CIS Insulin Market By Product Type (Rapid-acting Insulin, Combination Insulin, Long-acting Insulin, Biosimilar, and Others), By Type (Human Insulin and Insulin Analog), By Application (Type I Diabetes and Type II Diabetes), By Distribution Channel (Retail & Specialty Pharmacies, Hospitals Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 67407

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Type Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the CIS Insulin Market

- Recent Developments

- Report Scope

Report Overview

The CIS Insulin Market Size is expected to be worth around US$ 5.2 billion by 2033 from US$ 3.0 billion in 2023, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

Increasing prevalence of diabetes drives demand in the CIS insulin market, as the need for effective blood glucose management becomes more pressing. The International Diabetes Federation projects that the number of adults with diabetes in Europe will grow from 59 million in 2021 to 62 million by 2030, underscoring the urgency for reliable insulin solutions.

CIS insulin, known for its rapid onset and shorter action duration, is essential in managing post-meal glucose spikes, offering flexibility in blood sugar control for both Type 1 and Type 2 diabetes patients. Recent advancements in insulin formulations and delivery systems, such as smart insulin pens and continuous glucose monitors, create new opportunities for seamless integration of CIS insulin into daily diabetes management.

Innovations like these enhance patient adherence and optimize therapeutic outcomes by enabling real-time dose adjustments. Furthermore, the rise in personalized medicine strengthens the development of tailored CIS insulin therapies that address individual patient needs.

Collaborations between pharmaceutical companies and technology firms continue to improve insulin delivery mechanisms, supporting broader access to high-quality diabetes care. This growing focus on innovation, combined with rising diabetes rates, positions the CIS insulin market for substantial growth as it addresses evolving healthcare demands.

Key Takeaways

- In 2023, the market for CIS insulin generated a revenue of US$ 3.0 billion, with a CAGR of 5.7%, and is expected to reach US$ 5.2 billion by the year 2033.

- The product type segment is divided into rapid-acting insulin, combination insulin, long-acting insulin, biosimilar, and others, with long-acting insulin taking the lead in 2023 with a market share of 41.8%.

- Considering type, the market is divided into human insulin and insulin analog. Among these, insulin analog held a significant share of 68.7%.

