Cell Based Assays Market By Product Type (Reagents, Assay Kits (Second Messenger Assays, Reporter Gene Assays, Cell Growth Assays, and Cell Death Assays), Probes & Labels, Microplates, Instruments & Software, and Cell Lines (Stem Cell Lines, Primary Cell Lines, and Immortalized Cell Lines)), By Application (Basic Research, Drug Discovery, and Other), By End-use (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 65910

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

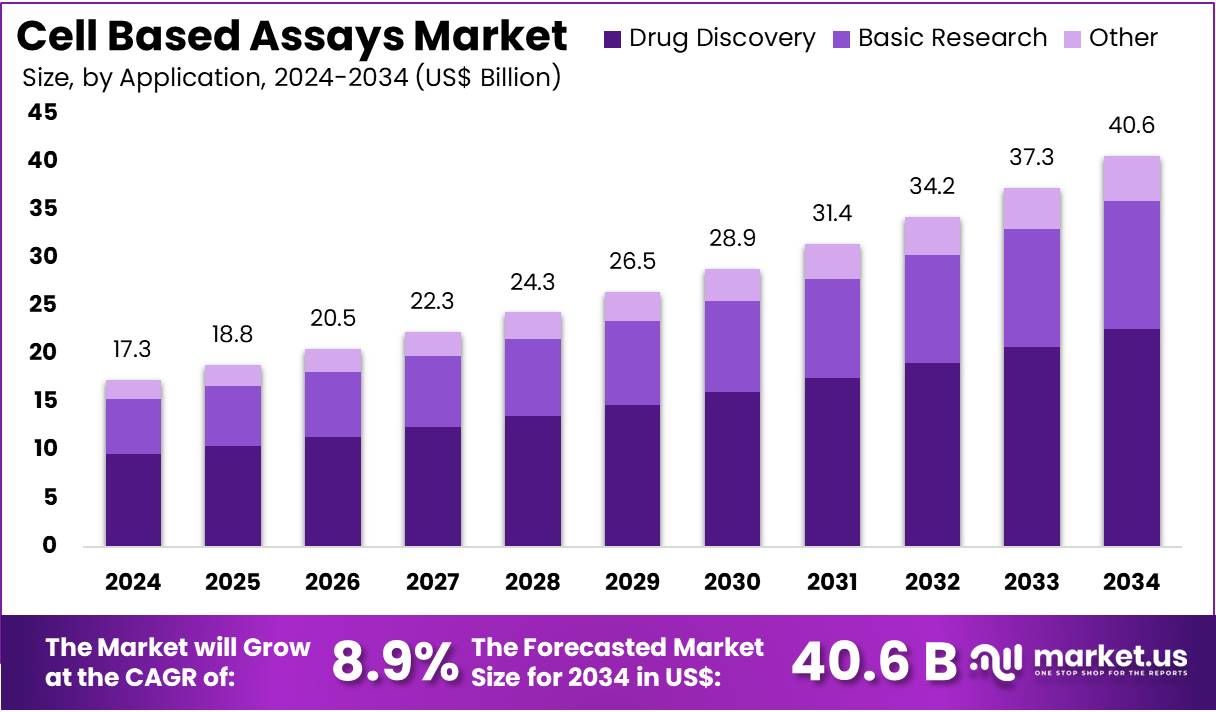

The Cell Based Assays Market size is expected to be worth around US$ 40.6 billion by 2034 from US$ 17.3 billion in 2024, growing at a CAGR of 8.9% during the forecast period 2025 to 2034.

Increasing demand for advanced drug discovery techniques and personalized medicine is driving the growth of the cell-based assays market. These assays are widely used in pharmaceutical and biotechnology research to evaluate cellular responses to various compounds, offering critical insights into drug efficacy, toxicity, and mechanism of action. The growing focus on high-throughput screening and the shift towards more accurate, biologically relevant in vitro models further contribute to the expansion of this market.

Cell-based assays play a pivotal role in disease modeling, cancer research, and the development of therapies for genetic disorders and neurodegenerative diseases. In September 2024, Ncardia launched new cell-based assays aimed at screening for neurodegenerative diseases, including Parkinson’s disease, highlighting the increasing application of these assays in disease-specific research.

