Global Cloud FinOps Market Report By Component (Solutions, Services), By Service Type (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS)), By Deployment (Public, Private, Hybrid), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, IT & Telecom, Retail & Consumer Goods, Healthcare, Manufacturing, Government & Public Sector, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127489

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

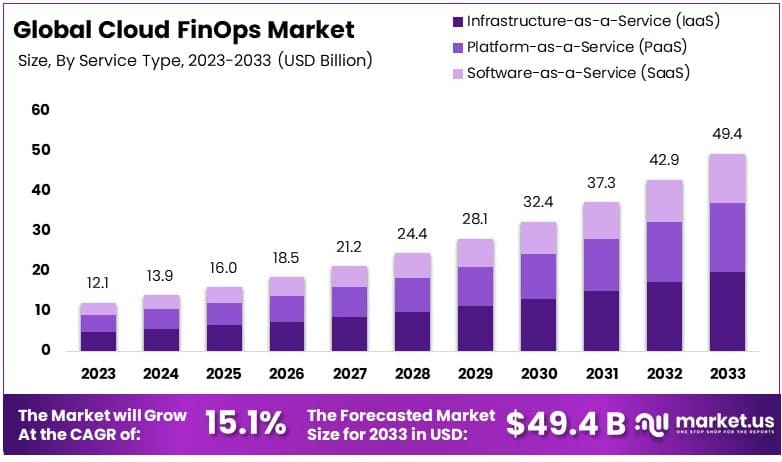

The Global Cloud FinOps Market size is expected to be worth around USD 49.4 Billion by 2033, from USD 12.1 Billion in 2023, growing at a CAGR of 15.1% during the forecast period from 2024 to 2033.

Cloud FinOps, short for Financial Operations, is a framework that helps organizations manage their cloud spending effectively. It combines financial accountability with operational efficiency to ensure that cloud costs are optimized without compromising performance. The Cloud FinOps market focuses on tools, processes, and best practices that enable businesses to gain visibility into their cloud usage, allocate resources efficiently, and optimize spending.

In this market, companies use data-driven insights to align their cloud usage with financial goals. Cloud FinOps solutions help teams work together, including finance, operations, and engineering, to manage cloud costs in real-time. This market is growing rapidly as more companies adopt cloud services and look for ways to control their spending.

The Cloud FinOps market is experiencing significant growth, driven by the increasing need for organizations to optimize cloud spending while maintaining business value. As enterprise IoT spending on cloud services is projected to reach $1.8 trillion by 2025, FinOps has become a crucial tool for managing cloud costs. Companies are adopting FinOps practices to gain better financial oversight, allowing for more efficient allocation of resources and improved return on investment in cloud infrastructure.

Government initiatives are playing a pivotal role in the expansion of the FinOps market, particularly in the public sector. The U.S. federal government, which spent approximately $60 billion on cloud services in 2023, recognizes the potential of FinOps to save up to $1 billion annually.

This has led to the development of tailored frameworks for government use, helping to address the challenges of legacy systems and regulatory compliance. The public sector’s embrace of FinOps reflects the growing awareness of its value across various industries.

However, several challenges remain. Despite the rising importance of cloud cost management, a significant number of organizations struggle with full-scale implementation. According to the FinOps Foundation, 33% of organizations face difficulties involving engineering teams in cloud cost optimization, limiting the potential effectiveness of FinOps initiatives.

Furthermore, only 13% of organizations have a mature FinOps practice, highlighting that the market is still in its early stages of adoption.

Corporate investments and partnerships in the private sector are further accelerating the growth of the FinOps market. Organizations that have integrated FinOps practices have reported potential cloud cost reductions of 20-30%, making it a valuable strategy for managing rising cloud expenses.

Additionally, 82% of companies now have a formal FinOps team, though the maturity levels of these teams vary widely. This demonstrates a strong commitment from the private sector, as businesses increasingly prioritize financial accountability in cloud operations.

While the Cloud FinOps market is poised for growth, the need for greater integration, particularly among engineering teams, remains critical for its full potential to be realized.

