Global Cloud Data Warehouse Market Size, Share, Trends Analysis Report By Type (Enterprise DWaaS, Operational Data Storage), By Deployment Mode (Public Cloud, Private Cloud), By Application (Business Intelligence (BI), Predictive Analytics, Customer Analytics, Operational Analytics, Data Modernization), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government and Public Sector, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2025

- Report ID: 132186

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

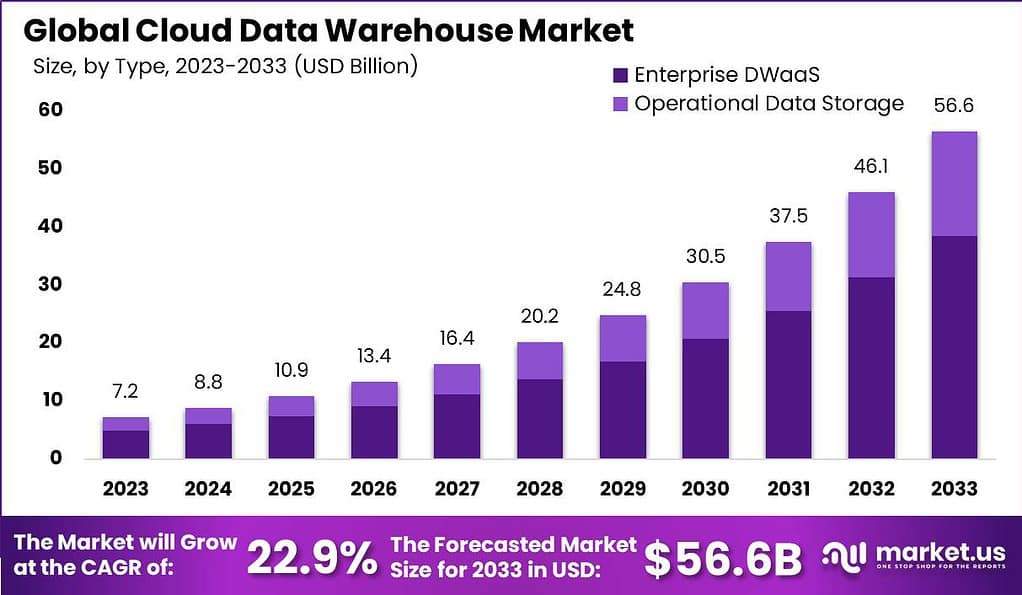

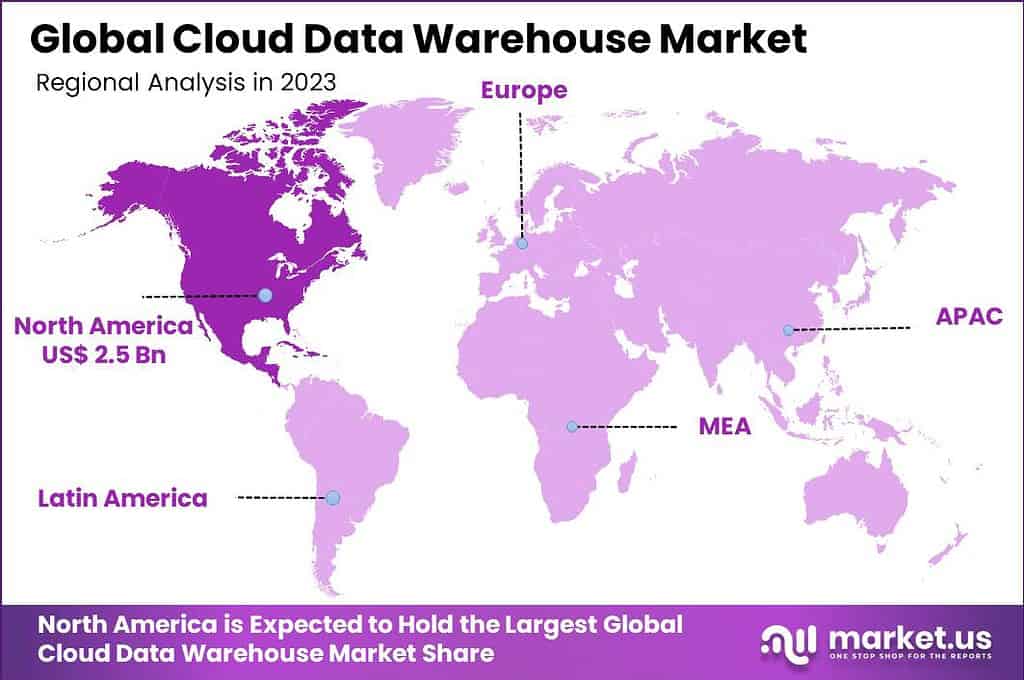

The Global Cloud Data Warehouse Market size is expected to be worth around USD 56.6 Billion By 2033, from USD 7.2 Billion in 2023, growing at a CAGR of 22.90% during the forecast period from 2024 to 2033. In 2023, North America captured more than 34.3% of the cloud data warehouse market share, generating revenues of USD 2.5 billion and maintaining a dominant market position.

