Global Canned Lychee Market Size, Share, And Business Benefits By Application (Desserts, Drinks and Beverages, Snacks, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158957

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

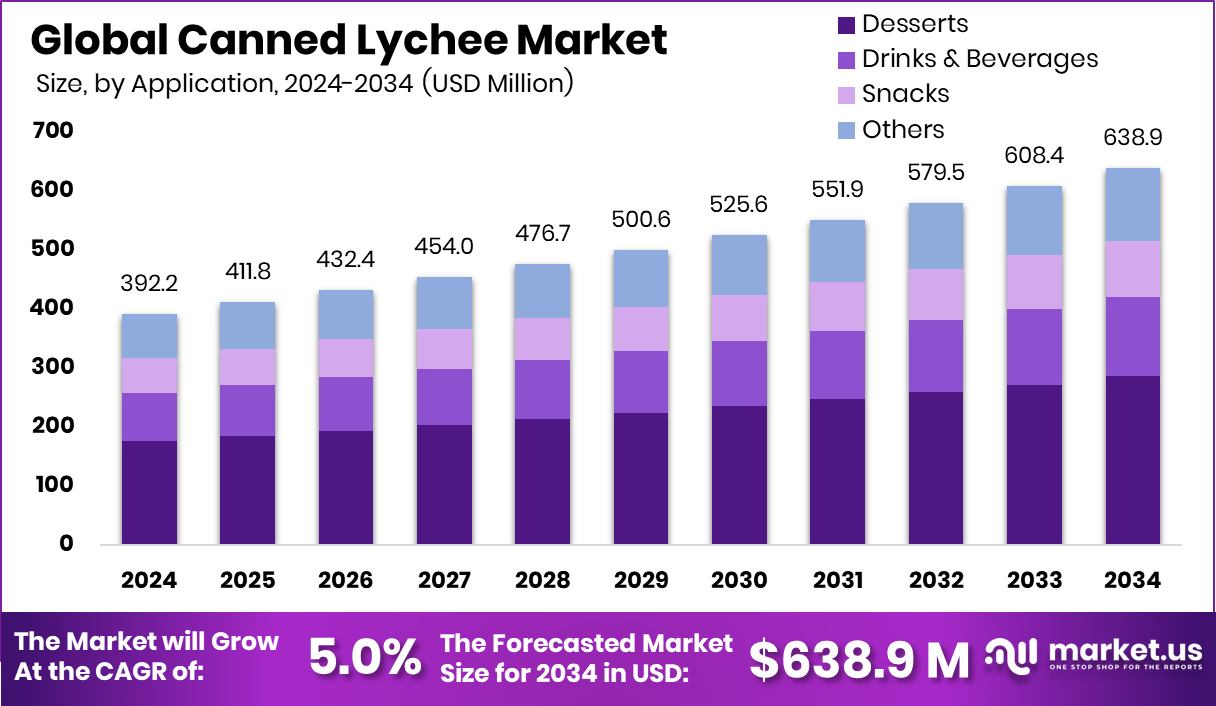

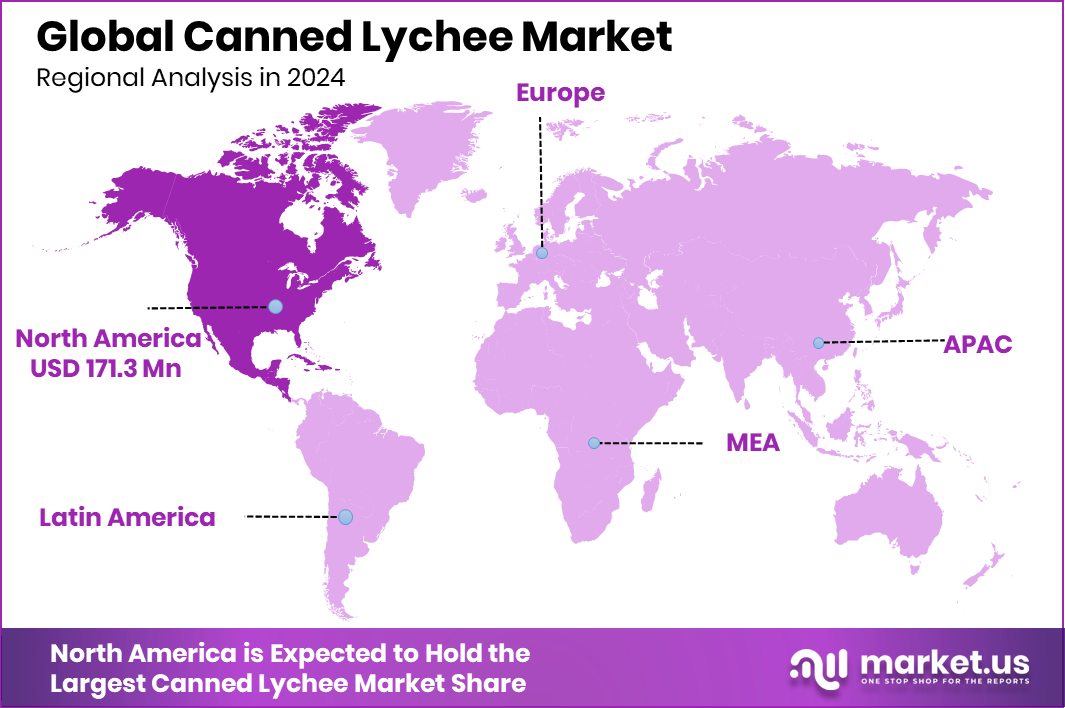

The Global Canned Lychee Market is expected to be worth around USD 638.9 million by 2034, up from USD 392.2 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. The market in North America, valued at USD 171.3 Mn, captured 43.70% globally.

Canned lychee is a preserved fruit product made from fresh lychees, peeled and packed in syrup or juice to retain flavor, sweetness, and freshness for extended shelf life. This convenient form of lychee allows consumers to enjoy the tropical fruit year-round, even when it is out of season. Its ready-to-use nature makes it suitable for desserts, beverages, and culinary dishes, offering a blend of taste and nutrition without the hassle of preparation.

The canned lychee market refers to the commercial trade and consumption of lychees in preserved form. It encompasses the production, distribution, and sale of canned lychee products across retail and foodservice channels. Growing awareness of healthy and exotic fruit options has supported market expansion, with demand coming from households, restaurants, and the hospitality industry. Funding developments in the food sector, such as “Canned Seafood Startup Raises $4M in Seed Funding”, highlight increasing investor confidence in processed fruit and convenience-based products, which indirectly boosts market growth.

The market growth is driven by rising consumer preference for ready-to-eat and exotic fruits, urbanization, and higher disposable incomes. With consumers seeking convenient ways to include fruits in their diets, canned lychee provides a nutritious alternative to fresh fruit, maintaining vitamins and antioxidants while being easily stored and transported.

Increasing use in beverages, desserts, and culinary applications has led to rising demand in households and the foodservice sector. Government programs like the “Midday meal scheme: State govt. sanctions ₹77.5 crore” emphasize nutritional initiatives, which further promote the inclusion of preserved fruits in daily diets, boosting overall consumption.

There is significant potential in expanding into emerging markets where tropical fruits are gaining popularity. Innovations in packaging, flavored syrups, and organic variants present opportunities to attract health-conscious and premium consumers. The market is poised for growth as awareness about convenience, nutrition, and exotic fruit options continues to rise.

Key Takeaways

- The Global Canned Lychee Market is expected to be worth around USD 638.9 million by 2034, up from USD 392.2 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- Canned Lychee Market sees desserts dominating with 44.7%, driven by growing home and restaurant usage.

