Global Chlorine Compressors Market By Product Type(Liquid Ring Compressors, Centrifugal Compressors), By Application(Water Treatment, Pharmaceuticals, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 67403

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

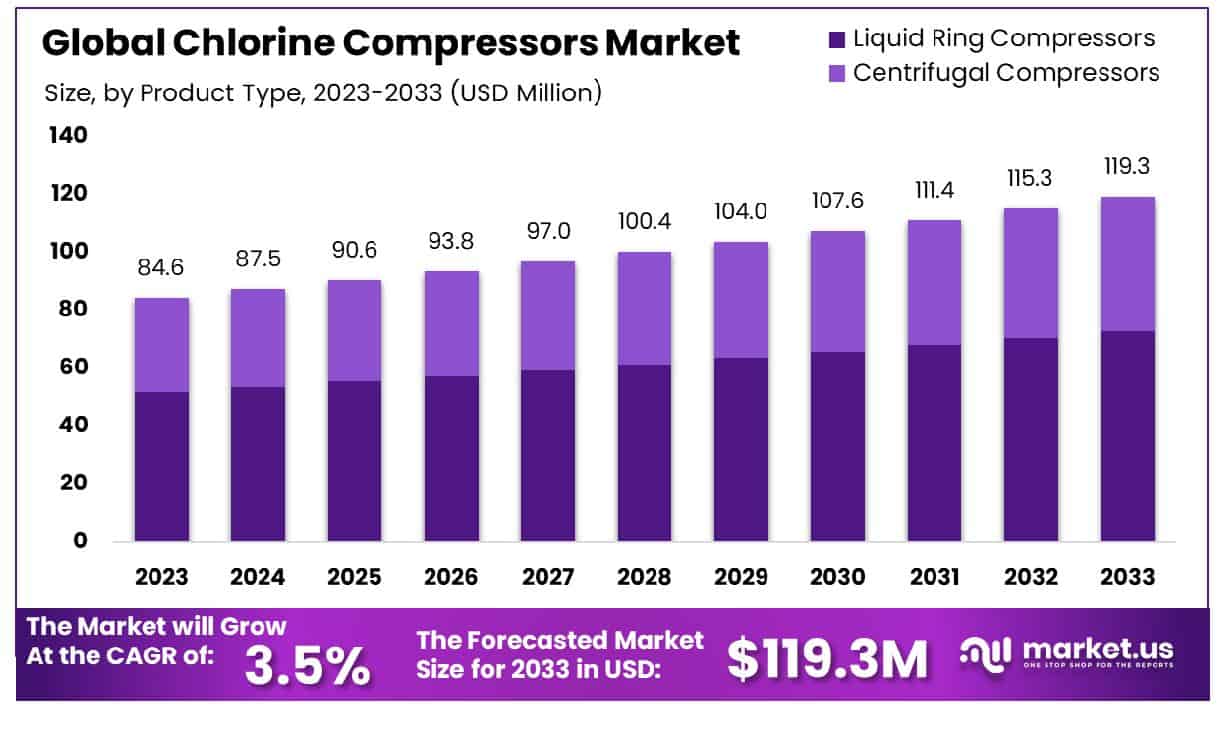

The Global Chlorine Compressors Market size is expected to be worth around USD 119.3 Million by 2033, From USD 84.6 Million by 2023, growing at a CAGR of 3.50% during the forecast period from 2024 to 2033.

The Chlorine Compressors Market refers to a specialized segment within the industrial machinery sector, focused on the production and distribution of compressors used for chlorine gas compression and transfer in various industries. These compressors are critical for chlorine processing and packaging, essential in chemical manufacturing, water treatment, and pharmaceuticals, among other sectors.

The market’s growth is driven by the expanding demand for clean water, stringent environmental regulations, and advancements in chemical processing technologies. For stakeholders such as Product Managers, understanding this market’s dynamics offers insights into strategic investments, innovation opportunities, and operational efficiencies in chlorine-related applications.

The Chlorine Compressors Market has garnered significant attention within the industrial sector, a development underpinned by robust production figures and a concentrated ownership landscape. According to the U.S. Environmental Protection Agency, the U.S. marked a chlorine production milestone of approximately 10,000 million kilograms in 2019, a testament to the sector’s capacity and efficiency.

