Global Cloth Diaper Market Size, Share, Growth Analysis By Type (Multi-Layer, Single-Layer), By Material (Cotton, Bamboo, Hemp, Microfibre, Others), By End-User (Women, Men), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Pharmacy/Drug Stores, Online Sales Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172704

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

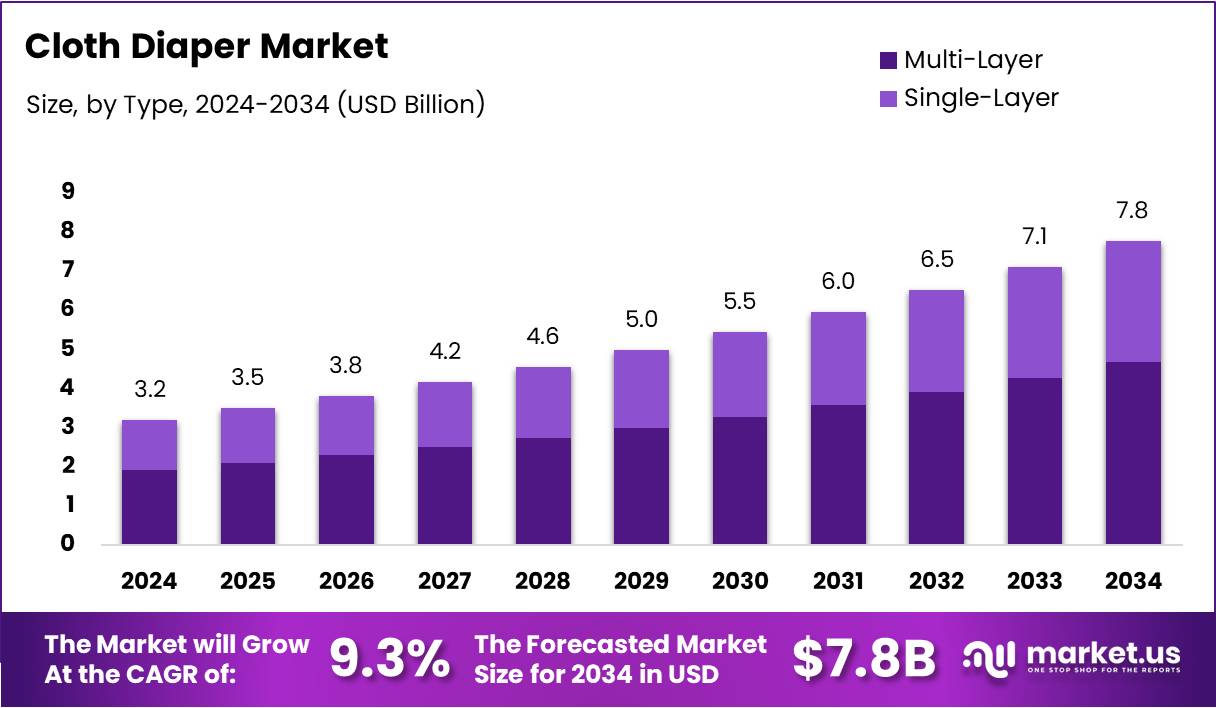

The Global Cloth Diaper Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

The cloth diaper market represents a sustainable alternative to disposable diapers, encompassing reusable fabric-based products designed for infant care. These products typically feature absorbent materials like cotton, bamboo, or microfiber, secured with adjustable fasteners. Modern cloth diapers incorporate innovative designs, including pocket styles, all-in-ones, and hybrid systems that balance convenience with environmental responsibility.

Market demand continues expanding as environmentally conscious parents prioritize eco-friendly baby care solutions. Rising awareness about chemical exposure from disposables drives adoption rates upward. Furthermore, the economic appeal strengthens as families recognize long-term cost savings despite higher initial investments. This shift reflects broader consumer preferences toward sustainable living practices.

Growing urbanization and increasing disposable incomes create substantial opportunities across developing regions. E-commerce platforms facilitate market penetration by enabling direct-to-consumer sales channels. Additionally, product innovation focuses on enhanced absorbency, breathability, and aesthetic appeal to attract modern parents. These developments position the sector for sustained expansion throughout upcoming years.

