Global Cloud Manufacturing Market Size and Growth Analysis By Component (Solutions, Services), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Predictive Maintenance, Business Analytics, Asset Management, Supply Chain & Logistics, Others), By End-User Industry (Automotive, Aerospace & Defense, Industrial Machinery & Heavy Equipment, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals & Healthcare, Energy & Utilities, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan. 2026

- Report ID: 173238

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Operational Impact and Efficiency

- Major Industry Challenges

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- U.S. Cloud Manufacturing Market Size

- Offering Analysis

- Deployment Model Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

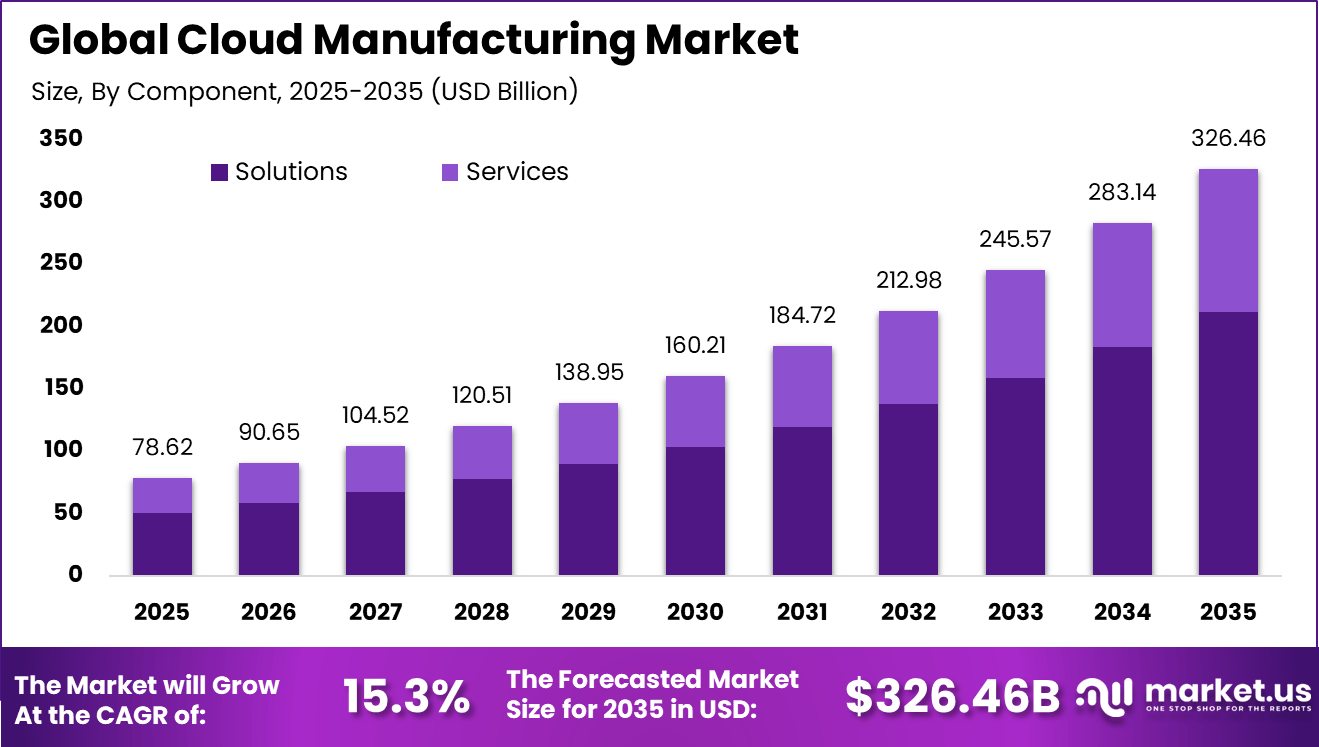

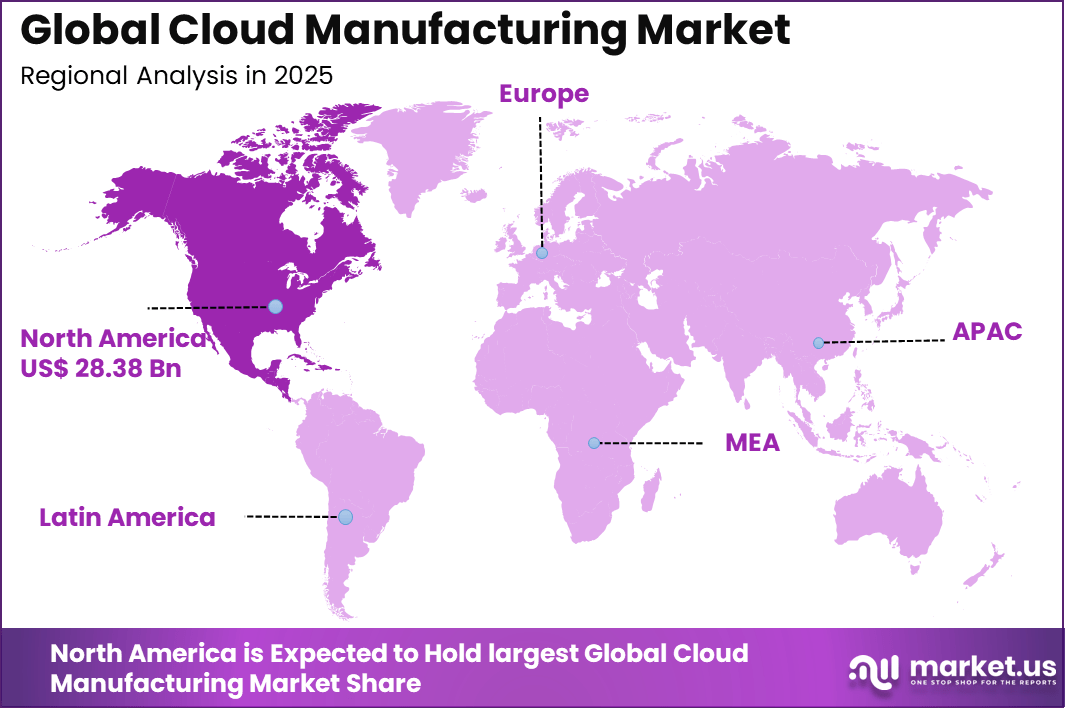

The Global Cloud Manufacturing Market size is expected to be worth around USD 326.46 billion by 2035, from USD 78.62 billion in 2025, growing at a CAGR of 15.3% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 36.1% share, holding USD 28.38 billion in revenue.

The cloud manufacturing market refers to the use of cloud computing technologies to deliver manufacturing resources and capabilities as services over the internet. In this model, manufacturing equipment, software, data storage, and analytics are shared and accessed on demand. Enterprises can coordinate production, design, and supply chain activities through centralized digital platforms that support collaboration and scalability. This market supports small and large manufacturers aiming to enhance operational agility and reduce capital expenditure.

Growth in this market has been influenced by the convergence of digital technologies with traditional manufacturing processes. Advances in cloud computing, the Internet of Things, and data analytics have enabled real time communication between machines and systems. Manufacturers are adopting cloud based models to improve flexibility and respond to changing customer needs quickly. As global competition increases, cloud manufacturing solutions are becoming crucial for modernization and efficiency.

For instance, in November 2025, AVEVA, partnering closely with Microsoft, won the 2025 Microsoft Manufacturing Partner of the Year for cloud-based solutions like CONNECT on Azure. Their AI-powered insights unify IT/OT data for smarter factories, proving North American cloud ecosystems lead in industrial digitalization.

Key Takeaway

- Solutions lead the market with a 64.8% share, as manufacturers prioritize integrated platforms for production planning, monitoring, analytics, and process optimization.

- Public cloud deployment accounts for 52.7%, reflecting strong demand for scalable infrastructure, lower upfront costs, and faster deployment across distributed manufacturing sites.

- Large enterprises dominate with 71.5%, driven by their need to manage complex operations, multi-plant coordination, and high-volume data generated from smart factories.

