Global Calcium Carbonate Market By Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate) By Application, By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 38094

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

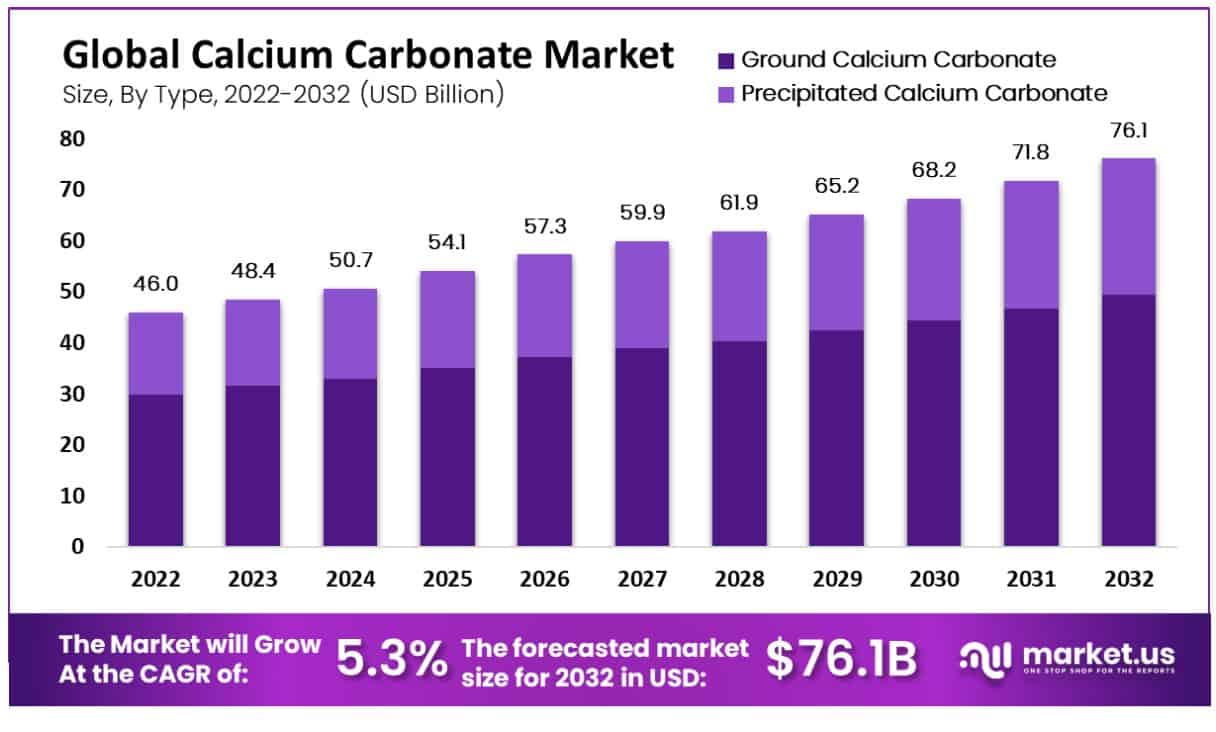

The Calcium Carbonate market size is expected to be worth around USD 76.1 Billion by 2032 from USD 46.0 Billion in 2022, growing at a CAGR of 5.3% during the forecast period 2023 to 2032.

The synthetic recipe CaCO3 addresses calcium carbonate, a compound that is made of substance. Calcium carbonate is estimated to cover around 4% of the earth’s outer layer. Calcium carbonate is commonly found in minerals and rocks. These include calcite and limestone, chalk, and marble.

You can use calcium carbonate in its natural state or in an unadulterated form. Different methods, such as mining and excavating, can be used to extract unadulterated calcium carbonate from the earth. Calcium carbonate is currently used for various purposes, including as a mineral filler and brightening specialist.

The market is experiencing significant growth due to the increasing demand for paper in packaging applications as well as hygiene-related products such as tissue paper. The coronavirus outbreak in 2020 caused a drop in product demand.

