Global Calcium Carbide Market Size, Share Analysis Report By Grade (High Grade, Medium Grade, Low Grade), By Form (Lump, Powder, Granular), By Application ( Desulfurizing Agent, Acetylene Gas, Reducing Agent, Calcium Cyanamide, Chemical Intermediate, Others), By End-Use (Chemical, Automotive, Aerospace, Construction, Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151950

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

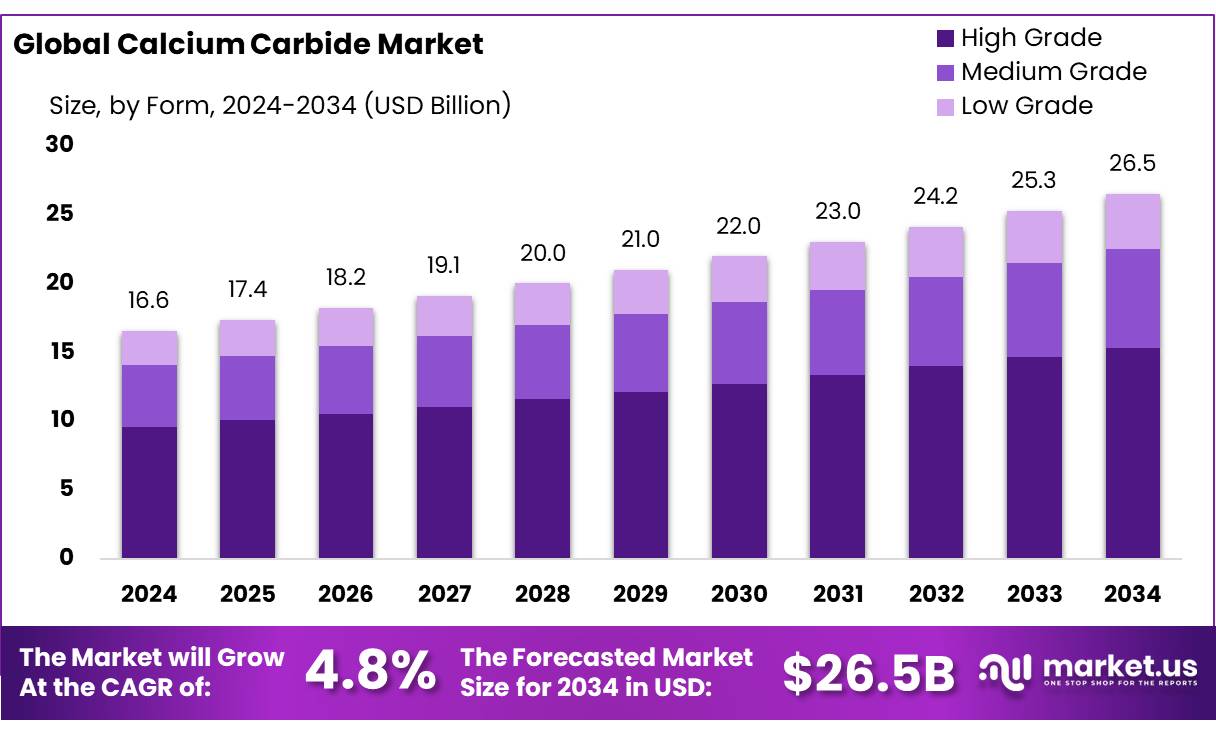

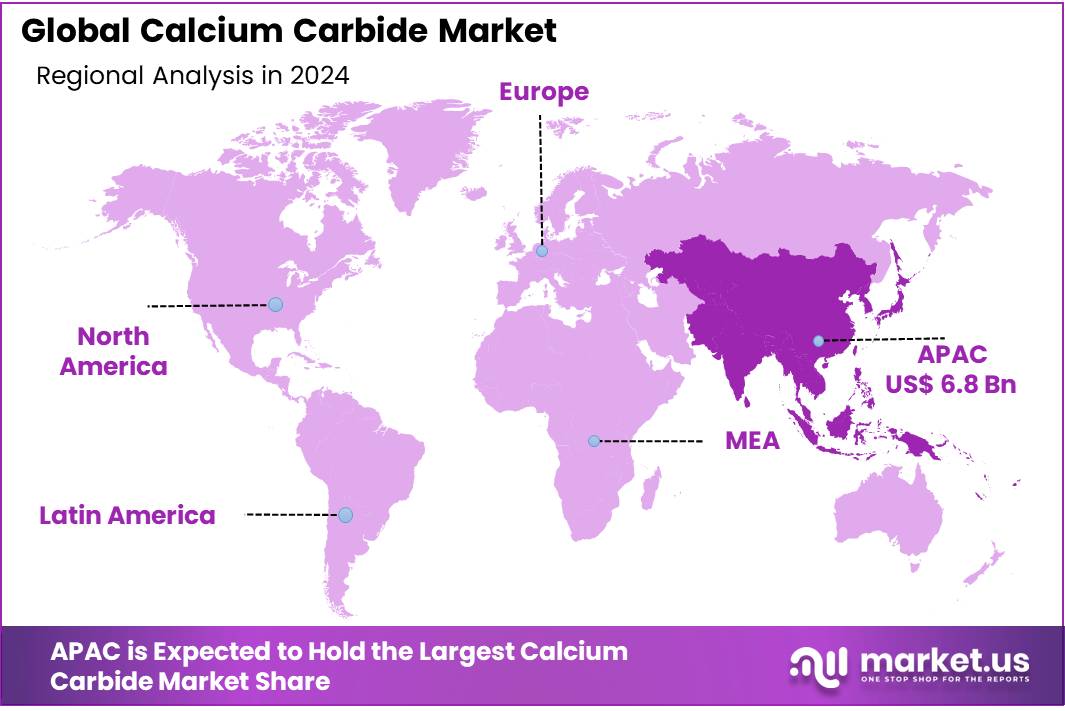

The Global Calcium Carbide Market size is expected to be worth around USD 26.5 Billion by 2034, from USD 16.6 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 41.3% share, holding USD 6.8 billion revenue.

Calcium carbide (CaC2) is a critical raw material fundamentally employed in the industrial synthesis of acetylene gas, a precursor for vinyl chloride monomer (VCM), polyvinyl chloride (PVC), and solvent-based specialty chemicals. Historically, the carbide-to-acetylene route was prominent; although methane-derived acetylene has gained traction in developed economies, China continues to produce ~8.94 million tonnes of CaC2 annually, supported by capacities reaching 17 million tonnes as of 2005.

