Global Cloud GIS Market By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), Service Model (Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS)), By End-User (Government and Public Sector, Utilities and Energy, Transportation and Logistics, Telecommunications, Other End-Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 21066

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

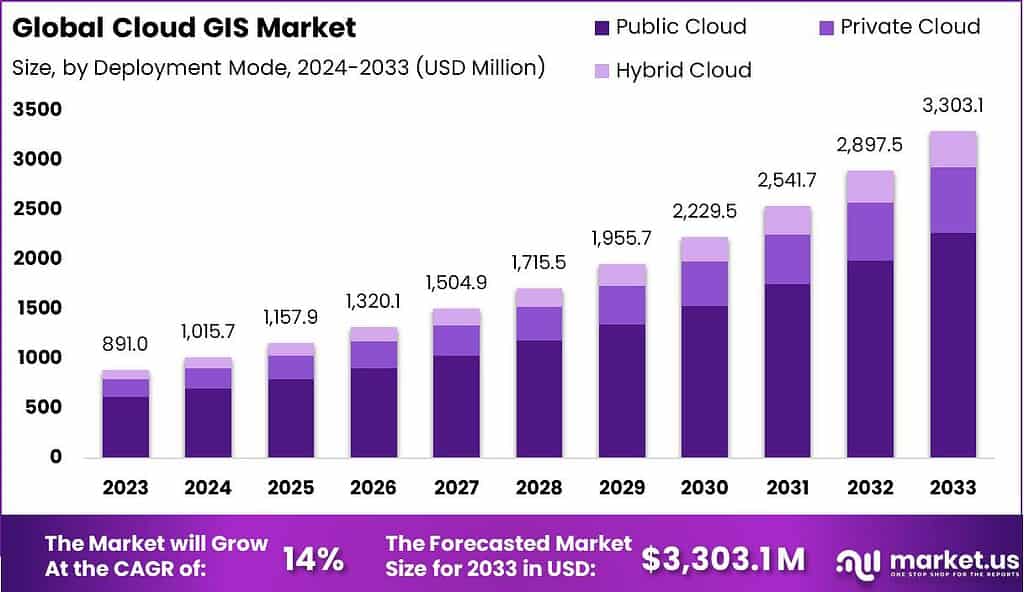

The Global Cloud GIS Market size is expected to be worth around USD 3,303.1 Million By 2033, from USD 891 Million in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

Cloud GIS refers to the use of cloud computing technology to store, manage, analyze, and share geographic information system (GIS) data. In simple terms, it means utilizing online platforms and services to handle spatial data and perform GIS tasks. This approach allows users to access GIS functionality and data remotely, without the need for expensive hardware or software installations.

The Cloud GIS market is currently experiencing robust growth. This expansion can be attributed to several factors, including the increasing demand for real-time data access, the scalability of cloud services, and the ongoing digital transformation in various industries. As businesses and governments continue to recognize the strategic value of geospatial data in decision-making processes, the market for Cloud GIS is expected to continue its upward trajectory.

advantage of Cloud GIS is the ability to collaborate and share data seamlessly. Multiple users can access and work on the same datasets simultaneously, facilitating better teamwork and information exchange. Cloud GIS also enables easy integration with other cloud-based services, such as data visualization tools or machine learning platforms, enhancing the overall capabilities of GIS applications.

Furthermore, the cloud-based approach reduces the burden of infrastructure maintenance and software updates. Cloud GIS providers handle the technical aspects, ensuring that users have access to the latest GIS functionalities and security measures. This allows organizations to focus on their core tasks and leverage GIS capabilities without the need for extensive IT resources.

Key Takeaways

- The Cloud GIS Market size is expected to be worth around USD 3,303.1 Million By 2033, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

- In 2023, the Public Cloud segment held a dominant position in the Cloud GIS market, capturing more than a 68.9% share.

- In 2023, the Software as a Service (SaaS) segment held a dominant market position in the Cloud GIS market, capturing more than a 72% share.

- In 2023, the Government and Public Sector segment held a dominant market position in the Cloud GIS market, capturing more than a 58.7% share.

- In 2023, North America held a dominant market position in the Cloud GIS market, capturing more than a 38.6% share.

Deployment Mode

In 2023, the Public Cloud segment held a dominant position in the Cloud GIS market, capturing more than a 68.9% share. This substantial market share is primarily driven by the cost-effectiveness, scalability, and ease of access that public cloud solutions offer.

