Global Cell Regeneration Medicine Market By Product Type (Therapeutics (Cell & Gene-based), Tools, Banks and Services), By Therapeutic Category (Oncology, Dermatology, Musculoskeletal and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171684

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

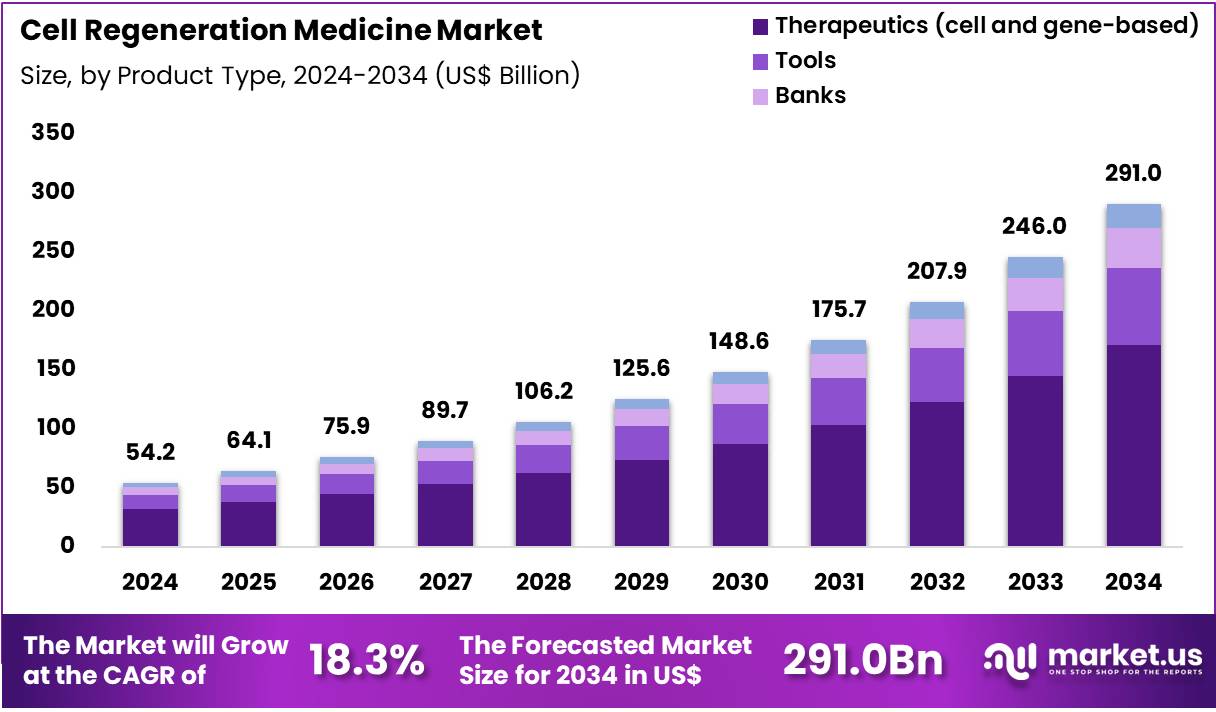

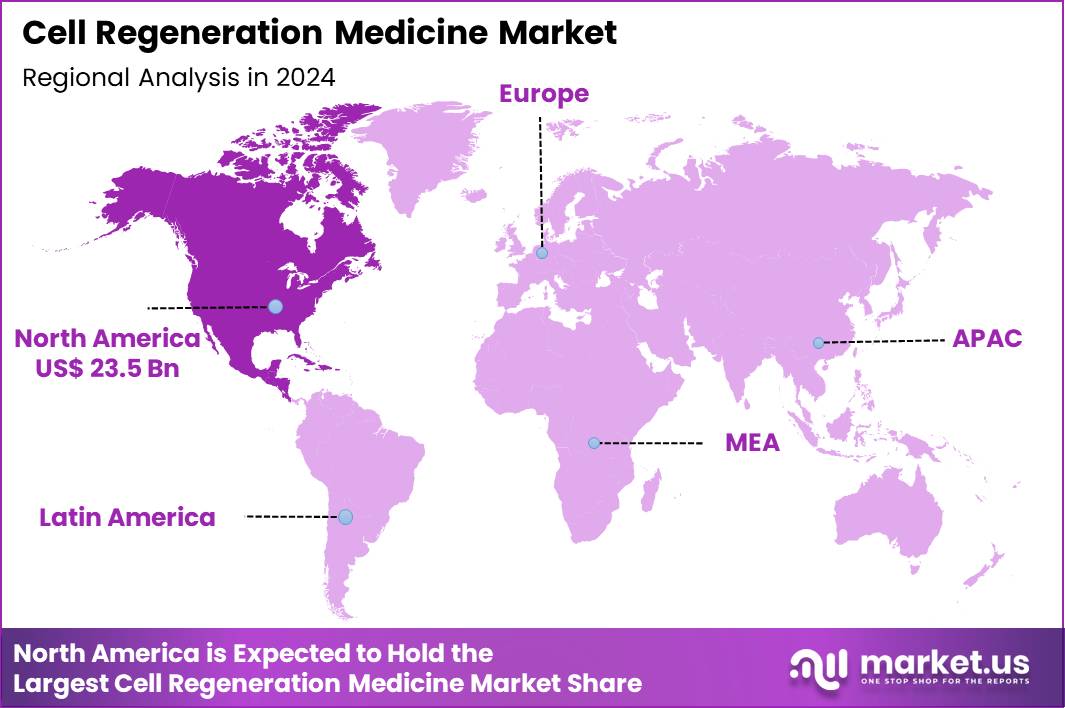

The Global Cell Regeneration Medicine Market size is expected to be worth around US$ 291.0 Billion by 2034 from US$ 54.2 Billion in 2024, growing at a CAGR of 18.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.3% share with a revenue of US$ 23.5 Billion.

Growing demand for innovative therapies propels the cell regeneration medicine market forward as healthcare providers seek effective solutions for tissue repair and organ restoration. Pharmaceutical companies invest heavily in stem cell technologies to address chronic conditions such as spinal cord injuries and cartilage degeneration, driving rapid research advancements.

Surgeons apply regenerative cells in orthopedic procedures to enhance bone and joint recovery, while dermatologists utilize them for accelerated wound healing in burn victims. Neurologists explore neural stem cell implants to combat degenerative diseases like Parkinson’s, expanding therapeutic horizons.

Recent collaborations, such as the December 2024 agreement between Sysmex and J-TEC, strengthen manufacturing infrastructures for scalable cell therapy production. This partnership tackles production challenges head-on, speeding up the transition from lab to clinic and broadening access to personalized regenerative interventions.

