Global Carpooling Apps Market Size, Share, Statistics Analysis Report By Type of Routes (Fixed-Route Carpooling, Dynamic Carpooling, Slugging), By Vehicle Capacity (Small Cars (4-6 seats) , Mid-Size Cars (7-9 seats), Vans (10+ seats)), By Distance Range (Short-Distance (less than 10 miles), Medium-Distance (10-50 miles), Long-Distance (50+ miles)), By Commuter Frequency (Daily Commuters, Weekly Commuters, Occasional Commuters), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144416

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Business Benefits

- China Carpooling Apps Market

- Type of Routes Analysis

- Vehicle Capacity Analysis

- Distance Range Analysis

- Commuter Frequency Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Growth Factors

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

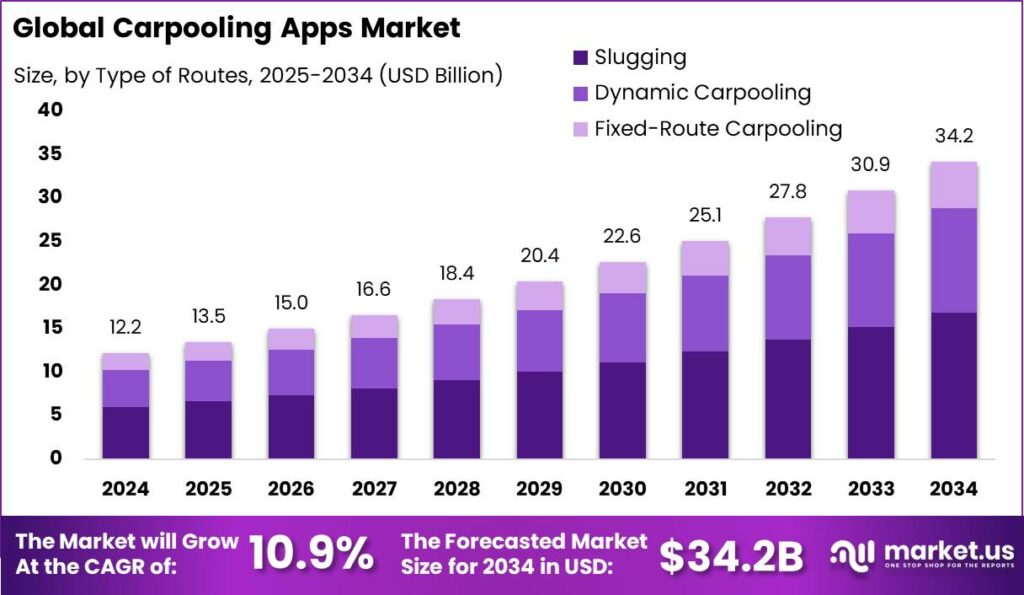

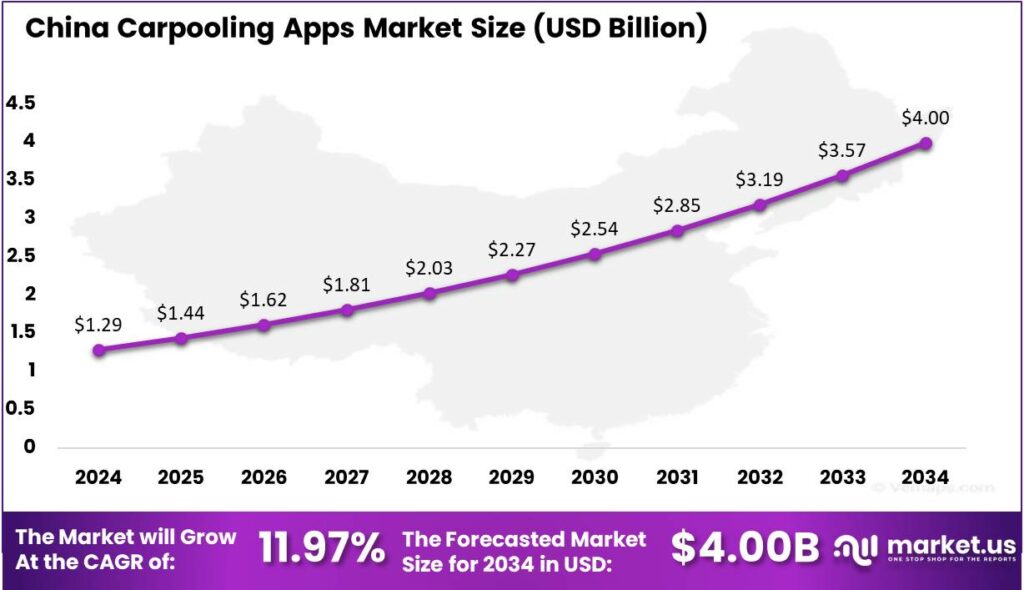

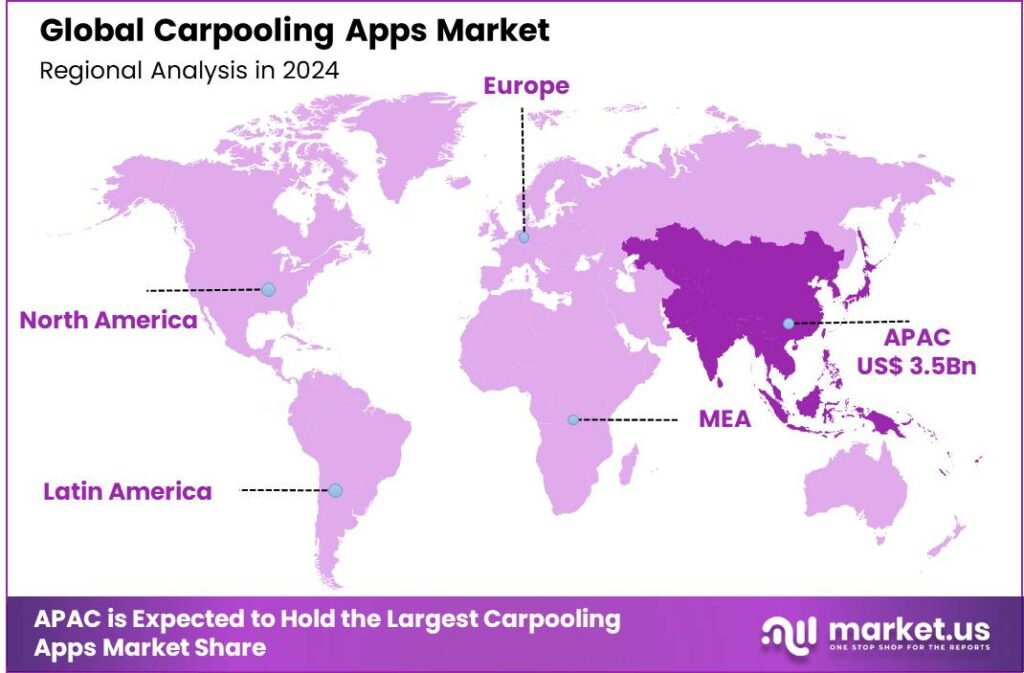

The Global Carpooling Apps Market size is expected to be worth around USD 34.2 Billion By 2034, from USD 12.17 Billion in 2024, growing at a CAGR of 10.90% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the global carpooling apps market with 29.48% share and revenues of USD 3.5 billion. The market in China was valued at USD 1.29 billion, growing at a CAGR of 11.97%.

Carpooling apps, also known as rideshare applications, facilitate shared rides between drivers and passengers who are traveling in the same direction. Carpooling apps reduce travel costs, traffic, and environmental impact by optimizing vehicle usage. With growing consumer awareness of sustainable travel, the market has expanded, offering features like route matching, scheduled rides, and payment integration for added convenience and safety.

The carpooling apps market is experiencing significant growth, driven by an increasing awareness of environmental issues, rising fuel costs, and the need for budget-friendly travel options. As urban areas become more congested, more commuters are turning to carpooling as a viable alternative to solo driving, fostering a reduction in traffic and pollution.

The primary driving factors behind the growth of the carpooling apps market include environmental concerns, economic benefits, and enhancements in commuting efficiency. Carpooling significantly reduces the carbon footprint of commuting by decreasing the number of vehicles on the road, thus lowering greenhouse gas emissions and air pollution.

