Global Chargeback Management Market By Component (Software/Platforms, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (Retail & E-commerce, Travel & Hospitality, Digital Goods & Services, Financial Services, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175042

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Chargeback Statistics and Trends

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Increasing Adoption Technologies

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

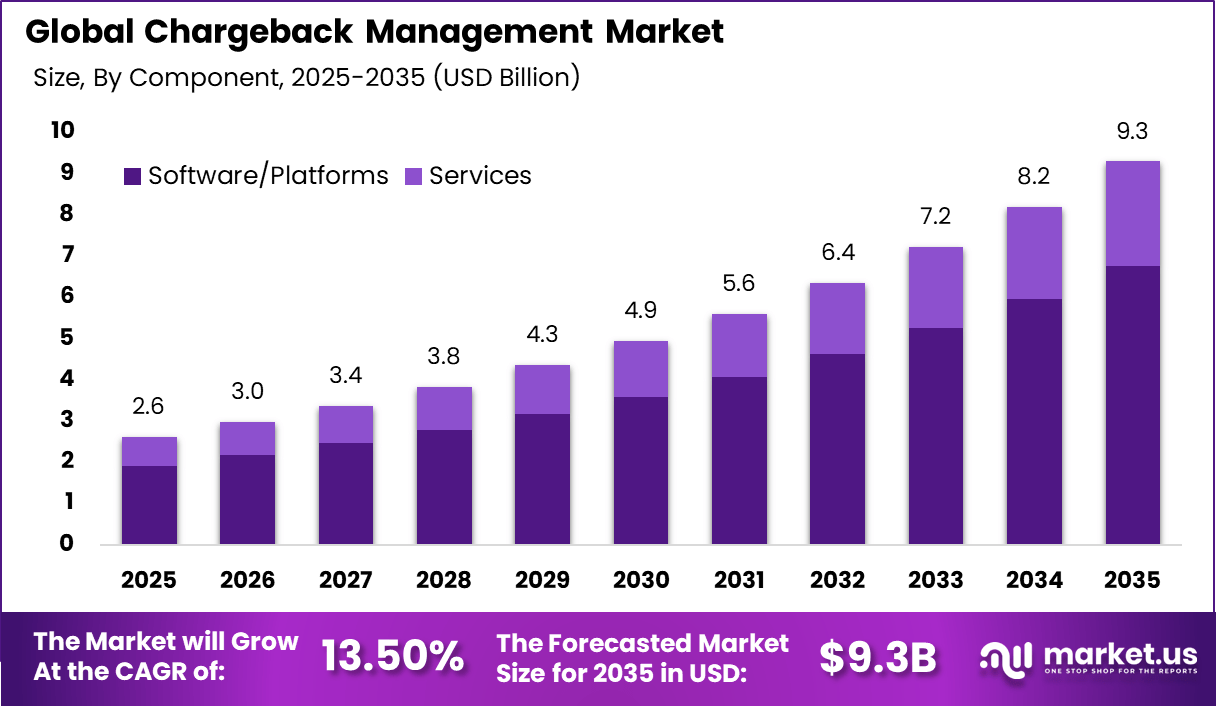

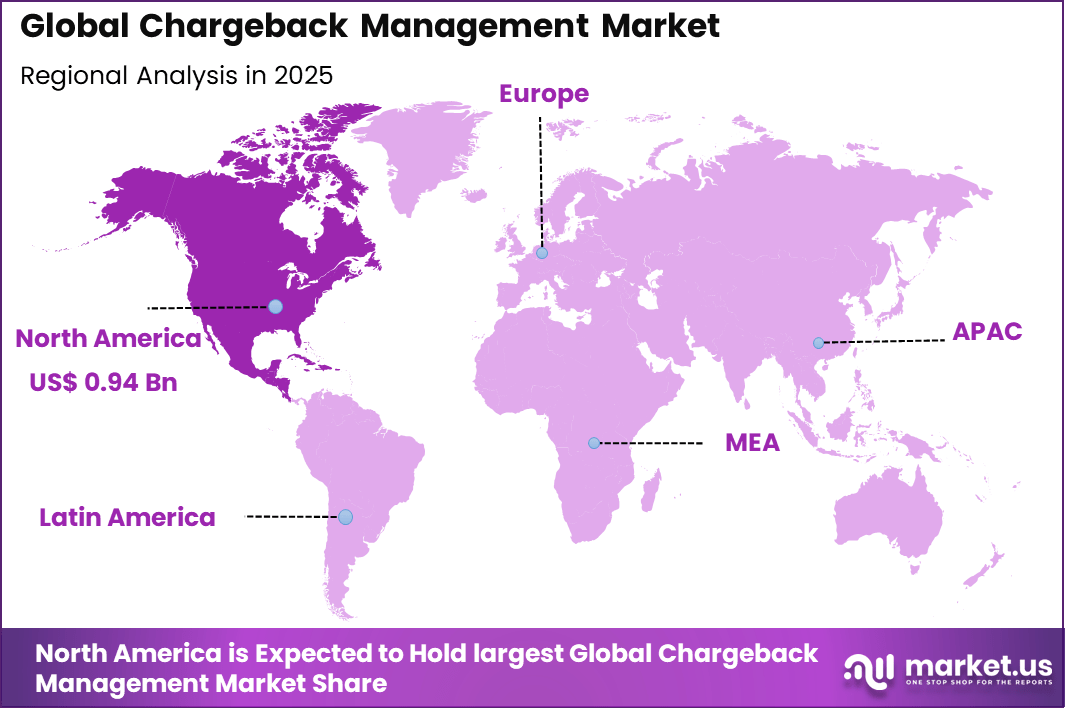

The Global Chargeback Management Market generated USD 2.6 billion in 2025 and is predicted to register growth from USD 3 billion in 2026 to about USD 9.3 billion by 2035, recording a CAGR of 13.50% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 36.1% share, holding USD 0.94 Billion revenue.

The Chargeback Management market refers to the systems, software, and services that help organisations monitor, prevent, and resolve chargebacks, which occur when a cardholder disputes a payment and requests a reversal from the issuing bank. Chargeback management involves tools and processes that track transactions in real time, analyse patterns that could lead to disputes, and guide businesses through the formal dispute resolution process with card networks.

These solutions are used widely by merchants, payment processors, and financial institutions to protect revenue, maintain relationships with payment networks, and reduce losses associated with disputed transactions. The purpose of chargeback management is to mitigate fraud, reduce financial impact, and improve operational efficiency in handling transaction reversals.

A principal driver of the Chargeback Management market is the continuing rise in e-commerce and digital payment transactions worldwide. As online transactions increase in volume, so too does the frequency of customer disputes and fraudulent chargebacks, placing pressure on merchants to adopt automated tools that can handle growing case loads efficiently. Chargebacks can arise from legitimate errors, misunderstood purchases, or fraud, and each instance creates financial risk for merchants if not resolved effectively.

This trend pushes businesses towards dedicated management systems that improve dispute resolution times and reduce revenue loss. Another important driver is the expanding sophistication of payment fraud and dispute tactics, including “friendly fraud”, where legitimate customers dispute valid charges, and true fraud involving unauthorised use of card details.

Demand analysis shows that interest in chargeback management solutions continues to grow as businesses seek ways to reduce payment risk and improve operational efficiency. eCommerce sellers are particularly invested in systems that can distinguish between genuine disputes and cases of fraud or misunderstanding. Small and medium sized merchants adopt chargeback tools to manage disputes without adding internal staff burden.

Top Market Takeaways

- By component, software/platforms dominated the chargeback management market with 72.8% share, automating dispute resolution and fraud analysis for merchants.

