost of product loss due to temperature excursions can be extremely high.

For instance, In August 2024, Sensitech, part of Carrier Global Corporation, successfully acquired the monitoring solution business of Berlinger & Co. AG. Berlinger is known for its reliable temperature monitoring solutions, crucial for clinical trials and the pharmaceutical sector. This strategic move enhances Sensitech’s offerings in the cold chain monitoring sector, significantly boosting its service capabilities in the life sciences and pharmaceutical industries.

Technological advancements in the cold chain data loggers market include the development of IoT-enabled devices that provide real-time updates and integration with broader supply chain management systems. Advancements in battery life, data storage capacity, and the miniaturization of devices are making it easier and more cost-effective to monitor products extensively.

The use of AI and machine learning for predictive analytics in cold chain logistics is becoming more prevalent, offering proactive rather than reactive solutions to temperature deviations. There are significant opportunities in the development of smarter, more connected devices that can offer real-time monitoring and alerts. The integration of cloud-based platforms for data logging and analytics provides enhanced visibility and control over the cold chain processes.

Key Takeaways

- The Cold Chain Data Loggers Market size is projected to reach approximately USD 2.5 billion by 2033, growing from USD 1.10 billion in 2023, with a compound annual growth rate (CAGR) of 8.70% during the forecast period from 2024 to 2033.

- In 2023, the Wireless Connected Data Loggers segment held the largest market share, accounting for more than 46.8% of the overall Cold Chain Data Loggers Market.

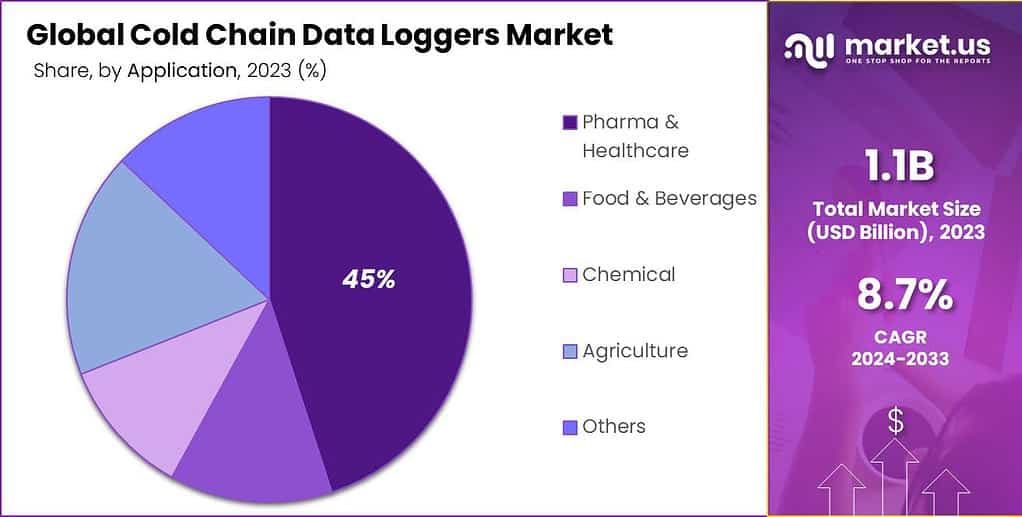

- The Pharma & Healthcare segment also held a dominant position in the market in 2023, representing more than 45% of the market share.

- North America was the leading region in the Cold Chain Data Loggers Market in 2023, with a market share exceeding 34%, generating revenues of approximately USD 0.3 billion.

Type Analysis

In 2023, the Wireless Connected Data Loggers segment held a dominant market position in the cold chain data loggers industry, capturing more than a 46.8% share. This segment’s dominance is largely attributed to its advanced capabilities in providing real-time monitoring and data analytics across the cold chain.

Wireless connected data loggers offer significant advantages over other types, such as offline or cellular connected loggers, because they enable seamless, continuous data transmission without the need for physical retrieval or manual data offloading. The primary appeal of wireless connected data loggers lies in their integration with IoT (Internet of Things) technologies.

This integration allows for the monitoring of various parameters such as temperature, humidity, and location in real-time, which is critical for maintaining the quality and safety of sensitive products during transit. The ability to remotely access data and receive alerts for any deviations in environmental conditions ensures immediate responses, thereby reducing the risk of spoilage and non-compliance with regulatory standards.

Moreover, the adoption of wireless connected data loggers is driven by their ease of use and the elimination of potential data gaps that can occur with offline loggers. The continuous data stream provided by wireless technologies facilitates more accurate and comprehensive analysis, enabling businesses to optimize their supply chain operations and improve decision-making processes.

As the cold chain logistics industry continues to evolve, the demand for more efficient and reliable monitoring solutions is expected to keep growing. This trend is supported by the increasing global trade of perishable goods, stricter regulatory requirements, and technological advancements that enhance the capabilities of wireless connected data loggers

Application Analysis

In 2023, the Pharma & Healthcare segment held a dominant market position in the cold chain data loggers market, capturing more than a 45% share. This significant market share is primarily due to the critical need for precise temperature control in the transportation and storage of pharmaceuticals and healthcare products, which include vaccines, biologics, and other temperature-sensitive medications.