The adoption of advanced technologies is crucial in the expansion of the carpooling apps market. Real-time tracking, automated scheduling, dynamic route optimization, and integrated payment systems are technologies that enhance the user experience by making carpool arrangements more convenient and reliable.

Commuters are increasingly adopting carpooling apps due to the convenience, cost-effectiveness, and environmental benefits they offer. These platforms provide a practical solution to commuting challenges such as high travel costs, traffic congestion, and the environmental impact of solo driving. The social aspect of meeting new people and networking during rides also contributes to their popularity.

The future of carpooling apps includes not only geographical expansion but also service diversification. Beyond ride-sharing, carpooling apps can expand into services like package delivery or car rentals, leveraging their existing user base and technology. This diversification opens new revenue streams and strengthens their market position.

Key Takeaways

- The Global Carpooling Apps Market size is expected to reach USD 34.2 Billion by 2034, up from USD 12.17 Billion in 2024, growing at a CAGR of 10.90% during the forecast period from 2025 to 2034.

- In 2024, the Slugging segment held a dominant position in the carpooling apps market, capturing more than 49.2% of the market share.

- The Small Cars (4-6 seats) segment held a dominant market position in 2024, accounting for more than 61.4% of the carpooling apps market share.

- The Short-Distance (less than 10 miles) segment led the carpooling apps market in 2024, with a market share of more than 52.6%.

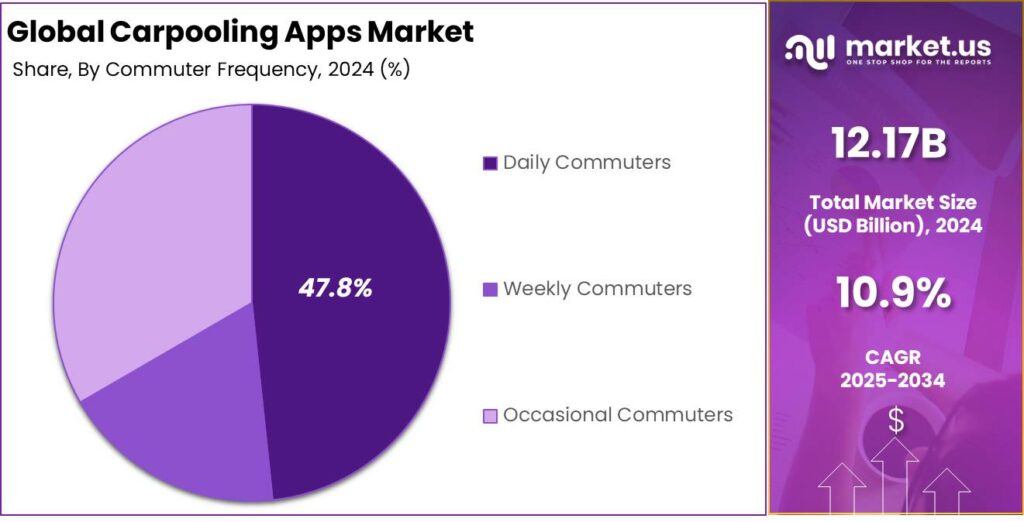

- The Daily Commuters segment also dominated the carpooling apps market in 2024, capturing more than 47.8% of the overall market share.

- In 2024, Asia-Pacific held the largest market share in the global carpooling apps market, with more than 29.48%, and revenues reaching USD 3.5 billion.

- In 2024, the carpooling apps market in China was valued at USD 1.29 billion, experiencing a robust growth rate with a CAGR of 11.97%.

Analysts’ Viewpoint

One notable trend in the carpooling apps market is the integration with other types of shared mobility, such as bike-sharing and public transportation, to offer a comprehensive mobility solution. There is also a trend towards providing more personalized travel experiences through artificial intelligence and machine learning technologies.

For businesses, promoting the use of carpooling apps can lead to reduced parking space requirements and contribute to an organization’s environmental goals. Companies that encourage carpooling can benefit from a positive public image and alignment with sustainable practices.

Technological advancements are central to the evolution of carpooling apps. Features like AI-driven route planning, automatic fare splitting, and real-time ride matching are transforming how carpool services operate, making them more user-friendly and efficient.

