Global Card Printers Market Size, Share, Industry Analysis Report By Type (Retransfer Card Printers, Direct-to-Card (DTC) Printers), By Technology (Dye-Sublimation, Inkjet, Laser Engraving), By Application (Commercial, Education, Government, Enterprise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156345

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Investment Opportunities and benefits

- US Market Size

- Economic Impact

- Emerging Trends

- By Type: DTC Printers (68%)

- By Technology: Dye-Sublimation (62%)

- By Application: Government Institutions (40%)

- Key Market Segments

- Driver Factor

- Driver Factor

- Restraint Factor

- Restraint Factor

- Opportunity Analysis

- Opportunity

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

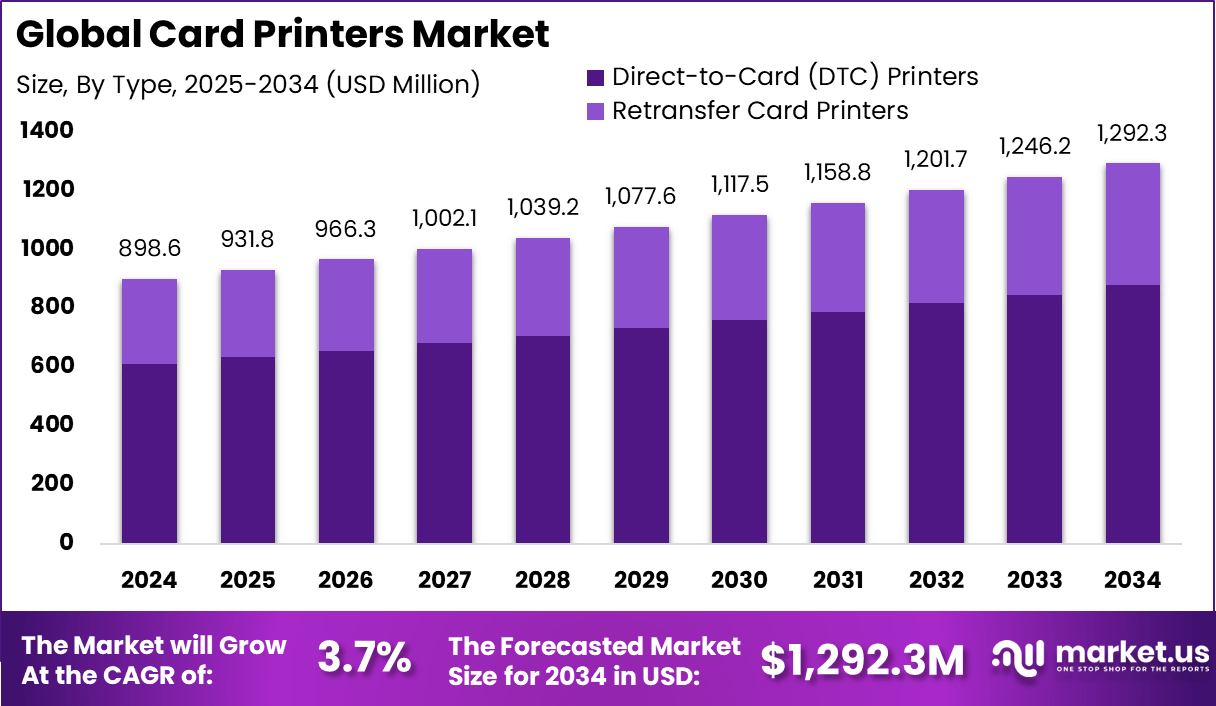

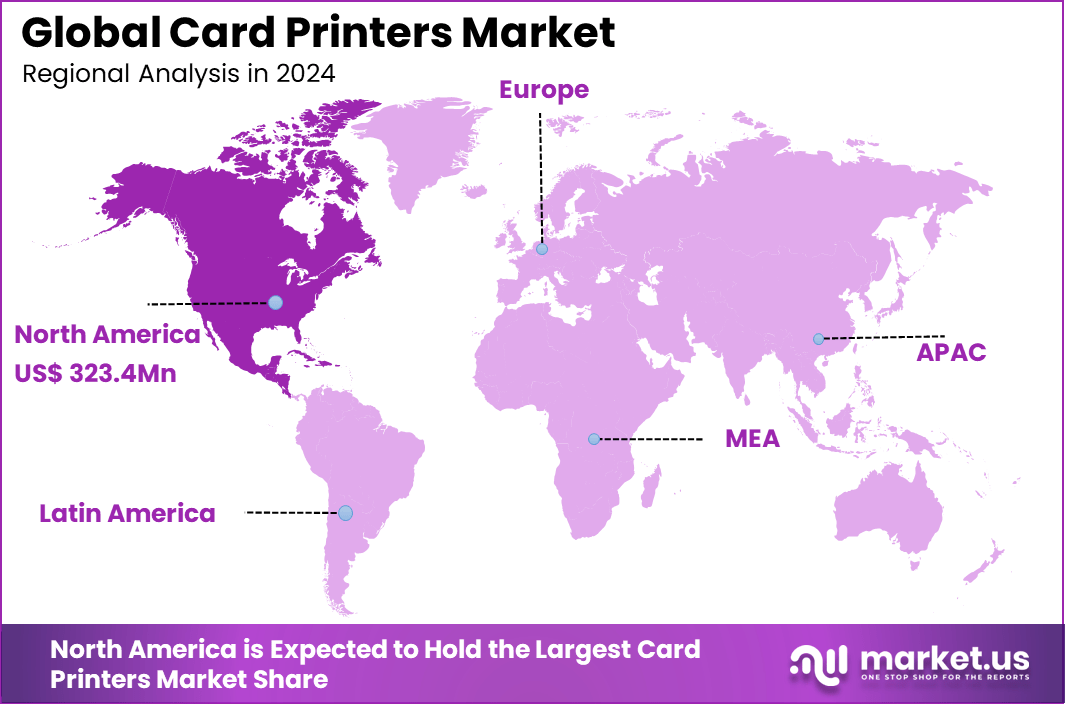

The Global Card Printers Market size is expected to be worth around USD 1,292.3 Million By 2034, from USD 898.3 Million in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36% share, holding USD 323.4 Million revenue.

The Card Printers Market revolves around devices designed to print on plastic cards such as ID cards, membership cards, and payment cards. These printers are crucial for various sectors including government, banking, healthcare, corporate, and education, where secure identification and access control are essential. Card printers enable organizations to produce customized, high-quality cards that incorporate security features, thereby supporting identity verification and fraud prevention.

Top driving factors include the increasing global need for secure, personalized card solutions to combat identity theft and fraud. Organizations across public and private sectors are adopting card printers to produce secure IDs for access control, payment cards embedded with chips, and loyalty cards. Technological improvements such as dye-sublimation, retransfer printing, and encoding of smart chips have enhanced print quality, security, and durability, thereby accelerating market growth.

Key Insight Summary

- By Type, Direct-to-Card (DTC) Printers led the market with a 68% share, driven by their cost-effectiveness and wide adoption for ID and access cards.