Calcium carbide production remains energy-intensive, typically sourced from coke and limestone via high-temperature electric arc furnace processes. Stricter environmental regulations have incentivized investment in emissions control, including wet scrubber systems to limit particulate and cyanide-laden effluent in compliance with effluent limitations frameworks. China’s environmental initiatives, in regions like Inner Mongolia, highlight transitioning to advanced pollution mitigation systems in facilities producing upwards of 150,000 tonnes/year.

Government regulation and initiatives have shaped industry practices. In the U.S., calcium carbide producers with greenhouse gas emissions must report CO2, CH4, and N2O under 40 CFR 98 Subpart XX. In India, the Food Safety and Standards Authority (FSSAI) has enforced a strict ban on the use of calcium carbide for artificial fruit ripening, citing risks under the Food Safety and Standards. This reflects regulatory attention to both production and application phases.

Key Takeaways

- Calcium Carbide Market size is expected to be worth around USD 26.5 Billion by 2034, from USD 16.6 Billion in 2024, growing at a CAGR of 4.8%.

- High Grade held a dominant market position, capturing more than a 57.9% share of the global calcium carbide market.

- Lump held a dominant market position, capturing more than a 53.9% share of the global calcium carbide market.

- Acetylene Gas held a dominant market position, capturing more than a 37.2% share of the global calcium carbide market.