Government initiatives promoting environmental sustainability indirectly benefit the cloth diaper segment. Several regions implement landfill reduction programs and incentivize eco-friendly products through tax benefits or subsidies. Regulatory frameworks addressing chemical safety in baby products also influence purchasing decisions. These policy measures collectively support market growth while ensuring consumer protection standards.

Performance metrics reveal compelling economic advantages for adopting reusable options. Cloth diapers typically function effectively for 3 to 4 hours during daytime use, extending to 8–10 hours overnight with supplementary padding. The durability factor proves particularly attractive, as individual units generally last 2–3 years, accommodating multiple children within families.Financially, average households invest approximately $800-$1000 for Cloth diapers, representing significant savings compared to continuous disposable purchases over equivalent periods.

Key Takeaways

- The Global Cloth Diaper Market is projected to grow from USD 3.2 Billion in 2024 to USD 7.8 Billion by 2034, at a 9.3% CAGR.

- Multi-Layer cloth diapers dominate the type segment with a 56.8% market share in 2024.

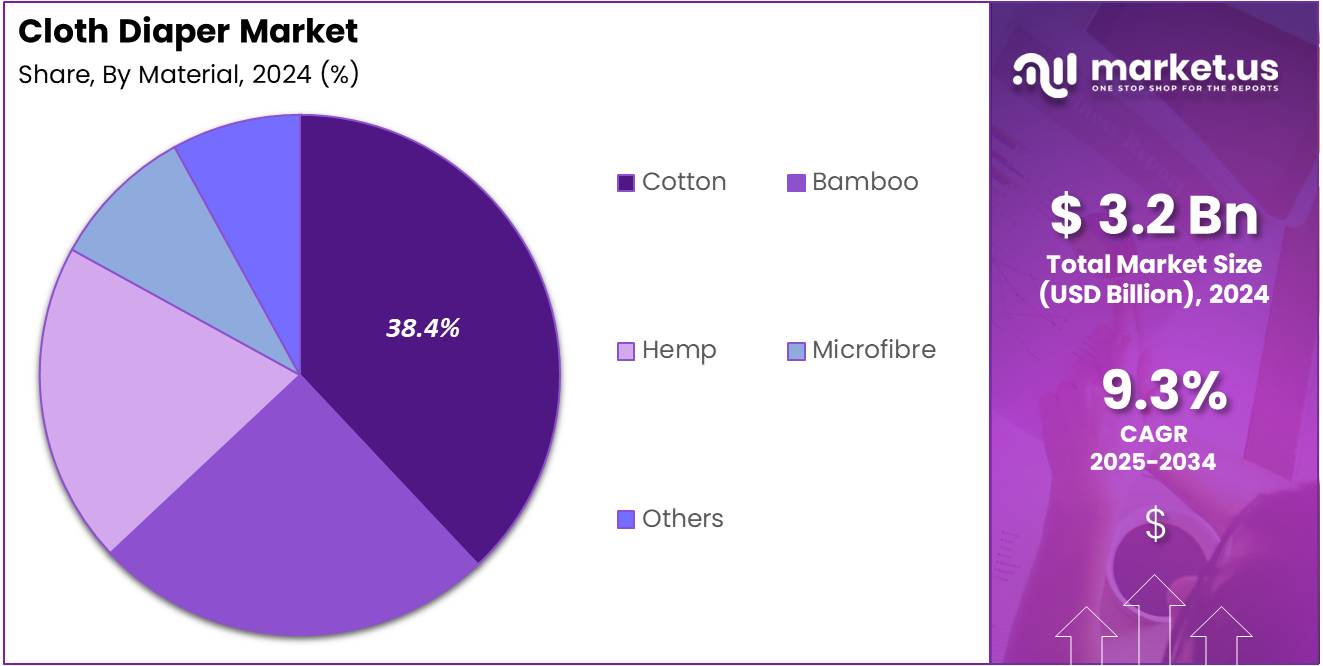

- Cotton leads the material segment, accounting for 38.4% of the global market share in 2024.

- Women represent the largest end-user segment, holding a 62.3% share of the market in 2024.

- Hypermarkets and Supermarkets are the leading distribution channel with a 38.5% market share in 2024.