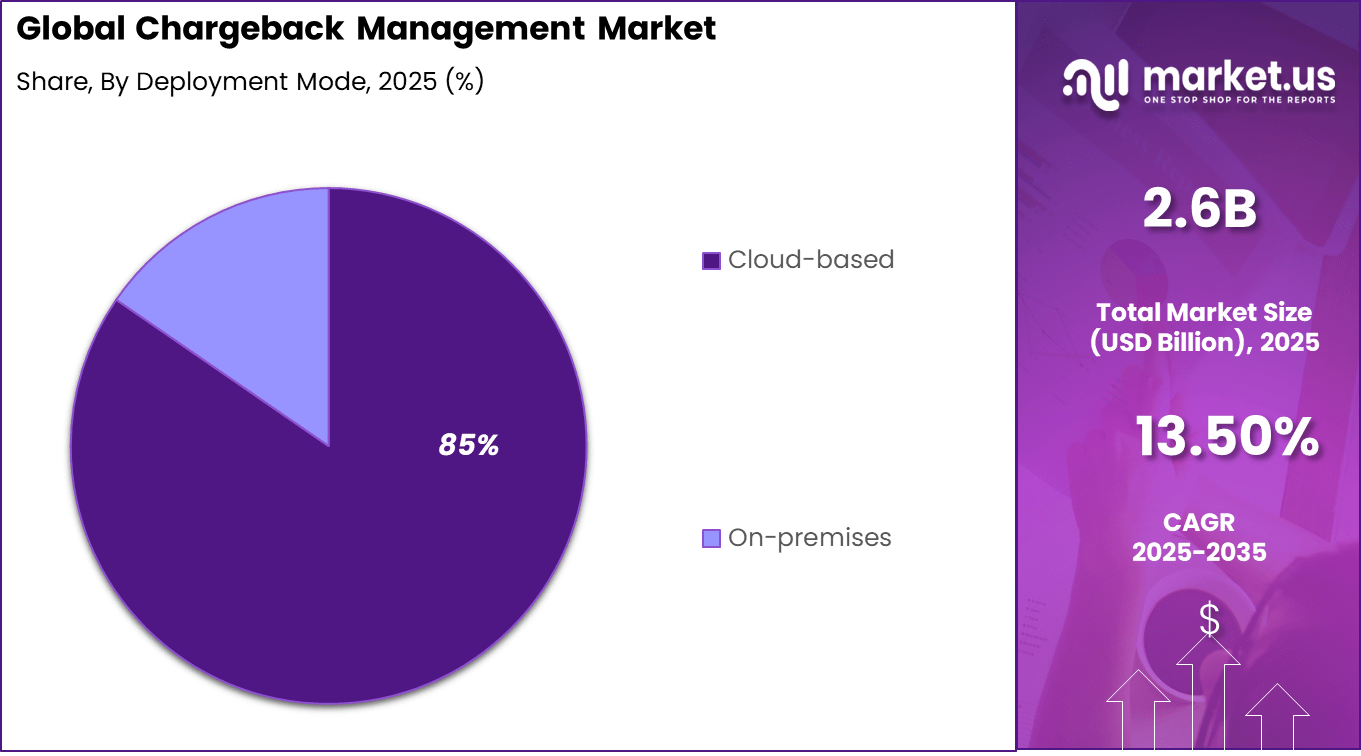

- By deployment mode, cloud-based solutions captured 84.6%, offering scalability and real-time updates across global operations.

- By organization size, large enterprises held 58.3%, implementing advanced tools to handle high transaction volumes and compliance needs.

- By end-user industry, retail and e-commerce led at 52.7%, combating fraudulent returns and payment disputes in online sales.

