Cellulose Gel Market By Source (Cotton Cellulose and Wood Cellulose), By Application (Food & Beverages, Pharmaceuticals, Paper & Pulp, Textile, and Automobile), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132576

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Source Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Cellulose Gel Market

- Recent Developments

- Report Scope

Report Overview

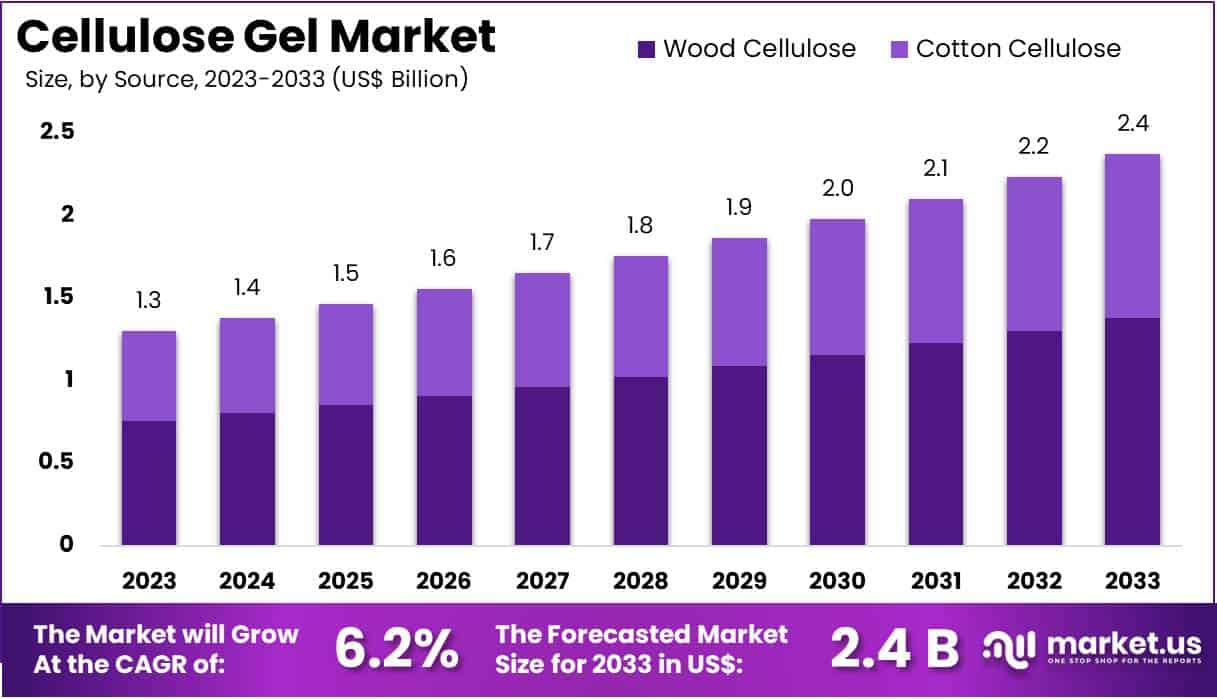

The Cellulose Gel Market size is expected to be worth around US$ 2.4 billion by 2033 from US$ 1.3 billion in 2023, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

Growing demand for natural and sustainable ingredients drives the cellulose gel market, as industries such as food, pharmaceuticals, and personal care seek eco-friendly alternatives for texture and stabilization. Cellulose gel, derived from plant-based cellulose, finds applications across these sectors due to its exceptional water-binding and thickening properties, which enhance product consistency and stability.

In April 2022, Nouryon, a Netherlands-based specialty chemicals company, introduced Bermocoll flow cellulose ethers, offering superior sag resistance, leveling, and spatter resistance compared to traditional thickeners. This water-soluble product, designed for low-VOC paint formulations and compatible with airless spray applications, provides a more sustainable solution for interior and exterior decorative paints, supporting the shift toward eco-conscious production.

Recent trends in the cellulose gel market also reflect growing interest in low-calorie and gluten-free food products, where cellulose gel enhances mouthfeel and structural integrity. In pharmaceuticals, cellulose gel enables the controlled release of active ingredients, aligning with the industry’s focus on precision dosing. Rising consumer preference for natural, renewable ingredients creates substantial opportunities for cellulose gel as a sustainable thickening and stabilizing agent in various formulations.

