Global Civil Engineering Market By Services (Planning And Design, Construction, Maintenance, Consulting, Others), By Type ( Structural Engineering, Geotechnical Engineering, Environmental Engineering, Transportation Engineering, Water Resources Engineering, Others), By Application (Real Estate, Infrastructure, Industrial), By End-users (Government, Private), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 67409

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

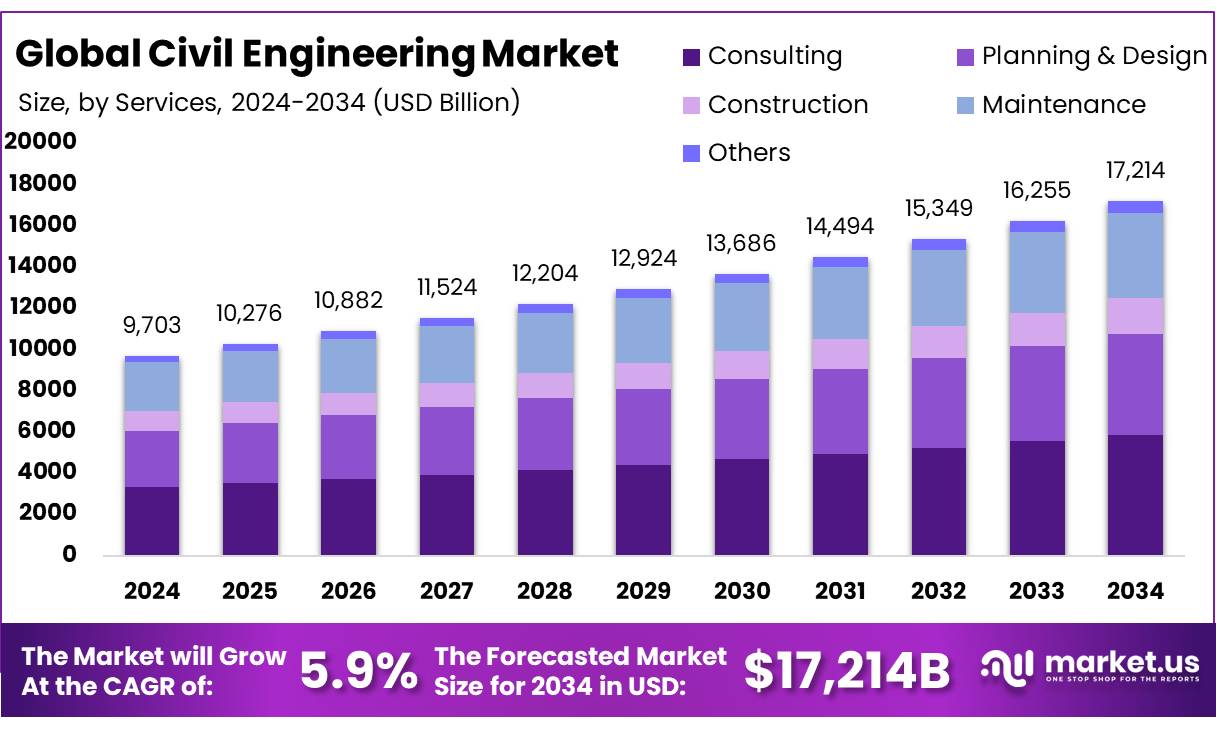

The Global Civil Engineering Market size is expected to be worth around USD 17,214 Billion by 2034, from USD 9,703.2 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The civil engineering market covers a wide range of specialties, each focusing on different aspects of infrastructure and urban development. Transportation engineering designs and maintains infrastructure for efficient movement, while structural engineering ensures the stability of buildings and bridges. Environmental engineering promotes sustainability through water treatment and waste management, geotechnical engineering designs stable foundations, and construction engineering manages the execution of projects.

The global civil engineering market is experiencing significant growth, driven by increasing urbanization, infrastructure development, and a rising demand for sustainable, resilient, and innovative solutions. In addition, other key factors include government investments in infrastructure, increasing focus on sustainability, and environmental concerns fuelling the growth of the global civil engineering market.

