Global Chemotherapy Market Analysis By Drug Class (Mitotic Inhibitors, Alkylating Agents, Antimetabolites, Topoisomerase Inhibitors, Antitumor Antibiotic) By Indication (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Stomach Cancer, Lymphoma, Leukemia, Ovarian Cancer) By Route of Drug Administration (Oral, Intravenous, Subcutaneous, Intra-Muscular, Intravesicular, Others) By End-User (Hospitals & Clinics , Research institutes, Specialty Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155198

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

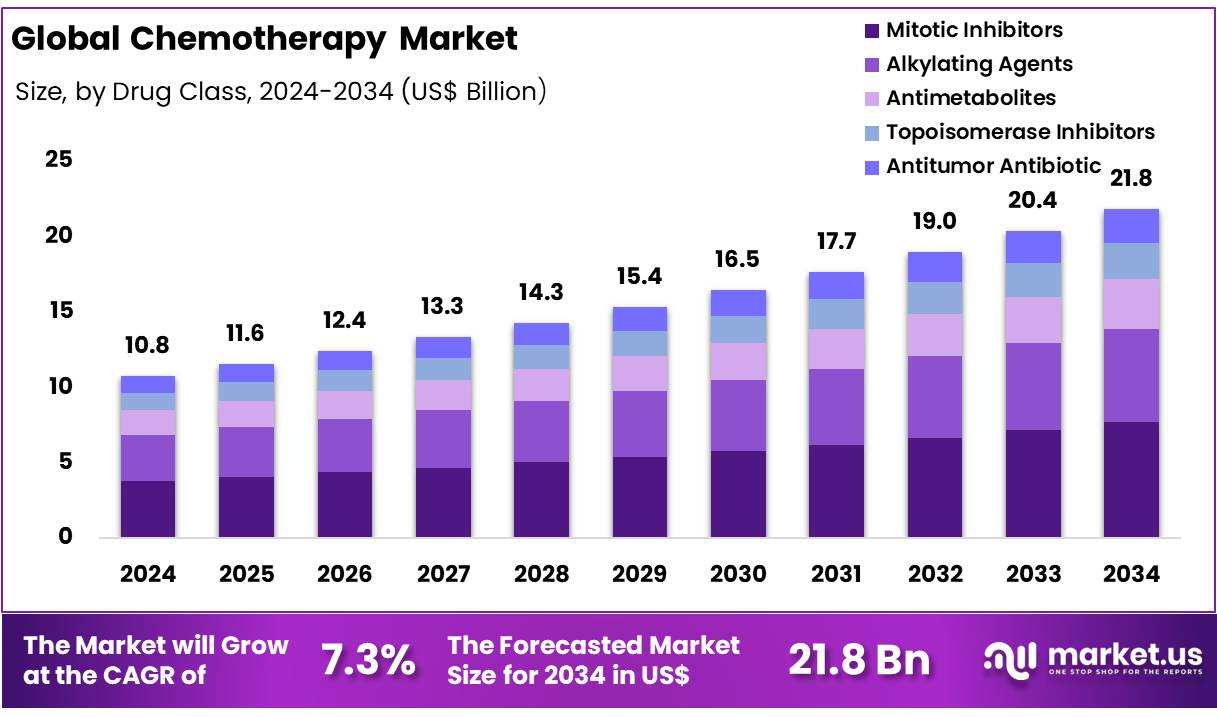

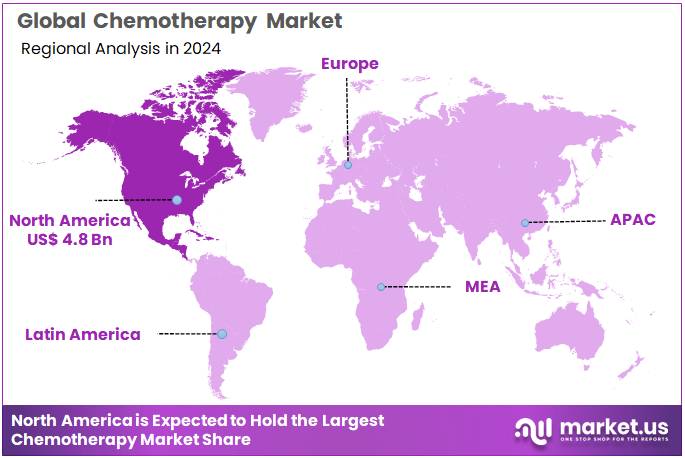

Global Chemotherapy Market size is expected to be worth around US$ 21.8 Billion by 2034 from US$ 10.8 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 44.5% share with a revenue of US$ 4.8 Billion.