The Cloud Data Warehouse Market is characterised by the rapid emergence of enterprise demand for scalable, analytics‑ready infrastructure hosted in cloud environments. This segment has gained prominence as organisations transition from rigid on‑premise systems to agile, cloud‑native platforms that offer flexibility, performance and integration with advanced tools.

The market is being driven by the relentless growth of data volumes and the need for real‑time insights. Enterprises are seeking systems capable of handling structured and semi‑structured data sources for business intelligence and analytics workloads. The shift towards consumption‑based pricing models and serverless compute models further accelerates adoption as it enables cost efficiency and operational agility

These platforms provide features such as automatic data backup, secure data storage, and advanced data management capabilities, making cloud data warehouses an attractive option for businesses looking to leverage big data for strategic insights.

Key factors driving the adoption of cloud data warehouses include the increasing volume of data businesses must process and the need for fast, scalable, and flexible data storage solutions. The shift from capital-intensive on-premise infrastructure to cost-effective cloud solutions also plays a crucial role, as does the need for businesses to access and analyze their data in real-time to stay competitive.

Market demand for cloud data warehouses is driven by businesses’ growing reliance on big data and advanced analytics to inform decision-making and strategy. Organizations across various industries are looking for efficient ways to store, access, and analyze their increasing data volumes in real-time, pushing the demand for sophisticated cloud data warehousing solutions.

For instance, In October 2023, mParticle, Inc. unveiled ComposeID, a new identity resolution service designed to integrate seamlessly with cloud data warehousing environments. This service leverages the capabilities of IDSync to offer versatile identity solutions that support a variety of data architectures.

According to G2, the unstructured data segment is currently leading the market and is expected to maintain its dominance with a projected market share of over 65% by 2025. Data mining is also gaining traction and is anticipated to account for more than 25% of the data warehousing market share by the same year. Cloud data warehouses stand out for their robustness, offering automatic backups that ensure 99.99% data availability and fault tolerance.

Data quality issues have significant economic repercussions, as highlighted by data from truelist. It is estimated that poor data quality costs the US economy approximately $3.1 trillion annually. Interestingly, only 18% of companies rely entirely on on-premise data warehouses. By 2025, daily data creation is expected to soar to more than 463 exabytes. Currently, around 2.5 quintillion bytes of data are generated each day.

Key Takeaways

- The Global Cloud Data Warehouse market is projected to expand from USD 7.2 billion in 2023 to an estimated USD 56.6 billion by 2033, achieving a compound annual growth rate (CAGR) of 22.90% from 2024 to 2033.

- In 2023, the Data Warehouse as a Service (DWaaS) segment for enterprises secured a commanding lead, capturing over 68.1% of the market share.

- The Public Cloud deployment model maintained a leading position in the cloud data warehouse market in 2023, holding more than 70.5% of the market share.

- Business Intelligence (BI) tools were a predominant application in the Cloud Data Warehouse market in 2023, accounting for more than 34.0% of the market share.