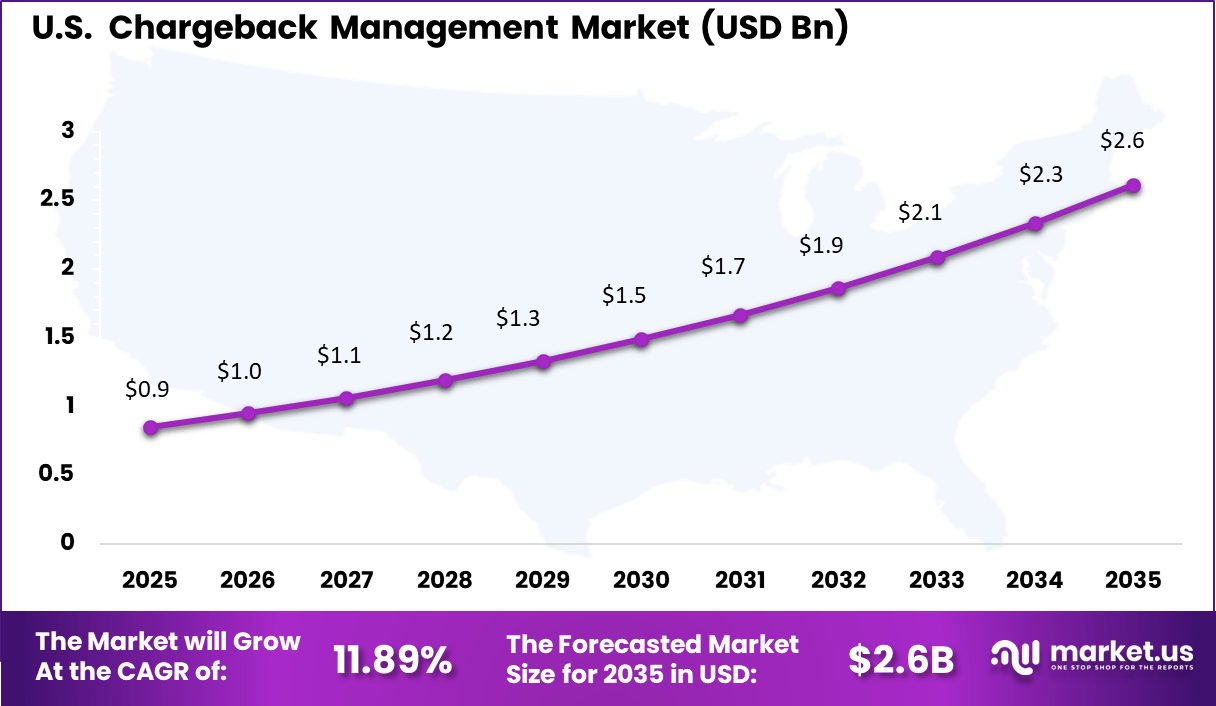

- North America accounted for 36.1% of the global market, with the U.S. valued at USD 0.85 billion and growing at a CAGR of 11.89%

Chargeback Statistics and Trends

- Volume growth: Global chargeback volumes are expected to increase by 24% between 2025 and 2028, reaching around 324 million cases annually.

- High risk industries: The travel and hospitality sector records the highest average chargeback value at USD 120, with online travel and lodging experiencing an 816% rise in incidents.

- First party fraud: Around 70% of chargebacks are classified as friendly fraud, where customers dispute transactions they actually authorized.

- Consumer behavior: About 84% of consumers find it easier to file a chargeback than to contact the merchant, and 72% treat chargebacks as an alternative to standard refund processes.

- Win rates: While 52% of large enterprises win more than half of their chargeback cases, the average net win rate across all merchants remains lower.

- Dispute costs: Processing a single chargeback costs financial institutions between USD 9.08 and USD 10.32, excluding additional operational overhead.

- Merchant impact: In 2025, US merchants lose USD 4.61 for every USD 1 of fraud, marking a 37% increase since 2020 and highlighting the rising indirect costs of chargebacks, including penalties and fees.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rising volume of online card and digital wallet transactions +4.8 North America, Europe, Asia Pacific Short to medium term Increase in payment fraud and friendly fraud incidents +4.2 Global Short term Growing merchant focus on revenue recovery and loss prevention +3.7 North America, Europe Medium term Expansion of cross border eCommerce increasing dispute complexity +3.1 Asia Pacific, Europe, North America Medium to long term Adoption of automated dispute and evidence management tools +2.6 Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact High cost of advanced chargeback management solutions -2.4 Small and mid sized merchants Short to medium term Limited awareness among smaller online sellers -2.0 Emerging markets Medium term Complexity of card network rules and compliance -1.8 Global Medium term Dependence on historical transaction data quality -1.5 Global Medium to long term Merchant resistance to outsourcing dispute handling -1.2 Global Long term Component Analysis

Software and platform solutions account for 72.8% of the Chargeback Management market, showing that automation and analytics are central to managing disputes effectively. These platforms handle chargeback alerts, evidence collection, reason code analysis, and reporting through a centralized system.

