Global Cereal Bar Market By Types(Granola Bars, Energy Bars, Nutritional Bars, Snack Bars, Protein Bars, Others), By Product Type(Fitness Bars, Weight Management Bars, Meal Replacement Bars), By Flavor(Caramel, Chocolate, Peanut Butter, Honey, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 67392

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

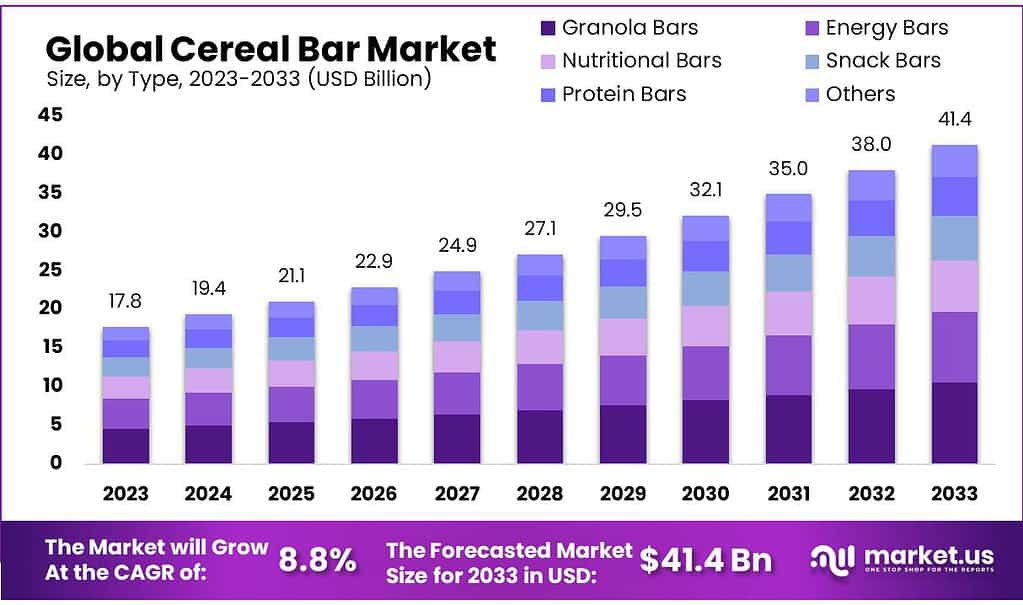

The Cereal Bar Market size is expected to be worth around USD 41.4 billion by 2033, from USD 17.8 Bn in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033.

This growth is due to high demand in different countries such as India, the U.S., and China for healthy cereal bars. Due to its ability to meet many dietary requirements, the product’s consumption is rising. The volatility in raw material prices will likely impact the growth.

However, high production costs could limit growth. To increase market share, large-scale companies are increasing their geographic presence. It is expected that in the coming years, the establishment of joint warehouses in key locations for the timely distribution of the products will remain a crucial success factor.

Key Takeaways

- Market Growth Projection: Cereal bar market set to reach USD 41.4 billion by 2033, growing at a CAGR of 8.8% from USD 17.8 billion in 2023.

- Global Demand Hotspots: Surge in cereal bar consumption in India, U.S., and China due to diverse dietary needs, driving market growth globally.

- Types and Market Dynamics: Granola Bars led in 2023 with a 25.6% market share, reflecting a preference for wholesome and nutritious snacks.

- Product Type Trends: Fitness Bars dominated with a 41.6% market share in 2023, aligning with the health and wellness trend.

- Flavor Preferences: Chocolate-flavored bars led with 28.6% market share, showcasing widespread appeal for this indulgent taste.

