Global Ceramic Wall Tiles Market Size, Share And Growth Analysis By Type (Porcelain, Ceramic), By Finish (Matt, Gloss), By Dimensions (20 * 20, 30 * 30, 30 * 60, 60 * 120, Others), By Construction Type (New Construction, Renovation), By Application (Floor Tiles, Internal Wall Tiles, External Wall Tiles), By End-use (Residential, HORECA, Office, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141013

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

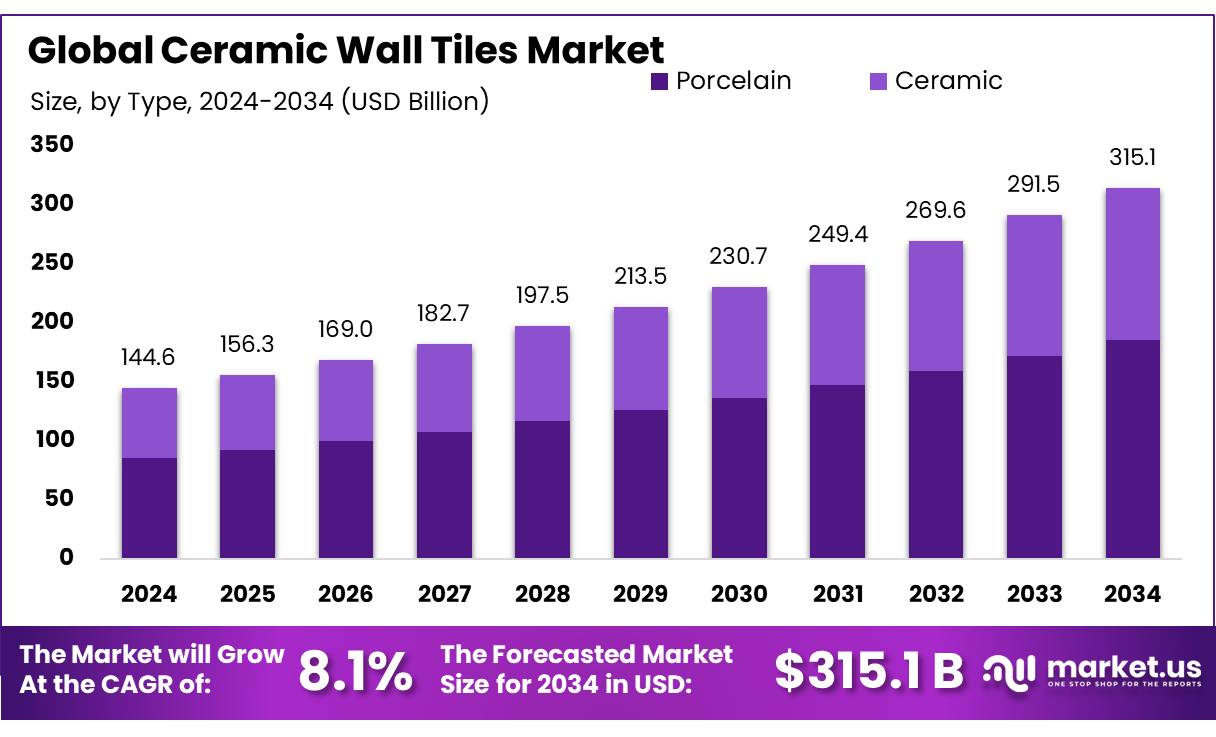

The Global Ceramic Wall Tiles Market size is expected to be worth around USD 315.1 Bn by 2034, from USD 144.6 Bn in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The rising demand for housing and commercial spaces, driven by increased construction activities, is expected to significantly boost the market for ceramic wall tiles. This demand will be further supported by a growing trend in renovation projects across commercial spaces such as offices, hospitals, and shopping malls. Ceramic wall tiles are gaining popularity as they replace traditional wall covering materials like paint, wallpaper, and wooden panels, due to their superior durability, resistance to stains and scratches, and low maintenance requirements.

These tiles are favored for their versatility and strength, offering a wide array of colors, textures, and finishes that suit various interior styles, from contemporary to traditional. Ceramic wall tiles are particularly well-suited for areas exposed to moisture, such as bathrooms, kitchens, porches, and balconies, thanks to their low porosity, which reduces moisture absorption.

