Global Cassava Flour Market Size, Share, And Business Benefits By Product (Conventional, Organic), By Application (Food and Beverage, Animal Feed, Pharmaceutical, Personal Care and Cosmetics, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158271

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

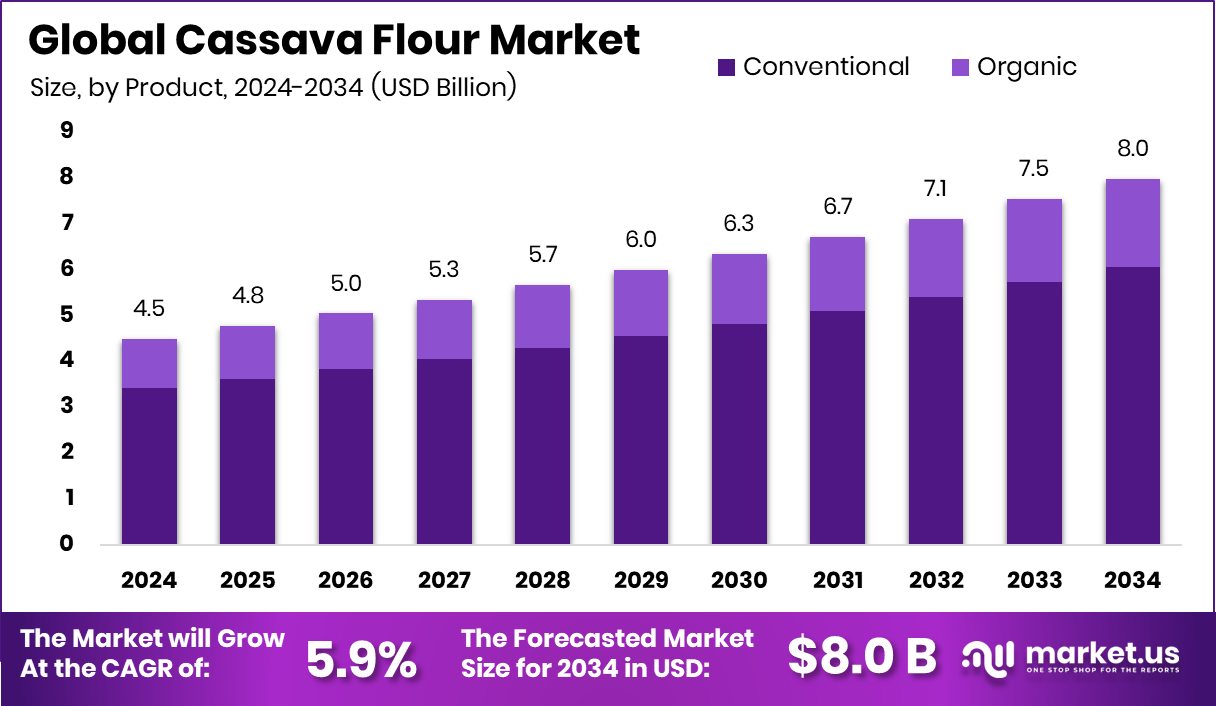

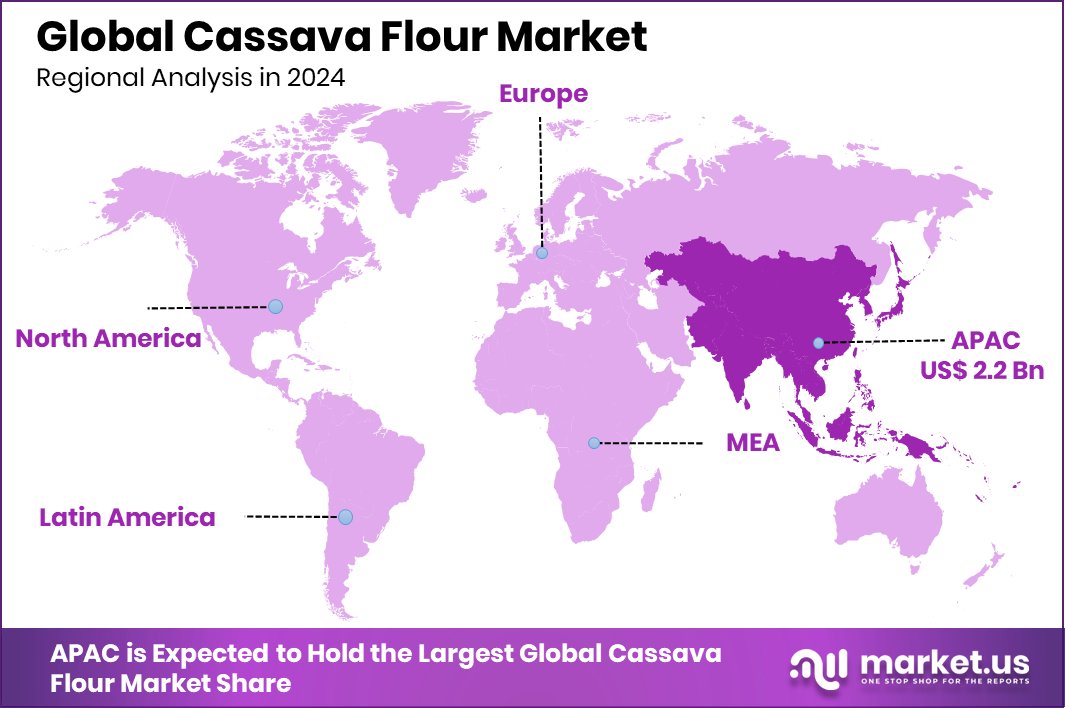

The Global Cassava Flour Market is expected to be worth around USD 8.0 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Government policies supported Asia Pacific’s Cassava Flour Market at USD 2.2 Billion with 49.7% share.

Cassava flour, made by processing the whole cassava root (Manihot esculenta), is gaining momentum as a versatile, gluten-free alternative to wheat. Unlike tapioca starch, which extracts only the starch, cassava flour retains fibre and nutrients, offering different textural and nutritional qualities. It is widely used in baking, cooking, and thickening due to its mild taste and compatibility with wheat flour. Cultivation thrives in tropical regions where cassava outperforms cereals under poor soils and drought, making it a reliable crop for food security.

The market’s growth is strongly driven by rising health awareness. With more consumers adopting gluten-free diets—whether for celiac disease, gluten sensitivity, or clean-label preferences—demand for cassava flour is expanding. Its resilience to climate change also makes it attractive for farmers.

Advances in processing, such as better drying and milling, reduce losses and enhance quality, encouraging investment. Demand is rising in both traditional markets, where cassava replaces costly wheat imports, and global niche markets, including bakeries, snacks, and health foods. Industrial buyers are fueling large-scale adoption, while urban consumers with higher incomes increasingly seek ready-to-use cassava-based products.

Opportunities lie in value-added processing, fortified blends, government-backed substitution policies, and improved cassava cultivars. Supply chain investments in storage and transport can further lower costs. Importantly, governments are backing the sector with significant funding. Nigeria’s Federal Government, alongside AfDB, IFAD, and IsDB, has committed over US$150 million through initiatives like Special Agro-Processing Zones. Additionally, the Bill & Melinda Gates Foundation granted US$28 million to boost cassava yields in Sub-Saharan Africa. These initiatives strengthen infrastructure, research, and farmer support, accelerating cassava flour’s global growth trajectory.

Key Takeaways

- The Global Cassava Flour Market is expected to be worth around USD 8.0 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- In 2024, conventional cassava flour led the market with a 76.9% share, showing strong dominance.

