Global Center Pivot Irrigation System Market Size, Share Analysis Report By Component (Pivot Points, Control Panels, Span, Sprinkler Drop, Tower Drive Wheels, Drive Train), By Mobility ( Stationary, Mobile), By Crop Type (Oilseeds And Pulses, Cereals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159264

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

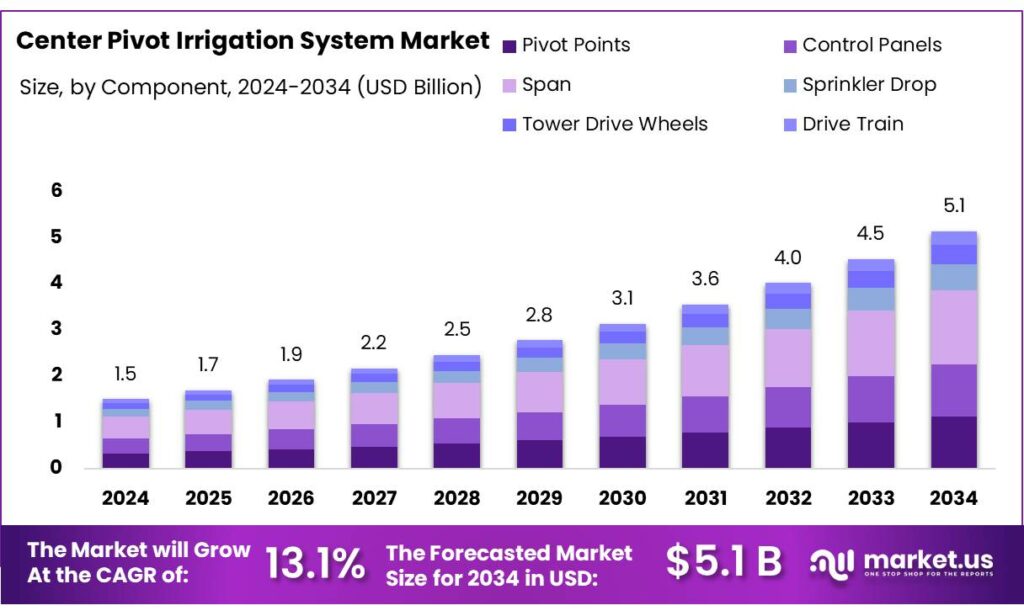

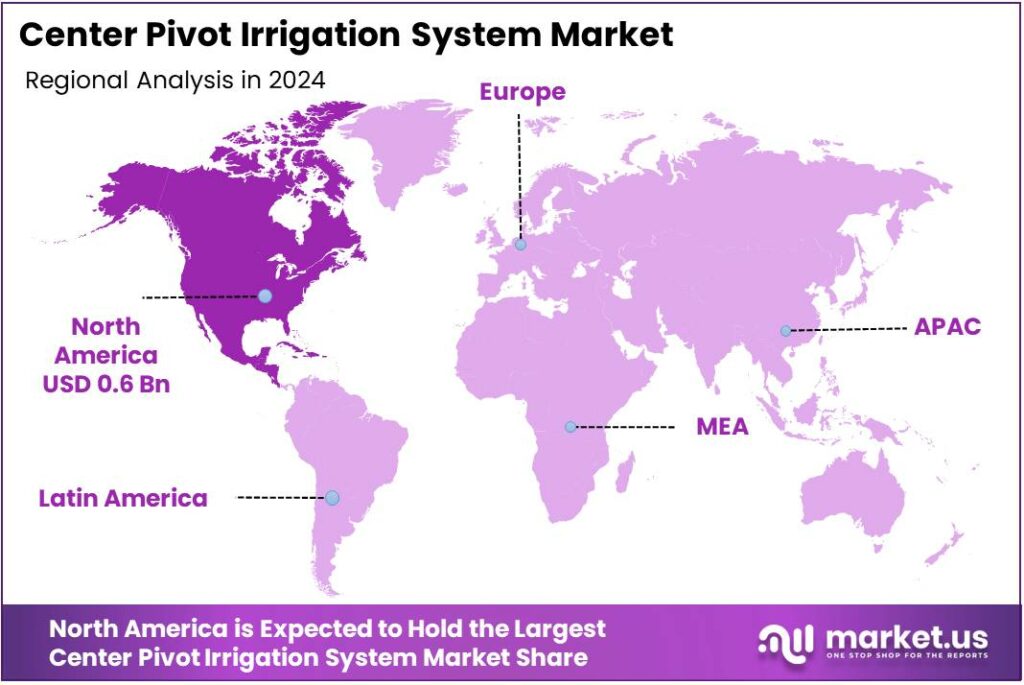

The Global Center Pivot Irrigation System Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.5% share, holding USD 0.6 Billion in revenue.

Center Pivot Irrigation Systems (CPIS) are revolutionizing agricultural practices globally by offering efficient and scalable solutions for water distribution. These systems consist of rotating sprinkler arms mounted on wheeled towers, irrigating crops in a circular pattern from a central pivot point. Their adoption has been particularly beneficial in arid and semi-arid regions, where water conservation is paramount.

In India, the integration of CPIS aligns with the government’s strategic initiatives to enhance water-use efficiency in agriculture. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), launched in 2015, aims to expand the cultivated area with assured irrigation and reduce wastage of water. Under the Accelerated Irrigation Benefit Programme (AIBP), 99 ongoing major/medium irrigation projects were prioritized during 2016-17, with an ultimate irrigation potential of 76.03 lakh hectares.

Government initiatives further support the adoption of CPIS. The “Per Drop More Crop” strategy, launched in 2015, focuses on increasing water-use efficiency through micro-irrigation systems, including CPIS. The government aims to bring two million hectares under micro-irrigation annually. In Uttar Pradesh, a subsidy of Rs 52,000 is offered to farmers for constructing farm ponds, with additional grants for installing ISI-marked pump sets, promoting rainwater harvesting and irrigation enhancement.

The adoption of CPIS in India has been gaining momentum. In Jalaun district, Uttar Pradesh, a community-owned CPIS was introduced, covering 75 acres and benefiting 26 farmers. Additionally, the Uttar Pradesh government has undertaken 29 irrigation projects over eight years, enhancing irrigation capacity by 1.91 million hectares and benefiting over 4.35 million farmers.

Key Takeaways

- Center Pivot Irrigation System Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 13.1%.

- Span held a dominant position in the center pivot irrigation system market, capturing more than 31.3% of the overall market share.

- Stationary systems held a dominant position in the center pivot irrigation market, capturing more than 67.7% of the market share.

