Global Calcined Anthracite Market By Technology(Electrically Calcined Anthracite, Gas Calcined Anthracite), By Fixed Carbon(Below 90%, 90% to 95%), By End-use(Basic Oxygen Steelmaking, Pulverized Coal Injection (PCI), Electric Arc Furnaces), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 19073

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

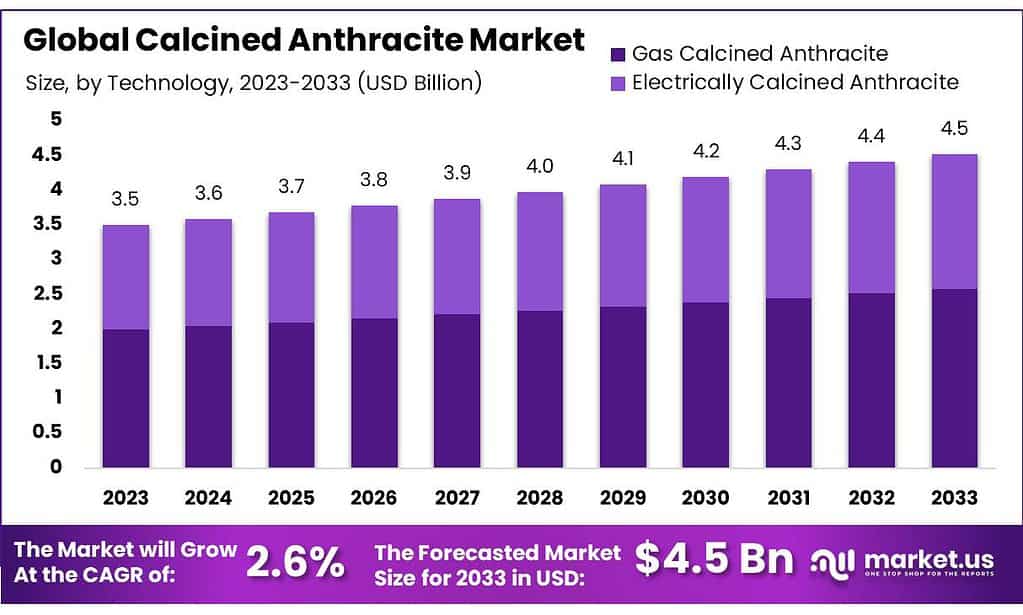

The Calcined Anthracite Market size is expected to be worth around USD 4.5 billion by 2033, from USD 3.5 Bn in 2023, growing at a CAGR of 2.6% during the forecast period from 2023 to 2033.

This market will be driven by the rising demand for carbon-rich charges materials in steel production. It is expected that it will have a competitive advantage over the next few decades due to its low environmental impact and low cost of production compared to calcined poke.

The calcined anthracite market refers to the industry involved in the production, distribution, and utilization of a processed form of anthracite coal known as calcined anthracite. Anthracite is a type of coal known for its high carbon content, low volatile matter, and excellent energy characteristics.

Calcined anthracite is produced by heating anthracite to high temperatures in the absence of air, resulting in the removal of volatile compounds and moisture, thus enhancing its carbon content and altering its physical properties.

Calcined anthracite finds various applications, primarily in the manufacturing sector, where it serves as a key additive in the production of carbon electrodes, cathodes, and other carbon-based products used in steelmaking, aluminum smelting, and other metallurgical processes. Its high carbon content and low impurities make it a preferred choice in industries requiring high-quality carbon materials for efficient and controlled reactions during manufacturing processes.

The market involves the production and supply of calcined anthracite to industries that depend on high-grade carbon materials for their manufacturing operations, catering to the demand for materials that offer superior heat resistance, electrical conductivity, and purity in various industrial applications.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Calcined Anthracite Market is expected to reach approximately USD 4.5 billion by 2033 from USD 3.5 billion in 2023, showcasing a steady growth rate at a CAGR of 2.6%.

- Drivers of Market Growth: Key industries such as Aluminum & Iron and Steel drive the demand for calcined anthracite due to its integral role in producing high-quality metals.

