Global Cider Market By Product Type (Sparkling, Still, Apple wine, and Other Product Types), By Source (Apple, Fruit flavored, Perry, and Other vegan sources), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 30462

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

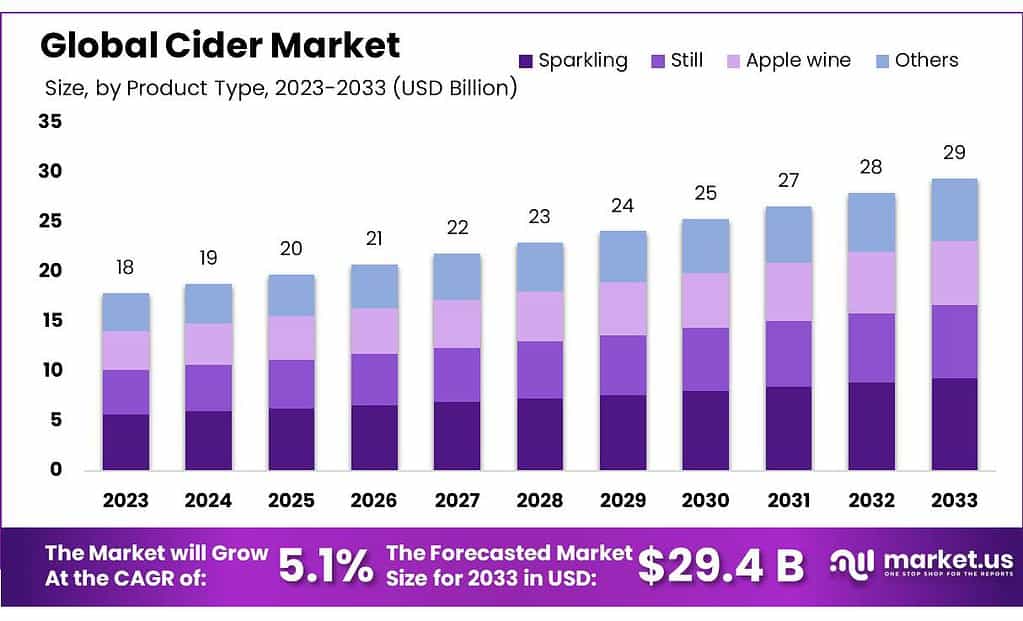

The global Cider market size is expected to be worth around USD 29.4 billion by 2033, from USD 17.9 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The major growth drivers are the rising demand for premium spirits due to increasing per capita income and increased consumption of alcohol as a status symbol. The consumer is increasingly looking for quality, heritage, and innovation in alcoholic beverages.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global cider market is anticipated to expand significantly, reaching approximately USD 29.4 billion by 2033, growing at a CAGR of 5.1% from the USD 17.9 billion recorded in 2023.