The integrity of these products is paramount as even slight deviations in temperature can compromise their efficacy and safety, leading to severe public health risks and substantial financial losses. The growing global demand for biopharmaceuticals, coupled with a surge in vaccine distribution efforts, particularly in response to global health crises, has driven the adoption of advanced cold chain solutions in this sector.

Pharmaceutical companies are increasingly investing in reliable cold chain logistics to meet stringent regulatory standards for product safety and to minimize the risk of product recalls. Furthermore, the development and approval of new pharmaceuticals that require refrigerated or frozen storage conditions continue to expand the market for cold chain monitoring.

Technological advancements in data loggers, offering features such as real-time tracking, detailed reporting, and easy integration with existing systems, have made them indispensable in the pharma & healthcare industry. These innovations help ensure compliance with global health regulations and maintain the highest standards of patient safety

Key Market Segments

By Type

- Offline Data Loggers

- Cellular Connected Data Loggers

- Wireless Connected Data Loggers

By Application

- Food & Beverages

- Pharma & Healthcare

- Chemical

- Agriculture

- Others

Driver

Demand for Temperature-Sensitive Goods

The cold chain data loggers market is driven significantly by the increasing global demand for temperature-sensitive goods, such as pharmaceuticals, vaccines, and perishable foods. This surge in demand has led to stringent requirements for the monitoring and regulation of temperature and humidity levels during transportation and storage.

Data loggers provide real-time data tracking, alerting supply chain stakeholders whenever there is a deviation from pre-set parameters. This allows for immediate corrective action, preventing costly losses and maintaining product safety.

With the rise of biologics and other temperature-sensitive medicines in healthcare, the demand for reliable monitoring solutions is expected to grow further. Similarly, the food industry has seen heightened consumer awareness about food safety and quality, prompting retailers and logistics companies to invest in sophisticated monitoring tools.

Restraint

High Cost and Complexity of Implementation

Despite their benefits, the adoption of cold chain data loggers faces hurdles due to the high cost and complexity of implementation. Advanced data loggers, particularly those that offer real-time monitoring and cloud connectivity, come with a hefty price tag.

Small and medium-sized enterprises (SMEs) often find it challenging to invest in such sophisticated systems, especially when operating on tight budgets. This financial barrier prevents some companies from upgrading to modern, reliable monitoring solutions, potentially risking product quality and safety.

Implementing a cold chain data logging system involves more than just purchasing hardware. It requires software integration, data analysis capabilities, employee training, and ongoing maintenance. For companies without a dedicated IT department, this complexity can be overwhelming and lead to operational disruptions during the transition.

Opportunity

Rising Adoption of IoT and Advanced Connectivity

The increasing integration of Internet of Things (IoT) technology and advanced connectivity in the logistics industry presents a substantial opportunity for the cold chain data loggers market. IoT-enabled data loggers provide enhanced capabilities such as real-time data transmission, predictive analytics, remote monitoring, and cloud storage.

IoT-driven data loggers offer more than just data recording; they enable predictive maintenance, reducing unexpected equipment failures and costly losses. Real-time alerts and data analytics empower supply chain managers to make proactive decisions to mitigate risks. In regions with growing industrialization and e-commerce, demand for reliable cold chain logistics is on the rise, further amplifying this opportunity.

Challenge

Cybersecurity and Data Privacy Risks

The increasing reliance on IoT and connected cold chain data loggers introduces significant challenges related to cybersecurity and data privacy. As these devices are integrated into supply chain operations, they often transmit large volumes of sensitive data in real-time, making them potential targets for cyberattacks.

Ensuring robust security measures for data loggers requires companies to invest in advanced cybersecurity solutions, such as data encryption, secure communication protocols, and regular software updates. However, many businesses, especially small and medium-sized enterprises, may lack the resources or expertise to implement and maintain these security measures.

Emerging Trends

The landscape of cold chain data loggers is evolving rapidly, driven by technological advancements and the increasing demand for precise temperature monitoring. A notable trend is the integration of wireless communication technologies, such as Bluetooth and Near Field Communication (NFC), into data loggers.

Another significant development is the incorporation of multiple sensors within a single data logger. Modern devices can simultaneously monitor various parameters, including temperature, humidity, and shock, providing a comprehensive overview of the environmental conditions affecting sensitive products.

The adoption of cloud-based storage solutions is also gaining momentum. Data loggers equipped with wireless connectivity can transmit information to centralized platforms, facilitating remote monitoring and data analysis. This shift not only streamlines operations but also supports compliance with regulatory standards by maintaining accessible and secure records.

Business Benefits

Implementing data loggers in cold chain operations offers numerous advantages that enhance business performance and product quality. One of the primary benefits is the reliable and continuous tracking of environmental conditions. Data loggers provide accurate and timely readings, allowing businesses to monitor temperature and other critical parameters in real-time.