Merchants and payment teams rely on software platforms to manage high volumes of disputes efficiently while reducing manual effort and processing time. From an operational perspective, software platforms improve visibility into dispute trends and root causes. They help organizations identify fraud patterns and transaction risks early. The strong share of this segment reflects increasing reliance on intelligent platforms to reduce revenue loss and improve chargeback win rates.

Deployment Mode Analysis

Cloud-based deployment dominates the market with 85%, highlighting strong preference for scalable and easily accessible solutions. Cloud platforms allow businesses to manage chargebacks across regions without maintaining on-site infrastructure. They also support real-time updates and integration with payment gateways and banking systems.

Cloud deployment enables faster onboarding and continuous feature updates. Organizations benefit from lower maintenance costs and improved flexibility. The strong adoption of cloud-based models reflects demand for agile and cost-efficient chargeback management solutions that can scale with transaction growth.

Organization Size Analysis

Large enterprises represent 58.3% of the market, driven by their high transaction volumes and exposure to chargeback risk. These organizations operate across multiple channels and geographies, which increases dispute complexity. Chargeback management platforms help large enterprises standardize processes and maintain control over dispute resolution.

Large enterprises also require detailed reporting and compliance support. Automated platforms provide audit trails and performance metrics. The strong presence of this segment reflects the need for structured and scalable chargeback management in complex enterprise environments.

End-User Industry Analysis

Retail and e-commerce account for 52.7% of end-user adoption, making them the largest industry segment. Online merchants face higher chargeback exposure due to card-not-present transactions and return-related disputes. Chargeback management platforms help retailers respond quickly and reduce revenue leakage.

These platforms also support fraud detection and transaction validation. Improved dispute handling enhances customer trust and operational efficiency. The strong share of this segment reflects the growing importance of chargeback control in competitive digital retail environments.

Increasing Adoption Technologies

Artificial intelligence and machine learning technologies are key to the increased adoption of chargeback management solutions. These technologies enable systems to analyze transaction patterns, identify anomalies, and predict high-risk transactions that may lead to disputes before they occur. Predictive analytics can also support representment strategies by flagging the most compelling evidence for dispute resolution, reducing manual effort and improving outcomes.

Cloud-based deployment and API-driven integration are additional enablers that make chargeback management platforms more accessible and scalable for businesses of all sizes. Cloud solutions reduce infrastructure costs and support seamless updates, while open APIs allow integration with payment processors, fraud detection engines, and customer service platforms. This technological integration enhances operational efficiency and provides a unified view of payment disputes across systems.

Benefits

- Payment acceptance becomes more convenient across different locations

- Hardware costs are reduced compared to traditional point-of-sale systems

- Checkout speed is improved, supporting better customer experience

- Business mobility is enhanced for field and on-the-go sales

- Payment security is maintained through certified software controls

Usage

- Used by retailers to accept card and contactless payments

- Applied by service providers for doorstep and on-site transactions

- Deployed by small merchants for quick payment setup

- Utilized in events and pop-up stores for temporary sales points

- Integrated with smartphones and tablets for software-based payment acceptance

Emerging Trends

Key Trend Description AI-powered prevention tools Machine learning identifies fraud patterns before disputes arise. Automated representment Dynamic evidence generation boosts win rates automatically. Real-time alerts networks Ethoca-Verifi style systems stop repeat chargebacks instantly. Root cause analytics Data insights prevent future occurrences systematically. Blockchain transaction proofs Immutable records strengthen merchant defense cases. Growth Factors

