Global Cable Car And Ropeway Market Size, Share, Growth Analysis By Propulsion (Electric, Diesel, Hybrid), By Product Type (Aerial Tramways, Funicular Ropeways, Surface Lifts, Material Ropeways), By End-use (Tourism, Public Transport, Material Handling), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174143

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

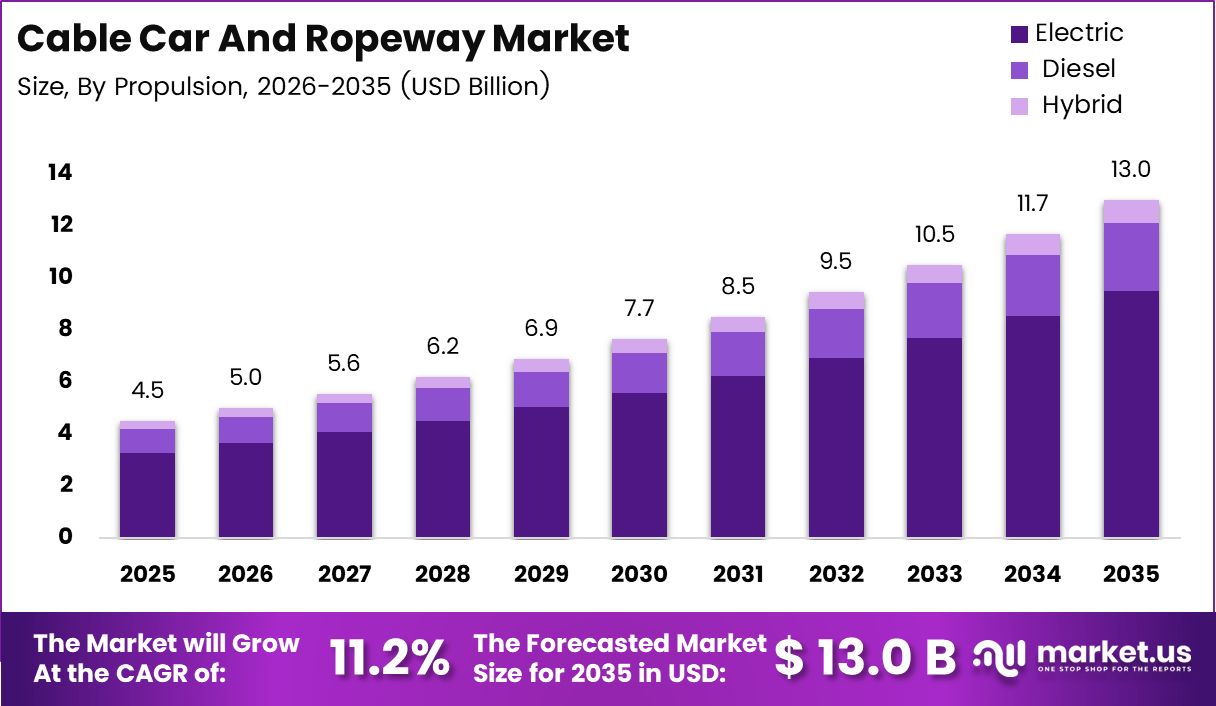

The Global Cable Car And Ropeway Market size is expected to be worth around USD 13.0 billion by 2035, from USD 4.5 billion in 2025, growing at a CAGR of 11.2% during the forecast period from 2026 to 2035.

The Cable Car and Ropeway represents an engineered aerial transportation system designed to move passengers or materials across challenging terrain efficiently. It operates using suspended cabins or carriers supported by towers and driven through mechanical or electric systems. Consequently, it enables safe mobility where conventional road or rail infrastructure remains impractical.

The Cable Car and Ropeway Market reflects growing demand for alternative transport and logistics solutions in urban, mountainous, and industrial environments. Governments and private developers increasingly adopt ropeways to address congestion, terrain constraints, and sustainability targets, thereby positioning the market as a strategic infrastructure segment.

Market growth remains supported by expanding urban mobility programs and tourism infrastructure investments. Ropeways enable connectivity across rivers, valleys, and dense cities while minimizing land acquisition. As a result, planners increasingly integrate cable-based transit into multimodal networks, supporting long-term infrastructure efficiency and reduced environmental impact.

Opportunities continue to expand across public transport, tourism, and material handling applications. Ropeway systems support point-to-point movement over distances up to 10 kilometers, with operational gaps reaching 2000 meters and grades extending up to 60 degrees.

