Global Cloud Based Apps Market Size, Share, Statistics Analysis Report By Application (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Supply Chain Management (SCM), Business Intelligence (BI) and Analytics, Content Management, Other Applications), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Retail, Healthcare, Manufacturing, Government and Public Sector, Transportation and Logistics, Energy and Utilities, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133074

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

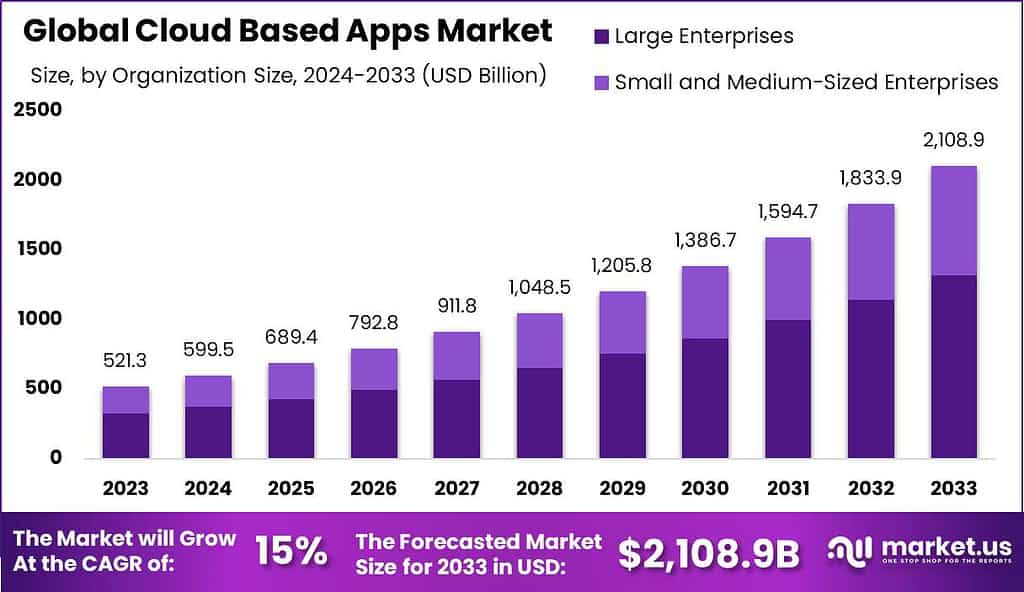

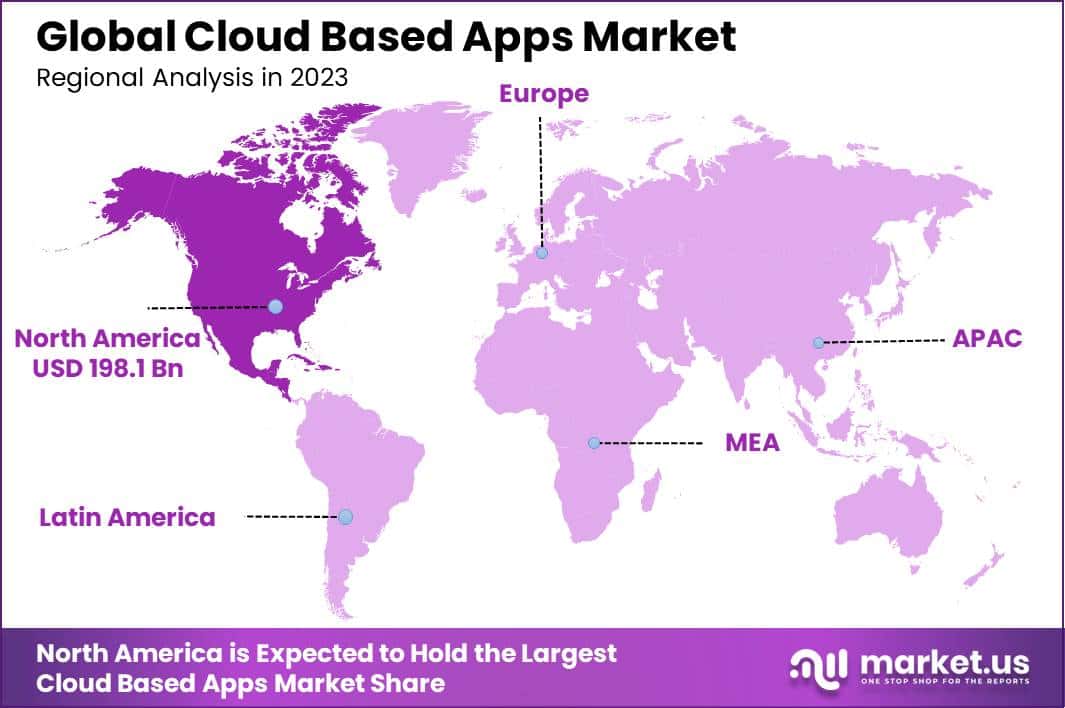

The Global Cloud Based Apps Market size is expected to be worth around USD 2,108.9 Billion By 2033, from USD 521.3 Billion in 2023, growing at a CAGR of 15.00% during the forecast period from 2024 to 2033. In 2023, North America led the cloud-based apps market, commanding over 38.0% of the global share and generating revenues of USD 198.1 billion.

Cloud-based apps are essentially software applications that use cloud computing platforms and services to operate. These apps utilize the internet for storing and processing data, making them accessible from any device with internet connectivity. This setup allows for a range of benefits including scalability, mobility, and flexible resource management. Unlike traditional applications that require local installation on every device, cloud-based apps run on servers maintained by cloud service providers.

The market for cloud-based apps has been expanding rapidly due to their ability to streamline operations across diverse industries. This growth is driven by the need for businesses to enhance collaboration, increase accessibility, and reduce IT overhead costs. The market features a variety of applications tailored to different business needs ranging from data storage solutions like Dropbox to customer relationship management systems like Salesforce.