Key Factors Description E-commerce transaction surge Digital sales volume amplifies dispute opportunities. Friendly fraud escalation Customers exploit systems leading to revenue losses. Regulatory complexity rise Varying rules demand sophisticated compliance tools. High merchant costs impact Disputes erode margins prompting automation needs. Payment method diversification New options like BNPL introduce novel risks. Key Market Segments

By Component

- Software/Platforms

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small & Medium Businesses

By End-User Industry

- Retail & E-commerce

- Travel & Hospitality

- Digital Goods & Services

- Financial Services

- Others

Regional Analysis

North America accounted for 36.1% share, supported by high volume of card based transactions and strong growth in eCommerce and digital payments. Merchants and payment service providers in the region have increasingly adopted chargeback management solutions to address rising transaction disputes and fraud related claims.

Demand has been driven by complex card network rules, strict timelines for dispute resolution, and the financial impact of excessive chargebacks. Automation and analytics have become essential for managing large volumes of disputes efficiently.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America High card usage and strict dispute monitoring Very High Mature Europe Strong consumer protection and digital payments High Mature Asia Pacific Rapid growth in online payments and marketplaces Medium to High Developing Middle East Expanding digital commerce ecosystems Medium Developing Latin America Rising card penetration and fraud exposure Medium Developing Africa Early stage digital payment adoption Low Early stage The U.S. market reached USD 0.85 Bn and is projected to grow at an 11.89% CAGR, reflecting steady demand from online retailers, subscription services, and financial institutions. Adoption has been driven by the need to reduce revenue loss and protect merchant accounts from penalties imposed by card networks. Chargeback management tools have helped U.S. businesses improve dispute win rates and identify root causes of customer disputes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Payment service providers Reduce merchant churn and dispute losses Medium High Fraud prevention platforms Expansion into post transaction risk management Medium High Venture capital firms Scalable fintech risk management solutions High Medium Private equity investors Stable SaaS revenue from compliance tools Medium Medium Large online merchants Protection of margins and payment reputation Low to Medium Medium Technology Enablement Analysis

Technology Enabler Functional Role Impact on Adoption Adoption Timeline AI driven dispute classification Faster identification of valid chargebacks High Short term Automated evidence compilation tools Reduced manual effort in dispute response Very High Short term Machine learning fraud pattern analysis Prevention of repeat chargeback abuse High Medium term API based integration with payment gateways Seamless transaction data access High Medium term Analytics dashboards and reporting tools Improved visibility into dispute trends Medium Medium to long term Driver Analysis

Higher Dispute Activity as Online Card Payments Grow

Chargeback activity is being driven by the steady shift of commerce to card not present channels, where disputes are easier to file and harder to resolve. Industry tracking has shown that dispute and chargeback pressure has increased sharply in retail e-commerce and other digital heavy categories, reflecting how refunds, delivery issues, and customer expectations can quickly turn into disputes when support is slow or unclear.

At the same time, banks and networks continue to encourage fast consumer protections, which keeps dispute volumes structurally high in many categories. As more merchants sell through marketplaces, subscriptions, and cross border channels, the transaction chain becomes longer and the chance of misunderstanding increases, which makes chargeback management a core operational function rather than a back office task.

Restraint Analysis

Complex Rules and Evidence Standards Across Networks

A key restraint is the rule complexity and strict evidence standards required to win disputes. Networks provide detailed guidelines on reason codes, time windows, and acceptable documentation, and these requirements differ across card brands and even by region. Merchants that cannot produce the right proof quickly often lose disputes even when the underlying sale was valid.

This complexity also increases the workload across teams such as support, risk, finance, and logistics. Dispute handling is rarely owned by a single function, so delays occur when order data, delivery confirmation, and customer communication are stored in separate systems. The result is that operational friction can limit how effectively chargeback management tools deliver value, especially for smaller merchants with lean teams.

Opportunity Analysis

Early Resolution Programs and Better Data Connections

A major opportunity is being created by dispute prevention and early resolution approaches that aim to stop issues before they become formal chargebacks. Network initiatives and dispute collaboration models are designed to surface concerns earlier, so merchants and acquirers can respond before the process escalates. When early signals are connected to order data and customer support history, preventable disputes can be reduced and recoveries can improve.