The industry’s structure is notably oligopolistic, with key players including Olin Corporation, Westlake Corporation, and Oxy Chemical Corporation dominating the landscape. This concentration of ownership not only underscores the strategic importance of these entities in maintaining chlorine supply chains but also highlights their pivotal role in influencing market dynamics and price structures.

The usage pattern of domestically produced chlorine reveals an interesting trend; it is estimated that in 2022, a substantial 68% of this production was directed towards captive consumption. This internal utilization of chlorine by producers for derivative products significantly reduces the volume available for the merchant market, potentially tightening supply and elevating prices. Such a scenario underscores the importance of chlorine compressors in ensuring efficient production and distribution processes, thereby mitigating potential supply constraints.

From a strategic viewpoint, the Chlorine Compressors Market is poised at a critical juncture. The existing production and consumption dynamics present both challenges and opportunities. Market players are advised to closely monitor supply trends, invest in technological advancements to enhance production efficiencies, and explore strategic partnerships to secure raw material supplies. Moreover, the evolution of environmental regulations and sustainability goals could influence production processes, urging companies to innovate and adapt to maintain competitiveness in a rapidly changing industrial landscape.

Key Takeaways

- Market Growth: The Global Chlorine Compressors Market size is expected to be worth around USD 119.3 Million by 2033, From USD 84.6 Million by 2023, growing at a CAGR of 3.50% during the forecast period from 2024 to 2033.

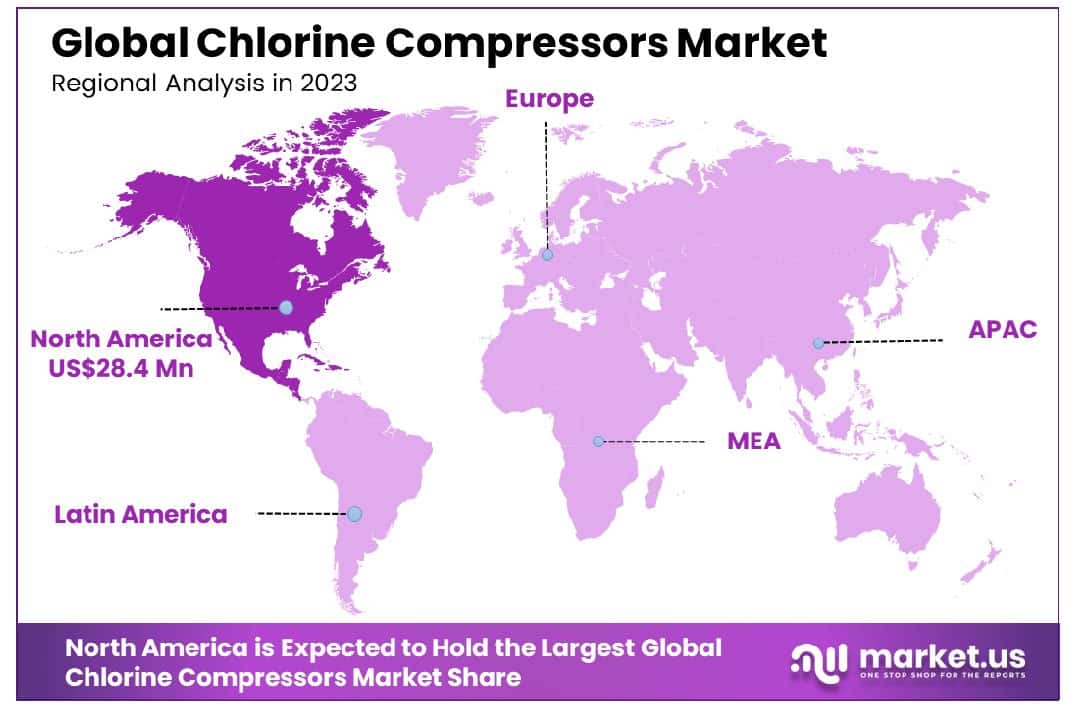

- Regional Dominance: North America holds 43.6% of the global chlorine compressors market.

- Segmentation Insights:

- By Product Type: The market share held by Liquid Ring Compressors is reported at 61.2%, showcasing their dominance.

