Global Chip Mounter Market; By Type (Surface Mount Technology (SMT) Equipment & Through-hole Technology (THT) Equipment), By Application (Consumer Electronics, Medical, and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast; 2023-2032

- Published date: May 2023

- Report ID: 65066

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Market Dynamics

- Global Chip Mounter Market Scope:

- Key Market Segmentation

- Regional Analysis

- Key Regions and Countries Covered in this Report:

- Market Share & Key Players Analysis:

- Recent Developments

- Market Key Players:

- Partnerships, Collaborations, and Agreements

- Product Launches and Product Expansions

- Mergers and Acquisitions

Report Overview

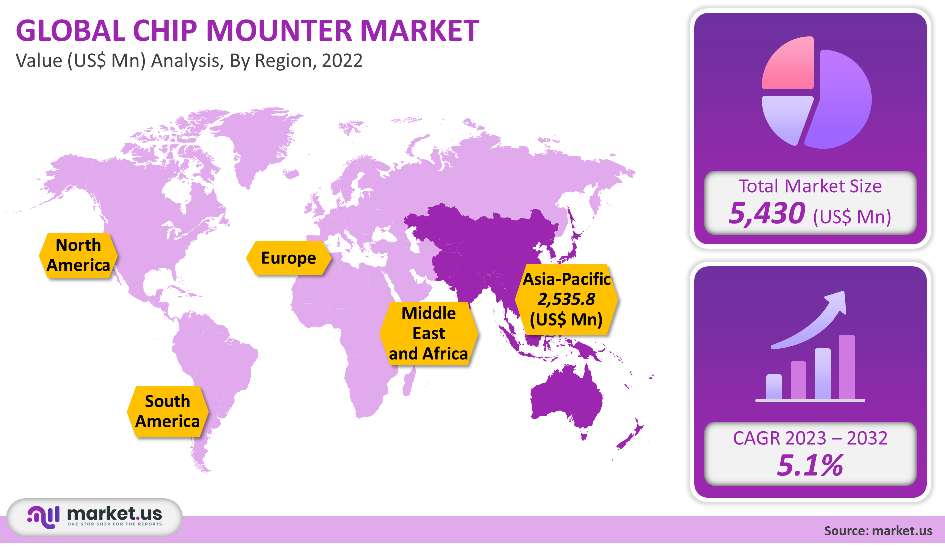

The market for chip mounters is estimated to be valued at USD 5.43 billion in 2022. Also, the market will expand at a CAGR of 5.1% between 2023 to 2032, and the market will reach USD 8.73 billion by 2032.

The chip mounting technology has advanced over the past few decades and has become a workable method for increasing packaging system density. The traditional Through Hole Technology (THT) then it reappeared as Surface Mount Technology (SMT), and finally, it became Fine Pitch Technology (FPT). The vast majority of manufacturers today install chips on substrates using both SMT and THT. The automobile, telecommunications, medical, and electronics industries use these technologies.

Market Dynamics

Drivers

Increase in Demand for Smaller Consumer Electronics Products.

The consumer electronics industry is growing to provide customers with more cutting-edge technologies, such as fingerprint sensors in mobile phones and smart televisions. The increased need for shrunk gadgets has led to the development of smaller hardware components, such as printed circuit boards, which are compact and can function even when combining a large number of components. This is what chip mounting technologies help with; as a result, their acceptability is expanding and driving the expansion of the chip mounter market.

Increasing Demand in The Automotive Industry

The market for chip mounters is observing new growth prospects as the electric vehicles market grows across the globe. According to the European Free Trade Association, the number of European electric car registrations increased by 54.3% in the first quarter of 2022.

The majority of the motor controller circuitry in electric vehicles is constructed on printed circuit boards. Hence the demand for chip mounting solutions for the construction of such PCBs is anticipated to rise. The usage of chip mounting technologies for PCBs will increase throughout the projection period as a result of the rising demand for electric vehicles and government programs to buy EVs, which will increase the size of the chip mounter market.

