Global Cloud Network Media Player Market Size, Share, Industry Analysis Report By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), By Application (VoD (Video-on-Demand), Live Streaming, Music Streaming, Interactive Media (AR/VR), Advertising/Commercial Content, Others), By Device Type (Smartphones/Tablets, Smart TVs/Set-Top Boxes, Gaming Consoles, PCs/Laptops, Wearables, Others), By End User (Residential/Consumers, Commercial/Enterprises, Industrial), By Content Type (Audio, Video, Live Broadcast, Interactive Media (AR/VR), Others), By Revenue Model (Subscription-based, Advertisement-based, Transactional-based), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Oct. 2025

- Report ID: 160220

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Cloud Infrastructure and Adoption

- Technology and Usage Trends

- Analysts’ Viewpoint

- Investment and Business Benefits

- U.S. Cloud Network Media Player Market Size

- Deployment Type Analysis

- Application Analysis

- Device Type Analysis

- End User Analysis

- Content Type Analysis

- Revenue Model Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Growth Factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

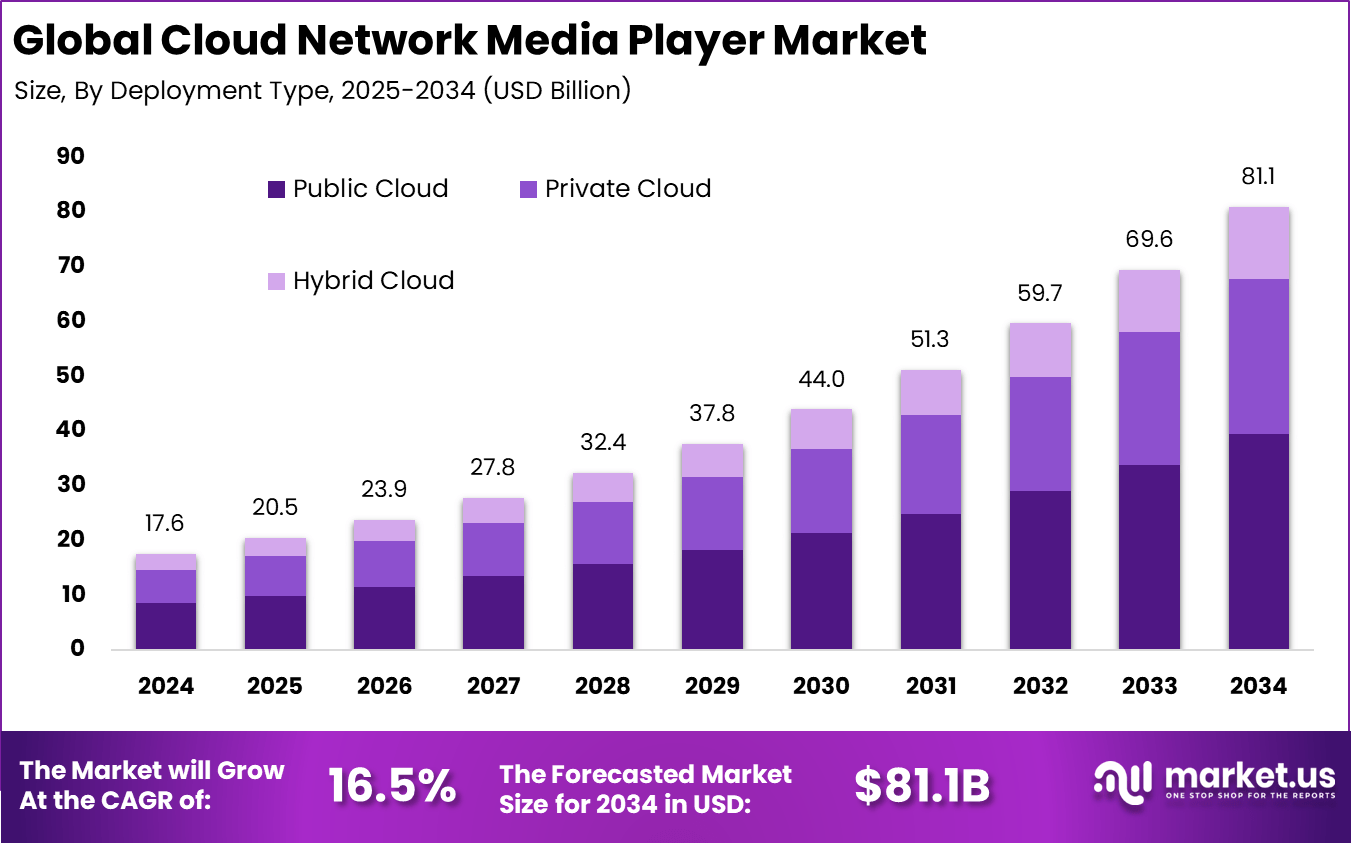

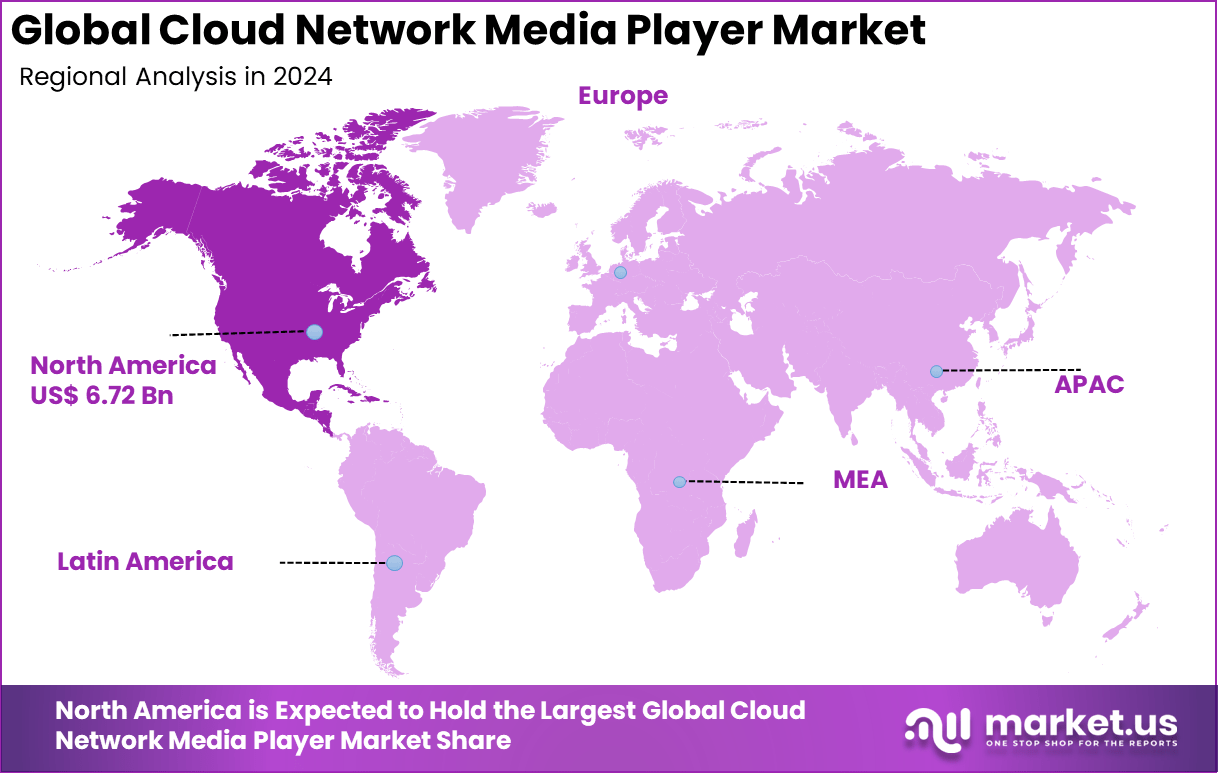

The Global Cloud Network Media Player Market size is expected to be worth around USD 81.1 billion by 2034, from USD 17.6 billion in 2024, growing at a CAGR of 38.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.2% share, holding USD 6.72 billion in revenue.

The cloud network media player market involves devices and systems that stream media (video, audio, interactive content) over the network using cloud infrastructure. These media players do not rely solely on local storage; instead, they fetch, buffer, decode, and play content sourced from cloud servers or content delivery networks (CDNs). The market includes hardware media player boxes, set-top units, smart appliances, and software clients that rely on cloud backend services to deliver media.