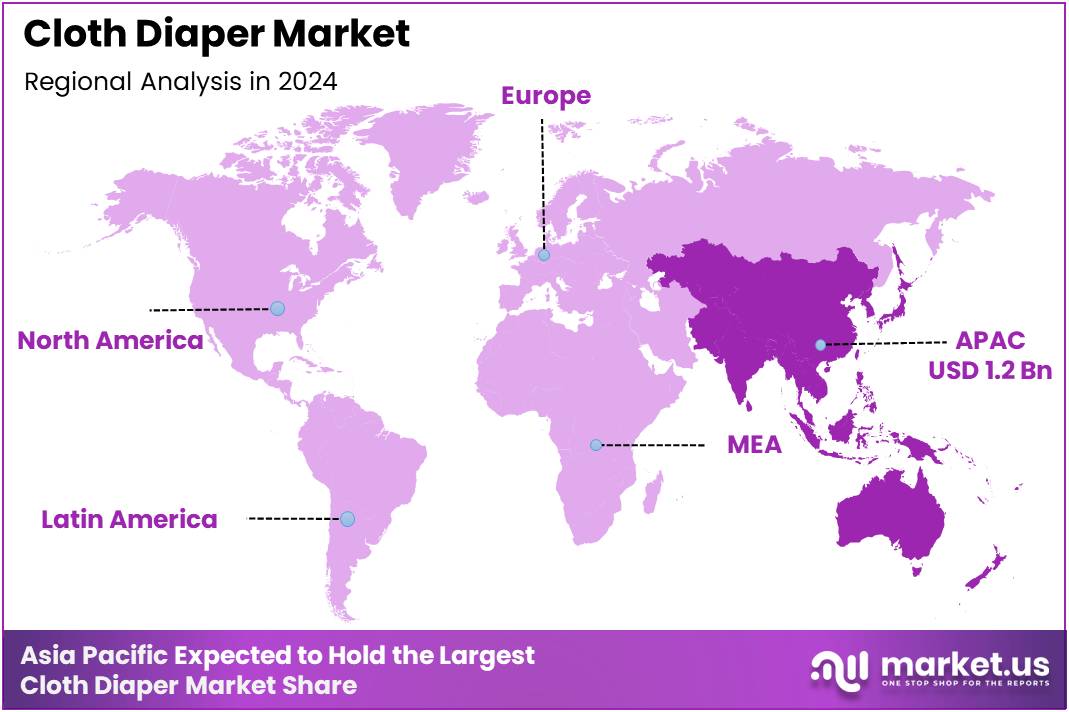

- Asia Pacific is the leading regional market, contributing 39.4% of global revenue, valued at USD 1.2 Billion.

By Type Analysis

Multi-Layer held a dominant market position in the By Type Analysis segment of Cloth Diaper Market, with a 56.8% share.

In 2024, Multi-Layer cloth diapers dominate due to superior absorbency and leak protection. Multiple fabric layers effectively manage moisture, keeping users dry for extended periods. Parents favor these designs for overnight use and heavy wetters. Enhanced durability justifies higher pricing, making them cost-effective long-term investments. Versatile fabric combinations optimize performance while maintaining exceptional comfort.

Single-Layer cloth diapers attract budget-conscious consumers seeking lightweight alternatives. These streamlined designs offer breathability and quick-drying benefits, ideal for daytime use. Simplified construction reduces drying time significantly, advantageous for families with limited laundry resources. Lower manufacturing costs create affordable pricing, making eco-friendly cloth diapering accessible to broader demographics.

By Material Analysis

Cotton held a dominant market position in the By Material Analysis segment of Cloth Diaper Market, with a 38.4% share.

In 2024, Cotton material leads through universal acceptance and proven reliability. Natural fibers offer exceptional softness, minimizing skin irritation and allergic reactions. High absorbency manages moisture effectively while breathability prevents diaper rash. Durability withstands repeated washing without degradation. Widespread availability and established supply chains ensure competitive pricing across economic segments.

Bamboo fabric emerges as a premium sustainable choice. Natural antibacterial properties inhibit odor-causing bacteria effectively. Superior moisture-wicking capabilities keep skin drier longer. Ultra-soft texture provides luxury comfort with hypoallergenic characteristics. Rapid renewable growth and minimal environmental impact resonate with eco-conscious parents despite higher costs.