As the demand for more precise and reproducible results rises, advancements in assay technologies, such as the integration of 3D cell cultures and microfluidic systems, are enhancing the sensitivity and scalability of cell-based assays.

Additionally, the growing use of cell-based assays in toxicology studies, stem cell research, and biomarker discovery offers new growth opportunities for the market. As pharmaceutical companies and research institutions prioritize efficiency and accuracy, the adoption of cell-based assays in drug development processes is expected to continue expanding, providing critical tools for advancing medical research and therapeutic innovations.

Key Takeaways

- In 2024, the market for Cell Based Assays generated a revenue of US$ 17.3 billion, with a CAGR of 8.9%, and is expected to reach US$ 40.6 billion by the year 2033.

- The product type segment is divided into reagents, assay kits, probes & labels, microplates, instruments & software, and cell lines, with assay kits taking the lead in 2024 with a market share of 46.3%.

- Considering application, the market is divided into basic research, drug discovery, and other. Among these, drug discovery held a significant share of 55.7%.

- Furthermore, concerning the end-use segment, the market is segregated into pharmaceutical & biotechnology companies, contract research organizations (cros), and academic & research institutes. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 63.8% in the Cell Based Assays market.

- North America led the market by securing a market share of 42.3% in 2024.

Product Type Analysis

The assay kits segment led in 2024, claiming a market share of 46.3% owing to the increasing demand for standardized and easy-to-use solutions for biological research and drug development. Assay kits provide a convenient and efficient way to measure cellular responses, making them highly sought after by researchers in various fields. The growing need for high-throughput screening in drug discovery and the rising number of research projects focusing on disease mechanisms are anticipated to drive the demand for assay kits.

Additionally, advancements in kit formulations, which offer more accurate and reproducible results, are likely to contribute to the segment’s growth. As the focus on precision medicine and targeted therapies increases, the demand for high-quality assay kits is projected to rise significantly in the coming years.

Application Analysis

The drug discovery held a significant share of 55.7% due to the increasing reliance on cell-based assays to identify potential drug candidates and assess their efficacy and toxicity. As the pharmaceutical and biotechnology industries continue to focus on discovering novel therapeutics, especially for complex diseases like cancer and neurological disorders, the need for reliable screening methods is expected to rise.

Cell-based assays offer the advantage of using live cells to better mimic human biology, making them crucial in the early stages of drug development. The demand for more effective and safer drug candidates, along with the growing interest in personalized medicine, is likely to contribute to the continued expansion of the drug discovery segment in the market.

End-use Analysis

The pharmaceutical & biotechnology companies segment had a tremendous growth rate, with a revenue share of 63.8% as these companies continue to invest in advanced assay technologies for drug discovery and development. Pharmaceutical and biotechnology companies are increasingly adopting cell-based assays to evaluate drug safety, efficacy, and mechanisms of action. As these companies focus on developing targeted therapies and biologics, the demand for cell-based assays is expected to rise.

Additionally, the increasing focus on reducing animal testing and improving the efficiency of drug development processes is likely to drive the adoption of cell-based assays in these industries. As the pharmaceutical and biotechnology sectors expand, the need for high-quality cell-based assays to accelerate research and development will continue to contribute to this segment’s growth.

Key Market Segments

By Product Type

- Reagents

- Assay Kits

- Second Messenger Assays

- Reporter Gene Assays

- Cell Growth Assays

- Cell Death Assays

- Probes & Labels

- Microplates

- Instruments & Software

- Cell Lines

- Stem Cell Lines

- Primary Cell Lines

- Immortalized Cell Lines

By Application

- Basic Research

- Drug Discovery

- Other

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

Drivers

Increasing R&D expenditure in drug discovery and development is driving the market

Increasing R&D expenditure in drug discovery and development is driving the cell based assays market. Pharmaceutical and biotechnology companies invest heavily in identifying and validating drug targets, screening compound libraries, and assessing the efficacy and toxicity of potential new medicines. Cell-based assays are fundamental tools used throughout these processes, providing crucial information about how compounds interact with biological systems.

