Global Chelated Minerals Market Size, Share and Report Analysis By Type (Zinc, Iron, Cobalt, Copper, Chromium, Others), By Chelating Agents (Amino Acid, Polysaccharide Complex, Proteinate, Others), By Application (Animal Feed, Dietary Supplement, Pharmaceutical, Fertilizer, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176726

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

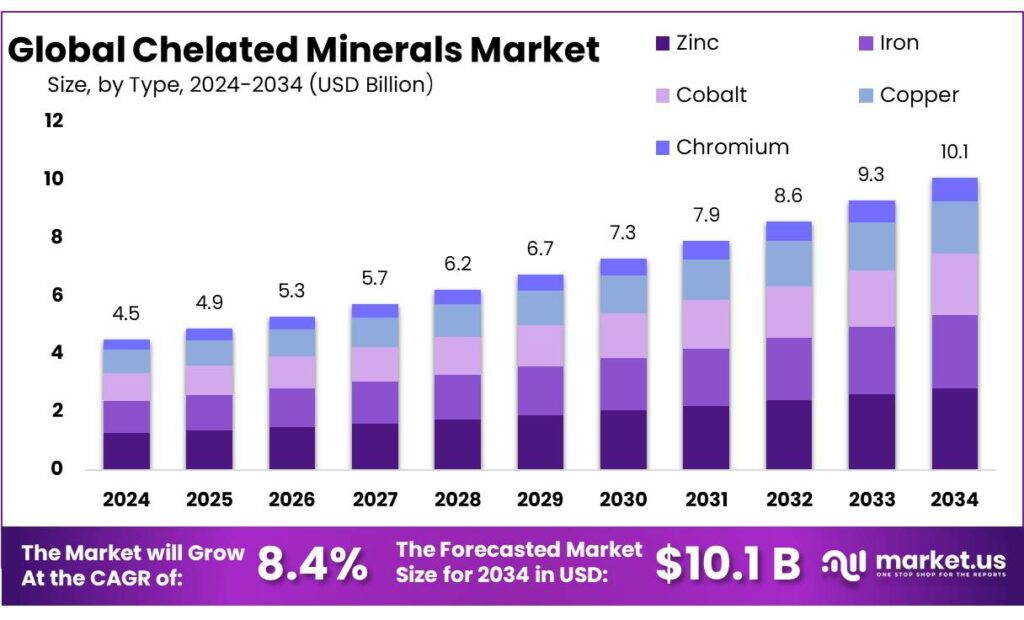

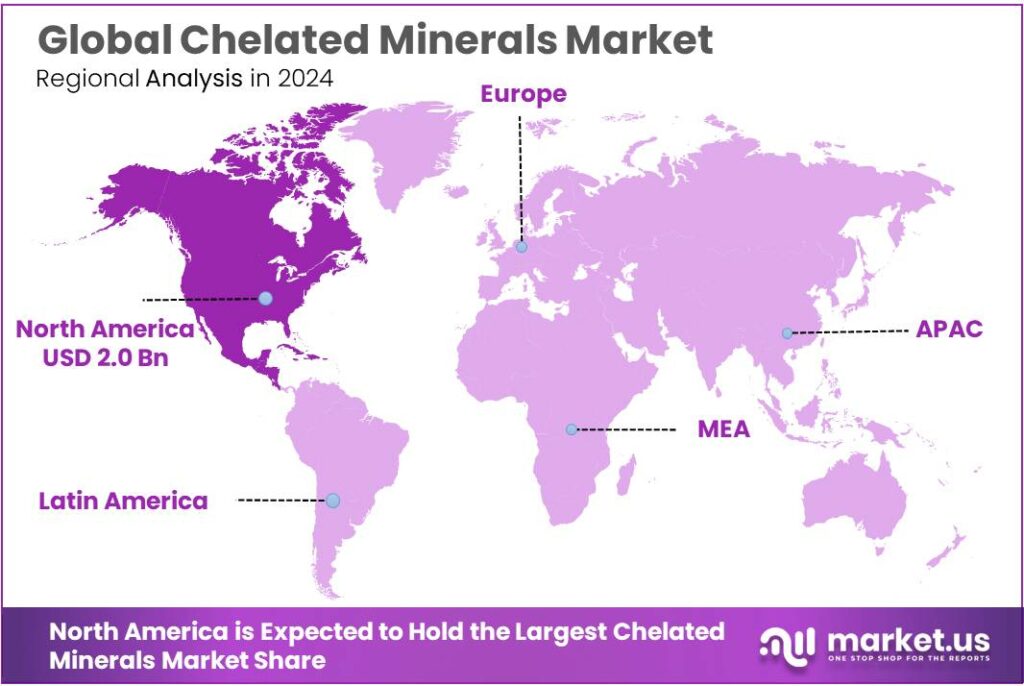

Global Chelated Minerals Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.9% share, holding USD 2.0 Billion in revenue.

Chelated minerals are metal nutrients (such as iron, zinc, copper, manganese, and selenium) that are bound to amino acids, peptides, or organic acids to improve stability and absorption in food, beverages, dietary supplements, and animal nutrition. In industrial terms, they sit at the intersection of preventive nutrition, clean-label formulation, and performance-focused feeding programs, because chelation can reduce mineral reactivity while improving bioavailability in finished products.

Feed remains the largest throughput channel, and global production scale illustrates why mineral efficiency matters: Alltech estimates world feed production rose 1.2% in 2024 to 1.396 billion metric tons, a base where even small inclusion-rate shifts toward organic/chelated trace minerals translate