Global Cement Paints Market By Type(Oil-based, Dry), By Technology(Acrylic, Synthetic, Waterproof, Others), By Application(Interior, Exterior), By End-use(Residential, Commercial, Industrial) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Sep 2024

- Report ID: 129606

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

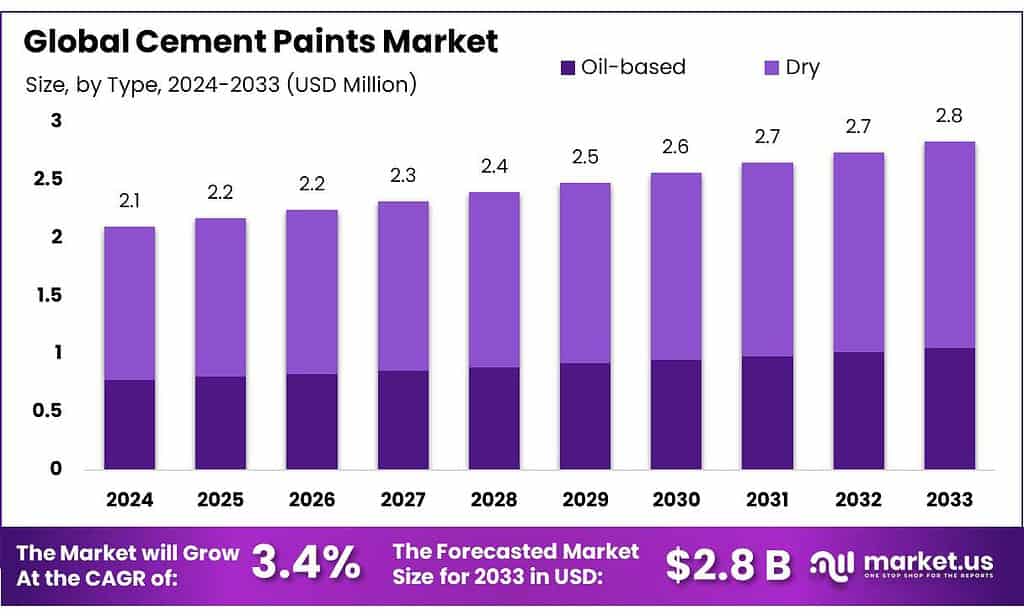

The global Cement Paints Market size is expected to be worth around USD 2.8 billion by 2033, from USD 2.1 billion in 2023, growing at a CAGR of 3.4% during the forecast period from 2023 to 2033.

The cement paints market encompasses the production and distribution of paints primarily made with cement as a binder, suitable for walls and surfaces in residential, commercial, and industrial settings. These paints are valued for their durability and weather resistance, making them ideal for exterior applications.

The market has been experiencing growth, driven largely by increased construction activities, especially in emerging economies where urbanization and infrastructure development are rapidly progressing. Government initiatives promoting sustainable building materials and regulations that encourage low-VOC (volatile organic compounds) formulations are further boosting market expansion.

Government regulations play a crucial role in shaping this sector. In regions like Europe and North America, stringent low-VOC regulations compel manufacturers to innovate and create eco-friendly products. Additionally, various governmental initiatives aimed at promoting green building practices have positively influenced the demand for cement paints.

Trade policies significantly affect the import-export dynamics of the cement paints market. For instance, Middle Eastern countries have ramped up imports of specialized cement paints due to ongoing construction projects fueled by urbanization. Meanwhile, the Asia Pacific region serves as both a major exporter and importer of cement paints, reflecting its vibrant construction sector.

Private investments in the construction and chemicals industries are also driving advancements in cement paint technology. Companies are prioritizing product innovations that enhance durability, color retention, and application ease.

Strategic partnerships between manufacturers and technology firms are leading to the development of smart coatings, offering benefits like self-cleaning properties and improved weather resistance. This comprehensive focus on sustainability and innovation underscores the industry’s adaptability to changing consumer preferences and regulatory demands.

Key Takeaways

- Cement Paints Market size is expected to be worth around USD 2.8 billion by 2033, from USD 2.1 billion in 2023, growing at a CAGR of 3.4%.

- oil-based cement paints held a dominant market position, capturing more than a 65% share.

- waterproof cement paints held a dominant market position, capturing more than a 38.5% share.

- exterior cement paints held a dominant market position, capturing more than a 63.4% share.

- residential applications held a dominant market position, capturing more than a 36.9% share.

- North America emerging as a dominant player, capturing approximately 36% of the market share.