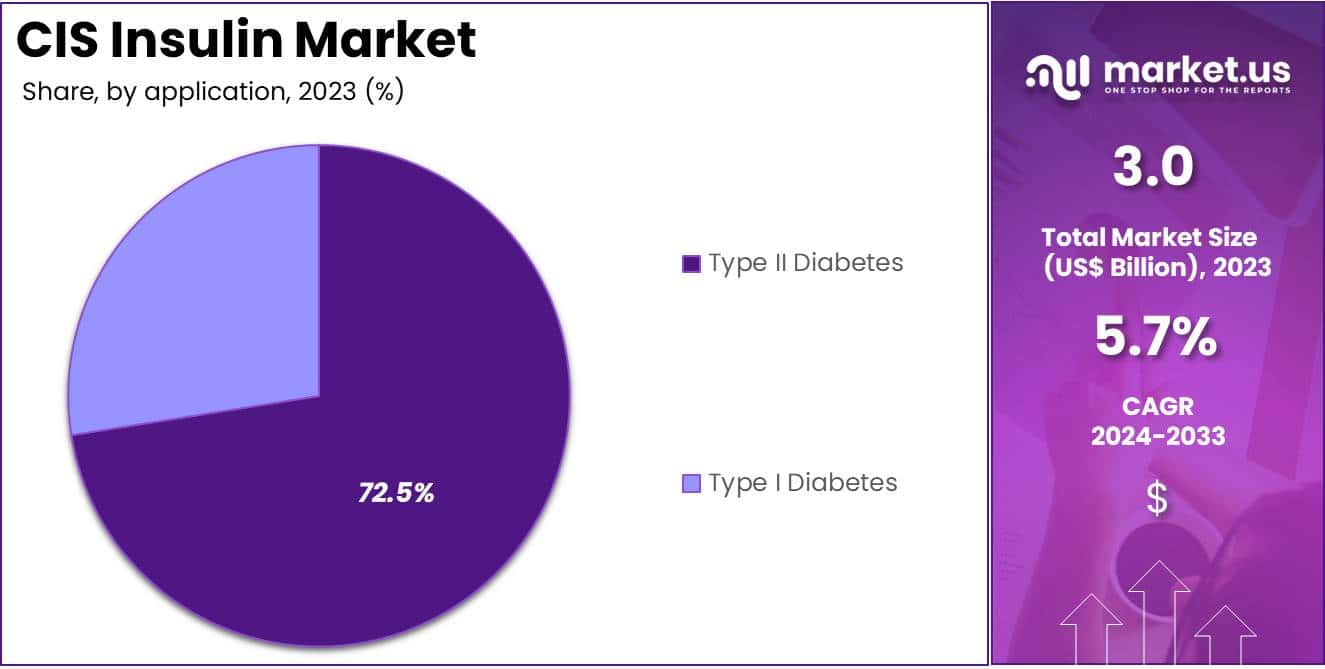

- Furthermore, concerning the application segment, the market is segregated into type I diabetes and type II diabetes. The type II diabetes sector stands out as the dominant player, holding the largest revenue share of 72.5% in the CIS insulin market.

- The distribution channel segment is segregated into retail & specialty pharmacies, hospitals pharmacies, and others, with the retail & specialty pharmacies segment leading the market, holding a revenue share of 58.4%.

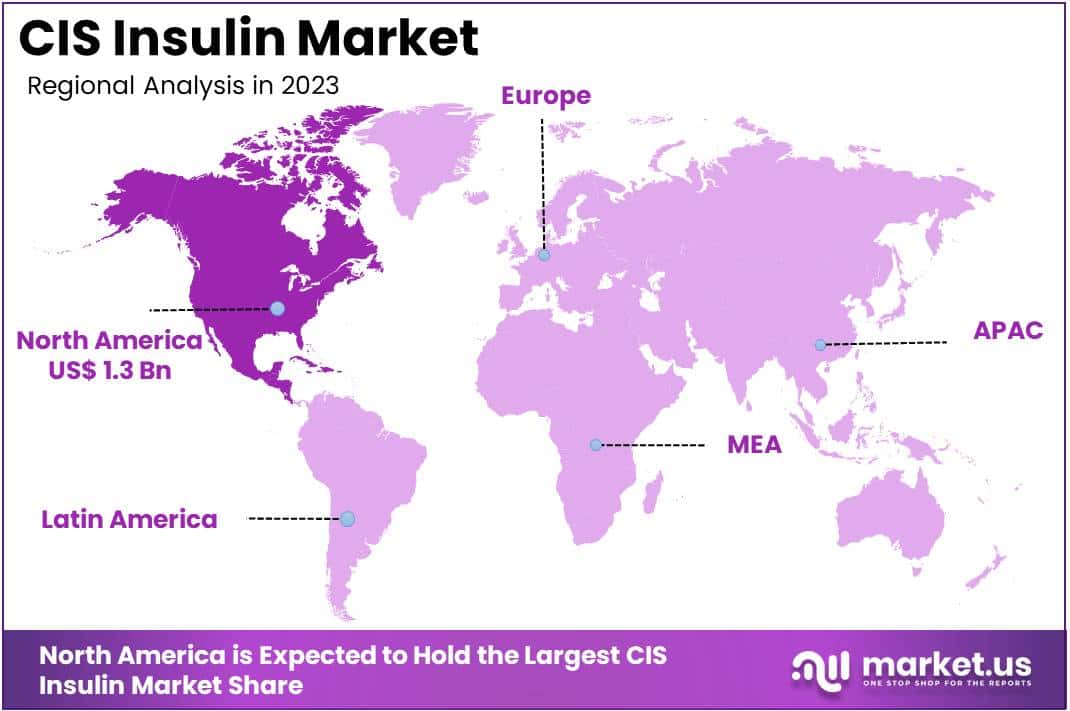

- North America led the market by securing a market share of 41.7% in 2023.

