Global Coconut Cream Market Size, Share, And Enhanced Productivity By Product Type (Organic Coconut Cream, Conventional Coconut Cream, Light Coconut Cream, Coconut Whipping Cream), By Claim (Organic, Vegan, Gluten-Free, Non-GMO, Kosher Certified), By Nature (Unsweetened, Sweetened Coconut Cream), By End Use (Food (Sauces, Ice cream, Soups, Cakes, Pastries, Smoothies), Beverages (Cocktail Drinks, Coffee Creamers, Blended Drinks), Cosmetics (Moisturizers, Face Masks, Body Lotion, Hair Mask, Face Wash)), By Sales Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176240

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

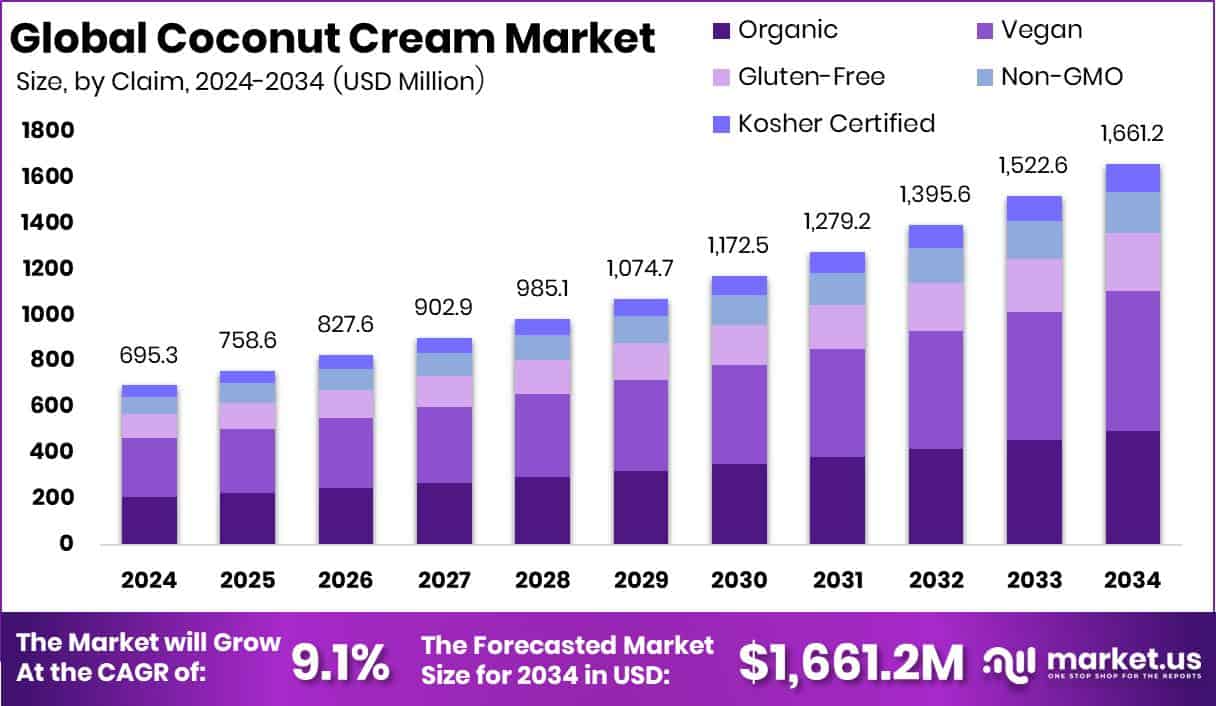

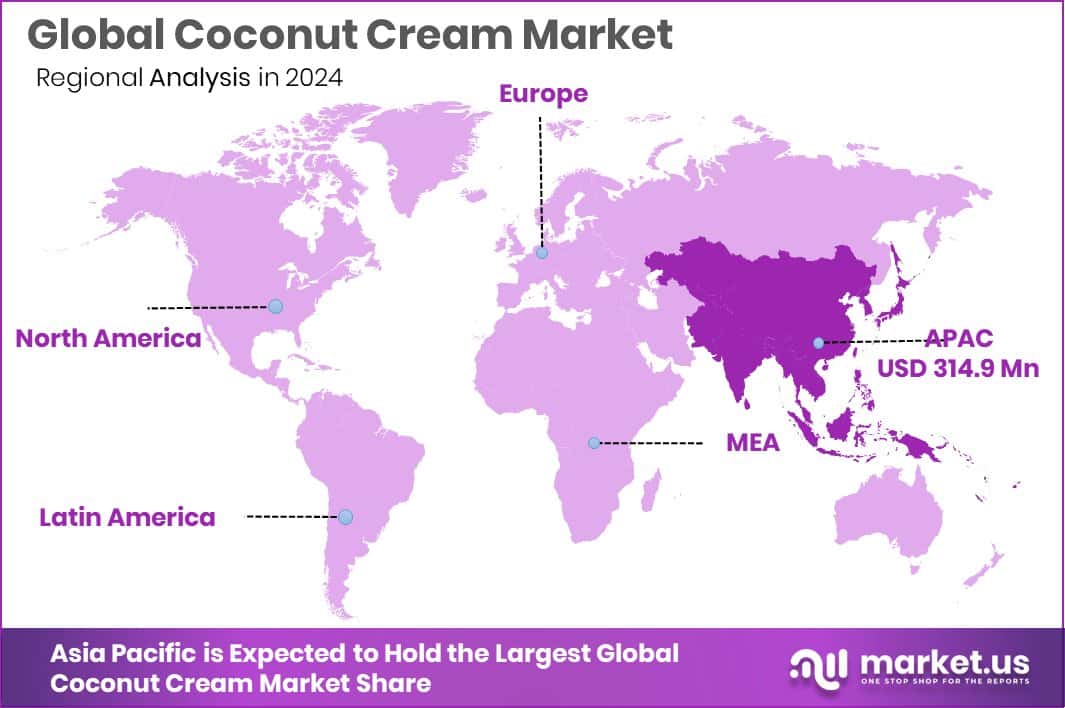

The Global Coconut Cream Market is expected to be worth around USD 1,661.2 million by 2034, up from USD 695.3 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034. In 2024, the Asia Pacific dominated coconut cream sales at 45.3%, totaling USD 314.9 Mn.

Coconut cream is a rich extract made from mature coconut flesh, valued for its thick texture and natural flavor. It is used across food, beverage, and cosmetic applications because it offers creaminess without dairy, making it suitable for clean-label and plant-based formulations. The Coconut Cream Market represents the global trade, production, and consumption of coconut-based cream products, categorized by product types, claims, nature, end-use industries, and sales channels.