By Type

In 2023, oil-based cement paints held a dominant market position, capturing more than a 65% share. These paints are favored for their durability and water resistance, making them suitable for various applications, especially in areas exposed to moisture. Oil-based formulations provide a smooth finish and are often used in industrial and commercial settings where robust protection is essential.

On the other hand, dry cement paints have been gaining traction of the market share. Known for their ease of application and quick drying times, these paints are increasingly popular for residential projects and renovations. Dry cement paints are environmentally friendly and often contain fewer harmful chemicals, appealing to consumers looking for sustainable options.

The growth in both segments reflects a diverse market catering to different needs. Oil-based paints are preferred in demanding environments, while dry paints are sought after for their convenience and eco-friendliness. As the cement paints market evolves, innovations in both types will likely enhance performance and sustainability, meeting the changing preferences of consumers and industry standards.

By Technology

In 2023, waterproof cement paints held a dominant market position, capturing more than a 38.5% share. These paints are highly valued for their ability to protect surfaces from moisture and weathering, making them ideal for exterior applications. Their durability and resistance to fading contribute to their popularity in both residential and commercial projects.

Acrylic cement paints followed closely, accounting for the market share. Known for their flexibility and ease of application, acrylic paints provide excellent adhesion and are suitable for various surfaces. They are often chosen for interior and exterior use due to their vibrant colors and long-lasting finish.

Synthetic cement paints represent paints are engineered for specific performance attributes, such as enhanced durability and resistance to harsh chemicals. Their applications are common in industrial settings where tough conditions require robust solutions.

The remaining segment includes other technologies. This category encompasses various niche products that cater to specialized needs. As the market evolves, advancements in technology across all segments are expected to drive innovation, improve performance, and meet the growing demand for sustainable and effective cement paint solutions.

By Application

In 2023, exterior cement paints held a dominant market position, capturing more than a 63.4% share. These paints are essential for protecting buildings from weather elements, making them ideal for outdoor applications. Their durability and resistance to fading ensure that surfaces remain attractive and well-maintained over time.

Interior cement paints are not as widely used as exterior options, interior paints are gaining popularity due to their aesthetic appeal and ease of maintenance. They offer a variety of finishes and colors, allowing for creative expression in residential and commercial spaces.

The strong demand for exterior cement paints is driven by ongoing construction and renovation activities, particularly in urban areas. In contrast, the interior segment benefits from trends in home improvement and design, as consumers seek durable and stylish options for their interiors. As the market continues to grow, innovations in both segments will likely enhance product performance and cater to evolving consumer preferences for sustainable and effective solutions.

By End-Use

In 2023, residential applications held a dominant market position, capturing more than a 36.9% share. This growth is driven by increasing homeowner interest in durable and aesthetically pleasing finishes for exterior and interior walls. Homeowners are increasingly choosing cement paints for their long-lasting properties and resistance to harsh weather conditions.

Commercial applications businesses are using cement paints to maintain attractive and durable facades, especially in retail and office spaces. The focus on creating welcoming environments has led to a rise in demand for high-quality finishes that can withstand heavy foot traffic and environmental exposure.

In industrial applications, these paints are essential for protecting facilities in sectors such as manufacturing and warehousing. Industrial environments require robust coatings that can resist chemicals and abrasions, making cement paints a practical choice.

cement paints market is supported by diverse end-use sectors, each with specific requirements. As trends in construction and design evolve, innovations in cement paint formulations will continue to enhance performance and appeal across residential, commercial, and industrial applications.

Key Market Segments

By Type

- Oil-based

- Dry

By Technology

- Acrylic

- Synthetic

- Waterproof

- Others

By Application

- Interior

- Exterior

By End-use

- Residential

- Commercial

- Industrial

Driving Factors

Increasing Construction Activities

One of the primary driving factors for the cement paints market is the robust growth in global construction activities. According to the Global Construction Perspectives and Oxford Economics, global construction output is expected to reach approximately USD 15 trillion by 2030, driven by urbanization and infrastructure development. This surge in construction projects significantly boosts demand for durable and weather-resistant cement paints.

Urbanization Trends

Urbanization continues to be a key trend, particularly in emerging economies. The United Nations estimates that by 2050, nearly 68% of the world’s population will live in urban areas. This trend is leading to a greater demand for housing and commercial spaces, directly increasing the need for effective building materials, including cement paints. As urban areas expand, the requirement for aesthetic and protective wall coatings becomes essential.