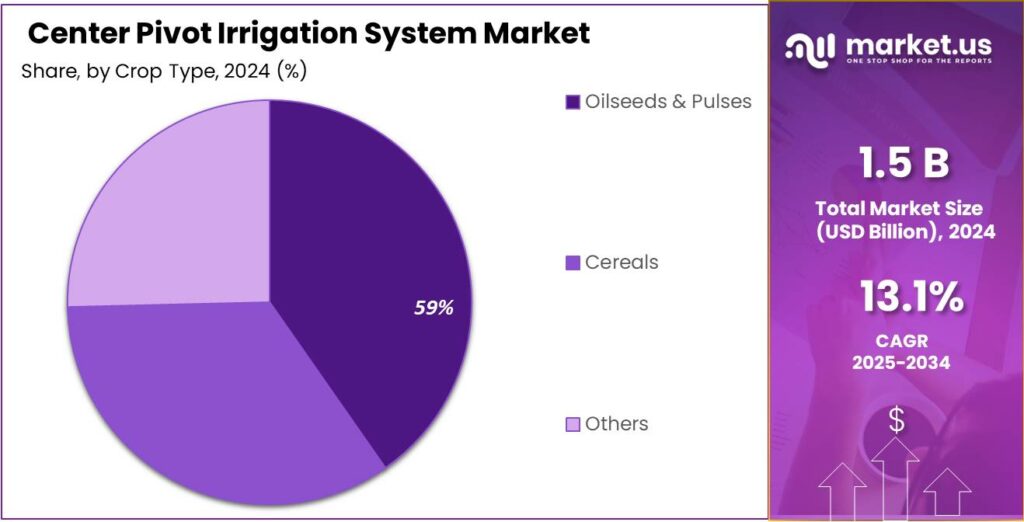

- Oilseeds & Pulses held a dominant position in the center pivot irrigation system market, capturing more than 59.9% of the market share.

- North America held a dominant share of 42.5% in the center pivot irrigation system market, valued at approximately USD 0.6 billion.

By Component Analysis

In 2024, Span dominates Center Pivot Irrigation System Market with 31.3% Share

In 2024, Span held a dominant position in the center pivot irrigation system market, capturing more than 31.3% of the overall market share. The span is a crucial component of the irrigation system, consisting of the framework that supports the rotating sprinklers, ensuring efficient water distribution over large agricultural fields. The segment’s leadership can be attributed to its role in enabling wider coverage of irrigated land with minimal maintenance. Spans are widely used in various agricultural regions, offering excellent durability and adaptability to different crop types and terrains.

By Mobility Analysis

In 2024, Stationary Dominates Center Pivot Irrigation System Market with 67.7% Share

In 2024, Stationary systems held a dominant position in the center pivot irrigation market, capturing more than 67.7% of the market share. These systems, which remain fixed at a single point, are widely favored for their simplicity, reliability, and cost-effectiveness. Stationary systems are often used in areas where the irrigation system doesn’t need to move frequently, making them ideal for small to medium-sized farms or areas with limited water resources. The high share can also be attributed to their ease of installation and maintenance, offering farmers a stable and long-lasting solution to water distribution. As the demand for efficient irrigation continues to rise, stationary systems are expected to retain their leadership in the market through 2025.

By Crop Type Analysis

In 2024, Oilseeds & Pulses Dominate Center Pivot Irrigation Market with 59.9% Share

In 2024, Oilseeds & Pulses held a dominant position in the center pivot irrigation system market, capturing more than 59.9% of the market share. This dominance is driven by the increasing demand for oilseeds and pulses, which are staple crops grown in large quantities globally. Center pivot irrigation systems are particularly well-suited for these crops, as they require consistent and efficient water distribution for optimal growth. The rising global population and the need for high-protein, affordable food sources have further fueled the demand for pulses, while oilseeds continue to be a critical part of the agricultural economy. As such, oilseeds and pulses are expected to maintain a strong presence in the market through 2025, with farmers continuing to rely on center pivot systems to maximize yields.

Key Market Segments

By Component

- Pivot Points

- Control Panels

- Span

- Sprinkler Drop

- Tower Drive Wheels

- Drive Train

By Mobility

- Stationary

- Mobile

By Crop Type

- Oilseeds & Pulses

- Cereals

- Others

Emerging Trends

The Rise of Automation and Precision Technology

A significant and transformative trend in center pivot irrigation is the integration of automation and precision technology. This shift is revolutionizing how water is managed in agriculture, making irrigation systems more efficient, cost-effective, and adaptable to varying field conditions.

Modern center pivot systems are increasingly equipped with automated controls that allow for real-time adjustments based on weather forecasts, soil moisture levels, and crop needs. This automation reduces the need for manual intervention, lowers labor costs, and ensures that water is applied only when and where it’s needed. For example, automated systems can adjust the pivot speed and water application rates to match the specific requirements of different zones within a field. This precision helps in optimizing water use and improving crop yields.

Recognizing the importance of modern irrigation technologies, the Indian government has implemented several initiatives to promote their adoption. Under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), the Per Drop More Crop (PDMC) component offers financial assistance to farmers adopting micro-irrigation systems, including automated center pivot systems. This support aims to reduce the financial burden on farmers and encourage the adoption of water-efficient technologies.

