Global Canned Fruits Market By Fruit (Pineapple, Peach, Guava, Apricot, Pear, Mango, Grapefruit, Cherry, Orange, and Mixed Fruit), By Form (Whole, and Cut), By Content (In Syrup, In Light Syrup, In Fruit Juice, and With Sugar), By Distribution Channel (Supermarkets/Hypermarkets, Independent Retailers, Convenience Stores, and E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 136666

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Global Canned Fruits Market Scope:

- Fruit Analysis

- Form Analysis

- Content Analysis

- Distribution Channel Analysis

- Key Market Segments:

- Market Dynamics:

- Drivers

- Restraints

- Opportunity

- Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Market Share & Key Players Analysis:

- Key Development:

- Report Scope

Report Overview

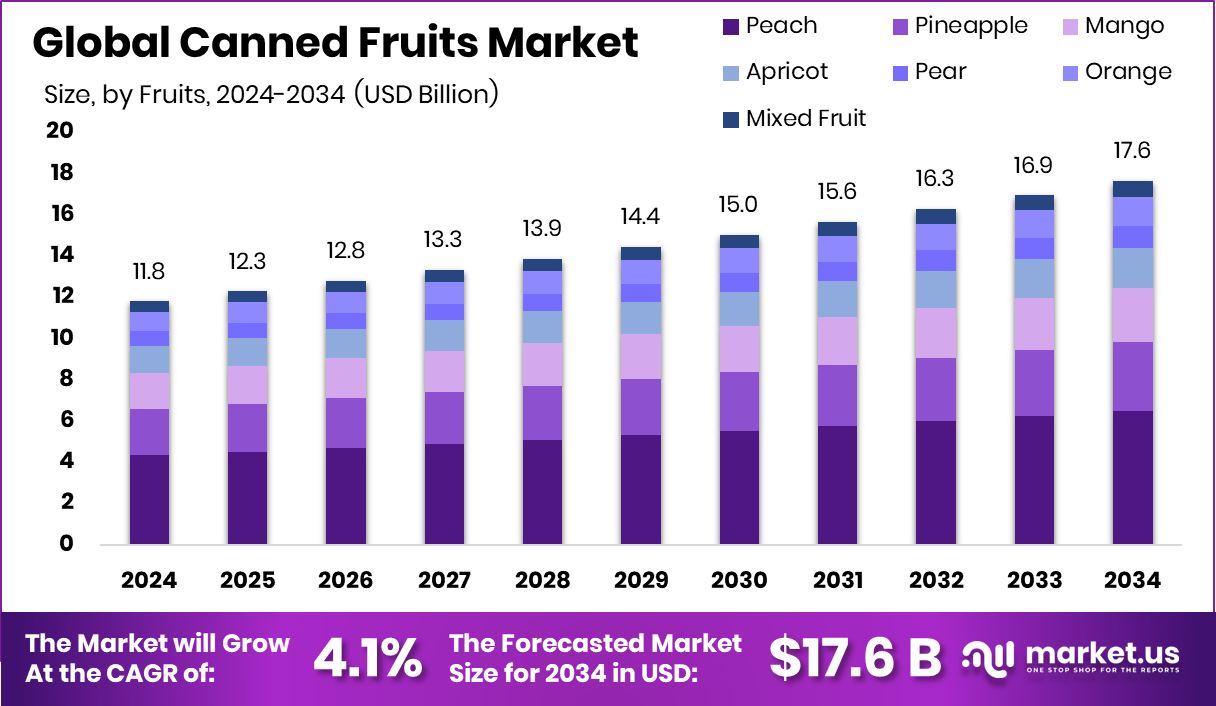

In 2024, the Global Canned Fruits Market was valued at US$11.8 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.1%, reaching about US$17.2 billion by 2034.

As consumer preferences for convenient and ready-to-eat meals increase, the processed food industry has seen significant growth. Demand for canned foods, including canned vegetables, fruits, meats, and sauces, increases. In the processed food industry, which has less nutritional value, canned fruit products are considered healthy options, driving the market.

In addition to nutritional value and convenience, the canned fruits have a long shelf life, which makes them an ideal solution for home-based uses as well as for the food service sector. The market is characterized by less sugar, fewer additives, sustainable packaging, and reduced food waste. Several players dive into action marked by these characteristics, particularly in European countries where laws are relatively strict.

Key Takeaways:

- The global canned fruits market was valued at US$11.8 billion in 2024.

- The global canned fruits market is projected to grow at a CAGR of 4.1% and is estimated to reach US$17.2 billion by 2034.

- In the product segment, peaches dominate the market with constituting around 36.8% of the market.