Government Initiatives and Regulations

Government initiatives promoting sustainable building practices are also influencing the cement paints market. Various countries are implementing regulations that encourage the use of eco-friendly materials. For instance, the European Union’s Green Deal aims to make Europe the first climate-neutral continent by 2050, which includes promoting low-emission building materials. These initiatives drive manufacturers to develop low-VOC and environmentally friendly cement paints, aligning with regulatory requirements and consumer preferences.

Rising Awareness of Aesthetic Appeal

There is an increasing consumer focus on aesthetic appeal in construction and renovation projects. Homeowners and businesses alike are looking for finishes that enhance the visual quality of their spaces. Cement paints, available in various colors and finishes, provide both durability and beauty, meeting these growing consumer expectations. The trend towards personalization in home design further fuels this demand.

Technological Advancements

Technological advancements in paint formulations also contribute to market growth. Innovations that enhance the performance characteristics of cement paints—such as improved adhesion, color retention, and self-cleaning properties—are attracting attention from both residential and commercial sectors. Manufacturers investing in research and development are introducing new products that meet evolving market needs, driving further adoption.

Increased Investment in Infrastructure

Increased investment in infrastructure projects, particularly in developing regions, acts as a significant driver for the cement paints market. According to the World Bank, global infrastructure investment needs are estimated to be around USD 97 trillion by 2040. This investment includes transportation, utilities, and residential buildings, all of which require protective coatings like cement paints. As governments and private entities commit to infrastructure development, demand for cement paints is expected to rise.

Restraining Factors

Volatility in Raw Material Prices

One of the significant restraining factors for the cement paints market is the volatility in raw material prices. Key ingredients like cement, pigments, and additives are subject to price fluctuations due to market demand and supply dynamics. According to the World Bank, the price of cement increased by around 8.6% from 2021 to 2022, and such volatility can impact the overall cost of cement paint production. This inconsistency can lead to higher prices for end consumers, potentially reducing demand.

Competition from Alternative Coatings

The cement paints market faces stiff competition from alternative coatings such as acrylic and synthetic paints. These alternatives often provide similar benefits, including durability and ease of application, but may be perceived as more user-friendly. The global acrylic paint market was valued at approximately USD 6.2 billion in 2023 and is projected to grow, indicating a robust competitive landscape that may hinder the growth of cement paints.

Environmental Regulations and Compliance Costs

While government initiatives promote sustainable building practices, they also impose stringent regulations that manufacturers must comply with. For example, the European Union’s REACH regulations require comprehensive testing and registration of chemicals used in paints. Compliance can be costly and time-consuming for manufacturers, diverting resources from research and development. According to a report by the European Commission, the costs of compliance with chemical regulations can account for up to 10% of a company’s annual budget, which may deter smaller manufacturers from entering the market.

Limited Awareness of Benefits

Despite the advantages of cement paints, limited consumer awareness poses a challenge. Many consumers are not fully informed about the benefits of cement paints, such as their durability, weather resistance, and aesthetic appeal. A survey by the International Council on Clean Transportation indicated that nearly 45% of consumers favored traditional paints over cement-based options due to unfamiliarity. This lack of awareness can lead to lower market penetration, particularly in residential applications.

Climate Change and Weather Variability

Climate change presents another restraint, affecting the construction sector as a whole. Unpredictable weather patterns can delay construction projects, reducing the demand for cement paints. The United Nations Framework Convention on Climate Change (UNFCCC) highlights that extreme weather events, including floods and hurricanes, are becoming more frequent, which can disrupt supply chains and impact the availability of materials for cement paints.

Skill Shortages in Application

The successful application of cement paints requires skilled labor. A shortage of skilled workers in the construction industry can hinder the effective use of cement paints, impacting their market growth. According to the U.S. Bureau of Labor Statistics, employment in the construction sector is expected to grow by 5% from 2020 to 2030, but skill gaps persist. This lack of trained personnel can lead to improper application and reduced customer satisfaction, further limiting market potential.

Growth Opportunities

Rising Demand for Eco-Friendly Products

One of the most significant growth opportunities in the cement paints market is the increasing consumer preference for eco-friendly and sustainable products. As environmental awareness rises, consumers and businesses are seeking materials that minimize environmental impact. According to a report from the United Nations Environment Programme, the global green building market is projected to reach USD 24.7 trillion by 2030, creating substantial demand for eco-friendly building materials, including cement paints. Manufacturers who focus on developing low-VOC and biodegradable formulations are well-positioned to capture this growing segment.

