Global Chestnut Market By Species Type(American Chestnut, Chinese Chestnut, European Chestnut, Japanese Chestnut), By Application(Food and Beverage Industry, Cosmetic Industry, Others), By Distribution Channel(Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132512

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

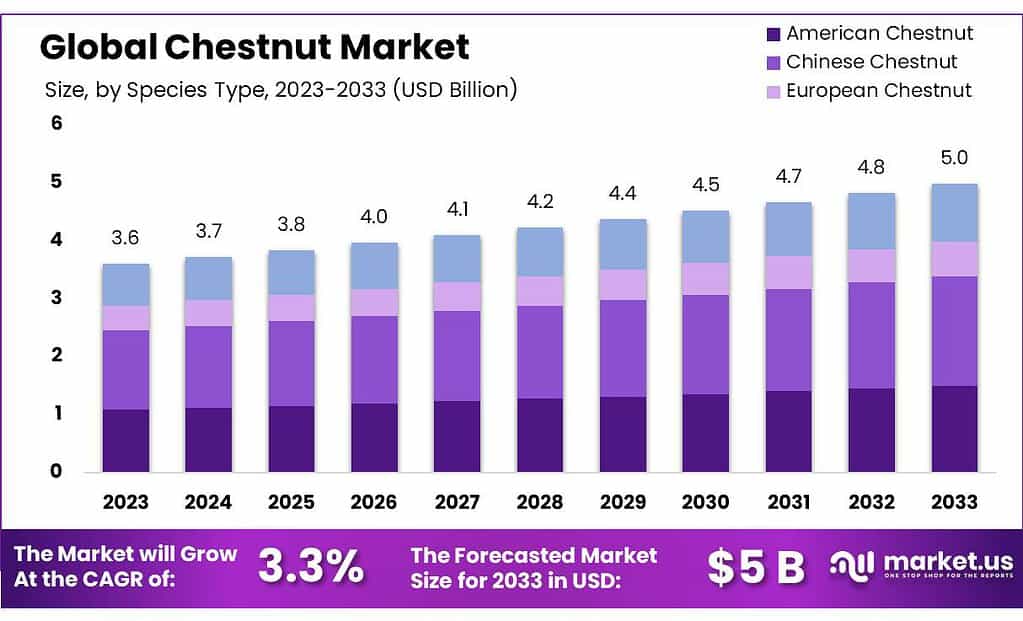

The Global Chestnut Market size is expected to be worth around USD 5.0 Bn by 2033, from USD 3.6 Bn in 2023, growing at a CAGR of 3.3% during the forecast period from 2024 to 2033.

Chestnuts, the sweet and edible nuts from the Castanea genus of the beech family, hold significant importance in the global market. These nuts grow inside prickly husks and are harvested during the autumn season. Among the key species, the American chestnut was once widespread in eastern North America but has been severely affected by chestnut blight. Meanwhile, the European chestnut continues to thrive and is extensively cultivated for its nuts.

In the United States, chestnut farming spans approximately 4,200 acres across 1,587 farms. However, U.S. production contributes less than 1% to the global chestnut supply. To meet domestic demand, the U.S. imported around 3,200 metric tons of chestnuts in 2017. Efforts to revive the American chestnut include planting transgenic varieties across 1,200 acres for research purposes.

This steady growth reflects rising demand for chestnuts, driven by their nutritional value and increasing use in culinary applications. Despite this growth, the average export price for chestnuts declined by 8.7% in 2022, settling at approximately USD 2,689 per ton. This price fluctuation highlights the dynamic nature of the chestnut trade.

Globally, the trade volume of fresh and dried chestnuts reached approximately 111,000 metric tons, with the majority—92.1%—comprising in-shell chestnuts. The export of in-shell chestnuts underscores their preference in various markets, particularly in regions where they are roasted and consumed as a traditional snack.

Key Takeaways

- Chestnut Market size is expected to be worth around USD 5.0 Bn by 2033, from USD 3.6 Bn in 2023, growing at a CAGR of 3.3%.