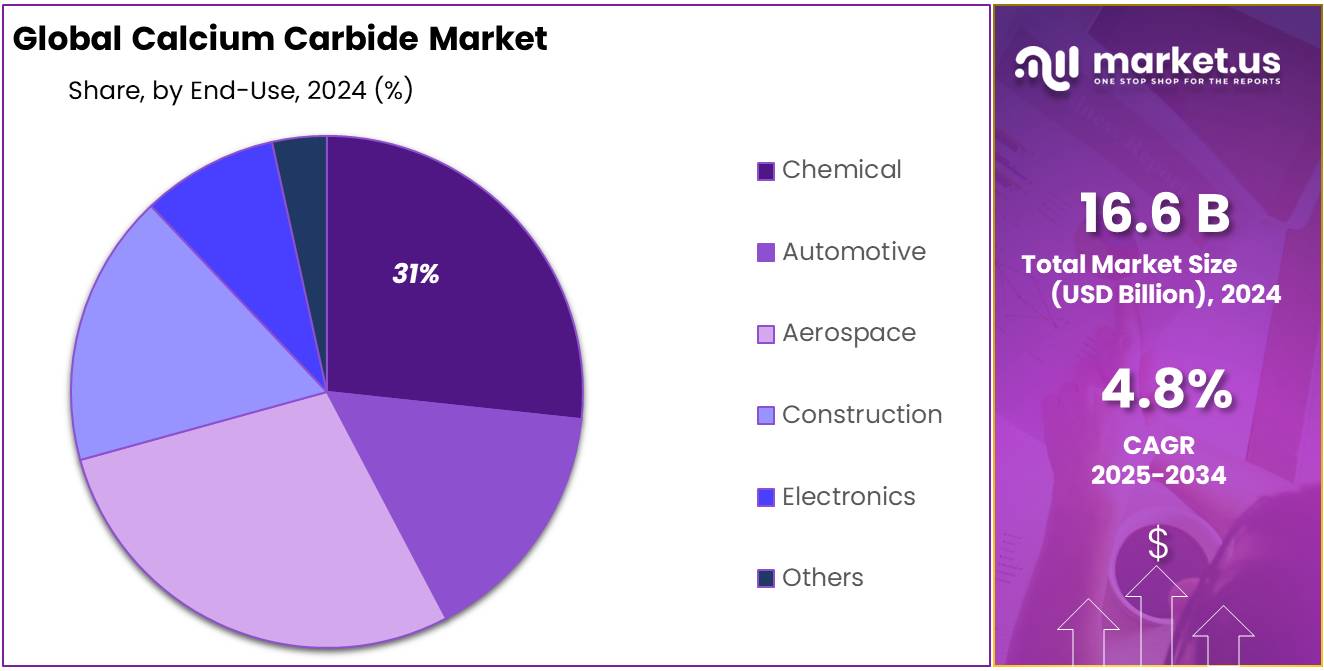

- Chemical held a dominant market position, capturing more than a 31.8% share of the global calcium carbide market.

- Asia-Pacific (APAC) region emerged as the dominant force in the global calcium carbide market, accounting for 41.3% of total market revenue, which translated to approximately USD 6.8 billion.

By Grade Analysis

High Grade Calcium Carbide Leads with 57.9% Market Share in 2024

In 2024, High Grade held a dominant market position, capturing more than a 57.9% share of the global calcium carbide market. This strong lead can be linked to its widespread use in key industrial applications such as acetylene gas production, metal cutting, and steel desulfurization, where purity and consistent chemical composition are critical. Industries such as construction, automotive, and chemical manufacturing increasingly prefer high-grade calcium carbide due to its higher yield, better efficiency, and reduced impurities.

Moreover, the rising demand for cleaner and more efficient industrial gases is encouraging end users to shift towards high-grade variants. As regulations around product quality and environmental safety tighten in both developing and developed regions, manufacturers are focusing more on refining production processes to meet the specifications of high-grade output. This trend is expected to continue in 2025, with industries maintaining their preference for superior-quality materials that offer reliable performance and meet safety standards.