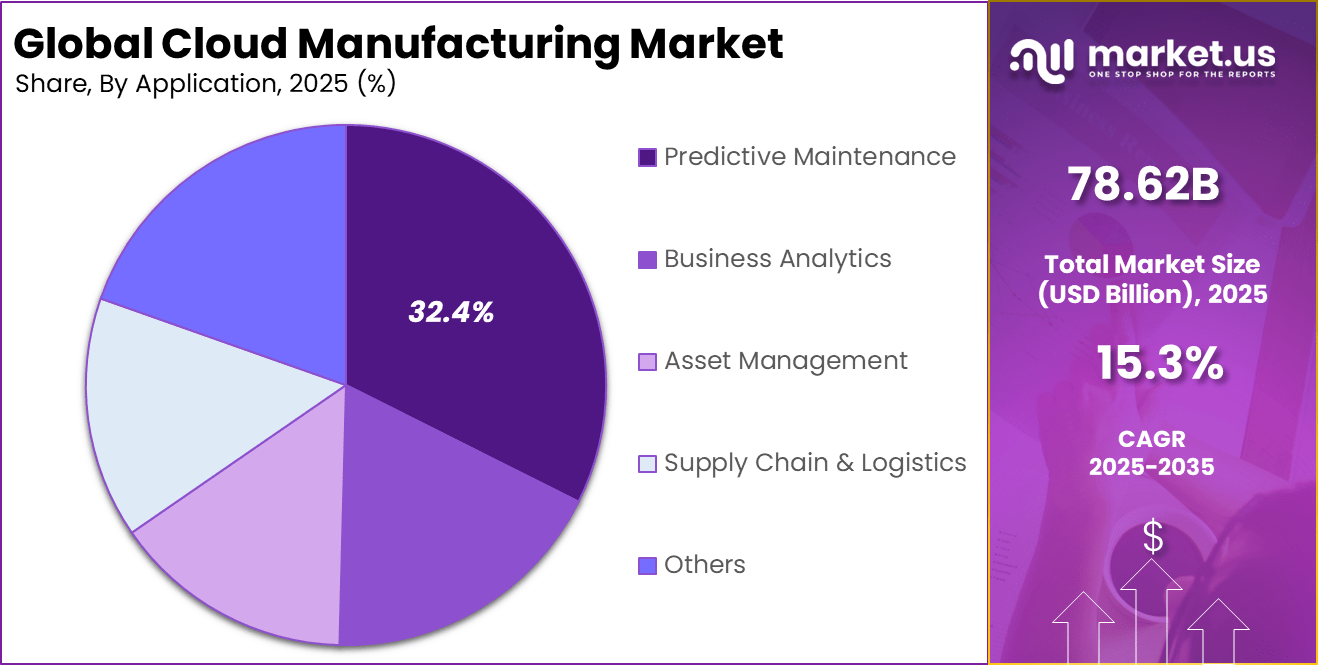

- Predictive maintenance represents 32.4% of applications, highlighting the growing use of cloud analytics and IoT data to reduce unplanned downtime and extend equipment life.

- The automotive industry holds 28.9%, as automakers increasingly rely on cloud manufacturing to support automation, digital twins, and connected production lines.

- North America captures a 36.1% share, supported by early adoption of Industry 4.0 technologies, strong cloud infrastructure, and advanced manufacturing ecosystems.