into meaningful volumes. In parallel, public health indicators keep mineral adequacy on the agenda: World Health Organization reports anaemia affected 30.7% of women aged 15–49 globally in 2023, and 39.8% of children 6–59 months in 2019, reinforcing the need for scalable micronutrient strategies.

Key demand drivers also come from public health nutrition gaps and policy-backed fortification. Food and Agriculture Organization of the United Nations has long estimated that micronutrient deficiency likely affects over two billion people globally, sustaining government and industry interest in scalable mineral delivery through fortified staples and affordable supplements.

Regulatory and sustainability pressures further strengthen the case for chelation. European risk assessors note that reducing mineral loads in feed—especially copper—can lower environmental release while still meeting nutritional needs, signaling a long-run shift toward more efficient mineral sources. European Food Safety Authority

Key Takeaways

- Chelated Minerals Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 8.4%

- Zinc held a dominant market position, capturing more than a 28.6% share.

- Amino Acid held a dominant market position, capturing more than a 28.7% share.

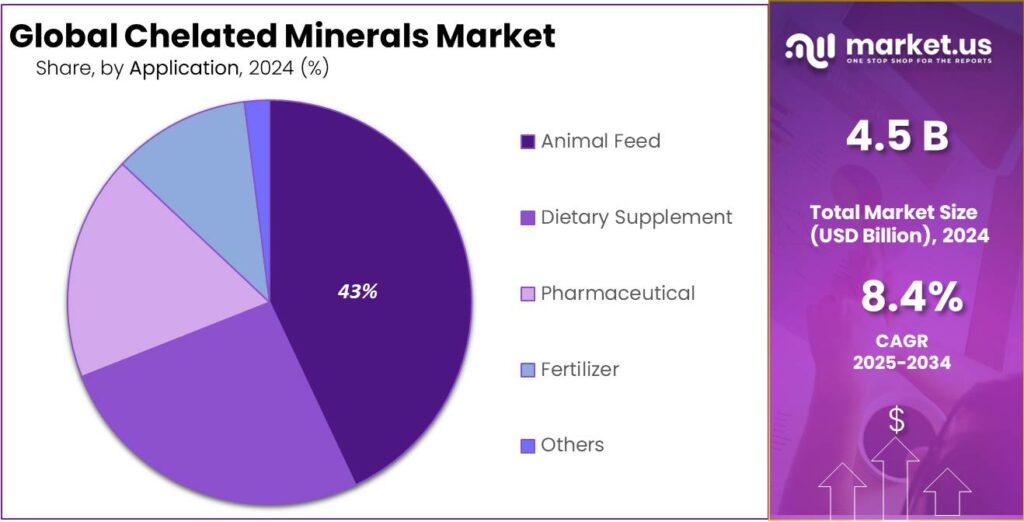

- Animal Feed held a dominant market position, capturing more than a 43.5% share.