Chemotherapy is a medical treatment that employs potent chemical agents to destroy cancer cells or impede their proliferation. It is primarily utilized to cure cancer, reduce the likelihood of disease recurrence, slow disease progression, or alleviate symptoms when cure is not feasible.

The mechanism of action of chemotherapeutic agents is based on targeting rapidly dividing cells, a characteristic of cancerous cells. Multiple mechanisms are involved, including interruption of DNA synthesis and damage to genetic material, which ultimately induces programmed cell death (apoptosis). However, normal cells that divide quickly such as those lining the gastrointestinal tract, hair follicles, and bone marrow may also be affected, resulting in side effects such as nausea, hair loss, or suppressed immunity.

Chemotherapy may be administered either alone or in combination with other modalities such as surgery, radiation therapy, or targeted treatments in various clinical contexts: as primary treatment, neoadjuvant therapy (to shrink tumors pre-operatively), adjuvant therapy (to eradicate residual disease post-surgery), or palliative therapy (to control symptoms in advanced stages).

It is delivered via multiple routes, including intravenous infusion, injection, oral administration, or topical application, depending on the specific drug, cancer type, and patient factors. The value of chemotherapy resides in its ability to transform cancer from a typically fatal diagnosis into a treatable and in some cases curable condition when administered appropriately.

Key Takeaways

- Market Size: Global Chemotherapy Market size is expected to be worth around US$ 21.8 Billion by 2034 from US$ 10.8 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

- Market Growth: In 2024, North America led the market, achieving over 44.5% share with a revenue of US$ 4.8 Billion.

- Drug Class Analysis: Mitotic Inhibitors represent the largest segment, accounting for 35.9% of the total market share.

- Indication Analysis: Breast Cancer dominates the market, holding 27.2% of the total share in 2024.