The pandemic led to widespread shutdowns around the world, which had a significant impact on the economy in the first half of 2020. Companies are making extra efforts to reopen their operations in the second half, which is a good sign for market growth.

Key Takeaways

Calcium Carbonate Market Trends: It is anticipated that the calcium carbonate market will experience an average compound annual rate increase between 2023-2032 of approximately 5.3% CAGR.

Calcium Carbonate Overview: Due to its versatile industrial uses, calcium carbonate’s market has gained immense recognition across fields including construction, plastics, and healthcare due to its unique qualities.

Analyzing Type: Analysis indicates a precipitated calcium carbonate (PCC) compound annual growth rate exceeding 4.2% over its predicted lifecycle.

Applications Analysis: Increased spending from both government and private industries is contributing to significant development within the building and construction industries, leading to impressive gains for calcium carbonate markets globally.

End-Use Industry: Celulosa, an Argentine firm, announced an increase of 30% in paper packaging production. Due to the increased food industry’s need for paper packaging products, Celulosa focused its efforts on this regard.

Driving factors: calcium carbonate industry growth includes factors like increasing demand from various sectors, technological progress, and economic stability – factors like these help shape industry expansion as a whole. Initiatives by governments as well as policies regarding investments play significant roles in expanding markets further.

Restraints: Calcium carbonate producers face several hurdles that restrict production and investment decisions, including demand fluctuations from end-user industries and economic slowdowns, changes to regulations that impede investments or production processes, as well as volatile regulatory requirements that impact investment or production processes.

Recent Trends: Recent developments in the global calcium carbonate market include an increase in demand for precipitated calcium carbonate as it finds greater use for healthcare purposes and an emphasis on eco-friendly production techniques.

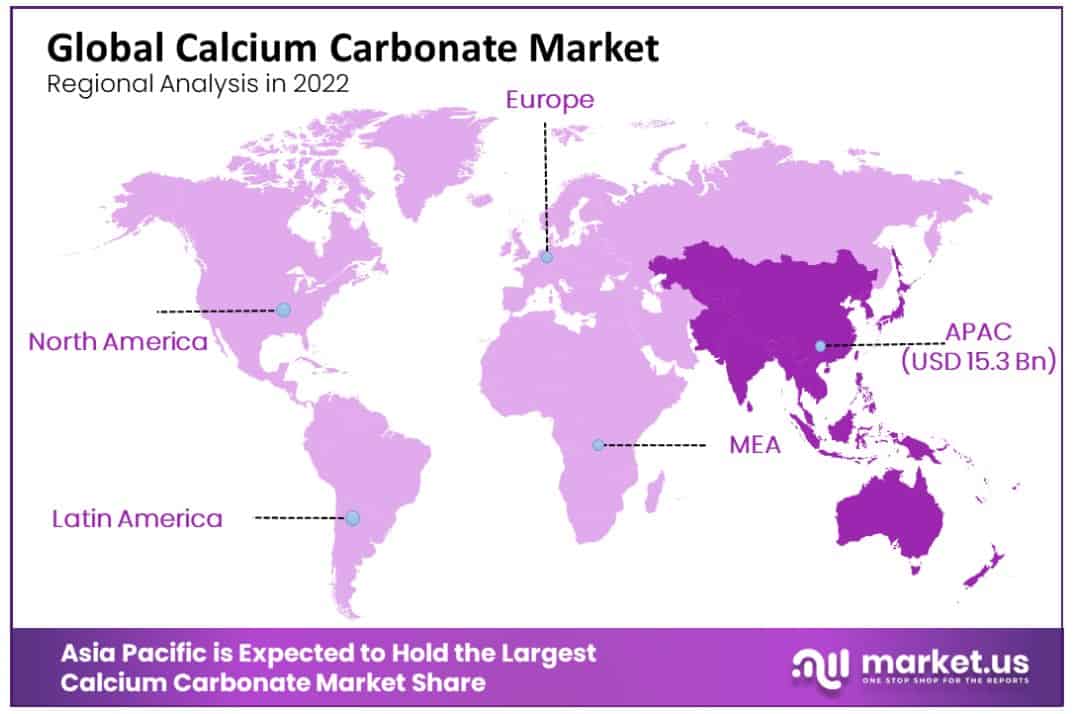

Regional Analyses: By 2022, Asia Pacific held the greatest market share and contributed 33.4% of worldwide income.