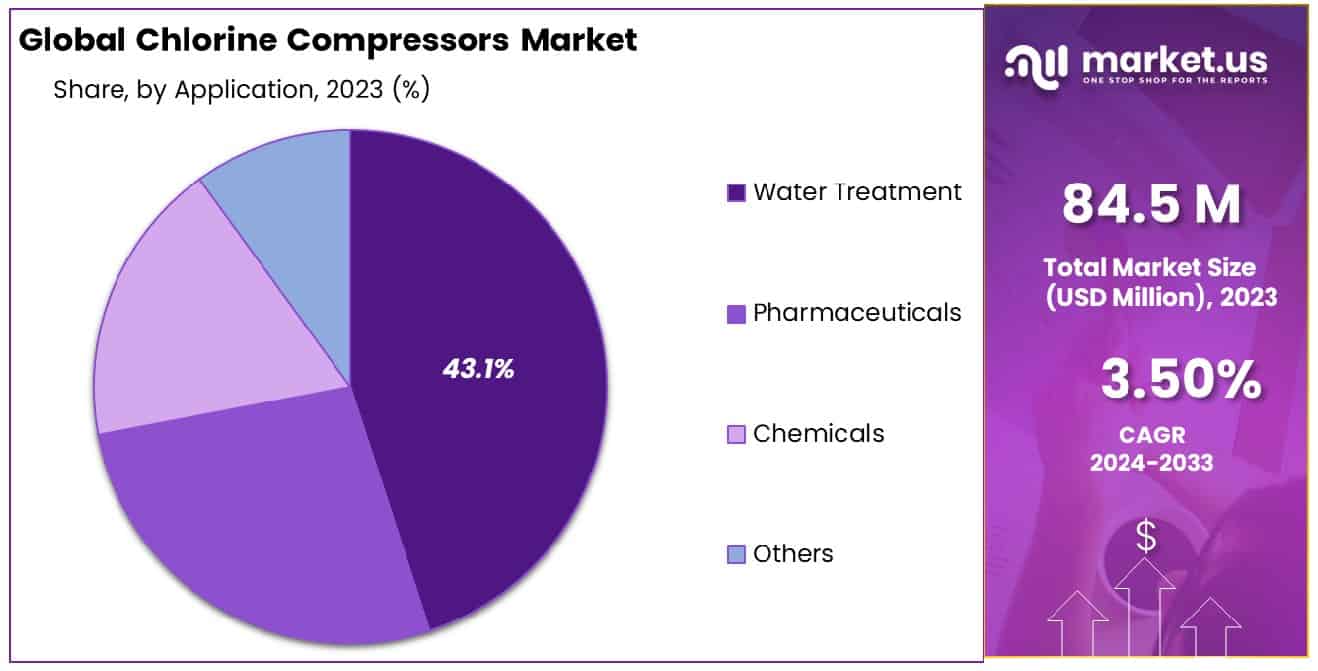

- By Application: In the realm of applications, Water Treatment claims a significant portion, amounting to 43.1%.

- Growth Opportunities: The 2023 global chlorine compressors market is set to grow, driven by increased demand in high-purity applications and the expanding oil and gas sector, despite high costs posing challenges.

Driving Factors

Accelerating Transition to Clean Energy: Implications for Chlorine Compressors

The Chlorine Compressors Market is experiencing significant growth, primarily fueled by the increased demand for clean energy carriers, particularly hydrogen. This surge is attributed to the global emphasis on renewable energy sources and concerted decarbonization efforts. Hydrogen, a clean energy carrier, plays a pivotal role in this transition, serving as a fundamental component in the production of chlorine through electrolysis processes. As nations and industries commit to reducing carbon footprints, the demand for hydrogen escalates, directly influencing the need for efficient chlorine compressors, which are critical for hydrogen storage and transportation.

Industrial Applications Necessitating High-Pressure Hydrogen

The requirement for high-pressure hydrogen in industrial applications—spanning chemical manufacturing, electronics production, and refining—further propels the Chlorine Compressors Market. These sectors rely on hydrogen as a key input for various processes, including the synthesis of ammonia, methanol, and other chemicals, where chlorine compressors are indispensable for managing hydrogen’s high-pressure needs. The precise control and safety offered by advanced chlorine compressors enable industries to enhance efficiency and reduce risks associated with hydrogen handling, thereby supporting market growth.

