Global Camel Milk Products Market Size, Share, Growth Analysis By Product (Plain Milk, Flavored Milk, Powder, Ice Cream, Fermented, Others), By Distribution Channel ( Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158010

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

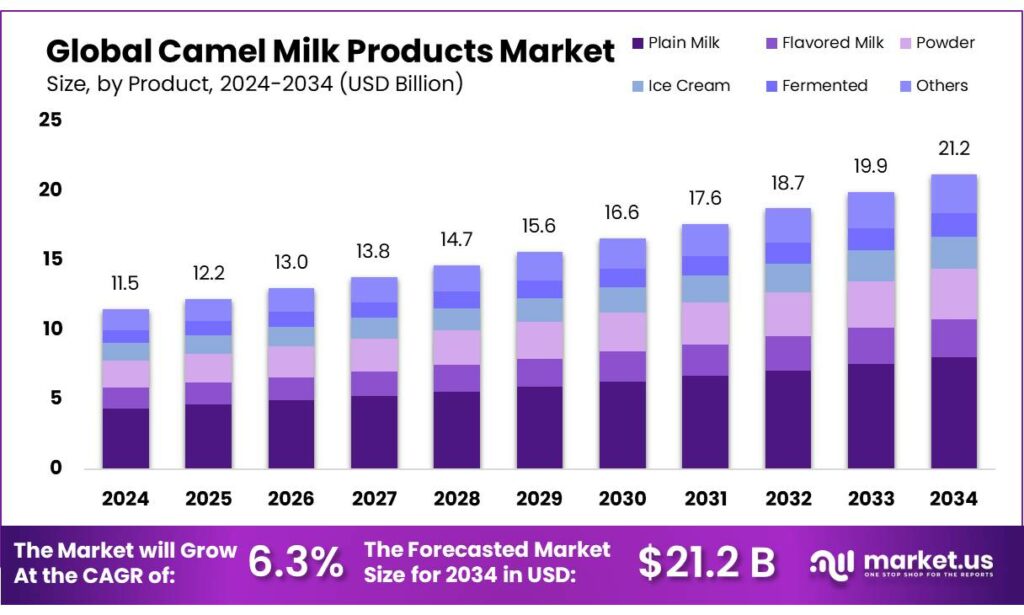

The Global Camel Milk Products Market size is expected to be worth around USD 21.2 Billion by 2034, from USD 11.5 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 Middle East & Africa held a dominant market position, capturing more than a 58.9% share, holding USD 8.4 Billion in revenue.

Camel milk, traditionally consumed in arid and semi-arid regions, is increasingly gaining recognition worldwide for its nutritional and therapeutic properties. It is rich in proteins, vitamins, and minerals, with lower fat content compared to cow’s milk. Camel milk is also noted for its bioactive compounds, including immunoglobulins and lactoferrin, which have been linked to antimicrobial, anti-diabetic, and anti-inflammatory benefits. The FAO reports that camel milk contains 3.1% protein and 3.5% fat on average, making it a viable alternative for consumers seeking functional and health-promoting dairy product.

The industrial scenario of camel milk is evolving rapidly, particularly in India, the Middle East, and parts of Africa. India accounts for approximately 3.3 million camels, predominantly in Rajasthan, Gujarat, and Haryana, and produces around 0.5 million liters of camel milk per day. The Indian government, under the National Camel Milk Mission, has set a target to double camel milk production by 2030 through improved breeding, fodder management, and veterinary support. Initiatives include the establishment of 150 functional camel milk cooperatives in Rajasthan, which have collectively increased daily procurement by 60,000 liters in the past year.

Driving factors for the growth of camel milk products include increasing consumer awareness about lactose-free alternatives, rising demand for functional foods, and government support for dairy innovation. Camel milk is naturally low in lactose, making it suitable for lactose-intolerant populations. Moreover, its high vitamin C content (about 40 mg per 100 ml) and anti-diabetic properties have positioned it as a premium health product. Urban demand in India, the UAE, and Saudi Arabia has surged, with camel milk-based products such as yogurt, cheese, and chocolates now available in retail chains. Additionally, camel milk exports from India and Kenya have risen by approximately 18% year-on-year, driven by health-conscious consumers in Europe and North America.