Growing interest in organic and natural foods continues to lift market demand. Investments such as EDFI AgriFI, committing USD 1.5 million to Kentaste and the USD 1.6 million joint U.S. project supporting 4,500 Kenyan coconut farmers, strengthen raw material availability and long-term sustainability.

Rising demand for plant-based and allergen-free products opens strong opportunities. Funding rounds like Mooala, securing $8.3 million, and Alec’s Ice Cream, raising $11 million, reflect consumer appetite for dairy-alternative innovations powered partly by coconut cream.

Expansion opportunities also come from facility upgrades and new production capabilities. Century Pacific’s acquisition of a coconut facility for $45 million and Ecovative receiving $11 million demonstrate stronger ingredient and technology pipelines supporting coconut-derived products.

Personal-care applications are rising as well, with brands like Kopari Beauty closing a $20 million round and a baby-skincare startup earning £50k on Dragons’ Den, adding momentum to coconut-based cosmetic formulations.

Key Takeaways

- The Global Coconut Cream Market is expected to be worth around USD 1,661.2 million by 2034, up from USD 695.3 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034.

- The Coconut Cream Market is strongly led by Conventional Coconut Cream, capturing a dominant 43.6% share.

- Rising plant-based preferences push the Coconut Cream Market toward Vegan products, holding 36.8% global demand.

- Consumers increasingly choose natural profiles, making Unsweetened variants dominate the Coconut Cream Market with 68.4%.

- The Food segment drives bulk utilization in the Coconut Cream Market, contributing a significant 59.5% share.