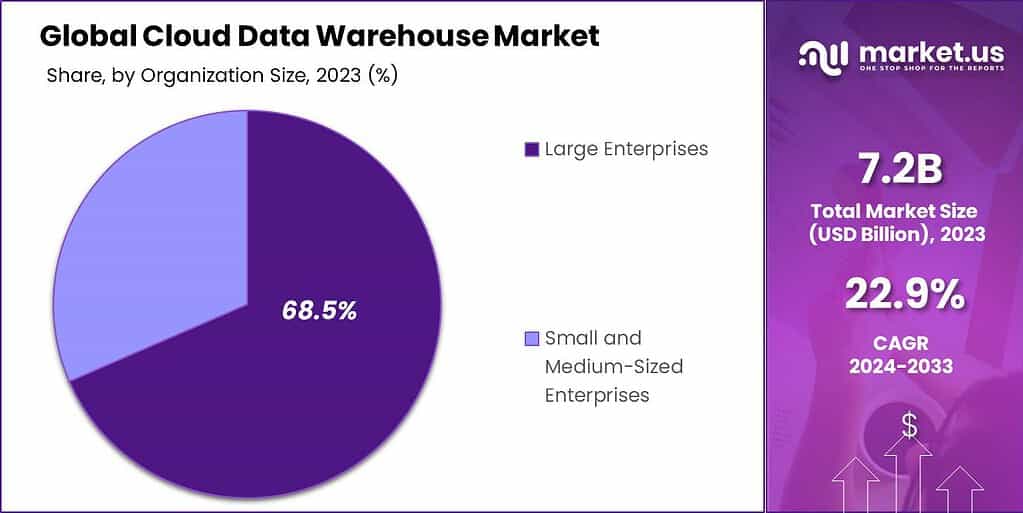

- Large enterprises dominated the Cloud Data Warehouse market in 2023, with a substantial 68.5% market share.

- The Banking, Financial Services, and Insurance (BFSI) sector was a significant user of cloud data warehouses in 2023, holding more than 23.0% of the market.

- North America led the Cloud Data Warehouse market in 2023, with a market share exceeding 34.3% and generating revenues of USD 2.5 billion.

Type Analysis

In 2023, the Enterprise DWaaS (Data Warehouse as a Service) segment held a dominant market position, capturing more than a 68.1% share of the cloud data warehouse market. This leadership is primarily attributed to its ability to offer tailored solutions that align with the complex data management needs of large organizations.

Enterprise DWaaS provides robust scalability and high-performance analytics, which are essential for handling large volumes of data efficiently. As enterprises continue to focus on data-driven decision-making to gain competitive advantages, the demand for Enterprise DWaaS has surged, reflecting its leading position in the market.

Another factor contributing to prominence of the Enterprise DWaaS segment is its integration capabilities with existing IT infrastructure. Large organizations often have complex systems and require seamless integration of new technologies. Enterprise DWaaS solutions are designed to integrate effectively with various data sources, which simplifies the architecture without compromising on operational efficiency.

Deployment Mode Analysis

In 2023, the Public Cloud segment held a dominant market position in the cloud data warehouse market, capturing more than a 70.5% share. This significant market share is largely attributed to the cost-effectiveness and scalability offered by public cloud solutions.

Businesses, especially small and medium-sized enterprises, find the public cloud model appealing because it requires lower upfront investment and offers greater flexibility in managing data workloads without the need for dedicated on-premise infrastructure.

The public cloud’s leading position is also reinforced by its widespread availability and robustness in handling large-scale data operations. Companies benefit from the extensive network of servers provided by public cloud services, ensuring better data redundancy and high availability. This is crucial for businesses operating in environments where data needs to be accessed frequently from multiple global locations.

Application Analysis

In 2023, the Business Intelligence (BI) segment held a dominant market position in the Cloud Data Warehouse market, capturing more than a 34.0% share. This segment leads primarily because BI tools are crucial for organizations aiming to make strategic decisions based on historical data insights.

BI applications in cloud data warehouses provide a robust environment where data from various sources can be consolidated, processed, and analyzed, offering actionable insights that drive business performance and operational efficiency.

The preference for BI tools is also fueled by their ability to improve reporting and planning processes. Organizations leverage BI to create comprehensive dashboards and reports that visualize complex datasets in an understandable format, aiding stakeholders at all levels to track key performance indicators in real-time.

Moreover, the integration of BI with cloud data warehouses represents a significant cost advantage over traditional data systems. Cloud-based solutions reduce the need for extensive on-premise hardware and cut down on the expenditure associated with data storage and management.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Cloud Data Warehouse market, capturing more than a 68.5% share. This segment’s leadership is largely attributed to the extensive data management needs that large enterprises face, which require robust, scalable solutions that cloud data warehouses provide.

Large enterprises are ahead in adopting advanced technologies due to their larger IT budgets or resources. This financial flexibility allows them to invest in cloud data warehouse solutions that offer enhanced security, compliance and performance features crucial for handling sensitive and complex business data.

The ability of cloud data warehouses to integrate with other enterprise applications and data sources plays a significant role in their dominance in this segment. Large enterprises often operate a complex array of systems and software, and cloud data warehouses provide the interoperability necessary to consolidate these into a cohesive, accessible, and manageable framework.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the Cloud Data Warehouse market, capturing more than a 23.0% share. This prominence is largely due to the escalating demand for real-time banking data solutions and the increasing necessity for compliance management in financial sectors.