Public Cloud platforms enable organizations to store and manage vast amounts of geospatial data without significant upfront investments in infrastructure. These platforms are managed off-site by third-party providers, which reduces the burden on internal IT resources and allows for a more efficient allocation of budget and personnel.

The leadership of the Public Cloud segment is further bolstered by its ability to integrate seamlessly with other cloud-based applications, enhancing operational efficiencies and data interoperability across multiple platforms. This is particularly advantageous for industries such as urban planning, environmental monitoring, and logistics, where real-time data access and collaboration are crucial.

Additionally, the Public Cloud model supports rapid deployment and global scalability, which are essential for businesses looking to expand their geographical footprint without compromising on data accessibility or processing capabilities. Moreover, the continuous advancements in cloud security and compliance measures have made Public Cloud solutions more attractive to sectors that handle sensitive geospatial data.

With enhanced security protocols and regular updates, public cloud providers can offer a level of data protection that is difficult for private clouds to match at a comparable cost. This aspect is particularly appealing to government entities and large organizations that prioritize data security but also require the flexibility and economic benefits of cloud technologies. Thus, the Public Cloud segment continues to lead the Cloud GIS market, driven by its ability to provide a blend of performance, security, and cost efficiency.

Service Model

In 2023, the Software as a Service (SaaS) segment held a dominant market position in the Cloud GIS market, capturing more than a 72% share. This leading stance is largely due to the segment’s capacity to offer user-friendly, flexible, and cost-efficient solutions for geospatial data management.

SaaS provides comprehensive software solutions hosted on remote servers, which are accessible via the web. This eliminates the need for organizations to invest in hardware or manage complex software installations and maintenance, significantly reducing IT overheads and accelerating deployment times.

The appeal of the SaaS model in Cloud GIS is also enhanced by its scalability and integration capabilities. Organizations can easily scale their usage up or down based on their changing needs without significant capital expenditure. Moreover, SaaS platforms often come with robust APIs that allow for seamless integration with existing enterprise applications, thereby enhancing workflow efficiencies and data coherence across various business functions.

This integration is vital for industries that rely on real-time data and geographic information systems, such as transportation, logistics, and environmental management. Furthermore, SaaS providers continuously update their offerings with the latest features and security enhancements without disrupting the end user’s operations. This ensures that organizations always have access to the most advanced tools without additional upgrade costs or downtime, which is particularly crucial in the fast-evolving field of geospatial data analysis.

End-User

In 2023, the Government and Public Sector segment held a dominant market position in the Cloud GIS market, capturing more than a 58.7% share. This prominence is attributed to the critical role that geospatial data plays in public administration and infrastructure management.

Government agencies utilize Cloud GIS for a variety of purposes, including urban planning, disaster management, public safety, and environmental monitoring. The adoption of Cloud GIS allows for enhanced decision-making capabilities, as it provides officials with accurate, real-time geographic data that is crucial for effective governance and emergency response.

The Government and Public Sector’s reliance on Cloud GIS is also driven by the need for cost-effective and scalable solutions that can handle large volumes of data across multiple departments. Cloud GIS platforms facilitate the integration and analysis of data from various sources, improving collaboration between different governmental bodies.

This interoperability is essential for projects that span multiple jurisdictions or require coordinated efforts across different sectors, such as transportation networks, utility management, and land-use planning. Additionally, the security features offered by Cloud GIS are particularly appealing to the public sector, where data sensitivity is paramount.

Cloud providers typically invest heavily in security, offering advanced measures such as data encryption, network security, and compliance with stringent regulatory standards. This level of security assurance is crucial for government agencies tasked with safeguarding public data against unauthorized access or cyber threats. Hence, the Government and Public Sector segment continues to lead the Cloud GIS market, driven by its need for robust, secure, and collaborative geospatial solutions.

Key Market Segments

Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

Service Model

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

End-User

- Government and Public Sector

- Utilities and Energy

- Transportation and Logistics

- Telecommunications

- Other End-Users

Driver

Increasing Demand for Real-Time Data

The Cloud GIS market is primarily driven by the increasing demand for real-time data, which is crucial across various industries such as transportation, logistics, urban planning, and emergency response. The ability to access and analyze geographic data in real-time allows organizations to respond more quickly to changes and make informed decisions promptly.