Expansion of Hydrogen Fueling Infrastructure

Lastly, the expansion of infrastructure for hydrogen fueling stations, driven by the adoption of hydrogen fuel cell vehicles (FCVs) and other hydrogen-powered transportation, significantly contributes to the market’s growth. The development of hydrogen fueling stations necessitates robust systems for hydrogen compression, storage, and distribution, wherein chlorine compressors play a vital role. As governments and private entities invest in hydrogen fueling infrastructure to support eco-friendly transportation options, the demand for chlorine compressors is expected to surge, aligning with the global move towards sustainable energy solutions.

Restraining Factors

The Economic Hurdle: High Cost of Chlorine Compressors

The Chlorine Compressors Market, despite its growth potential, faces a significant challenge due to the high cost of chlorine compressors. These compressors, essential for the compression and transportation of chlorine gas in various industrial applications, come with a hefty price tag. This initial investment can act as a deterrent for small and medium-sized enterprises (SMEs) or industries in developing regions, where budget constraints are tighter.

The high cost is attributed to the sophisticated technology and materials required to ensure the compressors can handle chlorine gas safely and efficiently. While large corporations may navigate these financial requirements, the overall market growth is restrained as potential adopters are forced to seek more affordable alternatives or delay the upgrade to advanced compressor systems.

Safety Concerns: Flammability of Chlorine Gas

Compounding the economic barrier is the inherent risk associated with chlorine gas—its flammability. Chlorine, while widely used in water treatment chemical synthesis, and manufacturing processes, poses significant safety risks due to its highly reactive nature. The management of chlorine gas necessitates specialized equipment and stringent safety measures to mitigate the risk of leaks or explosions, which in turn elevates the cost and complexity of chlorine compressor systems.

Industries are required to invest in advanced safety features and adhere to rigorous safety protocols, further inflating costs and complicating the operational processes. This safety concern not only impacts the direct cost associated with chlorine compressors but also influences the market indirectly by heightening regulatory scrutiny and insurance premiums for operators.

By Product Type Analysis

The market share held by liquid ring compressors in the product type category is observed at 61.2%.

In 2023, the Chlorine Compressors Market was significantly shaped by its By Product Type segment, where Liquid Ring Compressors and Centrifugal Compressors emerged as key players. Liquid Ring Compressors held a dominant market position, capturing more than a 61.2% share. This substantial market share can be attributed to the distinctive advantages offered by Liquid Ring Compressors, including their ability to handle highly corrosive gases such as chlorine without degradation of performance, their operational safety, and relatively low maintenance costs.

Centrifugal Compressors, while occupying a smaller portion of the market, played a crucial role in applications demanding higher flow rates and efficiencies. The preference for HVAC Centrifugal Compressors in large-scale industrial applications underscores the diverse needs of the Chlorine Compressors Market and highlights the technological advancements aimed at optimizing performance and energy efficiency.

The prominence of Liquid Ring Compressors in the market is further reinforced by their adaptability to a wide range of operating conditions and their exceptional reliability in hazardous environments. This has made them particularly indispensable in the chemical and water treatment industries, where the safe and efficient handling of chlorine is paramount.

The data indicates a continuing trend toward the adoption of technologies that offer environmental benefits, operational safety, and cost efficiency. The market’s leaning toward Liquid Ring Compressors signifies an alignment with these priorities, suggesting a pathway for future market developments. As industries continue to prioritize sustainability and operational efficiency, the demand for Liquid Ring Compressors is anticipated to sustain its growth trajectory, influencing market dynamics and competitive strategies within the Chlorine Compressors sector.

By Application Analysis

In the application segment, water treatment accounts for a significant 43.1% of the overall market utilization.

In 2023, the Chlorine Compressors Market was notably influenced by its Application segment, with Water Treatment, Pharmaceuticals, Chemicals, and Others as the primary categories. Water Treatment held a dominant market position, capturing more than a 43.1% share. This significant market share is attributed to the increasing global emphasis on clean and safe water supplies, necessitating the extensive use of chlorine compressors for disinfection and sanitation processes.

The Pharmaceuticals segment, while commanding a lesser share compared to Water Treatment, is recognized for its critical application of chlorine compressors in the production of pharmaceuticals, where the need for precise and contamination-free environments is paramount. Similarly, the Chemicals sector relies on chlorine compressors for a variety of processes, including the production of PVC, solvents, and other chlorine derivatives, underlining the versatility and indispensability of chlorine compressors in industrial applications.

The category labeled “Others” encompasses a broad range of applications, further illustrating the versatility and essential nature of chlorine compressors across multiple industries.