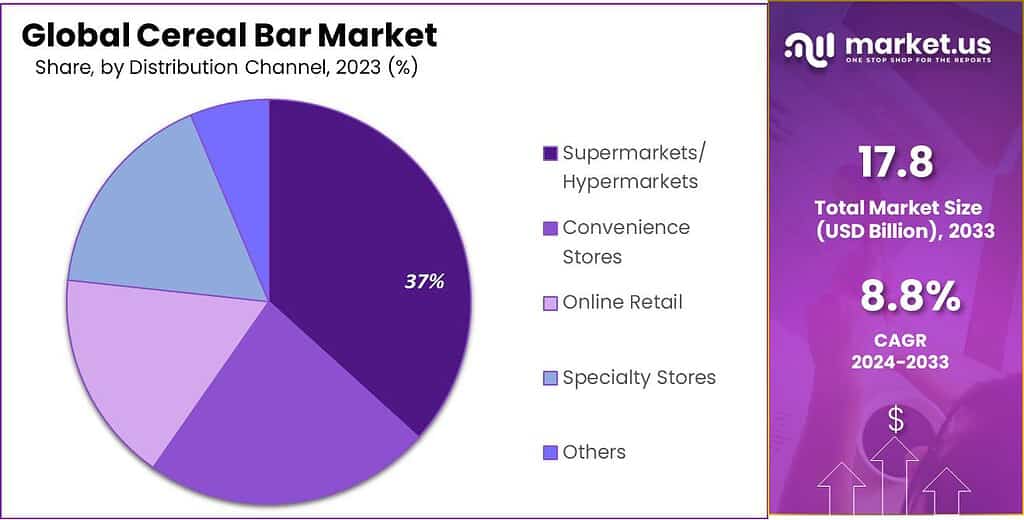

- Distribution Channel Dynamics: Supermarkets/Hypermarkets held a strong position with a 36.7% market share in 2023, emphasizing convenience and availability.

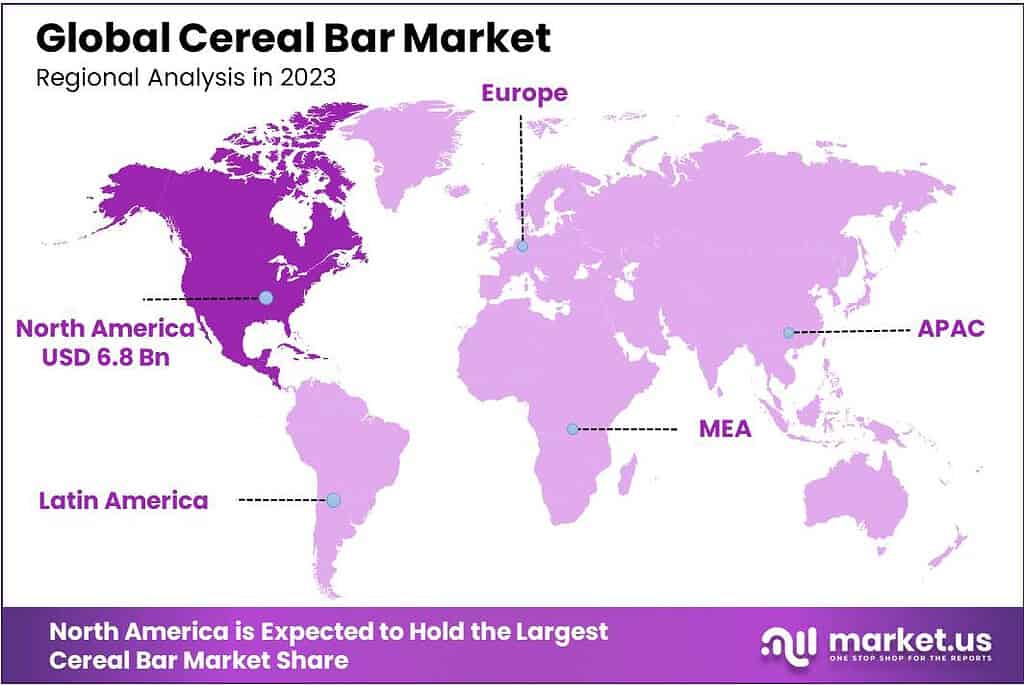

- Regional Analysis: North America, with over 38.7% revenue share in 2023, led due to changing eating habits and demand for healthy snacks.

By Types

In 2023, Granola Bars took the lead in the cereal bar market, securing a strong market position with over a 25.6% share. These bars, known for their wholesome ingredients like oats, nuts, and honey, resonated well with consumers seeking a tasty yet nutritious snack option. The popularity of Granola Bars can be attributed to their perceived health benefits and the widespread appeal of their natural ingredients.

Energy Bars also made a significant impact, accounting for a substantial portion of the market share. With their focus on providing a quick energy boost, these bars attracted consumers looking for a convenient source of vitality during busy days. The Energy Bars segment showcased a robust performance, capitalizing on the growing demand for on-the-go snacks that contribute to sustained energy levels.

Nutritional Bars emerged as another influential segment, gaining traction among health-conscious consumers. These bars, enriched with vitamins, minerals, and other essential nutrients, addressed the increasing consumer preference for snacks that not only satisfy hunger but also contribute to overall well-being. The Nutritional Bars segment witnessed steady growth as people sought convenient ways to incorporate essential nutrients into their daily diets.

