Global Cloud-based Email Security Market Size, Share, Industry Analysis Report By Component (Solution, Services), By Platform Integration (Secure Email Gateway (SEG), Integrated Cloud Email Security (ICES/API), Cloud-Native Email Security Platform, Hybrid Gateway and API), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By Industry Vertical (BFSI, Government and Defense, IT and Telecommunications, Healthcare and Life Sciences, Retail and E-Commerce, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157342

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

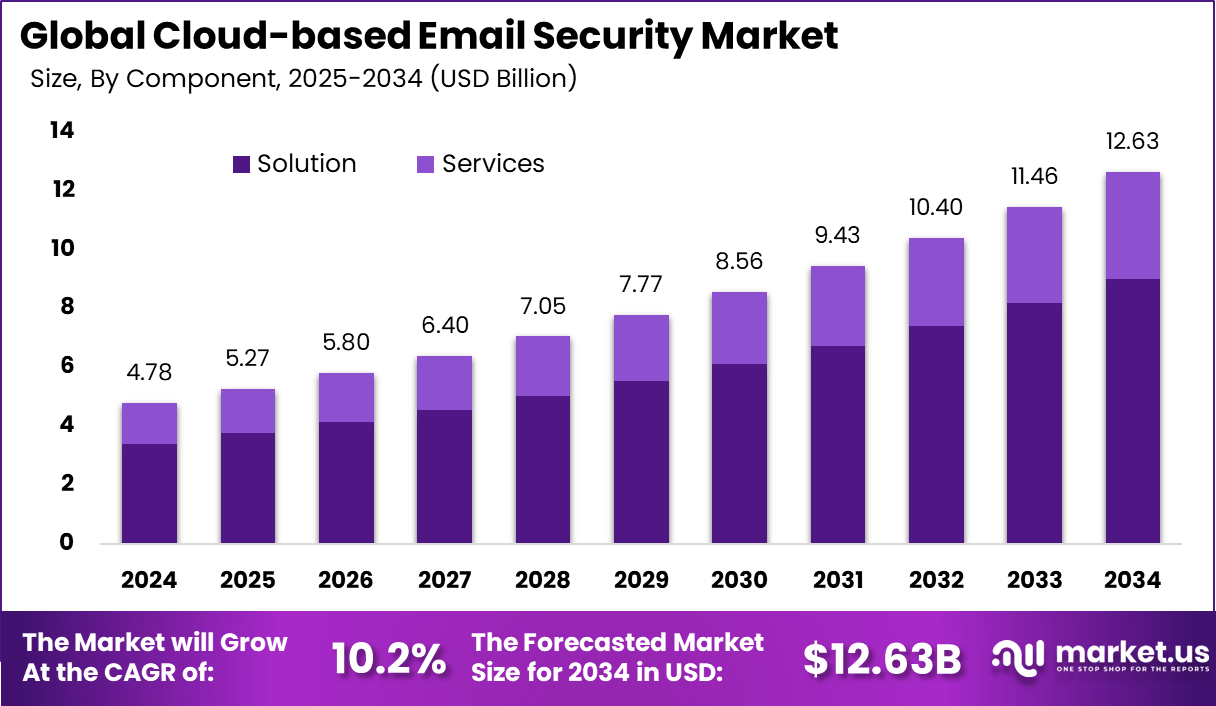

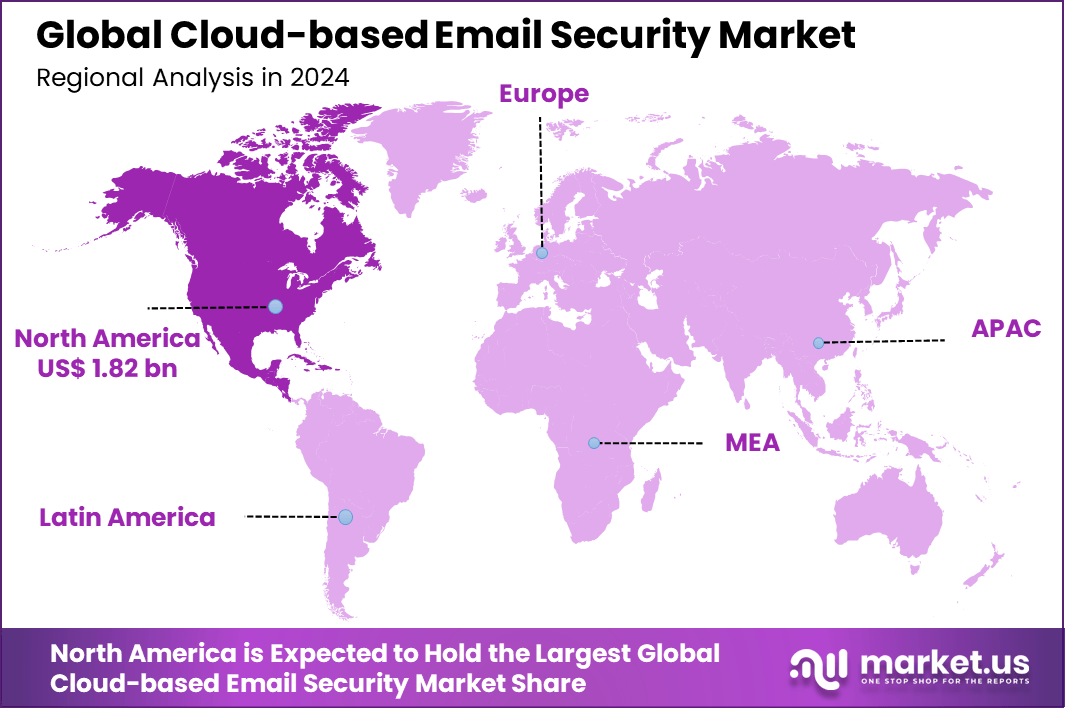

The Global Cloud-based Email Security Market size is expected to be worth around USD 12.63 billion by 2034, from USD 4.78 billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.1% share, holding USD 1.82 billion in revenue.

The Cloud-based Email Security Market refers to services and tools delivered via the internet that protect email communications from threats such as phishing, malware, spam, and data breaches. These solutions replace traditional on‑premises filters with software hosted in secure cloud environments. This model allows businesses, regardless of size or technical capacity, to secure email without heavy infrastructure investment and manage security through web‑based interfaces.

The market is driven by rising cyber threats targeting email, such as phishing and malware campaigns, combined with growing reliance on remote work and cloud platforms. Businesses recognize the need to safeguard sensitive data while maintaining flexibility. The ease of deployment and scalability of cloud‑based models further supports their adoption. These solutions are also seen as more cost‑effective than traditional systems, making them appealing to a wide range of organizations.