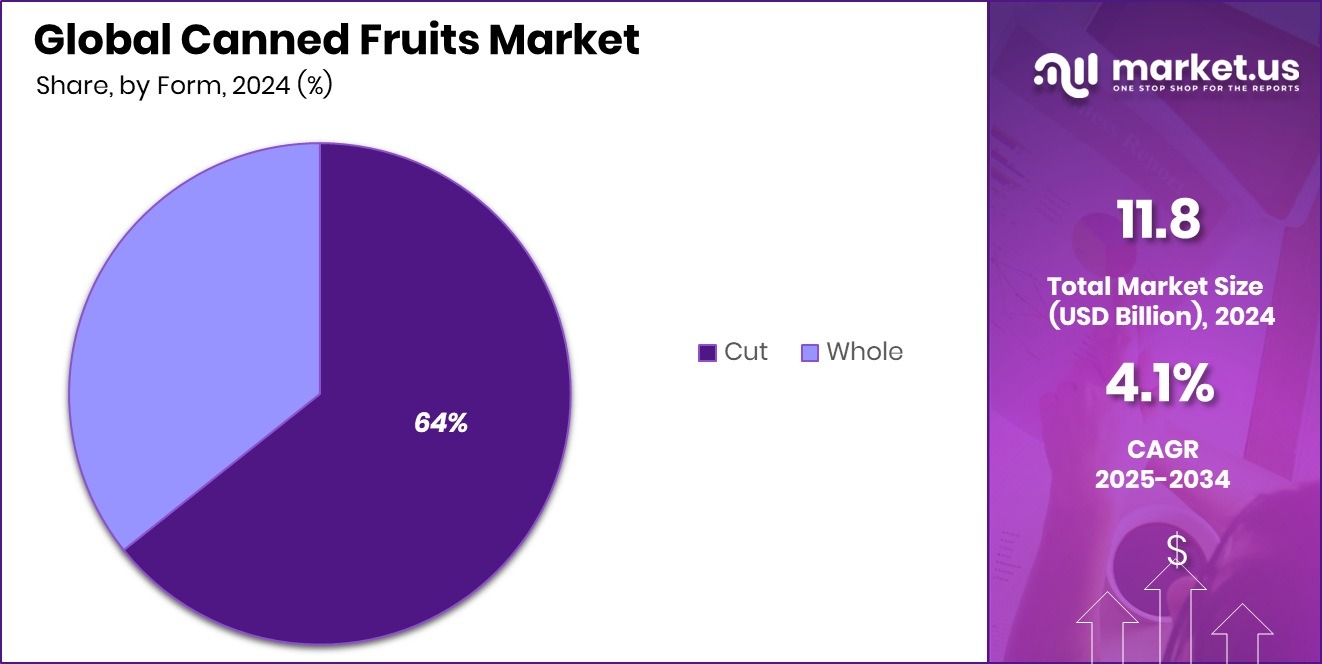

- Among the forms, cut canned fruits held the majority of revenue share in 2024 at 64.3%.

- Based on content, the market was led by canned fruits in light syrup with a substantial market share of 34% in 2024.

- In 2024, the global canned fruits market was dominated by supermarkets/hypermarkets with a significant market share of 53.8%.

Global Canned Fruits Market Scope:

Fruit Analysis

Peaches dominate the canned fruits market due to their stable production and health benefits.

The canned fruits market is segmented based on product type as pineapple, peach, guava, apricot, pear, mango, grapefruit, cherry, orange, and mixed fruit. In 2024, canned peaches held a dominant market position, capturing more than a 36.8% share of the global canned fruits market. According to the U.S. Department of Agriculture, California peach production in 2024 was 510,000 tons, a 6 percent increase from 2023. Similarly, many countries have noted the steady production of peaches, catering to the demand of consumers. Additionally, peaches offer a variety of health benefits due to their rich content of vitamins, minerals, and antioxidants, making them an ideal solution for snacks.

Form Analysis

The market is dominated by canned fruits owing to the demand for convenience and ease of use.

Based on form, the market is further divided into whole and cut canned fruits. In 2024, cut fruits held a dominant market position, capturing more than a 64% market share of the global canned fruits market. The cut fruits, further segmented into halves, slices, rings, cubes, and others, offer an ideal healthy snack with no effort spent, making it a convenient and easy product. According to the Bureau of Labor Statistics, in 2024, 87% of full-time employed individuals worked on an average weekday in the United States. As working professionals in all regions grow, customers expect the availability of ready-to-meal meals. The whole fruit canned market is very likely to grow, considering the consumer shift towards convenience.