- End-Use Applications: Notably, the Aluminum & Iron and Steel Industry holds a substantial market share, exceeding 42.1% in 2023.

- Technology Analysis: Electrically Calcined Anthracite Ceramics dominated the market in 2023, accounting for over 74.6% of the market share. Its use in various industries, facilitated by its consistent quality, contributes to this dominance.

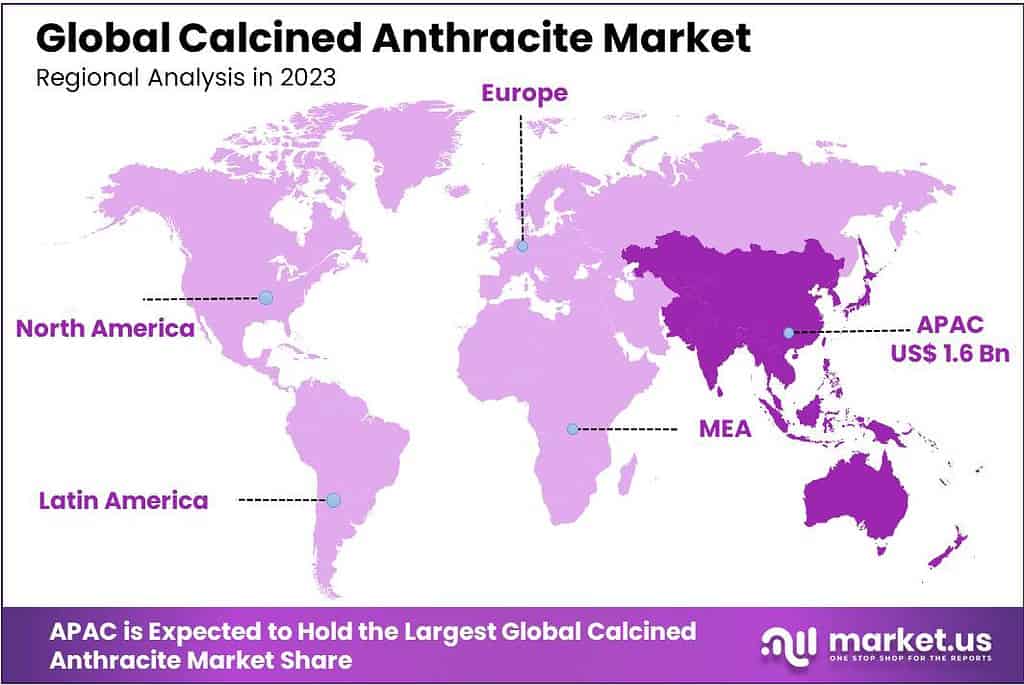

- Regional Market Dynamics: Asia Pacific (APAC) emerged as the leader in revenue share with over 46.3% in 2023, primarily driven by countries like China, Japan, and India, dominating global steel production.

- Challenges Faced: The market encounters hurdles due to its heavy dependence on sectors like Aluminum & Iron and Steel, posing risks with any fluctuations in these industries.

- Opportunities for Expansion: Exploring untapped industries like renewable energy, electronics, and pharmaceuticals offers avenues for broadening the market’s reach.

Technology Analysis

In 2023, Electrically Calcined Anthracite Ceramics ruled the Calcined Anthracite Market, taking up over 74.6% of the whole thing. This method uses electricity to heat up anthracite, making it a special material used in various industries. It was the most popular way to make calcined anthracite that year.

Electrically Calcined Anthracite Ceramics (ECA) is a process in which anthracite coal is heated with electricity at very high temperatures to produce anthracite ceramics for various industrial purposes, including steel production and manufacturing electrodes for electrical applications. ECA offers consistent quality over its lifespan for such uses as these.

Rheinfelden Carbon offers GCA in two grades: premium and standard. Premium-grade products have a higher carbon content than standard grades, making them ideal for use in steel manufacturing. Calcined coke can be heated to temperatures up to 2000°C. This heat transforms traditional anthracite into modified graphite with high carbon contents.