Key Market Segments

By Product Type

- Liquid Ring Compressors

- Centrifugal Compressors

By Application

- Water Treatment

- Pharmaceuticals

- Chemicals

- Others

Growth Opportunities

Increased Demand for High-Purity Chlor-Alkali Products

In 2023, the global chlorine compressors market is poised for substantial growth, driven by the escalating demand for high-purity chlor-alkali products. Industries with stringent purity requirements, including electronics, semiconductors, and pharmaceuticals, are at the forefront of this surge. The necessity for such high-purity products can be attributed to their critical applications in manufacturing processes that demand the utmost quality and reliability.

These sectors have witnessed significant expansion due to technological advancements and increased health sector investments, thereby augmenting the demand for chlor-alkali products that meet their exacting standards. Consequently, manufacturers of chlorine compressors are presented with a lucrative opportunity to cater to this niche yet rapidly growing market segment, emphasizing the development of compressors that can ensure the delivery of high-purity chlorine.

Growth of the Oil and Gas Sector

Another pivotal factor contributing to the opportunities within the global chlorine compressors market is the growth of the oil and gas sector. This sector’s expansion is directly influencing the hydrogen compressor market, showcasing a reciprocal relationship with the chlorine compressors market. Despite the high initial investment and maintenance costs associated with chlorine and hydrogen compressors, the burgeoning oil and gas industry continues to fuel demand.

This growth is underpinned by the increasing global energy demand and the pivotal role of chlorine in various oil and gas applications, including as a precursor for materials used in drilling and exploration. Thus, the sector’s expansion not only underscores the importance of chlorine compressors in supporting critical industrial processes but also highlights the market’s potential for robust growth amidst challenges.

Latest Trends

Focus on Sustainability and Environmental Concerns

In 2023, the global chlorine compressors market is witnessing a transformative shift towards sustainability and environmental stewardship. This trend is primarily influenced by growing global awareness and regulatory pressures concerning environmental protection. Manufacturers are increasingly integrating eco-friendly materials and technologies in the design and production of chlorine compressors.

The adoption of such innovations aims to reduce the carbon footprint and emissions associated with these compressors, aligning with broader environmental goals. This shift not only reflects the industry’s response to environmental concerns but also signifies a long-term strategic pivot towards sustainable operational practices. As a result, the market is expected to see a surge in demand for these greener, more efficient compressors from industries seeking to mitigate their environmental impact.

Advancements in Technology

Technological advancements represent another critical trend shaping the chlorine compressors market in 2023. The integration of digital monitoring and control systems stands out as a significant enhancement, bolstering the efficiency and reliability of chlorine compressors. These technologies facilitate real-time data analysis and predictive maintenance, enabling operators to preemptively address potential issues before they escalate into costly downtime.

Furthermore, the advent of such innovations contributes to operational cost savings over time, making high-tech compressors an increasingly attractive investment for end-users. The market’s trajectory is thus characterized by the rapid adoption of these advanced systems, driven by their proven benefits in operational efficiency and compressor longevity.

Regional Analysis

North America dominates the Chlorine Compressors Market with a significant share of 43.6%.

In the intricate landscape of the global chlorine compressors market, regional dynamics play a pivotal role in shaping market trends and opportunities. North America emerges as the dominant region, commanding a substantial 43.6% share, driven by robust industrial and manufacturing sectors, alongside stringent environmental regulations that necessitate advanced compressor technologies. The focus on sustainability and technological innovation significantly contributes to the market’s growth in this region.

Europe follows, characterized by its stringent environmental policies and a strong emphasis on reducing industrial emissions. The region’s advanced manufacturing base, particularly in the chemical and pharmaceutical sectors, fuels the demand for high-efficiency chlorine compressors. Moreover, Europe’s commitment to sustainability bolsters the adoption of eco-friendly and energy-efficient compressor technologies, aligning with the global shift towards environmental stewardship.

The Asia Pacific region is identified as a rapidly expanding market, buoyed by industrialization and the growing chemical manufacturing sector in countries such as China and India. Increasing investments in infrastructure and the oil and gas sector further propel the demand for chlorine compressors, with technological advancements and digitalization playing key roles in market penetration.

The Middle East & Africa, although smaller in comparison, exhibit potential for significant growth, primarily driven by the expansion of the oil and gas industry and related downstream activities, necessitating robust chlorine compression solutions.