- hinese Chestnut held a dominant market position, capturing more than a 38.4% share of the global chestnut market.

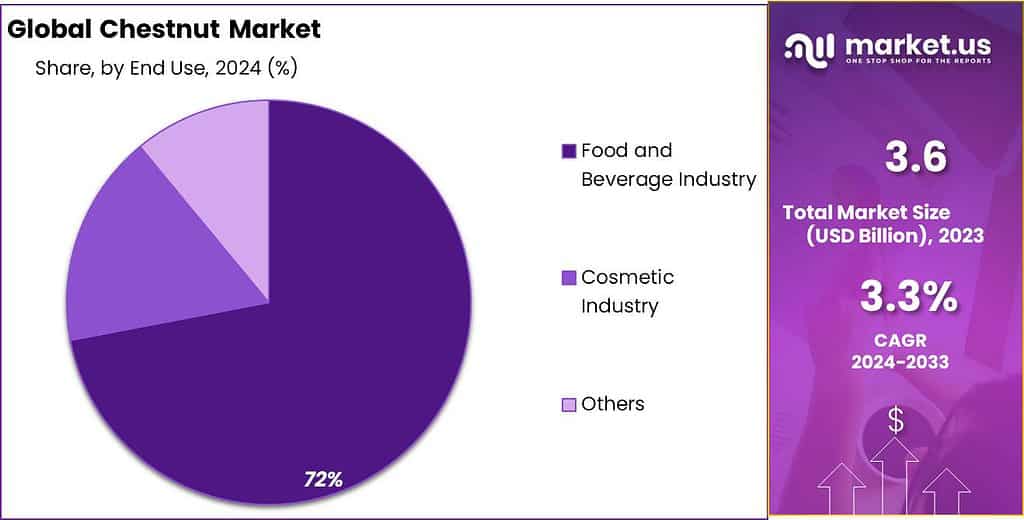

- Food and Beverage Industry held a dominant market position, capturing more than a 72.3% share.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.4% share.

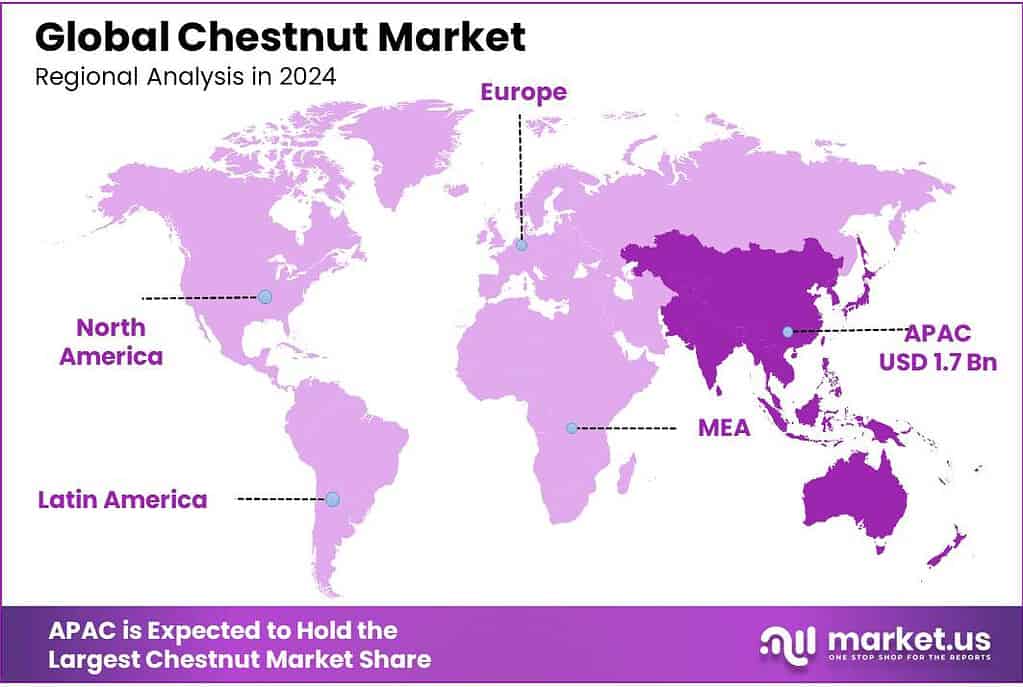

- Asia Pacific region dominates the global chestnut market, accounting for 47.6% of the market share, with a valuation of approximately USD 1.7 billion.