Content Analysis

The Canned Fruits in Light Syrup Segment Dominates the Market due to Consumer Awareness Regarding Consumption of Sugar.

Based on content, the market can be segregated into canned fruits in syrup, in light syrup, in fruit juice, and with sugar. In 2024, canned fruits in light syrup dominated the global market with a market share of 34%, driven by their extended shelf life and consumer awareness regarding sugar consumption. According to the European Union, added sugar consumed by an average person should not exceed 10% of daily energy intake. Consumer awareness regarding excessive sugar consumption leading to various negative health effects, including weight gain, type 2 diabetes, heart disease, and tooth decay, has supported the growth of canned fruits in the light syrup market segment. Additionally, canned fruits in fruit juice are another significant segment in the category due to fewer preservatives in the product and less addition of sugar preservatives.

Distribution Channel Analysis

The Canned Fruits Market is Dominated by Supermarkets/Hypermarkets.

Based on distribution channels, the market is further divided into supermarkets/hypermarkets, independent retailers, convenience stores, and e-commerce. The most dominant sales channel for the canned fruit industry is supermarkets/hypermarkets, constituting around 53.8% of the total market share. This dominance of supermarkets/hypermarkets is mostly attributed to the availability of a broad range of products and consumer preference to see and touch the product they are buying. As consumers prefer convenience over price, supermarkets have become the dominant sales channel for a variety of consumer goods. Additionally, another major segment is convenience stores, which offer discounted prices that attract the consumers, but a lack of variety discourages them. In recent years, e-commerce has also seen significant growth due to advancements in delivery services.

Key Market Segments:

By Fruit:

- Pineapple

- Peach

- Guava

- Apricot

- Pear

- Mango

- Grapefruit

- Cherry

- Orange

- Mixed Fruit

By Form:

- Whole

- Cut

- Halves

- Slices

- Rings

- Cubes

- Others

By Content:

- In Syrup

- In Light Syrup

- In Fruit Juice

- With Sugars

By Distribution Channels:

- Supermarkets/Hypermarkets

- Independent Retailers

- Convenience Stores

- E-commerce

- Others

Market Dynamics:

Drivers

Consumer Shift towards Healthy Snack Options due to Rising Awareness Regarding Processed Foods Propels the Canned Fruits Market the Most.

Rising consumer awareness regarding health and nutritional value has significantly impacted the canned fruits market due to the nutritional value it adds to consumers’ diets. Canned fruits are considered a good source of essential vitamins and minerals, including vitamin C, vitamin A, potassium, and others, depending on the specific fruit. They provide dietary fiber, which is important for digestive health, helping with regularity and potentially reducing the risk of certain diseases. Canned fruits can be a healthy and convenient addition to a diet, offering various vitamins, minerals, and fiber, similar to fresh or frozen options. While some water-soluble vitamins, such as Vitamin C, might be slightly reduced due to the canning process, they still retain significant nutritional value, along with ease of use. Some studies suggest that certain nutrients, like some B vitamins, vitamin E, and carotenoids, can be better preserved in canned tomatoes than in fresh ones.

Restraints

Competition from the Frozen Fruits Industry Might Restrain the Market from Growing.

One of the significant challenges for the canned fruits market is the competition from frozen fruits. Both frozen and canned fruits are considered to be nutritious and convenient alternatives to fresh produce. Frozen fruits are often flash-frozen at peak ripeness, preserving a high level of nutrients. They can be a good source of vitamins and minerals, and can be more affordable than fresh fruit, especially when out of season. Although canned fruits are a good source of nutrients and are a budget-friendly option, they are usually processed with added sugars or salts. This characteristic of canned fruit might confine the market from growing, as consumer awareness regarding sugar consumption rises. Additionally, canned fruits may contain some amount of sodium as a form of preservation or flavor enhancement, further decelerating the market.

Opportunity

Product Innovation is Expected to Create More Opportunities in the Market.

One of the important opportunities in the canned fruits market is to innovate the product, making it more nutritious and organic. As consumers become more health-conscious, the demand for products with less sugar and fewer additives increases. Leveraging on this trend, companies can offer a broad range of health-oriented products focusing on wellness-oriented enthusiasts. Canned fruit with no added sugar offers a convenient and healthy way to enjoy a variety of fruits, providing vitamins and minerals without the extra calories from added sugars. For instance, various brands offer products filled with juice or water. Product development in the canned fruit in fruit juice sector is currently focused on healthy options, sustainability, and innovation, with a notable trend towards reducing added sugar and utilizing upcycled ingredients.