Key Takeaways

- In 2023, the market for Cellulose Gel generated a revenue of US$ 1.3 billion, with a CAGR of 6.2%, and is expected to reach US$ 2.4 billion by the year 2033.

- The source segment is divided into cotton cellulose and wood cellulose, with wood cellulose taking the lead in 2023 with a market share of 58.3%.

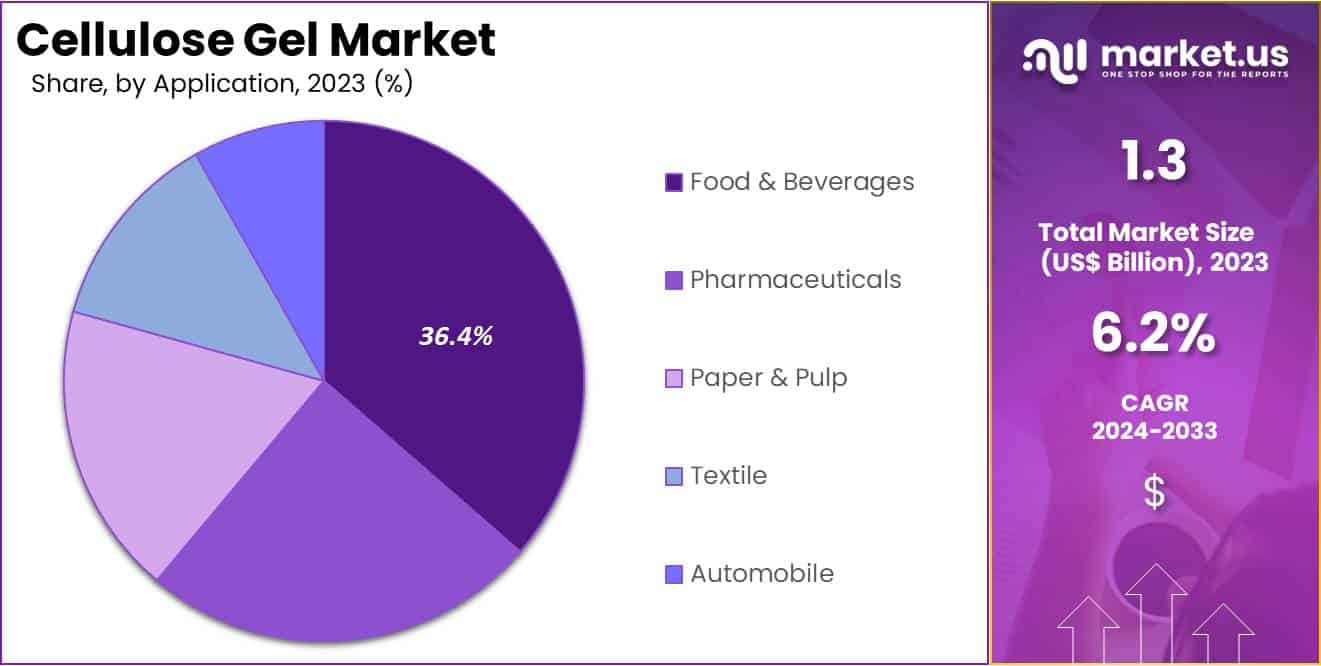

- Considering application, the market is divided into food & beverages, pharmaceuticals, paper & pulp, textile, and automobile. Among these, food & beverages held a significant share of 36.4%.