Several key drivers are propelling the expansion of the cloud-based apps market. The primary factor is the cost-effectiveness of cloud services, which reduces the need for significant hardware investments and lowers IT maintenance costs. Additionally, the ability to scale services to match business growth dynamically without the need for physical upgrades is a significant advantage.

The widespread adoption of mobile devices and the increasing demand for workplace flexibility have also contributed to the growth of cloud-based solutions, enabling users to access data and applications from anywhere. The demand for cloud-based apps is fueled by the increasing necessity for businesses to maintain operational flexibility and ensure data accessibility across multiple locations.

With more companies moving towards remote work setups and digital business models, cloud applications are becoming indispensable. This shift has opened up numerous opportunities in sectors like healthcare, education, and retail, where cloud-based solutions can significantly enhance service delivery and customer engagement.

Technological advancements are continuously shaping the cloud-based apps market. The integration of artificial intelligence and machine learning into cloud applications is enhancing functionalities like data analytics and automated decision-making processes. Additionally, advancements in cloud security technologies are addressing data protection concerns, making cloud solutions more robust against cyber threats.

According to Edge Delta, an impressive 98% of organizations worldwide are now using cloud services, encompassing options like Software as a Service (SaaS) and fully cloud-native networks. This marks a notable increase from 94% in 2023, underscoring a robust shift towards cloud infrastructure across businesses. Furthermore, a significant 63% of workloads for small and medium-sized businesses (SMBs) are managed in the cloud, with 62% of their data also being hosted on cloud platforms

Key Takeaways

- The Global Cloud-Based Apps Market size is projected to reach USD 2,108.9 Billion by 2033, up from USD 521.3 Billion in 2023, growing at a CAGR of 15.00% during the forecast period from 2024 to 2033.