As companies continue to allocate significant resources to populate their drug pipelines, the demand for diverse and sophisticated cell-based assay technologies grows proportionally. The overall landscape of drug development indicates this trend. For example, the FDA approved 50 novel drugs in 2024, following 55 in 2023, demonstrating sustained activity in drug discovery that relies heavily on cell-based assay technologies.

Restraints

The high cost of assay development and implementation is restraining the market

The high cost associated with cell-based assay development and implementation is restraining the market. Developing complex cell models, acquiring specialized instrumentation such as high-throughput screening systems and advanced imaging equipment, and purchasing often expensive reagents and consumables represent substantial upfront and ongoing investments.

Smaller research laboratories, academic institutions, or nascent biotech companies may face budgetary constraints that limit their ability to adopt or expand their use of advanced cell-based assay techniques. The need for highly skilled personnel to design, execute, and interpret complex assays further adds to the overall expense. While specific government statistics on assay development costs are not tracked, reports on the broader laboratory supplies market indicate that volatile raw material prices, such as plastics used in consumables, can contribute to increased operating expenses for laboratories performing these assays.

Opportunities

Growing adoption of advanced cell models is creating growth opportunities

Growing adoption of advanced cell models, such as 3D cell cultures and organ-on-a-chip technologies, is creating growth opportunities. These innovative models offer a more physiologically relevant environment compared to traditional two-dimensional cell cultures, leading to more predictive and translational research outcomes. Researchers are increasingly utilizing these complex systems to better mimic in vivo conditions for disease modeling, drug screening, and toxicity testing, opening up new avenues for discovery.

The increased complexity and biological relevance of these models drive demand for specialized reagents, media, and instrumentation. The National Institutes of Health (NIH) actively funds research incorporating advanced cell culture techniques; for example, in March 2025, a significant NIH grant was awarded to investigate cellular responses using novel biomaterials platforms that mimic native tissues, highlighting ongoing investment in advanced cell model research.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors influence the cell based assays market by affecting funding availability for research and development activities. Economic conditions can impact government budgets for science and health research agencies like the NIH, as well as corporate R&D spending within the pharmaceutical and biotechnology industries, directly affecting investment in laboratory infrastructure and assay technologies. Inflation increases the cost of laboratory supplies, reagents, and equipment necessary for performing these assays, pressuring research budgets.

Geopolitical factors can indirectly affect the market through disruptions in global supply chains for essential laboratory materials if sourcing is dependent on specific international regions. Despite potential economic fluctuations impacting funding levels, the fundamental and growing need for biological insights in drug discovery and basic research continues to underpin demand for assay technologies.

Current US tariff policies can impact the cell based assays market by increasing the cost of imported laboratory equipment, reagents, and consumables. Many specialized instruments, cell culture media components, and assay kits are manufactured internationally, and tariffs imposed on these goods can increase their acquisition cost for US research institutions and companies. This directly affects the operational expenses of laboratories performing cell-based assays, potentially impacting research budgets and the pace of discovery.

Reports in April 2025 indicated that tariffs on laboratory-related goods could create cost pressures. However, these tariff policies could also incentivize domestic manufacturing of certain laboratory supplies and equipment, potentially leading to a more resilient and less globally dependent supply chain for these essential research tools in the long term, offering a potential future benefit to the market.

Trends

Increased focus on phenotypic screening is a recent trend

Increased focus on phenotypic screening is a recent trend influencing the cell based assays market. Rather than solely targeting specific molecules, researchers are increasingly employing assays that measure observable changes in cell behavior or function in response to perturbations. This approach can reveal novel drug targets and provide a more comprehensive understanding of complex biological processes.

Phenotypic screening often requires more sophisticated assay design, advanced cell models, and high-content imaging and analysis capabilities. This trend drives the development and adoption of new technologies and reagents that enable the assessment of multiple cellular parameters simultaneously. NIH funding opportunities, such as those supporting assay development for brain disorders that include phenotypic screening approaches, indicate this growing area of research focus.