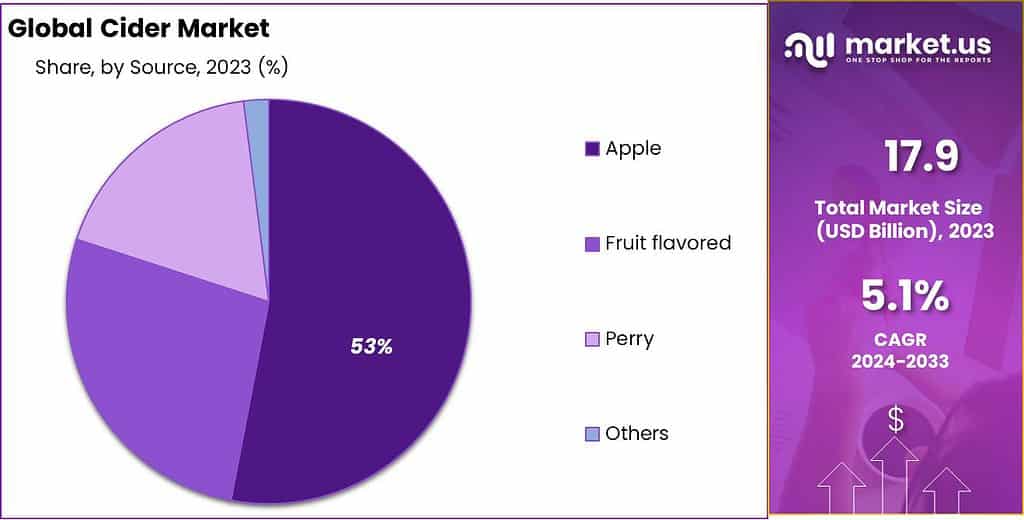

- Product Preferences: Sparkling Cider Dominance: In 2023, sparkling cider held the largest market share at over 30%. Its effervescent nature and diverse flavors attracted a broad consumer base. Apple as a Preferred Source: Apple-based ciders accounted for over 53.2% of the market share, offering a balanced taste and health benefits associated with apple consumption.

- Distribution Channels: Leading Retailers: Hypermarkets, supermarkets, and departmental stores were key players, offering convenience, variety, and often premium selections to consumers. Emerging OnlineTrend: Online stores witnessed steady growth, providing convenience and access to specialty or limited-edition ciders, catering to tech-savvy consumers.

- Driving Factors: Premiumization Trend: Rising demand for premium spirits due to increased per capita income and a desire for quality and innovation in alcoholic beverages is fueling market growth. Health Awareness: Growing interest in low-alcohol or alcohol-free ciders due to health-conscious consumers looking for beverages with potential health benefits like bioactive polyphenols found in cider.

- Challenges Faced: Sugar Content Concerns: High sugar levels in cider are a significant challenge due to increasing health consciousness, leading to consumer hesitation. Addressing this issue while maintaining taste is crucial for the industry.

- Opportunities: Asia-Pacific Market: A burgeoning opportunity for craft cider in the Asia-Pacific region due to economic growth, increased disposable income, and evolving consumer preferences, creating a ripe environment for market expansion.

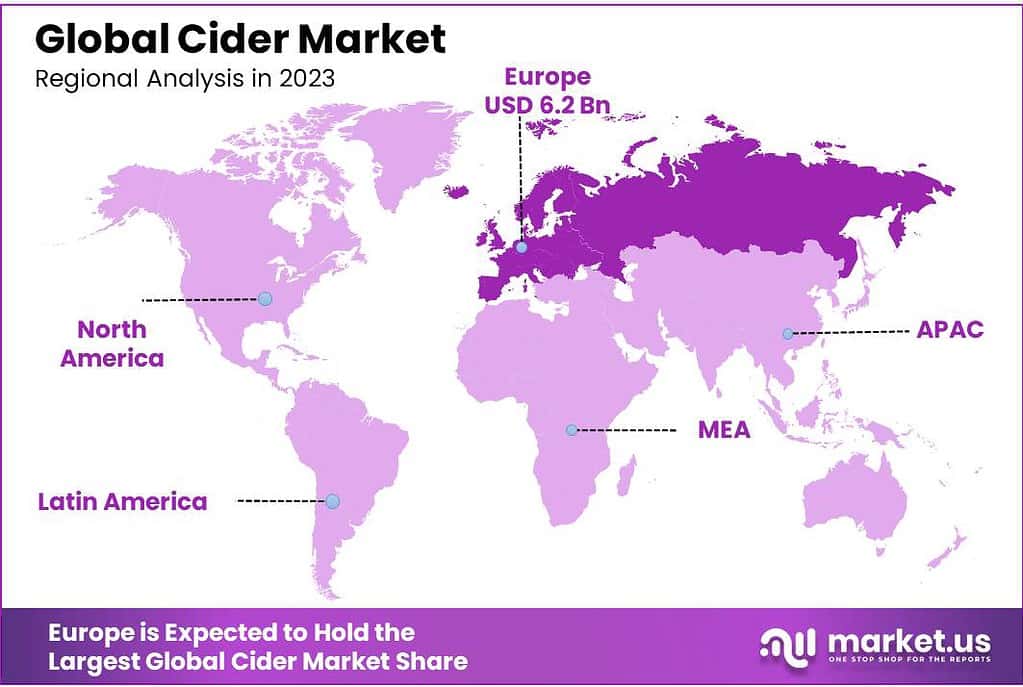

- Regional Insights: European Dominance: Europe held the largest market share, with the UK leading in cider consumption. Emerging markets like Poland and the Czech Republic show potential. Asia-Pacific Growth: The shift from beer to cider in countries like India and China, along with the demand for fruit-flavored alcohol, contributes to market growth.