Technological advancements, such as digital twins, smart cities, and green building practices, are further accelerating the market’s growth by improving efficiency, reducing costs, and enhancing safety. With ongoing infrastructure projects, especially in emerging economies, and the increasing focus on sustainable development, the global civil engineering market is expected to continue expanding in the coming years.

Key Takeaways

- The global civil engineering market was valued at USD 9,703.2 billion in 2024.

- The global civil engineering market is projected to grow at a CAGR of 5.9% and is estimated to reach USD 17,214 billion by 2034.

- Among services, consulting accounted for the largest market share of 34.1%.

- Among types, structural engineering accounted for the majority of the market share at 27.3%.

- By application, real estate accounted for the largest market share of 68.4%.

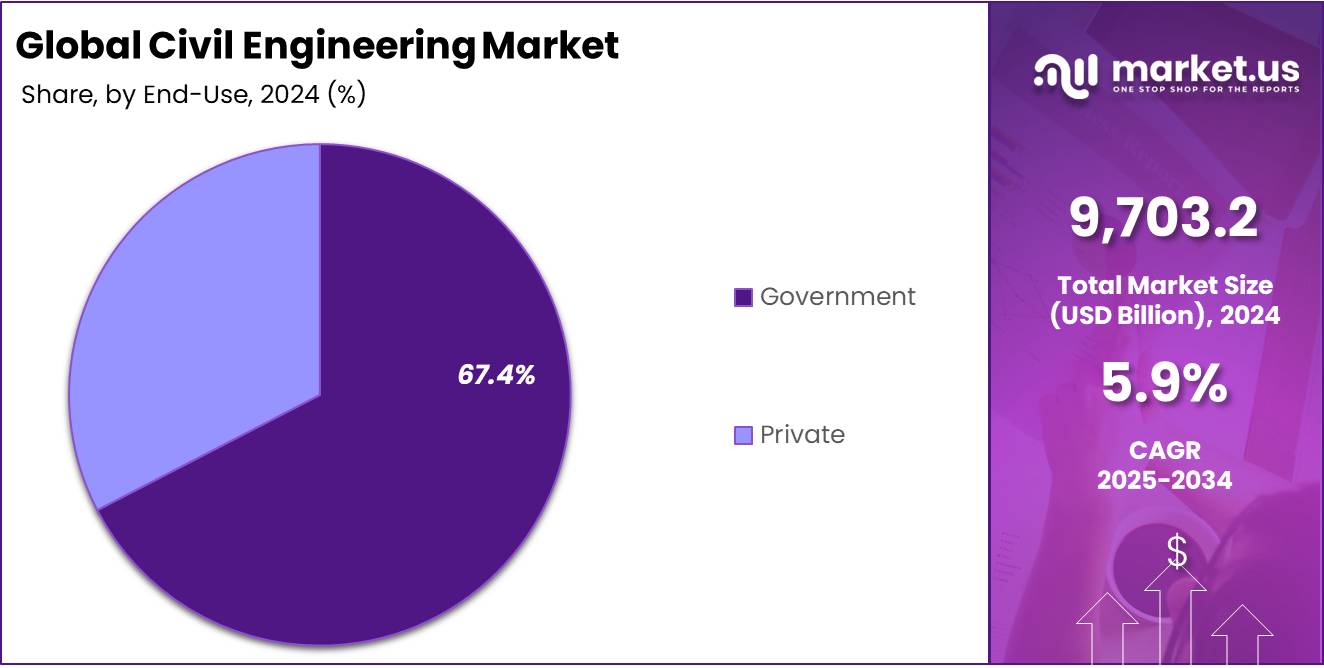

- By end-user, government accounted for the majority of the market share at 67.4%.