The cloud component enables centralized content management, updates, scalability, and stream routing. Top driving factors in this market include the widespread availability of high-speed internet and the ongoing global rollout of 5G networks. These technologies significantly enhance streaming quality and reduce latency, which is essential for user satisfaction.

The surge in demand for on-demand, personalized multimedia content also propels growth, as users increasingly expect flexible and immersive viewing experiences across multiple platforms. Moreover, the integration of cloud network media players into smart home ecosystems and commercial digital signage contributes to strong adoption patterns, with over 70% of new devices featuring connectivity with IoT and AI technologies.

Key Takeaway

- Public cloud deployment leads with 48.7%, reflecting preference for scalability and reduced infrastructure costs.

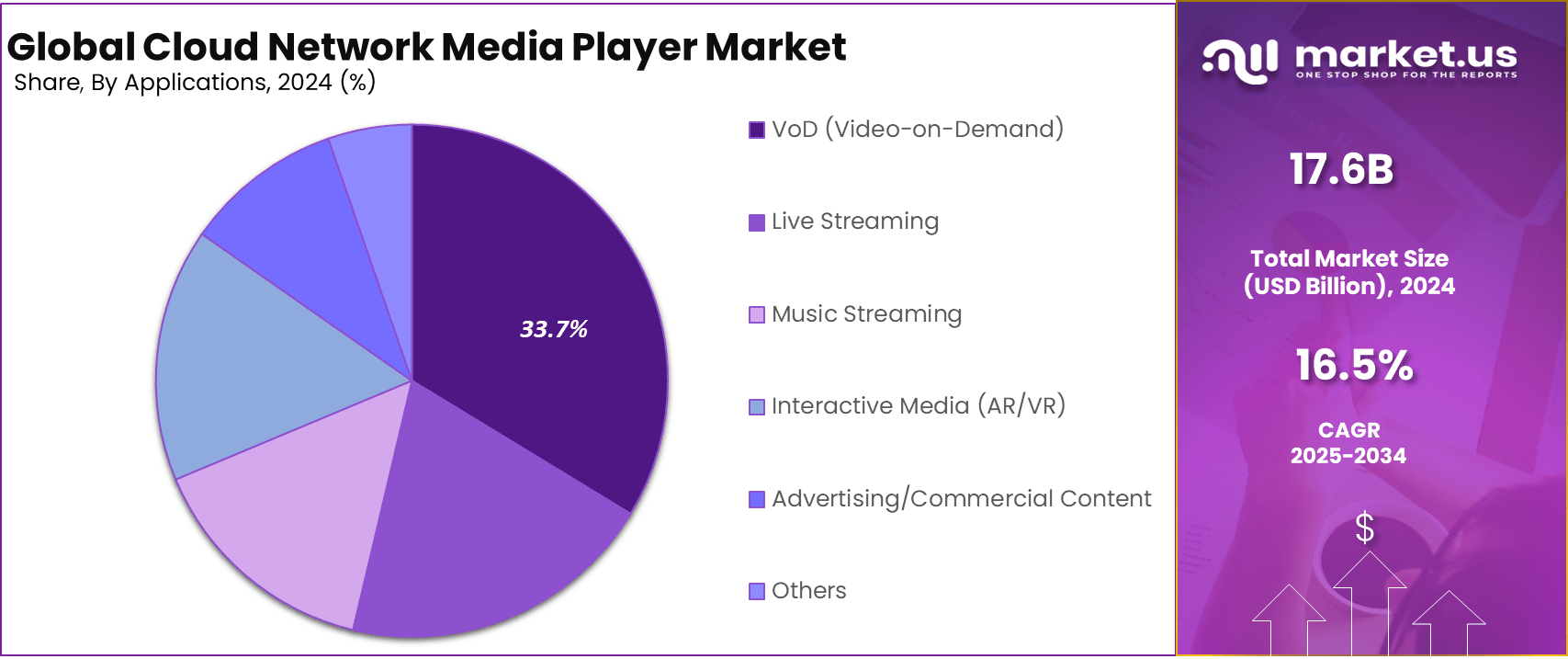

- Video-on-Demand (VoD) applications account for 33.7%, supported by growing demand for streaming services.

- Smartphones and tablets dominate with 35.7%, as mobile-first consumption continues to rise globally.

- Commercial and enterprise users represent 52.4%, driven by media distribution, corporate training, and digital engagement.