As the global population is projected to reach 9.5 billion by 2050, with urban dwellers making up 66.4% of the total, the demand for improved hygiene and sanitation will intensify, driving the need for more housing and commercial infrastructure. Specifically, the Asia-Pacific (APAC) region, expected to house 5.1 billion people by 2050, will see cities account for at least 68% of the population. This rapid urbanization will fuel the demand for construction materials, including ceramic wall tiles, to accommodate the growing population and the increasing need for infrastructure development.

Key Takeaways

- The Global Ceramic Wall Tiles Market is projected to reach USD 315.1 billion by 2034, growing at a CAGR of 8.1% from 2025 to 2034.

- Porcelain tiles dominate the market with a 59.6% share in 2024, attributed to their durability and water resistance.

- Matt finishes lead with a 66.8% market share, preferred for their subtle elegance and ease of maintenance.

- The 30 × 60 dimension accounts for 36.7% of the market, favored for its versatility in various design styles.

- New construction projects contribute 69.3% of the market demand in 2024, fueled by urbanization and infrastructure development.

- APAC is the largest market with a 41.8% share, driven by urbanization and significant infrastructure projects in China, India, and Japan.

By Type

In 2024, Porcelain held a dominant market position, capturing more than a 59.6% share of the ceramic wall tiles market. This strong performance can be attributed to porcelain’s durability, water resistance, and low maintenance, making it the preferred choice for both residential and commercial applications. As demand for high-quality, long-lasting materials continues to rise, porcelain tiles have become a go-to option for areas with high moisture exposure, such as bathrooms and kitchens.

The market for porcelain wall tiles is further strengthened by advances in production technology, which have led to more cost-effective options and enhanced product quality. Given these factors, porcelain’s share is projected to slightly increase in 2025, consolidating its position as the dominant type in the ceramic wall tiles sector.

By Finish

In 2024, Matt held a dominant market position, capturing more than a 66.8% share of the ceramic wall tiles market. The popularity of matt finishes can be attributed to their subtle elegance and practical benefits. Unlike glossy finishes, matt tiles offer a more understated look and are highly favored for creating a natural, minimalist aesthetic. They are particularly popular in spaces like living rooms, bedrooms, and kitchens, where a smooth, non-reflective surface helps to reduce glare and maintain a clean, sophisticated appearance.

The demand for matt ceramic tiles is expected to remain strong. The trend toward matte finishes is likely to continue, driven by consumer preferences for timeless designs and easy-to-maintain surfaces. Matt tiles also tend to show fewer smudges and fingerprints, which makes them ideal for high-traffic areas.

By Dimensions

In 2024, 30 × 60 held a dominant market position, capturing more than a 36.7% share of the ceramic wall tiles market. This size has become a popular choice due to its versatility and ability to fit a wide range of design styles. The 30 × 60 dimensions offer a balanced proportion, making it suitable for both smaller and larger spaces, and providing a modern yet classic look. Its widespread appeal is also driven by its ease of installation and the ability to cover large areas without the need for excessive grout lines.

The demand for 30 × 60 tiles is expected to stay strong. As interior design trends continue to favor clean lines and spacious layouts, this size remains highly sought after, especially for wall applications in kitchens, bathrooms, and living rooms. Its popularity is further bolstered by the growing trend toward larger tile formats, with 30 × 60 offering a comfortable middle ground that appeals to both traditional and contemporary preferences.

By Construction Type

In 2024, New Construction held a dominant market position, capturing more than a 69.3% share of the ceramic wall tiles market. The growing demand for residential, commercial, and industrial buildings has significantly driven this segment. New construction projects tend to prioritize high-quality materials like ceramic wall tiles due to their durability, aesthetic appeal, and ease of maintenance. Tiles are often chosen for both their practical advantages in moisture-rich areas like kitchens and bathrooms and their ability to add value to new properties.

The market for ceramic wall tiles in new construction is expected to maintain its strong position. With urbanization continuing to rise globally and infrastructure development projects on the upswing, new construction will remain a key driver of tile demand. In particular, emerging markets are seeing a surge in new residential and commercial developments, further boosting the share of ceramic tiles in these regions.

By Application

In 2024, Floor Tiles held a dominant market position, capturing more than a 58.6% share of the ceramic wall tiles market. This strong performance is driven by the widespread use of ceramic tiles for flooring in both residential and commercial spaces. Ceramic floor tiles are highly sought after due to their durability, easy maintenance, and versatile design options. They are ideal for high-traffic areas such as living rooms, kitchens, hallways, and offices, where durability is key.