Restraints

Several restraining factors limit the potential size of the chip mounter market. Such as, the machines are costly, with heavy capital investment, and the chip mounting process is technical and requires trained operators. Also, chip mount technology is evolving, which indicates machines must be upgraded to keep up with the latest changes.

Challenges

The Expansion of the Chip Mounter Market Is Hampered by Problems with Repair, Rework, And Dependability for Printed Circuit Boards.

The devices produced with this chip mounting approach are more feature-rich, more compact, and less expensive. But, this high component density makes it difficult to repair and rebuild the PCB boards in the event of a breakdown. For reworking on the board, conventional soldering techniques are worthless, and specialist procedures, like non-contact approaches, are needed to prevent further harm to the assembly. It is challenging to repair or rework an electronic device made with chip mounting technology. This is a large obstacle to the expansion of the chip mounter market.

Key Trends

The chip mounter market is anticipated to increase as a result of the growing use of chip mounters in the electronics sector. Chip mounters are employed in the consumer electronics sector. They are necessary to create electronic devices such as computers, tablets, and smartphones. As the consumer electronics sector develops, the demand for chip mounters is anticipated to increase over the next few years. The shrinking of electronic components is also expected to help the market.

The widespread usage of chip mounters in manufacturing telecommunications equipment is predicted to fuel industry expansion. The precise placement and soldering of components in telecom equipment are made possible by these devices’ great precision and accuracy. Additionally, chip mounters have rapid cycle times, which contributes to speeding up the production units of telecom equipment.

Global Chip Mounter Market Scope:

Type Analysis

By type, the market is segmented into Surface Mount Technology (SMT) Equipment & Through-hole Technology (THT) Equipment. The surface mount technology segment is anticipated to grow at a 5.3% CAGR and is expected to account for the largest revenue share as per the analysis.

Electrical components can be attached to a printed circuit board (PCB) surface using surface-mount technology. This type of component assembly has been supplanted through-hole technology in the industrial sector, owing to the SMT’s increased factory automation, which lowers prices and raises quality.

Additionally, it enables the placement of more components on a particular part of the substrate. The through-hole approach is often used for components that are not suited for surface mounting, such as big transformers and heat-sink power semiconductors, even though both technologies can be utilized on the same circuit board.

Another form of chip mounter called through-hole technology equipment is used to mount components on a printed circuit board surface through holes in the PCB. This technique is not as popular as it once was since surface mount technology has replaced it. , THT equipment clamps or employs screws to hold the component in position before soldering it to the PCB. During through-hole soldering, holes are bored in the printed circuit board (PCB) so that the component leads—a wire with an expanded end—can be placed through them before being soldered into place, forming an electrical connection.

Application Analysis

By application, the market is divided into consumer electronics, medical, automotive, telecommunication, and other applications. By application, the consumer electronics segment in the chip mounter market is analyzed to grow at the highest CAGR of 7.1% during the forecast period.

A chip mounter is used in the medical industry to create PCBs. The chip mounter is used in the automotive sector to assemble electrical devices and their parts. Increasing levels of urbanization in North America, Europe, Asia-Pacific, and the Rest of the World have driven the greater demand for these products in various end-use industries. This can be attributed to the increased demand for residential, industrial, and commercial infrastructure.

Furthermore, technological developments and the rising demand for electronic gadgets that are smaller in size are driving the chip mounter market. The creation of smaller electrical components on printed circuit boards is being done via Chip Mounting technologies in response to the increased need for downsized electronic products. The consumer electronics sector of the chip mounter market will grow as a result of these ongoing advances.

COVID-19 Analysis

The outbreak of COVID-19 has affected the chip mounter market in several ways., many chip mounter manufacturers are based in China, which has been affected by the virus. This has led to production delays and shortages of components. , the global semiconductor industry has been hit hard by the pandemic, with demand for chips plummeting as businesses worldwide cut back on investment.