The regulatory environment for carpooling apps varies by region, but there is a general trend towards supporting carpool initiatives as part of broader efforts to reduce urban traffic congestion and environmental impact. Some regions offer incentives such as tax benefits or toll reductions for carpooling vehicles, which can encourage more people to participate in carpooling programs.

Business Benefits

By promoting shared rides, carpooling apps help businesses reduce transportation expenses. According to the Citizen Matters report, a study in India found that 30% of participants might delay purchasing a car if car-sharing options were available, leading to decreased demand for corporate transportation services.

Reducing the number of vehicles on the road through carpooling leads to lower emissions. Carpooling apps often include features that allow users to track their carbon savings, promoting eco-friendly commuting. According to the Environmental Protection Agency (EPA), a single shared ride can reduce per-person Carbon Emission by up to 50%.

Carpooling alleviates traffic jams, resulting in more punctual employees and less time lost in transit. According to a study by INRIX, if only 20% of urban commuters opted for carpooling, traffic congestion could drop by 30%, resulting in the annual saving of millions of hours previously lost to gridlock. This means employees spend less time commuting and more time focused on their work.

China Carpooling Apps Market

In 2024, the market for carpooling apps in China was estimated to be valued at USD 1.29 billion. This sector is experiencing a robust growth rate, with a compound annual growth rate (CAGR) of 11.97%.

The significant expansion in the Chinese carpooling apps market can be attributed to several key factors. Increasing urbanization and a growing population in metropolitan areas are leading to more severe traffic congestion and pollution issues. This scenario drives the demand for cost-effective and efficient transportation solutions, such as carpooling.

Technological advancements are key to the growth of the carpooling app market. The widespread use of smartphones and better internet connectivity make these apps more accessible. Additionally, features like real-time tracking, secure payments, and intuitive interfaces build consumer trust and satisfaction, leading to higher usage rates.

The carpooling app market in China is expected to continue growing, driven by government initiatives supporting shared mobility, reducing traffic and pollution, and investments in digital infrastructure. As urbanization and environmental concerns increase, carpooling apps will play a key role in transforming urban mobility.

In 2024, Asia-Pacific held a dominant market position in the global carpooling apps market, capturing more than a 29.48% share with revenues reaching USD 3.5 billion. This region’s leading status can be primarily attributed to several key factors that are explored below.

The substantial growth of the carpooling apps market in Asia-Pacific is driven by the high rate of technological adoption and increasing mobile internet penetration in populous countries such as China and India. Rapid urbanization in these nations leads to increased traffic and pollution, driving consumers to seek efficient, sustainable travel options.

Moreover, the governments in this region are actively supporting the adoption of shared mobility solutions as part of their broader transportation and environmental policies. Initiatives aimed at reducing carbon emissions and improving urban air quality include the promotion of carpooling and other forms of shared transportation.

Economic factors drive growth in the carpooling app market, particularly in the Asia-Pacific region, where carpooling offers an affordable option for lower to middle-income populations. Increased entrepreneurial activity and investment in tech startups also foster innovation, making carpooling services more accessible and user-friendly.

Type of Routes Analysis

In 2024, the Slugging segment held a dominant position within the carpooling apps market, capturing more than 49.2% of the market share. This form of carpooling, which involves casual carpooling where riders gather at designated locations without prior arrangement, has gained popularity due to its convenience and efficiency.

The leading position of the Slugging segment can be attributed to several factors. Primarily, the no-cost nature of Slugging, where passengers ride free and drivers benefit from access to high-occupancy vehicle lanes, makes it an economically attractive option for many urban commuters.

Technological advancements in mobile apps have boosted the Slugging segment by improving real-time coordination and communication, effectively matching drivers with passengers and optimizing travel routes. With rapid urbanization and growing traffic congestion in major cities, Slugging has become a popular choice for commuters seeking to reduce travel time and environmental impact.

The Slugging segment is set for continued growth due to urban sprawl and rising environmental concerns. As cities adopt policies to reduce congestion and promote eco-friendly transport, Slugging is likely to gain more users. Improved app features and interfaces could also boost its market share in the future.