The demand for ceramic floor tiles is expected to remain robust. As construction and renovation projects continue to rise globally, ceramic tiles will maintain their stronghold in the flooring sector. Their ability to withstand wear and tear, combined with the growing trend of eco-friendly building materials, will help sustain this segment’s growth. The trend toward open-concept living and larger floor spaces will further drive the demand for floor tiles in both new and renovated properties.

By End-use

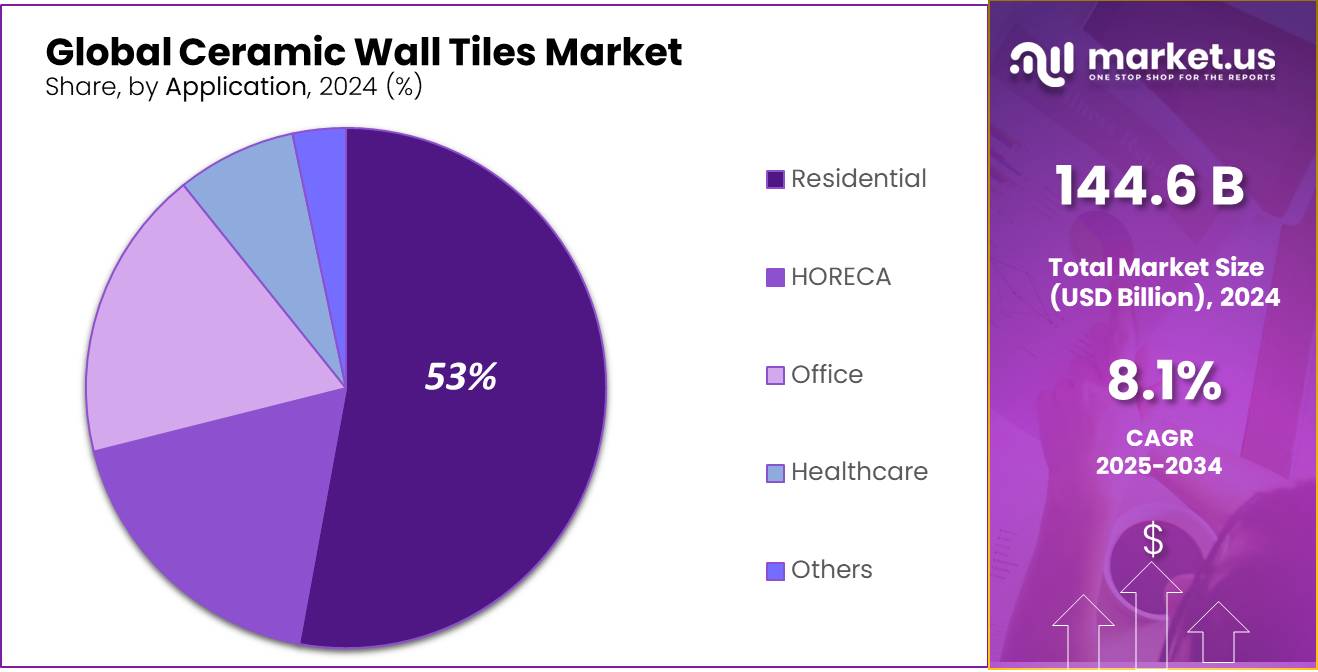

In 2024, Residential held a dominant market position, capturing more than a 53.9% share of the ceramic wall tiles market. The growth of this segment is primarily driven by the increasing demand for stylish, durable, and easy-to-maintain materials in homes. Ceramic wall tiles are widely used in areas like kitchens, bathrooms, and living rooms, offering a blend of functionality and aesthetic appeal.

The residential segment is expected to maintain its leading position. As more people invest in home improvement, especially in high-traffic areas and moisture-prone spaces, ceramic wall tiles will remain a top choice. The popularity of modern, minimalist interior designs and eco-conscious materials will further support the demand for ceramic tiles in residential applications.