- Key Players & Innovation: Leading Companies: SABMiller Plc, Heineken N.V., and other key players focus on innovation, introducing new flavors and products to meet consumer demands and maintain market interest.

Product Type Analysis

In 2023, Sparkling Cider was the most popular type, grabbing over 30% of the market. Its fizzy, bubbly nature appeals to many consumers who enjoy a livelier cider experience. This segment often offers diverse flavors, attracting a wide audience, from fruit enthusiasts to those seeking a more celebratory drink.

The fizzy beverage is rich in antioxidants, potassium, and vitamin B. It also contains carbohydrates. Sparkling cider contains vitamin B and riboflavin, which aids in eye health, energy production, nerve function, and digestion. The product is not recommended for diabetics as it does not contain enough fiber to regulate sugar absorption.

Companies are looking to launch new products that have different flavors. In 2017, Kopparberg’s Brewery introduced Sparkling Rose cider with raspberry flavor. S. Martinelli & Company released innovative juice blends in 2018 that included flavors like cranberry and grape, pomegranate, and pear. These juice blends were packaged in champagne-style bottles.

Source Analysis

In 2023, Apple was the leader in the market, holding over 53.2% of the share. It remains a classic and preferred source for cider production due to its widespread availability and familiarity. Apple-based ciders appeal to a broad consumer base, offering a balanced and familiar taste profile.

Apple cider accounted for over 56.5% of the global market share in 2021, accounting for the largest segment. It offers the health benefits associated with apple consumption. Brewing Research International scientists confirm that the product is rich in health-enhancing antioxidants. Half a pint (or a pint) of cider has the same antioxidants as red wine.

The market for fruit-flavored cider is expected to grow at a 3.8% CAGR between 2023 and 2032 due to increased awareness about the various types of fruit ingredients. In the future, the demand for fruit-flavored cider will increase due to the nutritional structure and health benefits of fruits in beverages.

Note: Actual Numbers Might Vary In the Final Report

By Distribution Channel

In 2023, Hypermarkets and Supermarkets dominated the cider market, holding a significant share due to their wide reach and accessibility. These retail giants offer a vast selection of ciders, providing consumers with convenience and variety under one roof.

Departmental Stores secured a notable portion of the market, catering to consumers seeking a more curated and often upscale shopping experience. Their emphasis on quality and presentation attracts a specific segment of cider enthusiasts looking for premium selections.

Convenience Stores also played a substantial role, offering a convenient shopping option for consumers seeking quick and on-the-go purchases. Their extended hours and easy accessibility cater to consumers looking for immediate cider options.

Online Stores witnessed a steady rise, capturing an increasing market share by providing consumers with convenience, a wide selection, and often direct access to specialty or limited-edition ciders. The ease of browsing and home delivery appeals to a growing segment of tech-savvy consumers.

The ‘Others’ category encompasses specialty liquor stores, independent retailers, and local markets. While individually contributing smaller shares, collectively, these channels play a vital role in offering unique, niche, or artisanal ciders, appealing to specific consumer preferences or supporting local producers.

Each distribution channel serves a unique purpose, whether it’s the convenience and variety of large retailers, the curated experiences of departmental stores, the accessibility of convenience stores, the convenience of online shopping, or the specialty offerings found in other outlets.

Маrkеt Ѕеgmеntѕ

By Product Type

- Sparkling

- Still

- Apple wine

- Other Product Types

By Source

- Apple

- Fruit flavored

- Perry

- Other vegan sources

By Distribution Channel

- Hypermarkets and Supermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

Drivers

The global cider market has seen substantial growth, and there are a few interesting factors behind this surge. As people’s incomes rise and drinking becomes a kind of status symbol, there’s been a noticeable shift toward premium spirits. Folks are really valuing tradition, quality, and new twists in their drinks.

