Global Cell Therapy Monitoring Kits Market Analysis By Type of Cell Therapy (T-Cell Therapies, Stem Cell Therapies, Chimeric Antigen Receptor (CAR) T-Cell Therapies, Natural Killer (NK) Cell Therapies, Others), By Application (Oncology (Cancer Treatment), Autoimmune Diseases, Cardiovascular Diseases, Neurological Disorders, Musculoskeletal Disorders, Others), By End-Use (Hospitals and Clinics, Research Institutes, Biotechnology and Pharmaceutical Companies, Contract Research Organizations (CROs)), By Technology (Flow Cytometry, PCR (Polymerase Chain Reaction), ELISA (Enzyme-Linked Immunosorbent Assay), Cell Imaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 84755

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Cell Therapy Monitoring Kits Market size is expected to be worth around USD 4.2 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 5% during the forecast period from 2024 to 2033.

In the rapidly developing sector of cell therapy, key stakeholders such as pharmaceutical and biotechnology companies, contract research organizations (CROs), and hospitals and academic institutions heavily depend on monitoring kits. These kits are essential for maintaining regulatory compliance and ensuring the effectiveness of treatments.

Pharmaceutical and biotechnology firms extensively utilize these monitoring kits in clinical trials to meet rigorous quality standards. A recent development by 908 Devices in 2023 introduced a device that allows real-time monitoring of crucial metabolites like glucose and lactate. This technology is vital for optimizing cell culture conditions and enhancing manufacturing processes.

CROs use these tools to conduct thorough analysis and validation of cell therapy procedures, ensuring that results adhere to scientific and regulatory requirements. Hospitals and academic institutions also rely on these technologies to track therapy outcomes, thus safeguarding patient safety and the effectiveness of treatments in both clinical and research environments.

In the United States, the Food and Drug Administration (FDA) sets strict standards for these monitoring kits under regulations like 21 CFR Parts 1271, 600, and 610. These guidelines focus on safety, potency, and consistency, mandating rigorous monitoring and quality control during production to manage the variability of biological materials and ensure the reproducibility of product batches. The European Medicines Agency (EMA) enforces similar stringent regulations for cell therapies in the European Union, emphasizing high safety and efficacy standards.

Government agencies and private sector investments are significantly boosting research in cell therapy. For instance, the U.S. National Institutes of Health (NIH) allocated nearly $48 billion in 2023 for medical research, supporting numerous research projects through grants. Venture capitalists are also actively investing in startups that innovate new technologies for cell therapy, recognizing the potential for substantial returns.

Strategic collaborations and business decisions, such as mergers and acquisitions, play crucial roles in market expansion. An example is Thermo Fisher’s acquisition of Life Technologies, which expanded their product range in the cell therapy field. Additionally, regulatory environments are adapting to allow quicker approvals for new therapies, particularly in critical areas like oncology, speeding up access to innovative treatments.

Key Takeaways

- Market Size: Expected to reach USD 4.2 Billion by 2033, growing at 5% CAGR from 2024 to 2033.

- Segment Dominance: T-Cell Therapies hold over 40.6% market share in 2023, driven by efficacy in treating autoimmune diseases and cancers.