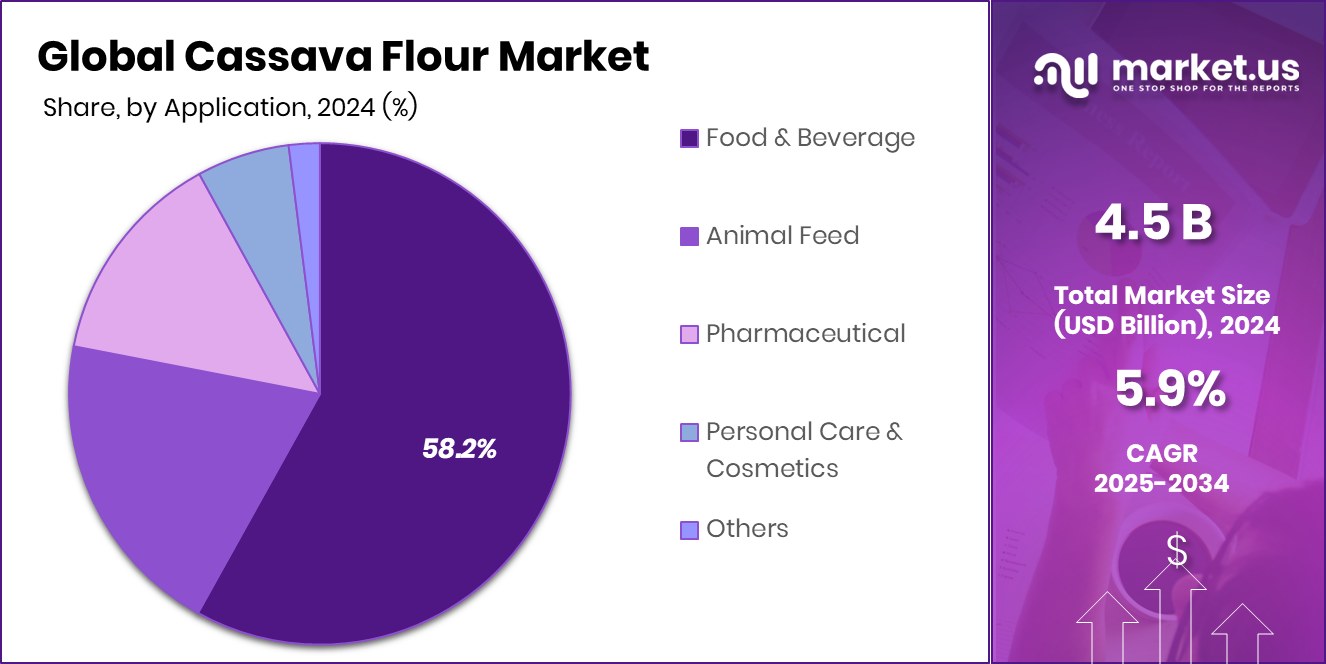

- Food and beverage applications captured a 58.2% share, highlighting cassava flour’s growing role in everyday consumption.

- Supermarkets and hypermarkets accounted for a 37.4% share, proving essential in distributing cassava flour to global consumers.

- Strong demand in the Asia Pacific, valued at USD 2.2 billion, reflects its 49.7% dominance.

By Product Analysis

Conventional cassava flour dominates the market, holding a strong 76.9% share.

In 2024, Conventional held a dominant market position in the byproduct segment of the Cassava Flour Market, with a 76.9% share. This strong lead reflects the widespread use of conventional cassava flour in both household consumption and industrial applications, particularly in regions where cassava is a staple crop. Conventional cassava flour benefits from lower production costs, established farming practices, and broader availability compared to premium or specialized alternatives.Its affordability makes it the preferred choice for bakeries, snack producers, and local food manufacturers, especially in emerging economies where wheat imports remain expensive. The segment’s dominance also highlights its role in food security, supporting substitution policies and driving steady demand across global and regional markets.

By Application Analysis

Food and beverage applications lead demand, capturing 58.2% of cassava flour usage.