- Audio content holds 36.7%, highlighting demand for music streaming and podcast platforms.

- Subscription-based revenue model captures 45.4%, showing customer preference for recurring, flexible access plans.

- North America contributes 38.2%, backed by advanced cloud infrastructure and strong media consumption.

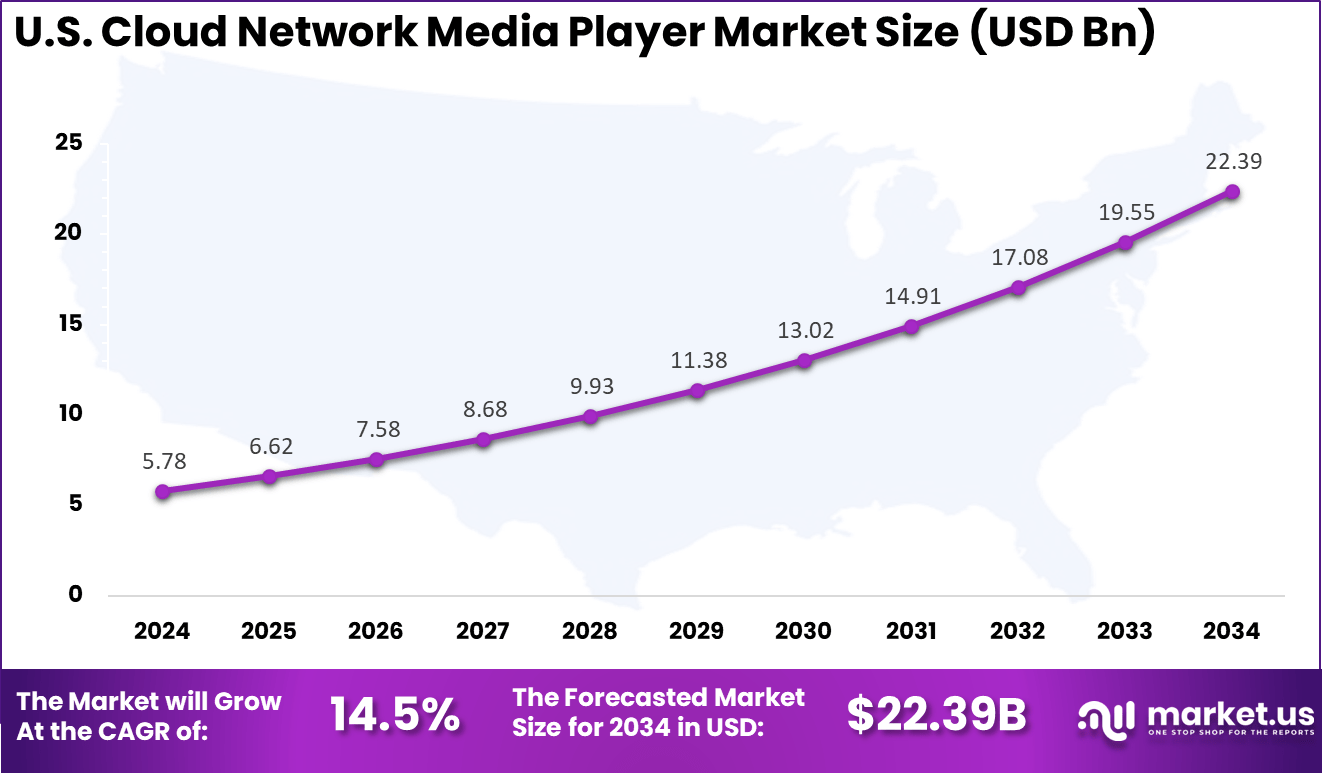

- The US market reached USD 5.78 billion and is expanding at a solid CAGR of 14.5%, reinforcing its role as a global leader in cloud-powered media services.

Role of Generative AI

The role of generative AI in the cloud network media player market is becoming increasingly significant. Generative AI is transforming content creation by enabling personalized recommendations and automating content production tasks. It is estimated that 72% of organizations currently use generative AI services, reflecting its swift adoption across industries.

AI-driven media players now offer personalized viewing experiences, with 28% of U.S. viewers relying on AI recommended content to discover new media. The expansion of generative AI solutions in media and entertainment is supported by growing investments, which reached nearly $16 billion in 2023 alone, illustrating a clear trend towards AI-powered content innovation.