Principal Players in the Calcium Carbonate Market: The key players within the calcium carbonate market consist of well-recognized suppliers, distributors, and producers who focus on innovation, creativity, and strategic expansion for relevance in an ever-evolving industry like calcium carbonate.

Driving Factors

Increasing Investment in the Construction and Building Industry is Driving the Growth of the Calcium Carbonate Market.

Due to increased investment from both the government and private sectors, the construction and building industries are experiencing significant growth. The rising construction of commercial and residential buildings due to growing urbanization and the increasing disposable income of middle-class people is expected to increase calcium carbonate consumption in the next few years.

Calcium carbonate is used for concrete production and ceramic material manufacturing to manufacture fillers and additives to paints and coatings adhesives sealants and plastic materials. The market value for calcium carbonate is increasing due to the increased demand for concrete, tiles, and marble in residential and commercial buildings.

Calcium carbonate can be used as a base unrefined material for plastics and paper. APAC is seeing a rise in demand for paper, despite the slow pace of advanced change. Paper bundling has seen an increase in popularity due to the economic development in APAC’s non-industrial countries. The largest buyers of paper in the area are China, India, South Asian countries, and India.

The growth of online businesses in India and China has led to an increase in interest in layered bundling arrangements. Paper bundling can also be used in various ventures, such as food, medical services, and schooling. These many elements are increasing the demand for paper locally.

Restraining Factors

Digitization and Increased Use of Computer Assisted Media are Hindering the Calcium Carbonate Market Growth.

Paper businesses are severely impacted by increasing digitization and electronic distribution. The global paper industry has been in decline in recent years due to the shift to paperless communications and computerized media in most developed countries. Interest in newsprint has also fallen recently due to oversupply.

The increasing use of computer-assisted media continues to replace paper, thus restraining the market for office paper and newsprint, which has been shrinking by about 5.5%. Increased digitization is a market test, as calcium carbonate is widely used as a filler incorporated into hard copy and printing paper, newsprint, and endless paper binding applications.

By Type Analysis

Ground Calcium Carbonate Rules the Type Segment of Calcium Carbonate Market.

The market can be sub-segmented as Ground Calcium Carbonate and Precipitated Calcium Carbonate. Precipitated Calcium Carbonate and Ground Calcium Carbonate, both share the same chemical formula but differ in their manufacturing processes, properties, and end-use. The item-type fragment was dominated by ground calcium carbonate.

Ground calcium carbonate can be used as a modern mineral. It is used in paints, coatings, paper, and plastic fillers. Ground calcium carbonate can also be used to track concrete applications and can be converted into calcium oxide or calcium hydroxide. It can increase the pH of soils and water, and it can also be used to eliminate ignition fumes.

GCC is made by grinding limestone to a fine powder. It is then sorted according to its size. The process does not involve any chemical changes. The market for Ground Calcium Carbonate (GCC), is expected to expand significantly over the forecast period. Ground calcium carbonate is beneficial for rubber and rubber products.

It provides stiffness and resistance to abrasion. You can use ground calcium carbonate to make silicone- and acrylic-based sealants. Agile, a calcium carbonate-based fertilizer, provides plants with an additional boost of calcium and neutralizes soil conditions.

The highest expected CAGR for precipitated calcium carbonate (PCC), is more than 4.2% during the forecast period. Precipitated calcium carbonate can be used as an added substance in glues and sealants, elastics, plastics, ink paper, nutraceuticals, and other applications.

By Application Analysis

Heavy Use of Calcium Carbonate in the Construction Industry is Driving the Growth of Segment in the Market.