Expansion in Emerging Markets

Emerging markets, particularly in Asia Pacific and Africa, present significant growth opportunities for the cement paints market. The Asian Development Bank projects that Asia alone will need USD 26 trillion in infrastructure investments by 2030. As urbanization accelerates in these regions, there is a corresponding rise in construction activities, which drives the demand for cement paints. Countries like India and China are witnessing rapid growth in residential and commercial sectors, providing a fertile ground for cement paint manufacturers.

Technological Innovations

Technological advancements in paint formulations offer another growth avenue. Innovations that enhance the properties of cement paints, such as improved durability, faster drying times, and self-cleaning capabilities, can attract more consumers. For instance, the introduction of smart coatings—paints that can adapt to environmental conditions—can revolutionize the market.

Government Initiatives and Infrastructure Projects

Government initiatives aimed at promoting sustainable construction and infrastructure development can significantly boost the cement paints market. In countries like India, the government’s “Housing for All” mission aims to provide affordable housing by 2022, which directly increases the demand for building materials, including cement paints. Additionally, the European Union’s Green Deal emphasizes sustainable construction practices, providing incentives for the use of eco-friendly materials. Such initiatives encourage investment and create a favorable environment for cement paint adoption.

Customization and Aesthetic Trends

The growing trend toward customization in home and commercial spaces offers a unique opportunity for the cement paints market. Consumers are increasingly looking for personalized solutions that reflect their style and preferences. Cement paints can be produced in a variety of colors and finishes, making them an appealing option for both residential and commercial applications. According to a survey by the National Association of Home Builders, 60% of homeowners are willing to pay more for custom features, indicating a strong market potential for customized cement paints.

Increased Focus on Maintenance and Longevity

As property owners prioritize long-term maintenance and longevity in their construction choices, cement paints, known for their durability and resistance to weathering, become an attractive option. According to a study by the American Society of Civil Engineers, the maintenance cost of buildings can be reduced by up to 20% through the use of high-quality materials. This focus on cost-effective solutions presents a compelling argument for the adoption of cement paints in both residential and commercial projects.

Latest Trends

Adoption of Eco-Friendly Formulations

A significant trend in the cement paints market is the increasing adoption of eco-friendly formulations. Consumers are becoming more environmentally conscious and prefer products with lower volatile organic compounds (VOCs). According to the U.S. Environmental Protection Agency (EPA), VOC emissions can contribute to air pollution and health issues. As a result, regulations in many countries are pushing manufacturers to develop low-VOC or zero-VOC cement paints. The global green paint market, which includes eco-friendly cement paints, is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2021 to 2028, indicating strong consumer demand for sustainable options.

Integration of Smart Coatings Technology

Another emerging trend is the integration of smart coatings technology into cement paints. Smart coatings have features that allow them to respond to environmental changes, such as self-cleaning properties and temperature regulation. This growth indicates a strong interest in innovative products, presenting an opportunity for cement paint manufacturers to invest in smart technology and cater to evolving consumer needs.

Customization and Aesthetic Appeal

Customization is increasingly becoming a focal point for consumers in the cement paints market. Homeowners and businesses are looking for unique finishes and colors that reflect their styles. A survey conducted by the National Association of Home Builders found that over 60% of homeowners are willing to pay more for custom features. This trend is pushing manufacturers to offer a wider variety of colors and textures, enabling customers to create personalized spaces.

Emphasis on Durability and Longevity

There is also a growing emphasis on the durability and longevity of building materials, including cement paints. Property owners are more focused on long-term maintenance costs, leading to an increased preference for high-quality, durable materials. The American Society of Civil Engineers states that using superior materials can reduce maintenance costs by up to 20%. This trend encourages consumers to invest in cement paints known for their weather resistance and longevity.

Government Support for Sustainable Building Practices

Government initiatives aimed at promoting sustainable building practices are influencing trends in the cement paints market. For instance, the European Union’s Green Deal encourages the use of environmentally friendly materials in construction. The initiative aims to make Europe the first climate-neutral continent by 2050, which includes promoting low-emission building materials like eco-friendly cement paints. Such regulatory frameworks create a conducive environment for manufacturers to innovate and meet new standards.

Digital Marketing and E-commerce Growth

The rise of digital marketing and e-commerce is also shaping the cement paints market. More consumers are turning to online platforms to research and purchase products. Global e-commerce sales are expected to reach USD 6.4 trillion by 2024. This shift towards online shopping encourages manufacturers to enhance their digital presence, making it easier for consumers to access information about cement paints, their benefits, and application methods.