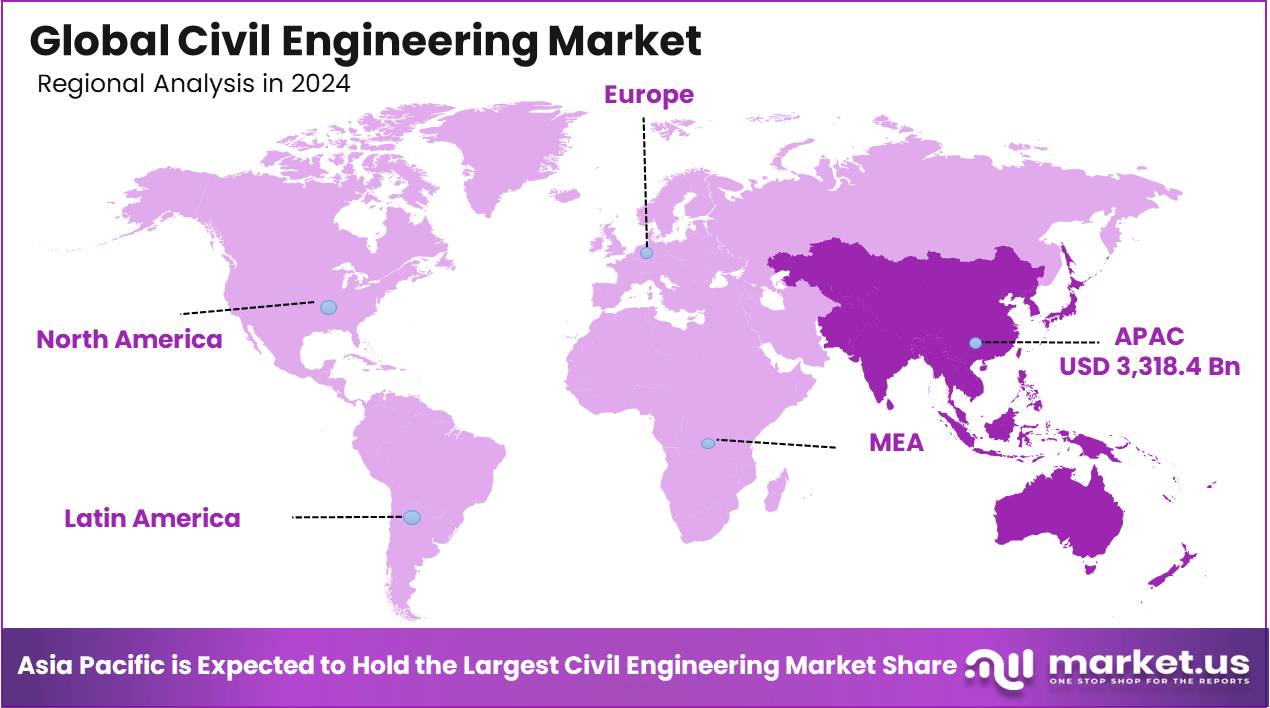

- Asia Pacific is estimated as the largest market for Caviar with a share of 34.2% of the market share.

Service Analysis

Consulting Services Lead the Civil Engineering Market in 2024

The global civil engineering market is segmented based on services into planning & design, construction, maintenance, consulting, and others. In 2024, the consulting segment held a significant revenue share of 34.1%. Due to rising project complexity and the growing need for expert guidance in regulatory compliance, sustainability, and technology integration. Increasing public-private partnerships and aging infrastructure in developed nations further drove demand for specialized consulting services. This segment plays a key role in feasibility analysis, risk management, and sustainable planning across major global projects.

Type Analysis

Structural Engineering Held Dominant Position in Civil Engineering Market in 2024

Based on type, the market is further divided into structural engineering, geotechnical engineering, environmental engineering, transportation engineering, water resources engineering, and others. The predominance of structural engineering, commanding a substantial 27.3% market share in 2024.

Due to its critical role in nearly all infrastructure projects, including residential, commercial, industrial, and public works. The growing demand for high-rise buildings, bridges, and resilient structures in urbanizing regions significantly boosted this segment. Additionally, increasing focus on earthquake-resistant and sustainable building designs further elevated the need for structural engineering expertise.

Application Analysis

Real Estate Fuels Civil Engineering Market Expansion in 2024

Among applications, the market is classified into real estate, infrastructure, and industrial. In 2024, real estate held a dominant position with a 68.4% share, due to increasing urbanization, high demand for both residential and commercial properties, and large-scale construction projects. Government initiatives promoting affordable housing and urban development, alongside private investments, significantly contributed to the growth of this sector. The global shift toward smart cities, which integrate advanced technologies into urban planning, has further propelled real estate demand, as such projects require significant construction and development.