Interestingly, the cider market is riding this wave too, but for a slightly different reason. With the rising popularity of low-alcohol beverages, it’s been seeing quite a boost. You see, especially after the tough times brought on by the COVID-19 pandemic, folks are more aware of the risks linked with cardiovascular diseases.

These conditions, often called “the silent killer,” are a major cause of deaths, especially among the younger crowd. And guess what? Alcohol tends to up the risk for these conditions.

The cider market has seen tremendous success recently. Products like “alcohol-free cider” and “low-alcohol cider” are drawing more interest, as are cider’s potential health benefits – especially apple cider’s bioactive polyphenols which appear to help manage inflammation and blood clotting – an integral element for good heart health.

Researchers have been highlighting the advantages of these bioactive polyphenols found in cider. They’ve seen how these compounds can really put a halt on PAF, this troublemaker lipid that causes inflammation and clotting.

Plus, the fats in cider, especially the n-3 PUFA and MUFA, have these fantastic anti-inflammatory and anti-blood-clotting powers too. And the presence of polyphenols seems to give a boost to cell receptors, making them pretty good at standing up to certain health issues.

So, while people are sipping on cider for its taste, they’re also appreciating these potential health bonuses it brings along. It’s a win-win – enjoying a drink while potentially giving your health a little extra love.

Restraints

The sugar levels in cider are causing quite a stir in the global market. Unlike wine, cider tends to have a lower glycemic index because apples usually contain less sugar compared to grapes. But here’s the thing – even in the fermented form, cider packs quite a sugary punch. Recent studies have found that a typical 470 ml serving of “natural cider” contains around 20.5 grams of sugar. That’s the entire recommended daily intake for adults in just one drink!

Cider and beer mixed together can lead to sugar levels skyrocketing ten-fold; diabetes, which is linked to sugar intake, becomes even more of a threat when people become more aware of its consequences. With more people becoming conscious about health-related matters like diabetes and its implications on sugar consumption, eating and beverage habits are changing; which puts cider market under immense strain.

With diabetes being a significant concern globally, folks are paying closer attention to what they consume. High sugar levels in cider might deter health-conscious consumers from enjoying it regularly. So, the cider market is trying to find ways to address this issue, perhaps by exploring lower-sugar options or providing clearer information about sugar content to consumers.

It’s a tough spot to be in because cider’s sweetness is part of its charm, but finding a balance between taste and health concerns is becoming increasingly important for both consumers and the cider industry.

Opportunity

There’s a buzzing opportunity brewing for craft cider in the Asia-Pacific region. The big players in crafting cider are turning their focus towards this part of the world, aiming to tap into the growing economies here and boost their global sales. Why? Well, a bunch of factors is at play.

For starters, the macroeconomic scene in the Asia-Pacific region is looking pretty promising. There’s significant economic growth, which means more people have cash to spare. With rising disposable incomes and stronger purchasing power, the market for craft cider is set to soar. It’s like the perfect recipe for success.

Consumer tastes are also changing and they have an appetite for various kinds of beverages. This shift in preferences is steering the craft cider market’s development in this region. People are exploring various drink options, and craft cider seems to be catching their eye.

So, it’s a win-win situation for both sides—the craft cider companies eyeing expansion and the eager consumers in the Asia-Pacific region looking for something new and exciting to sip on. With economic growth, increased spending capacity, and changing preferences, the stage is set for craft cider to make a splash in these developing economies.

Challenges

The cider market is grappling with a major challenge – sugar content. It’s a bit tricky because while cider typically ranks lower on the glycemic index compared to wine (thanks to apples having less sugar than grapes), the fermented product still packs quite a sugary punch. Recent studies found that a 470 ml serving of “natural cider” contains roughly 20.5 grams of sugar, hitting the recommended daily intake for adults. And if you mix it with lager or ale, those sugar levels can soar to five or ten times higher.

This poses a tough hurdle for the cider market. Diabetes, a significant cardiovascular concern, is closely tied to sugar intake. As people become more health-conscious, they’re rethinking their food and drink choices based on these health indicators. High sugar levels in cider might deter those trying to be mindful of their health.