By Form Analysis

Lump Form Leads with 53.9% Share in 2024 Driven by Industrial Demand

In 2024, Lump held a dominant market position, capturing more than a 53.9% share of the global calcium carbide market. This form is widely preferred in large-scale industrial applications due to its ease of handling, longer shelf life, and suitability for producing acetylene gas through direct water reactions. Lump calcium carbide is commonly used in metal fabrication, welding, and steelmaking sectors, where bulk operations require consistent and efficient material input.

Its popularity is also driven by the lower processing costs compared to powdered or granulated forms, making it a cost-effective option for manufacturers. Additionally, industries in countries with strong infrastructure and chemical processing bases continue to rely on lump form for its high reactivity and compatibility with existing equipment. As demand remains steady across Asia and other developing regions, the preference for lump form is expected to stay strong in 2025, backed by its proven performance in critical industrial uses.

By Application Analysis

Acetylene Gas Application Dominates with 37.2% Share in 2024

In 2024, Acetylene Gas held a dominant market position, capturing more than a 37.2% share of the global calcium carbide market. This strong demand is mainly driven by acetylene’s wide usage in metal cutting, welding, and brazing across construction, automotive, and heavy engineering industries. Calcium carbide remains the most common and cost-effective source for generating acetylene gas, especially in regions where alternative gas sources are limited or more expensive.

Its ability to produce high-temperature flames makes it ideal for precision metalwork, which is crucial in infrastructure projects and industrial fabrication. Additionally, acetylene is a key raw material for producing a range of chemicals such as vinyl acetate, acetaldehyde, and synthetic resins, further boosting its industrial importance. With developing economies investing in manufacturing and construction, the demand for acetylene gas is expected to remain strong in 2025, reinforcing calcium carbide’s role as a vital input in this value chain.

By End-Use Analysis

Chemical Industry Leads with 31.8% Share in 2024 Amid Strong Acetylene Demand

In 2024, Chemical held a dominant market position, capturing more than a 31.8% share of the global calcium carbide market. This leadership is largely due to calcium carbide’s crucial role in the production of acetylene gas, which serves as a key raw material in several chemical processes. Acetylene is used to manufacture vinyl compounds, synthetic rubbers, solvents, and other important intermediates in the chemical sector.

The growing demand for these derivatives, especially in emerging economies, has pushed chemical companies to secure stable and high-purity calcium carbide supplies. Additionally, ongoing expansion in the specialty chemicals segment—driven by applications in coatings, adhesives, and pharmaceuticals—continues to strengthen this end-use.

Key Market Segments

By Grade

- High Grade

- Medium Grade

- Low Grade

By Form

- Lump

- Powder

- Granular

By Application

- Desulfurizing Agent

- Acetylene Gas

- Reducing Agent

- Calcium Cyanamide

- Chemical Intermediate

- Others

By End-Use

- Chemical

- Automotive

- Aerospace

- Construction

- Electronics

- Others

Emerging Trends

Shift to Plasma Arc Furnaces for Cleaner Calcium Carbide Production

A significant new trend in the calcium carbide industry is the rapid adoption of plasma arc furnace technology, directly aimed at reducing environmental impact. The EU-funded “Carbide Zero” initiative is currently piloting modern plasma arc furnaces that can cut emissions by approximately 30% compared to traditional electric arc systems. These furnaces use high-energy plasma arcs to heat the lime and coke mixture more efficiently, achieving greater energy efficiency and faster reaction rates.

This technology is gaining traction notably in regions that are undergoing industrial modernization and tightening emissions standards. For example, pilot installations in Europe are demonstrating that plasma arc lines require around 20–25% less electricity per tonne of calcium carbide produced, addressing one of the industry’s most energy-intensive pressures . In parallel, similar technology investments are being planned in hydropower-rich provinces of China—such as Yunnan—where lower-cost renewable power supports cleaner production

Governments are reinforcing this technology shift with financial incentives and decarbonisation targets. The EU’s Net Zero Industry Act highlights CCUS and low-carbon industrial technologies as strategic levers for reducing greenhouse gases. Complementing this, national policies offer capital grants and tax credits aimed at reducing upfront costs for plasma furnace installations. In some cases, regions are linking subsidies to measurable emissions reductions, further accelerating adoption among manufacturers.