Key Takeaways

- The Cloud FinOps Market was valued at USD 12.1 billion in 2023, and is expected to reach USD 49.4 billion by 2033, with a CAGR of 15.1%.

- In 2023, Solutions dominated the component segment with 67% share due to the increasing demand for cost management and optimization tools.

- In 2023, Infrastructure-as-a-Service (IaaS) led the service type segment with 40% due to its scalability and flexibility in cloud operations.

- In 2023, Public deployment was the leading segment with 45% share, driven by cost efficiency and widespread adoption among enterprises.

- In 2023, Large Enterprises dominated the enterprise size segment with 65% share, reflecting their significant investment in cloud management.

- In 2023, North America held the dominant regional market share of 40%, driven by advanced cloud infrastructure and strong adoption rates.

Type Analysis

Solutions dominate the component segment with 67% due to comprehensive demand across industries for integrated cloud financial management tools.

The cloud financial operations (FinOps) market is significantly segmented by type, with Solutions emerging as the most dominant sub-segment. This segment accounts for a substantial 67% of the market share. The preeminence of Solutions in the cloud FinOps arena can be attributed to their essential role in providing comprehensive tools that enable businesses to optimize and manage their cloud spending efficiently.

These tools integrate various functions such as cost monitoring, real-time analysis, budgeting, and forecasting, which are critical for organizations aiming to harness the economic benefits of cloud technology while maintaining control over expenses.

The increasing complexity of cloud computing and the proliferation of multi-cloud strategies have further propelled the demand for robust FinOps solutions. These solutions empower organizations to gain visibility into their cloud usage and costs, leading to more informed decision-making and enhanced financial accountability.

Moreover, the shift towards digital transformation, accelerated by the global shift in work dynamics—predominantly remote operations—has necessitated the deployment of sophisticated FinOps solutions that can provide detailed insights and proactive cost management.

While Solutions dominate, Services also play a crucial role in supporting the implementation and ongoing optimization of cloud financial management strategies. Although they constitute a smaller portion of the market, services are vital for providing the expertise and support needed for effective FinOps execution. Services ensure that the solutions are aligned with the specific needs of an organization, thereby enhancing the overall efficacy of FinOps practices.

Service Type Analysis

Infrastructure-as-a-Service (IaaS) dominates the service type segment with 40% due to its foundational role in providing scalable and flexible cloud infrastructure.

In the cloud FinOps market, the service type segment is led by Infrastructure-as-a-Service (IaaS), which holds a 40% share. IaaS stands out as the backbone for many organizations’ cloud strategies, offering essential computing resources, storage, and networking capabilities on-demand.

The dominance of IaaS is primarily due to its ability to provide a scalable and flexible foundation that supports a wide range of applications and workloads. This flexibility is particularly crucial in an era where digital agility and scalability dictate business success.

IaaS enables organizations to pay only for the resources they use, which aligns perfectly with the FinOps principles of cost optimization and avoidance of overprovisioning. The scalability of IaaS allows businesses to adjust their resource consumption based on actual needs, which is critical for managing operational expenditures in a dynamic market environment.

While IaaS holds the largest share, other service types like Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS) also contribute significantly to the cloud FinOps landscape. PaaS provides a platform allowing customers to develop, run, and manage applications without the complexity of building and maintaining the infrastructure typically associated with the process.

SaaS, on the other hand, offers ready-to-use software applications on a subscription basis, which helps in further optimizing operational costs. Both segments are integral to the comprehensive deployment of cloud services, complementing IaaS by enabling a full spectrum of cloud solutions that cater to diverse business needs.

Deployment Analysis

Public cloud dominates the deployment segment with 45% due to its ease of access and cost-effectiveness.

The deployment segment of the cloud FinOps market is predominantly led by public cloud solutions, which account for 45% of the market. The public cloud’s dominance can be traced back to its high accessibility and cost-effectiveness, making it a preferred choice for a broad spectrum of industries.

Public clouds offer a pay-as-you-go model that allows businesses to scale their cloud managed services resources up or down based on real-time demands, aligning closely with FinOps objectives to control and optimize cloud expenditures.