Vehicle Capacity Analysis

In 2024, the Small Cars (4-6 seats) segment held a dominant market position in the carpooling apps market, capturing more than a 61.4% share. This segment’s leadership can be attributed to several factors that align with consumer preferences and urban transportation dynamics.

The popularity of small cars in carpooling also stems from their practicality in navigating dense urban environments. Smaller vehicles can easily maneuver through traffic and require less parking space, which is a significant advantage in crowded cities. This convenience not only appeals to drivers but also to passengers seeking efficient and hassle-free commuting.

Additionally, the environmental impact of small cars is typically lower compared to larger vehicles, aligning with the growing consumer trend towards sustainability. This ecological sensitivity resonates well with the target demographic of carpooling apps, which often includes young urbanites committed to reducing their carbon footprints.

Furthermore, regulatory frameworks in many cities that incentivize the use of smaller, more fuel-efficient cars have bolstered the dominance of this segment. Policies such as lower taxes and fees for eco-friendlier vehicles encourage both carpool drivers and passengers to opt for small cars, reinforcing their leading position in the market.

Distance Range Analysis

In 2024, the Short-Distance (less than 10 miles) segment held a dominant market position in the carpooling apps market, capturing more than a 52.6% share. This segment’s leadership can be attributed to several distinct factors that are examined in detail below.

The dominance of short-distance trips in urban and suburban areas drives the popularity of carpooling. Daily commutes to work, school, and errands often fall within this range, making carpooling a convenient option. The ease of coordinating rides with nearby residents or coworkers enhances the appeal of carpooling apps for everyday travel.

Moreover, the lower cost and minimal commitment associated with short-distance carpooling make it an attractive option for users. People are generally more willing to share rides for shorter distances as it requires less coordination and travel time, leading to increased frequency of use. This convenience factor is a significant driver behind the segment’s substantial market share.

Additionally, urban traffic congestion and the push for reduced parking demand encourage individuals to opt for carpooling for short distances. Cities are increasingly promoting carpooling as a means to alleviate traffic congestion and reduce the environmental impact of solo commutes. This governmental support aligns well with public sentiment towards more sustainable urban living practices.

Commuter Frequency Analysis

In 2024, the Daily Commuters segment held a dominant market position within the carpooling apps market, capturing more than 47.8% of the overall market share. This segment’s leadership can be attributed to the increasing adoption of carpooling solutions by individuals commuting to workplaces and educational institutions on a regular basis.

The Daily Commuters segment leads the carpooling apps market due to the regularity of their travel, which aligns well with the scheduled services of carpooling apps. Commuters value the cost savings of shared trips and the convenience of coordinating rides with the same group, making carpooling a preferred option for their daily travel.

Furthermore, the infrastructure and policy environment increasingly support the Daily Commuters segment. Urban centers are implementing policies that favor carpooling to reduce traffic congestion and pollution, thereby providing incentives such as dedicated lanes or reduced tolls for carpool vehicles. These initiatives make carpooling a more efficient and appealing option for daily commuters.

The Weekly and Occasional Commuters segments have less market penetration than Daily Commuters, as their infrequent travel leads to sporadic app usage and lower dependency. This affects customer retention and regular revenue flow, which are stronger in the Daily Commuters segment. Frequent use, supportive policies, and cost benefits position Daily Commuters as the leader in the carpooling apps market.

Key Market Segments

By Type of Routes

- Fixed-Route Carpooling

- Dynamic Carpooling

- Slugging

By Vehicle Capacity

- Small Cars (4-6 seats)

- Mid-Size Cars (7-9 seats)

- Vans (10+ seats)

By Distance Range

- Short-Distance (less than 10 miles)

- Medium-Distance (10-50 miles)

- Long-Distance (50+ miles)

By Commuter Frequency

- Daily Commuters

- Weekly Commuters

- Occasional Commuters

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising traffic gridlock

Urban areas worldwide are grappling with escalating traffic congestion due to high vehicle volumes, limited road capacities, and inadequate traffic management. This congestion leads to longer commute times, heightened stress levels among commuters, and increased environmental pollution.

Carpooling apps present a viable solution by reducing the number of vehicles on the road, thereby alleviating congestion. By facilitating shared rides, these platforms not only enhance travel efficiency but also contribute to environmental sustainability by lowering carbon emissions. The growing awareness of these benefits has led to a surge in the adoption of carpooling services, positioning them as a practical response to urban mobility challenges.

