Global Carob Bean Gum Market Size, Share, And Enhanced Productivity By Physical Type (Powder, Liquid, Granules), By Source Type (Organic Carob Bean Gum, Conventional Carob Bean Gum), By Application (Food and Beverages, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176501

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

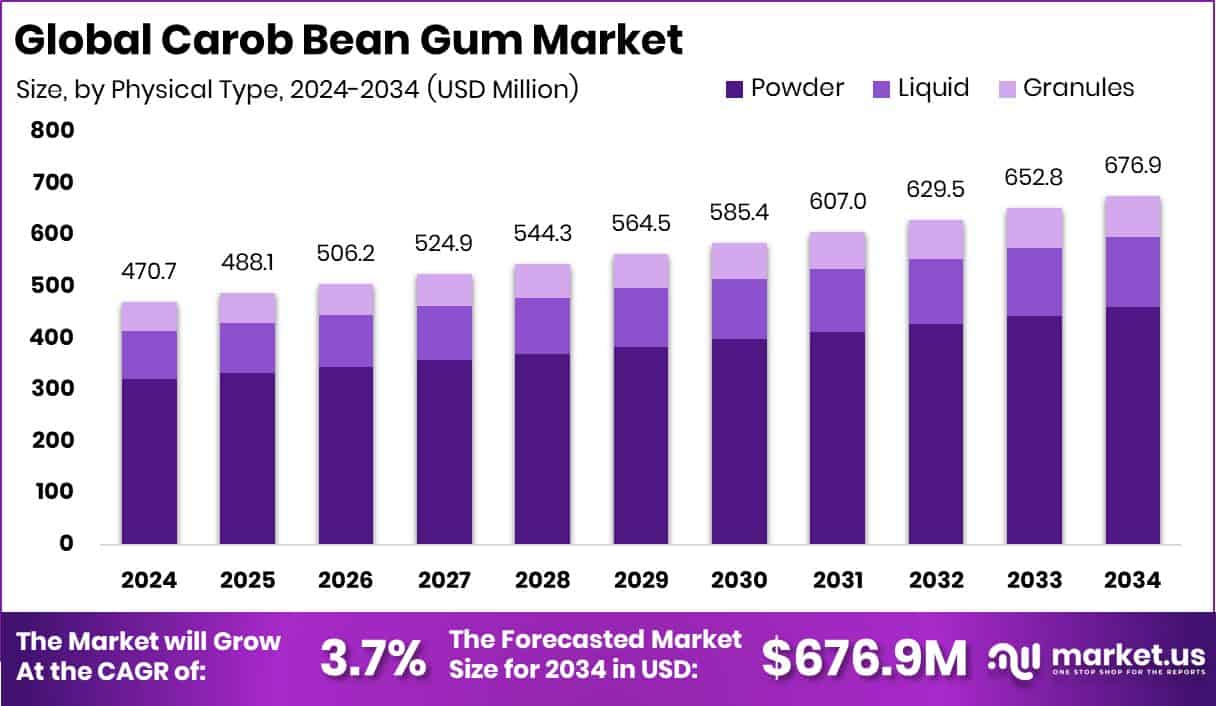

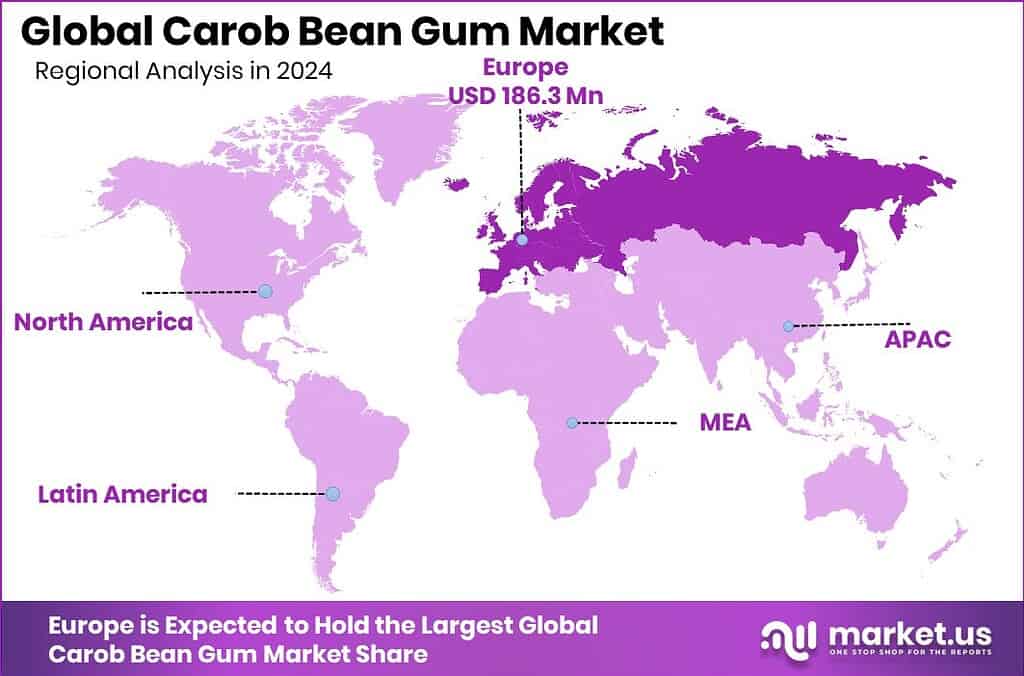

The Global Carob Bean Gum Market is expected to be worth around USD 676.9 Million by 2034, up from USD 470.7 Million in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The Carob Bean Gum Market in Europe recorded 39.6%, valued at USD 186.3 Mn.

The Carob Bean Gum is a natural thickener and stabilizer derived from the seeds of the carob tree. It is commonly used to improve texture, viscosity, and consistency in foods, beverages, pharmaceuticals, and cosmetic formulations. The gum is valued for its clean-label appeal and its ability to enhance product stability without synthetic additives. The Carob Bean Gum Market includes the production, processing, and distribution of gum across different physical forms such as powder, liquid, and granules, sourced organically or conventionally, and used in food, pharmaceuticals, and cosmetic applications.

Growth in this market is supported by rising demand for natural thickeners as consumers shift toward plant-based and label-friendly ingredients. The increasing use of carob-based stabilizers in dairy alternatives, snacks, and beverages strengthens market expansion. Additionally, the sector benefits from growing interest in sustainable hydrocolloids.

Demand is further elevated by investments that boost processing capabilities and innovation. For example, IFC invested $27.5 million in Lucid Colloids, supporting hydrocolloid manufacturing capacity, which indirectly enhances supply potential for gums like carob. Similarly, the €10M funding raised by Veganz Group to expand production of its printed oat-milk technology indicates growing opportunities in plant-based sectors where natural stabilizers are essential.

Key Takeaways

- The Global Carob Bean Gum Market is expected to be worth around USD 676.9 Million by 2034, up from USD 470.7 Million in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- Carob Bean Gum Market sees strong expansion as the powder form dominates with a 68.1% share.