Key Market Segments

By Type

- Porcelain

- Ceramic

By Finish

- Matt

- Gloss

By Dimensions

- 20 * 20

- 30 * 30

- 30 * 60

- 60 * 120

- Others

By Construction Type

- New Construction

- Renovation

By Application

- Floor Tiles

- Internal Wall Tiles

- External Wall Tiles

By End-use

- Residential

- HORECA

- Office

- Healthcare

- Others

Drivers

Growing Demand for Sustainable and Eco-friendly Materials

One of the major driving factors for the growth of the ceramic wall tiles market is the increasing demand for sustainable and eco-friendly building materials. As consumers, businesses, and governments alike place more emphasis on sustainability, ceramic tiles have gained popularity due to their long lifespan, recyclability, and energy-efficient production processes.

Ceramic wall tiles are made from natural materials such as clay and sand, and their production typically generates fewer emissions compared to other building materials. This is in line with global efforts to reduce carbon footprints and promote greener building practices.

A report by the International Energy Agency (IEA) highlights that energy efficiency improvements in the building sector are key to meeting climate goals. The building sector alone accounts for nearly 40% of global energy-related CO2 emissions, and much of this is due to construction materials. Ceramic tiles, being energy-efficient in production and long-lasting in use, are becoming a preferred choice for environmentally conscious consumers and builders.

Government initiatives are also playing a pivotal role in pushing the demand for eco-friendly materials. For instance, the European Union’s Green Deal and various sustainability programs worldwide are setting stricter standards for building materials. In the U.S., the Environmental Protection Agency (EPA) has been encouraging the use of sustainable materials in both commercial and residential construction. This trend is encouraging many manufacturers to shift toward greener practices, such as reducing water consumption during production and using recycled content in tiles.

Restraints

High Production Costs and Raw Material Prices

One of the major restraining factors for the growth of the ceramic wall tiles market is the rising production costs, primarily driven by increasing raw material prices and energy expenses. The production of ceramic tiles involves the use of natural materials like clay, kaolin, and feldspar, along with high energy consumption during the firing process. As the cost of raw materials continues to rise, manufacturers face challenges in keeping production costs low while maintaining quality. This, in turn, can lead to higher prices for end consumers, limiting the affordability and accessibility of ceramic tiles for certain market segments.

In recent years, there has been a noticeable increase in the prices of key raw materials. For example, the price of natural gas, which is used extensively in the firing process of ceramic tiles, has seen significant hikes due to global supply chain disruptions. According to the U.S. Energy Information Administration (EIA), natural gas prices in the U.S. rose by more than 20% in 2022, and this has impacted the production costs for many industries, including ceramics. Additionally, the increasing cost of transportation and labor due to inflationary pressures has further compounded the issue.

The ongoing global supply chain disruptions—exacerbated by events like the COVID-19 pandemic—have led to delays and shortages of raw materials. This has affected production timelines and, in some cases, forced manufacturers to raise prices to cope with the increased costs. Government initiatives, such as those from the European Union’s Green Deal, are pushing industries to become more sustainable, but the high upfront costs of green technologies and materials may also add financial pressure to ceramic tile manufacturers, making it harder to meet both environmental and economic demands.

Opportunity

Growing Demand for Smart and Sustainable Buildings

A major growth opportunity for the ceramic wall tiles market lies in the increasing demand for smart and sustainable buildings. As more homeowners and businesses seek energy-efficient, eco-friendly, and technologically advanced building materials, ceramic tiles are well-positioned to capitalize on this trend. Ceramic wall tiles, which are durable, long-lasting, and low-maintenance, align with the growing interest in creating buildings that are not only sustainable but also energy-efficient.

One of the key drivers of this opportunity is the global push for energy-efficient buildings. According to the International Energy Agency (IEA), the building sector accounts for nearly 40% of global energy-related CO2 emissions. Governments worldwide, such as the U.S. and EU, are offering incentives and regulations to reduce these emissions by encouraging the use of sustainable building materials. For example, the EU’s Green Deal is a major initiative that aims to make Europe the first climate-neutral continent by 2050, and this has spurred the use of energy-efficient materials like ceramic tiles in construction.

Moreover, advancements in smart building technology are also creating a new demand for high-performance building materials. Ceramic tiles are increasingly being integrated with technologies such as underfloor heating systems and temperature-regulating surfaces that contribute to overall energy efficiency. In the U.S., the demand for smart homes has been steadily growing, with more than 40% of households expected to have at least one smart device by 2025, according to the Consumer Technology Association (CTA). As smart homes become more popular, ceramic wall tiles that contribute to energy conservation and environmental sustainability are poised to benefit from this growing trend.