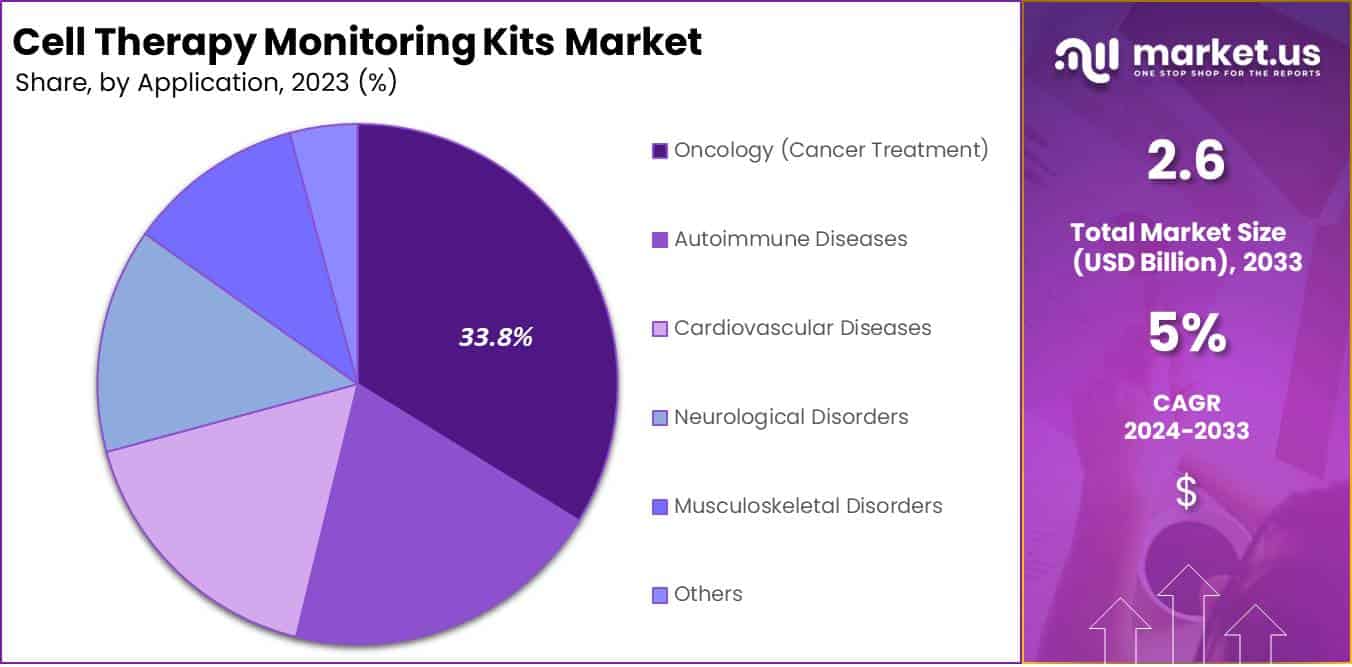

- Leading Application: Oncology secures 33.8% market share in 2023 due to rising cancer prevalence and need for precise monitoring.

- Primary End-Users: Hospitals and Clinics command 46.2% market share, followed by Research Institutes and Biotech/Pharma.

- Leading Technology: Flow Cytometry captures 34.0% market share in 2023, known for accurate cellular analysis.

- Market Driver: Increasing demand for personalized medicine fuels market growth, emphasizing monitoring kit necessity.

- Regulatory Restraints: FDA and EMA guidelines pose challenges, demanding strict compliance for safety and quality.

- Technological Opportunities: Advances in biomarker detection enhance diagnostic accuracy and treatment strategies.

- AI Integration: Artificial Intelligence revolutionizes monitoring, enabling real-time decision-making and process optimization.

- Regional Dominance: North America leads with 34% market share in 2023, driven by advanced research infrastructure and collaborations.

Type of Cell Therapy Analysis

In 2023, the T-Cell Therapies segment maintained a leading position in the Cell Therapy Monitoring Kits Market, accounting for over 40.6% of the market share. This segment’s growth is driven by the rising incidence of autoimmune diseases and various cancers, where T-cell therapies are critical. Enhanced techniques in T-cell engineering that improve their effectiveness against cancer have increased the demand for sophisticated monitoring kits. These kits are crucial for tracking therapy effectiveness and ensuring patient safety. Stem Cell Therapies also represent a significant market share, favored for their potential in regenerative medicine and chronic disease treatments, necessitating continuous monitoring to observe therapeutic progress and stem cell dynamics.

The market for Chimeric Antigen Receptor (CAR) T-Cell Therapies is witnessing rapid advancements. As a cutting-edge immunotherapy approach, it demands rigorous monitoring to handle complications such as cytokine release syndrome and neurotoxicity. This need has spurred the development of specialized monitoring kits. Meanwhile, the Natural Killer (NK) Cell Therapies segment, though smaller, is growing due to its increasing application in treating infectious diseases and cancers. The demand for NK cell monitoring kits is expected to rise with the expansion of clinical trials and therapeutic applications. Additionally, the market includes diverse emerging therapies, each requiring unique monitoring solutions to enhance treatment precision and monitor patient outcomes effectively.