Restraint

Privacy and Safety Concerns

Despite the advantages, privacy and safety concerns remain significant barriers to the widespread adoption of carpooling apps. Users may be hesitant to share rides with strangers due to fears of personal safety and the potential misuse of personal information.

While platforms implement measures such as background checks and real-time tracking to mitigate these concerns, apprehensions persist. The challenge lies in building and maintaining user trust through stringent safety protocols, transparent operations, and continuous engagement to address and alleviate these concerns effectively. In addition to safety and privacy concerns, trust issues also hinder carpooling app adoption. Users may feel uneasy sharing rides with strangers, worried about the behavior of the driver or other passengers.

Opportunity

Integration of Autonomous Vehicles

The advent of autonomous vehicle (AV) technology presents a substantial opportunity for the carpooling app industry. Integrating AVs into carpooling services can reduce operational costs by eliminating the need for human drivers, potentially leading to lower fares for consumers and increased profit margins for companies.

Additionally, autonomous vehicles can operate continuously without breaks, enhancing service availability and efficiency. However, realizing this opportunity depends on technological advancements, regulatory approvals, and public acceptance of autonomous transportation.

In addition to reducing operational costs, the integration of autonomous vehicles (AVs) in carpooling services can also improve the efficiency and availability of rides. AVs can operate around the clock without breaks, increasing ride availability and reducing wait times for users.

Challenge

Prioritizing driver well-being and fair pay

A significant challenge within the carpooling app industry is addressing concerns related to driver welfare and fair compensation. While gig work offers flexibility, issues such as low pay, lack of benefits, and job insecurity have been highlighted.

Drivers often incur expenses related to vehicle maintenance and fuel, which can diminish their overall earnings. Additionally, the classification of drivers as independent contractors rather than employees means they are typically ineligible for benefits such as health insurance and paid leave. Addressing these concerns is crucial for the sustainable growth of the industry and requires a balanced approach that considers the interests of both drivers and service providers.

Key Growth Factors

- Rising Fuel Prices and Transportation Costs: As fuel prices and daily commuting expenses increase, individuals seek cost-effective alternatives. Carpooling allows passengers to share travel costs, making it an economical solution for commuters.

- Environmental Awareness: Growing concerns about environmental sustainability and climate change have led people to adopt eco-friendly transportation options. Carpooling reduces the number of vehicles on the road, thereby decreasing air pollution and traffic congestion.

- Technological Advancements: The proliferation of smartphones and GPS technology has facilitated the development of user-friendly carpooling applications. These apps enable real-time ride matching, enhancing convenience and accessibility for users.

- Government Initiatives and Support: Many governments and organizations actively promote carpooling to alleviate traffic congestion and reduce environmental impact. Such support includes implementing policies and providing incentives that encourage the adoption of carpooling services.

- Increased Urbanization and Traffic Congestion: Rapid urbanization has led to overcrowded cities with significant traffic issues. Carpooling apps offer a practical solution by decreasing the number of vehicles on the road, thus improving traffic flow and reducing commute times.

Emerging Trends

Carpooling apps have evolved significantly, adapting to the changing needs of urban commuters and technological advancements. A prominent trend is the integration of real-time matching algorithms, which utilize artificial intelligence to connect drivers and passengers with similar routes and schedules, enhancing efficiency and user satisfaction.

In-app payment systems have streamlined the cost-sharing aspect of carpooling. Features such as automatic fare calculation based on distance, secure cost splitting among passengers, and multiple payment options, including digital wallets and UPI, have made transactions seamless and transparent.

Additionally, the rise of short-term and flexible carpooling options caters to individuals with irregular commuting patterns, such as remote workers who occasionally need to travel to the office. Apps like Waze Carpool and UberX Shared facilitate these ad-hoc arrangements, providing convenience without long-term commitments.

Key Player Analysis

Carpooling apps have become popular for their convenience, cost-efficiency, and eco-friendly benefits, connecting drivers and passengers for daily commutes or long trips. Hailo is a prominent player in the carpooling market, offering a ride-hailing service that connects users with licensed taxi drivers. While it initially started as a taxi-hailing app, Hailo has expanded into a carpooling platform, allowing passengers to share rides.

