Global Cell-free Fetal DNA Testing Market By Product Type (Cell Free DNA Extraction & Purification Kits, PCR & qPCR Based cffDNA Testing Kits, and NGS Based cffDNA Testing Kits), By Sample Type (Maternal Plasma/Serum and Urine cfDNA), By End-user (Hospitals, Maternity Clinics, Diagnostic Laboratories, and Academic & Research Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164166

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

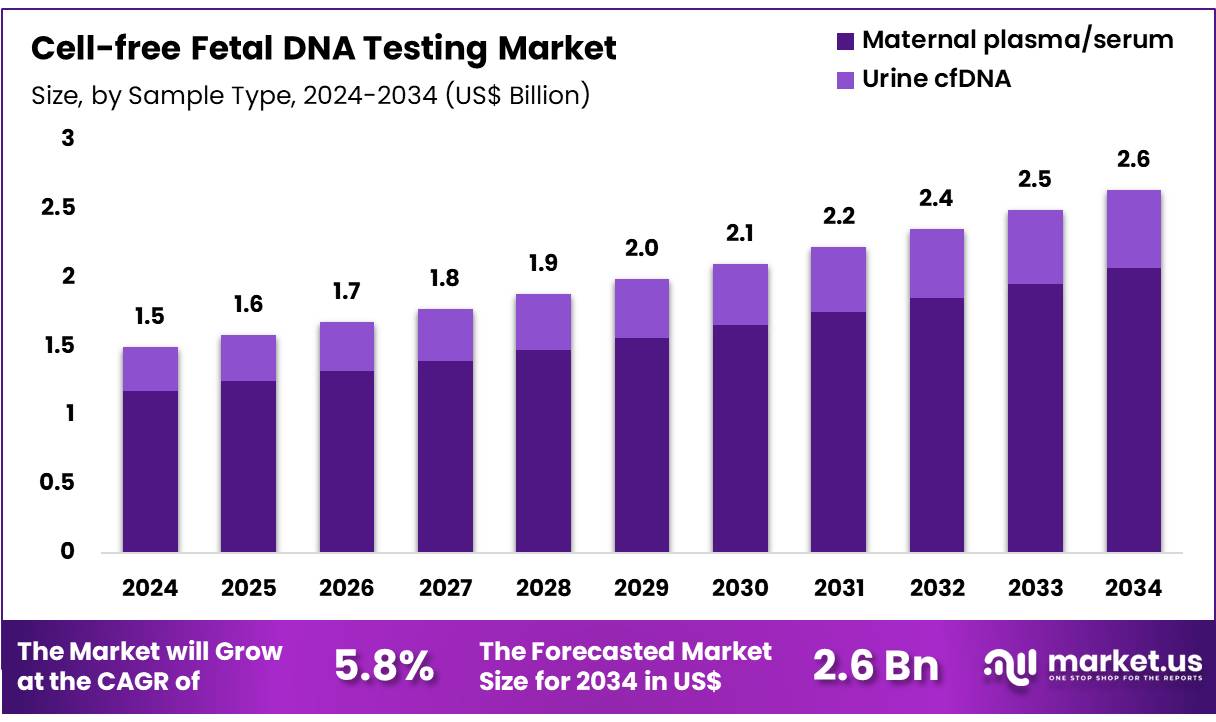

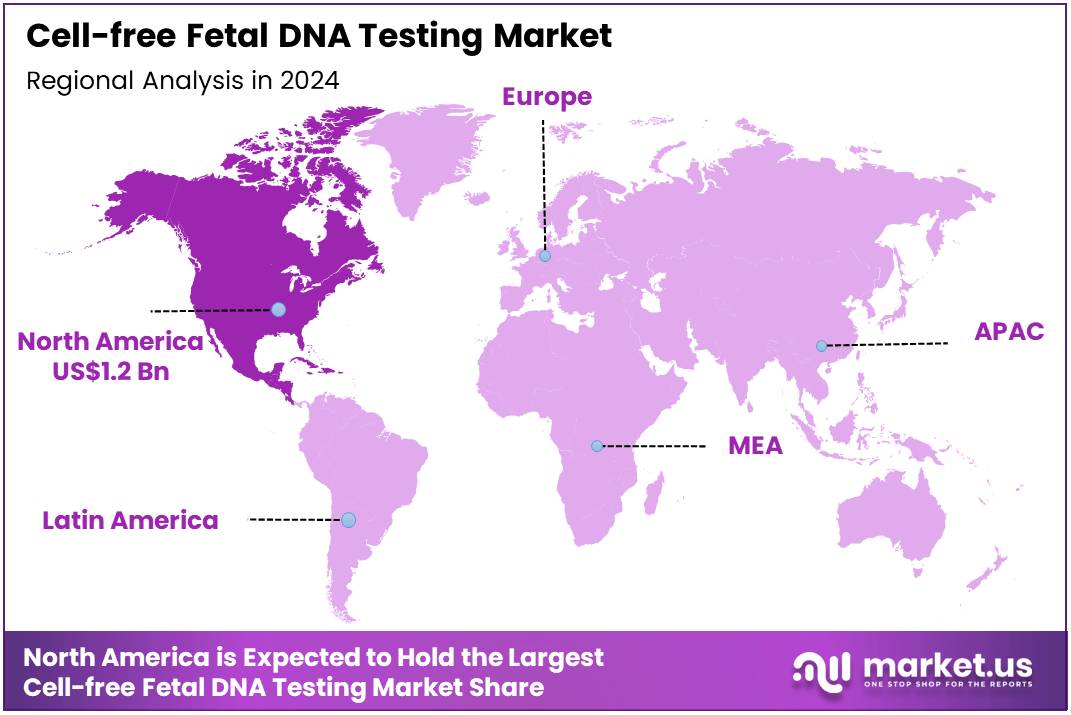

The Global Cell-free Fetal DNA Testing Market size is expected to be worth around US$ 2.6 Billion by 2034 from US$ 1.5 Billion in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 1.2 Billion.

Increasing maternal age trends drive the Cell-free Fetal DNA Testing Market, as obstetricians recommend non-invasive prenatal screening for aneuploidy risk assessment. Clinicians apply cfDNA assays to detect trisomy 21 in first-trimester maternal blood, providing high sensitivity without amniocentesis risks. These tests support gender determination and RhD genotyping in alloimmunized pregnancies, guiding anti-D prophylaxis administration.

Genetic counselors utilize expanded panels to screen for microdeletions, enhancing informed reproductive decision-making. In April 2025, Illumina partnered with Tempus AI to integrate artificial intelligence into cfDNA analysis, accelerating interpretation accuracy for prenatal diagnostics. This collaboration fuels market growth by refining clinical applications in routine obstetric care.