Trends

Shift Toward Eco-friendly and Recycled Materials

A major trend currently shaping the ceramic wall tiles market is the growing preference for eco-friendly and recycled materials. As sustainability becomes an increasing priority for consumers, manufacturers are adapting by using more environmentally conscious production methods and raw materials. This trend is driven by the broader push for greener building practices and the rising consumer demand for eco-friendly products, both in residential and commercial construction.

The use of recycled content in ceramic tiles is gaining traction, with manufacturers exploring ways to incorporate waste materials, such as glass, porcelain scraps, and other industrial by-products, into tile production. According to the U.S. Environmental Protection Agency (EPA), recycling of construction materials like ceramics can significantly reduce landfill waste and lower the carbon footprint of new building projects. In fact, the EPA reports that nearly 600 million tons of construction and demolition debris are generated annually in the U.S., with a large portion of this being recyclable materials such as ceramic tiles. As the demand for sustainability rises, more companies are adopting practices that minimize waste and maximize recycling in tile production.

Governments are also playing a significant role in encouraging the use of sustainable building materials. In Europe, the European Union’s Circular Economy Action Plan focuses on reducing waste and promoting the recycling of materials, including ceramics. This plan is designed to improve the sustainability of construction materials and is already influencing building codes and industry standards across member countries. Similarly, in the U.S., the Green Building Council’s LEED certification encourages the use of sustainable materials, driving the demand for eco-friendly tiles in both residential and commercial buildings.

Regional Analysis

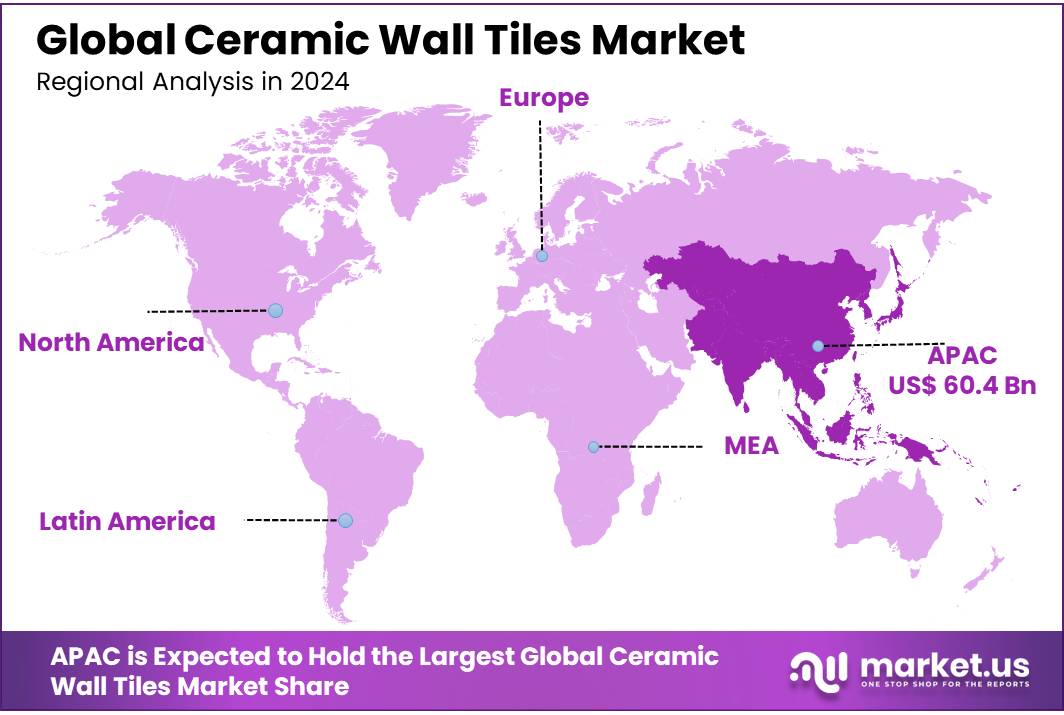

In 2024, the Asia Pacific (APAC) region held a dominant position in the ceramic wall tiles market, capturing more than 41.8% of the global share, with a market value of approximately $60.4 billion. This region continues to be the largest and most influential market for ceramic tiles, driven by rapid urbanization, significant infrastructure developments, and growing demand in both residential and commercial sectors. Countries such as China, India, and Japan are key contributors to the region’s growth, where ceramic wall tiles are extensively used in construction projects ranging from high-rise buildings to residential homes and commercial spaces.