Government investment plays a critical role in accelerating deployment, particularly in hilly regions and remote industrial zones. Public authorities increasingly approve ropeway projects due to lower construction footprints and faster implementation timelines. Regulatory frameworks emphasize structural integrity, passenger safety, wind tolerance, and operational reliability across diverse climatic conditions.

From a performance perspective, ropeways handle loads ranging from 75 kilograms to 5 tons using diesel, electric, manual, or unconventional drives, according to manufacturer technical specifications. System throughput typically ranges between 2 and 300 tons per hour, supporting both commuter movement and industrial logistics.

Operational resilience further strengthens market adoption. Ropeway systems function across varied temperature and weather conditions, remaining operational except during wind velocities exceeding 150 kilometers per hour, as outlined by international transport safety authorities.

Passenger and material capabilities highlight system versatility. Cabins typically carry 6 to 8 passengers, while larger installations transport over 100 people simultaneously. According to survey, advanced aerial tramways can move up to 200 passengers in a single cabin configuration.

Advanced installations illustrate scale and design evolution. Individual cabin weight limits range from 300 kilograms to over 7500 kilograms, while material ropeways lift up to 10000 kilograms, as cited in industrial ropeway design manuals. High-altitude systems reach 4200 meters, while urban cable cars operate at heights near 93 meters, demonstrating adaptability across terrains.

Key Takeaways

- The global Cable Car and Ropeway market is projected to grow from USD 4.5 billion in 2025 to USD 13.0 billion by 2035, registering a CAGR of 11.2%.

- By propulsion, the Electric segment dominates with a market share of 73.2% in 2025.

- By product type, Aerial Tramways hold the leading position with a share of 39.1% in 2025.

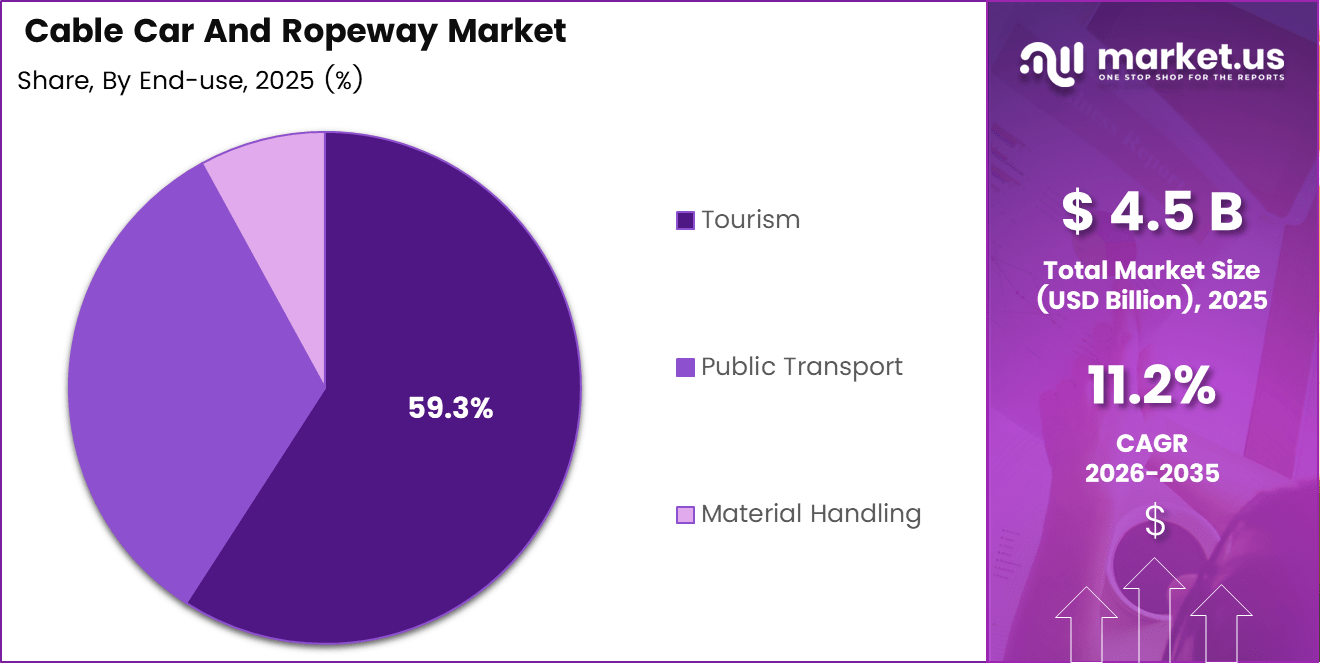

- By end-use, the Tourism segment leads the market, accounting for 59.3% share in 2025.