Cloud Infrastructure and Adoption

- Dominant providers: The “big three” providers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud – collectively hold more than 60% market share in cloud infrastructure as of Q2 2025.

- Q2 2025 Spending: Global spending on cloud infrastructure reached $99 billion in Q2 2025 alone, marking a 25% year-over-year increase.

- Enterprise adoption: By 2023, nearly 94% of enterprises had adopted cloud services, underscoring the mainstream shift to cloud-based infrastructure.

- Data storage: Around 60% of corporate data was stored in the cloud in 2022, with expectations of continued growth.

- Personal cloud use: Consumer adoption remains widespread, with 3.6 billion people using at least one cloud service in 2018. By 2020, around 2.3 billion people were estimated to be using personal cloud services.

Technology and Usage Trends

- Shift to cloud ecosystems: Media companies and digital platforms are transitioning to integrated cloud ecosystems that unify content delivery, storage, and real-time streaming.

- Mobile consumption: Mobile gaming, a leading form of cloud-based media consumption, accounted for 45% of the global gaming market in 2019 and was valued at over $68 billion.

- Performance optimization: Approximately 64% of companies use cloud-based content delivery networks (CDNs) to accelerate delivery speeds and reduce latency for applications and websites.

Analysts’ Viewpoint

Demand analysis highlights that both commercial and household segments are growing briskly. Commercial use cases include digital signage in retail spaces, airports, and corporate environments, where centralized media management lowers costs and improves operational efficiency. Household demand is fueled by smart TV proliferation and home entertainment systems that rely on cloud-based media streaming.

The ease of content delivery, coupled with the scalability of cloud infrastructure, translates into growing adoption rates, with many users valuing instant content updates and personalized recommendations powered by machine learning algorithms. Increasing adoption technologies revolve around 5G connectivity, edge computing, and AI-driven personalization.

5G provides the bandwidth and low latency needed for smooth 4K and emerging 8K video streaming. Edge computing places processing closer to the user, which reduces delays in data transfer. AI enables dynamic content filtering and personalized viewer experiences, leading to higher engagement rates. These technologies together address the critical need for real-time responsiveness and quality that viewers now demand, with recent surveys showing a 92% success rate reported by media companies implementing cloud solutions.

Investment and Business Benefits

Investment opportunities within this market focus on expanding cloud infrastructure, developing AI-powered content management tools, and exploring niche markets such as smart city digital signage and enterprise-level streaming solutions. Emerging economies with increasing internet penetration present fertile ground for growth, supported by government incentives for digital transformation.

The ongoing innovation in hardware-software integration and subscription-based models offers investors compelling value propositions, with industry reports indicating that cloud media investments are expected to yield robust returns due to shifting consumer behaviors and technological advancements. The business benefits of adopting cloud network media players are substantial.

They provide companies with flexible content delivery, reduced time to market for new media, enhanced customer engagement through personalized experiences, and cost savings on infrastructure. The shift toward cloud solutions also supports remote work and hybrid operations, boosting productivity and collaboration through real-time media sharing.

U.S. Cloud Network Media Player Market Size

The market for Cloud Network Media Player within the U.S. is growing tremendously and is currently valued at USD 5.78 billion, the market has a projected CAGR of 14.5%. The market is experiencing significant growth driven by the increasing demand for seamless streaming and improved content accessibility for both homes and businesses.

Advancements in 5G and broadband infrastructure have enhanced streaming quality, allowing for smooth delivery of high-resolution content. Additionally, innovations in cloud computing, AI-powered personalization, and the proliferation of smart devices are fueling the expansion of media consumption in the U.S., creating a dynamic and growing landscape for cloud network media players.

For instance, In March 2025, OVHcloud expanded its U.S. cloud network by launching a new Seattle Local Zone. This upgrade improves service latency and reliability, which is especially beneficial for the cloud network media player market by enabling smoother streaming, reduced buffering, and better user experiences.

In 2024, North America held a dominant market position in the Global Cloud Network Media Player Market, capturing more than a 38.2% share, holding USD 6.72 billion in revenue. This dominance is due to its advanced technological infrastructure, high internet penetration, and the widespread adoption of streaming platforms.