Moreover, the expansion of IoT and smart devices has further propelled this demand, as these devices rely on continuous data flow and geospatial analytics to function effectively. This trend is expected to continue, reinforcing the need for cloud-based GIS solutions that can handle large streams of data dynamically and efficiently.

Restraint

Integration Challenges with Legacy Systems

Integration issues with existing legacy systems pose a significant barrier to the adoption of Cloud GIS technologies. Many organizations face difficulties when attempting to merge new cloud-based GIS with their established, on-premises systems. This integration often requires substantial time and financial investment, and can lead to technical challenges, such as data discrepancies and system incompatibilities.

These hurdles can deter organizations from transitioning to cloud-based systems, despite the potential long-term benefits in scalability and cost-efficiency. Addressing these integration challenges is crucial for the wider adoption and success of Cloud GIS in the market.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant growth opportunity for the Cloud GIS sector. Countries in regions such as Asia-Pacific, Africa, and Latin America are experiencing rapid urbanization and need efficient planning and management tools. Cloud GIS can provide these tools without the necessity for heavy local infrastructure, making it an ideal solution for these fast-developing areas.

Additionally, governments in these regions are increasingly supportive of digital transformation initiatives, further boosting the adoption of cloud technologies. This expansion is facilitated by the decreasing costs of cloud computing and the increasing availability of high-speed internet.

Challenge

Data Security and Privacy Concerns

Data security and privacy remain formidable challenges in the Cloud GIS market. As the use of GIS expands into areas dealing with sensitive information, such as government operations, public safety, and healthcare, the need for robust security measures becomes paramount.

Concerns over data breaches and unauthorized access are significant, as these can lead to severe consequences, including privacy violations and operational disruptions. Cloud GIS providers must continuously update their security practices and compliance measures to address these risks and reassure clients of the safety and integrity of their data.

Growth Factors

- Technological Advancements: Innovations in technology, such as augmented reality, machine learning, and quantum computing, have significantly enhanced the capabilities of GIS applications, driving growth in the cloud GIS market.

- Increased Demand for Real-Time Data: The need for real-time geographic data analysis across various industries, such as transportation and logistics, has become a crucial driver. Cloud GIS supports dynamic data updates and real-time decision-making.

- Scalability and Flexibility: Cloud-based GIS solutions offer scalability and flexibility that are essential for handling large datasets and variable workloads, which traditional systems cannot manage efficiently.

- Cost-Effectiveness: The reduction in costs related to IT infrastructure and maintenance by adopting cloud GIS solutions is a significant growth factor. Organizations can utilize sophisticated GIS capabilities without heavy upfront investments.

- Government and Defense Applications: Increasing use of cloud GIS in government and defense for activities like urban planning, asset management, and emergency response also propels market growth.

Emerging Trends

- Cloud Computing: The integration of cloud computing with GIS technologies is making GIS services more accessible and cost-effective, allowing for enhanced data storage and processing capabilities.

- Mobile GIS: The rise of mobile GIS applications, which allow users to access and analyze geospatial data directly from mobile devices, is an emerging trend that enhances field operations and data collection.

- Artificial Intelligence and Machine Learning: These technologies are being increasingly integrated with GIS to automate data analysis, enhancing the accuracy and efficiency of spatial data interpretation.

- Drone-based GIS: The use of drones for data collection in GIS applications is growing, providing high-resolution imagery that can be used for detailed analysis and mapping.

- Geospatial AI (GeoAI): This technology uses AI to analyze and interpret large volumes of geospatial data, helping industries like agriculture, logistics, and urban planning to optimize operations and planning based on geographic insights.

Regional Analysis

In 2023, North America held a dominant market position in the Cloud GIS market, capturing more than a 38.6% share. This leadership is primarily due to the region’s advanced IT infrastructure and the widespread adoption of cloud technologies across various sectors, including government, defense, and private enterprises.

The demand for Cloud GIS in North America was valued at USD 343.9 billion in 2023 and is anticipated to grow significantly in the forecast period. North America’s robust technological ecosystem, supported by substantial investments in cloud computing and big data analytics, has facilitated the growth of cloud GIS solutions that are both scalable and efficient.

Moreover, the presence of major cloud GIS providers like Google, Esri, and Microsoft in this region further drives innovation and accessibility of cloud GIS services. These companies continually enhance their offerings, integrating advanced features such as real-time analytics and machine learning, which cater to the growing demand for more sophisticated and comprehensive geospatial analysis tools.