Growing applications in transplant monitoring create opportunities in the Cell-free Fetal DNA Testing Market, as cfDNA technologies extend beyond prenatal uses. Pediatric cardiologists employ donor-derived cfDNA testing to surveil rejection in heart transplant recipients, enabling early intervention adjustments. These assays aid multi-organ surveillance by quantifying graft injury in combined pancreas-kidney recipients, optimizing immunosuppressive regimens.

Automated platforms streamline serial sampling protocols, supporting longitudinal patient management. In March 2025, CareDx expanded AlloSure cfDNA testing to pediatric heart and combined pancreas–kidney transplant patients, demonstrating versatility across demographics. This extension drives market expansion through diversified diagnostic utility in precision medicine.

Rising integration of multi-omics approaches propels the Cell-free Fetal DNA Testing Market, as comprehensive profiling enhances diagnostic depth. Perinatologists combine cfDNA with maternal serum markers to refine preeclampsia risk prediction, facilitating proactive monitoring. These tests support twin pregnancies by distinguishing fetal fractions, ensuring accurate aneuploidy detection in complex gestations.

Trends toward whole-genome sequencing of cfDNA uncover rare variants, advancing carrier screening capabilities. High-throughput sequencers improve turnaround times for urgent clinical scenarios like fetal structural anomalies. These advancements position the market for sustained growth by broadening cfDNA applications in reproductive and maternal-fetal medicine.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.5 billion, with a CAGR of 5.8%, and is expected to reach US$ 2.6 billion by the year 2034.