Drivers

Water Efficiency and Conservation

One of the most compelling reasons for adopting center pivot irrigation systems is their ability to significantly enhance water use efficiency, a critical factor in regions facing water scarcity. According to the Food and Agriculture Organization (FAO), center pivot systems can achieve irrigation application efficiencies ranging from 75% to 85%. This means that a substantial portion of the water applied reaches the crops, reducing wastage and ensuring that water resources are utilized effectively.

In practical terms, this efficiency translates into considerable water savings. For instance, a study highlighted by the FAO found that implementing irrigation scheduling in center pivot systems led to a 22% reduction in the amount of water pumped for corn cultivation in northern Colorado. This reduction was achieved without compromising crop yields, demonstrating that efficient water management can lead to both conservation and sustained agricultural productivity.

The importance of such water-saving technologies is underscored by the increasing global concerns over water scarcity. The FAO emphasizes that improving irrigation water distribution and allocation efficiency is essential for enhancing food security and ensuring sustainable agricultural practices. By adopting systems like center pivots, farmers can contribute to these broader goals while also benefiting from improved crop yields and reduced operational costs.

Restraints

High Initial Investment and Affordability Challenges

One of the primary barriers to adopting center pivot irrigation systems, especially in developing countries like India, is the substantial initial investment required. These systems can cost between ₹8 to ₹12 lakh per hectare, which is a significant financial commitment for small and marginal farmers. This high upfront cost makes it challenging for many to transition from traditional irrigation methods to more efficient, but expensive, technologies.

To address this issue, the Indian government has implemented various subsidy schemes under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY). For instance, the Per Drop More Crop (PDMC) component offers financial assistance to farmers adopting micro-irrigation systems, including center pivots. Under this scheme, small and marginal farmers receive 55% of the cost as subsidy, while other farmers receive 45%. The subsidy is shared between the central and state governments, with the central government contributing 60% and the state government 40% for most states. However, even with these subsidies, the remaining cost can still be a burden for many farmers.

Recognizing these challenges, the government has been working towards making these technologies more accessible. The Atal Bhujal Yojana (ABY) focuses on sustainable groundwater management and encourages the adoption of water-efficient technologies. Additionally, the Command Area Development and Water Management (CADWM) program aims to modernize irrigation infrastructure and promote the use of pressurized irrigation systems, including center pivots, to improve water use efficiency. These initiatives are designed to reduce the financial burden on farmers and encourage the adoption of efficient irrigation practices.

Opportunity

Government Support and Policy Initiatives

One significant growth opportunity for center pivot irrigation systems lies in the robust support provided by government policies and initiatives aimed at enhancing agricultural productivity and water use efficiency. In India, the government has recognized the importance of modern irrigation techniques and has implemented various schemes to promote their adoption among farmers.

The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) is a flagship program designed to improve irrigation coverage and efficiency. Under the PMKSY, the Per Drop More Crop (PDMC) component offers financial assistance to farmers adopting micro-irrigation systems, including center pivot irrigation. The subsidy provided under this scheme can be up to 55% for small and marginal farmers, and 45% for other farmers, depending on the state-specific guidelines. This financial support significantly reduces the initial investment burden, making it more feasible for farmers to adopt advanced irrigation technologies.

The National Mission on Sustainable Agriculture (NMSA) also plays a crucial role in promoting sustainable agricultural practices. It emphasizes the adoption of integrated farming systems, efficient water management, and the use of modern technologies to enhance productivity. Through capacity building, training programs, and financial support, the NMSA encourages farmers to adopt practices that improve soil health and water use efficiency, complementing the objectives of center pivot irrigation systems.