Hemp material represents the most durable natural fiber option. Exceptional strength improves with washing, creating increasingly absorbent diapers. Natural mold resistance extends product lifespan considerably. Minimal pesticide requirements during cultivation appeal to organic-focused consumers. Absorbency capacity increases substantially after preparation, delivering outstanding long-term performance.

Microfibre material delivers synthetic high-performance absorbency affordably. Ultra-fine fibers rapidly wick moisture from skin. Quick-drying properties accommodate busy household schedules effectively. Careful maintenance prevents compression issues. Synthetic composition concerns some parents, though performance benefits attract practical-minded consumers seeking efficient solutions.

Other materials include innovative blends combining multiple fiber advantages. Fleece linings, wool covers, and proprietary technologies cater to niche preferences. These alternatives address specific performance requirements and ethical considerations. Specialty materials command premium pricing while serving dedicated segments seeking customized diapering solutions.

By End-User Analysis

Women held a dominant market position in the By End-User Analysis segment of Cloth Diaper Market, with a 62.3% share.

In 2024, Women consumers represent the predominant purchasing demographic as primary caregivers. Decision-making authority extends across product selection and sustainable parenting choices. Female buyers conduct extensive research, comparing absorbency, fabrics, and environmental credentials. Higher engagement with online communities significantly influences market trends. Preferences drive innovation in designs balancing practicality with aesthetics.

Men consumers constitute a growing segment as parenting evolves toward shared responsibilities. Male buyers increasingly participate in product decisions, prioritizing technical specifications and cost-effectiveness. This demographic values straightforward functionality and durability. Rising father involvement expands market reach, encouraging gender-neutral marketing strategies and user-friendly designs.

By Distribution Channel Analysis

Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of Cloth Diaper Market, with a 38.5% share.

In 2024, Hypermarkets and Supermarkets lead through convenient one-stop shopping experiences. Extensive product ranges enable physical comparison and immediate purchase satisfaction. Strategic placement and promotions increase visibility significantly. Competitive bulk pricing attracts budget-conscious families. Physical quality assessment builds confidence in first-time buyers hesitant about investments.

Convenience Stores serve immediate localized needs with limited retail access. Smaller outlets stock essentials for emergency purchases and quick replenishment. Extended operating hours accommodate diverse schedules, benefiting working parents. Limited selection fulfills crucial distribution gaps, ensuring availability across geographic regions effectively.

Pharmacy and Drug Stores position products alongside health and wellness items, emphasizing skin-safe materials. Professional staff provide informed recommendations addressing specific concerns. Trusted healthcare association enhances credibility for hypoallergenic and organic options. These channels effectively reach health-conscious consumers prioritizing quality standards.

Online Sales Channels experience rapid growth through unparalleled variety and competitive pricing. Digital platforms enable detailed comparisons, reviews, and educational content. Subscription services simplify recurring purchases conveniently. Home delivery eliminates transportation challenges for bulky packages. Convenience appeals to tech-savvy millennial parents comfortable with e-commerce.

Other distribution channels include specialty boutiques, direct sales, and eco-focused cooperatives. Alternative channels provide personalized service and expert consultations. Curated sustainable selections foster dedicated customer communities. Workshops and support groups build brand loyalty beyond transactions, serving specialized segments effectively.

Key Market Segments

By Type

- Multi-Layer

- Single-Layer

By Material

- Cotton

- Bamboo

- Hemp

- Microfibre

- Others

By End-User

- Women

- Men

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Pharmacy/Drug Stores

- Online Sales Channels

- Others

Drivers

Increasing Parental Focus on Chemical-Free, Hypoallergenic Infant Care Solutions

Modern parents are becoming more cautious about what comes in contact with their baby’s sensitive skin. Chemical-free and hypoallergenic products are gaining priority as awareness grows about potential irritants found in disposable diapers. Cloth diapers made from natural fabrics offer a safer alternative, reducing exposure to synthetic chemicals and fragrances. This shift reflects a broader trend toward health-conscious parenting decisions.

Environmental concerns are reshaping consumer behavior significantly. Parents are increasingly worried about the massive waste generated by single-use baby products, particularly disposable diapers that take centuries to decompose. Cloth diapers present an eco-friendly solution that aligns with sustainability goals. This growing environmental consciousness is pushing families to adopt reusable options that minimize their carbon footprint.