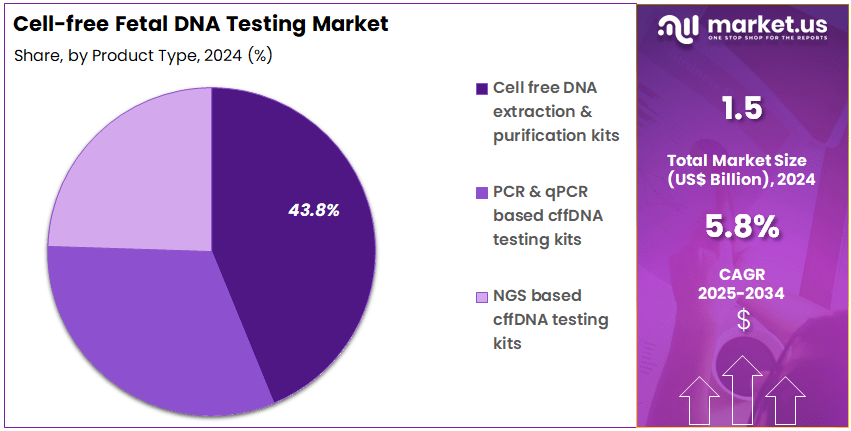

- The product type segment is divided into cell free DNA extraction & purification kits, PCR & qPCR based cffDNA testing kits, and NGS based cffDNA testing kits, with cell free DNA extraction & purification kits taking the lead in 2023 with a market share of 43.8%.

- Considering sample type, the market is divided into maternal plasma/serum and urine cfDNA. Among these, maternal plasma/serum held a significant share of 78.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, maternity clinics, diagnostic laboratories, and academic & research institutions. The hospitals sector stands out as the dominant player, holding the largest revenue share of 46.9% in the market.

- North America led the market by securing a market share of 41.1% in 2024.

Product Type Analysis

Cell free DNA extraction & purification kits account for 43.8% of the Cell-free Fetal DNA Testing market and are expected to dominate due to their critical role in ensuring high-quality DNA isolation for non-invasive prenatal testing (NIPT). These kits enable accurate detection of chromosomal abnormalities such as trisomy 21, 18, and 13 by providing pure cfDNA from maternal plasma samples.

The growing adoption of NIPT across hospitals and diagnostic centers drives consistent demand for efficient extraction solutions. Manufacturers are investing in automation-compatible kits that reduce manual handling and improve yield consistency. Rising emphasis on early and reliable prenatal screening is increasing usage of cfDNA purification systems integrated with microfluidic and magnetic bead technologies. Technological advancements in buffer chemistry and column design are improving extraction precision.

The growing preference for minimally invasive diagnostic procedures supports the expansion of this segment. As prenatal care standards strengthen globally and laboratory automation becomes more common, cell free DNA extraction & purification kits are anticipated to remain the foundation of the cffDNA testing workflow.

Sample Type Analysis

Maternal plasma/serum holds 78.6% of the Cell-free Fetal DNA Testing market and is anticipated to lead due to its proven reliability and clinical accuracy in fetal DNA analysis. Plasma provides the most stable and concentrated source of cfDNA, allowing precise detection of fetal aneuploidies and genetic abnormalities. Advances in sequencing and PCR technologies have improved the sensitivity of cfDNA detection from plasma, enabling earlier testing during pregnancy.

Increasing adoption of non-invasive prenatal screening (NIPS) as a safer alternative to invasive methods such as amniocentesis reinforces plasma-based testing. Hospitals and diagnostic laboratories prefer plasma over urine due to its consistency and established clinical validation. Global health organizations endorse plasma-based cfDNA testing for early risk assessment of Down syndrome and other chromosomal conditions.

The growing awareness among expecting parents about safe prenatal testing methods supports this segment’s expansion. Continuous innovation in plasma-based assay design and reduction in sequencing costs further enhance accessibility. As non-invasive testing becomes standard prenatal practice, maternal plasma/serum is expected to sustain dominance as the primary sample type for cfDNA analysis.

End-User Analysis

Hospitals account for 46.9% of the Cell-free Fetal DNA Testing market and are projected to remain dominant due to their integration of prenatal screening within comprehensive maternal healthcare services. Hospitals are increasingly incorporating cfDNA testing as part of routine obstetric care for early detection of chromosomal disorders. The availability of advanced diagnostic infrastructure, trained personnel, and collaboration with genetic counseling units enhances test adoption.

Hospitals often serve as referral centers for high-risk pregnancies, further increasing testing volume. The integration of cfDNA testing with electronic health records supports faster result turnaround and improved patient management. Rising government initiatives promoting prenatal screening programs strengthen hospital-based testing uptake. Partnerships between hospitals and diagnostic companies expand access to reliable testing technologies and reduce costs through bulk procurement.

The emphasis on early, non-invasive, and accurate risk assessment for fetal abnormalities drives consistent adoption. As hospitals expand their maternal and fetal medicine departments with advanced genomic testing capabilities, they are expected to remain the primary end-users of cfDNA testing solutions globally.