In 2024, Food and Beverage held a dominant market position in By Application segment of Cassava Flour Market, with a 58.2% share. This leadership is driven by the flour’s versatility in bakery products, snacks, sauces, and ready-to-eat meals. Its naturally gluten-free nature and mild taste make it a preferred substitute for wheat flour, especially in health-conscious and urban consumer markets.Food manufacturers are increasingly adopting cassava flour to cater to rising demand for clean-label, grain-free, and allergen-free products. Additionally, its role in traditional diets across Africa, Asia, and Latin America continues to support high consumption. With steady adoption by industrial bakeries and packaged food producers, the segment maintains consistent growth and strong market reliance.

By Distribution Channel Analysis

Supermarkets and hypermarkets drive sales, accounting for 37.4% of the distribution channel share.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of Cassava Flour Market, with a 37.4% share. This dominance is attributed to their extensive product variety, wider shelf space, and ability to attract bulk buyers as well as retail consumers. These outlets provide greater visibility and accessibility for cassava flour brands, catering to both health-conscious urban customers and mainstream households.

Promotional activities, attractive discounts, and well-organized product placement further strengthen sales through this channel. With consumers increasingly preferring one-stop shopping for groceries and specialty items, supermarkets and hypermarkets continue to be the most trusted and convenient point of purchase for cassava flour in domestic and international markets.

Key Market Segments

By Product

- Conventional

- Organic

By Application

- Food and Beverage

- Animal Feed

- Pharmaceutical

- Personal Care and Cosmetics

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Grocery Stores

- Online Retailers

- Others

Driving Factors

Rising Demand for Gluten-Free and Clean Label Foods

One of the biggest driving factors for the cassava flour market is the rising demand for gluten-free and clean label foods. More people are becoming aware of health issues like celiac disease, gluten sensitivity, or simply preferring diets free from wheat and grains. Cassava flour is naturally gluten-free, has a mild taste, and can be used in baking, cooking, and thickening just like wheat flour. This makes it very attractive to both home consumers and food manufacturers.

In addition, clean label trends—where people want simple, natural, and minimally processed ingredients—are pushing cassava flour forward. Its adaptability in bakery products, snacks, and ready mixes is helping it gain strong momentum in both local and global markets.

Restraining Factors

Limited Processing Infrastructure and Supply Chain Gaps

A key restraining factor for the cassava flour market is the limited processing infrastructure and weak supply chain systems in many cassava-growing regions. While cassava is widely cultivated, turning fresh roots into high-quality flour requires proper drying, milling, and storage facilities. In many areas, poor access to modern equipment and a lack of cold storage lead to high post-harvest losses and inconsistent quality.

Transportation challenges in rural regions also increase costs, making it harder for producers to supply large buyers or export markets. These gaps reduce competitiveness compared to wheat flour and other alternatives. Unless investments in processing plants, logistics, and quality control improve, the market growth of cassava flour may face significant hurdles.

Growth Opportunity

Government Funding Boosts Cassava Flour Market Expansion

One of the biggest growth chances for the cassava flour market is when governments force or strongly promote including cassava flour in everyday wheat‐flour products like bread. This policy helps by making sure there is guaranteed demand, which encourages farmers to grow more cassava, processors to build capacity, and businesses to invest in production lines.

For example, in Nigeria, the government created a “Cassava Bread Fund” (about N9.9 billion) to support both small processors and big cassava flour mills, giving out loans and grants to help them upgrade equipment and produce cassava blended flour.

Latest Trends

Increase in Government-Funded Cassava Bread Blending

A big new trend in the cassava flour market is governments pushing for cassava flour to be blended with wheat in bread and other flour-based foods. This means they require or encourage mills and bakeries to mix a percentage of cassava into wheat flour. The idea is to reduce dependency on imported wheat, cut costs, support local cassava farmers, and boost local agriculture.

Because governments often provide funds, subsidies, or grants to help mills, bakeries, or farmers get the equipment and raw cassava needed, this blending becomes more feasible. When supported by funding, this trend helps make cassava flour more common, improves local economies, and gives health/labelling benefits (gluten-free alternatives, etc.).