Rising investments in biotechnology fuel key drivers within the cell regeneration medicine sector, particularly as researchers develop autologous cell therapies for cardiovascular repair. Cardiologists deploy engineered heart tissues to mend post-infarct damage, restoring myocardial function with precision. Biotech firms prioritize induced pluripotent stem cells for diabetes management, enabling beta-cell regeneration to stabilize glucose levels.

Oncologists integrate regenerative approaches with immunotherapy to rebuild immune systems depleted by cancer treatments, fostering holistic recovery protocols. Regulatory bodies streamline approval pathways for these innovations, encouraging pharmaceutical giants to allocate resources toward clinical trials. Such momentum creates opportunities for market players to pioneer next-generation therapies that extend patient lifespans and improve quality of life.

Increasing adoption of gene-edited cells marks a pivotal trend in cell regeneration medicine, as scientists harness CRISPR tools to optimize regenerative outcomes in musculoskeletal applications. Orthopedic specialists engineer tendon and ligament cells for superior tensile strength, revolutionizing sports medicine recoveries. Gastroenterologists advance liver cell therapies to treat cirrhosis, promoting functional tissue regrowth without transplantation risks.

Emerging opportunities lie in ocular regeneration, where retinal pigment epithelial cells derived from stem sources preserve vision in macular degeneration cases. Academic institutions collaborate with industry leaders to refine delivery mechanisms, ensuring cells integrate seamlessly into host tissues. These developments position the market for sustained expansion, as clinicians embrace multifunctional regenerative strategies that address multifaceted disease profiles.