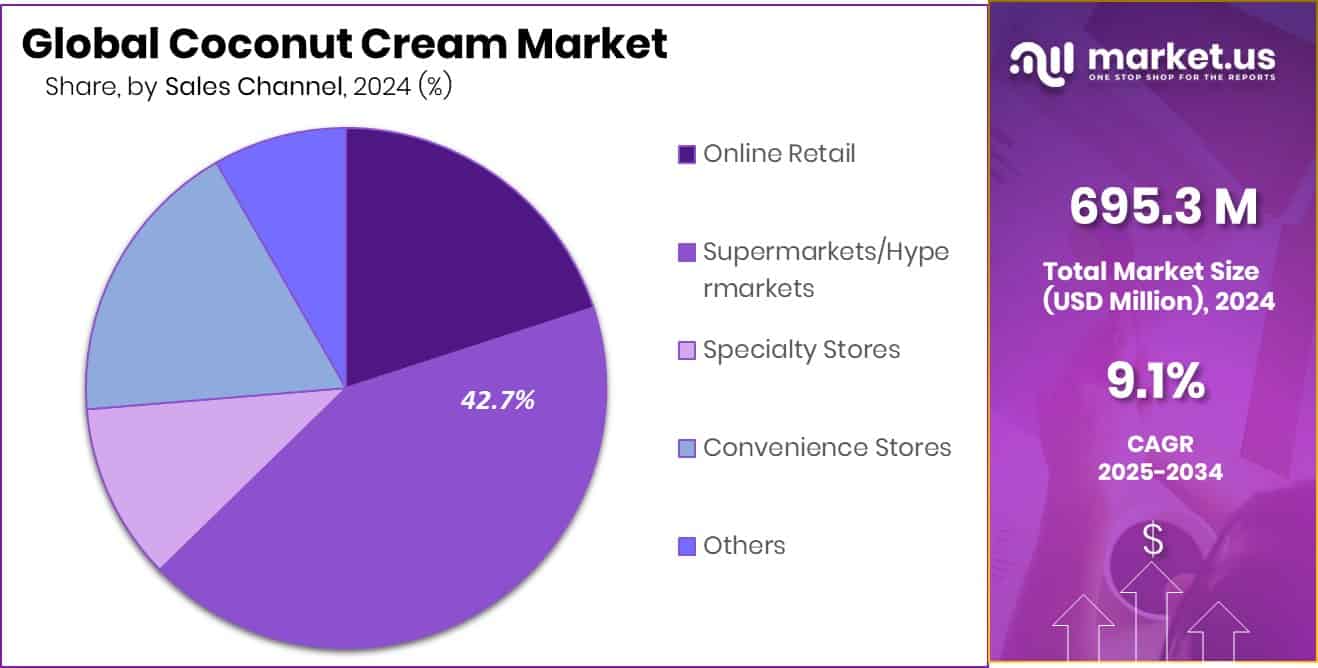

- Expanding retail accessibility boosts the Coconut Cream Market, with Supermarkets/Hypermarkets capturing 42.7% sales share.

- Strong demand in the Asia Pacific pushed the segment to 45.3% and USD 314.9 Mn.

By Product Type Analysis

The Coconut Cream Market sees 43.6% demand driven by conventional product types.

In 2024, the Coconut Cream Market continued strengthening as Conventional Coconut Cream held a dominant 43.6% share, reflecting its widespread acceptance across mainstream food manufacturing and retail categories. The segment benefited from consistent supply chains, competitive pricing, and a strong presence in Asian, European, and North American markets, where coconut-based ingredients remain essential for cooking, bakery, and dairy alternatives.

Manufacturers increased procurement from high-yield plantations in Indonesia, the Philippines, and India, helping stabilize volumes despite fluctuating coconut production cycles. Growing consumer preference for versatile, allergen-free ingredients supported higher adoption in ready meals, sauces, and confectionery applications. The segment’s influence remained pronounced as brands expanded bulk packaging formats for both industrial and foodservice operators.

By Claim Analysis

Vegan claims capture 36.8%, strengthening consumer trust across the Coconut Cream Market.

In 2024, the Coconut Cream Market saw meaningful traction for plant-based formulations as the Vegan segment captured 36.8% of total demand. Rising global interest in dairy-free and cruelty-free alternatives strengthened coconut cream’s role in vegan cooking, bakery, ice creams, beverages, and functional nutrition products. Consumers increasingly shifted toward products with clean labels, minimal processing, and naturally derived fats, which accelerated coconut cream’s usage in retail and foodservice innovation.

International food brands expanded vegan SKUs using coconut cream as a primary fat-rich base, offering smooth texture without synthetic stabilizers. Retailers also broadened shelf allocations for vegan-certified coconut cream variants, reinforcing strong penetration across urban markets where plant-forward diets continue gaining steady momentum.

By Nature Analysis

Unsweetened variants dominate with 68.4%, reshaping preferences in the Coconut Cream Market.

In 2024, the Coconut Cream Market experienced notable preference shifts as Unsweetened coconut cream dominated with a strong 68.4% share, driven by clean eating habits and the rising avoidance of added sugars. Food processors and consumers preferred unsweetened variants for their flexibility across savory and sweet applications, allowing customized sweetening depending on recipe needs. This segment’s growth accelerated within health-conscious demographics, particularly those following keto, paleo, and low-carb diets.

Restaurants and packaged foods increasingly introduced coconut-based curries, soups, desserts, and beverages relying on unsweetened cream for better flavor control. Manufacturers expanded low-fat and premium unsweetened formats to cater to both professional chefs and home cooks seeking authentic coconut flavors without artificial additives.