End-Use Analysis

Government Sector Drives Civil Engineering Growth in 2024

By end-use, the market is categorized into government and private. The government segment emerging as the dominant end-user, holding 67.4% of the total market share in 2024. Governments worldwide are major contributors to civil engineering projects, including infrastructure development, urban planning, transportation networks, and public utilities.

The rising need for public services, such as roads, bridges, schools, hospitals, and affordable housing, significantly drives demand. Additionally, government-backed funding for large-scale infrastructure projects, public-private partnerships (PPP), and investment in sustainable development have led to increased government involvement in civil engineering. Moreover, long-term infrastructure planning and maintenance by government bodies ensure a steady stream of civil engineering projects.

Key Market Segments

By Services

- Planning & Design

- Construction

- Maintenance

- Consulting

- Others

By Type

- Structural Engineering

- Geotechnical Engineering

- Environmental Engineering

- Transportation Engineering

- Water Resources Engineering

- Others

By Application

- Real Estate

- Residential

- Family Houses

- Apartments

- Others

- Commercial

- Office Buildings

- Retail Spaces

- Hospitality

- Healthcare

- Others

- Residential

- Infrastructure

- Roadways

- Roads

- Bridges

- Tunnels

- Others

- Aviation

- Railroad

- Water Supply and Resources

- Power and Energy

- Waste Management

- Others

- Roadways

- Industrial

- Manufacturing

- Warehouse and Distribution

- Flex Space

By End-users

- Government

- Private

Drivers

Growing Investments In Infrastructure Development Projects

The growing investments in infrastructure projects are one of the key drivers fueling the growth of the global civil engineering market. With the rapid rise in population and urbanization across the globe, the demand for efficient, modern infrastructure has significantly increased. Governments and private sectors are increasingly allocating substantial budgets, funds, and incentives for the development of transportation networks, smart cities, water infrastructure, and energy facilities to meet growing urban needs and enhance quality of life. This surge in infrastructure investment is significantly accelerating the growth of the civil engineering industry by generating a wide array of large-scale projects.

- For instance, according to a 2014 United Nations report, the majority of the 2.5 billion new urban inhabitants projected by 2050 will be in Africa and Asia. Driving significant demand for civil engineering-related services to design, construct, and maintain projects such as roads, bridges, buildings, and water systems.

- The U.S. is providing $1 trillion in funding through the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA), supporting infrastructure projects in transportation, water, energy, and broadband. This growing investment in infrastructure development is driving significant demand for civil engineering services.

- Delpha facilitated a $150 million development loan for Summa/FB Group’s expansion of Freetown International Airport in Sierra Leone. This initiative aims to enhance regional air connectivity and support trade logistics. The project highlights the growing demand for civil engineering services in strengthening global transportation networks.

Furthermore, governments around the world recognize the importance of the infrastructure sector in economic growth, increasingly prioritizing its expansion through infrastructure developments. As nations invest in retrofitting and renovating their infrastructure to support urbanization and economic development, civil engineering becomes essential to the successful execution of these projects. This industry plays an integral role in achieving infrastructure objectives, ensuring sustainable economic growth, and addressing the infrastructure needs of both emerging and developed markets.

- For instance, Saudi Arabia invested in the NEOM project in 2021 as a central component of its Vision 2030 strategy. NEOM includes developments such as The Line, a 2.4-kilometer linear city, and OXAGON, a futuristic octagon-shaped industrial hub, these large-scale projects are generating substantial opportunities for the civil engineering sector.

- For instance, According to a European Commission report, the European Union has launched the “Renovation Wave” initiative, which aims to renovate 35 million buildings by 2030. This initiative is expected to significantly increase the demand for construction development, along with supporting the growth of the civil engineering market.

Restraints

High Cost Of Construction Materials

The fluctuating prices of raw materials are significantly impacting the global civil engineering market, particularly in sectors like polycarbonate sheet manufacturing. The high costs of essential materials such as steel, aluminum, and concrete are contributing to project cost escalations, delays, and budget overruns. This creates uncertainty for manufacturers, making it difficult to maintain stable pricing for end products, especially in competitive regions where price sensitivity is high.

Additionally, ongoing supply chain disruptions, inflation, and trade tariffs add complexity to cost management, further hindering profitability. Furthermore, the petrochemical industry, which supplies many raw materials for civil engineering projects, is affected by government regulations aimed at reducing carbon emissions and promoting bio-based alternatives. These regulations could increase the fluctuations in raw material prices, further restraining the growth of the civil engineering market.