Future growth opportunities lie in product diversification and technological integration in production. Governments are promoting cold chain infrastructure for camel milk to prevent spoilage and maintain bioactive compound integrity. The Department of Animal Husbandry has approved a grant of ₹50 crore under the Camel Milk Value Addition Program to support modern processing units equipped with pasteurization and homogenization technologies. This is expected to enhance shelf life from 2–3 days to 7–10 days, enabling wider distribution

Key Takeaways

- Camel Milk Products Market size is expected to be worth around USD 21.2 Billion by 2034, from USD 11.5 Billion in 2024, growing at a CAGR of 6.3%.

- Plain Camel Milk held a dominant market position in the Camel Milk Products sector, capturing more than a 40.5% share.

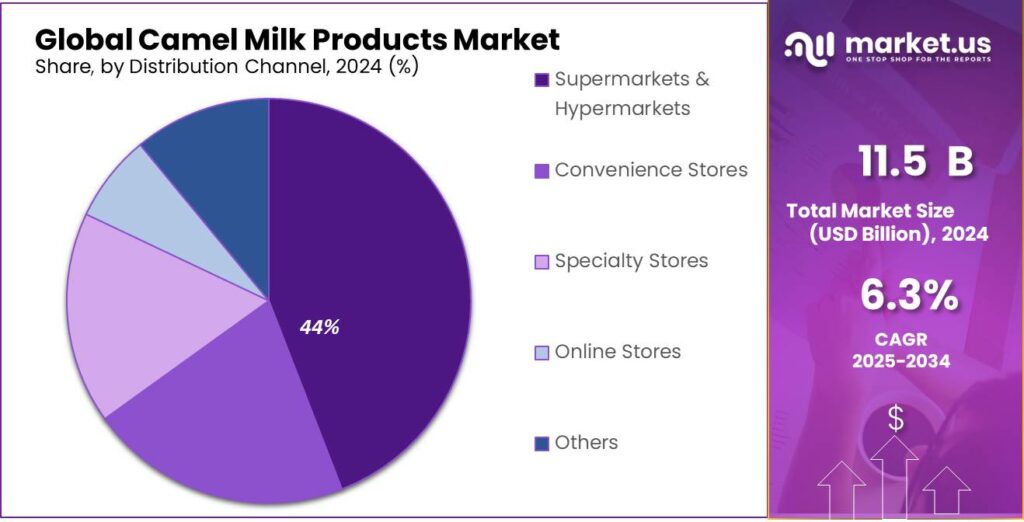

- Supermarkets & Hypermarkets held a dominant market position in the Camel Milk Products sector, capturing more than a 44.2% share.