Key Takeaways

- In 2024, the market generated a revenue of US$ 54.2 Billion, with a CAGR of 18.3%, and is expected to reach US$ 291.0 Billion by the year 2034.

- The product type segment is divided into therapeutics (cell & gene-based), tools, banks and services, with therapeutics taking the lead in 2024 with a market share of 58.9%.

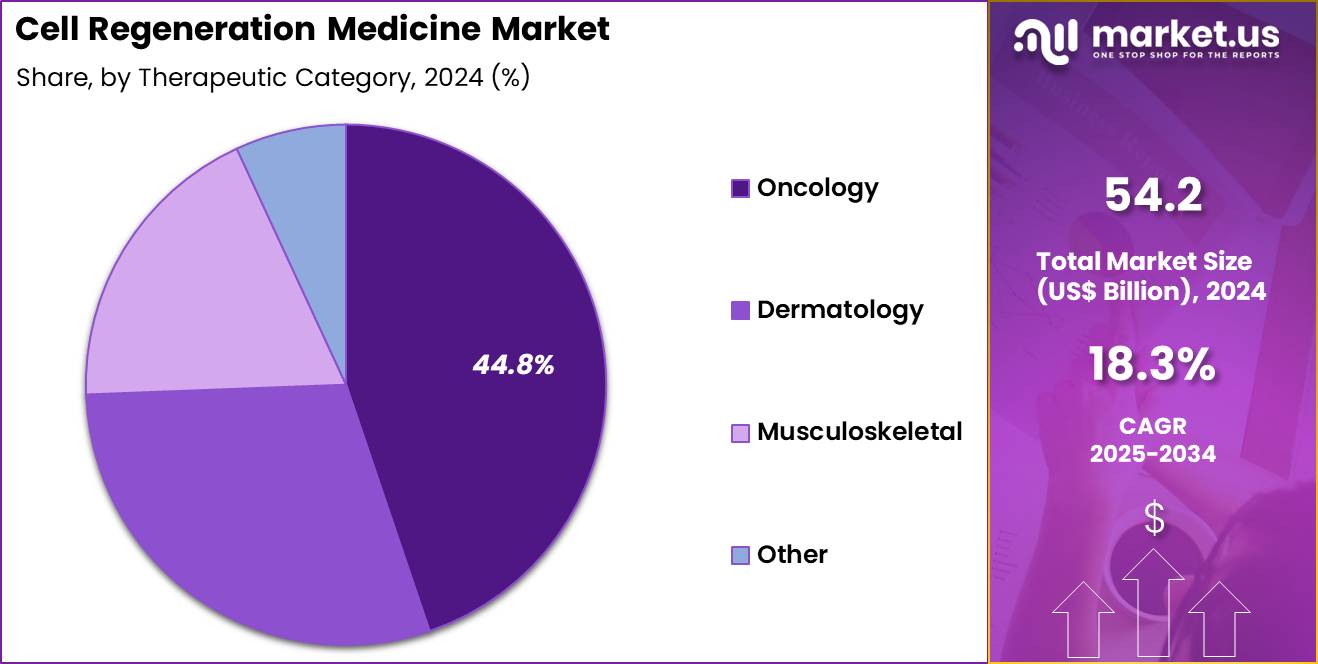

- Considering therapeutic category, the market is divided into oncology, dermatology, musculoskeletal and other. Among these, oncology held a significant share of 44.8%.

- North America led the market by securing a market share of 43.3% in 2024.

Product Type Analysis

Therapeutics, holding 58.9%, are expected to dominate because cell and gene-based interventions directly address tissue repair, immune modulation, and disease modification rather than symptomatic relief. Expanding clinical evidence supporting stem cell therapies, CAR-T treatments, and gene-edited products strengthens clinician confidence and patient adoption. Regulatory approvals and accelerated pathways increase commercialization momentum for advanced therapeutics.