Public clouds are managed by third-party providers, which reduces the internal management burden and lowers the IT overhead for businesses. This aspect is particularly appealing to small and medium-sized enterprises (SMEs) and startups that may not have extensive capital to invest in private cloud infrastructure. Furthermore, the public cloud offers robust security measures, high availability, and continuous updates that enhance business operations without the need for significant direct management.

Despite the prominence of public deployment, private and hybrid clouds also play critical roles within the FinOps framework. Private clouds offer enhanced security and control, which is crucial for industries with stringent regulatory requirements such as healthcare and finance.

Hybrid clouds, combining the benefits of both private and public clouds, provide a balanced approach by allowing sensitive data to be kept on a private cloud while still leveraging the scalability and cost-efficiency of the public cloud for less critical data. This flexibility makes hybrid clouds an attractive option for organizations seeking to optimize their cloud environments in alignment with FinOps principles.

Enterprise Size Analysis

Large Enterprises dominate the enterprise size segment with 65% due to their expansive resource base.

The enterprise size segment within the cloud FinOps market is predominantly controlled by Large Enterprises, which hold a commanding 65% market share. This significant dominance is primarily due to the substantial resources that large enterprises possess, which allow them to invest in and benefit from advanced cloud technologies.

Large enterprises often have complex operations and vast data management needs that require robust cloud infrastructure, making them ideal candidates for comprehensive FinOps solutions. These solutions enable them to monitor, manage, and optimize cloud spending across multiple departments and global offices efficiently.

The scale of operations in large enterprises often leads to sizable cloud expenditures, which necessitates a disciplined approach to FinOps to prevent cost overruns and ensure financial accountability. The adoption of FinOps practices in these enterprises is driven by the need to align cloud investment with business value, ensuring that every dollar spent on the cloud is justifiable and contributes to overall business objectives.

While Large Enterprises dominate, Small and Medium-sized Enterprises (SMEs) also represent a significant segment of the market. SMEs are increasingly adopting cloud technologies as they seek to leverage the operational flexibility and cost efficiency provided by the cloud.

FinOps solutions tailored for SMEs are designed to be more accessible and less resource-intensive, allowing these smaller companies to effectively manage their cloud resources without the need for extensive in-house expertise.

Industry Vertical Analysis

The BFSI sector dominates the industry vertical segment with 25% due to its stringent data security and compliance requirements.

In the cloud FinOps market, the industry vertical segment is led by the Banking, Financial Services, and Insurance (BFSI) sector, which accounts for 25% of the market share. The dominance of BFSI in this market can be attributed to the sector’s stringent requirements for data security, regulatory compliance, and the need for highly scalable and flexible IT resources to handle variable workloads.

Financial institutions leverage cloud technologies to enhance their service delivery while maintaining compliance with regulatory requirements and managing risks effectively.

The adoption of cloud technologies within the BFSI sector is driven by the need to innovate and improve customer experiences while also achieving cost efficiencies through FinOps practices. Cloud solutions enable BFSI institutions to deploy advanced analytics, artificial intelligence, and machine learning capabilities, which are essential for real-time decision-making and personalized customer services.

Other industry verticals, including IT & Telecom, Retail & Consumer Goods, Healthcare, Manufacturing, and Government & Public Sector, also contribute to the cloud FinOps market. Each of these sectors has unique needs that influence their cloud adoption and FinOps practices.

For instance, healthcare demands high data privacy and security, manufacturing focuses on scalability and integration with IoT, and government sectors prioritize compliance and public data management. Understanding the specific needs and challenges of each vertical is crucial for tailoring FinOps solutions that can effectively address and optimize cloud usage in diverse environments.

Key Market Segments

By Component

- Solutions

- Services

By Service Type

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Healthcare

- Manufacturing

- Government & Public Sector

- Other Industry Verticals

Driver

Cost Optimization and Scalability Drive Market Growth

The Cloud FinOps market is driven by several factors, including cost optimization and scalability needs, government regulations, and partnerships between organizations. Government initiatives, such as the U.S. government’s efforts to manage and optimize cloud spending in public sectors, have led to more structured FinOps strategies.