Regional Analysis

North America is leading the Cell Based Assays Market

North America dominated the market with the highest revenue share of 42.3% owing to the increasing use of these assays in drug discovery and development. The National Institutes of Health (NIH) plays a crucial role in funding research that utilizes cell-based assays. For example, in fiscal year 2023, the NIH allocated a substantial portion of its US$ 47.7 billion budget to extramural research, which includes funding for projects focused on understanding disease mechanisms; many of these projects rely on cell-based assay technologies.

This funding directly supports the development and application of new and improved assays. Furthermore, the FDA’s emphasis on evaluating drug safety and efficacy through in vitro studies, including those using cell-based models, contributes to the demand for these assays. The FDA has issued guidance documents that highlight the importance of cell-based assays in the drug approval process, with 5 new guidance documents referencing cell-based assays published between 2022 and 2024. This solidifies their role in North American pharmaceutical development.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing investments in pharmaceutical and biotechnology sectors across the region. Countries like China and India are expanding their research capabilities, which is projected to drive the adoption of advanced cell-based assay techniques. For instance, government initiatives in China, focused on developing its biopharmaceutical industry, are likely to increase the demand for these assays in drug screening and development.

China’s National Bureau of Statistics reported that R&D expenditure reached 2.54% of the country’s GDP in 2022. Additionally, the rising prevalence of chronic diseases in the Asia Pacific region is expected to stimulate research into new treatments, much of which relies on cell-based assays.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the global cell-based assays market drive growth through strategic acquisitions, technological innovation, and expansion into emerging therapeutic areas. They enhance product portfolios by acquiring specialized companies, enabling the integration of advanced technologies such as high-throughput screening and 3D cell culture models.

Investments in research and development facilitate the introduction of novel assay platforms tailored for drug discovery, cancer research, and personalized medicine. Collaborations with academic institutions and biotechnology firms accelerate innovation and market penetration. Additionally, companies focus on expanding their presence in underserved regions, addressing the increasing demand for advanced research tools and services.

PerkinElmer Inc. is a prominent player in the cell-based assays market, offering a comprehensive range of products and services for drug discovery and disease research. The company provides advanced assay technologies, including AlphaLISA and LANCE Ultra, to support high-throughput screening and biomarker analysis. PerkinElmer has expanded its capabilities through strategic acquisitions, such as the purchase of Cisbio Bioassays, enhancing its position in the cell-based assay market. With a strong focus on innovation and customer collaboration, PerkinElmer continues to be a key contributor to advancements in cell-based research.

Top Key Players in the Cell Based Assays Market

- Sphere Fluidics

- Promega Corporation

- Ncardia

- Merck KGaA

- Lonza Group AG

- Danaher Corporation

- Corning Incorporated

- Bio-Rad Laboratories, Inc

Recent Developments

- In October 2024, Sphere Fluidics introduced the second generation of its Cyto-Mine platform, Cyto-Mine Chroma. This upgraded version offers improved features such as multiplexing and enhanced assay flexibility, designed to optimize single-cell functional analysis workflows, making it a key tool for drug discovery and biotechnology research.

- In September 2024, Ncardia unveiled a series of ready-to-use cell-based assays to facilitate the screening and selection of treatments for neurodegenerative diseases like Parkinson’s. These assays are based on induced pluripotent stem cells (iPSCs) derived from human samples, which can be reprogrammed to become virtually any cell type for research purposes.

Report Scope

Report Features Description Market Value (2024) US$ 17.3 billion Forecast Revenue (2034) US$ 40.6 billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Assay Kits (Second Messenger Assays, Reporter Gene Assays, Cell Growth Assays, and Cell Death Assays), Probes & Labels, Microplates, Instruments & Software, and Cell Lines (Stem Cell Lines, Primary Cell Lines, and Immortalized Cell Lines)), By Application (Basic Research, Drug Discovery, and Other), By End-use (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sphere Fluidics, Promega Corporation, Ncardia, Merck KGaA, Lonza Group AG, Danaher Corporation, Corning Incorporated, Bio-Rad Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sphere Fluidics

- Promega Corporation

- Ncardia

- Merck KGaA

- Lonza Group AG

- Danaher Corporation

- Corning Incorporated

- Bio-Rad Laboratories, Inc