Product Type Analysis

The long-acting insulin segment led in 2023, claiming a market share of 41.8% owing to its effectiveness in managing blood glucose levels over extended periods. Patients with diabetes increasingly prefer long-acting insulin due to its steady release, reducing the need for frequent dosing and providing better glycemic control.

The rising prevalence of diabetes in the region, especially type II diabetes, heightens demand for reliable insulin options. Additionally, advancements in formulation have enhanced the duration and stability of long-acting insulin, improving patient compliance and outcomes. Healthcare providers favor this insulin type for its reduced risk of hypoglycemic episodes, which increases its adoption.

Government initiatives to improve diabetes management and access to essential medicines further support the segment’s growth. Increased insurance coverage and reimbursement policies also make long-acting insulin more accessible, contributing to its expected expansion in the CIS insulin market.

Type Analysis

The insulin analog held a significant share of 68.7% due to its superior performance compared to human insulin in blood glucose management. Insulin analogs offer faster absorption rates and better predictability, making them an attractive choice for patients and healthcare providers. Increasing prevalence of diabetes, particularly among the aging population, drives demand for more efficient and flexible insulin options.

Technological advancements in insulin delivery devices complement the effectiveness of insulin analogs, encouraging their adoption across various demographics. Healthcare policies promoting advanced diabetes treatments and favorable reimbursement structures enhance the accessibility of insulin analogs.

The ongoing shift toward personalized treatment in diabetes care, supported by growing awareness of advanced insulin options, further stimulates market demand. These factors are likely to bolster the insulin analog segment’s growth in the CIS insulin market, positioning it as a critical component in diabetes management.

Application Analysis

The type II diabetes segment had a tremendous growth rate, with a revenue share of 72.5% owing to the rising incidence of type II diabetes across the region. Sedentary lifestyles, aging populations, and dietary habits contribute to the increasing prevalence of type II diabetes, necessitating effective insulin solutions.

Long-term insulin therapy for type II diabetes, recommended by healthcare providers to improve blood sugar control, propels demand for advanced insulin products. Government initiatives focusing on diabetes awareness and early diagnosis encourage patients to seek timely treatment, supporting this segment’s growth.

Additionally, increased access to insulin therapies and improving healthcare infrastructure make insulin more available to type II diabetes patients. Innovative treatments, including combination therapies and patient-friendly delivery systems, further enhance the appeal of insulin therapy for type II diabetes management. These factors collectively position the type II diabetes segment for substantial expansion in the CIS insulin market.

Distribution Channel Analysis

The retail & specialty pharmacies segment grew at a substantial rate, generating a revenue portion of 58.4% due to increasing patient preference for convenient access to insulin therapies. Retail and specialty pharmacies offer patients an accessible and streamlined option for obtaining insulin, especially in urban areas where diabetes prevalence is high.

Expanding networks of specialty pharmacies, which provide tailored support and counseling services, contribute to improved medication adherence among patients. The rising availability of advanced insulin types in these channels, including long-acting and analog insulin, meets the growing demand for diverse treatment options.

Government efforts to enhance pharmacy access, especially in rural and underserved areas, also support this segment’s growth. Favorable reimbursement policies and healthcare partnerships with pharmacies make insulin therapies more affordable and accessible. These trends position the retail and specialty pharmacies segment for continued expansion in the CIS insulin market.

Key Market Segments

Product Type

- Rapid-acting Insulin

- Combination Insulin

- Long-acting Insulin

- Biosimilar

- Others

Type

- Human Insulin

- Insulin Analog

Application

- Type I Diabetes

- Type II Diabetes

Distribution Channel

- Retail & Specialty Pharmacies

- Hospitals Pharmacies

- Others

Drivers

Rising Product Launches are Driving the Market

Rising product launches significantly drive the CIS insulin market, providing patients with improved options for managing diabetes. In 2024, Novo Nordisk introduced Tresiba, an ultra-long-acting insulin analog, in the CIS region, enhancing glycemic control while reducing the risk of hypoglycemia.