Latin America, with its burgeoning chemical industry and progressive industrial policies, is poised for growth. Investments in manufacturing and environmental technologies are expected to stimulate the demand for advanced chlorine compressors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global Chlorine Compressors market of 2023, a comprehensive analysis of key players reveals a landscape marked by innovation, strategic expansions, and a focus on environmental sustainability. Companies such as Devi Hitech Engineers, Gardner Denver Nash, Sundyne, RefTec International Systems, Elliott, Mikuni Kikai, H. Industries, and Mayekawa have been instrumental in driving forward the market dynamics through their technological advancements and robust product offerings.

Devi Hitech Engineers has been recognized for its custom engineering solutions that cater to specific client needs, thereby enhancing operational efficiency. The company’s focus on research and development is evident in its product line, which is tailored for safety and reliability in chlorine gas compression.

Gardner Denver Nash, with its global footprint, offers a diverse portfolio of liquid ring compressors, known for their reliability and low maintenance costs. The company’s commitment to sustainability is demonstrated through energy-efficient designs that reduce operational costs for clients.

Sundyne stands out for its integration of innovative technologies in centrifugal compressors, which are designed for leak-free operations, ensuring safety in chlorine handling. Their products are a testament to their commitment to high safety standards and environmental protection.

RefTec International Systems specializes in custom-designed compression systems that meet the rigorous demands of chlorine gas handling, highlighting their flexibility and focus on client-specific solutions.

Elliott, with its extensive experience, offers chlorine compressors that are renowned for durability and performance, underpinning the company’s reputation for quality and reliability.

Mikuni Kikai’s contributions to the market include precision-engineered compressors that optimize performance and safety, while H. Industries and Mayekawa have been pivotal in introducing technological innovations that address both efficiency and environmental concerns.

Market Key Players

- Devi Hitech Engineers

- Gardner Denver Nash

- Sundyne

- RefTec International Systems

- Elliott

- Mikuni Kikai

- H. Industries

- Mayekawa

Recent Development

- In March 2024, Copeland develops an oil-free centrifugal compressor with Aero-lift tech for high efficiency, system flexibility, and compatibility with low-GWP refrigerants. Aimed at data centers, healthcare, and chillers, it exceeds ASHRAE 90.1 efficiency standards.

- In February 2024, The US Department of Energy funded four heat pump projects to reduce industrial greenhouse gas emissions, totaling over $10m. Initiatives include a CO2-temperature heat pump by Echogen Power Systems.

- In June 2021, De Nora launched CECHLO-MS 200, an on-site chlorine generation system, ensuring reliable water treatment, minimizing safety concerns, and offering supply chain independence for operators.

Report Scope

Report Features Description Market Value (2023) USD 84.6 Million Forecast Revenue (2033) USD 119.3 Million CAGR (2024-2033) 3.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Liquid Ring Compressors, Centrifugal Compressors), By Application(Water Treatment, Pharmaceuticals, Chemicals, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Devi Hitech Engineers, Gardner Denver Nash, Sundyne, RefTec International Systems, Elliott, Mikuni Kikai, H. Industries, Mayekawa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Chlorine Compressors Market in 2023?The Global Chlorine Compressors Market size is USD 84.6 Million in 2023.

What is the projected CAGR at which the Global Chlorine Compressors Market is expected to grow at?The Global Chlorine Compressors Market is expected to grow at a CAGR of 3.50% (2024-2033).

List the segments encompassed in this report on the Global Chlorine Compressors Market?Market.US has segmented the Global Chlorine Compressors Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa).By Product Type(Liquid Ring Compressors, Centrifugal Compressors), By Application(Water Treatment, Pharmaceuticals, Chemicals, Others)

List the key industry players of the Global Chlorine Compressors Market?Devi Hitech Engineers, Gardner Denver Nash, Sundyne, RefTec International Systems, Elliott, Mikuni Kikai, H. Industries, Mayekawa

Name the key areas of business for Global Chlorine Compressors Market?The US, Canada, Mexico are leading key areas of operation for Global Chlorine Compressors Market.

Chlorine Compressors MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Chlorine Compressors MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Devi Hitech Engineers

- Gardner Denver Nash

- Sundyne

- RefTec International Systems

- Elliott

- Mikuni Kikai

- H. Industries

- Mayekawa