Trends

Shift Towards Sustainable Packaging

As consumers demand environment-friendly options in every sector, there is a demand-side shift in the canned fruits market towards sustainable packaging. Canned food manufacturers are investing in packaging innovation to reduce their environmental footprint and meet consumers’ expectations for eco-friendly products. Sustainable packaging for canned fruits focuses on eco-friendly materials and design to minimize environmental impact. Options include glass jars, which are reusable and recyclable, and various biodegradable or compostable materials, such as mushroom production technology. By integrating mushroom production technology into their packaging processes, canned food manufacturers can reduce their reliance on conventional packaging materials. Additionally, steel cans that are usually used for packaging are highly recyclable, with a high recycling rate.

Geopolitical Impact Analysis

Geopolitical Tensions Between Several Countries Disrupted the Global Supply Chain, Leading to Increased Prices for Canned Fruits

Two main events that affected the agricultural prices in recent years are the Ukraine war and the recent tariffs introduced by the U.S. federal government on imports. For instance, in 2022, Russia’s incursion into Ukraine prompted global supply chain disruptions in markets for key food crops. The conflict has resulted in damage and losses, including the occupation or destruction of orchards, the destruction of agricultural machinery, storage facilities, and production resources. The conflict destabilized the market, causing price fluctuations, the cancellation of seasonal crediting, and disruptions in export routes, affecting overall production costs. According to NASA Harvest, NASA’s Global Food Security and Agriculture Consortium, the estimated amount of abandoned cropland in Ukraine in 2023 due to the war was equivalent to about 7.5% of the country’s total before the war.

The United States has significantly increased tariffs on imported steel and aluminum under Section 232 in early 2025, raising them to 50% from the previous 25% and 10%, respectively. These tariffs on steel and aluminum, used in canned food packaging, are significantly impacting the canned fruit sector by increasing production costs and potentially leading to higher prices for consumers. This is particularly true because a large portion of the tin mill steel used in the US is imported from China.

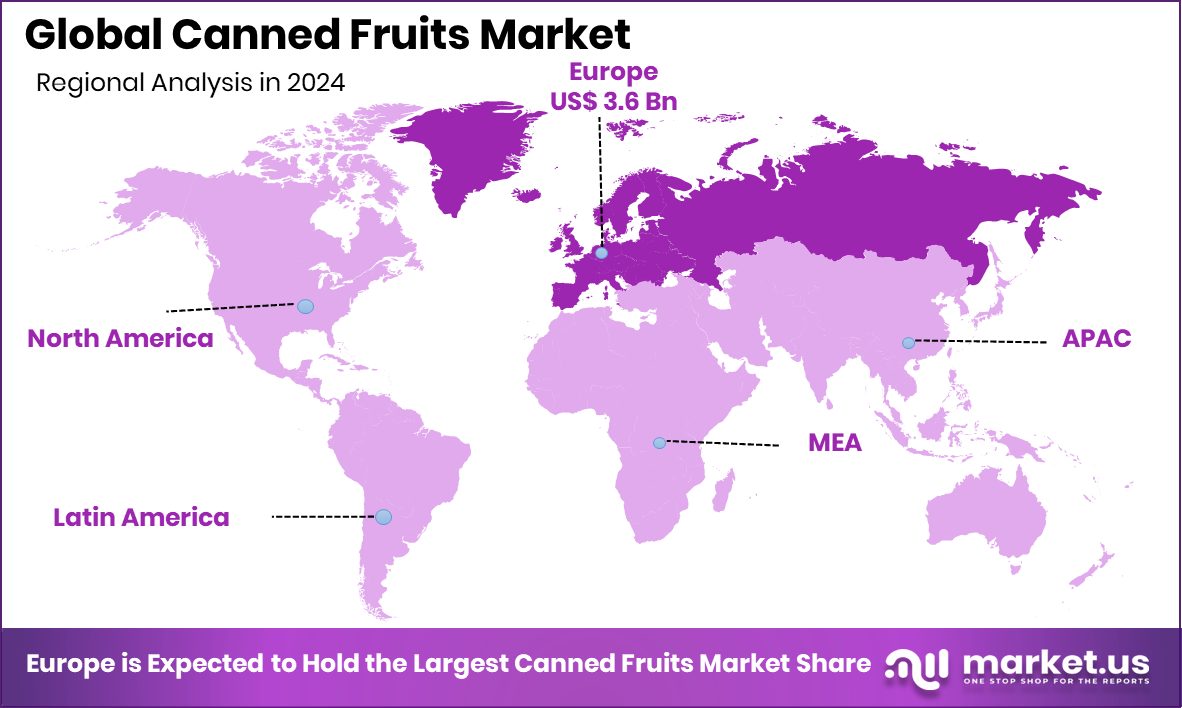

Regional Analysis

Europe Held the Largest Share of the Global Canned Fruits Market

In 2024, Europe dominated the global canned fruits market, holding about 33.8%, valued at approximately US$3.6 billion. The canned fruits market is highly diversified. The European market shows steady growth for canned fruits, driven by the strong emphasis on ease of use. The market in the region is characterized by the demand for sustainable packaging solutions and growing consumer awareness regarding highly processed foods. North America has also seen growth potential in the region, driven by the need for convenience as the working population increases.