Regional Insights

North America Leads Center Pivot Irrigation System Market with 42.5% Share in 2024

In 2024, North America held a dominant share of 42.5% in the center pivot irrigation system market, valued at approximately USD 0.6 billion. The region’s leadership in this market can be attributed to its advanced agricultural practices, large-scale farming operations, and strong demand for water-efficient irrigation systems. The United States, in particular, accounts for a significant portion of this market share, driven by the expansive farmland dedicated to water-intensive crops like corn, wheat, and soybeans. With increasing concerns over water scarcity and the rising cost of water, farmers in North America are increasingly adopting center pivot systems to optimize water use and improve crop yields.

In addition, government support and subsidies, particularly through programs such as the USDA’s Natural Resources Conservation Service (NRCS), have encouraged the adoption of advanced irrigation technologies. These initiatives aim to reduce water waste and enhance sustainable farming practices across the region. Moreover, North America’s emphasis on technological advancements, such as the integration of IoT and automation in irrigation systems, further bolsters the growth of the market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Netafim, an Israeli multinational, is a pioneer in drip and center pivot irrigation systems. It focuses on precision agriculture, water conservation, and yield enhancement through innovative automation, IoT, and remote management solutions. Netafim’s center pivots are designed for various terrains and crops, promoting sustainable farming practices. The company has a strong global presence, operating in over 110 countries, and collaborates with governments and NGOs to improve irrigation efficiency in water-scarce regions, driving adoption of modern irrigation technology worldwide.

Reinke Manufacturing Company, headquartered in the U.S., is recognized for its innovative center pivot and linear irrigation systems. Its solutions include automated and GPS-enabled pivots, improving water distribution and crop productivity. Reinke emphasizes energy-efficient designs and smart irrigation technology, catering to large-scale farms worldwide. With decades of experience, the company supports farmers through technical services, training, and robust after-sales support. Its systems are extensively used in North and South America, as well as parts of Africa and Asia.

Lindsay Corporation, based in Nebraska, U.S., manufactures high-quality irrigation systems including center pivots under its Zimmatic® brand. The company focuses on precision agriculture, integrating advanced sensors and remote monitoring technologies to optimize water use. Lindsay’s systems cater to various crops and terrains, supporting sustainable irrigation practices. It also offers engineering services, spare parts, and software solutions for efficient farm management. The corporation has a strong international footprint, serving farmers across North America, Latin America, and Australia.

Top Key Players Outlook

- Valmont Industries

- Lindsay Corporation

- T-L Irrigation Company

- Reinke Manufacturing Company

- Jain Irrigation Systems Ltd.

- Netafim

- Rivulis Irrigation

- Hunter Industries

- Pierce Corporation

- EPC Industries Limited (EPCO)

- Rain Bird Corporation

- Metzer

- OCMIS Irrigation

Recent Industry Developments

In 2024, Valmont reported full-year net sales of $4.08 billion, with the agriculture segment contributing approximately 26.7% to this total.

In 2023-24, JISL reported a turnover exceeding US$ 1.2 billion, with a significant portion attributed to its irrigation solutions, including center pivot systems. The company operates 33 manufacturing facilities across four continents and serves over 10 million farmers in more than 126 countries.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Pivot Points, Control Panels, Span, Sprinkler Drop, Tower Drive Wheels, Drive Train), By Mobility (Stationary, Mobile), By Crop Type (Oilseeds And Pulses, Cereals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Valmont Industries, Lindsay Corporation, T-L Irrigation Company, Reinke Manufacturing Company, Jain Irrigation Systems Ltd., Netafim, Rivulis Irrigation, Hunter Industries, Pierce Corporation, EPC Industries Limited (EPCO), Rain Bird Corporation, Metzer, OCMIS Irrigation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Center Pivot Irrigation System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Center Pivot Irrigation System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Valmont Industries

- Lindsay Corporation

- T-L Irrigation Company

- Reinke Manufacturing Company

- Jain Irrigation Systems Ltd.

- Netafim

- Rivulis Irrigation

- Hunter Industries

- Pierce Corporation

- EPC Industries Limited (EPCO)

- Rain Bird Corporation

- Metzer

- OCMIS Irrigation