Global Clinical Mass Spectrometry Market Analysis By Product Type (Gas chromatography Mass Spectrometry, Liquid chromatography Mass Spectrometry, MALDI-TOF Mass Spectrometer, Capillary Electrophoresis Mass Spectrometry, Ion Mobility Spectrometry), By Application (Drug Discovery, Clinical Testing, Proteomics, Others), By End User (Hospitals, Diagnostic Centers, Research Laboratories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 19078

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

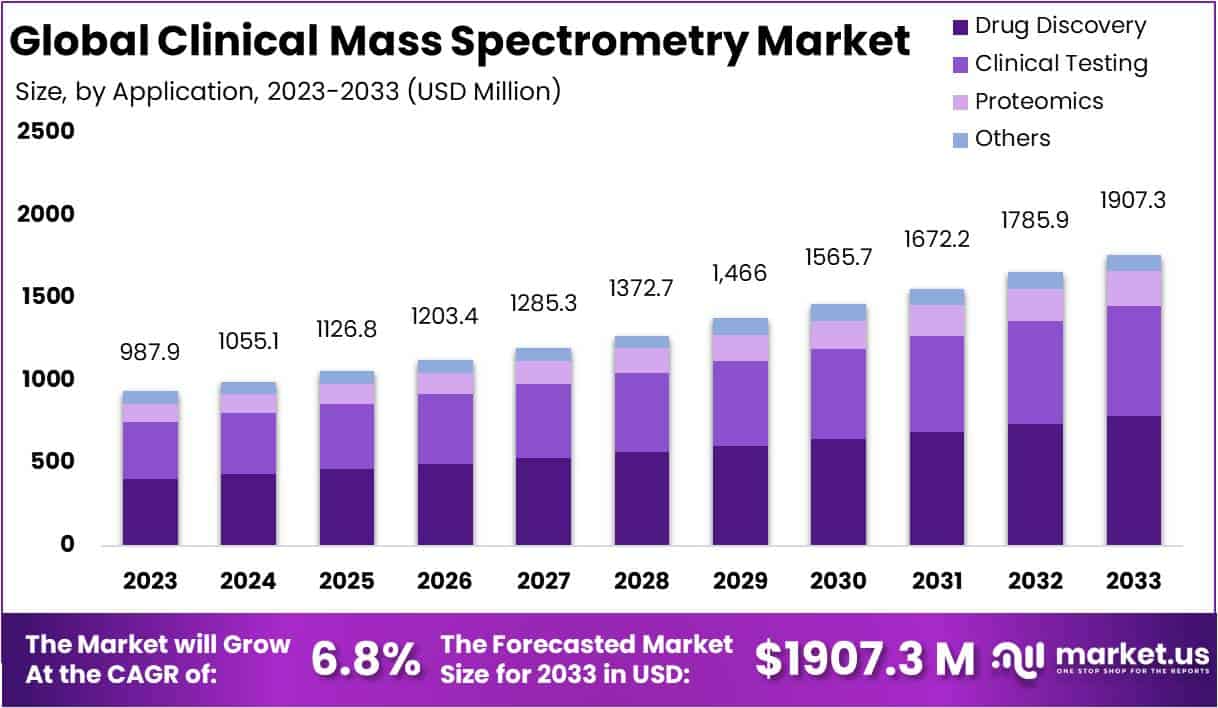

The Global Clinical Mass Spectrometry Market Size is expected to be worth around US$ 1907.3 Million by 2033, from US$ 987.9 Million in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Clinical Mass Spectrometry involves employing mass spectrometry techniques in clinical settings to analyze biological samples for diagnostic, prognostic, and therapeutic insights. This powerful analytical method discerns the mass-to-charge ratio of ions within blood, urine, and tissues, facilitating the identification and quantification of biomolecules like proteins, metabolites, and drugs. Its applications aid disease diagnosis, treatment monitoring, and understanding of physiological processes.

The Clinical Mass Spectrometry Market, comprising instruments, consumables, and services, thrives due to escalating disease prevalence, technological strides improving diagnostic precision, the surge in personalized medicine practices, increased healthcare spending, and the expanding spectrum of applications. The market fosters a diverse landscape with instrument manufacturers, consumable suppliers, and service providers, continually evolving to meet the dynamic demands of clinical diagnostics.

Key Takeaways

- Market Growth: Clinical Mass Spectrometry market set to reach USD 1,907.3 million by 2033, with a robust CAGR of 6.8% from 2024 to 2033.