Drivers

Regulatory Crackdown on Unsafe Calcium Carbide Use in Food Processing

In recent years, stricter food safety and environmental regulations have emerged as a key driver reshaping the calcium carbide market. In India, for instance, the Food Safety and Standards Authority of India (FSSAI) intensified efforts in May 2025 to eliminate the illicit use of calcium carbide for artificial fruit ripening. A nation-wide enforcement campaign was launched, mandating inspections of storage facilities and declaring that the mere presence of calcium carbide alongside fruit crates constitutes evidence of illegal activity.

Under the Food Safety and Standards (Prohibition and Restrictions on Sales) Regulations, 2011, carbide use is categorically banned. To promote safer practices, the FSSAI has endorsed ethylene gas as the approved alternative—permitting concentrations of up to 100 μl/L (100 ppm)—for uniform fruit ripening via controlled chamber systems. These regulatory steps reflect a widening trend where chemical use in food systems is increasingly scrutinized, significantly affecting demand for calcium carbide in agricultural sectors.

Globally, environmental policy measures are also affecting calcium carbide production and usage. In April 2024, the United States Environmental Protection Agency (EPA) amended its Greenhouse Gas Reporting Program to expand monitoring to include calcium carbide manufacturing—acknowledging emissions from the process and mandating annual CO2 output reporting for all operational facilities.

Restraints

Environmental Regulations Increase Production Costs

Stronger environmental regulations are significantly constraining the growth of the calcium carbide market. Modern production is tightly regulated due to its high carbon footprint. For every tonne of calcium carbide produced, approximately 1.8 tonnes of CO2 are released—followed by an additional 1.1 tonnes during end-use—totalling nearly 2.9 tonnes of CO2 emissions per tonne of product. Such high emissions place the industry under intense scrutiny from regulators and environmental agencies worldwide.

In the United States, for example, the Environmental Protection Agency (EPA) mandates all calcium carbide facilities to report their annual CO2, CH4, and N2O emissions under Subpart XX of the Greenhouse Gas Reporting Program, with no reporting threshold being exempt, as emissions typically exceed 25,000 metric tons CO2 equivalent annually. Regulatory compliance requires the installation of continuous emissions monitoring systems (CEMS) and regular third-party reporting—adding significant operational costs and forcing manufacturers to allocate capital toward monitoring infrastructure rather than production optimization.

Parallel measures are underway in Europe under the EMEP/EEA guidelines, which list calcium carbide among key chemicals with strict emission inventories. These measures often compel producers to adopt expensive pollution-control technologies, such as particulate and sulfur oxide scrubbers, or to retrofit furnaces to reduce emissions—further increasing costs. Smaller producers, particularly in developing economies, are struggling to meet these standards, potentially leading to plant shutdowns or consolidation.

Opportunity

Carbon Capture Integration in Calcium Carbide Production

The calcium carbide industry stands at the threshold of a transformative opportunity through the adoption of carbon capture, utilization, and storage (CCUS) technologies. These systems can significantly lower emissions from the energy-intensive carbide production process.

Calcium carbide production is notably carbon-heavy, often generating nearly 2 tonnes of CO2 per tonne of product. By integrating CCUS systems—such as calcium looping or post-combustion capture facilities—plant operators can capture a considerable portion of these emissions. Over 700 carbon capture projects are already underway globally in sectors such as cement, steel, and chemicals, signaling a growing infrastructure and policy support for decarbonisation. For carbide producers, participation in this momentum offers a route to cleaner output and regulatory compliance.

Government efforts are beginning to support these initiatives. In the U.S., the Department of Energy’s National Energy Technology Laboratory (NETL) has issued Requests for Information to expand carbon capture infrastructure under the Bipartisan Infrastructure Law, addressing transport and storage capacity . South Korea has also prioritized CCS in its national green-growth framework, backing research and pilot projects through the KCRC since 2011.