The significant growth of the BFSI segment is also propelled by the need for enhanced customer experience and operational agility. Cloud data warehouses offer scalable solutions that help financial organizations analyze customer data in real-time, enabling personalized customer service and improved decision making.

Moreover, the adoption of cloud data warehouses in BFSI is encouraged by stringent regulatory requirements. Financial institutions are leveraging cloud-based solutions to ensure compliance with regulations which mandate robust data management and security practices. This compliance is streamlined through cloud data warehouses, which provide advanced security features and regular updates.

Key Market Segments

By Type

- Enterprise DWaaS

- Operational Data Storage

By Deployment Mode

- Public Cloud

- Private Cloud

By Application

- Business Intelligence (BI)

- Predictive Analytics

- Customer Analytics

- Operational Analytics

- Data Modernization

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Other Industry Verticals

Driver

Surge in Data-Driven Decision-Making

In Digital landscape, data has become a critical asset for organizations seeking to gain a competitive edge. Cloud data warehouses are empowering companies to harness data at unprecedented speed and scale, enabling more effective, data-driven decision-making.

With the shift toward big data analytics, businesses are using cloud data warehouses to collect, store, and analyze massive datasets from diverse sources such as IoT devices, e-commerce platforms, and social media. Unlike traditional on-premise storage, cloud data warehouses offer flexibility and scalability, which are essential as data volumes increase.

Another factor driving the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities within cloud data warehouses. These features enable predictive analytics, anomaly detection, and trend analysis, helping companies uncover insights that were previously inaccessible.

Restraint

Data Security Concerns

While cloud data warehouses offer immense value, data security remains a major concern for businesses, especially those handling sensitive information such as financial records, personal customer data, or intellectual property. Cybersecurity threats are evolving at a rapid pace, and organizations are wary of exposing their data to potential risks in a cloud environment.

Businesses operating in heavily regulated industries, such as finance, healthcare, and government, are subject to strict compliance standards. The threat of data breaches, unauthorized access, and data loss creates hesitation among potential adopters, especially those unfamiliar with cloud security best practices. Additionally, the shared responsibility model in cloud services, where both the provider and the customer share the burden of security, can create confusion.

Opportunity

Rising Adoption of Hybrid and Multi-Cloud Environments

With businesses increasingly seeking flexibility in managing their data, the hybrid and multi-cloud approach offers a significant opportunity for the cloud data warehouse market. A hybrid model allows organizations to store some data on-premises while moving less-sensitive or less-critical workloads to the cloud.

Multi-cloud strategies, which involve using multiple cloud providers, are gaining traction as companies aim to avoid vendor lock-in and reduce reliance on a single provider. This trend presents an opportunity for cloud data warehouse vendors to offer solutions that are compatible with multiple cloud platforms, allowing businesses to leverage the strengths of various providers.

Challenge

Managing High Data Ingress and Egress Costs

One of the notable challenges cloud data warehouse providers face is managing data ingress (upload) and egress (download) costs, which can quickly escalate for businesses with large data requirements. While many cloud providers offer affordable storage rates, data transfer fees, especially for egress, can lead to unforeseen expenses, impacting operational budgets.

As organizations adopt multi-cloud or hybrid environments, data egress costs multiply. Transferring data between different cloud providers or from the cloud to on-premise servers can be expensive, limiting the flexibility that businesses initially sought in adopting cloud storage. This pricing complexity discourages frequent data movement, which can hinder real-time decision-making and overall benefits.

Emerging Trends

The landscape of cloud data warehousing is rapidly evolving, driven by technological advancements and shifting business needs. A notable trend is the convergence of data lakes and data warehouses, enabling organizations to manage both structured and unstructured data within a unified platform. This integration facilitates more comprehensive analytics and streamlined data management processes.

Another significant development is the adoption of hybrid and multi-cloud strategies. Businesses are increasingly leveraging multiple cloud providers to enhance flexibility, avoid vendor lock-in and optimize costs which allows organizations to select the best services from different providers.

Additionally, the emphasis on real-time analytics is growing. Organizations are seeking data warehousing solutions that support real-time data ingestion and analysis, enabling them to respond promptly to market changes and customer behaviors. This capability is becoming increasingly vital in today’s fast-paced business environment.

Business Benefits

Adopting cloud data warehousing offers numerous advantages for businesses. One of the primary benefits is scalability. Cloud data warehouses allow organizations to adjust storage and computing resources on demand, accommodating fluctuating workloads without significant infrastructure investments.