Application Analysis

In 2023, the Oncology (Cancer Treatment) segment emerged as a leading segment in the Cell Therapy Monitoring Kits Market, securing over 33.8% of the market share. This dominance is largely due to the rising prevalence of cancer worldwide and the vital need for accurate monitoring in cell therapy treatments within oncology. The use of these monitoring kits is crucial for providing real-time data on treatment effectiveness and patient response, thus supporting personalized therapeutic approaches and enhancing clinical outcomes. Additionally, the Autoimmune Diseases segment shows significant growth, driven by an increase in conditions like multiple sclerosis and rheumatoid arthritis, where continuous efficacy monitoring of cell-based therapies is essential.

The market segments dealing with Cardiovascular Diseases and Neurological Disorders are also seeing a rise in the adoption of cell therapy monitoring kits. For cardiovascular ailments, these kits are indispensable for tracking myocardial tissue regeneration and assessing cell transplant viability, which is critical for treatment success. Neurological conditions, including Parkinson’s and Alzheimer’s disease, require precise monitoring to ensure the integration and functionality of therapeutic cells in the nervous system. Moreover, the Musculoskeletal Disorders segment benefits from these kits in monitoring cell therapies for diseases like osteoarthritis. The ‘Others’ segment, which includes applications like wound healing, also predicts growth as new cell therapy uses are explored.

End-Use Analysis

In 2023, the Hospitals and Clinics segment secured a dominant position in the End-Use Segment of the Cell Therapy Monitoring Kits Market, accounting for over 46.2% of the market share. This leadership is largely due to the critical need for precise and timely monitoring of cell therapy outcomes within clinical environments. As key providers of advanced therapies, hospitals and clinics have rapidly integrated these kits to improve patient care and treatment outcomes. Following closely are Research Institutes, which play a crucial role in developing and refining new cellular therapies and monitoring techniques, further propelling the demand for specialized monitoring kits.

Meanwhile, Biotechnology and Pharmaceutical Companies also hold a significant share of the market. These companies utilize monitoring kits extensively during the development phases of new cell therapies, assessing both efficacy and safety. This segment’s growth is driven by the expanding pipeline of cell therapies entering clinical trials. Contract Research Organizations (CROs) have also increased their usage of these kits, supporting outsourced clinical trials for biopharmaceutical firms. The surge in outsourcing clinical development tasks necessitates robust monitoring tools to maintain regulatory compliance and ensure the integrity of trial data, underlining the growing importance of these kits in the market.

Technology Analysis

In 2023, the Flow Cytometry segment emerged as a leader in the Technology Segment of the Cell Therapy Monitoring Kits Market, securing over a 34.0% share. This method is especially favored for its accuracy and efficiency in analyzing cellular properties and complexities, which are essential for monitoring cell therapies. Its capability to provide quick and reliable results makes it an essential tool in both clinical and research settings. Meanwhile, the Polymerase Chain Reaction (PCR) technology also plays a crucial role, appreciated for its high sensitivity and specificity in detecting and quantifying genetic materials, thereby supporting the validation of cell therapies.

Additionally, the Enzyme-Linked Immunosorbent Assay (ELISA) remains a critical component of the market, primarily used for protein quantification and antibody detection in cell therapy applications. Cell Imaging technologies have also seen increased integration into monitoring kits, offering detailed insights into cell behavior and morphology. Moreover, emerging technologies like next-generation sequencing and bioinformatics are gaining popularity for their comprehensive analysis capabilities in cellular functions and treatment efficacy. As the demand for effective cell therapies grows, these technologies are expected to expand their market presence, further driving the sector’s growth.