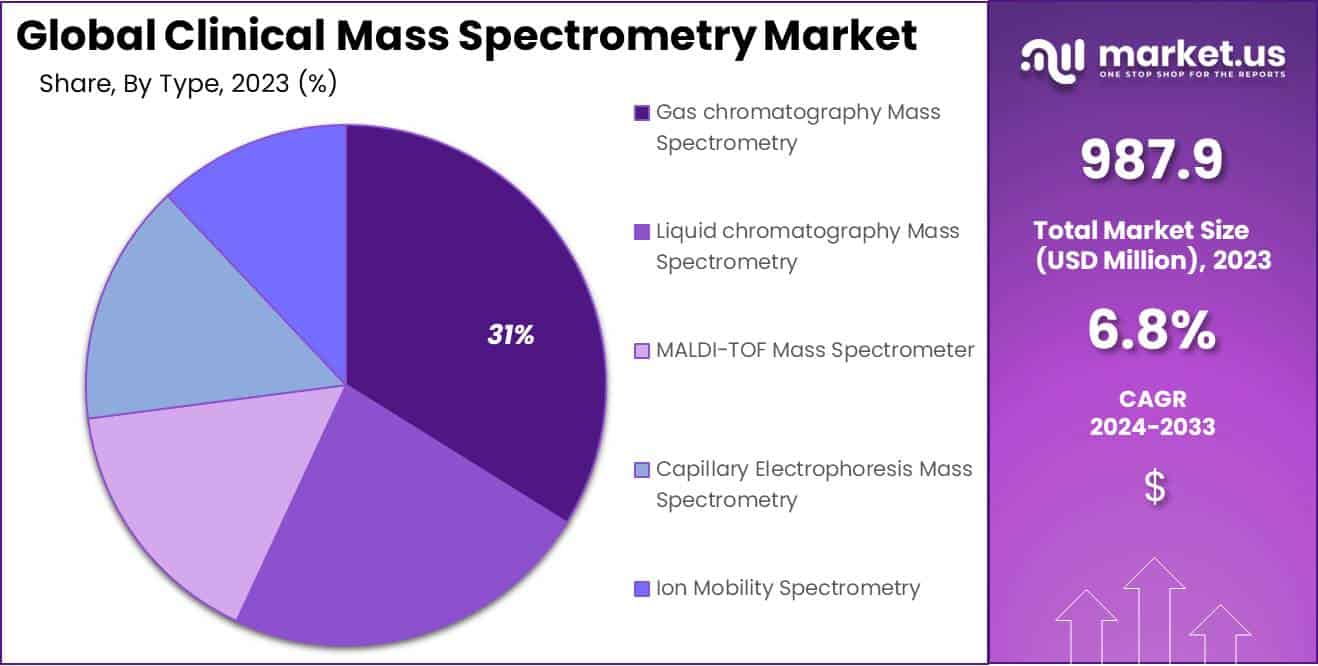

- Product Leadership: Gas Chromatography Mass Spectrometry (GC-MS) claims over 30.9% market share in 2023, underscoring its effectiveness.

- Application Dominance: Drug Discovery leads with a commanding 41.2% market share in 2023, showcasing its pivotal role.

- End User Preference: Hospitals dominate the market with a significant 58.2% share in 2023, indicating their integral role.