Increased investment from both the government and private sectors is boosting the construction and building industries which helps the calcium carbonate market to experience significant growth. The rising construction of commercial and residential buildings due to growing urbanization and the increasing disposable income of middle-class people is expected to increase calcium carbonate consumption in the next few years.

Calcium carbonate is used for concrete production and ceramic material manufacturing in the manufacture of fillers and additives to paints, coatings, adhesives, sealants, and plastic materials. A rise in demand for concrete, tiles, and marbles in commercial, residential, and public buildings is driving the calcium carbonate market.

By End-Use Industry

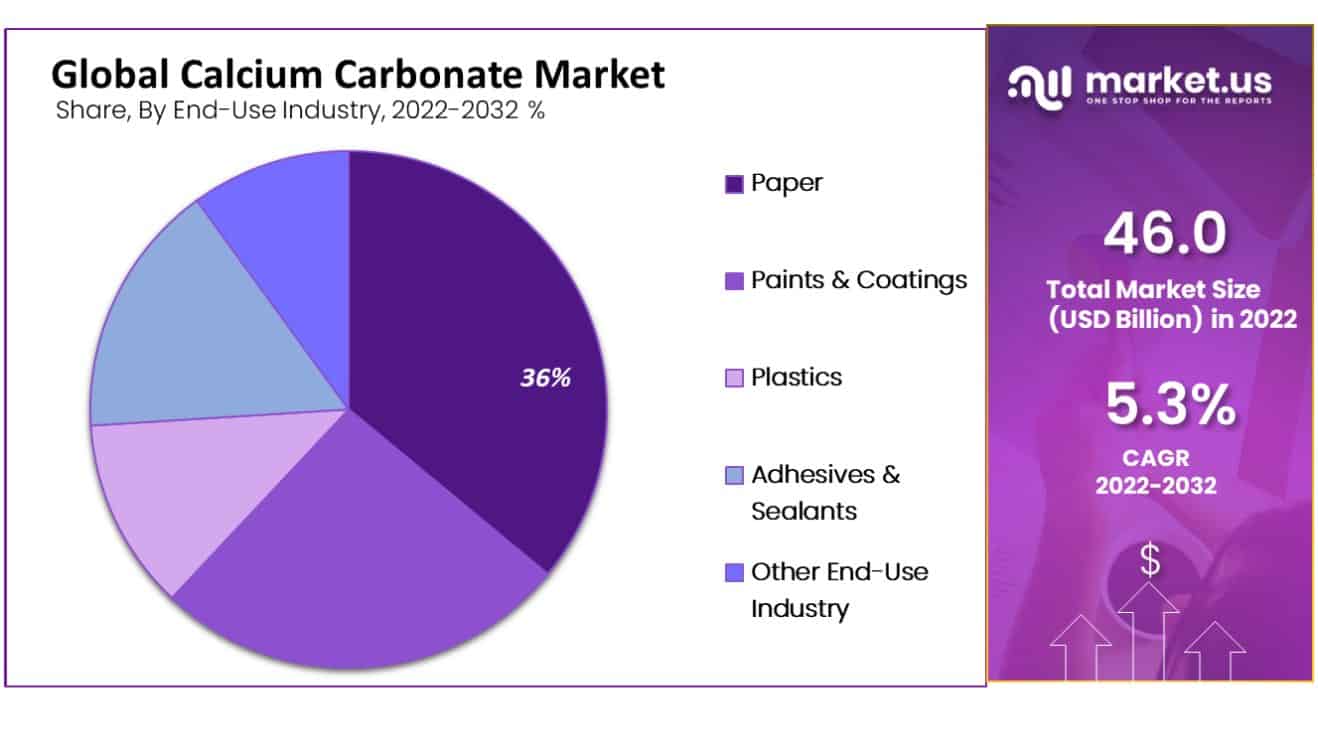

Paper Industry Dominated the End-Use Industry Segment In 2022.