Additionally, partnerships between organizations, such as collaborations between FinOps providers and cloud service platforms, help streamline cloud management processes, reducing inefficiencies. Roughly 30% of cloud expenditures are considered wasteful due to poor resource allocation. FinOps solutions have been shown to reduce these inefficiencies by 20% to 30%, making them a key driver in the market.

Moreover, the growing adoption of multi-cloud environments demands more sophisticated cost control strategies. Enterprises are increasingly using FinOps to optimize financial governance across complex cloud environments.

These tools also assist organizations in better complying with regulatory requirements, such as tagging resources for cost visibility, a strategy adopted by 31% of businesses. These factors, combined with the rising demand for cloud computing, regulatory pressures, and cost-saving innovations, are significantly driving the growth of the Cloud FinOps market.

Restraint

Complexity and Cost Control Restraints Market Growth

Several factors are restraining the growth of the Cloud FinOps market. One major challenge is the complexity of managing cloud environments. As organizations move towards multi-cloud and hybrid cloud strategies, monitoring and optimizing costs becomes increasingly difficult. This complexity can lead to inefficiencies and unexpected expenses, limiting cost control.

Another restraining factor is the lack of transparency in cloud billing. Many cloud service providers offer pricing models that are not easily understandable, making it hard for businesses to accurately predict and manage costs. This lack of clarity affects budgeting and financial planning.

Additionally, the skills gap in cloud financial management is a concern. Many businesses struggle to find qualified professionals who can effectively implement and oversee FinOps practices. Without the right expertise, organizations face difficulties in executing cost-saving strategies.

Lastly, regulatory compliance requirements add further complications. Managing data across different geographical locations involves navigating various legal frameworks, which can increase operational costs and slow down cloud adoption. These compliance challenges often make it harder for companies to achieve their financial goals.

Opportunity

Innovation and Multi-Cloud Adoption Provide Opportunities

The Cloud FinOps market presents numerous opportunities for players looking to capitalize on emerging trends. One major opportunity is the increasing demand for innovation in cloud cost management tools. As cloud environments become more complex, companies are seeking advanced solutions that offer automation and real-time cost optimization.

The rise of multi-cloud strategies also creates significant opportunities. More businesses are adopting multi-cloud environments to leverage the benefits of different platforms. This complexity increases the demand for FinOps tools that can manage costs across multiple providers efficiently. Providers that can develop solutions to address these challenges stand to gain.

Additionally, government initiatives and regulations focused on cloud adoption and financial governance are driving the need for compliant FinOps tools. Governments are investing in cloud technologies, creating opportunities for FinOps providers to support public sector cloud financial management.

Partnerships between cloud service providers and FinOps companies are another area of growth. These collaborations can lead to integrated solutions that enhance cloud cost transparency, opening up opportunities for market players to expand their offerings. By focusing on innovation, multi-cloud management, compliance, and strategic partnerships, players in the Cloud FinOps market can capitalize on these emerging opportunities.

Challenge

Data Security and Integration Challenges Market Growth

The Cloud FinOps market faces several challenges that affect its growth. One key challenge is data security. As organizations move more critical data to the cloud, concerns about data breaches and cyber threats increase. This need for enhanced security measures can slow cloud adoption and raise costs for businesses.

Integration issues also present a significant challenge. Many companies struggle to integrate cloud FinOps tools with their existing IT systems. The complexity of aligning different platforms often results in delays and inefficiencies, limiting the effectiveness of FinOps practices.

Another challenge is the lack of visibility into cloud usage. Without clear insights into how resources are being used, businesses find it difficult to optimize costs and manage their cloud environments effectively. This lack of transparency can hinder decision-making and financial planning.

Lastly, organizational resistance to change is a factor. Cloud FinOps requires collaboration between finance, IT, and operational teams, which may not always be embraced within traditional corporate structures. Resistance to adopting these new ways of working can slow down the implementation of cost optimization strategies.

Growth Factors

Enterprise Digital Transformation and Complex Cloud Environments Are Growth Factors

The ongoing digital transformation across enterprises is driving the need for Cloud FinOps to manage growing cloud expenditures effectively. As businesses increasingly shift operations to the cloud, managing cloud costs becomes a priority. This ensures cost efficiency while scaling operations.