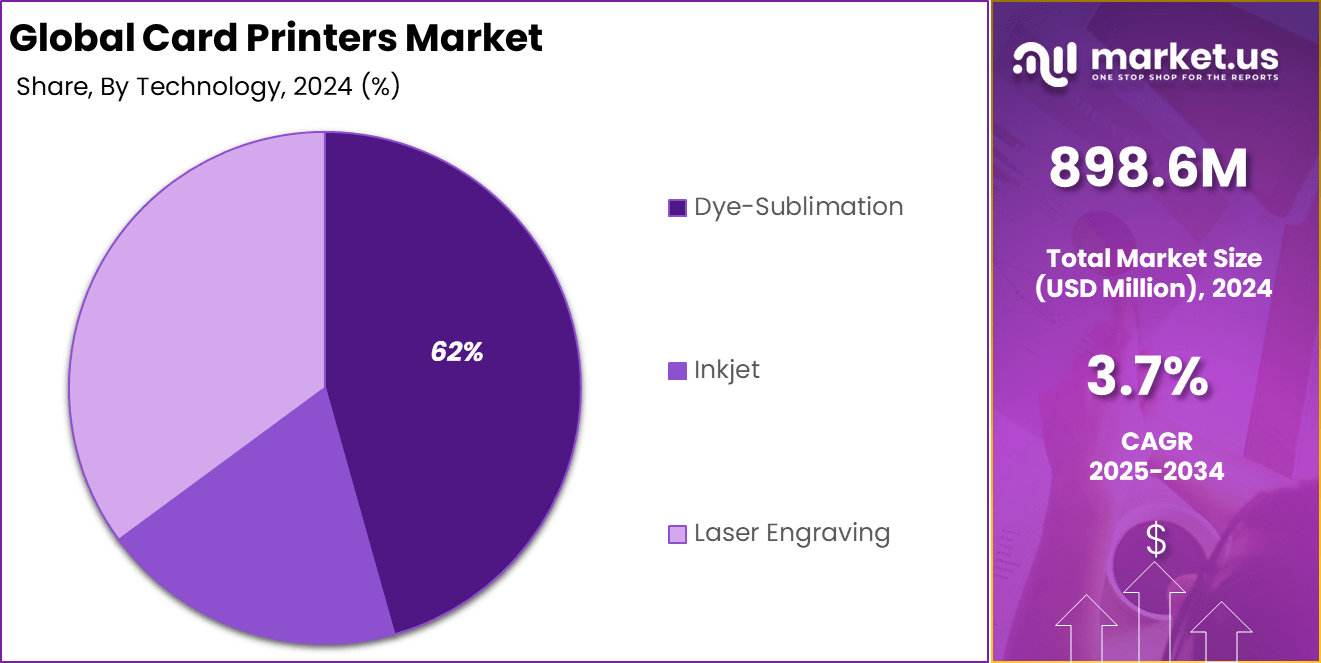

- By Technology, Dye-Sublimation printers dominated with a 62% share, favored for high-quality printing and durability.

- By Application, Government Institutions held the largest share at 40%, reflecting strong demand for secure identity and access solutions.

- By Region, North America accounted for 36% of the global market.