Regional Analysis

Asia-Pacific Dominates the Calcium Carbide Market with 41.3% Share Valued at USD 6.8 Billion

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force in the global calcium carbide market, accounting for 41.3% of total market revenue, which translated to approximately USD 6.8 billion. This strong regional leadership is primarily driven by the substantial industrial base in countries such as China, India, and South Korea, where calcium carbide is extensively used for acetylene gas production, steel manufacturing, and various chemical processes.

China, in particular, remains the world’s largest producer and consumer of calcium carbide, supported by its well-established electric arc furnace infrastructure and abundant coal and limestone reserves—key raw materials in carbide production.

The rising demand for acetylene-derived chemicals such as vinyl acetate, synthetic rubbers, and solvents in APAC’s fast-growing construction, automotive, and textiles sectors has further boosted consumption. India’s expanding steel sector, bolstered by government infrastructure spending and the “Make in India” initiative, continues to push demand for calcium carbide as a key desulfurizing agent in steel production.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AlzChem, based in Germany, is a prominent player in the calcium carbide market, known for producing high-purity carbide used mainly in the steel and chemical industries. The company leverages its vertically integrated manufacturing and strong R&D capabilities to supply calcium carbide for acetylene gas generation and specialty chemical applications. Its carbide production supports a wide range of industrial uses, including synthesis of intermediates. AlzChem focuses on sustainable practices and energy efficiency in response to environmental regulations.

American Elements, headquartered in the United States, manufactures calcium carbide as part of its extensive portfolio of advanced materials and industrial chemicals. The company offers technical-grade calcium carbide for laboratory, industrial, and commercial applications, particularly in metallurgy, lighting, and acetylene gas production. Known for its global distribution network, American Elements serves multiple sectors with consistent supply and customizable product specifications. Its focus on purity and innovation positions it as a reliable supplier in both bulk and specialty markets.

Fujian Calcium Carbide, based in China, is a leading manufacturer specializing in large-scale production of industrial-grade calcium carbide. The company supplies the domestic market, particularly the chemical and metallurgy sectors, with a focus on acetylene gas applications. Leveraging local access to raw materials such as limestone and coal, Fujian ensures cost-efficient and steady output. As environmental regulations tighten in China, the company has adopted measures to modernize its furnaces and reduce production-related emissions.

Top Key Players in the Market

- AlzChem

- American Elements

- DCM Shriram Ltd.

- Denka Company Limited

- Fujian Calcium Carbide

- Ningxia Wanding Chemical Co.,ltd

- Lonza

- MCB Industries Sdn. Bhd.

- Mil-Spec Industries Corporation

- PT Emdeki Utama Tbk

- Xiahuayuan Xuguang Chemical

- Xinjiang Tianshan Chemical

Recent Developments

In 2024 AlzChem plays, employed approximately 1,725 staff across five production sites—four in Germany and one in Sweden—and generated total sales of €554.2 million alongside an EBITDA of €105.3 million.

In 2024 Fujian Calcium Carbide, this matches national trends, including China’s large-scale carbide output—historically over 25 million tonnes in prior years.

Report Scope

Report Features Description Market Value (2024) USD 16.6 Bn Forecast Revenue (2034) USD 26.5 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High Grade, Medium Grade, Low Grade), By Form (Lump, Powder, Granular), By Application ( Desulfurizing Agent, Acetylene Gas, Reducing Agent, Calcium Cyanamide, Chemical Intermediate, Others), By End-Use (Chemical, Automotive, Aerospace, Construction, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AlzChem, American Elements, DCM Shriram Ltd., Denka Company Limited, Fujian Calcium Carbide, Ningxia Wanding Chemical Co.,ltd, Lonza, MCB Industries Sdn. Bhd., Mil-Spec Industries Corporation, PT Emdeki Utama Tbk, Xiahuayuan Xuguang Chemical, Xinjiang Tianshan Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AlzChem

- American Elements

- DCM Shriram Ltd.

- Denka Company Limited

- Fujian Calcium Carbide

- Ningxia Wanding Chemical Co.,ltd

- Lonza

- MCB Industries Sdn. Bhd.

- Mil-Spec Industries Corporation

- PT Emdeki Utama Tbk

- Xiahuayuan Xuguang Chemical

- Xinjiang Tianshan Chemical