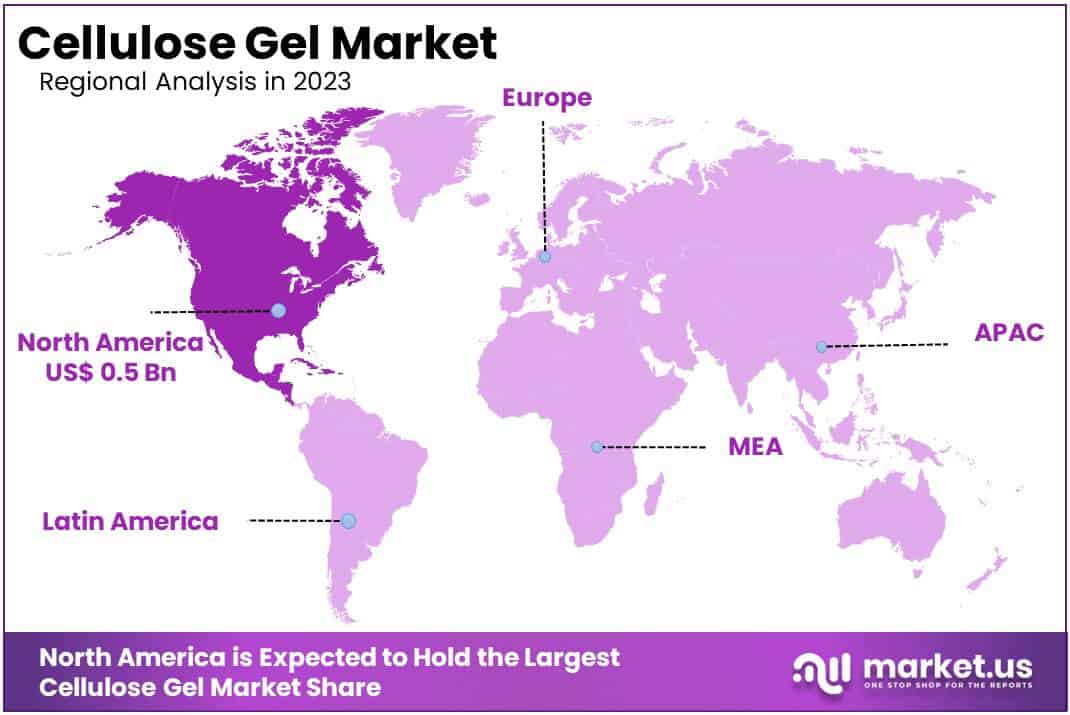

- North America led the market by securing a market share of 38.4% in 2023.

Source Analysis

The wood cellulose segment led in 2023, claiming a market share of 58.3% owing to wood cellulose’s abundant availability and cost-effectiveness, making it a preferred choice among manufacturers. As demand rises for sustainable, plant-based ingredients in food, pharmaceuticals, and cosmetics, wood cellulose offers an eco-friendly option due to its renewability and biodegradability.

Furthermore, advancements in extraction and processing technologies have improved the quality and consistency of wood cellulose-derived gel, increasing its applicability across various industries. Wood cellulose also provides a more efficient yield than cotton cellulose, contributing to a higher production rate and reduced resource consumption.

The growing focus on reducing the environmental impact of industrial inputs supports the shift toward wood cellulose, positioning this segment for significant expansion within the cellulose gel market.

Application Analysis

The food & beverages held a significant share of 36.4% due to the rising demand for stabilizers, thickeners, and fat replacers in processed foods, where cellulose gel serves as an effective ingredient for enhancing texture and shelf life. The increasing preference for low-fat and plant-based foods further supports the adoption of cellulose gel in various formulations, as it offers a natural alternative to synthetic additives.

As consumer awareness grows regarding clean-label ingredients, food manufacturers increasingly turn to cellulose gel to meet these demands. Additionally, the versatility of cellulose gel in various food applications, such as baked goods, dairy alternatives, and beverages, drives its appeal in the food industry. With an expanding focus on health-conscious and sustainable food products, the food and beverages segment is likely to witness substantial growth in the cellulose gel market.

Key Market Segments

By Source

- Cotton Cellulose

- Wood Cellulose

By Application

- Food & Beverages

- Pharmaceuticals

- Paper & Pulp

- Textile

- Automobile

Drivers

Rising Demand for Low-Fat and Low-Calorie Foods

The increasing consumer preference for healthier food options has significantly driven the demand for cellulose gel, a common food additive used to enhance texture and stability in low-fat and low-calorie products. As individuals become more health-conscious, there is a notable shift towards foods that offer reduced fat and calorie content without compromising taste or mouthfeel.

Cellulose gel serves as an effective fat replacer and stabilizer, making it indispensable in the formulation of such products. The global trend towards healthier eating habits has led food manufacturers to incorporate cellulose gel into a variety of products, including dairy alternatives, baked goods, and sauces, to meet consumer expectations.