Regional Analysis

The global cement paints market exhibits significant regional variations, with North America emerging as a dominant player, capturing approximately 36% of the market share, valued at USD 0.86 billion in 2023. This dominance can be attributed to a robust construction sector and a growing preference for eco-friendly building materials. In the U.S., the demand for sustainable products is propelled by stringent environmental regulations and a shift towards green building practices.

In Europe, the market is characterized by a strong emphasis on sustainability, driven by regulatory frameworks like the European Union’s Green Deal. The region is witnessing an increasing adoption of low-VOC cement paints, contributing to market growth. The European market is projected to grow at a steady pace, reflecting a commitment to environmentally friendly construction solutions.

The Asia Pacific region is anticipated to experience the highest growth rate due to rapid urbanization and infrastructure development. Countries like India and China are heavily investing in construction projects, which is expected to boost the demand for cement paints. According to the Asian Development Bank, infrastructure investment in Asia could reach USD 26 trillion by 2030, creating vast opportunities for cement paint manufacturers.

The Middle East & Africa market is also gaining traction, particularly in nations undergoing significant urban development and construction activities. Latin America, while smaller in market size, is seeing increasing demand driven by rising construction activities and a focus on sustainable building materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The cement paints market is characterized by the presence of several prominent players, each contributing to innovation and market expansion. Asian Paints stands out as a leader in the industry, leveraging its extensive distribution network and strong brand presence across Asia. Similarly, BASF Coatings and PPG Industries are recognized for their advanced technologies and sustainable product offerings, which align with the growing consumer demand for eco-friendly solutions. Jotun and Berger Paints India also play vital roles, focusing on product differentiation and customization to meet specific customer needs.

Other significant players include Nippon Paint Holding Co., Ltd. and Kansai Nerolac Paints Limited, both of which have established a robust market presence in the Asia Pacific region. The Sherwin-Williams Company and Akzo Nobel N.V. enhance their competitiveness through strategic acquisitions and partnerships, enabling them to expand their product portfolios and geographic reach. Additionally, Sika AG and Dulux (AkzoNobel) are notable for their focus on innovation, offering advanced cement paint solutions that enhance durability and performance.

The competitive landscape also features emerging players such as Acro Paints Limited, Tata Pigments, and Farrow & Ball Ltd., who are gaining market traction through niche marketing strategies and sustainable product lines. As the demand for high-quality and eco-friendly cement paints continues to rise, these key players are well-positioned to capitalize on growth opportunities while addressing evolving consumer preferences.

Market Key Players

- Asian Paints

- BASF Coatings

- PPG Industries

- Jotun

- Berger Paints India

- Nippon Paint Holding Co., Ltd.

- Kansai Nerolac Paints Limited

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- Acro Paints Limited

- Sika AG

- Dulux (AkzoNobel)

- Shawcor Ltd.

- Sika AG

- Tata Pigments

- Kreidezeit

- Johnson Paints

- Africa Paints

- Farrow & Ball Ltd.

Recent Developers

In 2023 Asian Paints, the company reported a revenue of approximately USD 3.5 billion, showcasing a significant growth trajectory. Asian Paints has effectively positioned itself by introducing eco-friendly cement paint products that cater to the rising demand for sustainable building materials.

In 2023 BASF Coatings, the company reported revenues of approximately USD 24.4 billion, with a significant portion attributed to its coatings division.

Report Scope

Report Features Description Market Value (2023) US$ 2.1 Bn Forecast Revenue (2033) US$ 2.8 Bn CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Oil-based, Dry), By Technology(Acrylic, Synthetic, Waterproof, Others), By Application(Interior, Exterior), By End-use(Residential, Commercial, Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Asian Paints, BASF Coatings, PPG Industries, Jotun, Berger Paints India, Nippon Paint Holding Co., Ltd., Kansai Nerolac Paints Limited, The Sherwin-Williams Company, Akzo Nobel N.V., Acro Paints Limited, Sika AG, Dulux (AkzoNobel), Shawcor Ltd., Sika AG, Tata Pigments, Kreidezeit, Johnson Paints, Africa Paints, Farrow & Ball Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asian Paints

- BASF Coatings

- PPG Industries

- Jotun

- Berger Paints India

- Nippon Paint Holding Co., Ltd.

- Kansai Nerolac Paints Limited

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- Acro Paints Limited

- Sika AG

- Dulux (AkzoNobel)

- Shawcor Ltd.

- Sika AG

- Tata Pigments

- Kreidezeit

- Johnson Paints

- Africa Paints

- Farrow & Ball Ltd.