The region’s regulatory framework also supports the growth of cloud-based technologies by promoting data security and privacy standards, encouraging organizations to adopt cloud GIS solutions without compromising on data integrity. Coupled with ongoing government initiatives to modernize public sector infrastructure, these factors collectively ensure that North America remains at the forefront of the Cloud GIS market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cloud GIS market is characterized by a competitive landscape with several key players contributing to its development and expansion. Esri, a major player, is renowned for its ArcGIS platform, which provides comprehensive GIS solutions that integrate seamlessly with cloud environments. Google LLC enhances the market through its Google Maps Platform, offering robust mapping and location data services that cater to a wide range of industries.

Microsoft Corporation also plays a crucial role with its Azure Maps service, providing enterprise-ready spatial analytics and mobility solutions that leverage cloud computing. SuperMap, another significant contributor, offers innovative GIS services that support various functions from data visualization to spatial data analysis, catering particularly to Asian markets.

Top Key Players in the Market

- Esri

- Google LLC

- Microsoft Corporation

- SuperMap

- Hexagon AB

- Trimble Inc.

- CARTO

- GIS Cloud

- HERE Technologies

- Pitney Bowes Inc.

- Other Key Players

Recent Developments

- Google LLC: In 2023, Google introduced various products including the Gemini AI model and updated the Google Maps platform with new capabilities like generative AI for creating images and an immersive view for routes. These enhancements leverage advanced AI to improve user interaction and functionality in geospatial services.

- Microsoft Corporation: Microsoft announced a substantial $3.3 billion investment in AI innovation in Wisconsin in May 2024, focusing on cloud and AI infrastructure. This investment is part of Microsoft’s broader strategy to integrate AI across its services, which could have implications for its geospatial offerings through platforms like Azure Maps.

- Esri: Esri continues to advance in the geospatial domain, hosting the Esri User Conference in July 2024 in San Diego, which will showcase the latest products and innovations in GIS technology. This event is a significant platform for demonstrating new advancements and training opportunities in ArcGIS and other Esri technologies.

- SuperMap: SuperMap GIS 2023: Launched in 2023, this includes new products like SuperMap ImageX Pro (Beta), a cross-platform remote sensing image processing desktop software. This software facilitates the integration of remote sensing and GIS, aiming to enhance data processing efficiency.

Report Scope

Report Features Description Market Value (2023) USD 891 Mn Forecast Revenue (2033) USD 3,303.1 Mn CAGR (2024-2033) 14% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), Service Model (Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS)), By End-User (Government and Public Sector, Utilities and Energy, Transportation and Logistics, Telecommunications, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Esri, Google LLC, Microsoft Corporation, SuperMap, Hexagon AB, Trimble Inc., CARTO, GIS Cloud, HERE Technologies, Pitney Bowes Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Cloud GIS?Cloud GIS (Geographic Information System) is a web-based platform that provides geospatial data and services via the cloud. It allows users to collect, store, analyze, and share geographic information in real-time. This technology is essential for various applications, including urban planning, disaster management, natural resource management, and transportation.

How big is Cloud GIS Market?The Global Cloud GIS Market size is expected to be worth around USD 3,303.1 Million By 2033, from USD 891 Million in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

What are the top players operating in the Cloud GIS Market?Esri, Google LLC, Microsoft Corporation, SuperMap, Hexagon AB, Trimble Inc., CARTO, GIS Cloud, HERE Technologies, Pitney Bowes Inc., Other Key Players

What are the key driving factors for the growth of the Cloud GIS Market?The key driving factors for the growth of the Cloud GIS market are increased adoption of IoT and smart devices, government investments in GIS technology, and the rising demand for real-time data analytics and location-based services.

What are the key challenges facing the Cloud GIS market?- High Initial Costs: The transition from traditional GIS systems to cloud-based solutions involves significant initial investment, which can be a barrier for some organizations.

- Data Security Concerns: Ensuring the security and privacy of sensitive geospatial data stored in the cloud is a major concern for users.

Which region is expected to hold the highest share in the Global Cloud GIS Market?In 2023, North America held a dominant market position in the Cloud GIS market, capturing more than a 38.6% share.

-

-

- Esri

- Google LLC

- Microsoft Corporation

- SuperMap

- Hexagon AB

- Trimble Inc.

- CARTO

- GIS Cloud

- HERE Technologies

- Pitney Bowes Inc.

- Other Key Players