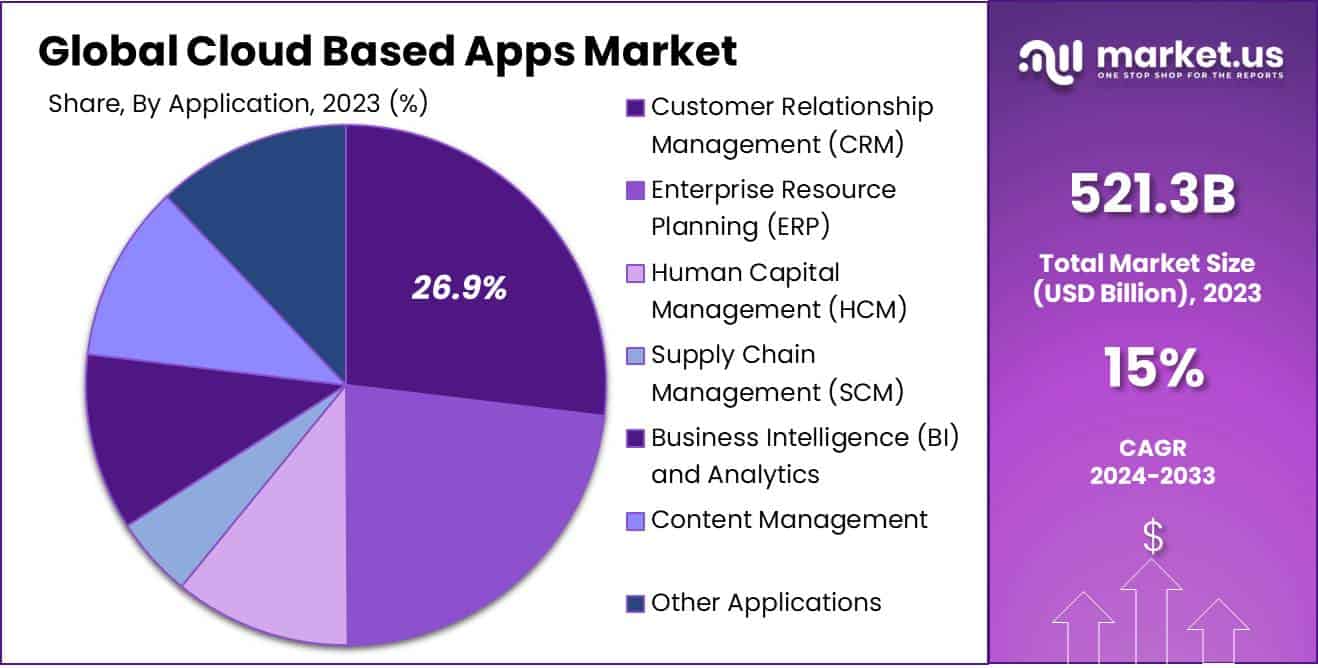

- In 2023, the Customer Relationship Management (CRM) segment dominated the cloud-based apps market, accounting for more than 26.9% of the market share.

- The Large Enterprises segment held a leading position in the cloud-based apps market in 2023, capturing over 62.5% of the market share.

- The BFSI (Banking, Financial Services, and Insurance) segment also led the market in 2023, securing more than 21.1% of the total share.

- North America was the largest market for cloud-based apps in 2023, representing over 38.0% of the global market share, with revenues reaching USD 198.1 billion.

Application Analysis

In 2023, the Customer Relationship Management (CRM) segment held a dominant market position within the cloud-based apps market, capturing more than a 26.9% share. This leading stance can be attributed to the critical role that CRM systems play in managing customer information and interactions.

By leveraging cloud-based CRM applications, businesses are able to offer enhanced customer service, streamline sales processes, and improve marketing strategies, all accessible from anywhere at any time. This has been particularly beneficial for remote and hybrid work environments, where access to centralized, real-time customer data is essential.

The appeal of CRM systems is further magnified by their scalability and integration capabilities. Cloud-based CRM platforms can easily integrate with other applications and data sources, which enriches customer data and provides comprehensive view of customer journey. This integration supports advanced analytics and personalized customer experiences, driving higher engagement and satisfaction rates.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the cloud-based apps market, capturing more than a 62.5% share. This leadership can be attributed to several factors that align well with the needs and capabilities of large organizations.

Large enterprises typically manage more complex operations and larger volumes of data, which necessitate robust cloud solutions that can integrate seamlessly with their existing systems and provide the necessary scalability and security.

Moreover, large enterprises often have the financial resources to invest in comprehensive cloud-based applications that offer advanced features, such as enhanced security, greater customization, and dedicated support. These features are critical for maintaining the vast IT infrastructures that large companies operate, which smaller enterprises might not require to the same extent.

Another reason for the leading position of this market is their capacity to drive enterprise-wide digital transformations. Large organizations are typically more inclined to adopt new technologies to enhance their market reach and operational capabilities.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the cloud-based apps market, capturing more than a 21.1% share. This prominence is largely attributable to the increasing digital transformation efforts within the sector.