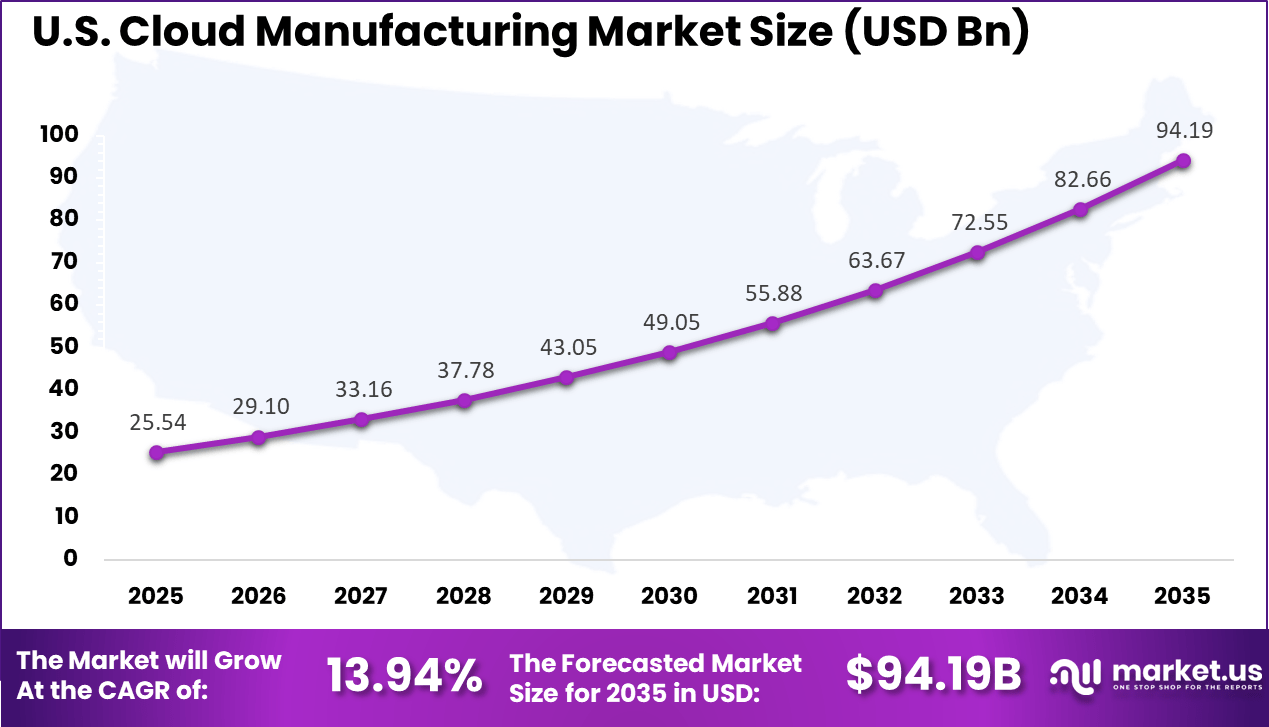

- The U.S. market reached USD 25.54 billion, expanding at a 13.94% CAGR, driven by rising investments in smart manufacturing, AI-driven analytics, and cloud-native production systems.

Operational Impact and Efficiency

- Cost reductions of 20% to 30% are commonly reported by manufacturers after adopting cloud manufacturing platforms, mainly through optimized resource use and lower infrastructure overhead.

- Performance improvements are significant, with some engineering workloads delivering up to 50% higher performance, while IT infrastructure costs decline by nearly 40% following successful cloud migration.

- Adoption maturity is advancing steadily, as around 87% of manufacturers have already embedded cloud solutions into their broader digital and operational strategies by 2025.

Major Industry Challenges

- Skills gaps remain a structural constraint, with 67% of manufacturing firms reporting difficulties in sourcing talent capable of managing cloud-enabled and data-driven production systems.

- Security and data privacy continue to be the primary concern, cited by 95% of companies, particularly in environments handling sensitive design, production, and supplier data.

- Cloud spend inefficiency is persistent, with an estimated 30% to 32% of cloud budgets lost to idle capacity and overprovisioned resources, limiting full return on investment.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Industry 4.0 adoption Shift toward connected and data driven manufacturing ~4.2% North America, Europe Short to Mid Term Demand for flexible production Need for scalable and on demand manufacturing capacity ~3.6% Global Short Term Cost optimization pressure Reduction in capital expenditure through cloud models ~3.1% Global Mid Term Growth of digital twins Virtual modeling improving production planning ~2.4% North America, Asia Pacific Mid Term Supply chain resilience Distributed manufacturing enabled by cloud platforms ~2.0% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security risks Exposure of sensitive manufacturing data ~2.9% Global Short Term Cloud dependency Operational risk from service outages ~2.2% Global Short Term Regulatory compliance Data residency and industrial regulations ~1.8% Europe, North America Mid Term Integration complexity Legacy system integration challenges ~1.4% Global Mid Term Vendor lock in Limited portability between platforms ~1.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High migration cost Transitioning from on premise systems ~3.1% Global Short to Mid Term Skills gap Shortage of cloud and OT expertise ~2.4% Global Mid Term Latency concerns Real time control limitations ~1.9% Emerging Markets Mid Term Resistance to change Conservative manufacturing culture ~1.5% Global Long Term Network reliability Dependence on stable connectivity ~1.1% Emerging Markets Short Term U.S. Cloud Manufacturing Market Size

The market for Cloud Manufacturing within the U.S. is growing tremendously and is currently valued at USD 25.54 billion, the market has a projected CAGR of 13.94%. The market is growing due to rising demand for real-time production data and smarter supply chains. Manufacturers adopt cloud tools to cut downtime through predictive analytics and scale operations without heavy hardware costs.