Balancing the natural sweetness that defines cider with addressing health concerns tied to excessive sugar intake is crucial. It might mean exploring lower-sugar options or being clearer about sugar content on labels. It’s a bit of a tightrope because that sweetness is part of what makes cider so appealing, but adapting to health-conscious consumer preferences is becoming more vital for the cider industry.

Regional Analysis

Europe held the largest market share, with more than 35.9%. This region is responsible for the largest global production of apples. The U.K. is the largest cider market. Its consumers consume 800 million liters per year of cider, which is approximately 12.18 liters per person. 46.5% of households buy the product. The product is expected to become a popular choice in emerging markets such as Poland and the Czech Republic.

The Asia Pacific is expected to see growth due to the shift to cider from beer, which has nutritional benefits for the health-conscious consumer. The market for fruit-flavored alcohol has seen a rise in demand due to the increasing use of fruit-sourced ingredients in various product categories, especially beverages. High demand is being seen in countries like India and China for fruit-flavored ciders and apple juice.

Note: Actual Numbers Might Vary In the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

SABMiller Plc is one of the top product manufacturers. Heineken N.V. Halewood Wines & Spirits and Distell Group Limited are other key players. C&C Group Plc, Carlsberg A/S Plc, Aston Manor Brewery, Diageo plc, Thatchers Cider, and Kopparberg’s Brewery are others. Innovation is the key focus of the top players. Consumer interest is maintained by new product launches.

Premium quality products have been made possible by popular brands like Woodchuck, Kopparberg, and Angry Orchard. These products are more in demand than those that are less expensive. To meet this demand, companies are increasing production investment.

The company plans to increase its capaci ty and capabilities, as well as improve loading and shipping facilities at the Devon production site. To take advantage of the increased demand from young, wealthy consumers, Diageo launched Tusker cider in Kenya.

Маrkеt Кеу Рlауеrѕ

- SABMiller Plc

- Heineken N.V.

- Halewood Wines & Spirits

- Distell Group Limited

- C&C Group Plc

- Carlsberg A/S Plc

- Aston Manor Brewery

- Diageo plc

- Thatchers Cider

- Kopparberg’s Brewery

- Other Key Players

Recent Development

June 2022: A new product known as High on the Mountain was launched by Bryant’s Cider, which is a dry cider, that has no artificial sweeteners and is gluten-free, and has net zero carbs.

March 2021: A new sustainable cider produced from 100% British apples in Europe was launched by Heineken. Inch is available in 500ml bottles, 4x440ml and 10x440ml cans.

Report Scope

Report Features Description Market Value (2023) USD 17.5 Billion Forecast Revenue (2033) USD 29.4 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bakery Products, Desserts & Ice Creams, and Other Products), By Distribution Channel (Convenience Stores, Specialty Stores, Online, and Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Conagra Brands, Inc., Nestlé SA, The Hershey Company, DR. SCHÄR AG/SPA, ENJOY LIFE NATURAL, General Mills, Inc., Kellogg Company, The Kraft Heinz Company, Genius Foods, Amys Kitchen Inc., Bobs Red Mill Natural Foods Inc., Campbell Soup Co., The Hain Celestial Group, Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cider?- Cider is an alcoholic beverage made from the fermented juice of apples. It can vary in taste from sweet to dry and can be still or sparkling.

What are the geographical trends in the cider market?The consumption and popularity of cider vary across regions. Traditionally, regions like the United Kingdom, Ireland, Spain, and parts of the United States have strong cider cultures.

What role does innovation play in the cider market?Innovation is significant in creating new flavors, exploring different apple varieties, experimenting with fermentation techniques, and meeting the demands of diverse consumer preferences.

Are there health trends impacting the cider market?Health-conscious consumers are looking for low-sugar and lower-alcohol options, driving the demand for lighter and sessionable ciders with reduced calories and sugar content.

-

-

- SABMiller Plc

- Heineken N.V.

- Halewood Wines & Spirits

- Distell Group Limited

- C&C Group Plc

- Carlsberg A/S Plc

- Aston Manor Brewery

- Diageo plc

- Thatchers Cider

- Kopparberg’s Brewery

- Other Key Players