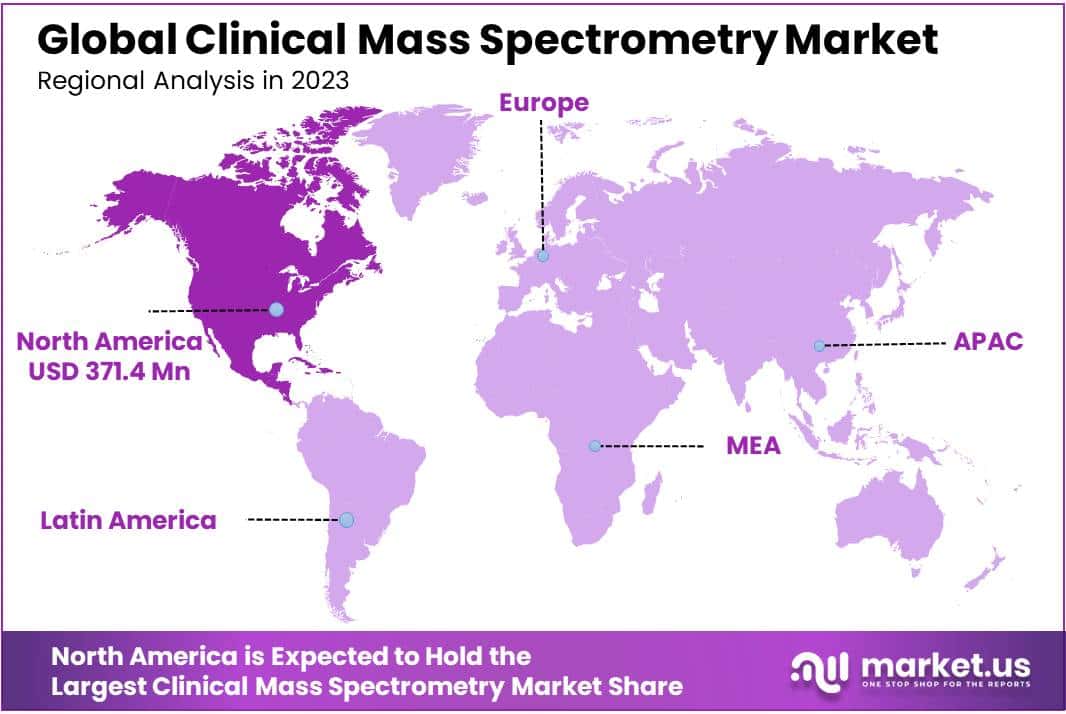

- Global Region Leadership: North America commands the market with a 37.6% share and USD 371.4 million value in 2023.

- Technological Trends: Ongoing miniaturization and integration of mass spectrometry instruments for point-of-care testing drive industry evolution.

- Industry Consolidation: Increased mergers, acquisitions, and licensing deals enhance market capabilities and foster innovation.

Product Type Analysis

In 2023, the Gas Chromatography Mass Spectrometry (GC-MS) segment has taken a leading position in the Clinical Mass Spectrometry market, capturing a substantial market share of more than 30.9%. This prominence is a result of the method’s effectiveness in separating and analyzing intricate mixtures, making it the preferred option in the field of clinical research and diagnostics.

Liquid Chromatography Mass Spectrometry (LC-MS), another vital player in the market, showcased substantial growth, accounting for a notable share. The technique’s ability to handle a diverse range of compounds with high sensitivity contributed to its popularity in clinical applications.

MALDI-TOF Mass Spectrometry, recognized for its rapid and accurate identification of biomolecules, experienced a steady rise in demand, reflecting its crucial role in clinical diagnostics. The technology’s proficiency in protein analysis and microbial identification positioned it as a valuable asset in healthcare settings.

Capillary Electrophoresis Mass Spectrometry (CE-MS) also made its mark, gaining traction in the Clinical Mass Spectrometry landscape. The method’s capability to separate and analyze charged molecules showcased its significance, especially in proteomic and metabolomic studies.

Ion Mobility Spectrometry, with its unique ability to characterize ionized molecules based on their mobility in a carrier gas, played a niche yet impactful role in the market. Its application in studying complex samples added a layer of versatility to the clinical research toolbox.

As the Clinical Mass Spectrometry market continues to evolve, these diverse segments contribute collectively to advancements in medical research, diagnostics, and personalized medicine, showcasing the dynamic nature of this vital healthcare technology.

Application Analysis

In 2023, the Clinical Mass Spectrometry market showcased remarkable growth, with the Drug Discovery segment emerging as a frontrunner, securing a commanding market position by capturing over 41.2% share. This highlights the pivotal role of mass spectrometry in the drug discovery process, aiding researchers in identifying and analyzing potential drug candidates.

Clinical Testing also played a significant role, contributing to the market’s vitality. This segment, driven by the need for accurate diagnostic tools, accounted for a substantial market share. The reliability and precision offered by mass spectrometry in clinical testing procedures further solidified its standing in the healthcare industry.

Proteomics, another crucial application, demonstrated a noteworthy presence in the market landscape. With mass spectrometry playing a key role in deciphering complex protein structures and functions, the Proteomics segment witnessed substantial adoption. Researchers and scientists leveraged this technology to gain deeper insights into the intricate world of proteins, contributing to advancements in personalized medicine and disease understanding.