The region benefits from a strong presence of major media companies and OTT service providers, alongside innovations in cloud computing, AI, and 5G connectivity. These factors, combined with high consumer demand for seamless, high-quality content delivery, drive the growth and leadership of North America in this market.

For instance, in April 2025, Hypertec acquired 5C AI Infrastructure, a move that significantly strengthens its cloud capabilities in North America. This acquisition enhances Hypertec’s ability to provide advanced AI-driven infrastructure, which is crucial for industries like cloud network media players. The integration of AI and high-performance computing into cloud services will enable more efficient media streaming, reducing latency and improving content delivery.

Deployment Type Analysis

In 2024, Public cloud leads the cloud network media player market with 48.7% share. Organizations and service providers prefer public cloud deployment because it enables flexible scaling, lower infrastructure costs, and faster global reach for streaming services. Public cloud also ensures easier integration with Content Delivery Networks (CDNs), which enhances media accessibility across different regions.

The availability of advanced security frameworks and compliance certifications in public cloud environments is further boosting adoption. Businesses benefit from faster content distribution and continuous updates from providers, making public cloud the most efficient deployment mode for media player applications.

For Instance, in May 2024, Telecom Egypt partnered with Huawei Cloud to host Huawei’s first public cloud in Egypt and Northern Africa. This collaboration is a significant step in expanding cloud infrastructure in the region, enabling faster and more reliable cloud-based services. For the Cloud Network Media Player market, this development is crucial, as it will improve the delivery and streaming of high-quality media content.

Application Analysis

In 2024, the VoD (Video-on-Demand) segment held a dominant market position, capturing a 33.7% share of the Global Cloud Network Media Player Market. This dominance is due to the increasing consumer preference for on-demand, flexible viewing experiences, allowing users to access content anytime, anywhere.

The growth of popular OTT platforms like Netflix, Hulu, and Amazon Prime has driven demand for VoD services. Additionally, advancements in cloud technology, enabling seamless streaming and content delivery, have further fueled the growth.

For instance, in May 2024, Kantar reported that the growth trajectory of Video-on-Demand (VoD) services continues to rise globally, driven by increasing consumer demand for personalized, on-demand content. This trend significantly impacts the Cloud Network Media Player market, as streaming platforms leverage cloud technologies to provide seamless, high-quality content delivery.

Device Type Analysis

In 2024, The Smartphones/Tablets segment held a dominant market position, capturing a 35.7% share of the Global Cloud Network Media Player Market. This dominance is due to the widespread use of mobile devices, offering users the convenience of accessing content anytime, anywhere.

With the rise of mobile streaming, fueled by high-speed internet, 5G advancements, and enhanced device performance, smartphones and tablets have become key platforms for media consumption. The growing popularity of streaming apps and social media, along with improved processing power and intuitive interfaces, has significantly boosted the demand.

For Instance, in September 2025, TCL launched the Tab 8 Nxtpaper 5G, an Android 15 tablet designed for optimal media consumption, including streaming and cloud-based services. With its 8.7-inch display, 5G connectivity, and long-lasting 6,000mAh battery, the tablet is positioned as a strong contender for cloud network media players. The device’s ability to deliver high-quality streaming experiences while minimizing glare and blue light makes it ideal for extended content viewing.

End User Analysis

In 2024, The Commercial/Enterprises segment held a dominant market position, capturing a 52.4% share of the Global Cloud Network Media Player Market. This dominance is due to the increasing use of cloud media players by businesses for internal communications, marketing, and training purposes.

Enterprises are adopting cloud-based solutions for scalable, cost-effective content delivery across multiple locations. Additionally, the growing demand for high-quality media presentations, video conferencing, and remote collaboration tools has further driven the adoption.

For Instance, in September 2025, ZTE, in collaboration with TELE System, debuted the UP Stick, a next-generation 4K set-top box (STB) at IBC 2025. This device integrates cloud network media player capabilities, allowing enterprises and commercial users to offer high-quality streaming and content delivery services. Designed for commercial and enterprise applications, the UP Stick provides seamless access to 4K content and supports cloud-based media solutions.

Content Type Analysis

In 2024, The Audio segment held a dominant market position, capturing a 36.7% share of the Global Cloud Network Media Player Market. This dominance is due to the increasing popularity of music streaming services, podcasts, and audiobooks, which have become integral to everyday media consumption. Cloud-based audio players offer users convenient access to a wide variety of content with seamless playback, while advancements in AI-powered recommendations and personalized listening experiences further boost demand for cloud audio services.