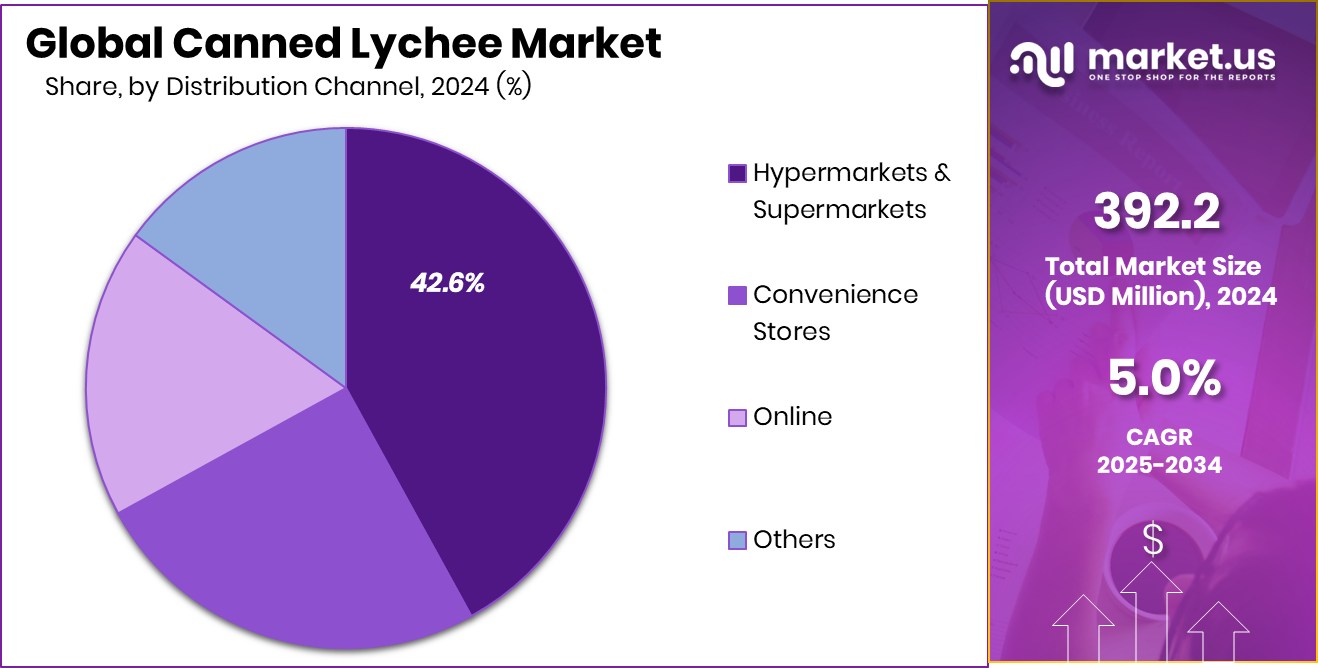

- Hypermarkets and supermarkets lead the Canned Lychee Market with a 42.6% share globally.

- North America dominated the canned lychee sector with a 43.70% market share valued at USD 171.3 Mn.

By Application Analysis

Desserts dominate the Canned Lychee Market with a 44.7% share.

In 2024, Desserts held a dominant market position in the By Application segment of the Canned Lychee Market, with a 44.7% share. The preference for canned lychee in desserts is driven by its natural sweetness, unique flavor, and ease of use in preparations such as puddings, ice creams, and fruit salads.Consumers are increasingly seeking convenient and ready-to-use fruit options for dessert making, which has fueled consistent demand in this segment. Additionally, the growing trend of home baking and dessert customization has further reinforced the adoption of canned lychee. This strong preference in dessert applications is expected to continue supporting market growth in the coming years.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead the canned lychee market at 42.6%.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Canned Lychee Market, with a 42.6% share. The strong presence of canned lychee in these organized retail channels is driven by their ability to offer a wide variety of products under controlled quality standards, ensuring freshness and consistency.

Consumers prefer purchasing from hypermarkets and supermarkets due to the convenience, competitive pricing, and availability of bulk or packaged options. Promotional activities and attractive in-store displays further encourage impulse purchases, strengthening this distribution channel. The organized retail segment is expected to continue leading market growth as consumer preference for reliable and convenient shopping experiences rises steadily.

Key Market Segments

By Application

- Desserts

- Drinks and Beverages

- Snacks

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Rising Health Consciousness Fuels Canned Lychee Demand

The growing global trend toward health-conscious eating is significantly boosting the canned lychee market. Consumers are increasingly seeking nutritious, convenient, and exotic food options that align with their wellness goals. Canned lychees, rich in vitamin C, antioxidants, and dietary fiber, offer a convenient way to incorporate these health benefits into daily diets. Their long shelf life and easy availability make them an attractive choice for busy individuals looking to maintain a healthy lifestyle without compromising on taste or nutrition. This shift in consumer preferences towards healthier and more convenient food options is a key driver of the market’s growth. As awareness of the health benefits of lychees continues to spread, demand for canned lychees is expected to rise, further propelling market expansion.

Beyond Snack, a company specializing in healthy snack options, has recently raised $8.3 million in a Series A funding round to support its expansion efforts. This investment underscores the increasing consumer interest in health-focused food products and the potential for growth in this sector.

Restraining Factors

High Production Costs Limit Canned Lychee Growth

The canned lychee market faces significant challenges due to high production costs. The canning process involves several steps, including peeling, preserving, and packaging, which require specialized equipment and labor. Additionally, the cost of raw materials can fluctuate based on factors like weather conditions and crop yields, leading to price instability. These increased production costs often result in higher retail prices, making canned lychees less competitive compared to other fruit products. Consumers may opt for more affordable alternatives, impacting sales and market growth. To remain competitive, companies must explore cost-effective production methods and efficient supply chain management to mitigate these financial pressures.

In a related development, Eat Better Co., a snack brand, has raised INR 17 crore in funding from Prath Ventures to support its expansion efforts. This investment highlights the growing interest in the healthy snack sector and underscores the importance of financial backing in scaling operations and reaching a broader consumer base.