Key Market Segments

By Product Type

- Cell‑Free DNA Extraction & Purification Kits

- PCR & qPCR‑Based cffDNA Testing Kits

- NGS‑Based cffDNA Testing Kits

By Sample Type

- Maternal Plasma/Serum

- Urine cfDNA

By End‑User

- Hospitals

- Maternity Clinics

- Diagnostic Laboratories

- Academic & Research Institutions

Drivers

Increasing Maternal Age and Chromosomal Risk is Driving the Market

The trend toward later childbearing has significantly advanced the cell-free fetal DNA testing market, as advanced maternal age correlates with higher probabilities of fetal chromosomal anomalies, necessitating reliable screening alternatives. Cell-free fetal DNA testing analyzes fetal genetic elements in maternal circulation, providing high-accuracy identification of trisomies 21, 18, and 13 without the hazards of invasive diagnostics such as amniocentesis.

This impetus is conspicuous in affluent societies, where deferred parenthood elevates the proportion of pregnancies beyond 35 years, spurring routine incorporation into antenatal protocols. Professional recommendations position it as an initial evaluation, weaving it into initial visits to deliver clarity and shape reproductive planning. Its capacity to ascertain fetal gender and select microdeletions enhances utility, facilitating anticipation of hereditary issues.

Regulatory entities back its deployment to diminish miscarriage incidences from procedures, stimulating facility upgrades for extensive coverage. The Centers for Disease Control and Prevention indicated that the mean age of women at birth in the United States increased to 30 years in 2022, compared to 29.8 years in 2021, thereby heightening the requirement for sophisticated prenatal evaluations. This progression emphasizes the medical essentiality, since testing aids in swift resolutions.

Enhancements in amplification techniques bolster detection of minimal fetal contributions, suiting varied gestation periods. In terms of economics, its exactness lessens subsequent expenditures, endorsing system-wide enlargements. Supranational bodies synchronize evaluation benchmarks, guaranteeing uniform guidance internationally. This age dynamic not only augments screening quantities but also affirms the test’s centrality in contemporary gynecology. Collectively, it galvanizes extensions in carrier detection, associating evaluations with bespoke fertility guidance.

Restraints

Limited Accessibility in Low-Resource Settings is Restraining the Market

Constrained reach of cell-free fetal DNA testing in underprivileged locales endures as a primary hindrance, where logistical shortcomings and monetary obstacles restrict it to metropolitan hubs. The assay’s dependence on cutting-edge amplification devices and proficient operators renders it unfeasible in peripheral or inadequately resourced outposts. This shortfall maintains dependence on antiquated protein markers, retarding verifications and intensifying disparities for isolated demographics.

Insurance voids in emerging economies aggravate the divide, with personal financing impeding engagement among at-risk households. Innovators grapple with customization impediments, including modifications for regional genomic profiles, postponing localized variants. The fallout upholds greater reliance on intrusive methods, magnifying intervention hazards.

The World Health Organization observed that merely 20% of low- and middle-income nations possessed availability to progressive prenatal genomic assessments in 2022, accentuating enduring worldwide imbalances in cell-free fetal DNA testing provision. These voids indicate foundational deficiencies, as economic barriers preclude extensive integration.

Personnel scarcities in isolated zones incline toward elementary sonography, disregarding molecular alternatives. Schemes for affordable reagents proceed deliberately, impeded by distribution vulnerabilities. These availability restrictions not only impede dissemination but also diminish the market’s impartial promise. Accordingly, they mandate directed funding to integrate progress with comprehensive medical services.

Opportunities

Integration of AI for Result Interpretation is Creating Growth Opportunities

The assimilation of artificial intelligence into cell-free fetal DNA result analysis has unveiled extensive potentials for the market, augmenting precision in discerning aneuploidies via intricate pattern discernment. AI frameworks scrutinize amplification yields to highlight trisomies and anomalies, diminishing erroneous alerts and assisting advisors. Possibilities abound in cooperative validations, where subsidies endorse verifications for heterogeneous cohorts, rectifying evidentiary lacunae in endorsements.

Enterprise-scholar partnerships finance algorithmic refinements, confronting hurdles in composite specimens. This intelligent augmentation dispels ambiguity in outcomes, designating tests as facilitators of deliberate selections. Appropriations for computational explorations hasten acquisitions, incorporating into holistic genomic consultations.

The National Human Genome Research Institute granted $5.8 million over five years in September 2023 for a computational genomics and data science educational hub, promoting diversity in early-career prenatal screening research. This endowment exemplifies adaptable structures, with validations foreseeing augmented apparatus requisitions in standard practice.