By Species Type

In 2023, Chinese Chestnut held a dominant market position, capturing more than a 38.4% share of the global chestnut market. This species is prized for its robust yield and adaptability to diverse climatic conditions, making it highly favored in both cultivation and consumption markets. The demand is primarily driven by its widespread use in culinary applications across Asia, particularly in China and Japan, where chestnuts are integral to various traditional dishes. The commercial viability of Chinese Chestnuts is enhanced by their longer shelf life and substantial size, which appeal to both domestic and international markets.

The American Chestnut, once a prevalent species in North America, has experienced a significant decline due to historical blight. However, recent conservation efforts and breeding programs aiming to reintroduce blight-resistant varieties have begun to revive its market presence. Despite these efforts, the American Chestnut’s market share remains considerably smaller. The species is gradually gaining traction, supported by niche markets that value its unique flavor and heritage status, which could potentially lead to a modest increase in its commercial footprint in the coming years.

The European Chestnut, known for its rich flavor and texture, holds a stable position in the market, particularly in European countries where it is culturally significant. The species is extensively used in traditional cuisines of Italy, France, and Spain, among others, contributing to its consistent demand. Commercial cultivation is primarily concentrated in these regions, which are also key in the processing and export of chestnuts, thus supporting the species’ steady market share.

Japanese Chestnut, while smaller in market share compared to its Chinese counterpart, is notable for its distinct sweetness and is primarily consumed within Japan. It finds its niche in local markets, particularly in the production of confectioneries and traditional sweets. Market growth for Japanese Chestnut is relatively limited but stable, with potential for expansion in specialty markets that cater to authentic Japanese produce.

By Application

In 2023, the Food and Beverage Industry held a dominant market position, capturing more than a 72.3% share of the global chestnut market. This segment benefits from the broad utilization of chestnuts in various culinary applications, ranging from whole roasted nuts to incorporation into pastries and other gourmet dishes.

The versatility and nutritional value of chestnuts enhance their appeal in both traditional and innovative food products, driving robust demand. Additionally, the rising popularity of gluten-free and plant-based diets has further propelled the inclusion of chestnuts in diverse food offerings, reinforcing their market dominance.

The Cosmetic Industry represents a smaller, yet rapidly growing segment of the chestnut market. Chestnut extract, known for its skin-conditioning and antioxidant properties, is increasingly being incorporated into skincare and haircare products. Although this segment currently holds a modest market share, it is experiencing significant growth due to consumer interest in natural and organic beauty products. The trend towards eco-friendly and sustainable cosmetic ingredients is likely to boost the demand for chestnut-based compounds in the cosmetic sector.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.4% share of the chestnut market. This distribution channel benefits from extensive consumer reach and the ability to offer a wide range of chestnut products, from fresh nuts to processed items. The convenience of one-stop shopping and the presence of these outlets in both urban and suburban areas contribute to their significant market share. Additionally, the visibility that hypermarkets and supermarkets provide for new and traditional chestnut-based products supports strong sales volumes.

Specialty Stores form a critical channel for the distribution of chestnuts, particularly those that are organic or have a unique provenance. While their market share is smaller compared to hypermarkets/supermarkets, specialty stores attract discerning customers looking for premium and niche products. These stores often provide a platform for regional and artisanal chestnut producers, and they play a key role in educating consumers about the unique qualities and uses of different chestnut varieties.

Convenience Stores, with their widespread and accessible locations, cater primarily to impulse buys and quick purchases. While they hold a lesser share of the chestnut market, their importance lies in the convenience they offer, particularly in urban settings. Chestnut products in these stores are typically pre-packaged or ready-to-eat, appealing to consumers seeking on-the-go snack options.