Another opportunity lies in connecting more merchant systems into the chargeback workflow. When payment, shipping, CRM, and refund systems are linked, the right evidence can be assembled faster and the merchant response becomes more consistent. This creates room for chargeback platforms to provide stronger automation in documentation, case routing, and reason specific playbooks, which is valuable for fast growing online businesses.

Challenge Analysis

First Party Misuse and Dispute Behavior Shifts

A continuing challenge is the growth of disputes linked to customer behavior, including situations where a valid purchase is disputed due to confusion, regret, or intentional misuse. Reports on fraud and dispute patterns highlight that unauthorized card not present fraud and first party misuse remain important drivers behind chargeback pressure, and these cases are difficult because the merchant often lacks direct visibility into the cardholder decision process.

This challenge is amplified by how quickly dispute patterns evolve across channels such as mobile commerce, subscriptions, and marketplaces. Merchants must balance customer friendly refund policies with strong controls, and the right balance changes by category and region. Chargeback management providers are therefore required to keep updating rules logic, evidence templates, and detection methods, while ensuring that genuine customer complaints are still handled fairly.

Competitive Analysis

The competitive landscape of the chargeback management market is shaped by specialized dispute management providers and fraud prevention platforms that help merchants reduce revenue loss and operational complexity.

Chargebacks911, Midigator, Chargehound, Justt, and Chargeback Gurus focus on end to end chargeback handling, including evidence collection, dispute filing, and representment services. These providers are widely used by eCommerce and digital merchants because they improve recovery rates and reduce manual effort through automation and expertise in card network rules.

At the same time, network linked and fraud focused players such as Verifi, Ethoca, Riskified, Signifyd, Kount, Sift, Forter, Radial, ClearSale, and Accertify intensify competition by combining chargeback prevention with real time fraud detection and transaction decisioning. Competitive differentiation increasingly depends on success rates, speed of resolution, integration with payment platforms, and analytics driven insights.

Top Key Players in the Market

- Chargebacks911

- Midigator

- Verifi

- Ethoca

- Riskified

- Signifyd

- Kount

- Sift

- Forter

- Radial

- ClearSale

- Accertify

- Chargehound

- Justt

- Chargeback Gurus

- Others

Future Outlook

Growth in the Chargeback Management market is expected to remain steady as online transactions increase and payment disputes become more frequent. Merchants and payment providers are using chargeback tools to monitor disputes, reduce fraud related losses, and protect revenue.

Rising regulatory scrutiny and complex payment rules are supporting demand for structured dispute handling. Over time, better automation, data analysis, and integration with payment systems are likely to improve resolution speed and success rates.

Recent Developments

- In 2025, Chargebacks911 updated stats showing average rates at 0.7-1.5%, stressing AI for fraud detection. Their platform handles alerts and expert fights, cutting losses for high-volume sellers. It pairs well with gateways for end-to-end flow.

- In 2025, Midigator automated full lifecycles with DisputeFlow, integrating Ethoca/Verifi for AI evidence packs. Merchants gain PCI-compliant analytics to drop ratios below thresholds. Pay-per-alert pricing fits scaling businesses

Report Scope

Report Features Description Market Value (2025) USD 2.6 Bn Forecast Revenue (2035) USD 9.3 Bn CAGR(2025-2035) 13.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platforms, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (Retail & E-commerce, Travel & Hospitality, Digital Goods & Services, Financial Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Chargebacks911, Midigator, Verifi, Ethoca, Riskified, Signifyd, Kount, Sift, Forter, Radial, ClearSale, Accertify, Chargehound, Justt, Chargeback Gurus, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chargeback Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Chargeback Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Chargebacks911

- Midigator

- Verifi

- Ethoca

- Riskified

- Signifyd

- Kount

- Sift

- Forter

- Radial

- ClearSale

- Accertify

- Chargehound

- Justt

- Chargeback Gurus

- Others