Growing investment from biopharmaceutical companies supports scale-up manufacturing and clinical translation. Improved delivery systems enhance targeting and persistence of therapeutic cells, improving outcomes. Rising prevalence of chronic and degenerative diseases increases demand for regenerative solutions. Collaborative research between academia and industry accelerates innovation cycles. Reimbursement expansion for high-impact therapies improves access. These factors keep therapeutics anticipated to remain the leading product type in this market.

Therapeutic Category Analysis

Oncology, holding 44.8%, is projected to dominate because regenerative medicine approaches increasingly complement and transform cancer care through immune-based and gene-modified therapies. Cell therapies enhance tumor targeting while reducing off-target toxicity compared with conventional treatments. Growing incidence of cancer globally drives sustained demand for innovative treatment modalities. Precision oncology strategies integrate regenerative platforms to improve response durability and survival outcomes.

Clinical success in hematologic malignancies expands exploration into solid tumors. Advancements in tumor microenvironment modulation strengthen therapeutic efficacy. Expanded clinical trial activity accelerates adoption across care pathways. Patient preference for personalized treatments supports uptake. These dynamics keep oncology expected to remain the dominant therapeutic category.

Key Market Segments

By Product Type

- Therapeutics (Cell & Gene –based)

- Tools

- Banks

- Services

By Application

- Oncology

- Dermatology

- Musculoskeletal

- Other

Drivers

Increasing number of FDA approvals for cellular and gene therapy products is driving the market

The acceleration in regulatory approvals for cellular and gene therapy products has significantly propelled advancements in cell regeneration medicine, enabling broader clinical translation of innovative treatments. In 2022, the U.S. Food and Drug Administration approved six such products, including Carvykti for multiple myeloma and Zynteglo for beta-thalassemia. This momentum continued in 2023 with another six approvals, such as Casgevy for sickle cell disease and Vyjuvek for dystrophic epidermolysis bullosa.

By 2024, four additional products received clearance, encompassing Tecelra for synovial sarcoma and Symvess for vascular trauma. These approvals validate the safety and efficacy of regenerative approaches, fostering investor confidence and research funding. Healthcare providers gain access to transformative therapies that address unmet needs in oncology, hematology, and rare genetic disorders.

The cumulative impact enhances market visibility, encouraging partnerships between biopharma entities and academic institutions. Standardized pathways under frameworks like Regenerative Medicine Advanced Therapy designations streamline subsequent submissions. As approvals proliferate, manufacturing scalability improves, reducing barriers to commercialization. Overall, this driver establishes a conducive ecosystem for sustained innovation in cell-based regenerative interventions.

Restraints

Stringent regulatory scrutiny and enforcement actions is restraining the market

Regulatory oversight in cell regeneration medicine imposes rigorous requirements for preclinical validation and manufacturing consistency, often delaying product timelines and escalating development expenses. The U.S. Food and Drug Administration’s intensified focus on unproven therapies has led to heightened enforcement, with warning letters issued to clinics promoting unauthorized stem cell interventions. This scrutiny stems from concerns over safety risks, including immune reactions and tumorigenicity, necessitating extensive post-approval surveillance.

Variability in international harmonization creates jurisdictional challenges, complicating global market entry for developers. Ethical considerations surrounding patient consent and equitable access further complicate compliance landscapes. Resource-intensive quality control measures, such as Good Manufacturing Practice adherence, strain smaller innovators with limited capital. The precautionary approach limits off-label expansions, confining therapies to narrowly defined indications.

Collaborative dialogues between regulators and industry aim to balance innovation with risk mitigation, yet progress remains incremental. These constraints foster a conservative investment climate, prioritizing established modalities over exploratory regenerative candidates. Ultimately, this restraint underscores the need for adaptive frameworks to expedite safe therapeutic deployment.

Opportunities

Proliferation of clinical trials for pluripotent stem cell therapies is creating growth opportunities

The expansion of clinical investigations into pluripotent stem cell-derived products presents substantial avenues for therapeutic breakthroughs in regenerative medicine, targeting diverse indications from neurodegeneration to cardiovascular repair. As of December 2024, 115 trials with regulatory approval were underway, evaluating 83 human pluripotent stem cell products across phase distributions. This volume reflects maturing technologies in differentiation protocols and immune evasion strategies, enhancing translational feasibility.