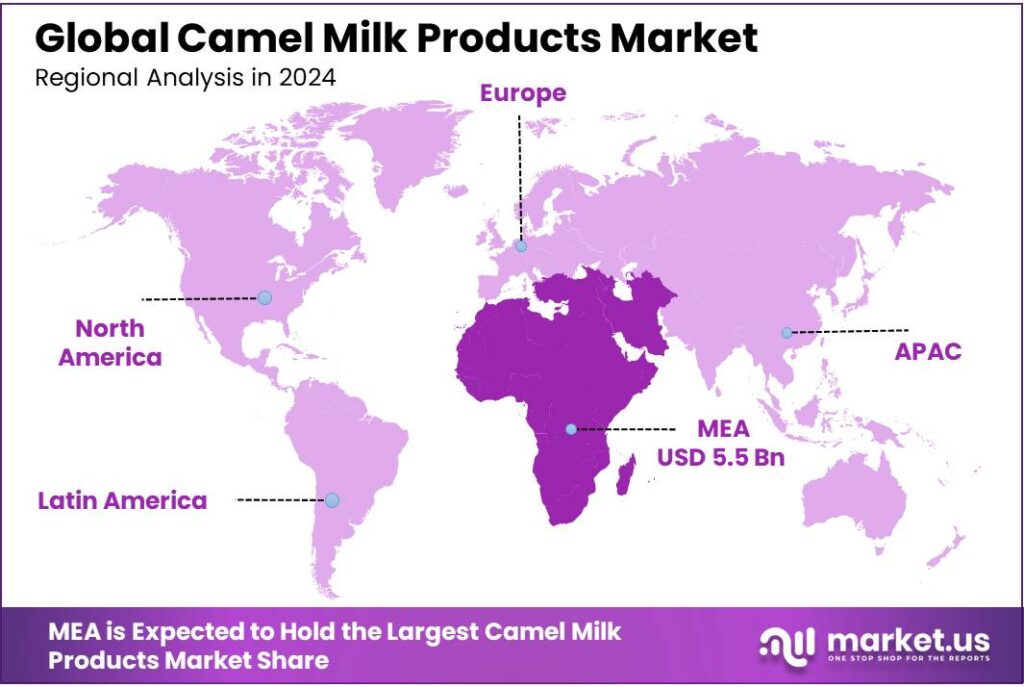

- Middle East & Africa region dominated the global Camel Milk Products Market, capturing 58.9% of the total market share, equivalent to approximately USD 8.4 billion.

By Product Analysis

Plain Camel Milk leads the Camel Milk Products Market with 40.5% share in 2024 due to its traditional appeal and health benefits.

In 2024, Plain Camel Milk held a dominant market position in the Camel Milk Products sector, capturing more than a 40.5% share. This segment’s strength is attributed to the traditional consumption habits in regions like the Middle East and Africa, where camel milk has been a staple for centuries. Its popularity is further bolstered by increasing consumer awareness of its health benefits, such as lower fat content, higher levels of vitamins A and C, and natural probiotic properties.

The demand for plain camel milk is also driven by its versatility and ease of consumption. As a fresh and minimally processed product, it appeals to health-conscious consumers seeking natural and functional food options. Additionally, the absence of beta-casein and beta-lactoglobulin, common allergens in cow’s milk, makes it a suitable alternative for individuals with milk allergies.

By Distribution Channel Analysis

Supermarkets & Hypermarkets dominate Camel Milk Products Market with 44.2% share in 2024 due to broad consumer access and convenience.

In 2024, Supermarkets & Hypermarkets held a dominant market position in the Camel Milk Products sector, capturing more than a 44.2% share. This leadership is primarily due to the extensive reach and convenience these retail outlets offer to consumers. Supermarkets and hypermarkets provide a wide variety of camel milk products, including plain milk, flavored milk, and milk powder, making it easier for consumers to access these products in one location. The strategic placement of these products in high-traffic areas within stores further enhances visibility and encourages impulse purchases.

The growth of this distribution channel is also supported by the increasing consumer awareness of the health benefits associated with camel milk, such as its suitability for lactose-intolerant individuals and its rich nutritional profile. Additionally, the ability to offer competitive pricing and promotional discounts in supermarkets and hypermarkets attracts a broader customer base, including health-conscious consumers seeking alternative dairy options.

Key Market Segments

By Product

- Plain Milk

- Flavored Milk

- Powder

- Ice Cream

- Fermented

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Emerging Trends

Rise of Packaged and Flavored Camel Milk Products

A significant trend shaping the camel milk industry is the increasing shift toward packaged and flavored camel milk products. Traditional camel milk consumption has largely been limited to direct farm use or local markets in arid regions. However, rising health awareness, urbanization, and consumer demand for convenience are encouraging the production of packaged milk and value-added flavored products. Packaged camel milk not only extends shelf life through pasteurization but also enhances hygiene and safety, which is crucial for urban and export markets.

- According to the Food and Agriculture Organization (FAO), camel milk is highly perishable, requiring chilling below 4°C immediately after milking to maintain its nutritional integrity.

Government initiatives are further supporting this trend. The Camel Milk Mission in Rajasthan has invested ₹50 crore (~US$6.2 million) in establishing milk collection centers, chilling units, and packaging facilities to ensure hygienic handling and processing (Rajasthan Department of Animal Husbandry. Similarly, the Dairy Processing Infrastructure Development Fund (DIDF), with an allocation of ₹10,005 crore, enables the modernization of processing plants, cold chains, and packaging technologies, which are crucial for the production of both plain and flavored camel milk.