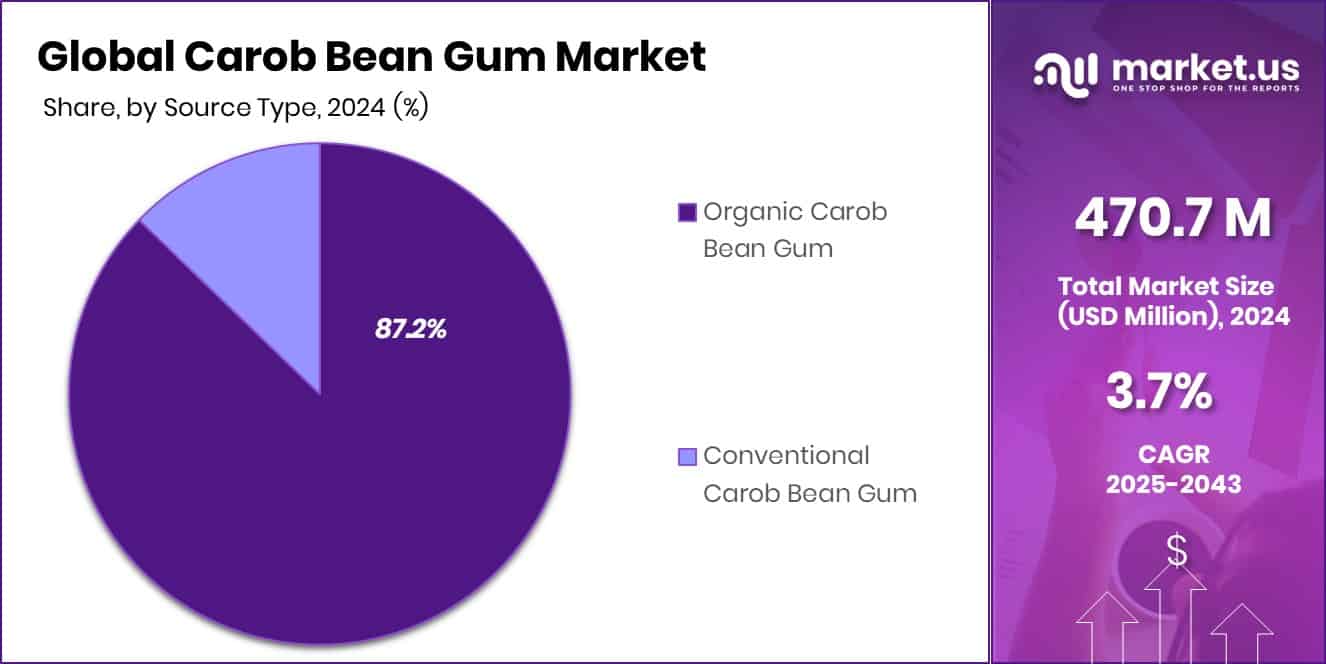

- Organic sourcing boosts the Carob Bean Gum Market, with organic carob bean gum capturing 87.2% demand.

- Rising formulations in foods strengthen the Carob Bean Gum Market, where food and beverages hold 74.5% share.

- In Europe, the market reached USD 186.3 Mn, accounting for a 39.6% share.

By Physical Type Analysis

Powder dominates the Carob Bean Gum Market with a strong 68.1%.

In 2024, the Carob Bean Gum Market saw powder-based formulations securing a dominant share of 68.1%, driven by their higher solubility, easy blending properties, and wide compatibility with processed foods. Manufacturers prefer powder carob bean gum because it offers better stability, longer shelf life, and smoother texture in dairy products, bakery fillings, and confectionery applications.

As clean-label and plant-derived thickeners continue to gain traction, powdered variants benefit from rising demand across both small-scale food processors and large industrial users. The format also supports cost efficiency in transportation and storage, which strengthens adoption in global supply chains. With expanding usage in vegan and gluten-free formulations, powder-type carob bean gum continues to hold strong growth momentum.

By Source Type Analysis

Organic carob sources dominate the Carob Bean Gum Market with 87.2%.

In 2024, the Carob Bean Gum Market experienced significant momentum for organic carob bean gum, which captured a leading 87.2% share due to growing consumer preference for natural and chemical-free stabilizers. Organic variants are increasingly used in premium food products such as natural ice creams, plant-based milk, organic bakery items, and health-focused beverages.

Strong global awareness about pesticide-free farming and sustainable sourcing supports the rapid adoption of organic carob gum in both B2B and retail segments. Food manufacturers choose organic sources to meet clean-label requirements and comply with stricter regulatory norms across the U.S. and Europe. This shift also reflects rising investments in organic farming, which ensures better quality, traceability, and long-term market stability.

By Application Analysis

Food and beverages lead the Carob Bean Gum Market with 74.5%.

In 2024, the Carob Bean Gum Market was largely driven by the food and beverages segment, which accounted for 74.5% of total demand. Its strong functional benefits—such as thickening, stabilizing, emulsifying, and water-binding—make it essential in products like dairy desserts, sauces, meat alternatives, beverages, and confectionery. As consumers increasingly shift toward healthier, plant-based, and additive-free foods, manufacturers rely on carob bean gum to enhance texture without artificial additives.

Its compatibility with gluten-free and vegan formulations further expands its usage across modern food categories. Growing processed food consumption, rising premium dairy innovation, and increased demand for natural hydrocolloids all contribute to the segment’s continued dominance and global expansion.

Key Market Segments

By Physical Type

- Powder

- Liquid

- Granules

By Source Type

- Organic Carob Bean Gum

- Conventional Carob Bean Gum

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

Driving Factors

Rising demand for natural food stabilizers

Growing interest in natural texturizers continues to push the Carob Bean Gum Market forward, especially as food and beverage manufacturers shift strongly toward cleaner, plant-sourced stabilizers. Carob bean gum fits this demand due to its functional versatility in dairy products, sauces, bakery, and premium formulations. This momentum is strengthened by the broader surge in natural ingredient development, where innovation is accelerating across niche hydrocolloids.

Supporting this direction, Oddball secured US$2 million in seed funding, helping expand its footprint in the natural ingredients ecosystem. Such investments contribute to a healthier supply chain environment, indirectly benefiting markets like carob bean gum, where demand for stable, natural, and label-friendly ingredients continues rising worldwide.

Restraining Factors

Limited raw material supply globally

Despite rising demand, the Carob Bean Gum Market faces constraints due to limited raw material availability. The carob tree is geographically concentrated, and fluctuations in regional harvesting volumes can affect supply consistency and pricing. This limitation becomes more noticeable as new industries explore carob-based solutions for clean-label applications. Interestingly, innovation within the carob ecosystem is increasing.