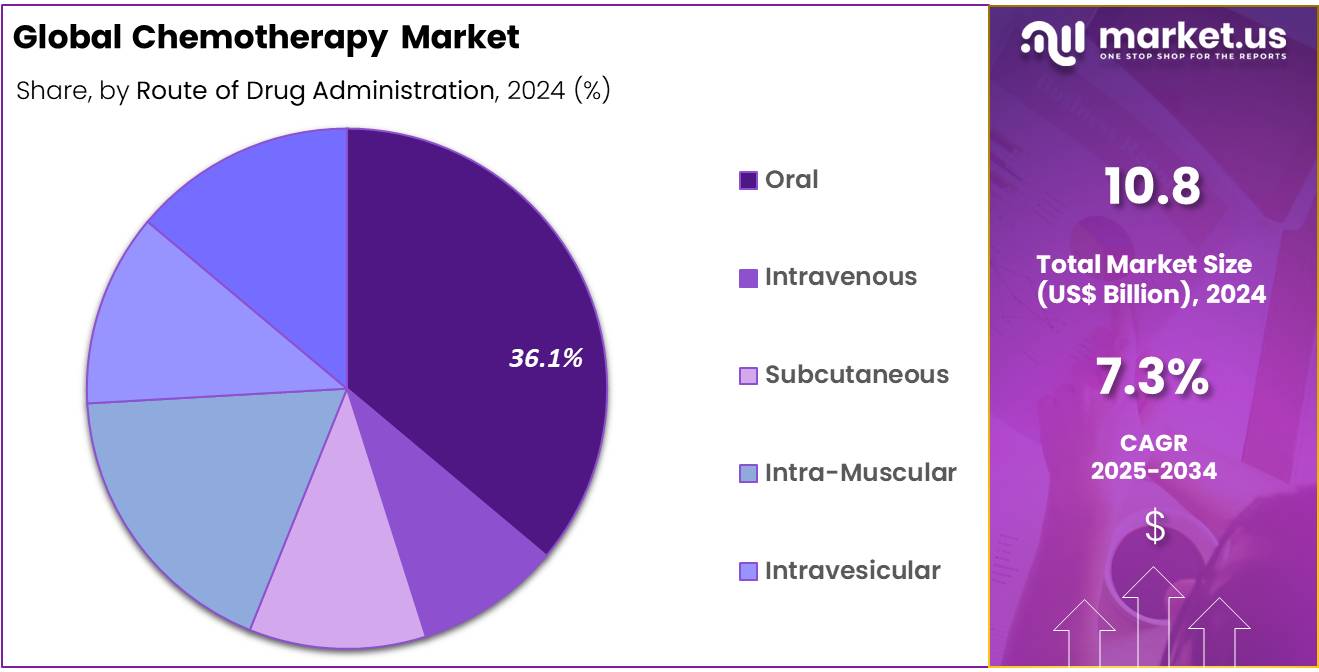

- Route of Drug Administration Analysis: Oral chemotherapy dominates with 36.1% of the total market share.

- End-Use Analysis: Hospitals & Clinics dominate the market with 45.7% of the total share, supported by their role as the primary settings for cancer diagnosis, treatment, and follow-up care.

- Regional Analysis: In 2024, North America is projected to dominate the global chemotherapy market, accounting for approximately 44.5% of the total market share.

Drug Class Analysis

In 2024, the chemotherapy market is segmented by drug class into Mitotic Inhibitors, Alkylating Agents, Antimetabolites, Topoisomerase Inhibitors, and Antitumor Antibiotics. Among these, Mitotic Inhibitors represent the largest segment, accounting for 35.9% of the total market share. This dominance can be attributed to their high efficacy in disrupting cell division, particularly in aggressive cancers such as breast, lung, and ovarian cancers.

Alkylating Agents hold a significant position due to their broad-spectrum applicability in hematologic malignancies and solid tumors. These agents work by directly damaging DNA, preventing replication, and are often integral to combination therapy protocols. Antimetabolites remain a core treatment option for leukemias, gastrointestinal, and breast cancers. Their mechanism involves mimicking natural substances to disrupt DNA and RNA synthesis, effectively targeting rapidly dividing cells.

Topoisomerase Inhibitors are essential in treating various cancers by interfering with enzymes that control DNA winding and repair, thereby triggering cell death. Antitumor Antibiotics, although a smaller segment, maintain clinical importance in combination regimens, acting by intercalating DNA strands and preventing replication. Collectively, these segments highlight a diversified therapeutic approach, with mitotic inhibitors maintaining a clear leadership position in 2024.

Indication Analyisis

By indication segment analysis into Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Stomach Cancer, Lymphoma, Leukemia, and Ovarian Cancer. Breast Cancer dominates the market, holding 27.2% of the total share, driven by the high global prevalence, established screening programs, and the continued adoption of combination chemotherapy in early and advanced stages.

Lung Cancer represents the second-largest segment, supported by its high mortality rate and the ongoing need for effective chemotherapeutic regimens, particularly in non-small cell and small cell lung cancers. Colorectal Cancer remains a key segment due to rising incidence rates and the integration of chemotherapy in adjuvant and metastatic treatment settings.

Prostate Cancer and Stomach Cancer collectively contribute a notable share, with chemotherapy often utilized in advanced or hormone-resistant stages. Lymphoma and Leukemia segments benefit from advances in targeted combinations, enhancing chemotherapy’s role in hematologic malignancies.

Ovarian Cancer maintains clinical importance, as chemotherapy remains a frontline and maintenance treatment. Overall, the market demonstrates strong diversity across cancer types, with breast cancer retaining clear leadership in 2024.

Route of Drug Administration Analysis

The chemotherapy market is segmented by route of drug administration into Oral, Intravenous, Subcutaneous, Intramuscular, Intravesicular, and Others. Oral chemotherapy dominates with 36.1% of the total market share, driven by its convenience, improved patient compliance, and advancements in oral formulations that maintain efficacy comparable to injectable therapies. The shift toward home-based treatment and reduced hospital visits further strengthens this segment’s position.