Online Retailers have seen a notable increase in their share of the chestnut market, driven by the growth of e-commerce and changing consumer shopping behaviors. This channel offers the advantage of reaching a broader audience, including buyers who prefer the convenience of home delivery. Online platforms are particularly effective for selling specialized chestnut products that may not be available in traditional retail settings, including imported or gourmet varieties.

Key Market Segments

By Species Type

- American Chestnut

- Chinese Chestnut

- European Chestnut

- Japanese Chestnut

By Application

- Food and Beverage Industry

- Cosmetic Industry

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

Driving Factors

Enhanced Health Awareness Boosts Chestnut Demand

The global chestnut market has witnessed substantial growth, driven by heightened consumer awareness of health and nutrition. Chestnuts are recognized for their low fat and high fiber content, making them a preferred ingredient in diets focused on heart health and weight management. The American Heart Association highlights chestnuts as beneficial in a low-fat, low-sodium diet, which has further popularized their consumption.

Nutritional Advantages Propel Market Expansion

Chestnuts offer a unique nutritional profile that includes high-quality protein, vitamins C and B, and essential minerals such as manganese and copper, positioning them as a superfood in various health-conscious communities. Their use extends beyond traditional consumption, finding a place in gluten-free and plant-based diets due to their versatility and health benefits. This has led to increased use in confectionery and as a flour substitute, boosting their market demand significantly.

Global Production and Export Dynamics

China, a leading producer and exporter of chestnuts, significantly influences the global market. In 2021, China’s export revenue from chestnuts was substantial, underscoring its dominance in the market. The country’s strategic initiatives in expanding chestnut orchards have been pivotal in meeting the growing international demand, which is expected to surge further as more consumers opt for healthier dietary choices.

Restraining Factors

Economic Barriers Impede Market Expansion

The growth of the global chestnut market faces significant constraints due to the high cost of chestnuts and their limited availability in certain regions. These factors are particularly pronounced in areas where chestnuts are not traditionally cultivated, leading to increased import costs and limited market penetration. The high costs are attributed to labor-intensive harvesting processes and the premium pricing of organically grown chestnuts, which can range from $4.00 to $12.50 per pound.

Supply Chain Disruptions Limit Market Reach

Supply chain inefficiencies further exacerbate the issue of availability. The chestnut market has been impacted by logistical challenges that affect the timely distribution and overall supply of the product. Disruptions in the supply chain, often caused by climatic factors or transportation issues, lead to a scarcity of chestnuts in markets that depend on imports, thereby hindering market growth.

Regional Production Disparities

Regions such as Asia Pacific, which lead in chestnut production, face fewer issues related to availability compared to regions like North America and Europe where production is less. This disparity in production capabilities affects the global distribution channels and makes it challenging to meet the rising demand in non-producing regions, ultimately restraining market growth.

These factors collectively contribute to the restrained growth of the chestnut market, impacting both the accessibility of chestnuts to consumers and the economic viability for producers. Market strategies focusing on improving agricultural practices, enhancing supply chain efficiency, and adopting advanced storage and processing technologies could mitigate some of these challenges and support market growth.

Growth Opportunity

Rising Popularity in Diverse Culinary Practices

The global chestnut market is poised for growth due to its increasing incorporation into diverse global cuisines. As a versatile ingredient, chestnuts are being used in various traditional and innovative dishes, which broadens their appeal and market reach. This trend is particularly strong in regions like Asia-Pacific, which leads in both production and consumption, and is known for integrating chestnuts into a multitude of traditional dishes.

Increased Demand for Gluten-Free and Vegan Options

Chestnuts are gaining popularity as a gluten-free and vegan ingredient, which aligns with the growing consumer demand for dietary-specific foods. The expansion of vegan and vegetarian markets globally supports this trend, offering significant growth opportunities for the chestnut market. Products like chestnut flour are becoming popular gluten-free alternatives, which enhances their market potential considerably.

