Global Cloud Data Observability Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Quality Monitoring, Pipeline Performance Monitoring, Cost and Usage Optimization, Security and Compliance Monitoring, Others), By End-User Industry (IT and Telecommunications, Banking, Financial Services, and Insurance, Retail and E-commerce, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175512

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User Industry

- By Region

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

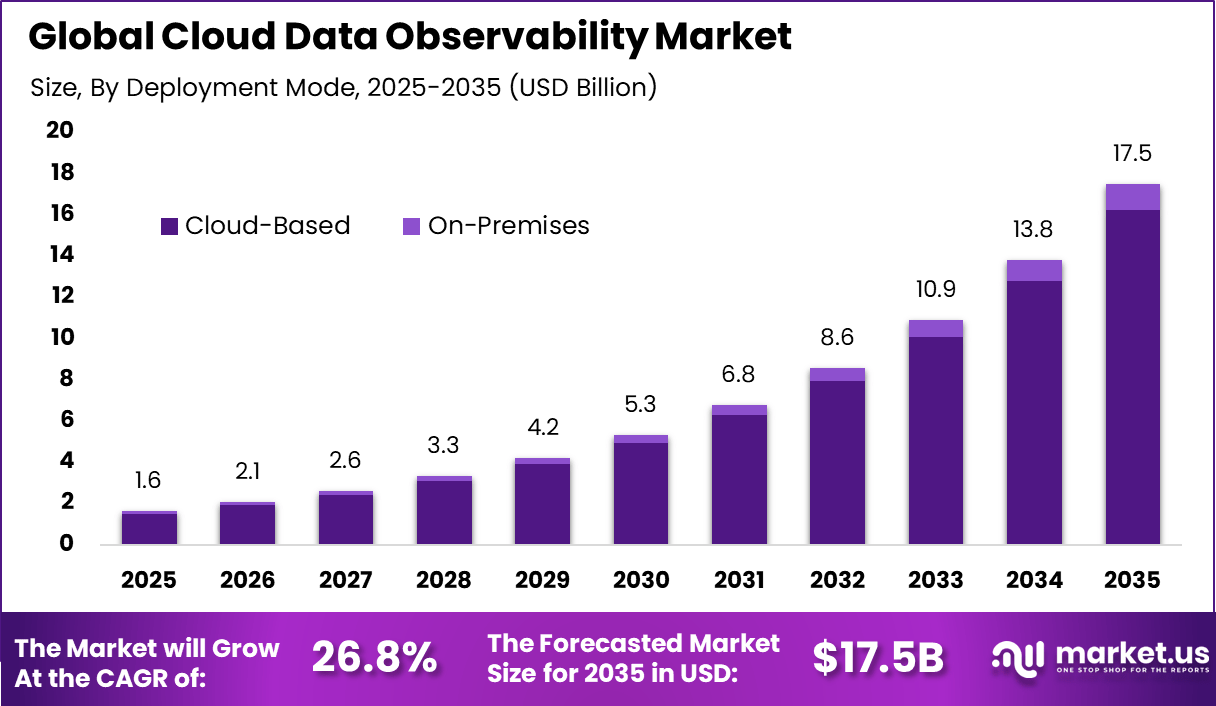

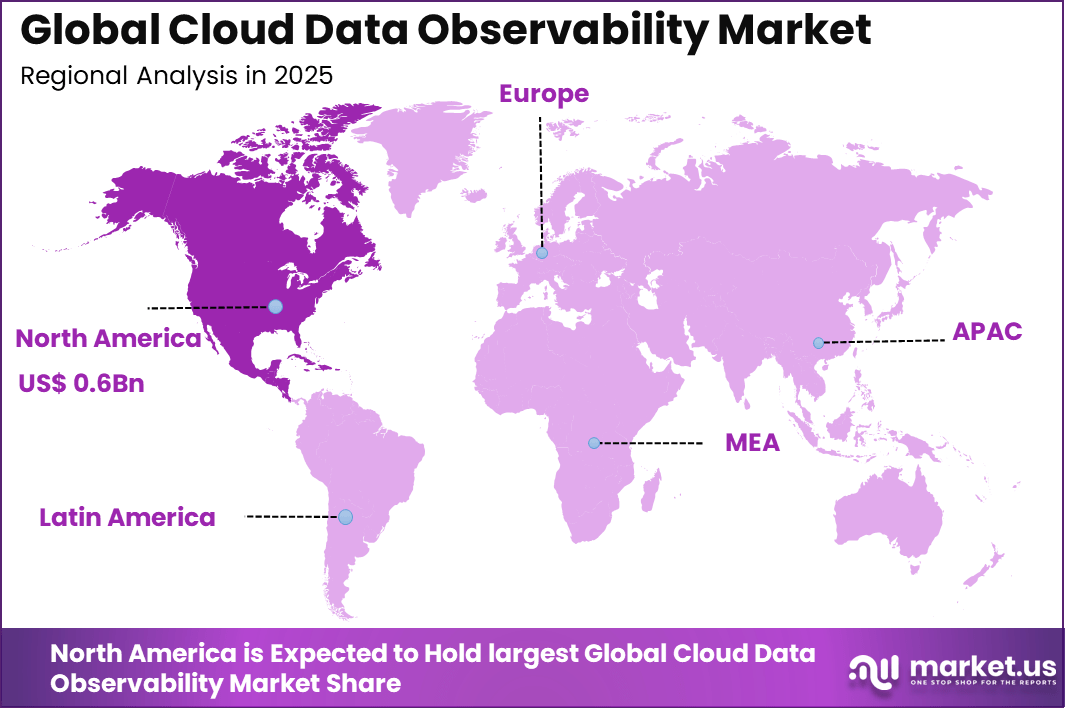

The Global Cloud Data Observability Market presents a USD 17.5 billion growth opportunity by 2035, fueled by cloud migration, real-time data operations, and the need for resilient analytics pipelines. The market is forecast to expand at a CAGR of 26.8%, highlighting its strong revenue outlook and long-term value creation potential for investors. North America held a dominan Market position, capturing more than a 39.6% share, holding USD 0.6 Billion revenue.

The Cloud Data Observability Market focuses on tools and platforms that enable organizations to monitor, track, and validate the health, quality, and reliability of data across cloud based data pipelines. These solutions provide visibility into data freshness, accuracy, volume, and lineage as data moves through complex cloud environments.

The market has gained importance as enterprises increasingly depend on cloud analytics, real time dashboards, and data driven decision making. Cloud data observability helps organizations detect issues early, reduce data downtime, and maintain trust in analytical outputs. As data architectures become more distributed and dynamic, traditional monitoring methods are no longer sufficient.

One of the main driving factors of the Cloud Data Observability Market is the growing complexity of cloud based data ecosystems. Organizations now operate with multiple data sources, pipelines, and analytics tools, which increases the risk of data failures and inconsistencies. Observability solutions help manage this complexity by providing end to end visibility across the data lifecycle.

Demand for cloud data observability solutions is closely linked to the adoption of modern analytics and business intelligence platforms. Teams require continuous assurance that the data feeding reports and models is complete and up to date. Observability tools support this need by monitoring data pipelines and alerting teams to anomalies before they affect end users.

Top Market Takeaways

- Software and solutions hold 81.4%, as organizations prioritize tools that provide end to end visibility into data health, reliability, and performance.

- Cloud-based deployment dominates with 92.7%, supported by scalable infrastructure, native integration with cloud data platforms, and real time monitoring needs.