By End Use Analysis

Food applications hold 59.5%, indicating strong industrial reliance on Coconut Cream Market offerings.

In 2024, the Coconut Cream Market saw heightened integration in the global food industry as the Food segment accounted for 59.5% of overall utilization. Food manufacturers relied heavily on coconut cream for achieving rich textures and natural fat profiles across sauces, bakery fillings, ice creams, plant-based yogurts, ready meals, and premium confectionery. The ingredient’s stability in high-heat cooking and its naturally creamy consistency helped expand its adoption into value-added processed foods.

Culinary businesses worldwide incorporated coconut cream to diversify menus with Southeast Asian and tropical dishes. This steady growth was reinforced by consumers choosing coconut-based products as cleaner alternatives to synthetic thickeners or animal-derived dairy components in everyday food preparations.

By Sales Channel Analysis

Supermarkets account for 42.7%, remaining the largest distribution channel in the Coconut Cream Market.

In 2024, the Coconut Cream Market achieved significant retail visibility as Supermarkets and Hypermarkets held 42.7% of total sales, fueled by wider product assortment and strong in-store merchandising. Larger retail chains prioritized coconut-based products to meet rising consumer interest in international cuisines, vegan diets, and clean-label pantry staples. Shelf placements expanded across baking, dairy alternatives, and ethnic food categories, helping shoppers discover premium and private-label coconut cream options.

Promotional pricing, seasonal discounts, and recipe-driven displays further supported volume growth. Retailers collaborated with manufacturers for consistent supply and improved packaging formats like easy-pour cartons. The segment remained crucial for market penetration, especially in urban areas where modern trade drives household purchasing behavior.

Key Market Segments

By Product Type

- Organic Coconut Cream

- Conventional Coconut Cream

- Light Coconut Cream

- Coconut Whipping Cream

By Claim

- Organic

- Vegan

- Gluten-Free

- Non-GMO

- Kosher Certified

By Nature

- Unsweetened

- Sweetened Coconut Cream

By End Use

- Food

- Sauces

- Ice cream

- Soups

- Cakes

- Pastries

- Smoothies

- Beverages

- Cocktail Drinks

- Coffee Creamers

- Blended Drinks

- Cosmetics

- Moisturizers

- Face Masks

- Body Lotion

- Hair Mask

- Face Wash

By Sales Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Others

Driving Factors

Growing demand for plant-based creamy alternatives

The Coconut Cream Market continues to benefit from a strong global appetite for plant-based creamy substitutes, driven by consumers seeking dairy-free richness in sauces, desserts, beverages, and ready meals. This shift is supported by rising investments in plant-forward food brands, such as GoodSam Foods, raising $9 million to expand its clean-label and sustainable food offerings.

Such funding signals confidence in plant-derived ingredients, reinforcing the market’s growth momentum for coconut cream as a natural, allergen-friendly base. As more households adopt vegan and flexitarian diets, manufacturers are expanding coconut cream applications to meet expectations for texture, flavor, and versatility. This steady demand remains a key driving force across retail and foodservice categories.

Restraining Factors

Limited raw coconut supply fluctuations

The Coconut Cream Market faces constraints from unstable coconut supply, influenced by weather changes, aging plantations, and inconsistent harvesting cycles. Periodic shortages can disrupt production volumes, increase ingredient prices, and limit manufacturers’ ability to meet rising global demand. This challenge becomes more visible as plant-based categories expand rapidly, highlighted by the surge in alternative protein brands such as Tiba Tempeh, which secured £1.1 million following a 736% jump in retail sales value.

Although not a coconut-cream product, the scale of growth in plant-based foods intensifies pressure on raw material sourcing, reinforcing how sensitive supply fluctuations can slow expansion for coconut-based manufacturers relying on dependable crop yield.

Growth Opportunity

Expanding use in cosmetic formulations globally

Coconut cream’s natural moisturizing and soothing properties create strong opportunities within skincare, haircare, and wellness products. Beauty and personal-care brands increasingly use coconut-based creams to cater to consumers seeking gentle, plant-derived alternatives to synthetic emollients. Global investment activity reflects this rising interest in natural formulations.

Vegan Sweets TREASURE IN STOMACH secured ¥50 million to support expanded product development, while Stop & Shop granted $12.5K to the SUNY Old Westbury food pantry, reinforcing broader community and health-focused initiatives. These developments highlight the growing acceptance of plant-based ingredients across industries, opening new avenues where coconut cream can be adapted into premium cosmetic and self-care lines worldwide.