Urban households and eco-conscious families are leading the acceptance of cloth diapers. These demographics value both environmental responsibility and long-term cost savings. As information spreads through parenting networks and social media, more families are willing to try modern cloth diapering systems. The perception of cloth diapers has evolved from old-fashioned to trendy and responsible, particularly among millennial and Gen Z parents who prioritize sustainable living practices.

Restraints

Perceived Complexity in Usage, Cleaning, and Daily Handling Requirements

Many parents hesitate to adopt cloth diapers due to perceived inconvenience. The process of washing, drying, and maintaining cloth diapers appears time-consuming compared to simply disposing of single-use alternatives. Concerns about proper cleaning methods, odor management, and storage create barriers for busy families. First-time parents especially may feel overwhelmed by the learning curve associated with cloth diapering systems.

Market penetration remains limited in regions where modern cloth diaper systems are relatively unknown or misunderstood. In many developing areas and conservative communities, traditional perceptions of cloth diapers persist without exposure to contemporary designs. Lack of educational resources and product demonstrations prevents potential users from understanding the improvements in today’s offerings. Without proper awareness campaigns and retail presence, these markets continue relying heavily on disposable options as the default choice. The absence of local support communities or experienced users makes adoption more challenging for interested parents.

Growth Factors

Innovation in Easy-to-Use, Leak-Proof, and Fast-Drying Cloth Diaper Technologies

Technological advancements are transforming cloth diaper functionality dramatically. Manufacturers are developing innovative designs featuring improved absorbency, leak-proof barriers, and quick-drying materials that address traditional concerns. Modern fastening systems using snaps and Velcro make cloth diapers as convenient as disposables. These innovations reduce the perceived hassle, making cloth diapers appealing to mainstream consumers who previously dismissed them.

Online retail platforms and parenting-focused websites are expanding cloth diaper accessibility significantly. E-commerce eliminates geographical barriers, allowing parents everywhere to explore diverse products and read authentic reviews. Subscription services and starter kits simplify the initial investment. Digital platforms also provide educational content, tutorials, and community support that demystify cloth diapering for newcomers.

Healthcare professionals and advocacy groups are increasingly promoting cloth diapers. Pediatricians recommend them for reducing diaper rash and chemical exposure. Parenting groups organize workshops demonstrating proper usage techniques. Sustainability programs highlight environmental benefits, encouraging adoption through incentive schemes. This multi-channel promotion builds credibility and trust, encouraging hesitant parents to consider reusable options as viable and beneficial choices.

Emerging Trends

Rising Demand for Organic, Bamboo, and Plant-Based Fabric Diapers

Premium natural materials are becoming highly sought after in the cloth diaper market. Parents increasingly prefer organic cotton, bamboo, and hemp fabrics that offer superior softness and breathability. These plant-based materials align with clean living philosophies while providing excellent absorbency and comfort. The trend reflects broader consumer preferences for organic baby products across all categories.

All-in-one and adjustable cloth diaper formats are gaining significant popularity. These convenient designs eliminate complicated folding and pinning, making cloth diapering accessible to beginners. Adjustable sizing allows single diapers to grow with babies from infancy through toddlerhood, improving cost-effectiveness. Simplified designs attract parents seeking eco-friendly solutions without sacrificing convenience or ease of use.

Digital parenting communities and eco-lifestyle influencers are powerfully shaping market trends. Social media platforms showcase real-life experiences, washing routines, and product comparisons that build confidence among potential users. Online support groups provide troubleshooting advice and encouragement. Influencers promoting sustainable parenting normalize cloth diapering, making it aspirational rather than alternative.

Regional Analysis

Asia Pacific Dominates the Cloth Diaper Market with a Market Share of 39.4%, Valued at USD 1.2 Billion

Asia Pacific leads the global cloth diaper market with a commanding share of 39.4%, valued at USD 1.2 billion. The region’s dominance is attributed to its large population base, particularly in China and India, coupled with rising environmental awareness among millennial parents. Growing middle-class demographics with increased disposable incomes and government initiatives promoting sustainable parenting practices are driving robust market expansion across the region.

North America Cloth Diaper Market Trends

North America represents a mature market characterized by strong environmental consciousness and well-established retail infrastructure. Increasing concerns about landfill waste from disposable diapers and rising awareness of chemical exposure are driving adoption. The region benefits from supportive community networks and e-commerce platforms that facilitate easy access to diverse cloth diaper products.