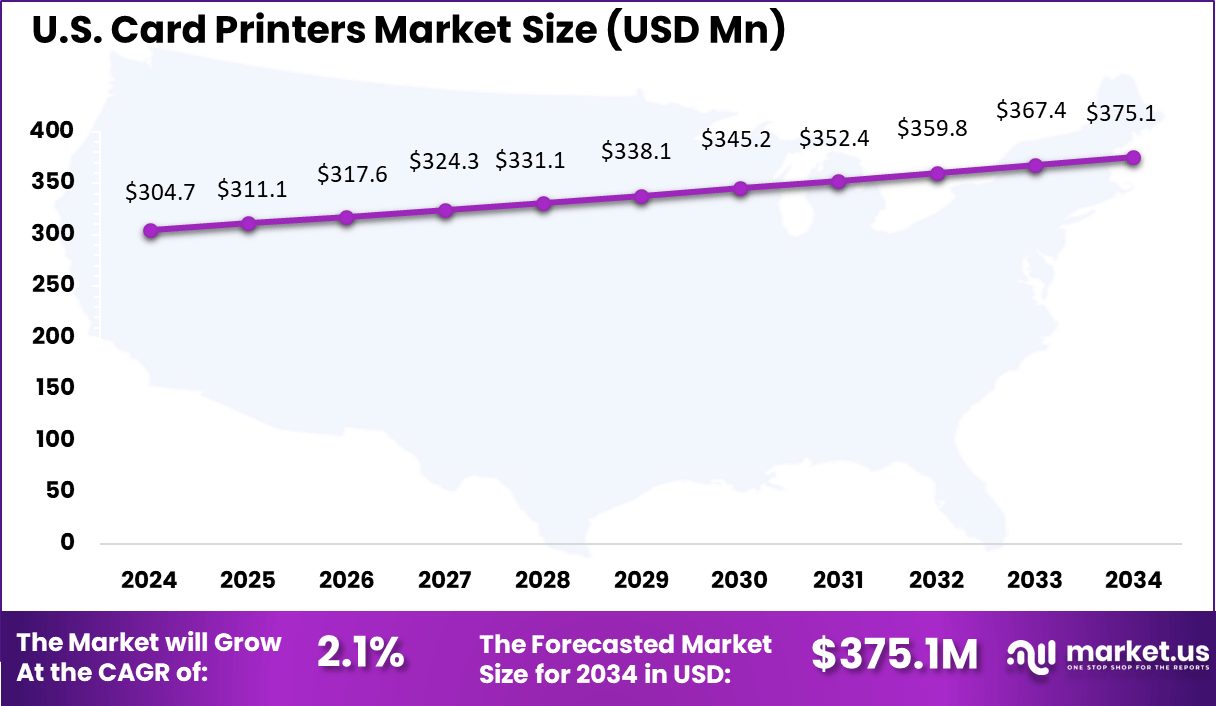

- The U.S. market was valued at USD 304.7 Million in 2024, with a projected CAGR of 2.1%, supported by demand in government and corporate sectors.

Investment Opportunities and benefits

Investment opportunities in the card printers market lie in developing advanced printing technologies, such as holographic and UV printing, and smart card integration with embedded chips and contactless features. Growth prospects also exist in eco-friendly and sustainable printing materials and processes to meet increasing regulatory and consumer demands for sustainability.

Business benefits of implementing card printers include improved security by preventing identity fraud, enhanced operational efficiency through automation and batch printing, and reduced total cost of ownership by eliminating outsourcing. The in-house capability supports timely issuance, essential for customer satisfaction and operational agility.

The regulatory environment around card printers emphasizes compliance with data protection, privacy, and security standards. Governments and industries impose regulations that drive demand for cards with advanced security features such as encryption and biometric data embedding. Environmental regulations influence the development of energy-efficient printers and the use of biodegradable or recyclable consumables, promoting sustainability in card production processes.

US Market Size

The U.S. Card Printers Market was valued at USD 304.7 Million in 2024 and is anticipated to reach approximately USD 375.1 Million by 2034, expanding at a compound annual growth rate (CAGR) of 2.1% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 38.2% share and generating around USD 323.4 Million in revenue. The region’s leadership is largely explained by the early adoption of advanced identification and access control solutions across sectors such as banking, healthcare, government, and education.

Strong regulatory compliance requirements for secure identification have further driven demand for reliable card printing systems. Enterprises and institutions across the United States and Canada continue to prioritize high-quality, tamper-resistant card issuance, which has created a consistent demand base for card printers.

The dominance of North America is also supported by its strong technological ecosystem and established distribution networks. Vendors in the region have invested heavily in innovation, offering printers with faster speeds, wireless connectivity, and cloud integration, which align with the rising need for secure and convenient ID management.

Economic Impact

Aspect Details Market Expansion Driven by increased demand in emerging economies Cost Savings Automated and on-demand printing reduces operational costs Security & Fraud Reduction Enhanced card security lowers identity-related Emerging Trends

Trend Details Retransfer Printing Higher quality, durable print output Cloud & Mobile Printing Remote issuance, cloud management platforms Security Enhancements Biometric integration, holographic, RFID, smart chips Eco-Friendly & Sustainable Solutions Biodegradable cards, energy-efficient printers Advanced Encoding Technologies Contactless, NFC, and multi-function cards By Type: DTC Printers (68%)

Direct-to-Card (DTC) printers dominate the card printers market with a significant 68% share. This type of printer is favored for its ability to print images and data directly onto plastic cards efficiently and with high quality. The direct printing process reduces intermediate steps, enhancing speed and allowing for on-demand card production, which is particularly valuable for applications requiring personalization such as employee IDs, access cards, and membership cards.

The preference for DTC printers is driven by their versatility and reliability across multiple sectors, including corporate, education, and government. These printers support features such as dual-sided printing, encoding, and lamination which enhance the durability and security of printed cards. As security concerns rise and organizations demand faster turnaround in identification processes, DTC printers continue to see growing adoption globally.