Cost efficiency is another significant advantage. By eliminating the need for on-premises hardware and associated maintenance, cloud data warehouses reduce capital expenditures. Moreover, the pay-as-you-go pricing model enables companies to pay only for the resources they use, optimizing operational costs.

Enhanced data accessibility and collaboration are also key benefits. With data stored in the cloud, teams across different locations can access and work with the data in real time, fostering better collaboration and more agile decision-making processes. This is particularly relevant in today’s globalized business environment, where teams are often spread out across the globe.

Regional Analysis

In 2023, North America maintained a leading position in the cloud data warehouse market, securing over 34.3% of the global share and generating revenue of USD 2.5 billion. This dominance is attributed to several factors that are intrinsic to the region’s approach to technological adoption and data management strategies.

The robust market stance in North America largely stems from the concentration of major cloud service providers and advanced technological infrastructure. The region is home to industry giants such as Amazon Web Services, Google Cloud, and Microsoft Azure, which not only spearhead innovations but also drive adoption across various industries including retail, healthcare, and financial services.

The advanced ecosystem for technology startups and the supportive regulatory environment further bolster cloud data warehouse adoption, facilitating sophisticated data management and analytics solutions. High investment in R&D activities related to cloud technologies and a strong emphasis on adopting digital transformation strategies across enterprises underline the region’s market growth.

Moreover, the integration of artificial intelligence and machine learning with cloud data warehouses is becoming increasingly prevalent, enhancing the capabilities of businesses to perform real-time analytics and data-driven decision-making. This technological integration helps companies optimize their operations and engage in predictive analytics, securing a competitive advantage in a rapidly evolving market landscape

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The cloud data warehouse market is highly competitive, with several key players leading the way, each offering unique features and capabilities to meet the diverse needs of businesses.

Microsoft Corporation stands out as a leader in the cloud data warehouse market through its robust offering, Azure SQL Data Warehouse, which integrates seamlessly with other Azure services. The platform is renowned for its scalability, allowing businesses to adjust resources dynamically to handle fluctuations in data processing demands.

Google LLC is another top contender in the cloud data warehouse space, with its product, BigQuery, gaining substantial traction. BigQuery is highly regarded for its serverless, highly scalable, and cost-effective data warehouse solution, which enables companies to manage and analyze data seamlessly, with minimal overhead.

Oracle Corporation excels in the cloud data warehouse market with its Oracle Cloud Infrastructure (OCI) offerings, particularly the Oracle Autonomous Data Warehouse. This solution is designed for high-performance and autonomous operations, which greatly reduce the management overhead for database administrators by automating database tuning, security, backups, and updates.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- SAP SE

- Teradata Corporation

- Snowflake Inc.

- Cloudera, Inc.

- Yellowbrick Data, Inc.

- Other Key Players

Recent Developments

- In February 2024, Tealium introduced advanced AI capabilities, including real-time personalization features and consent orchestration tools, alongside forming partnerships with prominent cloud data warehouse providers. This development is aimed at boosting the quality and accessibility of data for AI applications, ensuring that businesses can easily access consented and enriched data on-the-fly.

- Also in February 2024, Ushur took a significant step by integrating the Yellowbrick Cloud Data Warehouse into its Customer Experience Automation (CXA) platform. This collaboration is designed to enhance Ushur’s AI-driven customer experience offerings, improving data analysis, scalability, and the speed of analytics to foster better customer interactions and increase platform engagement.

- In July 2023, IBM enhanced its IBM Db2 Warehouse with new capabilities. The update introduces the integration of cloud object storage and advanced caching, which together increase query response speeds by four times and reduce storage costs by 34%.

Report Scope

Report Features Description Market Value (2023) USD 7.2 Bn Forecast Revenue (2033) USD 56.6 Bn CAGR (2024-2033) 22.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Enterprise DWaaS, Operational Data Storage), By Deployment Mode (Public Cloud, Private Cloud), By Application (Business Intelligence (BI), Predictive Analytics, Customer Analytics, Operational Analytics, Data Modernization), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government and Public Sector, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Microsoft Corporation, Google LLC, Oracle Corporation, IBM Corporation, SAP SE, Teradata Corporation, Snowflake Inc., Cloudera, Inc., Yellowbrick Data, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Data Warehouse MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Data Warehouse MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- SAP SE

- Teradata Corporation

- Snowflake Inc.

- Cloudera, Inc.

- Yellowbrick Data, Inc.

- Other Key Players