Opportunity

Offshore and Marine Infrastructure Growth

The offshore and marine infrastructure sector is creating significant opportunities for the global civil engineering market, driven by rising demand for offshore renewable energy, ongoing oil and gas exploration, and the increasing need for resilient coastal defense. These developments are leading to complex, large-scale projects that require multidisciplinary engineering expertise. Civil engineers can play a crucial role in the design and execution of essential infrastructure such as subsea cables, offshore platforms, ports, and seawalls, often in harsh marine environments that demand innovative and sustainable construction solutions.

- For instance, in Ireland, WSP major engineering firm was appointed as the client’s representative on the landmark 500MW East-West Interconnector HVDC project. This initiative serves as a critical component in the country’s efforts to meet its target of generating 40% of electricity from renewable sources by 2020. This project highlights the important role of civil and electrical engineering in supporting national energy transition goals.

Furthermore, marine infrastructure also plays a crucial role in national economic growth, as approximately 80% of global trade is conducted via maritime routes. As the modernization and expansion of marine infrastructure become essential for sustaining economic development and global supply chains, the demand for civil engineering services continues to rise. This growth discovered the critical role of civil engineers in designing, building, and maintaining ports, offshore platforms, and other vital structures that support global trade and energy security.

The ongoing shift in marine infrastructure projects has further highlighted the strategic importance of civil engineering, unveiling new opportunities and positioning it as a key driver in the expansion of the global civil engineering market.

- For instance, the Palm Jumeirah project in Dubai exemplifies the growth potential for the civil engineering market, as it requires innovative solutions in dredging, breakwater construction, and infrastructure protection. This iconic development highlights the demand for specialized civil engineering expertise in large-scale marine projects, fostering growth opportunities across various engineering disciplines.

Trends

Digital Twin Application in Urban Planning

The increasing use of digital twin technology in urban planning is significantly contributing to the growth of the global civil engineering market. As cities generate vast amounts of data, digital twins as virtual models can help to replicate urban systems like traffic, infrastructure, and energy usage are becoming key tools for planners.

These models provide valuable insights, enabling more efficient decision-making for things such as traffic management, energy optimization, and disaster prevention. By simulating different scenarios, digital twins help streamline processes, from planning repairs to ensuring zoning compliance. As the demand for digital twin applications grows, it further strengthens the role of civil engineering in creating smarter, more sustainable cities.

Geopolitical Impact Analysis

The US Tariffs On Key Construction Material Imports From Canada And Mexico Are Expected To Disrupt Supply Chains, Escalate Costs, And Delay Civil Engineer Projects.

On April 2, 2025, the U.S. announced the imposition of 25% tariffs on steel and aluminum imports from countries such as Canada, Mexico, and China have led to increased material costs for construction projects worldwide. The imposition of these tariffs on key construction materials, such as steel and aluminum, has significantly impacted the civil engineering sector, particularly for engineers involved in international projects.

These materials are essential for a wide range of construction activities, from structural components to roofing. The tariffs, coupled with rising inflation, supply chain disruptions, and currency fluctuations, have driven up material costs, complicating the sourcing of materials from overseas and straining project budgets.

Fixed-price contracts, in particular, leave contractors vulnerable to unexpected cost increases, often leading to disputes over who should absorb the additional expenses. Furthermore, the uncertainty surrounding the tariffs has contributed to project delays, cancellations, and budget overruns.

Contractors are facing challenges in securing financing for new projects, leading to delays or scaling back of planned developments. As material costs continue to rise, developers are becoming increasingly concerned about the future of their projects, with many struggling to secure the necessary funding to proceed. This growing financial uncertainty has resulted in the postponement or reassessment of various construction plans.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Civil Engineering Market

In 2024, Asia Pacific dominated the global civil engineering market, accounting for 34.2% of the total market share, driven by rapid urbanization and infrastructure development across the region. Civil engineering services are increasing as nations such as China, India, and Southeast Asia emphasize modernizing their infrastructure, including roads, bridges, public transportation systems, and commercial and residential buildings. These large-scale projects present significant opportunities for the civil engineering industry for the planning, design, and execution of such developments.