The complexity of modern cloud environments, with multi-cloud and hybrid cloud setups, further increases the need for sophisticated financial management solutions. Organizations must monitor and optimize cloud usage across various platforms, adding complexity that Cloud FinOps can address.

In response to this, automation tools are in high demand. These tools streamline cost monitoring, enabling real-time analysis and optimization of cloud resources. Automated processes allow faster, more accurate tracking of cloud consumption, empowering businesses to react quickly to cost inefficiencies.

Thus, digital transformation, complex cloud infrastructures, and automation collectively drive the growth of the Cloud FinOps market. They address the increasing challenges and requirements of modern cloud financial management.

Emerging Trends

Hybrid Cloud Infrastructure Is Latest Trending Factor

The growth of the Cloud FinOps market is being driven by several key trends. One major factor is the adoption of hybrid cloud infrastructure. This approach integrates both public and private cloud environments, offering businesses greater flexibility and efficiency in managing their cloud resources.

Edge computing is another key trend. By processing data closer to its source, it reduces latency and optimizes the performance of cloud services. This enables faster decision-making and better resource utilization, especially for time-sensitive applications.

Additionally, cloud-native applications are becoming increasingly popular. These applications are designed specifically for cloud environments, enhancing scalability and performance. Their ability to run seamlessly across different cloud platforms makes them valuable for businesses.

Serverless computing also plays a significant role by simplifying cloud infrastructure management. It eliminates the need to handle servers manually, allowing developers to focus on code and innovation rather than infrastructure. This drives cost savings and operational efficiency.

Finally, the rise of Infrastructure as Code (IaC) is automating cloud infrastructure management through programmable scripts. This further streamlines operations and reduces the potential for human error. Together, these trends are contributing to the Cloud FinOps market by improving cost management, optimizing resources, and enhancing operational efficiency.

Regional Analysis

North America Dominates with 40% Market Share

North America’s dominance in the Cloud FinOps market with a 40% share and a valuation of USD 4.84 billion, is largely due to its advanced technological infrastructure and the presence of major cloud service providers. The region’s businesses are highly inclined towards adopting cloud technologies to enhance operational efficiencies, which directly fuels the demand for FinOps solutions to manage and optimize cloud expenditures.

The robust economic environment in North America supports significant investments in cloud technologies. Moreover, the region’s stringent regulatory standards regarding data security and privacy push companies to adopt FinOps practices to ensure compliance and cost management. This, combined with a culture of technological innovation, drives the Cloud FinOps market forward.

Given the rapid adoption of cloud services and the ongoing technological advancements, North America is expected to maintain its lead in the Cloud FinOps market. Increasing awareness about cloud cost management and the introduction of more sophisticated FinOps tools are likely to further enhance the region’s market position.

- Europe: Holds a significant position in the Cloud FinOps market, characterized by strong data protection laws and growing demand for cost-efficient cloud solutions among European enterprises.

- Asia Pacific: Fast-growing due to rapid digital transformation and increased cloud adoption in major economies like China, Japan, and India. The region shows potential for high growth in cloud investment, influencing its Cloud FinOps market.

- Middle East & Africa: Emerging in the Cloud FinOps landscape with investments in cloud technologies fueling market growth, particularly in Gulf Cooperation Council (GCC) countries focusing on digital transformation.

- Latin America: Exhibits gradual growth in the Cloud FinOps market, driven by digitalization efforts and increasing cloud adoption among SMEs seeking cost-effective business solutions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the Cloud FinOps market, the top three key players—Amazon Web Services (AWS), Microsoft, and Google—dominate with significant influence.

AWS leads the market with its robust cloud infrastructure, extensive customer base, and advanced financial management tools. AWS’s deep integration with its cloud services provides unmatched cost optimization features, driving its market leadership.

Microsoft follows closely with Azure. Microsoft’s strategic positioning is strengthened by its enterprise relationships and comprehensive suite of cloud financial management tools. Azure’s seamless integration with other Microsoft products gives it a competitive edge, particularly in hybrid cloud environments.