According to CloudHQ, global email usage stands at 4.83 billion users in 2025 and is projected to reach 5.61 billion by 2030, with daily traffic rising from 392 billion to 523 billion messages. Growth is strongest in Asia and Africa, led by India and Nigeria. Email marketing maintains high profitability with an ROI of USD 36 per USD 1 spent, while personalization continues to improve engagement. Inbox storage demand is expected to climb by 64% by 2030, with MFA and AI-based filtering reducing spam and phishing risks.

SentinelOne and IBM data highlight rising cybersecurity challenges, as the average cost of a data breach is USD 4.35 million. Over 51% of organizations plan to raise cloud security investments, focusing on incident response and advanced detection tools. Ransomware has increased by 13% in the past five years, while phishing remains the most common attack vector, reported by 51% of enterprises as a primary method for stealing cloud credentials.

For instance, in December 2024, Fortinet acquired Perception Point, a company specializing in advanced email and collaboration security. This acquisition enhances Fortinet’s FortiMail platform, integrating Perception Point’s capabilities to provide comprehensive protection against email threats.

Key Takeaway

- In 2024, the Solution segment held a dominant market position, capturing a 71.3% share of the Global Cloud-based Email Security Market.

- In 2024, the Secure Email Gateway (SEG) segment held a dominant market position, capturing a 40.8% share of the Global Cloud-based Email Security Market.

- In 2024, the Large Enterprises segment held a dominant market position, capturing a 62.5% share of the Global Cloud-based Email Security Market.