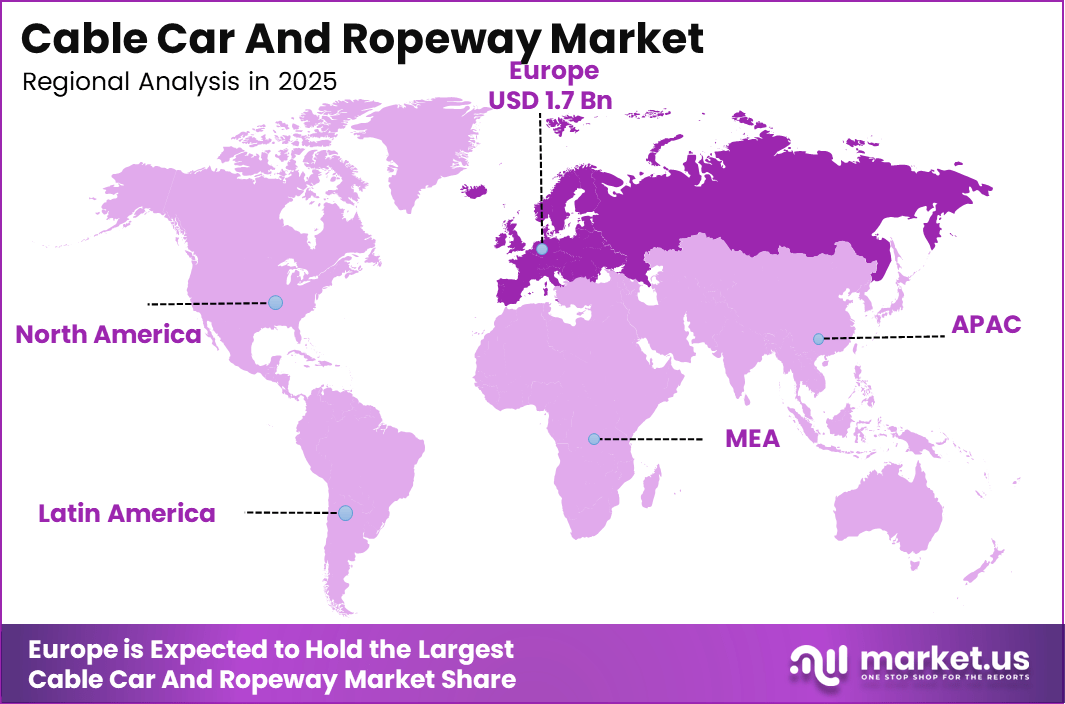

- Regionally, Europe dominates the global market with a 39.5% share, valued at approximately USD 1.7 billion.

By Propulsion Analysis

Electric dominates with 73.2% due to rising electrification, energy efficiency mandates, and low-emission transport adoption.

In 2025, Electric sub-segment held a dominant market position in the By Propulsion Analysis segment of Cable Car And Ropeway Market, with a 73.2% share. Electric systems benefit from lower operating costs, reduced emissions, and compatibility with renewable energy sources, thereby aligning with government sustainability goals and long-term infrastructure planning priorities.

Diesel propulsion continues to maintain relevance in remote and off-grid locations. It supports ropeway operations where grid connectivity remains limited or unreliable. Consequently, diesel systems provide flexibility for temporary installations, rugged terrains, and regions prioritizing reliability over emissions performance during early infrastructure development phases.

Hybrid propulsion systems gradually gain attention as operators seek balanced performance. These systems combine electric efficiency with diesel backup, thereby improving resilience and operational continuity. As a result, hybrid ropeways appeal to regions with fluctuating power availability while supporting partial decarbonization objectives.

By Product Type Analysis

Aerial Tramways dominates with 39.1% due to high passenger capacity and suitability for complex terrains.

In 2025, Aerial Tramways sub-segment held a dominant market position in the By Product Type Analysis segment of Cable Car And Ropeway Market, with a 39.1% share. These systems enable long-span crossings, high-capacity cabins, and urban skyline integration, thereby supporting tourism growth and city-level mobility solutions.

Funicular Ropeways remain essential for steep-gradient transport across short distances. They operate efficiently on inclined tracks and support controlled movement in densely populated or heritage-sensitive areas. Consequently, funicular systems retain strong relevance in hillside cities and tourist destinations.