Advanced automation and IoT integration help firms respond faster to market shifts. Large plants lead the charge, linking factories nationwide for better oversight. This shift boosts efficiency and competitiveness in a fast-paced industry.

For instance, in April 2025, Microsoft released Cloud for Manufacturing 2025 Wave 1, enhancing intelligent factories with IT/OT interoperability, real-time data visibility, and AI-driven insights across the manufacturing value chain, solidifying U.S. leadership in cloud manufacturing transformation.

In 2025, North America held a dominant market position in the Global Cloud Manufacturing Market, capturing more than a 36.1% share, holding USD 28.38 billion in revenue. This lead stems from robust tech infrastructure and early adoption by key industries like automotive and aerospace.

Manufacturers here leverage cloud platforms for seamless data sharing across plants, cutting costs and boosting agility. Strong investments in IoT and AI drive predictive tools that minimize downtime. Skilled talent and supportive policies further speed up integration, keeping the region ahead in efficient production.

For instance, in October 2025, Oracle collaborated with Microsoft Azure to integrate Fusion Cloud SCM with Azure IoT Operations, enabling manufacturers to capture live factory data for faster decision-making and reduced downtime, reinforcing North American cloud dominance.

Offering Analysis

In 2025, The Solutions account for 64.8%, indicating that cloud manufacturing is mainly driven by software-based platforms. These solutions support production planning, monitoring, and process optimization. Manufacturers use cloud solutions to gain centralized visibility across operations. Digital platforms help reduce manual intervention in manufacturing workflows. This improves efficiency and coordination.

The strong adoption of solutions is driven by the need for real-time operational insights. Manufacturers prefer integrated platforms over isolated tools. Cloud solutions support data-driven decision-making. They also allow faster adaptation to production changes. This keeps solutions as the dominant offering.

For Instance, in August 2025, SAP SE unveiled innovations in the SAP Cloud ERP Private 2025 release. Key features include advanced available-to-promise capabilities and AI-assisted predictive labor demand planning in Extended Warehouse Management, helping manufacturers optimize fulfillment and workforce allocation efficiently.

Deployment Model Analysis

In 2025, the Public cloud deployment holds 52.7%, reflecting preference for scalable and shared infrastructure. Public cloud environments allow manufacturers to deploy applications quickly. They reduce capital expenditure on on-site infrastructure. Accessibility across locations supports distributed production models. This improves operational flexibility.

Growth in public cloud adoption is driven by ease of maintenance and scalability. Manufacturers benefit from regular system updates. Public cloud platforms support analytics and monitoring tools. Security capabilities continue to improve. These factors sustain adoption.

For instance, in November 2025, Amazon Web Services, Inc. strengthened partnerships with Siemens and Schneider Electric. These collaborations advance cloud-edge integrations, supporting scalable public cloud deployments for real-time manufacturing data processing and operational agility.

Organization Size Analysis

In 2025, The Large enterprises represent 71.5%, highlighting their dominant role in cloud manufacturing adoption. These organizations manage complex and multi-location manufacturing operations. Cloud platforms help standardize processes across sites. Centralized systems support governance and control. Scale increases the need for cloud solutions.

Adoption among large enterprises is driven by digital transformation goals. Cloud manufacturing supports automation and data integration. Large organizations require reliable and scalable platforms. Cloud systems integrate with enterprise applications. This sustains strong enterprise demand.

For Instance, in May 2025, Johnson Controls International plc adopted Red Hat OpenShift Service on AWS for its C-CURE Cloud. This hybrid public cloud foundation modernizes security and access for large-scale enterprise operations, enabling consistent experiences across on-premises and cloud environments.