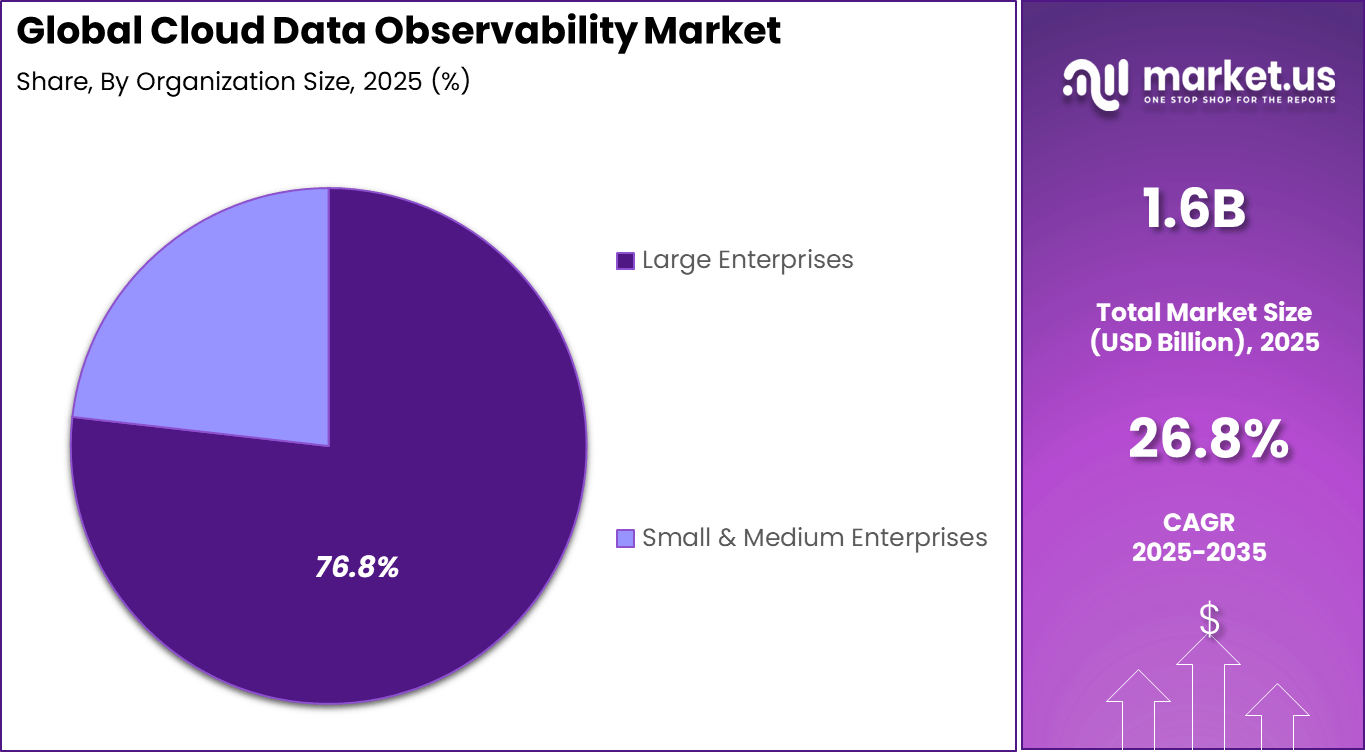

- Large enterprises account for 76.8% adoption, driven by complex data environments, higher governance requirements, and the need for continuous data reliability.

- Data quality monitoring leads applications at 44.3%, reflecting strong focus on accuracy, consistency, and trust in analytics outputs.

- IT and telecommunications represent 58.9% share, due to high data velocity, distributed systems, and constant demand for operational visibility.