China, as the world’s largest producer and consumer of ceramic tiles, accounts for a significant portion of the APAC market. The country’s large-scale construction boom, particularly in urban centers, has been a major driver for ceramic tile consumption. Similarly, India’s expanding middle class, increasing disposable incomes, and rapid urban development have further propelled the demand for ceramic tiles, as consumers increasingly prioritize aesthetics, durability, and low maintenance.

In addition to new construction, the growing trend of home renovation, particularly in more developed APAC economies, is also fostering demand for ceramic wall tiles. The shift towards modern designs, coupled with a strong preference for durable, easy-to-clean materials, continues to support the growth of the market in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the ceramic wall tiles market include industry leaders like Atlas Concorde, Ceramica Carmelo Fior, China Ceramics Co., Ltd., Crossville Inc., Florida Tile, Grupo Lamosa, and Gruppo Ceramiche Ricchetti. These companies are known for their strong market presence and commitment to innovation in design, product quality, and sustainability. Atlas Concorde, for example, is recognized for its high-end porcelain and ceramic tile collections, catering to both residential and commercial projects worldwide.

Companies like Ceramica Carmelo Fior and China Ceramics Co., Ltd. focus heavily on catering to diverse regional demands, with China Ceramics being one of the largest manufacturers in Asia. Crossville Inc. and Florida Tile have carved out niches in the North American market, offering a wide range of ceramic tiles known for their durability and style.

Grupo Lamosa, based in Mexico, has a significant presence in Latin America and is known for both its wall and floor tile products. Gruppo Ceramiche Ricchetti, an Italian tile manufacturer, stands out in Europe for its premium ceramic and porcelain tiles, blending craftsmanship with technology to meet the demand for high-quality materials in luxury projects.

Top Key Players

- Atlas Concorde

- Ceramica Carmelo Fior

- China Ceramics Co., Ltd.

- Crossville Inc.

- Florida Tile

- Grupo Lamosa

- Gruppo Ceramiche Ricchetti

- Kajaria Ceramics Limited

- Mohawk Industries Inc.

- Pamesa Ceramica

- Panariagroup Industrie Ceramiche S.p.A.

- Porcelanosa Grupo

- Porcelanosa Grupo A.I.E.

- RAK Ceramics

- Saloni Ceramica

- Siam Cement Public Company Limited

Recent Developments

In 2024, Atlas Concorde continues to prioritize sustainability, using eco-friendly materials and energy-efficient production methods. It has also invested heavily in digital technologies to enhance the customer experience, such as offering virtual design tools for architects and homeowners.

In 2024, Ceramica Carmelo Fior’s market share is growing, driven by its ability to adapt to modern design trends and the increasing demand for eco-friendly materials.

Report Scope

Report Features Description Market Value (2024) USD 144.6 Bn Forecast Revenue (2034) USD 315.1 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Porcelain, Ceramic), By Finish (Matt, Gloss), By Dimensions (20 * 20, 30 * 30, 30 * 60, 60 * 120, Others), By Construction Type (New Construction, Renovation), By Application (Floor Tiles, Internal Wall Tiles, External Wall Tiles), By End-use (Residential, HORECA, Office, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Concorde, Ceramica Carmelo Fior, China Ceramics Co., Ltd., Crossville Inc., Florida Tile, Grupo Lamosa, Gruppo Ceramiche Ricchetti, Kajaria Ceramics Limited, Mohawk Industries Inc., Pamesa Ceramica, Panariagroup Industrie Ceramiche S.p.A., Porcelanosa Grupo, Porcelanosa Grupo A.I.E., RAK Ceramics, Saloni Ceramica, Siam Cement Public Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Concorde

- Ceramica Carmelo Fior

- China Ceramics Co., Ltd.

- Crossville Inc.

- Florida Tile

- Grupo Lamosa

- Gruppo Ceramiche Ricchetti

- Kajaria Ceramics Limited

- Mohawk Industries Inc.

- Pamesa Ceramica

- Panariagroup Industrie Ceramiche S.p.A.

- Porcelanosa Grupo

- Porcelanosa Grupo A.I.E.

- RAK Ceramics

- Saloni Ceramica

- Siam Cement Public Company Limited