Beyond these primary segments, other applications also made valuable contributions to the Clinical Mass Spectrometry market. These miscellaneous applications, ranging from environmental testing to food safety, underscored the versatility of mass spectrometry technology. Its adaptability across diverse fields further fueled its adoption and market expansion.

Looking ahead, the market is poised for continued growth, with each segment contributing to the evolving landscape of Clinical Mass Spectrometry. The emphasis on drug discovery, the critical role in clinical testing, the exploration of proteomics, and the versatility in various other applications collectively propel the market forward, making Clinical Mass Spectrometry a cornerstone in modern scientific research and healthcare diagnostics.

End User Analysis

In 2023, the clinical mass spectrometry market showcased a significant dominance by the Hospitals segment, securing a substantial market share of more than 58.2%. Hospitals emerged as the leading end user in the market, underscoring their pivotal role in the adoption of mass spectrometry technologies for clinical applications.

Diagnostic Centers also played a noteworthy role, contributing to the market landscape with their sophisticated diagnostic capabilities. This segment exhibited a substantial presence, accounting for a considerable portion of the market share. The accessibility and efficiency of clinical mass spectrometry in diagnostic centers have positioned them as key stakeholders in advancing healthcare diagnostics.

Research Laboratories, known for their dedication to scientific exploration and innovation, constituted a substantial share in the clinical mass spectrometry market. These laboratories harnessed the power of mass spectrometry for diverse research purposes, contributing significantly to the growth of the overall market.

The Other category, comprising various healthcare facilities and institutions beyond hospitals, diagnostic centers, and research laboratories, also made a noteworthy impact. These diverse end users collectively enriched the market dynamics, reflecting the widespread adoption of clinical mass spectrometry across different healthcare settings.

The year 2023 marked a dynamic landscape for the clinical mass spectrometry market, with each end user segment playing a distinct yet interconnected role in driving advancements in diagnostics, research, and overall healthcare outcomes. The substantial market presence of hospitals underscores their integral position in the widespread integration of mass spectrometry technologies for enhanced patient care and diagnostic precision.

Key Market Segments

Product Type

- Gas chromatography Mass Spectrometry

- Liquid chromatography Mass Spectrometry

- MALDI-TOF Mass Spectrometer

- Capillary Electrophoresis Mass Spectrometry

- Ion Mobility Spectrometry

Application

- Drug Discovery

- Clinical Testing

- Proteomics

- Others

End User

- Hospitals

- Diagnostic Centers

- Research Laboratories

- Others

Drivers

Rising Adoption of Mass Spectrometry Techniques for Clinical Diagnostics

The increasing prevalence of mass spectrometry techniques in clinical diagnostics can be attributed to their enhanced sensitivity and accuracy compared to alternative methods. This rise in adoption signifies a pivotal shift towards more precise and reliable diagnostic tools within the medical field.

Growing Focus on Personalized Medicine and the Need for Biomarkers

The surge in interest in personalized medicine has fueled a demand for biomarkers, driving the integration of mass spectrometry in the development of patient-specific therapies and medications. This shift towards individualized treatment approaches underscores the pivotal role that mass spectrometry plays in advancing medical practices.

Continued Technological Advancements in MS Instrumentations

Ongoing technological progress in mass spectrometry instrumentations, encompassing improvements in resolution, speed, and software capabilities, is pivotal. These advancements not only enhance the overall performance of mass spectrometry but also contribute to its evolving role in diverse scientific and clinical applications.

Increased Investment and Funding for Clinical Research Involving Mass Spectrometry Platforms

The augmented investment and funding allocated to clinical research employing mass spectrometry platforms signify a growing recognition of their significance in advancing medical knowledge. This financial support facilitates the exploration of new applications, methodologies, and discoveries, thereby propelling the field of mass spectrometry forward.

Restraints

High Costs Associated with Mass Spectrometry Equipment

Investing in mass spectrometry equipment involves substantial expenses, covering purchase, operation, and maintenance. These costs act as a significant restraint, hindering a more widespread adoption of this technology in various fields.

Regulatory Guidelines for New Clinical MS Applications

The absence of clear regulatory guidelines about the utilization of newer clinical mass spectrometry applications poses a challenge. This lack of regulatory clarity can impede the seamless integration of these advancements into routine practices.

Shortage of Trained Clinical Laboratory Personnel

A shortage of adequately trained clinical laboratory personnel with expertise in mass spectrometry is a critical constraint. The scarcity of skilled professionals can limit the effective implementation and utilization of mass spectrometry in clinical settings.