Surface Lifts primarily support ski resorts and recreational facilities. Their simple mechanical design and cost efficiency enable rapid installation and seasonal usage. As a result, surface lifts continue to serve niche applications within winter sports and controlled recreational environments.

Material Ropeways address industrial logistics challenges by enabling bulk material transport over inaccessible terrain. They support mining, cement, and hydropower projects by reducing road dependency, thereby improving safety and operational efficiency in high-altitude or forested regions.

By End-use Analysis

Tourism dominates with 59.3% driven by rising mountain tourism and experiential travel demand.

In 2025, Tourism sub-segment held a dominant market position in the By End-use Analysis segment of Cable Car And Ropeway Market, with a 59.3% share. Scenic travel demand, resort expansion, and year-round tourism strategies continue to accelerate ropeway deployment across mountain and coastal destinations.

Public Transport applications increasingly integrate ropeways into urban mobility networks. These systems help reduce congestion, connect underserved areas, and support last-mile connectivity. Consequently, municipalities view ropeways as cost-effective alternatives to bridges and elevated road infrastructure.

Material Handling applications leverage ropeways for continuous cargo movement across difficult terrain. These systems improve supply chain efficiency while minimizing environmental disruption. As a result, industries adopt ropeways to transport raw materials safely and consistently over long distances.

Key Market Segments

By Propulsion

- Electric

- Diesel

- Hybrid

By Product Type

- Aerial Tramways

- Funicular Ropeways

- Surface Lifts

- Material Ropeways

By End-use

- Tourism

- Public Transport

- Material Handling

Drivers

Government Backed Investments in Sustainable and Low Emission Transport Infrastructure Drive Market Growth

Urban congestion continues to pressure city transport systems, pushing planners to explore aerial cable mobility as a practical solution. Cable car and ropeway systems operate above existing roads, reducing surface traffic load while offering predictable travel times. As cities grow denser, these systems support smoother passenger movement without requiring large land acquisition.

Government backed investments play a central role in market growth. Many national and municipal authorities promote ropeways as low emission transport options aligned with climate targets. Electric ropeway systems consume less energy per passenger kilometer and integrate well with sustainable mobility plans, strengthening public funding support.

The expansion of year round mountain tourism also drives demand. Mountain and Ski resorts, adventure parks, and scenic destinations increasingly rely on gondolas and chairlifts to ensure continuous visitor access beyond seasonal peaks. This improves asset utilization and stabilizes revenue streams for operators.

In hilly and remote regions, ropeways support last mile connectivity where roads are costly or environmentally disruptive. Governments use these systems to improve access to education, healthcare, and markets. As a result, ropeways increasingly serve both tourism and essential mobility needs, reinforcing steady market expansion.

Restraints

High Upfront Capital Expenditure Limits Market Adoption

Complex regulatory approvals remain a key restraint in the cable car and ropeway market. Passenger transport systems must meet strict safety standards related to design, construction, and operations. Multiple inspections and certifications often extend project timelines and increase development risk.

Safety compliance requirements vary across regions, adding further complexity for international suppliers. Operators must align with local building codes, evacuation protocols, and operational audits. These procedures increase administrative costs and slow down project execution, especially in urban environments.

High upfront capital expenditure represents another major challenge. Ropeway systems require specialized towers, cables, drive stations, and control systems. Civil works in mountainous or urban areas further raise project costs due to terrain constraints and logistics.

Long project payback cycles also discourage private investors. Revenue generation depends on passenger volumes, tourism flows, or government subsidies, which can fluctuate. As a result, financing institutions often apply conservative risk assessments. These combined factors restrain faster market penetration despite clear long term benefits.

Growth Factors

Smart City Programs Create New Growth Opportunities

Smart city programs present strong growth opportunities for the cable car and ropeway market. Urban planners increasingly view ropeways as complementary systems that integrate with metro lines, buses, and rail networks. This multimodal approach improves network coverage and passenger convenience.

Material ropeways are gaining demand across mining, cement, and hydropower projects. These systems efficiently transport bulk materials over difficult terrain while reducing fuel consumption and road congestion. Industries adopt ropeways to lower operating costs and improve environmental performance.

Mature markets offer opportunities through replacement and modernization of aging infrastructure. Many existing ropeways require upgrades to improve safety, capacity, and energy efficiency. Modern cabins, control systems, and drives extend asset life and enhance passenger experience.