ECA products are low in moisture, sulfur, or ash. This makes them suitable for high-purity processes that use them. Due to its consistent quality and cost savings, carbon sources are expected to grow in the future. Elkem, which caters to the steel industry, was the world’s largest producer of ECA in 2023.

By Fixed Carbon

Below 90% Fixed Carbon: This segment comprises calcined anthracite with a fixed carbon content below 90%. It caters to specific industrial applications where slightly lower carbon content is acceptable or where other properties of the material are more critical than carbon content. Industries might utilize this grade in processes where a high carbon content isn’t the primary focus.

90% to 95% Fixed Carbon: This category encompasses calcined anthracite with a fixed carbon content ranging between 90% and 95%. This segment represents materials with higher carbon purity and finds extensive use in industries where a high carbon content is crucial. It is preferred in applications demanding superior carbon-based materials, such as steelmaking, aluminum smelting, and other metallurgical processes where precise control of carbon content is essential for optimal performance.

End-Use Analysis

In 2023, the Aluminum & Iron and Steel Industry emerged as a key player in the Calcined Anthracite Market, securing a substantial market share exceeding 42.1%. This industry heavily relies on calcined anthracite for metal production processes.Metal purification systems play a pivotal role in metal smelting processes by filtering out impurities that prevent production of high-quality metal products.

Due to its integral usage in metal manufacturing, this sector commanded a significant portion of the market. The Carbon Products segment made notable strides in the market by utilizing calcined anthracite in the production of various carbon-based products.

These products serve diverse industries, including their application in electrodes for electrical purposes and as filtration mediums in water treatment processes. Their versatility across different sectors contributes to their prominence and influence within the market.

The use of products in steel manufacturing lowers the need for high-cost metallurgical coke and reduces overall production costs. In 2023, the segment of electric arc furnaces was worth US$ 700 million. To remove metal oxides, calcined anthracite can be added to electric arc furnaces.

The blast furnace plays an important role in removing impurities from the steel when the product is fed into it during the basic oxygen process. Removing flux, iron, and steel from the oven, this procedure creates liquid steel. Market growth will be influenced by the increasing use of high-quality coke. This produces better quality steel.

*Actual Numbers Might Vary In The Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Technology

- Electrically Calcined Anthracite

- Gas Calcined Anthracite

By Fixed Carbon

- Below 90%

- 90% to 95%

By End-use

- Basic Oxygen Steelmaking

- Pulverized Coal Injection (PCI)

- Electric Arc Furnaces

Drivers

The Calcined Anthracite Market thrives on several driving forces that sustain its growth and significance across industries. First and foremost, demand from key sectors such as Aluminum & Iron and Steel Industries remains vitally important. Calcined anthracite plays an integral part in these industries by aiding in producing high-grade metals; its ability to remove impurities during metal smelting processes contributes significantly to this sector’s steadfast demand and further drive market expansion.

The market benefits from the versatility of calcined anthracite in creating various carbon-based products. These products find utility across a spectrum of industries, from serving as electrodes in electrical applications to acting as effective filtration media in water treatment processes. This diverse application range drives the market’s expansion and relevance across multiple sectors.

The increasing emphasis on clean water resources escalates the demand for calcined anthracite in water treatment systems. Its efficiency in filtering and purifying water adds to its significance, establishing a stable foothold within the market. While industries like Aluminum & Iron and Steel and Carbon Products hold substantial shares, the market’s diversity expands further due to contributions from other sectors.

These industries, despite holding smaller shares individually, bring forth new applications and innovations, contributing to the market’s dynamism and growth potential. These driving factors sustain the Calcined Anthracite Market, ensuring its continuous evolution and adaptability to the evolving needs of various industries.

Restraints

Calcined Anthracite Market faces several impediments that threaten its progress, most significantly its heavy reliance on industries like Aluminum & Iron & Steel which pose significant risks. Any downturn or fluctuations in these key industries directly impact the demand for calcined anthracite, potentially limiting the market’s expansion prospects and stability.

The market faces challenges stemming from the cost sensitivity prevalent in certain industries. The high production costs associated with calcined anthracite production might discourage its widespread use, particularly in industries vigilant about controlling expenses.