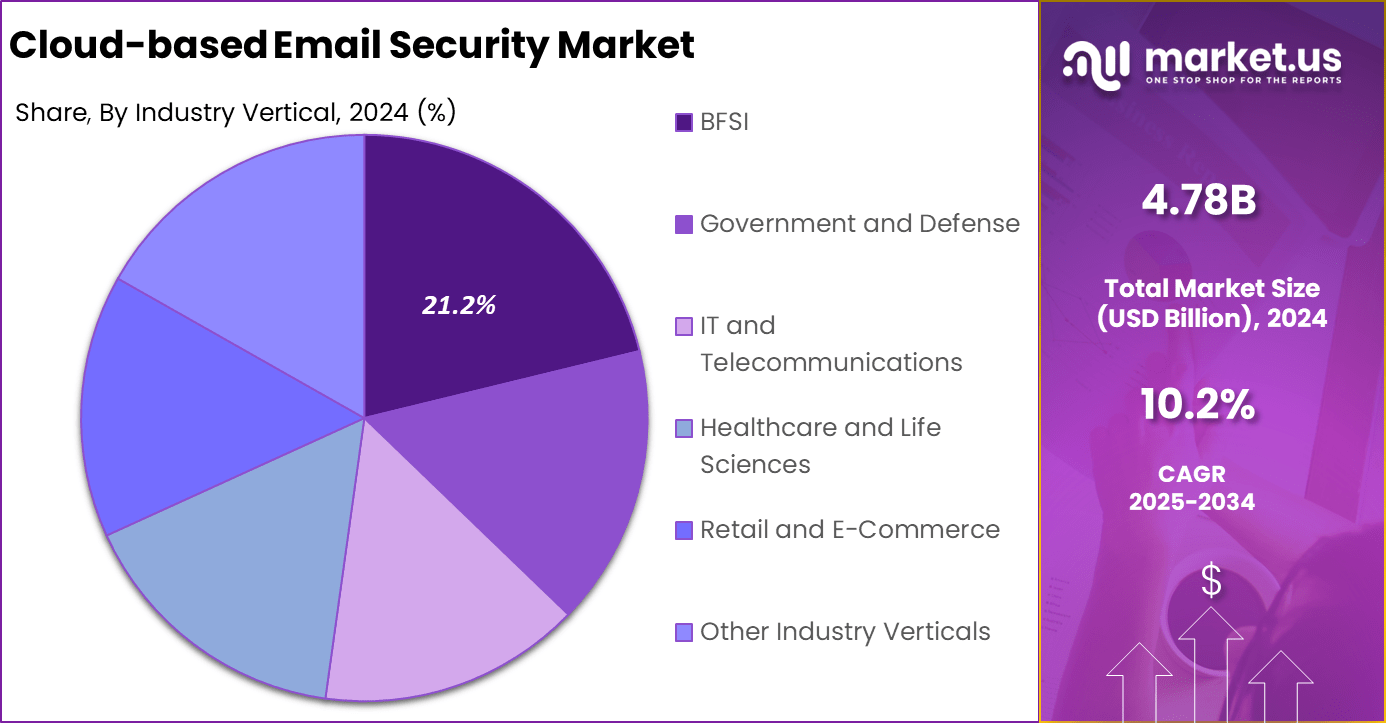

- In 2024, the BFSI segment held a dominant market position, capturing a 21.2% share of the Global Cloud-based Email Security Market.