Snack Bars, characterized by their diverse flavor profiles and convenient packaging, secured a notable market share as well. Positioned as versatile snacks suitable for various occasions, these bars appealed to a broad consumer base looking for both indulgence and convenience. The Snack Bars segment capitalized on the evolving snacking habits of consumers who sought flavorful options without compromising on nutritional value.

Protein Bars, recognized for their muscle-building properties, experienced a surge in popularity, capturing a considerable market share. With an emphasis on protein content, these bars attracted fitness enthusiasts and individuals aiming to meet their protein requirements conveniently. The Protein Bars segment demonstrated substantial growth, reflecting the increasing awareness of the importance of protein in a balanced diet.

By Product Type

In 2023, Fitness Bars emerged as the frontrunners in the cereal bar market, commanding a substantial market share of over 41.6%. These bars, tailored to cater to the fitness-conscious consumer, gained dominance by offering a convenient and nutritionally rich option for those seeking a healthy snack to complement their active lifestyle. The success of Fitness Bars can be attributed to their alignment with the growing trend of health and wellness, as consumers increasingly prioritize products that support their fitness goals.

Weight Management Bars also made a significant impact, securing a notable portion of the market share. With a focus on providing a satisfying yet calorie-conscious option, these bars resonated well with individuals seeking a convenient snack as part of their weight management journey. The Weight Management Bars segment demonstrated strong growth, reflecting the increasing awareness of the role snacks play in achieving and maintaining a healthy weight.

Meal Replacement Bars positioned themselves as a viable alternative to traditional meals, contributing to a diversified market landscape. These bars, formulated to provide a balanced mix of nutrients, gained popularity among consumers looking for a quick and nutritious on-the-go meal solution. The Meal Replacement Bars segment showcased a promising market presence, addressing the demand for convenient and nutritionally complete meal options in today’s fast-paced lifestyle.

By Flavor

In 2023, Chocolate took the lead in the cereal bar market, securing a dominant market position with over a 28.6% share. The popularity of Chocolate-flavored cereal bars can be attributed to their universal appeal and indulgent taste, making them a favorite among consumers of all ages. The familiar and beloved flavor of chocolate contributed significantly to the strong market presence of this segment.

Caramel-flavored cereal bars also made a significant impact, capturing a notable share of the market. The sweet and buttery notes of caramel resonated well with consumers seeking a delightful and indulgent snack option. The Caramel segment showcased a robust performance, attracting those with a preference for rich and decadent flavors in their cereal bars.

Peanut Butter emerged as another influential flavor segment, appealing to the taste buds of consumers who appreciate the savory and nutty profile of peanut butter. This segment secured a considerable market share, reflecting the enduring popularity of peanut butter as a versatile and satisfying flavor option for cereal bars.

Honey-flavored cereal bars catered to those seeking a natural and sweet taste. The unique sweetness of honey contributed to the segment’s market presence, attracting consumers who prefer a wholesome and traditional flavor profile in their snacks. The Honey segment demonstrated steady growth, reflecting the enduring appeal of this classic sweetener.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets played a pivotal role in the cereal bar market, securing a dominant market position with over a 36.7% share. The widespread availability and convenience of these retail giants made them a preferred choice for consumers looking to grab cereal bars during their routine grocery shopping. Supermarkets/Hypermarkets served as crucial distribution hubs, offering a diverse range of cereal bars, attracting a significant portion of the market share.

Convenience Stores also made a noteworthy impact, capturing a considerable share of the market. These small, accessible outlets catered to on-the-go consumers seeking quick and convenient snack options. The Convenience Stores segment demonstrated a strong presence, leveraging its strategic locations to meet the immediate needs of consumers looking for cereal bars during their daily routines.

Online Retail emerged as a rapidly growing distribution channel, gaining traction in the cereal bar market. The ease of online shopping and the ability to explore a wide variety of brands and flavors contributed to the appeal of this channel. The Online Retail segment showcased a robust performance, reflecting the increasing trend of consumers opting for the convenience of purchasing cereal bars from the comfort of their homes.

Key Market Segments

By Types

- Granola Bars

- Energy Bars

- Nutritional Bars

- Snack Bars

- Protein Bars

- Others

By Product Type

- Fitness Bars

- Weight Management Bars

- Meal Replacement Bars

By Flavor

- Caramel

- Chocolate

- Peanut Butter

- Honey

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

Regional Analysis

North America held the highest revenue share at over 38.7% in 2023. This was due to consumers changing their eating habits, such as snacking or eating between meals. The market is likely to grow quickly due to the rising demand for healthy snacking alternatives. Shortly, regional growth will be further fueled by attractive packaging and innovative flavors at affordable prices.