Growth Opportunity

Expanding E-Commerce Channels Boost Canned Lychee Sales

The growth of e-commerce platforms presents a significant opportunity for the canned lychee market. Online grocery shopping is becoming increasingly popular due to convenience, wide product availability, and doorstep delivery. Consumers can easily explore international and exotic fruits like canned lychees without geographical limitations. E-commerce also allows brands to target niche customer segments, promote seasonal offers, and run subscription services, further increasing product accessibility and visibility.

The digital space enables companies to gather consumer insights, personalize marketing, and optimize inventory management efficiently. By leveraging online channels, canned lychee producers can expand their reach, improve customer engagement, and capture the growing demand from tech-savvy and health-conscious buyers worldwide. This trend is expected to drive market growth significantly.

Latest Trends

Canned Lychee Desserts Gain Popularity Worldwide

Canned lychees are increasingly being used in desserts, offering a convenient and exotic ingredient for various sweet treats. Their natural sweetness and unique flavor profile make them an appealing addition to puddings, ice creams, tarts, and fruit salads. This trend aligns with the growing consumer preference for tropical and exotic fruits in desserts, as they provide a refreshing and novel taste experience.

Moreover, the versatility of canned lychees allows for easy incorporation into both traditional and contemporary dessert recipes, catering to diverse culinary preferences. As consumers seek new and exciting flavors, the demand for canned lychee-based desserts is expected to continue rising, contributing to the overall growth of the canned lychee market.

Regional Analysis

In North America, the canned lychee market reached USD 171.3 Mn, holding 43.70% share.

In 2024, North America emerged as the dominant region in the canned lychee market, accounting for a substantial 43.70% share, valued at USD 171.3 Mn. The region’s strong performance is driven by high consumer awareness of exotic and healthy fruit options, coupled with widespread availability through modern retail channels such as hypermarkets, supermarkets, and e-commerce platforms. The increasing adoption of convenient and ready-to-eat fruit products among busy urban consumers further supports market growth.

Europe, Asia Pacific, the Middle East & Africa, and Latin America are also witnessing rising demand for canned lychees, driven by evolving dietary preferences and growing interest in international cuisines. While these regions are experiencing steady growth, North America continues to lead the market due to its higher consumption rates and well-established distribution networks.

The popularity of canned lychees in North America is further amplified by a focus on health-conscious lifestyles, where vitamin-rich and antioxidant-packed fruits are highly preferred. Overall, North America’s dominant position highlights its critical role in shaping market trends and driving expansion globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dole Food Company, Inc. continues to be a significant entity in the canned lychee market. Known for its commitment to quality and sustainability, Dole offers lychees preserved in light syrup, emphasizing natural ingredients and minimal processing. Their products are designed to cater to health-conscious consumers seeking convenient, nutritious options.

Ayam Brand, a household name in Asia for over 120 years, specializes in quality canned products that are preservative-free and halal-certified. Their extensive distribution network across Asia, including markets like Malaysia, Singapore, and Thailand, positions them as a strong player in the canned lychee segment.

Rubicon Drinks Ltd has carved a niche in the beverage sector with its lychee-flavored drinks, such as the Sparkling Lychee Juice. By offering a refreshing, exotic fruit experience, Rubicon caters to consumers looking for unique, flavorful beverages.

SK Foods Ltd, with over 40 years of experience, manufactures a variety of canned foods, including lychees preserved in syrup. Their products are known for quality and are widely distributed, meeting the demands of diverse markets.

Top Key Players in the Market

- Dole

- Ayam Brand

- Rubicon Drinks Ltd

- SK Foods Ltd

Recent Developments

- In February 2025, Dole plc reported its fourth-quarter and full-year 2024 financial results, highlighting a revenue increase of 4.6%. Additionally, in March 2024, Dole canceled the sale of its fresh vegetables division due to regulatory concerns, indicating a strategic focus on core business areas.

- In January 2023, SK Food Group announced a $205.2 million investment to construct its fourth production facility in Cleveland, Tennessee. This expansion is expected to create 840 new jobs by 2030, reflecting the company’s commitment to growth and increased production capacity.

Report Scope

Report Features Description Market Value (2024) USD 392.2 Million Forecast Revenue (2034) USD 638.9 Million CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Desserts, Drinks and Beverages, Snacks, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dole, Ayam Brand, Rubicon Drinks Ltd, SK Foods Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dole

- Ayam Brand

- Rubicon Drinks Ltd

- SK Foods Ltd