- Asia Pacific remains close behind at 45.9% share, valued at 2.0 Bn, powered by the world’s largest feed ecosystem.

By Type Analysis

Zinc dominates the Chelated Minerals Market with a strong 28.6% share in 2024.

In 2024, Zinc held a dominant market position, capturing more than a 28.6% share, supported by its wide use in animal feed, supplements, and fortified foods. The growing preference for chelated zinc is driven by its higher absorption efficiency and improved biological response compared to inorganic forms. Industries continued to adopt chelated zinc due to its ability to support immune strength, growth performance, and reproductive health across livestock categories. This dominance remained visible in 2025 as well, with demand rising from poultry and dairy sectors that increasingly rely on bioavailable mineral formulations to meet nutritional efficiency targets.

By Chelating Agents Analysis

Amino Acid chelating agents lead the market with a solid 28.7% share in 2024 due to their superior absorption efficiency.

In 2024, Amino Acid held a dominant market position, capturing more than a 28.7% share, mainly because industries increasingly prefer amino acid–based chelates for their high bioavailability and better tolerance across both human and animal nutrition applications. These chelates closely mimic natural absorption pathways, making them more efficient than many inorganic alternatives. This advantage allowed the amino acid segment to maintain strong adoption in feed formulations, dietary supplements, and fortified food products throughout 2024.

By Application Analysis

Animal Feed dominates the chelated minerals market with a strong 43.5% share in 2024, driven by efficiency-focused livestock nutrition.

In 2024, Animal Feed held a dominant market position, capturing more than a 43.5% share, largely because livestock producers increasingly preferred chelated minerals to improve nutrient absorption and reduce wastage. As global poultry, dairy, and swine sectors continued expanding, feed formulators shifted toward chelated forms to enhance growth performance, strengthen immunity, and support reproductive health. The segment’s leadership in 2024 reflects a steady industry shift toward more reliable and bioavailable mineral solutions that help maintain productivity even under fluctuating raw material conditions.

Key Market Segments

By Type

- Zinc

- Iron

- Cobalt

- Copper

- Chromium

- Others

By Chelating Agents

- Amino Acid

- Polysaccharide Complex

- Proteinate

- Others

By Application

- Animal Feed

- Dietary Supplement

- Pharmaceutical

- Fertilizer

- Others

Emerging Trends

Post-ZnO shift is accelerating the move to chelated minerals

A clear latest trend in chelated minerals is the industry shift away from high-dose zinc oxide (ZnO) strategies toward lower-dose, higher-bioavailability mineral programs, where chelated forms play a bigger role. This trend is strongest in commercial pig and poultry systems, where producers want stable gut health, growth, and immunity results—but are also under rising pressure to reduce heavy-metal loading in manure and comply with tighter rules. The change is not happening in isolation; it is tied to how governments and supply chains now link nutrition inputs to environmental outcomes and responsible production claims.

Regulatory decisions have been a major trigger. In Europe, veterinary medicines containing zinc oxide for oral use in pigs faced withdrawal timelines, and the UK’s Veterinary Medicines Directorate noted the European Commission Implementing Decision to withdraw marketing authorisations by 26 June 2022. As a result, the market has been pushed to find nutritional alternatives that can support animal performance without relying on “pharmaceutical-level” zinc. In parallel, industry guidance and technical commentary around the EU’s zinc supplementation approach commonly references a 150 ppm limit in piglet diets as the legal ceiling for zinc supplementation—meaning the old “more zinc” method is no longer an easy lever.

Scale makes the trend commercially meaningful. Alltech estimates global feed production reached 1.396 billion metric tons in 2024, up 1.2% from 2023, and notes poultry accounts for 42.7% of total feed tonnage. In a system this large, a small reformulation—such as shifting part of a trace-mineral pack toward chelated sources to improve uptake and reduce excretion—can translate into substantial recurring volume. The practical story heard across integrators is simple: if a more bioavailable mineral reduces performance variability, helps maintain health outcomes under stress, and supports lower inclusion levels, it can protect margins even when it costs more per kilogram.

Sustainability targets are reinforcing this direction. European Commission has linked its Farm to Fork pathway to measurable outcomes, including reducing nutrient losses by at least 50% by 2030. While that goal spans the full food system, it strengthens procurement and compliance narratives that favor “efficient nutrition” approaches—exactly where chelated minerals tend to be positioned, because they are marketed around improved absorption and reduced wastage.