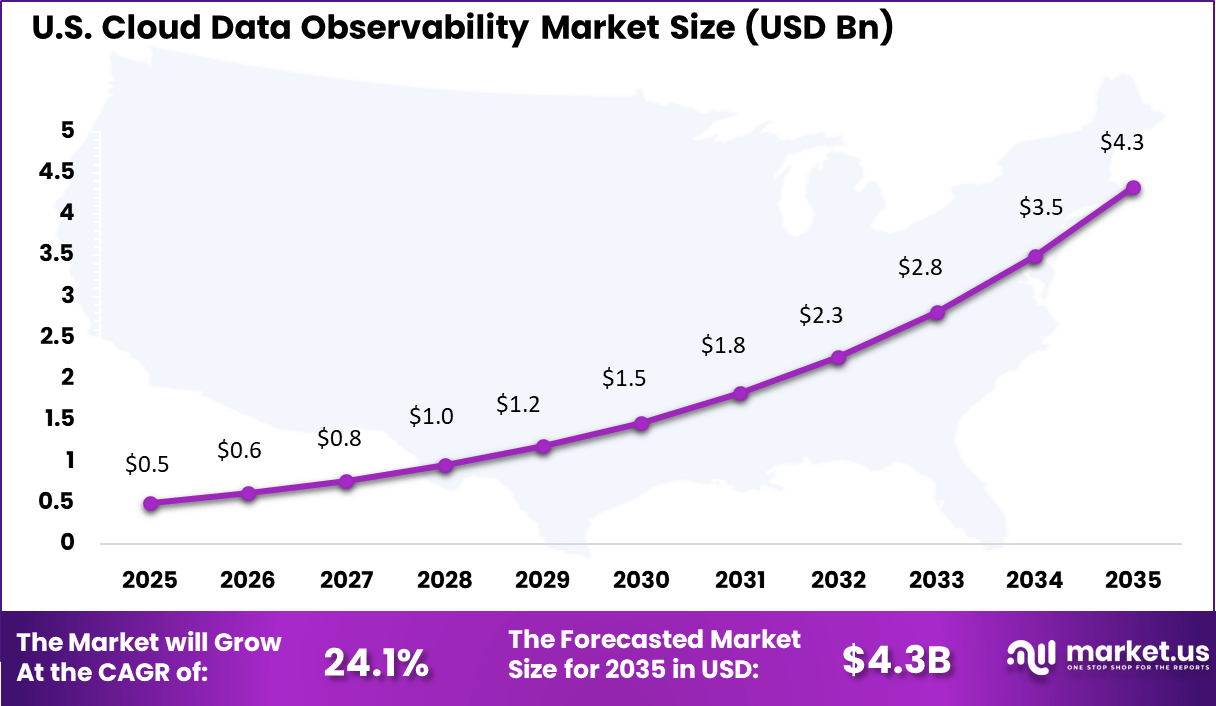

- North America holds 39.6% share, with the US valued at USD 0.58 billion and a 24.11% CAGR, supported by early cloud adoption and mature data management practices.

Quick Market Facts

- By 2026, 60% of organizations describe their observability practices as mature or expert, up from 41% in 2025.

- Only 7% of organizations remain at an early adoption stage, showing rapid market maturity.

- About 96% of IT leaders expect observability budgets to remain stable or increase through 2026.

- Large enterprises account for 73.9% of total adoption due to complex data environments and governance needs.

- Cloud-based deployment dominates with 78.4%-78.6% share, driven by scalability and centralized monitoring.

- Average incident resolution time has risen to 15 hours, compared with 9 hours last year, due to higher system complexity.

- Nearly 91% of machine learning models degrade over time without continuous monitoring.

- Data teams spend close to 50% of their time fixing data issues instead of analysis and innovation.

- Data quality problems impact around 31% of total business revenue on average.

- About 84% of organizations are pursuing tool consolidation to reduce observability platform sprawl.

- Production use of OpenTelemetry has increased to 11%, up from 6% in 2025.

- Around 85% of organizations have standardized on OpenTelemetry for data collection to reduce vendor lock-in.

- Nearly 70% of enterprises use observability to monitor agentic AI and model behavior in real time.

- Observability data is now used by 68% of cybersecurity teams for incident response and audit tracking.

By Component

Software and solutions account for 81.4%, highlighting their dominant role in cloud data observability. These platforms provide end-to-end visibility into data pipelines, quality, and performance. Centralized dashboards help teams detect data issues early. Automated alerts support faster resolution of anomalies. Reliability and accuracy remain core requirements.

The dominance of software and solutions is driven by growing data complexity. Organizations manage data across multiple cloud environments. Observability platforms reduce manual monitoring efforts. Integrated solutions improve collaboration between data teams. This sustains strong demand for software-based components.

By Deployment Mode

Cloud-based deployment holds 92.7%, reflecting near-universal preference for cloud-native observability. Cloud deployment supports real-time monitoring of distributed data systems. Organizations benefit from rapid scalability and flexibility. Centralized access improves operational visibility. Maintenance and updates are handled efficiently.