AI constructs calibrated on extensive archives elevate identification rates, easing intricate scenarios. As remote genetic advising proliferates, AI deductions generate digital revenue channels. These AI incorporations not only variegate assessment modalities but also interlink the market into thorough antenatal frameworks.

Impact of Macroeconomic / Geopolitical Factors

Surging maternal ages and heightened public health initiatives propel expectant parents toward cell-free fetal DNA testing for early detection of trisomies and microdeletions, empowering obstetricians to counsel families with precision and confidence while curbing invasive procedure risks. Persistent economic slowdowns, however, curtail insurance reimbursements for elective screenings, compelling clinics to prioritize essential diagnostics and sidelining advanced genomic panels amid fiscal scrutiny.

Geopolitical escalations, notably US-China trade frictions, sever access to rare earth elements vital for next-generation sequencers, obliging developers to endure protracted validation cycles and expose labs to reagent scarcity during high-demand periods. Current US tariffs, enacting a 10% universal levy on imported biotech instruments and reagents effective April 2025, amplify outlays for overseas-sourced extraction kits and analyzers, imperiling affordability for community-based providers and stalling rollout in emerging demographics.

Latest Trends

Evolution of Expanded NIPT for Broader Genetic Screening is a Recent Trend

The advancement of all-encompassing genomic scrutiny has exemplified a pivotal transformation in cell-free fetal DNA testing throughout 2025, encompassing copy number discrepancies and infrequent trisomies to sharpen hazard evaluation across maternal cohorts. Broadened non-invasive prenatal testing, appraising sub-chromosomal alterations and duplications, attains elevated affirmative forecast values for syndromes like DiGeorge, bolstering discerning consultations. This progression denotes a sophistication in assessment methodologies, suiting isolated and dual gestations via upgraded computational conduits.

Endorsement mechanisms substantiate its functionality, hastening endorsements for demographic-wide utilizations. This breadth harmonizes with impartiality objectives, associating outputs with electronic archives for extended monitoring. The technique counters circumscribed-range constraints, preferring computations impervious to maternal chimerism.

A Frontiers in Medicine publication from January 2025 outlined the therapeutic efficacy of broadened NIPT in assessing fetal trisomy and copy number discrepancies across varying hazard categories, illustrating its progressing recipient demographics. These observations stress extensibility, as corroborations correspond with established measures. Prognostications foresee methodological incorporations, magnifying its eminence in maternity directives.

Successive appraisals disclose discrepancy diminutions, optimizing asset utilizations. The prospect envisions isolated-gene amalgamations, projecting monogenic ailment collaborations. This genomic extension not only intensifies assessment sharpness but also synchronizes with comprehensive antenatal aspirations.

Regional Analysis

North America is leading the Cell-free Fetal DNA Testing Market

The market in North America is anticipated to have held a 41.1% share of the global cell-free fetal DNA testing landscape in 2024, advanced by ACOG’s updated guidelines endorsing noninvasive prenatal screening for all pregnant individuals regardless of risk, which boosted utilization rates to 60% among high-risk pregnancies and facilitated earlier aneuploidy detection in trisomies 21, 18, and 13.

Labs expanded NGS-based platforms to analyze circulating fetal DNA from maternal plasma, achieving 99.9% sensitivity for Down syndrome, enabling informed decision-making as early as 10 weeks gestation and reducing invasive procedures by 70% in average-risk cohorts aged 35 and older. The NIH’s All of Us Research Program integrated cfDNA data into diverse genomic cohorts, correlating with federal grants to address ethnic disparities in screening access for African American and Hispanic women, where uptake lagged at 40% in 2022.

Regulatory efficiencies under the FDA’s Breakthrough Device Designation expedited clearances for expanded carrier screening, aligning with Medicare expansions for high-risk monitoring. Demographic trends, including a 15% rise in maternal age over 35, amplified demand for multigene panels in obstetric practices. These elements positioned the region as a leader in equitable prenatal genomic screening. The American College of Obstetricians and Gynecologists reported NIPT utilization at 60% for high-risk pregnancies in 2023, up from 50% in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as national health policies promote cell-free DNA screening to mitigate chromosomal disorder risks in aging maternal populations across urbanizing economies. Governments in China and India invest in NGS kits, outfitting prenatal centers to detect trisomy 21 in high-parity cohorts from rural districts.