This shift is evident in the growing market share of health-oriented food products, which has, in turn, bolstered the demand for functional ingredients like cellulose gel. As the focus on health and wellness continues to intensify, the utilization of cellulose gel in food processing is expected to expand, supporting the development of innovative, health-conscious food products.

Restraints

Regulatory Challenges and Compliance

Stringent regulatory standards and compliance requirements pose significant challenges to the cellulose gel market. Food safety authorities, such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), have established rigorous guidelines governing the use of food additives, including cellulose gel.

Manufacturers must ensure that their products meet these standards, which often involves extensive testing and documentation to demonstrate safety and efficacy. Navigating the complex regulatory landscape can be resource-intensive and time-consuming, potentially delaying product launches and increasing operational costs.

Additionally, variations in regulations across different regions necessitate tailored compliance strategies, further complicating market entry and expansion efforts. Non-compliance can result in product recalls, legal penalties, and reputational damage, underscoring the critical importance of adhering to regulatory requirements. These challenges may deter smaller companies from entering the market and limit the growth potential of existing players.

Opportunities

Expansion into Emerging Markets

The burgeoning food and beverage industries in emerging markets present a significant growth opportunity for cellulose gel manufacturers. Countries in Asia, Africa, and Latin America are experiencing rapid urbanization and rising disposable incomes, leading to increased consumption of processed and convenience foods. This shift in dietary habits drives the demand for food additives that enhance product quality and shelf life.

Cellulose gel, known for its stabilizing and texturizing properties, is increasingly sought after in these regions to meet consumer expectations for high-quality food products. Moreover, the growing awareness of health and wellness in these markets has led to a preference for low-fat and low-calorie foods, further boosting the demand for cellulose gel as a fat replacer.

Manufacturers that strategically invest in these emerging markets can capitalize on the expanding consumer base and the evolving food industry landscape. Establishing local production facilities and distribution networks can enhance market penetration and foster long-term growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the cellulose gel market, presenting both challenges and opportunities. Economic downturns can reduce consumer spending on processed foods, leading to decreased demand for food additives like cellulose gel. Trade tensions and tariffs may disrupt the supply chain, affecting the availability and cost of raw materials essential for cellulose gel production.

Additionally, geopolitical instability can lead to regulatory uncertainties, complicating market operations. However, economic growth in emerging markets offers opportunities for expansion, as rising incomes and urbanization increase the consumption of processed foods, thereby boosting demand for cellulose gel.

Furthermore, international trade agreements can facilitate market access and reduce costs, enhancing profitability. Government initiatives promoting sustainable and plant-based ingredients align with the properties of cellulose gel, potentially increasing its adoption. Overall, while macroeconomic and geopolitical factors present certain risks, strategic planning and adaptability can enable companies to navigate these challenges and capitalize on growth opportunities in the cellulose gel market.

Latest Trends

Adoption of Sustainable and Plant-Based Ingredients

There is a notable trend towards the adoption of sustainable and plant-based ingredients in the food industry, which positively impacts the cellulose gel market. Consumers are increasingly conscious of environmental sustainability and animal welfare, leading to a surge in demand for plant-derived food products. Cellulose gel, extracted from plant sources such as wood pulp and cotton, aligns with this consumer preference for natural and sustainable ingredients.

Food manufacturers are responding by reformulating products to include plant-based additives, thereby reducing reliance on animal-derived components. This shift is evident in the growing market share of plant-based foods, which has, in turn, bolstered the demand for functional ingredients like cellulose gel.

Additionally, cellulose gel’s biodegradability and low environmental impact make it an attractive choice for companies aiming to enhance their sustainability profiles. As the focus on sustainability and plant-based diets continues to intensify, the utilization of cellulose gel in food processing is expected to expand, supporting the development of innovative, eco-friendly food products.

Regional Analysis

North America is leading the Cellulose Gel Market

North America dominated the market with the highest revenue share of 38.4% owing to rising demand in the food and beverage industry and increasing interest in sustainable food additives. The expanding processed food sector, particularly in Canada and the United States, has significantly fueled the use of cellulose gel as a stabilizer and thickening agent in various food products.