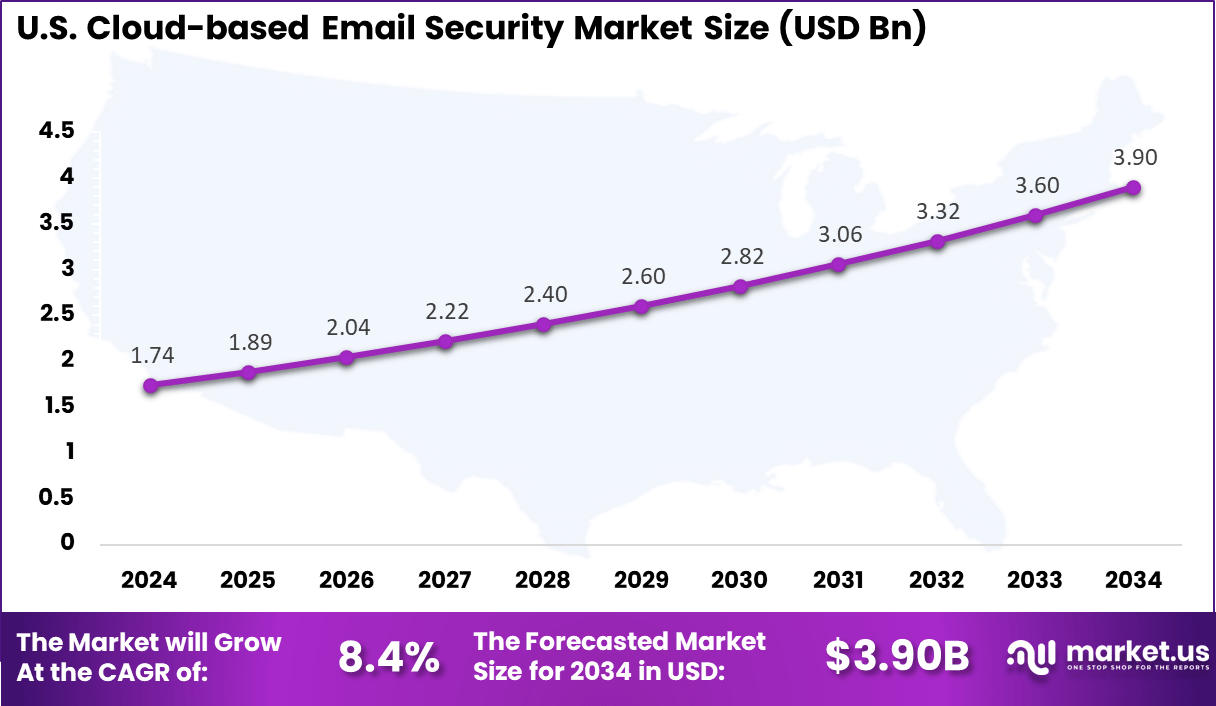

- The U.S. Cloud-based Email Security Market was valued at USD 1.74 billion in 2024, with a robust CAGR of 8.4%.

- In 2024, North America held a dominant market position in the Global Cloud-based Email Security Market, capturing more than a 38.1% share.

U.S. Market Size

The market for Cloud-based Email Security within the U.S. is growing tremendously and is currently valued at USD 1.74 billion, the market has a projected CAGR of 8.4%. The market is experiencing significant growth due to the rising frequency of cyberattacks targeting businesses, government agencies, and individuals.

The shift toward cloud email platforms, accelerated by remote work and digital transformation, has expanded attack surfaces, driving the need for scalable and AI-driven security solutions. Additionally, stringent data privacy regulations like CCPA and growing compliance requirements are pushing U.S. companies to adopt stronger email security measures to safeguard sensitive data.

For instance, in November 2024, Microsoft Defender for Office 365 introduced innovative features to combat QR code phishing attacks, showcasing its leadership in cloud-based email security. As phishing attacks evolve, Microsoft’s cutting-edge solutions provide proactive threat detection and real-time defense, reinforcing the U.S.’s dominant position in the global email security market.

In 2024, North America held a dominant market position in the Global Cloud-based Email Security Market, capturing more than a 38.1% share, holding USD 1.82 billion in revenue. This dominance is due to the region’s high adoption of advanced technologies, including AI and machine learning, in cybersecurity solutions.

The increasing frequency of cyberattacks, coupled with strict data protection regulations such as CCPA and HIPAA, has driven businesses across various sectors to prioritize email security. Additionally, the presence of major tech companies and cloud service providers in the U.S. has further bolstered the demand for scalable, cloud-based email security solutions.

For instance, in May 2025, VIPRE acquired Cryoserver Solar Archive to enhance its cloud-based email security solutions, reinforcing its position in the North American market. This acquisition expands VIPRE’s capabilities in secure email archiving, providing businesses with advanced protection against email threats and compliance risks.

Component Analysis

In 2024, the Solution segment held a dominant market position, capturing a 71.3% share of the Global Cloud-based Email Security Market. This dominance is due to its critical role in protecting organizations from evolving cyber threats.

Solutions such as advanced threat protection, email encryption, anti-phishing, and spam filtering provide proactive defense mechanisms, ensuring data security and regulatory compliance. The growing complexity of email-borne attacks and increasing adoption of cloud email platforms have further driven demand for comprehensive, integrated security solutions, reinforcing the segment’s market leadership.

For Instance, in May 2025, Cloudflare was named a “Strong Performer” in email security by Forrester, recognizing its advanced cloud-based email security solutions. This acknowledgment highlights Cloudflare’s robust capabilities in protecting businesses from email-borne threats like phishing, malware, and spam.

Platform Integration Analysis

In 2024, the Secure Email Gateway (SEG) segment held a dominant market position, capturing a 40.8% share of the Global Cloud-based Email Security Market. This dominance is due to its ability to provide comprehensive protection against spam, phishing, malware, and advanced email-borne threats.

SEG solutions offer seamless integration with existing email platforms, enabling real-time threat detection and policy enforcement. Their scalability, reliability, and ease of deployment make them a preferred choice for enterprises seeking robust and efficient email security solutions.