Regional Analysis

In 2024, the Asia Pacific held a 49.7% share, reaching USD 2.2 billion Cassava Flour Market.

Asia Pacific leads the Cassava Flour Market as the dominating region with 49.7% share (USD 2.2 Bn), anchored by abundant cassava cultivation, rising gluten-free adoption, and steady integration of cassava flour into mainstream packaged foods. North America shows healthy traction driven by clean-label and allergen-friendly baking trends, with retail and foodservice using cassava flour in tortillas, snacks, and premium bakery mixes.

Europe advances on the back of strict reformulation goals and the growth of artisanal and industrial gluten-free bakeries, where cassava flour supports texture and label simplicity. The Middle East & Africa benefit from cassava’s role in staple foods and milling upgrades that improve flour consistency for bakery and quick-service chains.

Latin America, supported by strong cassava roots in local cuisine, expands processing for export-ready flours and blends used in snacks and bakery applications. Across regions, manufacturers prioritize consistent granulation, low cyanogenic content, and supply-chain traceability to meet retailer and brand standards. Strategic sourcing partnerships with growers and investments in drying/milling capacity are widening availability for large buyers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, three companies—DADTCO Rivers Cassava Processing Company, Psaltry International, and Green Hills Natural Foods—are playing a crucial role in shaping the global cassava flour market through localized expertise and strong integration into value chains.

DADTCO Rivers Cassava Processing Company has established itself as a pioneer in decentralized cassava processing. By operating mobile processing units close to farming communities, the company reduces post-harvest losses and ensures steady income streams for smallholder farmers. This model strengthens rural economies and provides a consistent supply of high-quality flour for both domestic use and industrial buyers.

Psaltry International, based in Nigeria, focuses on scaling up cassava processing for both food and industrial applications. The company’s investment in state-of-the-art milling facilities and partnerships with small farmers underscores its dual mission of social impact and industrial efficiency. With an expanding customer base in local and regional markets, Psaltry is well-positioned to capitalize on the rising demand for gluten-free alternatives and cassava-based sweeteners.

Green Hills Natural Foods emphasizes a health-focused, premium product strategy. Its cassava flour is marketed toward clean-label and gluten-free niches, meeting the needs of conscious consumers in both developed and emerging regions. The company leverages strong branding and organic certifications to differentiate itself in competitive retail spaces.

Top Key Players in the Market

- DADTCO Rivers Cassava Processing Company

- Psaltry International

- Green Hills Natural Foods

- MHOGO Foods

- Mocaf Factory

- Cargill

- Archer Daniels Midland Company (ADM)

- Tereos Group

- Thai Wah Public Company Limited

- Roquette Frères

Recent Developments

- In December 2024, Psaltry published an overview of its operations, highlighting that beyond just producing cassava flour, they also make food-grade cassava starch and glucose. They emphasized selling these products both locally and internationally. One point made was that being close to farms helps them maintain the freshness of the cassava root, which is important to ensure better flour quality.

- In June 2024, Tereos mentions operations under its “Starch, Sweeteners & Renewables” segment, which processes “cereals and tubers” in its plants. Cassava is a tuber, so this indicates Tereos has infrastructure that could process cassava‐based starch or flour.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 8.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Organic), By Application (Food and Beverage, Animal Feed, Pharmaceutical, Personal Care and Cosmetics, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DADTCO Rivers Cassava Processing Company, Psaltry International, Green Hills Natural Foods, MHOGO Foods, Mocaf Factory, Cargill, Archer Daniels Midland Company (ADM), Tereos Group, Thai Wah Public Company Limited, Roquette Frères Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DADTCO Rivers Cassava Processing Company

- Psaltry International

- Green Hills Natural Foods

- MHOGO Foods

- Mocaf Factory

- Cargill

- Archer Daniels Midland Company (ADM)

- Tereos Group

- Thai Wah Public Company Limited

- Roquette Frères