According to Agriculture and Agri-Food Canada (AAFC), exports of processed food and beverage products from Canada reached a record high of $54.3 billion in 2022, marking a substantial 14.1% increase from 2021. This surge in exports highlights the growing demand for processed foods that rely on functional ingredients like cellulose gel for texture and shelf life enhancement.

Additionally, the push for plant-based and clean-label ingredients has encouraged manufacturers to incorporate cellulose gel as a sustainable alternative to synthetic additives. Regulatory support for natural food ingredients, along with technological advancements in cellulose processing, has further strengthened the market for cellulose gel across North America’s food, cosmetics, and pharmaceutical sectors.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing demand across the food, cosmetics, and textile industries. With urbanization and rising disposable incomes in countries such as China and India, demand for processed foods and personal care products containing natural ingredients is anticipated to rise.

In February 2024, Birla Cellulose introduced its innovative product, Birla Viscose – Intellicolor, at the Bharat Tex event, marking a breakthrough in the textile industry by addressing long-standing challenges in conventional reactive dyeing. This development exemplifies the region’s push for sustainable and efficient solutions in cellulose-based applications.

The rise of eco-friendly production processes and the adoption of cellulose gel in various end-use industries are expected to support market expansion. As the region increasingly emphasizes sustainable production and natural additives, collaborations between manufacturers and research institutions are likely to drive innovations in cellulose gel applications, particularly in Asia’s fast-growing markets for food and textile products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Cellulose Gel market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the cellulose gel market drive growth by diversifying their product portfolios to cater to various industries, including food, pharmaceuticals, and cosmetics.

Many companies invest in research and development to improve the functionality and quality of their offerings, aiming to meet specific industry requirements such as enhanced stability or improved texture. Strategic partnerships with suppliers and distributors allow them to secure a steady supply chain and broaden market reach.

Businesses also focus on sustainable sourcing and production methods to appeal to environmentally conscious consumers. Robust marketing and educational initiatives further promote product benefits, boosting adoption across multiple sectors.

Top Key Players in the Cellulose Gel Market

- Sigachi Industrial Pvt. Ltd.

- Roquette

- Rayonier Advanced Materials

- JRS Pharma GmbH and Co.KG

- DowDuPont

- DFE Pharma GmbH and Co.KG

- Avantor Performance Materials Inc

- Asahi Kasei Chemicals Corporation

- Accent Microcell Pvt. Ltd.

Recent Developments

- In February 2023: the Japanese multinational corporation Asahi Kasei completed the construction of its second plant for Ceolus microcrystalline cellulose (MCC) at its Mizushima Works in Japan. This new facility is strategically designed to meet the growing demand for MCC, which is extensively used in the formulation of pharmaceutical tablets. This expansion supports the growth of the cellulose gel market by increasing production capacity to fulfill demand from the pharmaceutical sector for high-quality cellulose-based excipients.

- In September 2022: Roquette, a leading provider of plant-based ingredients from France, acquired Crest Cellulose Pvt. Ltd., further strengthening its position in the cellulose derivatives market. This acquisition expands Roquette’s portfolio and capabilities in cellulose-based products for pharmaceutical and personal care applications. By enhancing its production and distribution capabilities in cellulose derivatives, Roquette’s strategic move supports growth in the cellulose gel market, as demand for plant-based and functional ingredients continues to rise across multiple industries.

Report Scope

Report Features Description Market Value (2023) US$ 1.3 billion Forecast Revenue (2033) US$ 2.4 billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Cotton Cellulose and Wood Cellulose), By Application (Food & Beverages, Pharmaceuticals, Paper & Pulp, Textile, and Automobile) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sigachi Industrial Pvt. Ltd., Roquette, Rayonier Advanced Materials, JRS Pharma GmbH and Co.KG, DowDuPont, DFE Pharma GmbH and Co.KG, Avantor Performance Materials Inc, Asahi Kasei Chemicals Corporation, and Accent Microcell Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sigachi Industrial Pvt. Ltd.

- Roquette

- Rayonier Advanced Materials

- JRS Pharma GmbH and Co.KG

- DowDuPont

- DFE Pharma GmbH and Co.KG

- Avantor Performance Materials Inc

- Asahi Kasei Chemicals Corporation

- Accent Microcell Pvt. Ltd.