Intravenous (IV) administration remains the second-largest segment, widely used for high-potency drugs requiring rapid systemic distribution. It continues to be the preferred method for many combination regimens and high-dose protocols. Subcutaneous delivery is gaining traction due to shorter administration times and reduced infusion-related complications. Intramuscular chemotherapy, although less common, is utilized for specific localized treatments.

Intravesicular administration plays a critical role in bladder cancer management, enabling targeted drug delivery with minimal systemic exposure. The Others category includes emerging and specialized routes designed to optimize efficacy and minimize toxicity. Overall, the market reflects a gradual shift toward patient-friendly administration methods, with oral chemotherapy maintaining clear dominance in 2024.

End-User Analysis

In 2024, the chemotherapy market is segmented by end-user into Hospitals & Clinics, Research Institutes, Specialty Centers, and Others. Hospitals & Clinics dominate the market with 45.7% of the total share, supported by their role as the primary settings for cancer diagnosis, treatment, and follow-up care. The availability of advanced oncology infrastructure, multidisciplinary treatment teams, and the capability to manage complex chemotherapy regimens contribute significantly to their leading position.

Research Institutes hold a vital share, driven by ongoing clinical trials, drug development programs, and translational research aimed at improving chemotherapy efficacy and safety.

Specialty Centers, including dedicated cancer treatment facilities, are gaining prominence due to their focus on personalized medicine, targeted therapies, and integrated patient care models. These centers often provide advanced chemotherapy protocols with enhanced patient support services.

The Others category encompasses home care settings and smaller medical facilities, reflecting the gradual adoption of outpatient and home-based chemotherapy delivery for select patient groups. Overall, while emerging treatment environments are expanding, hospitals and clinics remain the central hub for chemotherapy administration in 2024.

Key Market Segments

By Drug Class

- Mitotic Inhibitors

- Alkylating Agents

- Antimetabolites

- Topoisomerase Inhibitors

- Antitumor Antibiotic

By Indication

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Stomach Cancer

- Lymphoma

- Leukemia

- Ovarian Cancer

By Route of Drug Administration

- Oral

- Intravenous

- Subcutaneous

- Intra-Muscular

- Intravesicular

- Others

By End-User

- Hospitals & Clinics

- Research institutes

- Specialty Centers

- Others

Driving Factors

Rising Cancer Prevalence

The increasing global incidence of cancer is a key driver for the chemotherapy market. Factors such as aging populations, lifestyle changes, and environmental exposures contribute to rising cancer cases, prompting higher demand for effective treatment options. Chemotherapy remains a cornerstone in both curative and palliative care, supported by established clinical protocols and accessibility across healthcare settings. This growing patient base continues to expand market needs, fostering advancements in drug development and delivery methods to improve therapeutic outcomes.Trending Factors

Shift Toward Targeted and Personalized Therapies

A significant trend shaping the chemotherapy market is the integration of targeted and personalized treatment approaches. Advancements in genomics, molecular diagnostics, and biomarker research are enabling the customization of chemotherapy regimens tailored to individual tumor profiles. This shift aims to enhance efficacy, minimize toxicity, and improve patient quality of life. Combination strategies that integrate chemotherapy with immunotherapy or targeted agents are becoming increasingly common, reflecting the industry’s transition toward precision oncology and more patient-centered treatment paradigms.Restraining Factors

Severe Side Effects and Toxicity

One of the primary restraints in the chemotherapy market is the potential for severe side effects and toxicity. Chemotherapy drugs affect both cancerous and healthy rapidly dividing cells, leading to complications such as nausea, fatigue, immune suppression, and organ damage. These adverse effects can limit patient tolerance, disrupt treatment continuity, and reduce overall quality of life. Moreover, long-term toxicities raise safety concerns, influencing both patient and physician preferences toward less harmful alternatives and driving demand for supportive care solutions.Opportunity