Turo offers a unique twist on the traditional carpooling model by providing a peer-to-peer car-sharing service. Instead of relying on taxis or professional drivers, Turo allows car owners to rent out their vehicles to other users for short-term use. This flexibility has made Turo one of the fastest-growing platforms in the carpooling and car-sharing market.

Car2Go is a well-known car-sharing service that allows users to rent vehicles by the minute, hour, or day. Car2Go offers short-term car rentals, allowing users to pick up and drop off vehicles at various locations. This flexible service is ideal for urban dwellers who need a car for brief trips without the hassle of ownership.

Top Key Players in the Market

- Hailo

- Turo

- Car2Go

- Maven

- Bridj

- Zipcar

- ReachNow

- moovel

- BlaBlaCar

- mytaxi

- Lyft

- Uber

- Via

- Green Pea

- Getaround

- Others

Top Opportunities for Players

The carpooling apps market is poised for significant growth, driven by various factors that present promising opportunities for players in the industry.

- Government Initiatives and Environmental Policies: Increasing government initiatives to reduce carbon emissions are significantly driving the growth of the carpooling market. Governments around the world are implementing policies that encourage the adoption of carpooling to alleviate traffic congestion and reduce pollution. Such policies, along with incentives for shared mobility, are expected to boost market growth.

- Technological Advancements in Mobile Platforms: There is a continuous evolution in mobile technologies and app functionalities, enhancing user experience and efficiency in carpooling services. Advances in mobile app technologies allow for better matching algorithms, real-time data processing, and enhanced user interfaces, making it easier for consumers to adopt carpooling solutions.

- Integration of Electric Vehicles (EVs): The integration of electric vehicles into carpooling services is an emerging trend, driven by the need for more sustainable transportation solutions. Government support for EVs, such as incentives for charging infrastructure, is making EV-based carpooling an attractive option for operators and consumers alike.

- Expansion into New Geographic Markets: There is a growing opportunity for carpooling apps to expand into new geographic regions where the market is still untapped. Regions like Asia-Pacific are experiencing rapid urbanization and an increase in smartphone penetration, which are key drivers for the adoption of carpooling services. Leveraging digital platforms to facilitate shared mobility can help tap into these growing markets.

- Corporate Partnerships and B2B Opportunities: Companies are increasingly adopting corporate carpooling programs as a part of their sustainability goals and to reduce operational costs. Partnering with businesses for employee carpooling services can create new revenue streams for carpooling app providers. Collaborations with automakers and tech companies can further enhance offerings and broaden market reach.

Recent Developments

- In March 2025, Carpool Logistics, a leader in vehicle logistics, has secured $12 million in Series funding. The investment will fuel the company’s growth by advancing its technology, boosting product development, optimizing logistics, and scaling sales and marketing to accelerate customer acquisition and expand its market presence.

- In July 2024, Spacer Technologies has broadened its reach by acquiring the commute assets from Scoop Technologies. This strategic move paved the way for the launch of the Scoop Commute app, a carpooling platform designed to make daily commuting more accessible and efficient for users.

Report Scope

Report Features Description Market Value (2024) USD 12.17 Bn Forecast Revenue (2034) USD 34.2 Bn CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Routes (Fixed-Route Carpooling, Dynamic Carpooling, Slugging), By Vehicle Capacity (Small Cars (4-6 seats) , Mid-Size Cars (7-9 seats), Vans (10+ seats)), By Distance Range (Short-Distance (less than 10 miles), Medium-Distance (10-50 miles), Long-Distance (50+ miles)), By Commuter Frequency (Daily Commuters, Weekly Commuters, Occasional Commuters) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hailo, Turo, Car2Go, Maven, Bridj, Zipcar, ReachNow, moovel, BlaBlaCar, mytaxi, Lyft, Uber, Via, Green Pea, Getaround, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hailo

- Turo

- Car2Go

- Maven

- Bridj

- Zipcar

- ReachNow

- moovel

- BlaBlaCar

- mytaxi

- Lyft

- Uber

- Via

- Green Pea

- Getaround

- Others