Healthy cereal bars are expected to see decent growth during the forecast period. This is because of the high demand for breakfast cereals and cereals, particularly in countries like the U.S. and China among consumers of all ages.

The market in Europe held the largest revenue share of 41% in 2021. Europe’s companies are working hard to increase product sales. They focus on attracting more customers through innovative products, eye-catching packaging, and other marketing strategies.

European demand has been boosted by the rising popularity of snacking among young people. The demand for cereal bars is expected to rise due to increasing awareness about the health benefits associated with innovative snacks over the forecast period. Urban consumers are increasingly under pressure to balance work and family life. This is increasing the demand for ready-to-eat snacks. This is expected to increase the demand for regional products.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Markets are characterized by joint ventures as well as mergers and acquisitions. Diversification of distribution channels is important to increase the market share and strengthen the position. High barriers to entry due to difficult registration and high capital investment are likely to keep industry participants in the competition.

The industry’s rapid growth, brand loyalty, and high level of industrial rivalry are expected to continue. Companies are focusing on optimal business growth through executing multiple growth strategies.

Маrkеt Кеу Рlауеrѕ

- Gеnеrаl Міllѕ

- Nestlé SA

- Atkins Nutritionals

- Kellogg Company

- Quaker Oats Co.

- Clif Bar & Company

- Kind LLC

- Mars, Incorporated

- McKee Foods

- Naturell India Pvt. Ltd.

- Pharmavite

- Freedom Nutritional Products Limited

- PepsiCo, Inc.

- Jinsa Essentials Inc.

- The Hain Celestial Group, Inc

Recent Developments

- 2023 General Mills:

- Debuted Chex Mix Muddy Buddies Cereal Bars, inspired by the popular snack mix.

- Expanded Lärabar with Simply Lärabar, a line with simpler ingredients and lower sugar content.

- 2023 Mars, Incorporated:

- Announced plans to acquire PROBAR, a leader in plant-based protein bars, further strengthening its plant-based portfolio.

- Expanded CLIF BAR with CLIF Nut Butter Filled, featuring nut butter and chia seed fillings.

Report Scope

Report Features Description Market Value (2022) US$ 17.8 Bn Forecast Revenue (2032) US$ 41.4 Bn CAGR (2023-2032) 8.8% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Types(Granola Bars, Energy Bars, Nutritional Bars, Snack Bars, Protein Bars, Others), By Product Type(Fitness Bars, Weight Management Bars, Meal Replacement Bars), By Flavor(Caramel, Chocolate, Peanut Butter, Honey, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gеnеrаl Міllѕ, Nestlé SA, Atkins Nutritionals, Kellogg Company, Quaker Oats Co., Clif Bar & Company, Kind LLC, Mars, Incorporated, McKee Foods, Naturell India Pvt. Ltd., Pharmavite, Freedom Nutritional Products Limited, PepsiCo, Inc., Jinsa Essentials Inc., The Hain Celestial Group, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Cereal Bar Market size in 2021?The Cereal Bar Market size is $ 15,110.17 million in 2021.

What is the CAGR for the Cereal Bar Market?The Cereal Bar Market is expected to grow at a CAGR of 9.1% during 2023-2032.

What are the segments covered in the Cereal Bar Market report?Market.US has segmented the Global Cereal Bar Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented energy & nutrition bar, snacks bar, and other products. By Distribution Channel, market has been further divided into convenience stores, food specialty stores, hypermarket & supermarket, and other distribution channels.

Who are the key players in the Cereal Bar Market?Кеllоgg, Nеѕtle, Gеnеrаl Міllѕ, Рерѕі, Мсkее, Quаkеr Оаtѕ, Аtkіnѕ Nutrіtіоnаlѕ, and Other Key Players

Which region is more attractive for vendors in the Cereal Bar Market?Europe accounted for the highest revenue share of 41% among the other regions. Therefore, the Cereal Bar Market in Europe is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Cereal Bar?Key markets for Cereal Bar are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Which segment has the largest share in the Cereal Bar Market?In the Cereal Bar Market, vendors should focus on grabbing business opportunities from the Energy & Nutrition Bar product type segment as it accounted for the largest market share in the base year.

-

-

- Кеllоgg

- Nеѕtle

- Gеnеrаl Міllѕ

- Рерѕі

- Мсkее

- Quаkеr Оаtѕ

- Аtkіnѕ Nutrіtіоnаlѕ

- Other Key Players