In 2022, the paper segment was the largest segment in the market. Calcium carbonate can be added to the pulp as a filler or coating pigment. This increases the paper’s brightness and transparency. The internet had an impact on the print media market but it didn’t affect the demand for paper in other applications such as packaging or tissue paper. To meet rising consumer demand, manufacturers have had to increase their production.

Celulosa, an Argentinian company, announced a 30% increase in paper packaging production. As the demand for paper packaging increased, the company’s main focus was on the food sector. The paper application segment will continue to lead the market over the forecast period due to the expansion of e-commerce and the growing use of tissue paper.

Paints and coatings emerged as the second-largest segment of the market. It is used in a variety of applications within the paints-and-coatings sector. It can be used as an agent to reduce or enhance gloss, an extender, a modifier of rheology, and an additive to increase density.

Despite its many uses, this segment of the market saw a drop in product demand in 2021. This was due to a halting of manufacturing operations that disrupted the entire supply and production chain for the paints and coatings industry.

Although production has been resumed without restrictions, market players are still concerned about the increasing incidences of COVID-19 as well as operations at minimal capacity. Several companies have developed strategies to deal with this situation. Asian Paints, an Asian leader, launched a new product line in the hygiene and health segment.

To increase its sales, the company has launched a “Safe Painting Campaign”. The company also offers a “San Assure” service that can be used to clean homes, offices, and shops. These initiatives are expected to boost the market demand for paints, and coatings, and thereby lead to market growth.

Key Market Segments

Type

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

Application

- Fillers

- Neutralizing Agents

- Construction Materials

- Dietary Supplements

- Desulfurization

- Additive

- Other Applications

End-Use Industry

- Paper

- Paints & Coatings

- Plastics

- Adhesives & Sealants

- Other End-Use Industry

Growth Opportunity

Nano Calcium Carbonate Market Opens Many Opportunities in the Calcium Carbonate Market.

Calcium carbonate is now widely used in the fields of paper, plastics, paints, coatings, cement, and sealants. Calcium carbonate-based materials are biodegradable and biocompatible, making them ideal as sophisticated transporters for carrying grades, proteins, and pharmaceuticals. In addition, nano calcium carbonate has several possible applications.

Nano calcium carbonate is of interest to analysts, especially because of its useful applications. Research is underway to use these nanoparticles for useful applications such as specialized antibacterial agents, high-quality delivery to target disease cells, and drug delivery against malignant growths. These potential applications open various doors for future calcium carbonate market development.

Latest Trends

Globally, the paper industry is the largest user of calcium carbonate. As technology has evolved from acid to neutral sizing, calcium carbonate usage has increased significantly. Calcium carbonate is today the most commonly used mineral in paper manufacturing. Both precipitated calcium carbonate (ground calcium carbonate) and precipitated calcium carbonate (precipitated calcium carbonate) are used as fillers and coating pigments.

They help to produce high-quality papers with good printing properties, glosses, and whiteness. The main reason calcium carbonate is used in papermaking is the increasing demand for thicker, brighter paper. The paper industry’s growth is due to the increasing demand for cardboard packaging.

This is in line with rising manufacturing activities and skyrocketing online e-commerce, rising manufacturers’ initiatives to create sustainable packaging solutions, and growing demand to make hygiene products. The future will see a rise in demand for calcium carbonate due to technological advancements and the availability of high-quality papers with improved physical attributes.

Calcium carbonate is the most important mineral to compound with polymers. More than 60% of the market for filler and reinforcements is made up of calcium carbonate. The main applications are plasticized and rigid PVC as well as unsaturated polyesters, nylon, polypropylene, and polyethylene. Rubber, foamed latex carpet backings and sealants are also important.

Calcium carbonate can be used as a filler to lower costs and increase petroleum-based resources. It can also influence the properties of plastics. Imerys, one of the major producers of calcium carbonate, has created innovative products like breathable PE film for hygiene products for adults and babies. Breathable PE films can also be used in the construction industry.

These films cannot be made without a filler like calcium carbonate. The market players have been focusing on the development of plastic additives to meet the increasing demand for calcium carbonate. This will likely drive growth in the Calcium Carbonate market revenue.