Another important aspect of this trend is the rise of e-commerce and direct-to-consumer delivery models. Packaged camel milk and flavored products are increasingly available through online platforms, allowing consumers in metropolitan areas to access fresh and processed camel milk without geographic constraints. Pilot projects in Rajasthan and Gujarat have reported distributing over 15,000 liters of packaged camel milk per month through cooperative networks, demonstrating strong consumer acceptance and operational feasibility.

Drivers

Rising Health Awareness and Nutritional Benefits

The growing awareness of camel milk’s unique nutritional and therapeutic properties is a major driving factor behind the expansion of the camel milk products industry. Camel milk contains lower fat content (2–3%), higher vitamin C (3 mg per 100 ml), and bioactive proteins such as lactoferrin and immunoglobulins, which exhibit antimicrobial and anti-inflammatory effects. Studies conducted by the Indian Council of Medical Research (ICMR) indicate that regular consumption of camel milk can help in managing diabetes, improving immunity, and supporting gut health. For example, research found that Type 2 diabetes patients consuming 500 ml of camel milk daily showed a reduction of blood sugar levels by 15–20% over three months.

This rising health consciousness has translated into higher consumer demand in urban areas, where individuals increasingly prefer functional and organic food products. Camel milk is being positioned as a “superfood” due to its high vitamin B12, iron, and immunoglobulin content, making it attractive to health-conscious consumers, including those with lactose intolerance. Camel milk contains approximately 4.5% lactose, lower than cow milk, allowing individuals who struggle with conventional dairy to benefit from dairy nutrients without digestive discomfort.

Government initiatives are also amplifying this driving factor by promoting camel rearing and milk commercialization as a means of supporting rural livelihoods. In India, the Camel Milk Mission in Rajasthan received funding of ₹50 crore (~US$6.2 million) to develop collection centers, chilling units, and processing facilities. These measures not only ensure the availability of high-quality camel milk but also create trust among consumers regarding safety and hygiene standards.

Additionally, the Dairy Processing Infrastructure Development Fund (DIDF) by the Ministry of Fisheries, Animal Husbandry & Dairying, with an allocation of ₹10,005 crore, supports modern dairy processing infrastructure, cold chains, and value addition facilities that directly benefit camel milk processing.

Restraints

Limited Production Capacity and Supply Chain Challenges

One of the primary restraining factors for the camel milk industry is the inherently limited production capacity of camels combined with underdeveloped supply chains. Camels produce significantly less milk than cows, averaging 4–6 liters per day under optimal conditions, according to the Food and Agriculture Organization (FAO) (FAO, Camel Production and Health, 2020. This low yield makes large-scale production challenging, especially when compared to cow milk, which can average 15–20 liters per day per animal. As a result, even as demand for camel milk grows in urban and health-conscious markets, the availability of raw milk remains constrained, limiting the ability of producers to scale operations and meet market expectations.

Supply chain issues exacerbate this limitation. Camel milk is highly perishable due to its delicate composition, necessitating rapid chilling and transport. The majority of camel herders operate in remote, arid regions with limited cold chain infrastructure.

- For instance, Rajasthan, which has one of India’s largest camel populations, faces challenges in transporting milk from villages to processing units without spoilage. While government programs like the Camel Milk Mission have funded the creation of collection centers and chilling units with ₹50 crore (~US$6.2 million) in investment, these facilities cover only a fraction of the total production, leaving many smallholder farmers reliant on local, informal markets.

Additionally, the scarcity of trained personnel and modern processing technologies presents another hurdle. While government initiatives such as the Dairy Processing Infrastructure Development Fund (DIDF) with ₹10,005 crore allocation aim to modernize processing plants and expand cold chains, most facilities remain concentrated in limited urban areas, leaving rural herders with restricted access to technology for pasteurization, quality testing, and packaging.

Opportunity

Expansion of Value-Added Camel Milk Products

The growing consumer interest in functional foods and nutritionally rich dairy products presents a significant growth opportunity for camel milk products through the expansion of value-added offerings. Camel milk is naturally rich in bioactive proteins, immunoglobulins, and insulin-like peptides, making it suitable for the production of premium dairy products such as yogurt, cheese, flavored milk, and probiotic beverages.