Latest Trends

Increased adoption of organic coconut cream

The organic segment is gaining momentum as consumers look for clean, chemical-free ingredients in both food and personal-care products. Organic coconut cream fits naturally into this trend, offering purity and consistent quality that appeals to health-conscious shoppers.

Recent funding across the natural food ecosystem supports this momentum, with London’s Doughlicious raising €4.3 million for gluten-free frozen desserts and VEGDOG securing €9 million in Series A to scale plant-based pet nutrition. Although these companies operate in different categories, their growth reflects a wider shift toward ethical, allergen-friendly, and organic products. This environment strengthens demand for certified organic coconut cream across supermarkets, specialty stores, and online platforms.

Regional Analysis

Asia Pacific led the Coconut Cream Market with 45.3%, reaching USD 314.9 Mn.

In 2024, the Coconut Cream Market showed clear regional variation, with Asia Pacific emerging as the dominant region at 45.3% and USD 314.9 million, supported by strong consumption in major coconut-processing countries and steady retail uptake across urban centers. North America followed with consistent growth driven by rising interest in dairy-free and clean-label ingredients within mainstream retail categories.

Europe maintained stable demand, supported by bakery, dessert, and plant-based food producers that rely on coconut cream for texture and flavor consistency. The Middle East & Africa region recorded moderate expansion as coconut-based products gained visibility in premium retail shelves and foodservice chains.

Latin America continued building momentum as consumers adopted coconut cream in home cooking and packaged food applications, strengthening its position in emerging markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BioMar Group continued strengthening its ingredient diversification strategy, where coconut-derived inputs supported selected nutrition-focused product lines. Although its core operations revolve around aquaculture solutions, the company’s inclusion of plant-based ingredients positioned it favorably as global food producers expanded coconut cream usage within healthier formulations. This alignment with clean-label preferences helped reinforce BioMar’s broader sustainability-driven portfolio direction.

Kaira demonstrated strong engagement in the coconut products space by focusing on consistent quality and reliable supply for regional buyers. Its market presence in 2024 benefited from rising demand for versatile coconut cream in packaged foods, culinary applications, and value-added processing. By emphasizing product purity and stable distribution, Kaira held a competitive footing among mid-scale suppliers.

Vivecosmetic contributed from a niche angle, particularly where coconut cream intersects with beauty-focused and wellness-oriented formulations. The company leveraged coconut cream’s natural moisturizing and texturizing attributes to strengthen its product appeal in personal care lines. This expanded cross-industry relevance supported overall market demand in 2024, as coconut cream continued gaining traction beyond traditional food segments into lifestyle and cosmetic applications.

Top Key Players in the Market

- BioMar Group

- Kaira

- vivecosmetic

- Greenville Agro Corporation

- Zoic cosmetic

- Red V Foods

- The Coconut Company

- FAGE

- Natures-spice

Recent Developments

- In May 2025, Zoic Cosmetic was listed as a contract manufacturer of cosmetic products based in Mohali, India. This confirms its operational focus in herbal and natural product manufacturing, including creams and other personal care items.

- In March 2025, Greenville Agro Corporation expanded its product range by manufacturing organic certified frozen coconut cream to meet the rising demand for quality coconut cream in food and beverage applications. This move highlights the company’s commitment to high standards and versatility in product offerings, especially for international buyers seeking premium frozen coconut cream solutions from the Philippines.

- In November 2024, The Coconut Company posted an update on its blog about global coconut supply and demand issues, noting that coconut cream and coconut milk prices rose due to shortages and production challenges in major exporting countries affected by weather and logistics. This update reflects how supply-side factors are affecting coconut cream availability.

Report Scope

Report Features Description Market Value (2024) USD 695.3 Million Forecast Revenue (2034) USD 1,661.2 Million CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Coconut Cream, Conventional Coconut Cream, Light Coconut Cream, Coconut Whipping Cream), By Claim (Organic, Vegan, Gluten-Free, Non-GMO, Kosher Certified), By Nature (Unsweetened, Sweetened Coconut Cream), By End Use (Food (Sauces, Ice cream, Soups, Cakes, Pastries, Smoothies), Beverages (Cocktail Drinks, Coffee Creamers, Blended Drinks), Cosmetics (Moisturizers, Face Masks, Body Lotion, Hair Mask, Face Wash)), By Sales Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BioMar Group, Kaira, vivecosmetic, Greenville Agro Corporation, Zoic cosmetic, Red V Foods, The Coconut Company, FAGE, Natures-spice Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BioMar Group

- Kaira

- vivecosmetic

- Greenville Agro Corporation

- Zoic cosmetic

- Red V Foods

- The Coconut Company

- FAGE

- Natures-spice