Application Analysis

In 2025, Predictive maintenance accounts for 32.4%, making it a key application area. Cloud platforms analyze equipment data to predict potential failures. Early detection helps reduce downtime and maintenance costs. Manufacturers improve asset performance through continuous monitoring. Maintenance planning becomes more efficient.

Demand for predictive maintenance is driven by the need for operational reliability. Unexpected equipment failures disrupt production. Cloud analytics support proactive maintenance strategies. Real-time data improves decision accuracy. This application continues to gain importance.

For Instance, in October 2025, PTC Inc. and Rockwell Automation extended their ThingWorx partnership. They emphasize IoT software resale for predictive maintenance, integrating DPM solutions to monitor assets and prevent downtime in manufacturing settings.

End-User Industry Analysis

In 2025, The automotive industry holds 28.9%, making it the leading end-user segment. Automotive manufacturers operate high-volume and complex production lines. Cloud manufacturing supports coordination across production stages. Real-time insights improve quality control. Efficiency remains a critical requirement.

Adoption in automotive is driven by innovation and competitiveness. Manufacturers invest in digital production technologies. Cloud platforms support flexible manufacturing processes. Integration with automation systems enhances performance. This sustains strong industry adoption.

For Instance, in March 2025, Siemens AG demonstrated cloud-based manufacturing at Hannover Messe with Microsoft and Rolls-Royce. The showcase used AI-driven CAM programming and digital twins for automotive parts, like jet engine components, via the cloud for faster innovation.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large manufacturing enterprises Very High ~38% Scalability and cost efficiency Long term platform contracts Industrial SMEs High ~27% Flexible access to manufacturing resources Phased cloud adoption Technology providers Moderate to High ~18% Platform and service expansion R and D driven investment System integrators Moderate ~11% Digital transformation services Project based deployment Research institutions Low to Moderate ~6% Advanced manufacturing innovation Pilot programs Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Cloud computing platforms Core infrastructure for manufacturing services ~4.6% Mature Industrial IoT Real time machine data integration ~3.4% Growing Digital twin technology Virtual production modeling ~2.6% Growing AI driven analytics Predictive maintenance and optimization ~2.1% Developing Edge computing Low latency processing ~1.3% Developing Emerging Trends

In the cloud manufacturing market, one observable trend is the adoption of distributed and networked production models that connect manufacturing resources across geographic locations. Organisations are increasingly using cloud platforms to unify design, production planning, and execution data in a centralised environment. This networked approach supports coordination across partner facilities, suppliers, and service providers without requiring all operations to be physically co-located.

Another emerging trend is the integration of digital twins and simulation tools with cloud manufacturing systems. Digital replicas of production lines and equipment are maintained in the cloud to test process changes, forecast bottlenecks, and validate system behaviour before applying adjustments on the factory floor. This simulation-based workflow improves confidence in operational decisions and reduces downtime associated with trial-and-error process changes.

Growth Factors

A key growth factor in the cloud manufacturing market is the demand for real-time visibility into production operations. Manufacturers face pressure to improve responsiveness to customer orders, supply chain disruptions, and changing demand patterns. By centralising production data in cloud platforms, organisations gain timely insights into capacity, utilisation, and work-in-progress status, which supports more effective planning and execution.

Another important factor supporting growth is the drive to reduce capital expenditure on local computing infrastructure. Cloud manufacturing solutions allow organisations to leverage scalable computing resources managed by providers, which reduces investment in on-site servers and maintenance personnel. This model can lower barriers to modernising manufacturing IT and enables access to advanced analytics and optimisation tools without significant upfront cost.

Opportunity

An opportunity exists in the development of modular cloud manufacturing solutions tailored to specific industry needs. Sectors such as automotive, aerospace, electronics, and pharmaceuticals have distinct compliance, quality, and operational requirements. Cloud offerings that embed domain specific templates, workflows, and analytics can reduce adoption friction and deliver more immediate value to manufacturing teams.

Another opportunity lies in enhancing collaboration with extended supply networks. Manufacturers that adopt cloud platforms can invite suppliers, logistics partners, and contract producers into shared workflows, enabling coordinated planning, demand forecasting, and inventory optimisation. This extended visibility supports leaner supply chains and reduces production risk.