Europe Cloth Diaper Market Trends

Europe maintains a significant market position driven by stringent environmental regulations and deeply rooted sustainability values. Countries like Germany, the UK, and France show strong adoption rates, supported by government incentives and rebate programs. The region’s consumers demonstrate high willingness to invest in premium, organic cloth diaper products aligned with eco-conscious lifestyles.

Middle East and Africa Cloth Diaper Market Trends

The Middle East and Africa region represents an emerging market with substantial growth potential. Urban centers in the UAE and South Africa are witnessing gradual adoption among affluent, environmentally conscious consumers. Economic constraints and limited distribution networks currently restrict widespread penetration, though e-commerce expansion is improving accessibility.

Latin America Cloth Diaper Market Trends

Latin America exhibits a developing market driven by growing environmental awareness and interest in cost-effective diapering solutions. Brazil, Mexico, and Argentina lead regional adoption, though price sensitivity and infrastructural challenges impact growth. Grassroots movements promoting natural parenting and expanding social media influence are gradually transforming consumer perceptions across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cloth Diaper Company Insights

The global cloth diaper market in 2024 continues to witness significant growth, driven by increasing environmental consciousness among parents and rising concerns about synthetic materials in disposable diapers. The market landscape is characterized by both established consumer goods giants and specialized sustainable baby product manufacturers who are innovating to meet evolving consumer demands.

The Procter & Gamble Company maintains a notable presence in the cloth diaper segment, leveraging its extensive distribution network and brand recognition built over decades in the baby care industry. The company’s research and development capabilities enable it to introduce advanced fabric technologies that enhance absorbency and comfort.

Babee Greens has carved out a strong position as a dedicated cloth diaper brand, focusing on organic and eco-friendly materials that appeal to environmentally conscious millennial and Gen-Z parents. Their commitment to chemical-free products resonates with health-focused consumers seeking safer alternatives for their infants. The brand’s transparency in sourcing and manufacturing processes further strengthens consumer trust.

Thirsties Baby distinguishes itself through innovative designs and customizable sizing options, addressing common fit concerns that parents face with reusable diapers. The brand’s emphasis on durability and ease of use has helped reduce barriers to cloth diaper adoption among first-time users. Their one-size adjustable systems offer long-term value by growing with babies from infancy through toddlerhood.

Modern Cloth Nappies brings contemporary aesthetics and functionality to the market, offering stylish patterns and prints that make cloth diapering more appealing to modern parents. Their focus on user-friendly features and quick-drying fabrics addresses practical concerns about laundry management.

Top Key Players in the Market

- The Procter Gamble Company

- Babee Greens

- Thirsties Baby

- Modern Cloth Nappies

- Cotton Babies, Inc.

- LittleLamb

- Kinder Cloth Diaper Co.

- Happy BeeHinds Cloth Diaper Company

Recent Developments

- In August 2025, Kinder Cloth Diaper Co. secured exclusive rights to Kekoa’s premium nappy line, strengthening its high-end product portfolio.This move enhances brand positioning in the premium cloth diaper segment and supports expanded customer reach.

- In July 2025, The Kanga Care Cloth Diaper Company, known for its top-selling Rumparooz Pocket Diaper, completed the acquisition of GroVia LLC.The acquisition broadens product offerings and consolidates its presence across multiple reusable diaper categories.

- In January 2025, Kinder Cloth Diaper Co. launched a Luxe Pocket Diaper featuring patented dual inner gusset technology.The innovation focuses on leak protection and comfort, targeting performance-driven and premium consumers.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 7.8 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Multi-Layer, Single-Layer), By Material (Cotton, Bamboo, Hemp, Microfibre, Others), By End-User (Women, Men), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Pharmacy/Drug Stores, Online Sales Channels, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Procter & Gamble Company, Babee Greens, Thirsties Baby, Modern Cloth Nappies, Cotton Babies, Inc., LittleLamb, Kinder Cloth Diaper Co., Happy BeeHinds Cloth Diaper Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Procter Gamble Company

- Babee Greens

- Thirsties Baby

- Modern Cloth Nappies

- Cotton Babies, Inc.

- LittleLamb

- Kinder Cloth Diaper Co.

- Happy BeeHinds Cloth Diaper Company