Google is also a key player with Google Cloud Platform (GCP). Known for its strong data analytics and AI capabilities, Google leverages these strengths to offer advanced FinOps solutions. GCP’s focus on innovation and efficiency helps it maintain a competitive position in the market.

Together, these three companies set the pace in the Cloud FinOps market, driving innovation and setting industry standards. Their strategic positioning and influence shape the market’s evolution, with other players striving to compete against their dominance.

Top Key Players in the Market

- VMware

- Amdocs

- SoftwareOne

- Apptio, Inc.

- Nagarro

- HCL

- Flexera

- KubeCost

- Nordcloud Oy

- AWS

- Microsoft

- IBM

- Oracle

- Other Key Players

Recent Developments

- June 26, 2023: IBM announced the acquisition of Apptio Inc., a leader in financial and operational IT management, for $4.6 billion. Apptio’s FinOps tools, including ApptioOne, Cloudability, and Targetprocess, will be integrated with IBM’s Watsonx AI platform, expanding IBM’s cloud optimization and automation offerings.

- March 2024: AWS introduced several updates to its FinOps toolkit, including a new 7-day return window for Savings Plans and enhancements to AWS Compute Optimizer. These updates aim to help organizations optimize cloud costs by offering more flexibility in managing commitments and improving rightsizing recommendations.

- May 2022: Broadcom’s $61 billion acquisition of VMware, initiated earlier, continues to impact the cloud FinOps landscape. VMware’s integration into Broadcom’s portfolio is expected to strengthen Broadcom’s cloud and software services, enhancing multi-cloud services that can drive FinOps efficiencies.

- 2024: SoftwareOne was recognized as a major player in cloud professional services by IDC. The company reported that its customers achieved over $1.95 billion in software savings through optimized cloud management services. SoftwareOne continues to expand its cloud services, including FinOps offerings, which help businesses optimize their cloud investments across various platforms.

Report Scope

Report Features Description Market Value (2023) USD 12.1 Billion Forecast Revenue (2033) USD 49.4 Billion CAGR (2024-2033) 15.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Service Type (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS)), By Deployment (Public, Private, Hybrid), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, IT & Telecom, Retail & Consumer Goods, Healthcare, Manufacturing, Government & Public Sector, Other Industry Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape VMware, Amdocs, SoftwareOne, Apptio, Inc., Nagarro, HCL, Flexera, KubeCost, Nordcloud Oy, AWS, Microsoft, IBM, Google, Oracle, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Cloud FinOps Market?The Cloud FinOps Market focuses on the financial operations and management of cloud computing resources, optimizing cloud spending, and ensuring financial accountability across various cloud services and deployment models.

How big is the Cloud FinOps Market?The Cloud FinOps Market was valued at USD 12.1 billion and is expected to grow to USD 49.4 billion, with a CAGR of 15.1% during the forecast period.

What are the key factors driving the growth of the Cloud FinOps Market?The growth of the Cloud FinOps Market is driven by increasing cloud adoption, the need for optimized cloud spending, and the rising complexity of managing multi-cloud environments and financial operations.

What are the current trends and advancements in the Cloud FinOps Market?Trends include the adoption of FinOps practices to improve cloud cost management, the integration of advanced analytics for financial visibility, and the growing emphasis on optimizing Infrastructure-as-a-Service (IaaS) expenditures.

What are the major challenges and opportunities in the Cloud FinOps Market?Challenges include the complexity of managing costs across various cloud platforms and services, and integrating financial operations into cloud strategies. Opportunities lie in the increasing demand for solutions that provide real-time financial insights and control over cloud spending.

Who are the leading players in the Cloud FinOps Market?Leading players include VMware, Amdocs, SoftwareOne, Apptio, Inc., Nagarro, HCL, Flexera, KubeCost, Nordcloud Oy, AWS, Microsoft, IBM, Google, Oracle, and other key players.

-

-

- VMware

- Amdocs

- SoftwareOne

- Apptio, Inc.

- Nagarro

- HCL

- Flexera

- KubeCost

- Nordcloud Oy

- AWS

- Microsoft

- IBM

- Oracle

- Other Key Players