Development of Novel Drug Delivery Systems

The development of innovative drug delivery systems presents a significant opportunity in the chemotherapy market. Technologies such as nanoparticle carriers, liposomal formulations, and targeted delivery devices aim to enhance drug concentration at tumor sites while reducing systemic exposure and associated side effects. These advancements improve treatment precision, patient compliance, and therapeutic efficiency. Expanding research collaborations and regulatory support for novel delivery platforms are expected to accelerate adoption, positioning these technologies as a transformative force in modern chemotherapy.Regional Analysis

In 2024, North America is projected to dominate the global chemotherapy market, accounting for approximately 44.5% of the total market share. This significant share can be attributed to the high prevalence of cancer, advanced healthcare infrastructure, and strong adoption of innovative oncology therapies. The presence of leading pharmaceutical companies, coupled with substantial investments in research and development, further supports market growth.

Favorable reimbursement policies and increased accessibility to advanced treatment options have accelerated the adoption rate. Additionally, growing awareness about early cancer detection and the availability of personalized treatment approaches are contributing to sustained demand. The region’s strong regulatory framework and continuous pipeline advancements position North America as the central hub for chemotherapy market expansion in the forecast period.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The chemotherapy market is characterized by the presence of several established global manufacturers, regional producers, and emerging entrants, each contributing to competitive intensity. Leading participants maintain dominance through extensive product portfolios, strong distribution networks, and continuous innovation in drug formulations. Strategic initiatives, including mergers, acquisitions, and collaborations, are being undertaken to expand therapeutic offerings and strengthen market positioning.

A strong emphasis is placed on developing targeted chemotherapeutic agents with improved efficacy and reduced toxicity profiles. Significant investments in research and development are directed toward next-generation therapies and combination treatments to address unmet clinical needs. Competitive advantage is also derived from robust regulatory approvals, patent protection strategies, and cost-optimization measures, enabling sustained market leadership and resilience against pricing pressures in an evolving oncology landscape.

Market Key Players

- Johnson & Johnson Services Inc.

- GlaxoSmithKline PLC

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Pfizer Inc.

- Merck & Co. Inc.

- Sanofi S.A.

- Celgene Corporation

- Bristol-Myers Squibb Company

Recent Developments

- Johnson & Johnson Services Inc.: 2024 interim data showed RYBREVANT plus chemotherapy improved survival in previously treated EGFR-mutated lung cancer, reinforcing combination regimens’ value and J&J’s oncology focus amid investment in bispecific and cell therapies.

- GlaxoSmithKline PLC: August 2024, U.S. FDA expanded Jemperli plus chemotherapy approval to adults with primary advanced or recurrent endometrial cancer, including MMRp/MSS tumors, demonstrating survival benefit over chemotherapy alone in pivotal trial.

- Eli Lilly and Company: May 2025, Lilly announced oncology presentations at ASCO, including additional Verzenio data across HR+/HER2- breast cancer, reinforcing earlier-line use trends that can defer chemotherapy exposure and meaningfully improve disease control.

- F. Hoffmann-La Roche Ltd: January 2025, Roche reported 2024 sales growth and momentum, highlighting oncology medicines and diagnostics; continued investment supports access and lifecycle management for chemotherapy backbones and targeted combinations across tumor types.

Report Scope

Report Features Description Market Value (2024) US$ 10.8 Billion Forecast Revenue (2034) US$ 21.8 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Mitotic Inhibitors, Alkylating Agents, Antimetabolites, Topoisomerase Inhibitors, Antitumor Antibiotic) By Indication (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Stomach Cancer, Lymphoma, Leukemia, Ovarian Cancer) By Route of Drug Administration (Oral, Intravenous, Subcutaneous, Intra-Muscular, Intravesicular, Others) By End-User (Hospitals & Clinics , Research institutes, Specialty Centers, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Johnson & Johnson Services Inc., GlaxoSmithKline PLC, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc., Merck & Co. Inc., Sanofi S.A., Celgene Corporation, Bristol-Myers Squibb Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson Services Inc.

- GlaxoSmithKline PLC

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Pfizer Inc.

- Merck & Co. Inc.

- Sanofi S.A.

- Celgene Corporation

- Bristol-Myers Squibb Company