- According to the Food and Agriculture Organization (FAO), camel milk contains approximately 3.5% protein and 2–3% fat, providing a high-quality nutritional profile ideal for value-added processing.

Consumer demand for health-focused dairy is on the rise, driven by increasing awareness of camel milk’s potential benefits for lactose-intolerant individuals, diabetes patients, and immune-compromised populations. Research by the Indian Council of Medical Research (ICMR) shows that regular consumption of camel milk can reduce blood sugar levels in Type 2 diabetes patients by 15–20% over three months.

Furthermore, there is considerable potential for export-oriented growth. Middle Eastern and European markets are increasingly receptive to camel milk products due to their nutritional and exotic appeal. With proper value addition, including pasteurization, flavored variants, and dairy-based supplements, camel milk can capture higher price points compared to conventional dairy products. For instance, camel milk yogurt can be marketed at 20–25% higher retail price than traditional cow milk yogurt in niche health markets, enhancing profitability for producers.

Regional Insights

Middle East & Africa leads Camel Milk Products Market with 58.9% share in 2024, valued at USD 8.4 billion.

In 2024, the Middle East & Africa region dominated the global Camel Milk Products Market, capturing 58.9% of the total market share, equivalent to approximately USD 8.4 billion. This dominance is primarily attributed to the region’s deep-rooted cultural ties to camel husbandry and the increasing consumer awareness of the health benefits associated with camel milk, such as its suitability for lactose-intolerant individuals and its rich nutritional profile.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Camelicious operates the world’s largest camel dairy in Dubai, UAE, with over 530 staff and producing approximately 4 million liters of camel milk annually. The company offers a range of products including plain and flavored milk, cheese, and camel milk powder. Camelicious is renowned for its advanced production facility and commitment to quality, ensuring that its products are free from hormones and antibiotics.

Based in Irvine, California, Desert Farms is a leading producer of camel milk products in the United States. The company offers products such as fresh camel milk, camel milk powder, and camel milk-based skincare items. Desert Farms emphasizes the health benefits of camel milk, including its suitability for lactose-intolerant individuals and its rich nutritional profile.

Located in Berlicum, Netherlands, Camel Dairy Smits is Europe’s only professional camel dairy. The company produces camel milk that is legally allowed to be sold raw within the European Union. Camel Dairy Smits exports its products to several European countries and is known for its commitment to animal welfare and sustainable farming practices.

Top Key Players Outlook

- Camelicious

- Desert Farms, Inc.

- The Camel Milk Co. Australia Pty Ltd.

- Camel Charisma Pvt. Ltd

- CAMEL DAIRY SMITS

- Al Ain Farms

- Tiviski pvt Ltd.

- UK Camel Milk Ltd

- Aadvik Foods

- QCamel

- GCMMF

Recent Industry Developments

In March 31, 2023, Camel Charisma generated revenue close to ₹27 Lakh (i.e. 2.7 million rupees) according to corporate/legal data sources.

QCamel is a family‑owned organic camel dairy in Australia which in 2023 produced about 10,000 litres/year of pasteurised organic camel milk, and by end 2024 is targeting to reach 40,000 litres/year.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Bn Forecast Revenue (2034) USD 21.2 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Plain Milk, Flavored Milk, Powder, Ice Cream, Fermented, Others), By Distribution Channel ( Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Camelicious, Desert Farms, Inc., The Camel Milk Co. Australia Pty Ltd., Camel Charisma Pvt. Ltd, CAMEL DAIRY SMITS, Al Ain Farms, Tiviski pvt Ltd., UK Camel Milk Ltd, Aadvik Foods, QCamel, GCMMF Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Camelicious

- Desert Farms, Inc.

- The Camel Milk Co. Australia Pty Ltd.

- Camel Charisma Pvt. Ltd

- CAMEL DAIRY SMITS

- Al Ain Farms

- Tiviski pvt Ltd.

- UK Camel Milk Ltd

- Aadvik Foods

- QCamel

- GCMMF