Financial institutions are rapidly adopting cloud-based applications to enhance operational efficiency and customer service. The integration of these applications helps streamline processes such as mobile banking and compliance management, which are crucial for staying competitive in this digitally evolving landscape.

The rise in demand for cloud-based apps within BFSI is also driven by the need for robust cybersecurity measures and regulatory compliance. As financial data is highly sensitive, banks and financial institutions are investing significantly in secure cloud solutions that offer enhanced data protection features.

Moreover, the adoption of cloud-based apps in BFSI is facilitating better customer relationship management (CRM) strategies. These applications enable banks and financial service providers to offer personalized services and improve customer engagement through data analytics and tailored marketing campaigns.

Key Market Segments

By Application

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Human Capital Management (HCM)

- Supply Chain Management (SCM)

- Business Intelligence (BI) and Analytics

- Content Management

- Other Applications

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- IT and Telecommunications

- Retail

- Healthcare

- Manufacturing

- Government and Public Sector

- Transportation and Logistics

- Energy and Utilities

- Other Industry Verticals

Driver

Growing Need for Remote Access and Flexibility

The demand for cloud-based apps is driven by the increasing need for remote access and flexibility across industries. With a growing number of employees working remotely, businesses seek solutions that offer accessibility and collaborative tools regardless of physical location.

Cloud-based applications enable seamless sharing, real-time communication, and efficient workflows, which have become critical components of modern work environments. This flexibility empowers employees to work from anywhere, using any device with internet connectivity, leading to enhanced productivity and better work-life balance. Also, the rapid adoption of Software-as-a-Service (SaaS) models for business operations has accelerated the demand for cloud-based apps.

Restraint

Security and Privacy Concerns

Security and privacy concerns continue to be a major restraint for cloud-based apps. Many organizations worry about potential data breaches, unauthorized access, and the safety of sensitive customer and corporate information when stored in the cloud. High-profile data leaks and security incidents have heightened these fears, making companies more cautious when adopting cloud solutions.

Compliance with global data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), further complicates cloud adoption. Businesses must ensure that cloud-based apps meet stringent data security requirements, and any lapse in compliance could result in severe penalties.

Opportunity

Expansion in Small and Medium Enterprises

An emerging opportunity for cloud-based apps lies within the expansion of small and medium-sized enterprises (SMEs). Unlike large corporations, SMEs often face budgetary constraints when investing in traditional IT infrastructure.

Cloud-based apps provide an affordable solution by offering flexible pay-as-you-go models that reduce the upfront capital costs associated with IT development. This democratization of technology allows SMEs to access the same sophisticated software and capabilities that were once exclusive to larger organizations.

Cloud-based apps also provide the agility and scalability needed for SMEs to adapt quickly to market changes, allowing them to innovate and compete effectively. As many smaller businesses increasingly digitize their processes, cloud services offer tools for streamlining workflows, enhancing customer experiences, and automating tasks, all of which contribute to overall business growth.

Challenge

Ensuring Consistent Connectivity

One of the significant challenges associated with cloud-based apps is ensuring consistent and reliable internet connectivity. The performance of these applications relies heavily on stable internet access, which can be a major obstacle for businesses in regions with limited or inconsistent network infrastructure. In areas where connectivity drops or experiences latency, productivity may suffer, and business processes can come to a standstill, leading to potential operational and financial setbacks.

Moreover, as organizations increasingly adopt cloud-based apps, the demand for bandwidth also rises. If network speeds cannot keep up with this growth, users may experience sluggish performance, which can impact their satisfaction and overall adoption of cloud solutions.

Emerging Trends

One significant trend is the rise of hybrid and multi-cloud strategies. Companies are no longer relying on a single cloud provider. They are distributing workloads across multiple platforms to enhance flexibility and avoid vendor lock-in. This approach allows businesses to optimize performance and cost-efficiency by leveraging the strengths of different cloud services.

Edge computing is also gaining traction. By processing data closer to its source, edge computing reduces latency and improves real-time data handling. This is particularly beneficial for applications requiring immediate responses, such as autonomous vehicles or industrial automation systems.

Serverless computing is simplifying application deployment. Developers can run code without managing the underlying infrastructure, allowing them to focus on writing code and deploying applications faster. This model also scales automatically with demand, making it cost-effective for varying workloads.