Diagnostic firms collaborate with local institutes to validate plasma-based assays, anticipating refined risk assessments for sex chromosome aneuploidies in consanguineous families. Regulatory agencies in Japan and South Korea subsidize expanded panels, enabling community clinics to profile microdeletions without invasive amniocentesis.

Countrywide programs estimate integrating cfDNA results into digital maternal health records, expediting counseling for Edwards syndrome in migrant women. Regional geneticists advance methylation-specific methods, aligning with WHO networks to monitor fetal RhD status in hemolytic disease-prone groups. These strategies forge a comprehensive pathway for noninvasive prenatal equity.

The World Health Organization estimated 1.62 billion people required interventions against neglected tropical diseases in 2022, including maternal health impacts extending to prenatal screening needs in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent organizations in the non-invasive prenatal screening sector propel advancement by engineering SNP-based assays that distinguish maternal and fetal DNA with superior precision, enabling early detection of chromosomal anomalies like trisomies 21, 18, and 13. They secure licensing collaborations with international biotech firms to launch NGS-integrated platforms, as Illumina’s VeriSeq NIPT v2 rollout in emerging markets exemplifies, to hasten regulatory clearances and broaden therapeutic indications.

Enterprises channel resources into automation-compatible extraction kits that yield higher fetal DNA purity, minimizing errors in clinical workflows and appealing to high-volume labs. Executives orchestrate acquisitions of regional genetic analysis providers, strengthening localized expertise and accelerating market penetration in high-risk demographics.

They intensify pursuits in Asia-Pacific and Latin America, tailoring solutions to national prenatal programs for subsidized access and volume growth. Moreover, they establish outcome-tied reimbursement advocacy with payers, embedding real-world evidence to elevate adoption rates and fortify revenue predictability.

Natera, Inc., founded in 2003 as Gene Security Network and headquartered in Austin, Texas, pioneers cell-free DNA diagnostics through proprietary molecular and bioinformatics innovations that transform women’s health, oncology, and organ transplant management worldwide. The company deploys its Panorama NIPT platform, leveraging SNP technology for accurate aneuploidy screening, and processes over 840,000 tests quarterly to support precision prenatal care.

Natera allocates substantial R&D to AI-enhanced analytics, expanding indications to single-gene disorders and microdeletions for comprehensive fetal assessments. CEO Steve Chapman directs a Nasdaq-listed enterprise (NTRA) operating globally, emphasizing equitable access via partnerships with health systems and insurers.

The firm engages with regulatory bodies to refine guidelines, ensuring robust validation and scalability. Natera cements its leadership by fusing cutting-edge sequencing with data-driven insights to empower informed reproductive decisions.

Top Key Players

- Illumina, Inc.

- Natera, Inc.

- Hoffmann‑La Roche Ltd

- Qiagen N.V.

- BillionToOne, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Eurofins Scientific

- BGI Genomics Co., Ltd.

- Myriad Genetics, Inc.

- Quest Diagnostics Incorporated

Recent Developments

- In May 2025, BillionToOne expanded its UNITY Fetal Risk Screen to include both ACOG-recommended and additional recessive conditions. This advancement widened prenatal screening coverage and strengthened the role of cell-free fetal DNA (cfDNA) testing in detecting inherited disorders early through a single, noninvasive method.

- In April 2025, Natera announced findings from its DEFINE-HT trial showing that the Prospera Heart cfDNA test identifies graft dysfunction more effectively than biopsies. This success reinforces clinical confidence in cfDNA’s precision, encouraging broader adoption of cfDNA-based diagnostic platforms, including prenatal and fetal screening applications.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 2.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cell Free DNA Extraction & Purification Kits, PCR & qPCR Based cffDNA Testing Kits, and NGS Based cffDNA Testing Kits), By Sample Type (Maternal Plasma/Serum and Urine cfDNA), By End-user (Hospitals, Maternity Clinics, Diagnostic Laboratories, and Academic & Research Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina, Inc., Natera, Inc., F. Hoffmann‑La Roche Ltd, Qiagen N.V., BillionToOne, Inc., Laboratory Corporation of America Holdings (LabCorp), Eurofins Scientific, BGI Genomics Co., Ltd., Myriad Genetics, Inc., Quest Diagnostics Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell-free Fetal DNA Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Cell-free Fetal DNA Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Illumina, Inc.

- Natera, Inc.

- Hoffmann‑La Roche Ltd

- Qiagen N.V.

- BillionToOne, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Eurofins Scientific

- BGI Genomics Co., Ltd.

- Myriad Genetics, Inc.

- Quest Diagnostics Incorporated