Opportunities arise in multiplexing applications, where stem cells integrate with biomaterials for organoid-based repairs. Funding from national institutes supports phase escalations, bridging gaps between proof-of-concept and pivotal studies. Digital twins and predictive modeling optimize trial designs, accelerating enrollment and endpoint validations. Equity-focused initiatives prioritize underrepresented populations, broadening generalizability and market potential.

Synergies with gene editing tools amplify potency, unlocking combination regimens for complex diseases. Cost efficiencies from scalable bioprocessing position these therapies for reimbursement advocacy. In aggregate, this trial surge catalyzes a pipeline primed for commercialization and paradigm-shifting clinical impact.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics invigorate the cell regeneration medicine market as surging healthcare investments and escalating chronic disease burdens compel biotech firms to accelerate stem cell therapies and tissue engineering solutions for transformative patient care. Executives at leading companies strategically expand pipelines with innovative regenerative platforms, harnessing global trends in personalized medicine to capture emerging opportunities in aging societies.

Lingering inflation and economic slowdowns, however, compress R&D budgets and heighten investor caution, prompting smaller players to curtail ambitious trials amid volatile funding landscapes. Geopolitical challenges, notably U.S.-China trade frictions and regulatory divergences across regions, often fracture international collaborations and delay access to critical biomaterials for developers reliant on cross-border expertise.

Current U.S. tariffs apply a universal baseline duty on imported biotechnology products alongside steeper rates on Chinese-origin devices, amplifying procurement costs for American innovators and disrupting supply affordability in domestic labs. These tariffs also elicit counter-measures from trading partners that constrain U.S. exports of advanced regenerative technologies and slow joint ventures on breakthrough applications. Still, the imposed duties motivate substantial commitments to U.S.-based manufacturing and supply diversification, cultivating robust ecosystems that promise enhanced innovation and enduring market prosperity ahead.

Latest Trends

FDA approval of Waskyra for Wiskott-Aldrich syndrome is a recent trend

In December 2025, the U.S. Food and Drug Administration approved Waskyra (etuvetidigene autotemcel), creating the first cell-based gene therapy specifically for Wiskott-Aldrich syndrome, a rare primary immunodeficiency. This autologous hematopoietic stem cell therapy involves ex vivo lentiviral transduction to insert a functional WAS gene, addressing the underlying genetic defect.

The approval, based on phase 1/2 trial data demonstrating sustained immune reconstitution in pediatric patients, expands options beyond allogeneic transplants. It highlights a regulatory preference for curative, one-time interventions in monogenic disorders. This trend aligns with accelerated pathways under the 21st Century Cures Act, prioritizing therapies with breakthrough potential. Early post-approval monitoring emphasizes long-term engraftment and malignancy risks, informing future safety profiles.

The decision catalyzes similar applications in other immunodeficiencies, fostering a cluster of gene-modified cell products. Manufacturing partnerships ensure supply for ultra-rare indications, mitigating access barriers. This advancement signals maturing infrastructure for personalized regenerative modalities. Overall, the 2025 approval exemplifies evolving standards for cell therapy integration into standard-of-care regimens.

Regional Analysis

North America is leading the Cell Regeneration Medicine Market

North America accounted for 43.3% of the overall market in 2024, and the region recorded strong growth as clinical adoption of regenerative therapies expanded across orthopedics, cardiology, neurology, and wound care. Hospitals and specialty clinics increased use of cell-based approaches to address chronic conditions that show limited response to conventional treatments.

Strong translational research ecosystems accelerated movement of regenerative therapies from trials to clinical practice. Favorable regulatory pathways and expanded FDA regenerative medicine advanced therapy designations supported faster clinical development. The U.S. Food and Drug Administration reported more than 90 regenerative medicine advanced therapy (RMAT) designations granted cumulatively by 2023, reflecting growing innovation momentum in this field.