Additionally, government-led initiatives, such as China’s Belt and Road Initiative (BRI), are promoting large-scale infrastructure projects across the region, fostering investments in both transportation and energy sectors. Moreover, the rising focus on sustainability and smart city development is spurring the adoption of advanced technologies, such as digital twins, Building Information Modeling (BIM), and renewable energy infrastructure, which further enhances the demand for skilled civil engineers in the region. With infrastructure needs continuing to rise, especially in rapidly expanding urban a reas, the Asia-Pacific region has become a major hub for civil engineering growth.

The region is also benefiting from substantial investments in renewable energy, including wind, solar, and hydropower, alongside an increased emphasis on disaster resilience and climate adaptation. These factors, combined with continued urban development and industrialization, are creating a favorable environment for the civil engineering market to stay dominant position in the Asia-Pacific region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Existing companies in the civil engineering market are not likely to face much competition from new players because entering the industry requires a lot of capital. These established companies already have access to advanced technology and expensive machinery, which helps them create efficient and high-quality engineering solutions.

Existing market leaders are well-positioned to maintain their dominance and meet the increasing demand for large-scale infrastructure projects. Major industry players are involved in both domestic and foreign projects. To increase civil engineering market share, these companies also form strategic mergers & acquisitions to improve their services.

The following are some of the major players in the industry

- Fluor Corporation

- China State Construction Engineering Corporation Ltd.

- Bechtel Corporation

- Power Construction Corporation of China

- Turner Construction

- AECOM

- Jacobs Engineering Group

- Kiewit Corporation

- HDR, Inc.

- Skidmore, Owings & Merrill

- Galfar Engineering & Contracting SAOG (Galfar)

- Tetra Tech, Inc.

- Stantec, Inc.

- Parsons Corporation

- The Walsh Group Ltd

- Granite Construction Inc.

- Samsung C&T Corporation

- China Railway Construction Corporation Limited

- Consor Holdings LLC (Consor)

- Other Key Players

Recent Development

- In February 2025 – Consor Holdings LLC acquired Murfee Engineering Company (MEC), a Texas-based firm specializing in water and wastewater infrastructure. This acquisition enhances Consor’s expertise in planning, design, and construction management, expanding its capabilities to address aging infrastructure and population growth challenges.

Report Scope

Report Features Description Market Value (2024) USD 9,703.2 Bn Forecast Revenue (2034) USD 17,214 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Services (Planning & Design, Construction, Maintenance, Consulting, Others), By Type (Structural Engineering, Geotechnical Engineering, Environmental Engineering, Transportation Engineering, Water Resources Engineering, Others), By Application (Real Estate, (Residential, Family Houses, Apartments, Others), Commercial (Office Buildings, Retail Spaces, Hospitality, Healthcare, Others), Infrastructure (Roadways, Roads, Bridges, Tunnels, Others), Aviation, Railroad, Water Supply and Resources, Power and Energy, Waste Management, Others), Industrial (Manufacturing, Warehouse and Distribution, Flex Space), By End-users (Government, Private) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Fluor Corporation, China State Construction Engineering Corporation Ltd., Bechtel Corporation, Power Construction Corporation of China, Turner Construction, AECOM, Jacobs Engineering Group, Kiewit Corporation, HDR, Inc., Skidmore, Owings & Merrill, Galfar Engineering & Contracting SAOG (Galfar), Tetra Tech, Inc., Stantec, Inc., Parsons Corporation, The Walsh Group Ltd, Granite Construction Inc., Samsung C&T Corporation, China Railway Construction Corporation Limited, Consor Holdings LLC (Consor), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fluor Corporation

- China State Construction Engineering Corporation Ltd.

- Bechtel Corporation

- Power Construction Corporation of China

- Turner Construction

- AECOM

- Jacobs Engineering Group

- Kiewit Corporation

- HDR, Inc.

- Skidmore, Owings & Merrill

- Galfar Engineering & Contracting SAOG (Galfar)

- Tetra Tech, Inc.

- Stantec, Inc.

- Parsons Corporation

- The Walsh Group Ltd

- Granite Construction Inc.

- Samsung C&T Corporation

- China Railway Construction Corporation Limited

- Consor Holdings LLC (Consor)

- Other Key Players