Another restraint lies in the competitive landscape. The market contends with alternatives that offer similar functionalities. These alternatives might serve as substitutes, creating hurdles for calcined anthracite’s market penetration and growth. The complexity involved in customizing calcined anthracite to specific industrial requirements poses a challenge. This intricate customization process might hinder quick adaptability to diverse industry needs, potentially slowing down the market’s growth pace.

Environmental regulations further add to the market’s challenges. Certain variations of calcined anthracite might contain elements raising environmental concerns during production or disposal. Stricter environmental regulations or the need for more sustainable production practices could impact market dynamics and growth potential.

The market faces a barrier due to limited awareness about the benefits and applications of calcined anthracite across various industries. Bridging this awareness gap becomes critical to overcoming adoption barriers and expanding the market’s reach and acceptance among potential users. Addressing these restraints is crucial for the Calcined Anthracite Market to navigate challenges effectively and pave the way for sustained growth and adaptability.

Opportunities

The Calcined Anthracite Market is poised for growth with several promising opportunities on the horizon. One avenue lies in diversifying applications beyond traditional sectors like Aluminum & Iron and Steel. Exploring untapped industries such as renewable energy, electronics, and pharmaceuticals presents a chance to broaden the market’s reach and discover new applications for calcined anthracite.

Technological advancements offer another promising opportunity. Investing in research and development to enhance production processes and discover innovative applications can propel the market forward. This approach not only improves existing uses but also unlocks new possibilities, fostering continuous growth and adaptation.

The growing emphasis on sustainability opens doors for the market to align with environmental goals. Developing eco-friendly production methods or formulations for calcined anthracite can appeal to industries and consumers prioritizing green initiatives, creating a niche for environmentally conscious applications.

Exploring emerging markets and regions with burgeoning industrial sectors provides a strategic opportunity for market expansion. By targeting areas with increasing demand for metals, carbon products, and water treatment solutions, calcined anthracite can find new applications and tap into growing industries.

Collaborative partnerships are key to unlocking market potential. Working closely with industries to showcase the unique properties and benefits of calcined anthracite can drive adoption. Educational initiatives and promotional efforts highlighting its diverse applications across sectors contribute to building awareness and unlocking new opportunities.

Customization and innovation play a crucial role. Tailoring calcined anthracite properties to meet specific industry needs and fostering innovation in product development lead to novel applications, creating niche markets and driving sustained growth. By capitalizing on these opportunities, the Calcined Anthracite Market can evolve and establish itself as a versatile and indispensable material across diverse industries.

Challenges

The Calcined Anthracite Market confronts several challenges that pose obstacles to its seamless growth and development. Firstly, the market’s heavy dependence on industries like Aluminum & Iron and Steel exposes it to fluctuations in these sectors.

Any slowdown or changes in these key industries directly impact the demand for calcined anthracite, leading to market instability. The high production costs associated with calcined anthracite production present a significant challenge. Industries sensitive to expenses might hesitate to widely adopt this material, limiting its extensive use across various sectors and industries.

The market also contends with competitive alternatives that offer similar functionalities to calcined anthracite. These alternatives pose challenges for the material’s market penetration and growth, compelling the market to differentiate and highlight its unique benefits and applications. Tailoring calcined anthracite to specific industrial needs can be complex and time-consuming. This customization challenge hinders its swift adaptability to diverse industry requirements, potentially impeding the market’s expansion pace.

Environmental regulations add another layer of challenge. Certain variations of calcined anthracite might contain elements raising environmental concerns during production or disposal. Adhering to strict environmental regulations or the need for more sustainable production practices can impact market dynamics and growth potential.

The market faces hurdles due to limited awareness of calcined anthracite’s benefits and applications across various industries. Bridging this awareness gap becomes critical to boosting market acceptance and expanding its reach among potential users. Overcoming these challenges demands strategic initiatives, innovative solutions, and education efforts to ensure the Calcined Anthracite Market’s resilience and sustained growth in a dynamic industrial landscape.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 46.3% in 2023. China, Japan, India, and China dominated global steel production in 2023, and they are expected to continue their dominance over the forecast period, which will benefit the region’s market. In 2023, the European market was worth US$ 429.1 million. This region is expected to have lower CAGRs than those in the Asia Pacific due to the decline in steel production in Europe and the wider gap between demand and supply in the region.