Perception of Mass Spectrometry as Esoteric Technology

There exists a perception that mass spectrometry is an esoteric technology, considered unsuitable for routine clinical use. Overcoming this perception barrier is essential for broadening the acceptance of mass spectrometry as a practical and valuable tool in routine clinical applications.

Opportunities

Emerging Clinical Applications of Mass Spectrometry (MS)

In the ever-evolving landscape of healthcare, Mass Spectrometry (MS) is carving out new paths in areas like tissue imaging, metabolomics, and proteomics. These applications offer promising avenues for growth, unlocking innovative ways to understand diseases at a molecular level. By leveraging MS technology, researchers and clinicians can delve deeper into the intricacies of biological samples, paving the way for more precise diagnostics and targeted treatments.

Focus on Early Disease Diagnosis

The spotlight on early disease diagnosis aligns seamlessly with the inherent strengths of Mass Spectrometry – sensitivity and specificity. As healthcare systems globally prioritize proactive healthcare approaches, the demand for diagnostic tools that can detect diseases in their nascent stages is escalating. MS’s ability to provide accurate and detailed insights into biomarkers positions it as a pivotal player in the drive towards timely and effective disease detection.

Geographic Expansion into Developing Countries

Traditionally, developing countries have faced challenges in accessing advanced clinical testing infrastructure. Mass Spectrometry presents a unique opportunity to bridge this gap by enabling geographic expansion. As we extend our reach into these regions, we not only contribute to improving healthcare accessibility but also tap into previously untapped markets. This strategic move not only aligns with our mission to make quality healthcare more widespread but also promises significant market penetration.

Cross-Industry Partnerships

In the dynamic landscape of healthcare, collaboration is key. The prospect of cross-industry partnerships between instrument manufacturers, pharmaceutical companies, and testing labs opens up a realm of possibilities. By fostering synergies between these diverse entities, we can harness collective strengths to drive innovation, streamline processes, and create comprehensive solutions. Such collaborations not only amplify our impact but also position us at the forefront of a network that is reshaping the future of healthcare diagnostics.

Trends

Ongoing MS Instrument Miniaturization and Integration for Point-of-Care Testing

In the realm of mass spectrometry (MS), a prominent trend is the continuous miniaturization and integration of instruments, specifically tailored for point-of-care testing. This means that MS devices are becoming smaller and more seamlessly incorporated into on-site testing scenarios. This evolution is driven by the need for rapid and decentralized diagnostic capabilities, allowing for quicker decision-making in various healthcare settings.

Development of Less Expensive, Easy-to-Use, and Compact MS Devices for Broader Adoption

Another key market trend involves the concerted effort to develop mass spectrometry devices that are not only more affordable but also user-friendly and compact. The aim is to make MS technology more accessible across a broader spectrum of users, including smaller healthcare facilities and research laboratories. This democratization of MS devices is fostering increased adoption and application in diverse scientific and clinical fields.

Use of Cloud Computing and Informatics Solutions to Enhance Clinical Workflow Integration

The integration of cloud computing and informatics solutions marks a significant advancement in the field of mass spectrometry. This trend involves leveraging cloud-based platforms and advanced data analytics to streamline and enhance clinical workflow integration. By doing so, the analysis and interpretation of MS data become more efficient, aiding healthcare professionals in making informed decisions based on real-time insights.

Increased Industry Consolidation via Mergers, Acquisitions, and Licensing Deals Involving Key MS Technology and Solutions Providers

A noteworthy trend in the mass spectrometry market is the escalating industry consolidation through mergers, acquisitions, and licensing deals among key technology and solutions providers. This strategic maneuvering is aimed at enhancing technological capabilities, expanding market reach, and fostering innovation. The resulting synergies contribute to the development of comprehensive solutions and drive the evolution of MS technologies to meet the dynamic demands of the market.

Regional Analysis

In 2023, North America emerged as the frontrunner in the Clinical Mass Spectrometry Market, commanding a dominant market position with a substantial 37.6% share and an impressive market value of USD 371.4 million. This robust market presence can be attributed to several key factors that underscore the region’s significance in shaping the landscape of clinical mass spectrometry technologies.