As more advanced insulin formulations enter the market, healthcare providers can offer solutions that meet varied patient needs for blood sugar management. The release of innovative insulin options likely fosters competition and encourages companies to prioritize research and development, resulting in high-quality products with better patient outcomes.

These new introductions are anticipated to strengthen the market by expanding access to next-generation insulin options, supporting the broader adoption of specialized diabetes management products in the CIS region.

Restraints

Strict Regulatory Requirements are Restraining the Market

Strict regulatory requirements for insulin approval impede the CIS insulin market’s growth. The stringent protocols enforced by regulatory authorities create substantial barriers, delaying the introduction of new products and limiting the market’s ability to address emerging patient needs swiftly.

Pharmaceutical companies often face high costs and extended timelines to meet safety, efficacy, and quality standards, which hampers rapid innovation. Smaller manufacturers may struggle to navigate these rigorous standards, restraining competition and potentially leading to limited insulin options for patients.

Additionally, frequent updates to regulatory guidelines require companies to adapt quickly, further adding to development costs. This regulatory burden likely restricts the market, slowing the entry of promising insulin formulations in the CIS region.

Opportunities

Growing Innovation is Creating Opportunities in the Market

Growing innovation in insulin therapies presents significant opportunities for the CIS insulin market. In June 2022, Eli Lilly showcased new mechanism of action data and analysis on Mounjaro (tirzepatide) injection for treating type 2 diabetes at the American Diabetes Association’s 82nd Scientific Sessions.

Such advancements highlight the industry’s commitment to developing more effective diabetes treatments with novel mechanisms that improve patient outcomes. Continuous innovation is expected to drive a competitive landscape, leading to the release of next-generation insulin products that address a wide range of patient needs.

This trend supports the potential for enhanced glucose management and better adherence to treatment protocols, making the CIS insulin market poised for significant growth in response to these technological advancements.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the CIS insulin market, impacting both accessibility and production costs. Economic downturns reduce disposable incomes, limiting patient access to essential diabetes medications in certain regions.

Conversely, economic growth supports healthcare budgets, encouraging broader availability of insulin therapies and improving disease management. Geopolitical tensions, particularly those affecting trade policies, disrupt insulin supply chains, which raises costs and may create delays for patients in remote areas. Inflation and currency fluctuations also affect pricing, sometimes making insulin less affordable for lower-income populations.

Nonetheless, government healthcare initiatives in several CIS countries continue to support local production, minimizing reliance on imports and stabilizing supply. With a rising focus on diabetes management, the market is positioned for growth as healthcare infrastructure and policies prioritize accessibility.

Trends

Mergers and Acquisitions Driving Growth in the CIS Insulin Market

Growing mergers and acquisitions drive substantial growth in the CIS insulin market, with companies expanding research capabilities and therapeutic portfolios. Key players actively acquire smaller firms to access novel technologies and bolster production capabilities. For instance, in November 2021, Novo Nordisk acquired Dicerna Pharmaceuticals to leverage Dicerna’s proprietary GalXC RNAi platform technology in developing RNAi therapies. Such strategic acquisitions are anticipated to accelerate innovation, creating advanced insulin products tailored to specific patient needs.

Through partnerships, companies gain expertise that enhances drug development and regulatory approval processes. The trend of consolidation within the industry is projected to improve market efficiency, expand geographical reach, and support the creation of specialized therapies. As mergers and acquisitions continue, the market is likely to experience robust growth, catering to the rising demand for effective diabetes management solutions.

Regional Analysis

North America is leading the CIS Insulin Market

North America dominated the market with the highest revenue share of 41.7% owing to rising diabetes prevalence and ongoing innovations in insulin formulations. Increasing rates of obesity and metabolic disorders have exacerbated the need for effective diabetes management solutions, contributing significantly to market demand.