Russia is a major producer of anthracite around the globe and a major exporter to major end users like China, the U.S., and Germany. Russian raw material prices are lower than those of major manufacturing areas like Australia. This makes Russia one of the most important raw material suppliers on the market.

The market in Japan was worth US$ 229.8 million in 2023. Anthracite is mainly imported from Australia and Russia. In 2023, it imported more than 7 million tonnes of anthracite. Anthracite imports to Japan are forecast to rise due to the rising demand for several end-use applications.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the last few years, declining coal production has been due to a reduction in mining activities as a result of growing environmental awareness by governments in various countries. The decline in anthracite reserves is expected to lead to increased competition for raw material procurement and increase the bargaining power of suppliers.

The low availability of raw materials has led to a persistent gap in demand and supply. Due to the insufficient production volumes of large players, small-scale businesses have managed to survive in this industry. To ensure consistent raw material supply, many industry players seek partnerships with anthracite mining firms.

Маrkеt Кеу Рlауеrѕ

- Fujifilm Global Graphic Systems Co., Ltd.

- SK Innovation Global Technology

- Island Polymer Industries GmbH

- Catalina Graphic Films, Incorporated

- Hyosung Corporation

- TacBright Optronics Corp

- Zeon Corp.

- Konica Minolta, Inc.

- Cayman Chemical

- China Lucky Film Group Corporation

- Lucky Group Corporation

- Other Key Players

Recent Developments

In 2023, Asbury Carbons Inc. declared that it would raise the prices of its non-carbon materials, cokes, and natural and synthetic graphite products. Price hikes will take effect for shipments starting on 1 January 2024, and they might reach up to 10%, based on the product and grade. These price hikes are required in part to cover the rising costs of energy, raw materials, transportation, and production.

Report Scope

Report Features Description Market Value (2022) US$ 3.5 Bn Forecast Revenue (2032) US$ 4.5 Bn CAGR (2023-2032) 2.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology, Electrically Calcined Anthracite, Gas Calcined Anthracite, By Fixed Carbon, Below 90%, 90% to 95%, By End-use, Basic Oxygen Steelmaking, Pulverized Coal Injection (PCI), Electric Arc Furnaces Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Fujifilm Global Graphic Systems Co., Ltd., SK Innovation Global Technology, Island Polymer Industries GmbH, Catalina Graphic Films, Incorporated, Hyosung Corporation, TacBright Optronics Corp, Zeon Corp., Konica Minolta, Inc., Cayman Chemical, China Lucky Film Group Corporation, Lucky Group Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Calcined Anthracite Market?Calcined Anthracite Market size is expected to be worth around USD 4.5 billion by 2033, from USD 3.5 Bn in 2023, growing at a CAGR of 2.6%

What is the CAGR for the Calcined Anthracite Market?The Calcined Anthracite Market expected to grow at a CAGR of 2.6% during 2023-2032.Who are the key players in the Calcined Anthracite Market?Fujifilm Global Graphic Systems Co., Ltd., SK Innovation Global Technology, Island Polymer Industries GmbH, Catalina Graphic Films, Incorporated, Hyosung Corporation, TacBright Optronics Corp, Zeon Corp., Konica Minolta, Inc., Cayman Chemical, China Lucky Film Group Corporation, Lucky Group Corporation, Other Key Players

-

-

- Fujifilm Global Graphic Systems Co., Ltd.

- SK Innovation Global Technology

- Island Polymer Industries GmbH

- Catalina Graphic Films, Incorporated

- Hyosung Corporation

- TacBright Optronics Corp

- Zeon Corp.

- Konica Minolta, Inc.

- Cayman Chemical

- China Lucky Film Group Corporation

- Lucky Group Corporation

- Other Key Players