Key Market Segmentation

By Type

- Surface Mount Technology (SMT) Equipment

- Through-hole Technology (THT) Equipment

By Application

- Consumer Electronics

- Medical

- Automotive

- Telecommunication

- Other Applications

Regional Analysis

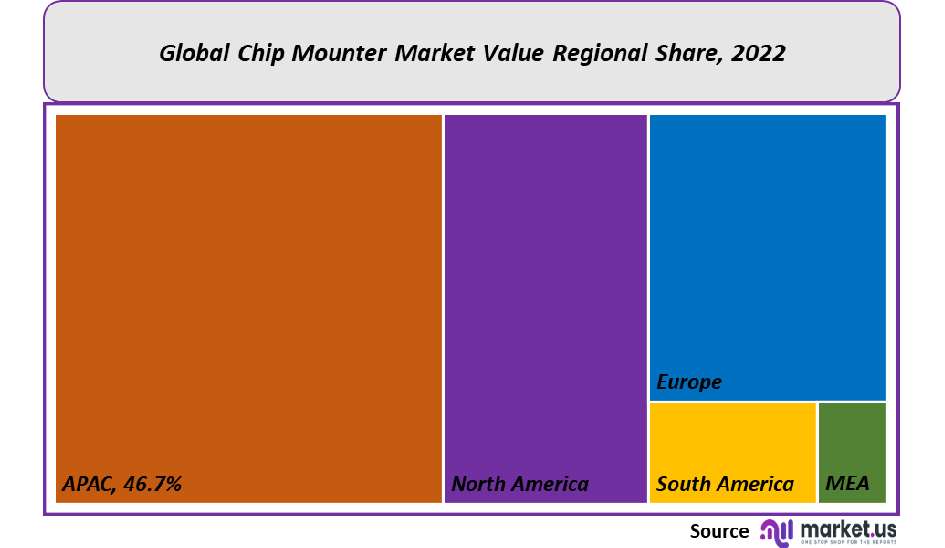

Based on regional market analysis, the global chip mounter market is classified into North America, Europe, Asia Pacific, and the Rest of the world. APAC accounted for the chip mounter’s most significant market share of 46.7% during the forecast period.

The major markets for chip mounters in APAC include China, the US, Germany, Japan, India, and South Korea. APAC has experienced a rapid growth rate and is anticipated to present several commercial chances to market vendors is the significant reason propelling the robust growth in APAC.

Moreover, the region’s high demand for consumer electronics, growing population, and rapid digitalization are all contributing causes to this rise. The size of the Chip Mounter Sector is also being increased by the existence of significant printed board circuit manufacturers and their ongoing investment in the market.

According to research from the Indian Cellular and Electronics Association, there would be up to US$ 320 million printed board circuit assembly units in use in India by the end of the year 2022, with more than half of them being utilized in consumer electronics. These elements support APAC’s position as one of the industry’s most robust areas for chip mounters.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

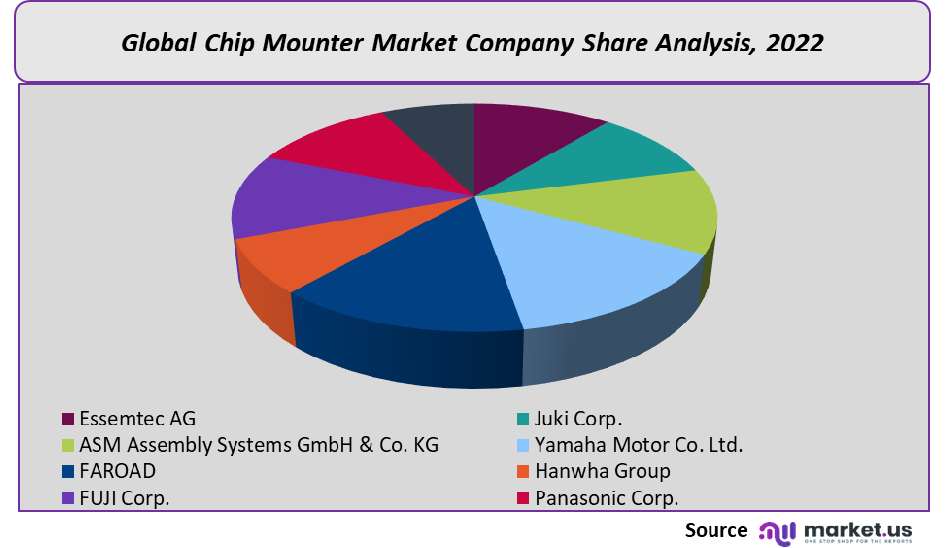

Major companies in this industry focus on the expansion of their respective capacities as well as potential mergers & acquisitions. Moreover, various companies are now focusing on product approvals, growth strategies, events, and patents. These activities will lead to growth opportunities in the future.