By Technology: Dye-Sublimation (62%)

Dye-sublimation technology holds a commanding 62% share in the card printers market. This printing technology is popular due to its ability to produce vibrant, photo-quality images with smooth gradations of colors, making it ideal for high-quality ID cards and secure credentials. Dye-sublimation printers heat dye panels which then transfer ink onto cards, resulting in sharp, durable prints resistant to fading and wear.

The technology’s widespread use reflects its balance between print quality, speed, and cost-efficiency. It supports complex color prints and security features that are crucial for government, healthcare, and corporate identification needs. Additionally, dye-sublimation helps organizations maintain stringent quality standards while managing printing costs effectively, which supports its strong market position.

By Application: Government Institutions (40%)

Government institutions represent a substantial 40% application share in the card printers market. This sector relies heavily on card printing technologies for issuing official identification, such as national ID cards, driver’s licenses, voter ID cards, and other secure credentials. The use of card printers in government extends to secure access control and welfare programs, emphasizing the critical need for authentication and fraud prevention.

The growing demand in this sector is fueled by increasing government initiatives for digitization and enhanced security protocols. With the rise in identity theft and fraudulent activities, governments are investing in advanced card printing solutions with security features like holograms, watermarks, and embedded chips, ensuring the authenticity and durability of issued cards. This application area remains a significant driver of the overall market’s growth and innovation.

Key Market Segments

By Type

- Retransfer Card Printers

- Direct-to-Card (DTC) Printers

By Technology

- Dye-Sublimation

- Inkjet

- Laser Engraving

By Application

- Commercial

- Education

- Government

- Enterprise

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Factor

Growing Demand for Secure Identification Solutions

The card printers market is driven primarily by the increasing need for secure and reliable identification across various sectors such as banking, government, corporate, and education. Industries are placing greater emphasis on identity verification methods to prevent fraud and unauthorized access. This has led to a surge in demand for advanced card printers capable of producing high-security ID cards with features like embedded chips, holograms, and biometric data.

The banking sector especially relies heavily on these solutions for secure credit, debit, and employee ID cards. Further technological advancements in printing methods, such as direct-to-card and reverse transfer printing, enhance the quality and security of printed ID cards. These innovations increase efficiency and durability of cards, ensuring they serve as dependable tools for secure identification.

Driver Factor

Increasing Security Demands

In today’s world, concerns over security breaches and identity theft have escalated across industries. This has driven demand for card printers that produce secure, tamper-resistant cards. Organizations require solutions that integrate advanced security features, facilitating reliable identity verification and access control. This holistic focus on security creates steady growth momentum for the card printers market.

Moreover, government initiatives around national ID programs and employee verification systems further stimulate market demand. These mandates encourage the adoption of modern card printing technologies, embedding security measures directly into physical ID cards. Together, these trends contribute strongly to the widespread use of card printers in critical sectors.

Restraint Factor

High Initial Investment and Operational Costs

One major restraint affecting the card printers market is the high cost associated with acquiring and maintaining advanced printing technologies. Sophisticated printers, especially those offering features like dual-sided printing, embedded chip encoding, and retransfer capabilities, require significant upfront investment. Such costs can be prohibitive, particularly for small and medium-sized enterprises with limited capital budgets.

Alongside purchase costs, ongoing maintenance and consumable expenses add financial burden. These costs challenge widespread adoption in cost-sensitive environments, especially when budget constraints prevent frequent upgrades. Moreover, the complexity of these machines demands skilled technical staff for operation and upkeep, raising operational costs and limiting the ease of integration for smaller organizations.

Restraint Factor

Cost Barriers to Adoption

The high price of advanced card printing systems acts as a hurdle, slowing market penetration among smaller businesses and institutions. Often, organizations must weigh the benefits of card printer capabilities against the financial resource commitment required. This cost consideration limits the pool of potential customers who can afford top-tier technology.

In addition, replacement parts, specialized ribbons, and technical support contribute to the cost over the printer’s lifetime. These recurring expenses can strain operational budgets, particularly when usage volumes are low or highly variable. Hence, despite growing demand, cost factors pose a tangible barrier in the card printers industry.