In June 2024, Eli Lilly and Company shared findings from the SYNERGY-NASH phase 2 trial, involving 190 participants, with and without type 2 diabetes, exploring tirzepatide’s potential for treating metabolic dysfunction-associated steatohepatitis (MASH) with stage 2 or 3 fibrosis. Such studies reflect a broader industry trend towards innovative solutions that support diabetes and associated conditions.

Additionally, advancements in CIS insulin delivery systems, such as smart insulin pens, have further fueled market growth by improving patient adherence and management of blood glucose levels. Supportive healthcare policies and widespread access to insulin therapies have also facilitated this growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising diabetes cases and enhanced distribution channels. Increasing urbanization and lifestyle changes have contributed to a higher incidence of diabetes across the region. To support this demand, pharmaceutical companies are forming strategic alliances to expand access to essential medications. For instance, in February 2022, Novartis India Limited entered an exclusive sales and distribution agreement with Dr. Reddy’s Laboratories, covering multiple established medicines, including the Voveran and Calcium ranges.

This collaboration enhances market accessibility and affordability of key treatments, which is likely to positively impact CIS insulin availability. Moreover, growing awareness of diabetes management and the expansion of healthcare infrastructure are anticipated to support demand. Economic growth in countries such as India and China is expected to further boost market expansion, making Asia Pacific a key growth region for CIS insulin.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the CIS insulin market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the CIS insulin market pursue various strategies to drive growth and capture larger market shares.

They invest in advanced formulations and delivery systems that improve patient convenience and adherence, making treatment more effective. Partnerships with healthcare providers and diabetes clinics enable broader distribution and foster trust among prescribers. Companies also focus on increasing their reach in underserved regions, addressing the growing prevalence of diabetes.

Additionally, they run educational initiatives to inform patients and healthcare professionals about the benefits of CIS insulin, thereby enhancing market demand and acceptance.

Top Key Players in the CIS Insulin Market

- Sanofi

- Pfizer, Inc

- Novo Nordisk

- Novartis AG

- Merck

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Boehringer Ingelheim

Recent Developments

- In May 2024: Novo Nordisk published the findings of the FRONTIER 2 trial, a 26-week, open-label, randomized, multicenter study involving 254 participants aged 12 and older with hemophilia A, with or without inhibitors. The trial assessed the efficacy and safety of weekly and monthly subcutaneous injections of Mim8 compared to no preventive treatment and prior use of coagulation factor prophylaxis. This study is relevant to the growth of the CIS insulin market, as it reflects ongoing innovation in subcutaneous treatments, underscoring Novo Nordisk’s commitment to advancing therapeutic solutions, which is likely to influence the broader injectable therapy market, including CIS insulin.

- In January 2022: Bristol Myers Squibb and Century Therapeutics entered into a collaboration and licensing agreement to develop and commercialize up to four induced pluripotent stem cell (iPSC) derived, engineered natural killer (iNK) and/or T cell (iT) therapies for hematologic malignancies and solid tumors. This collaboration supports the CIS insulin market’s growth by advancing cutting-edge cell therapy solutions, fostering an environment of innovation, and increasing industry focus on biologic and cell-based treatments that inform developments in insulin and other biotherapeutics.

Report Scope

Report Features Description Market Value (2023) US$ 3.0 billion Forecast Revenue (2033) US$ 5.2 billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rapid-acting Insulin, Combination Insulin, Long-acting Insulin, Biosimilar, and Others), By Type (Human Insulin and Insulin Analog), By Application (Type I Diabetes and Type II Diabetes), By Distribution Channel (Retail & Specialty Pharmacies, Hospitals Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sanofi, Pfizer, Inc, Novo Nordisk, Novartis AG, Merck, Eli Lilly and Company, Bristol-Myers Squibb Company, and Boehringer Ingelheim. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sanofi

- Bristol-Myers Squibb

- Eli Lilly

- Novartis

- Boehringer Ingelheim

- Takeda Pharmaceuticals

- Biocon

- Merck KGaA

- Dongbao Enterprise Group Co. Ltd.

- Other key players