Manufacturers are employing these chipsets to shrink the size of the devices without impairing their performance in response to the growing demand for small gadgets and wearables. Also, hardware developers are investing in the creation of novel approaches to manage more circuitry at comparable costs to stay up with the increasing level of integration.

Recent Developments

Yamaha Motors displayed its One-Stop Smart Solution, prepared to power high-speed, high-quality intelligent production, in May 2022 at SMT connect 2022. The PCBs were constructed utilizing surface mount methods by Yamaha Motors’ robotics division. They have modified PCB production units lines to produce parts for medical respirators. The market share of the business is expected to rise as a result. REDARC was declared in March 2022. Given that REDARC has cutting-edge chip mounting technology, this will help the chip mounting market grow even further.

ROHM Semiconductor released AC/DC converter ICs with an integrated surface mount package in June 2021. Both commercial and industrial applications benefit most from the gadgets. The Chip Mounter Market will grow due to the widespread use of chip mounting methods.

Market Key Players:

- Essemtec AG

- Juki Corp.

- ASM Assembly Systems GmbH & Co. KG

- Yamaha Motor Co. Ltd.

- FAROAD

- Hanwha Group

- FUJI Corp.

- Panasonic Corp.

- Ohashi Engineering

- Other Key Companies.

Partnerships, Collaborations, and Agreements

The chip mounter market is a competitive and dynamic space. To stay ahead of the curve, market players must collaborate and merge with one another. This partnership and collaboration allow sharing of resources, knowledge, and best practices, leading to more innovation and better customer products.

Product Launches and Product Expansions

A chip mounter is a device that places and attaches electronic components to a printed circuit board. New product launches from chip-mounted manufacturers offer advances in speed, accuracy, and capacity over previous models. These new products are often accompanied by new software releases that expand the machine’s capabilities.

Mergers and Acquisitions

The chip mounter market is currently undergoing a period of intense consolidation, with a large number of mergers and acquisitions taking place. This consolidation is being driven by several factors, including the need to achieve scale to compete in the global market and the desire to get new technologies and capabilities. This is likely to result in a smaller number of larger firms dominating the industry, with increased market power and higher barriers to entry for new entrants.

For the Chip Mounter Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 5.43 Billion

Growth Rate

5.1%

Forecast Value in 2032

USD 8.73 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Chip Mounter Market in 2022?The Chip Mounter Market market size is US$ 5.43 billion in 2022.

What is the projected CAGR at which the Chip Mounter Market is expected to grow at?The Chip Mounter Market is expected to grow at a CAGR of 5.1% (2023-2032).

List the key industry players of the Chip Mounter Market?Essemtec AG, Juki Corp., ASM Assembly Systems GmbH & Co. KG, Yamaha Motor Co. Ltd., FAROAD, Hanwha Group, FUJI Corp., Panasonic Corp., Ohashi Engineering, Other Key Companies are leading key vendors in the Chip Mounter Market.

Which region is more appealing for vendors employed in the Chip Mounter Market?APAC has experienced a rapid growth rate and is anticipated to present several commercial chances to market vendors is the significant reason propelling the robust growth in APAC.

Name the key areas of business for the Chip Mounter Market.The US, Canada, India, Mexico, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Chip Mounter Market.

-

-

- Essemtec AG

- Juki Corp.

- ASM Assembly Systems GmbH & Co. KG

- Yamaha Motor Co. Ltd.

- FAROAD

- Hanwha Group

- FUJI Corp.

- Panasonic Corp.

- Ohashi Engineering

- Other Key Companies.