For Instance, in March 2022, Windows 11 introduced a revamped media player with significant improvements to both audio and video playback. The new media player enhances the user experience by offering better integration with cloud storage, allowing users to stream audio and video content seamlessly. These advancements in the Windows 11 media player reflect the growing importance of cloud network media players, enabling more efficient content delivery and smoother playback of high-quality media.

Revenue Model Analysis

In 2024, The Subscription-based segment held a dominant market position, capturing a 45.4% share of the Global Cloud Network Media Player Market. This dominance is due to the growing preference for ad-free, on-demand content, with consumers increasingly valuing premium experiences.

Subscription models offer stable, recurring revenue for service providers while providing users with access to exclusive content and features. The success of major streaming platforms, such as Netflix, Spotify, and Apple Music, has further reinforced the popularity of subscription-based revenue models in the media industry.

For Instance, in April 2024, streaming platforms are navigating shifting market dynamics amidst a surge in subscriber growth. As the demand for subscription-based services continues to rise, platforms are focusing on enhancing user experience and diversifying content offerings. This growth in subscriptions is driving the adoption of cloud network media players, which offer scalable, cost-effective solutions for delivering high-quality content.

Key Market Segments

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- VoD (Video-on-Demand)

- Live Streaming

- Music Streaming

- Interactive Media (AR/VR)

- Advertising/Commercial Content

- Others

By Device Type

- Smartphones/Tablets

- Smart TVs/Set-Top Boxes

- Gaming Consoles

- PCs/Laptops

- Wearables

- Others

By End User

- Residential/Consumers

- Commercial/Enterprises

- Industrial

By Content Type

- Audio

- Video

- Live Broadcast

- Interactive Media (AR/VR)

- Others

By Revenue Model

- Subscription-based

- Advertisement-based

- Transactional-based

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Drivers

Rising demand for streaming and on‑demand content

The increasing preference for on-demand content and OTT platforms is driving the demand for cloud network media players. Consumers now expect immediate access to personalized, high-quality video, which cloud-based players are well-equipped to deliver.

These players are essential for transcoding, caching, and streaming media over IP networks, enabling seamless content delivery across multiple devices. This growing demand for flexibility and convenience in content consumption is fueling the expansion of the cloud media player market globally.

For instance, in September 2022, it was reported that the hospitality industry is experiencing a rising demand for streaming and on-demand content, driven by the increasing preference for personalized, flexible media consumption. Hotels and other hospitality providers are responding by integrating advanced in-room entertainment solutions, including cloud-based media players, to offer guests seamless access to popular streaming platforms.

Restraint

Data privacy, security, and regulatory compliance

As cloud network media players handle vast amounts of user data and media content, they face significant challenges related to data privacy, security, and regulatory compliance. Ensuring compliance with various regional regulations (such as GDPR in Europe or CCPA in California) can be complex, especially when dealing with cross-border data transfers and content rights management.

For instance, In September 2024, Cloudera introduced Private Link, a secure data-sharing service that connects cloud platforms to on-premise networks while protecting sensitive information. For the cloud network media player market, this supports encrypted streaming and more secure content delivery.

Opportunities

Expansion in Emerging Markets

Emerging markets, particularly in the Asia Pacific, Latin America, and Africa, offer substantial growth opportunities for cloud network media players. As internet infrastructure improves and mobile penetration increases, these regions are becoming key markets for streaming services.

With demand for affordable and accessible content growing, companies can expand their offerings to untapped audiences, taking advantage of low competition and high growth potential. The expansion into these markets can drive adoption of cloud-based media players, fostering new business models and partnerships.

For instance, In March 2025, South Africa became part of Google’s global cloud network with a new R25 billion data center hub. This expansion strengthens cloud infrastructure across Africa and will support the cloud network media player market through faster data processing and smoother, higher-quality streaming.

Challenges

Competition from Incumbents and Alternative Models

Traditional cable, satellite, and terrestrial broadcasting models continue to pose significant competition to cloud-based streaming solutions. These established services still dominate certain markets, offering bundled services and capturing loyal customer bases.