Key Market Segments

Type of Cell Therapy

- T-Cell Therapies

- Stem Cell Therapies

- Chimeric Antigen Receptor (CAR) T-Cell Therapies

- Natural Killer (NK) Cell Therapies

- Others

Application

- Oncology (Cancer Treatment)

- Autoimmune Diseases

- Cardiovascular Diseases

- Neurological Disorders

- Musculoskeletal Disorders

- Others

End-Use

- Hospitals and Clinics

- Research Institutes

- Biotechnology and Pharmaceutical Companies

- Contract Research Organizations (CROs)

Technology

- Flow Cytometry

- PCR (Polymerase Chain Reaction)

- ELISA (Enzyme-Linked Immunosorbent Assay)

- Cell Imaging

- Others

Drivers

Increasing Demand for Personalized Medicine

The rise in demand for personalized medicine acts as a significant driver for the Global Cell Therapy Monitoring Kits Market. Personalized medicine, which tailors medical treatment to the individual characteristics of each patient, often requires the use of cell therapy monitoring to optimize therapeutic outcomes. This has led to an increase in the use of monitoring kits which are essential for tracking the efficacy and safety of cell therapies.

Restraints

Regulatory and Ethical Challenges

The regulatory and ethical challenges associated with cell therapy monitoring kits significantly restrain the market’s growth. These challenges primarily revolve around the complex approval processes mandated by regulatory bodies like the FDA and the EMA, which are designed to ensure the safety, efficacy, and quality of new therapies. For instance, the FDA’s stringent guidelines for cell therapy products require detailed documentation of the manufacturing processes and controls used to prevent the transmission of communicable diseases. The WHO has also highlighted the need for regulatory convergence to facilitate the global development and approval of such therapies.

Opportunities

Advances in Biomarker Detection Technology

Advances in biomarker detection technology are significantly enhancing the capabilities of cell therapy monitoring kits in the healthcare sector. Recent developments in nano-fluorescent probes, such as the use of metal nanoclusters and quantum dots, have led to breakthroughs in cancer biomarker detection. These advancements have resulted in increased sensitivity and specificity, allowing for the simultaneous detection of multiple biomarkers and the visualization of disease-specific sites at a molecular level. Additionally, next-generation sequencing (NGS) technologies have revolutionized the field by enabling the rapid identification of unknown genetic variants and supporting the development of companion diagnostics for precision therapies.

Moreover, the National Cancer Institute highlights that biomarkers play a critical role in the early detection of diseases, guiding treatment decisions, and monitoring disease progression, which is crucial for the effective management of cancer and other diseases. The integration of these technologies into cell therapy monitoring kits offers a promising opportunity to improve diagnostic accuracy and personalize treatment strategies, addressing the growing demands of the healthcare industry. These technological advancements are set to expand the diagnostic toolkit, previously dominated by traditional methods like PCR and ELISA tests, providing a more comprehensive approach to disease management and treatment efficacy evaluation.

Trends

Integration of Artificial Intelligence (AI)

The integration of Artificial Intelligence (AI) in the Cell Therapy Monitoring Kits Market is poised to transform the landscape of healthcare monitoring significantly. AI applications in data analysis and pattern recognition enhance predictive accuracy and efficiency in monitoring cell therapies. This technological advancement enables more personalized treatment plans and supports real-time decision-making, which are crucial in clinical settings. Notably, AI-driven deep learning algorithms improve monitoring and inspection activities in biomanufacturing, previously challenging to automate fully. This integration not only optimizes manufacturing processes by enabling adaptive modeling and the use of “digital twins” to emulate physical systems but also improves process control, ensuring batch quality through real-time assessment and anomaly detection.

Regional Analysis

In 2023, North America asserted its dominance in the Cell Therapy Monitoring Kits Market, commanding over 34% market share and a value of USD 0.8 Billion. This stronghold stems from the region’s advanced research infrastructure and continuous technological innovations. Collaborations among academic institutions and pharmaceutical companies have further propelled the development of cutting-edge monitoring solutions, solidifying North America’s position as a frontrunner in the industry. Additionally, stringent regulatory oversight by bodies like the FDA ensures the safety and efficacy of monitoring kits, instilling trust among stakeholders and driving market growth in the region.