For instance, in July 2024, Cisco addressed a critical vulnerability in its Secure Email Gateway (SEG) that could have allowed attackers to add root users and compromise system integrity. By releasing a patch to resolve this issue, Cisco strengthened its SEG solution, ensuring better protection against cyber threats.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 62.5% share of the Global Cloud-based Email Security Market. This dominance is driven by large organizations’ extensive reliance on email for critical business operations, which makes them prime targets for cyberattacks such as phishing, ransomware, and business email compromise (BEC).

With complex IT infrastructures and stringent regulatory compliance requirements, large enterprises increasingly invest in advanced, scalable, and AI-powered email security solutions to protect sensitive data and maintain operational continuity.

For Instance, in September 2025, Varonis acquired SlashNext for up to USD 150 million to enhance its AI-driven email security capabilities, specifically targeting large enterprises. The acquisition enables Varonis to offer more advanced, AI-powered email protection solutions that can detect and mitigate emerging threats such as phishing, business email compromise (BEC), and malware.

Industry Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 21.2% share of the Global Cloud-based Email Security Market. This dominance is due to the sector’s high sensitivity to cyber threats, with email being a common vector for attacks like phishing, fraud, and ransomware.

The BFSI industry’s strict regulatory requirements, such as GDPR and PCI DSS, also drive the adoption of advanced email security solutions to safeguard sensitive financial data and ensure compliance with data protection laws.

For Instance, in February 2023, Georgia Banking Company adopted Microsoft’s security solutions to strengthen its cloud-based email security infrastructure. This move was aimed at enhancing the protection of sensitive financial data and preventing cyber threats such as phishing and fraud.

Key Market Segments

By Component

- Solution

- Filtering and Anti-Spam

- Malware and Advanced Threat Protection

- Data Loss Prevention

- Encryption and Tokenization

- Others

- Services

- Professional Services

- Managed Services

By Platform Integration

- Secure Email Gateway (SEG)

- Integrated Cloud Email Security (ICES/API)

- Cloud-Native Email Security Platform

- Hybrid Gateway and API

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical

- BFSI

- Government and Defense

- IT and Telecommunications

- Healthcare and Life Sciences

- Retail and E-Commerce

- Other Industry Verticals

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Surge in Cyber Threats

The rising number of sophisticated cyberattacks, such as phishing, ransomware, and business email compromise (BEC), has dramatically increased the demand for advanced email security technologies. They can cause catastrophic financial and reputational harm, encouraging organizations to take email security much more seriously and adopt a robust proactive approach.

Because of the sophisticated nature of attacks, organizations are also adopting cloud-based email security to protect their communications and data from these ever-evolving threats, creating strong market demand.

For instance, in April 2025, according to the latest IBM X-Force report, infostealer malware attacks surged by 84% on a weekly basis. This rise in cyber threats, especially phishing, malware, and business email compromise (BEC) attacks, has made email systems prime targets for cybercriminals. These threats increasingly exploit vulnerabilities in email platforms to steal sensitive data, disrupt communication, and cause financial harm.

Restraint

High Implementation Costs

The high initial investment and continuous maintenance costs associated with high-end email security solutions provide a considerable barrier, especially for small and medium-sized enterprises (SMEs). While advanced email security solutions are necessary to defend against rising cyber threats, many SMEs face budget constraints and do not have the funds to put in place comprehensive protections.

For instance, in February 2024, a report from Guardian Digital highlighted the significant investment required for robust email security systems. The initial setup and ongoing maintenance of cloud-based email security solutions can be quite expensive, especially for small and medium-sized enterprises (SMEs).

Opportunities

Advancements in AI and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into email security solutions allows for a significant development opportunity for the market. AI and ML enable real-time analysis of email traffic, identifying patterns and anomalies that may indicate a potential threat. AI and ML systems can prevent attacks (for example, a phishing attack or malware) before they reach the user.

As organizations look for more dynamic and intelligent security solutions, AI- and ML-enabled email protection systems are in demand. For instance, in August 2025, Paubox unveiled a new generative AI-powered email security solution to combat the rising number of healthcare cyber threats. As cybercriminals continue to develop more sophisticated phishing and ransomware tactics, especially targeting sensitive healthcare data, the need for advanced email security has never been greater.

Challenges

Evolving Threat Landscape

The rapidly evolving nature of cyber threats remains a significant challenge for the cloud-based email security market. Cyber attackers continuously develop new techniques to bypass traditional security measures, requiring email security providers to stay ahead of emerging threats.