The use of data loggers also leads to greater efficiency through improved processes. By automating the monitoring of temperature-sensitive goods, businesses can reduce the need for manual checks, thereby minimizing labor costs and the potential for human error. This automation streamlines operations and allows staff to focus on other critical tasks, enhancing overall productivity.

In terms of compliance, data loggers provide a fully documented chain of custody, which is essential for meeting regulatory requirements. The recorded data serves as verifiable evidence that products have been stored and transported under appropriate conditions, facilitating audits and ensuring adherence to industry standards.

Regional Analysis

In 2023, North America held a dominant market position in the Cold Chain Data Loggers Market, capturing more than a 34% share with revenues reaching USD 0.3 billion. This leading stance is largely attributed to the region’s advanced pharmaceutical and food safety sectors, which demand rigorous monitoring and compliance with stringent health regulations.

The presence of major pharmaceutical companies and a robust food processing industry in North America necessitates reliable cold chain management solutions to ensure the quality and safety of sensitive products.

The region’s commitment to implementing advanced technologies in logistics and supply chain operations further strengthens its market leadership. North American companies are early adopters of IoT and big data analytics, integrating these technologies with cold chain data loggers to enhance real-time monitoring and data-driven decision-making.

Additionally, regulatory bodies in North America, such as the FDA and Health Canada, enforce strict guidelines on the transportation of pharmaceuticals and perishable food items, which mandate the use of cold chain data loggers. The increasing export of pharmaceutical products and perishables from the region also drives the need for compliance with international standards.

Economic growth and healthcare advancements in the region further propel the market, as more investments are funneled into research and development of biopharmaceuticals, which often require controlled temperature conditions. As the North American market continues to evolve, the demand for cold chain data loggers is expected to rise, maintaining its leadership in the global arena.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Cold Chain Data Loggers Market, several key players stand out due to their innovative solutions and strategic market presence. Each of these companies plays a crucial role in cold chain logistics, offering technologies that enhance the safety, efficiency, and compliance of temperature-sensitive product transportation.

Testo SE & Co. KGaA is a significant player in the cold chain data loggers market, renowned for its robust and versatile monitoring solutions. Testo’s products are well-suited for a wide range of applications, from pharmaceuticals to food safety, which allows them to serve a diverse customer base.

ELPRO-BUCHS AG specializes in providing high-end data logging solutions that cater specifically to the stringent requirements of the pharmaceutical industry. Their focus on ensuring compliance with global medicinal transportation standards makes their products indispensable for drug manufacturers and healthcare providers.

Sensitech Inc. offers some of the most advanced cold chain data logging solutions on the market. Their products are equipped with cutting-edge technology that enables detailed tracking and reporting of temperature conditions. Sensitech’s strong focus on innovation and customer service has earned them a loyal customer base.

Top Key Players in the Market

- Testo SE & Co. KGaA

- ELPRO-BUCHS AG

- Sensitech Inc.

- DeltaTrak, Inc.

- Dickson

- Onset Computer Corporation (HOBO)

- Berlinger & Co. AG

- Monnit Corporation

- MadgeTech, Inc.

- Rotronic AG

- Lascar Electronics Limited

- NXP Semiconductors

- Other Key Players

Recent Developments

- In October 2024, Cold Chain Technologies (CCT) Acquires Tower Cold Chain. CCT expanded its product portfolio and global service network by acquiring Tower Cold Chain, a provider of advanced passive reusable cold chain solutions.

- In June 2024, Sensitech, a subsidiary of Carrier Global Corporation, announced plans to acquire the Monitoring Solutions business of Berlinger & Co. AG, aiming to enhance its life sciences cold chain solutions.

- In September 2024, UPS, one of the world’s largest companies, with 2023 revenue of $91.0 billion, agreed to acquire Frigo-Trans and its sister company BPL, both based in Germany, to bolster its temperature-controlled logistics capabilities in Europe.

Report Scope

Report Features Description Market Value (2023) USD 1.10 Bn Forecast Revenue (2033) USD 2.5 Bn CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Offline Data Loggers, Cellular Connected Data Loggers, Wireless Connected Data Loggers), By Application (Food & Beverages, Pharma & Healthcare, Chemical, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Testo SE & Co. KGaA,ELPRO-BUCHS AG,Sensitech Inc.,DeltaTrak, Inc.,Dickson,Onset Computer Corporation (HOBO),Berlinger & Co. AG,Monnit Corporation,MadgeTech, Inc.,Rotronic AG,Lascar Electronics Limited,NXP Semiconductors,Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Chain Data Loggers MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Cold Chain Data Loggers MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Testo SE & Co. KGaA

- ELPRO-BUCHS AG

- Sensitech Inc.

- DeltaTrak, Inc.

- Dickson

- Onset Computer Corporation (HOBO)

- Berlinger & Co. AG

- Monnit Corporation

- MadgeTech, Inc.

- Rotronic AG

- Lascar Electronics Limited

- NXP Semiconductors

- Other Key Players