Additionally, alternative models, like hybrid or ad-supported platforms, may limit the growth of paid subscription services. As the media landscape becomes more fragmented and competitive, cloud media players must differentiate by offering unique features, improving service quality, and focusing on niche content to attract and retain users.

For instance, in April 2025, Amazon launched its first batch of Kuiper internet satellites, marking a significant move to compete with SpaceX’s Starlink in providing global satellite-based internet services. This initiative aims to expand broadband access in remote and underserved areas, which could have a direct impact on the cloud network media player market.

Latest Trends

Emerging trends in the cloud network media player sector include the integration of AI-powered content recommendations that enhance user engagement by tailoring media streams to individual preferences. The market is also moving towards advanced video capabilities such as 8K resolution and HDR, improving visual experiences, along with increased use of IoT connectivity to integrate these players into smart home ecosystems.

5G-enabled media players allow faster content updates and remote management, supporting the growing demand for flexible and high-quality streaming. Subscription-based models are gaining traction, offering users flexible access to diverse content libraries.

Growth Factors

Growth factors driving the cloud network media player market center around expanding internet penetration and the rise of high-speed broadband connectivity. The rollout of 5G networks plays a key role by enabling smoother streaming and reduced latency, which are essential for high-quality media delivery.

There is increasing demand from both commercial and household users for scalable and centralized media management solutions offered through cloud platforms. Government initiatives that promote digital infrastructure development further stimulate market growth, especially in developing regions with rising internet usage.

Key Players Analysis

The Cloud Network Media Player Market is dominated by major consumer technology brands such as Amazon.com, Inc., Roku, Inc., Google LLC, and Apple Inc. These companies deliver streaming devices and platforms that integrate cloud-based content delivery, app ecosystems, and voice-enabled interfaces. Their products, including Fire TV, Chromecast, Apple TV, and Roku players, support high-resolution media, multi-device access, and subscription-based streaming.

Key Asian manufacturers such as Xiaomi Corporation, Huawei Technologies Co., Ltd., ZTE Corporation, and TCL Technology Group Corporation contribute through competitively priced smart media players and cloud-connected TVs. These companies focus on expanding access to streaming services across emerging markets, with strong adoption in Asia-Pacific, Latin America, and the Middle East. Their offerings often combine smart home integration, localized content, and 4K support.

Technology and cloud players like NVIDIA Corporation and Alibaba Group Holding Limited enhance the market with high-performance streaming and AI-powered media processing. NVIDIA contributes through GPU-accelerated streaming platforms, while Alibaba supports large-scale cloud distribution and OTT infrastructure in Asia. A range of other companies continue to expand the market with niche solutions for gaming, entertainment, and hybrid streaming environments.

Top Key Players in the Market

- Amazon.com, Inc.

- Roku, Inc.

- Google LLC

- Apple Inc.

- Xiaomi Corporation

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Alibaba Group Holding Limited

- TCL Technology Group Corporation

- Others

Recent Developments

- In September 2025, Amazon introduced Alexa Plus across its Fire TV lineup, enhancing voice control with contextual information and scene-specific navigation. This feature is available on new Fire TV models and will be rolled out to existing devices.

- In September 2025, Google TV received a significant update, streamlining the home screen for a more user-friendly experience. The update also includes performance enhancements and improved content discovery features.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Bn Forecast Revenue (2034) USD 81.1 bn CAGR(2025-2034) 16.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), By Application (VoD (Video-on-Demand), Live Streaming, Music Streaming, Interactive Media (AR/VR), Advertising/Commercial Content, Others), By Device Type (Smartphones/Tablets, Smart TVs/Set-Top Boxes, Gaming Consoles, PCs/Laptops, Wearables, Others), By End User (Residential/Consumers, Commercial/Enterprises, Industrial), By Content Type (Audio, Video, Live Broadcast, Interactive Media (AR/VR), Others), By Revenue Model (Subscription-based, Advertisement-based, Transactional-based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc., Roku, Inc., Google LLC, Apple Inc., Xiaomi Corporation, NVIDIA Corporation, Huawei Technologies Co., Ltd., ZTE Corporation, Alibaba Group Holding Limited, TCL Technology Group Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Cloud Network Media Player MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Network Media Player MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com, Inc.

- Roku, Inc.

- Google LLC

- Apple Inc.

- Xiaomi Corporation

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Alibaba Group Holding Limited

- TCL Technology Group Corporation

- Others