Adoption of cloud-based deployment is driven by cloud-first data strategies. Enterprises increasingly rely on cloud data platforms. Observability tools integrate directly with cloud services. Secure access controls support enterprise requirements. This keeps cloud-based deployment dominant.

By Organization Size

Large enterprises represent 76.8%, making them the primary adopters of cloud data observability solutions. These organizations manage large volumes of data across teams. Observability supports governance and compliance needs. Automation reduces operational risk. Scale increases the importance of proactive monitoring.

Adoption among large enterprises is driven by operational complexity. Data failures can impact multiple business units. Observability tools provide early detection of issues. Centralized monitoring improves accountability. This sustains strong enterprise-level adoption.

By Application

Data quality monitoring accounts for 44.3%, making it the leading application segment. Organizations rely on accurate data for analytics and reporting. Monitoring tools identify inconsistencies and errors. Continuous checks improve trust in data outputs. Data reliability remains critical.

Growth in this application is driven by increased data usage. Enterprises depend on real-time insights. Poor data quality can disrupt decisions. Automated monitoring reduces manual validation. This keeps data quality monitoring central to adoption.

By End-User Industry

IT and telecommunications account for 58.9%, making them the largest end-user industry. These sectors generate high volumes of operational data. Cloud observability supports system performance monitoring. Data accuracy impacts service reliability. Continuous monitoring is essential.

Adoption in IT and telecom is driven by digital service expansion. Networks and platforms produce complex data flows. Observability tools improve operational insight. Integration with analytics supports optimization. This sustains strong adoption in this industry.

By Region

North America accounts for 39.6%, supported by strong cloud adoption across enterprises. Organizations in the region invest in data reliability and governance. Advanced cloud infrastructure supports observability deployment. Skilled workforce accelerates adoption. The region remains influential.

The United States reached USD 0.58 Billion with a CAGR of 24.11%, reflecting rapid market growth. Expansion is driven by data-driven business models. Enterprises prioritize observability to reduce data risks. Automation adoption continues to rise. Market momentum remains strong.

Driver Analysis

The cloud data observability market is being driven by the growing need for organisations to ensure reliability, quality, and transparency of data across complex, distributed cloud environments. Modern analytics, artificial intelligence, and business intelligence platforms depend on timely and accurate data to deliver value.

Traditional monitoring approaches often lack end-to-end visibility into data flows, dependencies, and anomalies, which can lead to undetected issues, incorrect insights, and costly remediation. Cloud data observability solutions enable automated detection of data quality issues, lineage tracking, and performance monitoring across storage, pipelines, and workloads, supporting trust in data and faster issue resolution.

Restraint Analysis

A significant restraint in the cloud data observability market relates to the technical and operational challenges associated with integrating observability tools into existing data ecosystems. Organisations often operate a mix of legacy systems, ongoing cloud migrations, and disparate data sources.

Aligning observability solutions with varied architectures and ensuring consistent telemetry collection can demand specialised skills and careful planning. Without clear standards for observability instrumentation and data governance, integration may be inconsistent or incomplete, which can reduce the effectiveness of observability efforts and slow adoption.

Opportunity Analysis

Emerging opportunities in the cloud data observability market are linked to the expansion of observability into predictive analytics, root-cause analysis, and proactive issue prevention. Platforms that combine real-time telemetry, historical behaviour models, and anomaly detection can alert teams to potential quality or performance problems before they impact downstream analytics and business decisions.

There is also opportunity in observability solutions tailored for hybrid and multicloud environments that provide consistent monitoring across public cloud, private cloud, and on-premises data infrastructures. Enhanced dashboarding, tracing, and collaboration features further extend value by supporting cross-team visibility and incident response.

Challenge Analysis

A central challenge confronting this market involves balancing comprehensive observability with data security, privacy, and cost control. Collecting and processing detailed telemetry and metadata at scale can generate significant storage and compute overhead if not carefully managed.