Moreover, North America’s escalating burden of chronic diseases, including cancer and cardiovascular disorders, has fueled the demand for innovative cell-based therapies. This, in turn, has heightened the need for reliable monitoring tools to assess treatment efficacy. With a supportive regulatory environment and a robust healthcare ecosystem, North America is poised to maintain its leadership in the Cell Therapy Monitoring Kits Market. However, market players must remain vigilant, adapting to emerging trends and regulatory shifts to capitalize on future growth prospects in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic Cell Therapy Monitoring Kits Market, several key players stand at the forefront of innovation and progress. Among these influential figures are STEMCELL Technologies Inc., Lonza Group, Thermo Fisher Scientific Inc., and Merck KGaA (Sigma-Aldrich), alongside other notable contributors. STEMCELL Technologies Inc. is renowned for its dedication to advancing cell science through the development of high-quality products and pioneering solutions. Lonza Group, with its expertise in life sciences and biotechnology, offers a diverse range of products and services tailored specifically to cell therapy applications, contributing significantly to technological advancements in the market.

Thermo Fisher Scientific Inc., a global leader in scientific services, provides an extensive portfolio of monitoring solutions, playing a crucial role in driving the adoption of monitoring kits across various cell therapy applications. Merck KGaA, operating under the Sigma-Aldrich brand, is recognized for its excellence in delivering top-tier products and services in the life sciences industry, including reliable tools and technologies for efficient monitoring and quality control processes. Together, these key players, alongside others in the market, collectively shape the landscape of the Cell Therapy Monitoring Kits Market, driving advancements that support the growth and efficacy of cell therapy applications on a global scale.

Market Key Players

- STEMCELL Technologies Inc.

- Lonza Group

- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- BD Biosciences

- Miltenyi Biotec

- GE Healthcare

- Sartorius AG

- PerkinElmer Inc.

- Cell Biolabs Inc.

Recent Developments

- In March 2024, BD Biosciences disclosed a collaboration with Celgene, a Bristol Myers Squibb company. Together, they aim to develop and bring to market a novel flow cytometry-based cell therapy monitoring kit tailored for CAR-T therapies targeting B-cell malignancies. This partnership combines BD’s proficiency in flow cytometry with Celgene’s extensive experience in CAR-T therapy development.

- In February 2024, Merck KGaA (Sigma-Aldrich) made a strategic investment in the Cell Therapies Group. This company specializes in the development of CAR-T cell therapies for solid tumors. Merck’s investment underscores its commitment to expanding its footprint in the field of cell therapy, potentially paving the way for future advancements in cell therapy monitoring kits.

- In August 2023, Thermo Fisher Scientific introduced the Applied Biosystems QuantiGene Plex CFTR Cell Therapy Monitoring Kit. This new product streamlines the process of quantifying CFTR mRNA expression in CAR-T cells, facilitating the monitoring of cell therapy effectiveness.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Bn Forecast Revenue (2033) USD 4.2 Bn CAGR (2024-2033) 5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Cell Therapy (T-Cell Therapies, Stem Cell Therapies, Chimeric Antigen Receptor (CAR) T-Cell Therapies, Natural Killer (NK) Cell Therapies, Others), By Application (Oncology (Cancer Treatment), Autoimmune Diseases, Cardiovascular Diseases, Neurological Disorders, Musculoskeletal Disorders, Others), By End-Use (Hospitals and Clinics, Research Institutes, Biotechnology and Pharmaceutical Companies, Contract Research Organizations (CROs)), By Technology (Flow Cytometry, PCR (Polymerase Chain Reaction), ELISA (Enzyme-Linked Immunosorbent Assay), Cell Imaging, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape STEMCELL Technologies Inc., Lonza Group, Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), BD Biosciences, Miltenyi Biotec, GE Healthcare, Sartorius AG, PerkinElmer Inc., Cell Biolabs Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Therapy Monitoring Kits MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Cell Therapy Monitoring Kits MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- STEMCELL Technologies Inc.

- Lonza Group

- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- BD Biosciences

- Miltenyi Biotec

- GE Healthcare

- Sartorius AG

- PerkinElmer Inc.

- Cell Biolabs Inc.