Foreverland recently raised €3.4 million to develop sustainable carob-based chocolate alternatives, highlighting both the value and pressure on carob-derived resources. While such developments expand carob’s market relevance, they also underline the need for improved cultivation strategies to ensure stable availability for gum processors worldwide.

Growth Opportunity

Expanding use in dairy alternatives

Opportunities in the Carob Bean Gum Market are growing as dairy alternatives gain widespread acceptance. Carob bean gum plays an essential role in improving creaminess, stability, and mouthfeel in plant-based yogurts, ice creams, and milk substitutes. As consumers seek indulgent textures in vegan formulations, manufacturers increasingly rely on natural hydrocolloids like carob gum. This trend is reinforced by market movements such as Van Leeuwen securing $18.7 million to scale its luxury vegan ice cream range.

Such investments highlight the rising demand for premium plant-based products, creating fresh opportunities for carob bean gum suppliers to expand into high-growth, texture-focused applications.

Latest Trends

Shift toward clean-label ingredient solutions

A major trend shaping the Carob Bean Gum Market is the strong shift toward clean-label and minimally processed ingredient systems. Food and beverage brands are reducing synthetic stabilizers and embracing natural gums that support transparent labeling. Carob bean gum aligns well with this movement due to its plant origin and multifunctional performance. This trend is also reflected in broader carob-based innovation.

Foreverland’s €3.4 million funding for new cocoa-free chocolate products shows how carob continues entering modern, sustainability-driven product categories. These developments reinforce the growing appeal of carob-derived ingredients within clean-label and environmentally aligned food innovation.

Regional Analysis

Europe leads the Carob Bean Gum Market with 39.6%, totaling USD 186.3 Mn.

In 2024, Europe dominated the Carob Bean Gum Market with a strong 39.6% share, valued at USD 186.3 Mn, driven by its established food processing sector and high adoption of natural stabilizers across bakery, dairy, and clean-label product categories. North America followed with steady usage supported by rising demand for plant-based formulations and the increasing preference for natural hydrocolloids in packaged foods.

The Asia Pacific region continued expanding due to growing processed food consumption and greater utilization of natural gums in emerging markets like India and Southeast Asia. The Middle East & Africa market showed moderate growth, influenced by rising bakery and confectionery production alongside increasing interest in natural thickening agents.

Latin America also contributed to the market’s development, supported by expanding food manufacturing capabilities and the gradual adoption of natural ingredient solutions within beverages and dairy applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill, Incorporated. continued strengthening its position by leveraging its broad portfolio of hydrocolloids and deep integration within global food supply chains. The company’s focus on functionality, texture enhancement, and clean-label formulations positioned it favorably as demand for natural stabilizers increased across bakery, dairy, and beverage applications. Its global processing footprint also supported consistent availability and product reliability, which are essential in this category.

Tate & Lyle demonstrated strong capability in texture and stabilization systems, using its formulation expertise to support food manufacturers transitioning toward plant-derived solutions. The company’s long-standing presence in specialty ingredients and its ability to tailor application-specific solutions helped expand the use of carob bean gum in premium dairy, reduced-sugar foods, and performance-oriented product lines.

Meanwhile, Ingredion maintained its growth trajectory by integrating carob bean gum into broader clean-label and functional ingredient systems. Its emphasis on innovation, customer partnerships, and application support enabled wider adoption in emerging markets and niche product categories. Collectively, these companies contributed to market stability, enhanced technical development, and greater global accessibility of carob bean gum solutions.

Top Key Players in the Market

- Cargill, Incorporated.

- Tate & Lyle

- Ingredion.

- Kerry Group plc.

- CAROB S.A.

- Ceamsa.

- Altrafine Gums.

Recent Developments

- In March 2025, Cargill showcased a range of new food ingredient solutions at the AAHAR food expo in India, including functional blends and alternatives like cost-effective pectin substitutes and bake-stable systems for bakery, snacks, and dairy products. These launches help food brands improve quality and performance.

- In June 2024, Tate & Lyle agreed to acquire CP Kelco, a major supplier of pectin, specialty gums, and natural ingredient solutions, to expand its portfolio. This strategic move aimed to strengthen its role in texture and mouthfeel solutions for food and beverages.

Report Scope

Report Features Description Market Value (2024) USD 470.7 Million Forecast Revenue (2034) USD 676.9 Million CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Physical Type (Powder, Liquid, Granules), By Source Type (Organic Carob Bean Gum, Conventional Carob Bean Gum), By Application (Food and Beverages, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated., Tate & Lyle, Ingredion., Kerry Group plc., CAROB S.A., Ceamsa., Altrafine Gums. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated.

- Tate & Lyle

- Ingredion.

- Kerry Group plc.

- CAROB S.A.

- Ceamsa.

- Altrafine Gums.