Additionally, observability tools often require access to sensitive data and system logs, which raises concerns about secure handling, compliance with privacy regulations, and access governance. Organisations must implement robust security controls, encryption, and access policies to protect sensitive information while maintaining observability coverage.

Emerging Trends

Emerging trends in the cloud data observability landscape include the adoption of unified observability platforms that consolidate data quality, lineage, performance, and reliability metrics into a single view. AI-enabled pattern recognition and anomaly detection are becoming core features that reduce manual configuration and improve detection accuracy.

Another trend is the integration of observability with data catalogues and governance frameworks, enabling organisations to link quality issues with business context and data ownership. There is also growing use of analytics that forecast potential data degradation and suggest remediation actions before operational impact occurs.

Growth Factors

Growth in the cloud data observability market is supported by the increasing volume and complexity of data workloads, the rise of real-time analytics, and the strategic importance of data integrity for business operations. Organisations invest in observability tools to sustain digital transformation efforts, reduce time spent on data troubleshooting, and improve confidence in data-driven decisions.

Advances in cloud computing, automation, and machine learning enhance observability platform capabilities and scalability. As businesses seek to accelerate insights while maintaining data reliability and operational continuity, demand for cloud data observability solutions continues to strengthen.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Data Quality Monitoring

- Pipeline Performance Monitoring

- Cost and Usage Optimization

- Security and Compliance Monitoring

- Others

By End-User Industry

- IT and Telecommunications

- Banking, Financial Services, and Insurance

- Retail and E-commerce

- Healthcare

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large platform providers such as Datadog, Splunk, Dynatrace, and New Relic lead the market through end-to-end monitoring capabilities. Their platforms combine infrastructure, application, and data observability into unified dashboards. AI is used for anomaly detection and root cause analysis. These players benefit from strong enterprise adoption and deep integration with cloud-native environments.

Hyperscale cloud providers such as Amazon Web Services, Microsoft, Google, and IBM embed data observability within broader cloud ecosystems. Their tools support data pipeline monitoring, governance, and compliance. Native integration with storage, analytics, and AI services strengthens adoption. These players address large enterprises seeking simplified vendor stacks and scalable observability across hybrid and multi-cloud environments.

Specialized data observability vendors such as Monte Carlo, Acceldata, and Bigeye focus on pipeline health and data quality issues. Anomalo, Metaplane, and Soda target analytics-driven organizations. These players differentiate through fast deployment and user-focused insights. Other vendors expand competition and innovation in this evolving market.

Top Key Players in the Market

- Datadog

- Splunk

- Dynatrace

- New Relic

- IBM

- Microsoft

- Amazon Web Services

- Observe

- Monte Carlo

- Acceldata

- Bigeye

- Anomalo

- Metaplane

- Soda

- Others

Recent Developments

- In January 2026, Snowflake announced plans to acquire Observe, an AI observability platform built on its data cloud, to handle massive telemetry data at lower costs. This taps into a $50 billion+ market and unifies data ops for AI reliability across enterprises.

- In September 2025, Dynatrace teamed up with Crest Data to help big companies switch to its observability platform faster and cheaper. The partnership targets migrations from older tools, fitting the needs of modern cloud setups. It highlights how observability now supports enterprise-wide shifts.

Report Scope

Report Features Description Market Value (2025) USD 1.6 Bn Forecast Revenue (2035) USD 17.5 Bn CAGR(2026-2035) 26.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Quality Monitoring, Pipeline Performance Monitoring, Cost and Usage Optimization, Security and Compliance Monitoring, Others), By End-User Industry (IT and Telecommunications, Banking, Financial Services, and Insurance, Retail and E-commerce, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, Splunk, Dynatrace, New Relic, IBM, Microsoft, Google, Amazon Web Services, Observe, Monte Carlo, Acceldata, Bigeye, Anomalo, Metaplane, Soda, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Data Observability MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Cloud Data Observability MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Datadog

- Splunk

- Dynatrace

- New Relic

- IBM

- Microsoft

- Amazon Web Services

- Observe

- Monte Carlo

- Acceldata

- Bigeye

- Anomalo

- Metaplane

- Soda

- Others