Challenge

One of the main challenges for the cloud manufacturing market is ensuring consistent performance and reliability in production critical environments. Manufacturing systems often demand high levels of uptime and low latency in data exchange. Cloud platforms must meet these operational requirements while handling variable network conditions and distributed endpoints.

Another challenge involves harmonising data standards and semantic definitions across systems. Effective cloud manufacturing depends on consistent interpretation of production metrics, machine states, and process parameters. Disparate systems and data formats can impede analytics and visibility unless unified structures and conversion frameworks are established.

Key Market Segments

By Component

- Solutions

- Enterprise Resource Planning

- Customer Relationship Management

- Manufacturing Execution Systems

- Product Lifecycle Management

- Supply Chain Management

- Asset Performance Management

- Others

- Services

- Professional Services

- Managed Services

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Predictive Maintenance

- Business Analytics

- Asset Management

- Supply Chain & Logistics

- Others

By End-User Industry

- Automotive

- Aerospace & Defense

- Industrial Machinery & Heavy Equipment

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceuticals & Healthcare

- Energy & Utilities

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Microsoft Corporation, Oracle Corporation, SAP SE, and International Business Machines Corporation lead the cloud manufacturing market by providing cloud platforms that connect design, production, and enterprise systems. Their solutions support real time data access, analytics, and integration across distributed manufacturing operations. These companies focus on scalability, security, and interoperability with existing IT systems.

PTC Inc., Siemens AG, Dassault Systèmes SE, and Rockwell Automation, Inc. strengthen the market with cloud based product lifecycle management, industrial IoT, and digital twin solutions. Their platforms enable remote monitoring, predictive maintenance, and faster product innovation. These providers emphasize seamless integration between engineering and shop floor systems. Growing focus on operational efficiency supports wider adoption.

Amazon Web Services, Inc., Google LLC, Cisco Systems, Inc., Hewlett Packard Enterprise Company, Honeywell International Inc., and Schneider Electric SE expand the landscape with cloud infrastructure, edge computing, and connected automation solutions. Their offerings support flexible manufacturing models and global collaboration. These companies focus on reliability and data driven decision making.

Top Key Players in the Market

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- International Business Machines Corporation

- PTC Inc.

- Siemens AG

- Amazon Web Services, Inc.

- Google LLC

- Cisco Systems, Inc.

- Rockwell Automation, Inc.

- Hewlett Packard Enterprise Company

- Dassault Systèmes SE

- Honeywell International Inc.

- Johnson Controls International plc

- Schneider Electric SE

- Others

Recent Developments

- In April 2025, Google Cloud showcased AI-driven manufacturing at Next ’25, featuring edge AI for factory ops with Distributed Cloud and Vertex AI alongside partners like Genuine Parts and Intenseye. Demos emphasized real-time analytics and quality control, pushing cloud-edge convergence for operational gains.

- In October 2025, IBM at TechXchange advanced hybrid cloud for manufacturing with agentic AI orchestration and multi-cloud observability, plus OEM partnership with Cockroach Labs for resilient databases. These updates target production-scale AI, helping manufacturers modernize without silos.

Report Scope

Report Features Description Market Value (2025) USD 78.6 Bn Forecast Revenue (2035) USD 326.4 Bn CAGR(2026-2035) 15.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Predictive Maintenance, Business Analytics, Asset Management, Supply Chain & Logistics, Others), By End-User Industry (Automotive, Aerospace & Defense, Industrial Machinery & Heavy Equipment, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals & Healthcare, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Oracle Corporation, SAP SE, International Business Machines Corporation, PTC Inc., Siemens AG, Amazon Web Services, Inc., Google LLC, Cisco Systems, Inc., Rockwell Automation, Inc., Hewlett Packard Enterprise Company, Dassault Systèmes SE, Honeywell International Inc., Johnson Controls International plc, Schneider Electric SE, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Manufacturing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Cloud Manufacturing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- International Business Machines Corporation

- PTC Inc.

- Siemens AG

- Amazon Web Services, Inc.

- Google LLC

- Cisco Systems, Inc.

- Rockwell Automation, Inc.

- Hewlett Packard Enterprise Company

- Dassault Systèmes SE

- Honeywell International Inc.

- Johnson Controls International plc

- Schneider Electric SE

- Others