Regional Analysis

Asia Pacific Dominated the Global Calcium Carbonate Market in 2022.

Asia Pacific was the dominant market region and represented a greater than 33.4% of global revenue in 2022. Due to increased investments in infrastructure development and the manufacturing sector, the region is expected to grow at a steady CAGR of 5% between 2023 and 2032.

The pandemic has had a profound impact on the supply chain and manufacturing operations. All major Asian countries, except China, have reported negative GDP growth in the second quarter of 2020. The economies are making extra efforts to ensure the smooth operation of their operations across all sectors.

They also maintain the necessary protocols that were required during the pandemic. Several industries report positive news as operations resume. For example, Indian automotive sales have increased in the last two months. The demand for paints, coatings, and vehicles is expected to rise, which will, in turn, increase the demand for calcium carbonate.

In 2022, North America was the second-largest regional market. Despite being severely affected by the pandemic in the region, the end-use industry of the market has started its operations at a minimal capacity due to the increase in consumer demand.

The market is seeing positive signs as industries such as medical, packaging, and DIY are increasing their demand for adhesives and paper. Huntsman Corporation, Audax Private Equity, acquired Gabriel Performance Products (Gabriel), in January 2021.

Gabriel is a North American specialty chemical manufacturer of epoxy curing agents, additives, and sealants for the coatings, composites, and adhesives markets.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Market competition is fierce because many players are integrated throughout the value chain, including their presence in mining operations, processing plants, and the application industry. To maintain their market leadership and calcium carbonate market share, many players have taken key strategic steps to merge and acquire.

Some of the major players in the calcium carbonate market include AGSCO Corp., Carmeuse, Blue Mountain Minerals, Carmeuse Lime & Stone Company, GCCP Resources, GLC Minerals LLC, Greer Limestone Company, Midwest Calcium Carbonates, and Other Key Players

Top Key Players

- AGSCO Corp.

- Carmeuse

- Blue Mountain Minerals

- Carmeuse Lime & Stone Company

- GCCP Resources

- GLC Minerals LLC

- Greer Limestone Company

- Midwest Calcium Carbonates

- ILC Resources

- Imerys

- J.M. Huber Corp

- LafargeHolcim

- Other Key Players

Recent Developments

- In August 2022, Cimbar Resources Inc. announced the acquisition of Imerys Carbonates USA Inc., a calcium carbonate manufacturer in Sahuarita (Arizona), United States. This was done to expand its portfolio and support its goal to provide a wide range of products to customers in multiple locations.

- In May 2022, Omya Inc. announced with its affiliates that they would raise prices for all calcium carbonate products at a minimum of 9.9% effective November 1, 2022. The price rise is due to the cost escalation in energy and quarrying costs that the company has experienced in the United States, Canada, and other countries throughout 2022.

Report Scope

Report Features Description Market Value (2022) US$ 46.0 Bn Forecast Revenue (2032) US$ 76.1 Bn CAGR (2023-2032) 5.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Ground Calcium Carbonate, and Precipitated Calcium Carbonate; By Application – Fillers, Neutralizing Agents, Construction Materials, Dietary Supplements, Desulfurization, Additive, and Other Applications; By End-Use Industry – Paper, Paints & Coatings, Plastics, Adhesives & Sealants, and Other End-Use Industry. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AGSCO Corp., Carmeuse, Blue Mountain Minerals, Carmeuse Lime & Stone Company, GCCP Resources, GLC Minerals LLC, Greer Limestone Company, Midwest Calcium Carbonates, ILC Resources, Imerys, J.M. Huber Corp, LafargeHolcim, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGSCO Corp.

- Carmeuse

- Blue Mountain Minerals

- Carmeuse Lime & Stone Company

- GCCP Resources

- GLC Minerals LLC

- Greer Limestone Company

- Midwest Calcium Carbonates

- ILC Resources

- Imerys

- J.M. Huber Corp

- LafargeHolcim

- Other Key Players