Drivers

Feed-efficiency pressure is the biggest driver pushing chelated minerals

In 2024 and 2025, the strongest demand driver for chelated minerals has been the practical need to get more nutrition output from every kilogram of feed, while keeping waste and environmental load under control. This is not a small, niche shift—animal nutrition runs at industrial scale. A widely cited annual global survey estimates world feed production reached 1.396 billion metric tons in 2024, up 1.2% from 2023, showing how even minor formulation changes can create large-volume demand for more efficient mineral sources.

That scale effect is also visible inside the feed mix itself. The same global survey notes poultry remains a major driver, accounting for 42.7% of all feed tonnage in 2024. This matters because poultry and other intensive systems often operate with tight margins and short production cycles, making nutrient absorption and uniformity extremely valuable. Chelated minerals fit that need by improving bioavailability versus many inorganic sources, helping formulators achieve target mineral status with more predictable uptake. Over 2024, this fed directly into higher adoption in premixes and complete feeds where performance stability is commercially rewarded.

Policy direction is reinforcing the same trend, especially around nutrient efficiency and leakage reduction. The European Commission has tied the Farm to Fork agenda to measurable environmental targets, including reducing nutrient losses by at least 50% by 2030, alongside lower fertilizer use. While that target is not written specifically for feed minerals, it reflects the wider regulatory and buyer expectation: nutrient inputs should be used more efficiently, and losses to the environment should fall. In practice, chelated minerals support this direction because better absorption can mean lower inclusion rates for the same biological response, which can reduce excretion risks in high-density production areas.

Restraints

High production cost remains the biggest restraint limiting wider adoption of chelated minerals

One of the most significant restraints for the chelated minerals market is the higher production cost compared with conventional inorganic mineral sources. Chelation requires controlled chemical reactions, purity-checked ligands, and more stringent testing, which increases manufacturing expenses. For many feed producers working with tight margins, even small differences in cost-per-ton can influence purchasing decisions. This challenge becomes even more pronounced in large-volume markets such as poultry, dairy, and aquaculture, where nutrition programs must balance precision with affordability.

- According to the Alltech, world feed production reached 1.396 billion metric tons in 2024, growing 1.2% year-over-year—meaning even a slight cost increase in mineral premixes can have a large financial impact on producers operating at scale. At the same time, input price volatility often pushes buyers toward lower-cost inorganic minerals, even though chelated forms offer better absorption.

This tension limits adoption in cost-sensitive regions, especially across parts of Asia and Africa, where livestock farmers continue to prioritize affordability. For example, FAO data shows that feed costs already account for 60–70% of total livestock production expenses in several developing markets, leaving little room for premium nutrient inputs.

Regulatory expectations can also indirectly increase costs. The European Commission under its Farm to Fork strategy aims to cut nutrient losses by 50% by 2030, which pressures producers to adopt more efficient but often more expensive solutions. While chelated minerals fit the environmental goals, the upfront cost of switching formulations slows adoption—especially among small and mid-sized integrators who struggle with reformulation budgets.

In human nutrition, affordability is again an issue. Even though chelated iron and zinc are better tolerated, cost-sensitive public health programs often stay with cheaper inorganic sources. This is notable considering World Health Organization reports that 30.7% of women aged 15–49 globally had anaemia in 2023—highlighting the need for improved mineral delivery but also the cost barriers that limit upgrades in mass fortification programs.

Opportunity

Pet nutrition expansion is a clear growth opportunity for chelated minerals

One of the strongest growth opportunities for chelated minerals is the rapid “health-first” upgrade happening in pet nutrition and premium animal diets. The opportunity is attractive because pet owners increasingly treat food as a wellness choice, and brands respond by improving ingredient quality, digestibility, and nutrient delivery. In this environment, chelated minerals fit naturally: they are positioned as gentler, more absorbable forms that support immunity, skin-and-coat health, and overall vitality—claims that are easier to communicate when the product is premium and the buyer is willing to pay for performance.