Business Benefits

Adopting cloud-based applications offers numerous advantages for businesses. Cost savings are a primary benefit. By moving to the cloud, companies can reduce expenses related to hardware, maintenance, and energy consumption. Cloud services operate on a pay-as-you-go model, allowing businesses to pay only for the resources they use, which can lead to significant savings.

Enhanced collaboration is facilitated through cloud-based tools. Teams can access and work on documents simultaneously from different locations, improving productivity and fostering innovation. This is especially beneficial in today’s remote work environment, where seamless collaboration is essential.

Also, cloud-based applications contribute to business continuity. Data is stored in the cloud, safeguarding it from local hardware failures or disasters. This ensures that businesses can quickly recover and continue operations with minimal disruption, maintaining service reliability for customers.

Regional Analysis

In 2023, North America held a dominant market position in the cloud-based apps market, capturing more than a 38.0% share with revenues amounting to USD 198.1 billion. This leadership is primarily driven by the robust digital infrastructure and the presence of major cloud service providers and technology innovators in the region.

North America, especially the United States, has been at the forefront of cloud technology adoption, driven by industries that are quick to implement new technologies to enhance operational efficiencies and competitiveness. Businesses in North America are increasingly leveraging cloud applications to ensure scalability, reduce costs, and improve their ability to respond to market dynamics.

The region’s market dominance is further bolstered by the strong focus on enterprise solutions and the rapid adoption of cloud-based applications across small, medium, and large enterprises. The high level of digital literacy and the presence of a tech-savvy workforce also contribute to the widespread use of cloud-based solutions.

Moreover, stringent data protection regulations in North America, such as GDPR compliance requirements for companies operating in Europe and similar standards in the US, have prompted businesses to invest in secure and compliant cloud-based applications.

This regulatory environment has encouraged innovation in cloud technologies, focusing on security and data privacy, which are critical factors for businesses when choosing cloud-based solutions. The combination of technological advancement, regulatory frameworks, and a strong push towards digital transformation has firmly positioned North America as the leading market for cloud-based applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the rapidly evolving market of cloud-based apps, several key players are leading the innovation and adoption across various industries.

Microsoft Corporation has established itself as a leader in the cloud-based apps market through its comprehensive suite of services, including Microsoft 365 and Azure. Microsoft’s strength lies in its integration capabilities that allow seamless connectivity between different applications and services.

IBM Corporation is another major player in this field, known for its robust cloud offerings like IBM Cloud and Red Hat. IBM’s focus on hybrid cloud environments and artificial intelligence has positioned it as a key enabler of digital transformation for businesses.

Google LLC impacts the market with its Google Cloud Platform (GCP), which offers highly scalable and reliable infrastructure solutions. Google’s strengths include data analytics, machine learning, and artificial intelligence capabilities embedded within its cloud services. These features are particularly attractive to businesses looking to harness big data for strategic insights and decision-making.

Top Key Players in the Market

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Adobe Inc.

- Workday, Inc.

- Infosys Limited

- Zoho Corporation

- Other Key Players

Recent Developments

- In June 2023, IBM announced its acquisition of Apptio, a cloud cost management company, for $4.6 billion. This acquisition aims to enhance IBM’s IT automation portfolio by integrating Apptio’s capabilities into its offerings

- In June 2023, DigitalOcean purchased Paperspace, a startup focused on cloud computing and AI development, for $111 million. This acquisition is intended to strengthen DigitalOcean’s position in the cloud computing market.

Report Scope

Report Features Description Market Value (2023) USD 521.3 Bn Forecast Revenue (2033) USD 2,108.9 Bn CAGR (2024-2033) 15.00% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Supply Chain Management (SCM), Business Intelligence (BI) and Analytics, Content Management, Other Applications), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Retail, Healthcare, Manufacturing, Government and Public Sector, Transportation and Logistics, Energy and Utilities, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Google LLC, Salesforce, Inc., Oracle Corporation, SAP SE, Adobe Inc., Workday, Inc., Infosys Limited, Zoho Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Based Apps MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Cloud Based Apps MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Adobe Inc.

- Workday, Inc.

- Infosys Limited

- Zoho Corporation

- Other Key Players