Growth in Processed and Convenient Food Products

There is an increasing trend towards the use of chestnuts in processed foods, driven by consumer preferences for convenient and healthy food options. The chestnut’s nutritional benefits make it an ideal ingredient for the food processing industry, which is continually developing new products to meet health-conscious consumer demands.

Technological Advancements in Agriculture and Distribution

Technological advancements in cultivation methods and post-harvest technologies are set to improve yield and quality, making chestnuts more widely available and affordable. Innovations in distribution channels, particularly through online retail, are also expanding market access, allowing consumers from regions without local production to access a variety of chestnut products.

Latest Trends

Embracing Sustainability and Environmental Impact

One of the significant trends in the global chestnut market is the increasing emphasis on sustainability and the environmental benefits of chestnuts. Known for their carbon-negative and water-positive impact, chestnuts are becoming a favored choice among consumers and companies aiming for positive environmental outcomes. This trend is fueled by the broader consumer shift towards products with environmental, social, and governance (ESG) claims, which have experienced substantial growth. For instance, products with ESG-related claims saw a 28% growth rate compared to a general market growth rate of 20%.

Leveraging Nutritional Benefits for Market Growth

Chestnuts are increasingly recognized for their nutritional benefits, which include a high content of carbohydrates, proteins, vitamins, and essential minerals. These attributes position chestnuts as a health-promoting food, aligning with the growing consumer trend towards healthier dietary choices. The market sees a rising demand in sectors like confectionery, where chestnuts are valued for their nutrient-rich profile. Moreover, their status as gluten-free ingredients enhances their appeal in the food industry, catering to the dietary needs of consumers with specific health conditions or preferences.

Advancing Culinary Applications

The culinary versatility of chestnuts is another driving factor in their rising market popularity. Chestnuts are being increasingly used in diverse cuisines around the world, not only in traditional dishes but also in innovative culinary creations. This trend is evident in the food services sector, where chestnuts are integrated into the menu offerings of restaurants, cafes, and catering services, driven by consumer preferences for unique and diverse flavors.

Focus on Processed Chestnut Products

The industrial use of chestnuts is expanding, particularly in the manufacturing of chestnut-derived products such as flours, purees, and extracts. These ingredients are increasingly utilized in a variety of food products, catering to the consumer demand for convenience and health-oriented food options. This segment’s growth highlights the adaptability of chestnuts to meet the evolving needs of the food processing industry, further broadening the market reach and enhancing the value chain of chestnut products.

Regional Analysis

The Asia Pacific region dominates the global chestnut market, accounting for 47.6% of the market share, with a valuation of approximately USD 1.7 billion. This region’s dominance is driven by high production volumes and extensive consumption patterns, particularly in countries like China, Japan, and South Korea. China leads as both the largest producer and consumer, significantly influencing regional market dynamics with its extensive orchard areas and integrated value chains that support both domestic consumption and substantial export volumes.

In North America, the chestnut market is gradually expanding, with the United States and Canada working to revive the cultivation of varieties resistant to chestnut blight. Market growth in this region is fueled by increasing consumer interest in healthful and gluten-free food options. North America’s market is also benefiting from advanced agricultural practices and a growing preference for local, sustainable produce.

Europe holds a significant position in the global chestnut market, driven by traditional consumption in Mediterranean countries such as Italy, Spain, and France. The market in Europe is characterized by high demand during the holiday season and the integration of chestnuts into various traditional cuisines. Additionally, European markets are increasingly using chestnuts in value-added forms like flours and pastes.

Latin America presents a smaller segment of the global chestnut market, with niche production and consumption primarily in countries like Brazil and Mexico. The region shows potential for market growth through increased cultivation efforts and the exploration of chestnuts as a sustainable crop option that aligns with regional biodiversity.

The Middle East and Africa (MEA) region exhibits modest market activity with emerging opportunities for chestnut cultivation and consumption. Interest in non-traditional nuts and healthy dietary components could drive future market expansion in this region, particularly in affluent areas where there is growing exposure to diverse international cuisines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The chestnut market is characterized by a diverse array of key players who contribute to the industry’s dynamism across various regions. Notably, Chengde Shenli Food Co. Ltd. and Shandong Zhifeng Foodstuffs Co., Ltd. are significant contributors in Asia, particularly in China, where they benefit from the region’s vast production capabilities and extensive market reach. These companies are known for their comprehensive involvement in the processing and distribution of chestnuts, catering to both domestic and export markets.