One of the primary drivers of North America’s supremacy in the clinical mass spectrometry sector is the well-established and advanced healthcare infrastructure in the region. The presence of leading healthcare institutions, research facilities, and a highly developed pharmaceutical industry has fostered a conducive environment for the adoption and integration of clinical mass spectrometry technologies. The region’s commitment to cutting-edge medical research and diagnostic advancements further solidifies its leading position in the market.

Moreover, the North American market benefits from substantial investments in research and development activities, ensuring continuous innovation and technological advancements in clinical mass spectrometry. Industry collaborations, partnerships between academia and industry players, and government initiatives supporting healthcare innovation contribute significantly to the region’s leadership in this sector. The availability of skilled professionals and a supportive regulatory framework further streamline the implementation of clinical mass spectrometry solutions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic Clinical Mass Spectrometry Market, key players significantly influence the industry’s trajectory. Thermo Fisher Scientific Inc., utilizing extensive technological expertise to deliver cutting-edge solutions. Their commitment to innovation and quality positions them as pivotal influencers.

Danaher, another major player, boasts a diversified portfolio and strategic emphasis on research and development, ensuring adaptability to market demands for a competitive edge. Agilent Technologies, a noteworthy contributor, is renowned for precision instrumentation and analytical solutions, addressing clinical sector needs with a customer-centric approach, thereby enhancing mass spectrometry efficiency.

PerkinElmer Inc., as a key player, is dedicated to propelling healthcare innovation. Their technological advancements and research focus drive the Clinical Mass Spectrometry Market, providing clinicians with potent diagnostic and research tools.

Bruker, a prominent player, is acknowledged for state-of-the-art mass spectrometry systems, continually pushing analytical performance boundaries. Collectively, these players foster competition, innovation, and technological progress in clinical mass spectrometry, creating a robust ecosystem benefiting clinicians, researchers, and patient outcomes.

Market Key Players

- Thermo Fisher Scientific Inc.

- Danaher

- Agilent Technologies

- PerkinElmer Inc

- Bruker

- Shimadzu Corporation

- Kore Technologies

- BME Bergmann

- Mass Spectrometry Instruments

- Photonics GmbH

Recent Developments

- In October 2023, Bruker, a prominent life sciences instrumentation company, successfully acquired BioAnalysis NoVa. This strategic move enhances Bruker’s footprint in the Asia Pacific region and bolsters its mass spectrometry capabilities, especially for both research and clinical applications.

- In September 2023, Agilent Technologies introduced a groundbreaking addition to the field with the launch of the Infinity-QS Infinity-qToF mass spectrometer. Specifically designed for high-throughput screening and drug candidate identification, this instrument boasts enhanced speed and sensitivity. Researchers can now analyze more samples, gaining deeper insights into drug interactions and significantly advancing drug discovery efforts.

- In July 2023, witnessed a strategic collaboration between Shimadzu, a leading analytical instruments manufacturer, and Biognosys, a specialist in companion diagnostics. The partnership focuses on the development of mass spectrometry-based companion diagnostics for cancer. This initiative aims to bring personalized medicine to cancer patients by identifying genetic and proteomic markers that can predict responses to therapy.

- In May 2023, Danaher, a diversified medical device and diagnostics company, acquired Cytiva for a substantial $21.4 billion. This merger positions the combined entity as a powerhouse in the life sciences industry, offering a comprehensive range of instruments, consumables, and services for research and clinical laboratories. Notably, Cytiva has a strong presence in mass spectrometry, particularly in biopharmaceutical applications.

Report Scope

Report Features Description Market Value (2023) USD 987.9 Mn Forecast Revenue (2033) USD 1907.3 Mn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gas chromatography Mass Spectrometry, Liquid chromatography Mass Spectrometry, MALDI-TOF Mass Spectrometer, Capillary Electrophoresis Mass Spectrometry, Ion Mobility Spectrometry), By Application (Drug Discovery, Clinical Testing, Proteomics, Others), By End User (Hospitals, Diagnostic Centers, Research Laboratories, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Danaher, Agilent Technologies, PerkinElmer Inc, Bruker, Shimadzu Corporation, Kore Technologies, BME Bergmann, Mass Spectrometry Instruments, Photonics GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Mass Spectrometry MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Clinical Mass Spectrometry MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Danaher

- Agilent Technologies

- PerkinElmer Inc

- Bruker

- Shimadzu Corporation

- Kore Technologies

- BME Bergmann

- Mass Spectrometry Instruments

- Photonics GmbH