According to the Bureau of Labor Statistics (BLS), in 2024, Americans spent an average of just under an hour per day, specifically 53 minutes, on food preparation and cleanup. This willingness to spend less time on food preparation demands high-quality canned vegetables and fruits, boosting the canned fruits market. Additionally, the region is also characterized by a robust chain of retail sectors, making it easy to buy the product. Although Latin America, Asia Pacific, and MEA comprise smaller shares, there is increasing demand for canned fruits owing to the ability of canned fruits to be healthy with less or no energy spent on preparation.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

In the niche market of canned fruits, various big giants such as Del Monte, Rhodes, Kraft Heinz, Dole, and CHB Group try to achieve an edge in the market through product packaging development, investments, partnerships and collaborations, and mergers and acquisitions.

Rhodes Food Group (RFG) is a South African company with a long history in food production, particularly known for its canned fruit and other convenience foods. They own the popular Rhodes Quality brand, which offers a wide range of canned fruits and is committed to food safety and uses advanced technology to ensure high-quality products.

Dole Packaged Foods claims that their canned fruit products are made with all-natural, non-GMO fruits and rich in Vitamin C each can is filled with fruit picked at peak ripeness for optimal taste and quality.

CHB Group’s canned fruit products that serve diverse sectors such as the beverage, dairy, and HORECA industries give them a competitive edge in the industry.

Princes Group, which is a major international food and drink company, offers a variety of canned fruits, including fruit cocktail, peaches, pears, pineapple, mandarins, and various fruit fillings. Other companies such as La Doria, St. Mamet, Roland Foods, Delicia India Foods, Oregon Fruit Company, and Polar Group also contribute largely to the industry.

Key Development:

- In July 2025, Del Monte Foods, the 139-year-old company best known for its canned fruits and vegetables, filed for bankruptcy protection as U.S. consumers increasingly bypass its products for healthier or cheaper options. Del Monte has secured US$912.5 million in debtor-in-possession financing that will allow it to operate normally as the sale progresses.

- In April 2025, the Dominican Republic’s agriculture industry reached a significant milestone in producing an above-average volume of table grapes for both export and domestic consumption, and shipped its first container to the United States. The country shipped 2,250 boxes (16 tons) of Timpson grapes and 550 boxes of Allison grapes, equivalent to one container of Bloom Fresh table grapes, to the United States.

The following are some of the major players in the industry.

- Del Monte Food, Inc.

- Rhodes Food Group Holdings Ltd.

- The Kraft Heinz Company (Golden Circle)

- CHB Group

- Dole Packaged Foods, LLC

- LDH (La Doria) Ltd

- Princes Group

- St. Mamet

- Roland Foods, LLC.

- Delicia India Foods Pvt. Ltd.

- Oregon Fruit Company

- Polar Group

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$ 11.8 Bn Forecast Revenue (2034) US$17.2 Bn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fruit (Pineapple, Peach, Guava, Apricot, Pear, Mango, Grapefruit, Cherry, Orange, Mixed Fruit), By Form (Whole, Cut), By Content (In Syrup, In Light Syrup, In Fruit Juice, With Sugar), By Distribution Channel (Supermarkets/Hypermarkets, Independent Retailers, Convenience Stores, E-commerce) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Del Monte Food, Inc., Rhodes Food Group Holdings Ltd., The Kraft Heinz Company (Golden Circle), CHB Group, Dole Packaged Foods, LLC, LDH (La Doria) Ltd., Princes Group, St. Mamet, Roland Foods, LLC., Delicia India Foods Pvt. Ltd., Oregon Fruit Company, Polar Group, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Del Monte Food, Inc.

- Rhodes Food Group Holdings Ltd.

- The Kraft Heinz Company (Golden Circle)

- CHB Group

- Dole Packaged Foods, LLC

- LDH (La Doria) Ltd

- Princes Group

- St. Mamet

- Roland Foods, LLC.

- Delicia India Foods Pvt. Ltd.

- Oregon Fruit Company

- Polar Group

- Other Key Players