The size of the spending base shows why suppliers are paying attention. American Pet Products Association reports total U.S. pet industry expenditures of $151.9 billion in 2024, with $157 billion projected for 2025. Within that, “Pet Food & Treats” alone is listed at $65.8 billion for 2024, which signals a very large addressable pool for functional upgrades, including mineral forms. When pet food becomes more premium and functional, manufacturers tend to adopt ingredients that can justify the price point, reduce formulation complaints (like tolerance issues), and deliver consistent outcomes—factors that often favor chelated formats over basic inorganic salts.

A similar premium shift is visible in Europe through FEDIAF, which states European industry production of 10.5 million tonnes of pet food valued at around €29.1 billion (reported in its annual review). This kind of scale supports steady, repeat demand for specialty premixes and higher-grade inputs. In practical terms, chelated minerals benefit when brands aim for “complete and balanced” nutrition but also want to differentiate with better absorption, cleaner labeling language, and fewer formulation trade-offs.

Government direction strengthens this opportunity by rewarding nutrient efficiency and discouraging avoidable losses. The European Commission Farm to Fork strategy includes a target to reduce nutrient losses by at least 50% by 2030, a clear signal that food systems are expected to use nutrients more efficiently. While this target is broader than animal feed minerals, it supports a market logic that favors inputs which can maintain performance with lower waste. In premium pet food and advanced livestock programs, this alignment between performance and responsibility makes chelated minerals easier to justify commercially.

Regional Insights

Asia Pacific remains close behind at 45.9% share, valued at 2.0 Bn, powered by the world’s largest feed ecosystem.

In 2024, Asia Pacific accounted for 45.9% share, valued at 2.0 Bn, supported by the region’s sheer production footprint and ongoing shift toward more commercial, formulated feeds. Alltech estimates Asia-Pacific produced 533.137 million mt of feed in 2024, and also hosted 8,211 feed mills versus 6,069 in North America—showing how broad and distributed the manufacturing base is. This structure creates steady opportunities for chelated minerals in premixes as integrators look for reliable mineral delivery across diverse raw materials and farm conditions, especially in poultry, aquaculture, and rapidly modernizing dairy systems.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM, founded in 1902, operates in over 200+ locations and employs nearly 41,000 people worldwide. The company reported approximately $102 billion in revenue in 2023 and continues expanding its specialty nutrition portfolio, including chelated mineral ingredients. ADM’s global production network across 190+ processing plants strengthens its supply capability for customized mineral premixes.

DSM, founded in 1902, merged into dsm-firmenich in 2023, forming a nutrition and health powerhouse with more than 30,000 employees. The group recorded about €9 billion in combined revenues. DSM is known for its high-purity mineral formulations, supplying chelated and specialty minerals through 60+ innovation and production sites worldwide.

Nutreco, established in 1994, generates nearly €6.4 billion in annual revenue and operates in 37+ countries. With over 12,000 employees, Nutreco supplies advanced feed, premixes, and mineral solutions, including chelated formulations. Its Trouw Nutrition division serves thousands of feed mills and farms, supported by 50+ research centers and production facilities.

Top Key Players Outlook

- Archer Daniels Midland (ADM)

- Altech Corporation

- DSM N.V

- Nutreco N.V

- Kemin Industries Inc, Invivo Group

- BASF SE

- China National Bluestar (Group) Co., Ltd

- Cargill

Recent Industry Developments

In 2024, Alltech continued to strengthen its presence in the chelated minerals segment through its Bioplex® organic trace mineral range, which binds essential minerals like zinc, copper, iron, manganese, and cobalt to amino acids for better uptake.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Bn Forecast Revenue (2034) USD 10.1 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Zinc, Iron, Cobalt, Copper, Chromium, Others), By Chelating Agents (Amino Acid, Polysaccharide Complex, Proteinate, Others), By Application (Animal Feed, Dietary Supplement, Pharmaceutical, Fertilizer, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland (ADM), Altech Corporation, DSM N.V, Nutreco N.V, Kemin Industries Inc, Invivo Group, BASF SE, China National Bluestar (Group) Co., Ltd, Cargill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland (ADM)

- Altech Corporation

- DSM N.V

- Nutreco N.V

- Kemin Industries Inc, Invivo Group

- BASF SE

- China National Bluestar (Group) Co., Ltd

- Cargill