In the Western market, companies like ConAgra Foods Inc and Roland Foods LLC play pivotal roles by integrating chestnuts into their varied food product lines, thus meeting the rising demand for health-oriented food options in North America and Europe. Chestnut Charlie’s Organic Nuts and Harrison’s California Chestnuts in the U.S. emphasize organic and sustainable practices, appealing to a niche market that values environmental stewardship and natural food products.

European players such as Clément Faugier in France and The Galician Naiciña Company in Spain focus on value-added chestnut products like purees and preserves, which are integral to local culinary traditions. Similarly, Battistini Vivai and Pomar das Castanhas showcase the integration of chestnuts into diverse agricultural and food practices, reflecting the regional preferences and consumption patterns in Europe and Latin America respectively. These companies’ strategic approaches to production, coupled with their innovative product offerings, significantly shape the competitive landscape of the global chestnut market.

Top Key Players in the Market

- Battistini Vivai

- Chengde Shenli Food Co. Ltd.

- Chestnut Charlie’s Organic Nuts

- Clément Faugier

- ConAgra Foods Inc

- Harrison’s California Chestnuts

- Pomar das Castanhas

- Potash Farm

- Poulis S.A.

- Qinhuangdao Yanshan Chestnut Co., Ltd.

- Roland Foods LLC

- Route 9 Cooperative

- Shandong Zhifeng Foodstuffs Co., Ltd

- Shuuwa Industrial Co., Ltd

- Tangshan Goldentang Food Co., Ltd

- The Galician Naiciña Company

- The Washington Chestnut Company

- Valley Chestnuts

Recent Developments

In 2023 Battistini Vivai, an established nursery based in Italy, specializes in the production of fruit plants and is particularly renowned for its work in the chestnut sector. Celebrating over 70 years of operation, the company has carved out a strong presence in international markets due to its expertise and innovative approach in agriculture.

In 2023 Chengde Shenli Food Co., Ltd., established in 2000 and located in Kuancheng Town, Chengde City, Hebei Province, China, is a prominent player in the agricultural industrialization sector. The company operates as a full-spectrum food processing enterprise, encompassing a variety of activities from planting and research and development to processing and marketing.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Bn Forecast Revenue (2033) USD 5.0 Bn CAGR (2024-2033) 3.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Species Type(American Chestnut, Chinese Chestnut, European Chestnut, Japanese Chestnut), By Application(Food and Beverage Industry, Cosmetic Industry, Others), By Distribution Channel(Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Battistini Vivai, Chengde Shenli Food Co. Ltd., Chestnut Charlie’s Organic Nuts, Clément Faugier, ConAgra Foods Inc, Harrison’s California Chestnuts, Pomar das Castanhas, Potash Farm, Poulis S.A., Qinhuangdao Yanshan Chestnut Co., Ltd., Roland Foods LLC, Route 9 Cooperative, Shandong Zhifeng Foodstuffs Co., Ltd, Shuuwa Industrial Co., Ltd, Tangshan Goldentang Food Co., Ltd, The Galician Naiciña Company, The Washington Chestnut Company, Valley Chestnuts Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Battistini Vivai

- Chengde Shenli Food Co. Ltd.

- Chestnut Charlie's Organic Nuts

- Clément Faugier

- ConAgra Foods Inc

- Harrison's California Chestnuts

- Pomar das Castanhas

- Potash Farm

- Poulis S.A.

- Qinhuangdao Yanshan Chestnut Co., Ltd.

- Roland Foods LLC

- Route 9 Cooperative

- Shandong Zhifeng Foodstuffs Co., Ltd

- Shuuwa Industrial Co., Ltd

- Tangshan Goldentang Food Co., Ltd

- The Galician Naiciña Company

- The Washington Chestnut Company

- Valley Chestnuts