Opportunity Analysis

Expansion of Cloud and Mobile-Based Printing Solutions

A significant growth opportunity in the card printer market lies in the rising adoption of cloud-based and mobile card printing solutions. These technologies enable remote card issuance, allowing organizations to manage and print IDs from any location. It greatly enhances operational flexibility and reduces dependency on bulky on-premises hardware setups.

Cloud and mobile integration also streamline workflows, improve scalability, and lower the total cost of ownership by minimizing infrastructure needs. This opens markets for card printers in sectors with distributed workforces or decentralized operations such as retail chains, healthcare facilities, and educational institutions. The continual digital transformation across industries creates a fertile environment for these innovations to propel market growth.

Opportunity

Cloud and Mobile Printing Innovations

The shift toward cloud-enabled card printers is reshaping the market by offering convenience and scalability. Organizations can now efficiently issue cards on demand without the need for local IT infrastructure. This innovation reduces time-to-issue and operational hurdles, especially for multi-location businesses.

Similarly, mobile printing solutions cater to on-the-go needs, supporting events, temporary access control, and rapid identity issuance. These advancements leverage wireless connectivity and smartphones, expanding the applicability of card printers beyond traditional office environments. Together, these trends unlock new customer segments and usage scenarios, driving the market forward.

Competitive Analysis

In the card printers market, Entrust Corporation, HID Global, and Zebra Technologies stand out as the leading players. Their dominance is supported by a strong presence in secure ID card printing, advanced technology portfolios, and widespread distribution networks. These companies are consistently innovating by integrating smart card features and improving printing speeds.

Evolis, Nisca & Swiftcolor, Matica Technologies, and Magicard play a vital role in addressing the mid-tier and specialized customer base. Their offerings are known for flexibility, design customization, and reliable performance. These companies focus on delivering cost-efficient card printers that meet the needs of small and medium businesses, educational institutions, and regional enterprises.

Other participants such as DASCOM, NBS Technologies, Pointman, IDP, HiTi Digital, CIM USA, and Seaory strengthen competition through regional strategies and niche applications. Many of these players emphasize affordability, localized customer support, and adaptability to specific industries like retail and hospitality. Their ability to cater to emerging markets with affordable card printers has helped them capture growing demand.

Top Key Players in the Market

- Entrust Corporation

- HID Global

- Zebra Technologies

- Evolis

- Nisca & Swiftcolor

- Matica Technologies

- Magicard

- DASCOM

- NBS Technologies

- Pointman

- Swiftcolor

- IDP

- HiTi Digital

- CIM USA

- Seaory

- Other Key Players

Recent Developments

- Evolis launched the Primacy 2 smart PVC card printer in 2025, boasting speeds of up to 180 cards per hour, improved durability with up to 50,000 prints per month, and dual connectivity options (LAN, USB). It targets professional environments with a 3-year warranty and features thermal transfer printing for long-lasting cards.

- In September 2024, HID Global launched the FARGO HDP5000e, featuring seventh-generation retransfer technology. This printer sets new standards in image quality, usability, and reliability, targeting universities, healthcare, government, and medium-to-large businesses. HID Global also highlights the FARGO DTC4500e for high-volume card issuance with fast print speeds and large input capacity.

Report Scope

Report Features Description Market Value (2024) USD 898.6 Mn Forecast Revenue (2034) USD 1,292.3 Mn CAGR(2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Retransfer Card Printers, Direct-to-Card (DTC) Printers), By Technology (Dye-Sublimation, Inkjet, Laser Engraving), By Application (Commercial, Education, Government, Enterprise) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Entrust Corporation, HID Global, Zebra Technologies, Evolis, Nisca & Swiftcolor, Matica Technologies, Magicard, DASCOM, NBS Technologies, Pointman, Swiftcolor, IDP, HiTi Digital, CIM USA, Seaory, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Entrust Corporation

- HID Global

- Zebra Technologies

- Evolis

- Nisca & Swiftcolor

- Matica Technologies

- Magicard

- DASCOM

- NBS Technologies

- Pointman

- Swiftcolor

- IDP

- HiTi Digital

- CIM USA

- Seaory

- Other Key Players