Rising incidence of degenerative diseases and an aging population further increased therapeutic demand. Investment from biotech firms and academic medical centers strengthened infrastructure. These factors collectively drove robust market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience accelerated expansion during the forecast period as governments and healthcare systems increase focus on regenerative approaches for chronic and age-related diseases. Hospitals integrate cell-based therapies into treatment pathways for musculoskeletal disorders, cardiovascular damage, and neurological conditions.

Growing medical tourism in countries such as Japan, South Korea, and India encourages adoption of advanced regenerative procedures. Academic institutions expand stem cell and tissue engineering research programs, strengthening clinical translation. The Japan Ministry of Health, Labour and Welfare approved over 20 regenerative medicine products under conditional or time-limited authorization frameworks by 2023, highlighting strong regulatory support.

Rising healthcare expenditure and expanding private hospitals improve patient access. Industry collaborations with research centers accelerate therapy development. These dynamics position Asia Pacific for sustained and high-growth potential in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key participants in the Cell Regeneration Medicine market accelerate growth by expanding stem cell, gene-edited cell, and tissue-engineered therapy pipelines that address unmet needs in orthopedics, neurology, cardiology, and wound healing. Companies active in the Cell Regeneration Medicine market strengthen positioning through strategic collaborations with academic institutes, biotech innovators, and contract development partners to shorten development timelines and improve translational success.

Product and R&D leaders in the Cell Regeneration Medicine market invest heavily in scalable manufacturing platforms, automated bioprocessing, and quality-by-design frameworks to support regulatory compliance and commercial readiness. Commercial teams within the Cell Regeneration Medicine market pursue geographic expansion by targeting regions with supportive regulatory pathways and rising demand for advanced regenerative therapies.

Business strategies in the Cell Regeneration Medicine market also emphasize clinical validation and long-term outcome data to secure reimbursement confidence and physician adoption. Vericel Corporation exemplifies a focused player in the Cell Regeneration Medicine market, leveraging its cell-based therapeutic portfolio, specialized manufacturing expertise, and strong presence in cartilage repair and burn treatment to drive sustainable growth and clinical credibility.

Top Key Players

- Mesoblast Ltd.

- Astellas Pharma Inc.

- Novartis AG

- Organogenesis Holdings Inc.

- Takeda Pharmaceutical Company

- Vericel Corporation

- Pluristem Therapeutics

- Smith+Nephew

Recent Developments

- In January 2025, AstraZeneca entered into a licensing collaboration with Neurimmune AG to advance NI006, a novel antibody therapy for patients with advanced transthyretin amyloid cardiomyopathy (ATTR-CM). This agreement strengthens investment momentum in biologics and regenerative approaches for degenerative cardiovascular conditions, reinforcing the broader shift toward disease-modifying regenerative therapies and supporting expansion of the cell regenerative medicine ecosystem.

- In October 2024, the US FDA granted priority approval to REGEN-COV for the treatment of COVID-19, highlighting continued regulatory support for advanced biologics developed through innovative therapeutic platforms. Such expedited approvals increase confidence in regenerative and antibody-based technologies, encouraging sustained R&D funding and faster clinical translation within the cell regenerative medicine market.

Report Scope

Report Features Description Market Value (2024) US$ 54.2 Billion Forecast Revenue (2034) US$ 291.0 Billion CAGR (2025-2034) 18.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Therapeutics (Cell & Gene-based), Tools, Banks and Services), By Therapeutic Category (Oncology, Dermatology, Musculoskeletal and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mesoblast Ltd., Astellas Pharma Inc., Novartis AG, Organogenesis Holdings Inc., Takeda Pharmaceutical Company, Vericel Corporation, Pluristem Therapeutics, Smith+Nephew Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Regeneration Medicine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Regeneration Medicine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mesoblast Ltd.

- Astellas Pharma Inc.

- Novartis AG

- Organogenesis Holdings Inc.

- Takeda Pharmaceutical Company

- Vericel Corporation

- Pluristem Therapeutics

- Smith+Nephew