Constant updates, patches, and innovation are needed to ensure that email security solutions remain effective. This dynamic landscape can strain resources, increase operational costs, and create a continuous cycle of adaptation, making it difficult for vendors to maintain consistent protection for users.

For instance, in September 2025, Columbia River IT Solutions joined EasyDMARC’s MSP program to enhance email security and deliverability for its clients. This partnership highlights the ongoing challenge posed by the evolving threat landscape. As cyber threats become increasingly sophisticated, businesses face difficulties in keeping their email security measures up-to-date.

Latest Trends

The latest trend in cloud-based email security is the growing adoption by small and medium-sized businesses (SMBs). As cyber threats continue to rise, SMBs are turning to affordable, scalable cloud solutions that provide robust protection without the high costs associated with traditional on-premise systems.

These cloud-based platforms offer flexibility, allowing businesses to scale security measures as needed, ensuring they stay protected while managing costs effectively. This trend is making advanced email security accessible to a broader range of organizations.

For instance, in May 2025, Proofpoint announced its acquisition of Hornetsecurity, enhancing its AI-powered email security offerings specifically for small and medium-sized businesses (SMBs). As cyber threats escalate, SMBs are increasingly turning to cloud-based solutions that provide advanced protection without the heavy costs of traditional security systems.

Key Players Analysis

Barracuda Networks Inc., Proofpoint Inc., and Mimecast Ltd. are positioned as strong players with a long track record in advanced email threat protection. Their focus has been on securing cloud-native environments and ensuring compliance for enterprise clients. Cisco Systems Inc. and Trend Micro Inc. continue to expand their offerings by integrating AI-driven threat detection, helping businesses address phishing, ransomware, and evolving social engineering attacks.

Microsoft Corporation and Google LLC have a dominant influence due to their integration of security within widely used productivity and collaboration platforms. Their solutions benefit from global scale and embedded features that enhance user adoption. Fortinet Inc. and Broadcom Inc. (Symantec) further strengthen the competitive landscape by offering enterprise-level defense tools with extensive global reach.

Forcepoint LLC and Dell Technologies Inc. add value by focusing on endpoint integration and data protection. Zscaler Inc. and Cloudflare Inc. emphasize zero-trust security and cloud-native resilience, aligning with enterprise digital transformation priorities. Ironscales Ltd. and Egress Software Technologies Ltd. focus on human-layer defense, addressing phishing and insider risk.

Top Key Players in the Market

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC (Google Cloud)

- Fortinet Inc.

- Broadcom Inc. (Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix (Musarubra US LLC)

- OpenText Cybersecurity

- Other Key Players

Recent Developments

- In July 2024, Barracuda expanded its email security offerings in India by launching its Email Gateway Defense, Data Inspector, and Cloud Archiving services through AWS India. This move aims to help businesses comply with the Digital Personal Data Protection Act (DPDPA) and address the country’s growing cybersecurity needs.

- In October 2024, Mimecast introduced AI-powered enhancements to its email security platform, utilizing natural language processing to bolster defenses against Business Email Compromise (BEC) and insider threats. These updates aim to improve threat detection and response capabilities.

Report Scope

Report Features Description Market Value (2024) USD 4.78 Bn Forecast Revenue (2034) USD 12.68 Bn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Platform Integration (Secure Email Gateway (SEG), Integrated Cloud Email Security (ICES/API), Cloud-Native Email Security Platform, Hybrid Gateway and API), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By Industry Vertical (BFSI, Government and Defense, IT and Telecommunications, Healthcare and Life Sciences, Retail and E-Commerce, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Barracuda Networks Inc., Proofpoint Inc., Mimecast Ltd., Cisco Systems Inc., Trend Micro Inc., Microsoft Corporation, Google LLC (Google Cloud), Fortinet Inc., Broadcom Inc. (Symantec), Check Point Software Technologies Ltd., Sophos Group PLC, Forcepoint LLC, Dell Technologies Inc., Zscaler Inc., Cloudflare Inc., Ironscales Ltd., Egress Software Technologies Ltd., Trellix (Musarubra US LLC), OpenText Cybersecurity, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud-based Email Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud-based Email Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC (Google Cloud)

- Fortinet Inc.

- Broadcom Inc. (Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix (Musarubra US LLC)

- OpenText Cybersecurity

- Other Key Players