Public private partnership models further expand market potential. Governments increasingly collaborate with private players to share investment risks and operational expertise. These partnerships improve project viability, accelerate execution, and attract long term institutional funding into ropeway development.

Emerging Trends

Shift Toward Fully Electric and Digital Ropeway Systems Shapes Market Trends

A key trend in the cable car and ropeway market is the shift toward fully electric and energy regenerative propulsion systems. These technologies recover braking energy and reduce overall power consumption, supporting sustainability goals and lowering operating costs.

Digital monitoring and predictive maintenance are becoming standard features. Operators deploy sensors, IoT platforms, and real time analytics to monitor cable tension, drive performance, and cabin movement. This improves safety, reduces downtime, and optimizes maintenance schedules.

Detachable gondola systems and high capacity cabins are gaining popularity. These designs allow higher throughput without increasing line speed, improving passenger comfort and operational efficiency. Resorts and urban systems favor these solutions to manage peak demand effectively.

Ropeways are also increasingly deployed for urban tourism and scenic transit corridors. Cities leverage gondolas as both transport and attraction assets, offering panoramic views while easing congestion. This dual purpose positioning strengthens public acceptance and long term market relevance.

Regional Analysis

Europe Dominates the Cable Car And Ropeway Market with a Market Share of 39.5%, Valued at USD 1.7 Billion

Europe holds the leading position in the Cable Car And Ropeway Market, accounting for 39.5% of global demand and generating approximately USD 1.7 billion in market value. The region benefits from a well established alpine tourism ecosystem, extensive year round mountain mobility needs, and strong public investment in sustainable transport solutions. Countries across Western and Central Europe continue to deploy ropeway systems for both tourism and urban mobility, supporting consistent infrastructure upgrades and system expansions. In addition, strict environmental regulations favor low emission aerial transport, reinforcing Europe’s dominant market position.

North America Cable Car And Ropeway Market Trends

North America represents a mature yet steadily expanding market, driven by ski resort modernization and growing interest in urban aerial transit solutions. Mountain tourism hubs continue to invest in high capacity gondolas to improve visitor flow and safety. Urban applications are gradually gaining attention as cities explore alternative mobility options to address congestion and geographical constraints.

Asia Pacific Cable Car And Ropeway Market Trends

Asia Pacific is emerging as a high growth region due to rapid urbanization and expanding infrastructure development in mountainous and densely populated areas. Governments increasingly adopt ropeway systems to improve last mile connectivity and reduce road construction challenges. Tourism development in hilly regions further supports new installations across the region.

Middle East and Africa Cable Car And Ropeway Market Trends

The Middle East and Africa market is driven by tourism focused developments and selective urban mobility projects. Ropeway systems are used to enhance access to heritage sites, resorts, and elevated terrains. Public sector initiatives aimed at diversifying tourism offerings and improving transport efficiency support gradual market expansion.

Latin America Cable Car And Ropeway Market Trends

Latin America shows growing adoption of cable car systems, particularly for urban mobility in densely populated and hilly cities. Governments increasingly use ropeways to improve social connectivity and access to essential services. These systems provide cost effective transport solutions while supporting inclusive urban development across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cable Car And Ropeway Company Insights

In 2025, the global Cable Car And Ropeway Market reflects diverse strategies and strong positioning among established equipment manufacturers and service providers.

Bartholet Maschinenbau AG continues to leverage its engineering expertise to deliver customized aerial ropeway solutions, emphasizing reliability and performance for both tourism and urban transit applications, which strengthens its presence in specialized project requirements. The company’s focus on tailored system design supports complex terrain and infrastructure needs.

Faber Leisure maintains a stable market position by prioritizing innovation in cable car aesthetics and passenger experience. Its approach aligns with rising demand for visually appealing and comfortable ropeway systems in tourism driven destinations, helping operators enhance destination value while meeting safety and operational standards.

Conveyor & Ropeway Services Pvt. Ltd. plays a critical role through its strong capabilities in installation, refurbishment, and long term maintenance services. The company supports expanding ropeway networks in developing and mountainous regions, positioning itself as a lifecycle partner rather than only an equipment provider.

Doppelmayr Seilbahnen GmbH remains a dominant force in the market due to its broad product portfolio and consistent investment in technology advancement. Its systems address high capacity transport, energy efficiency, and operational reliability across urban mobility, alpine tourism, and industrial applications.

Top Key Players in the Market

- Bartholet Maschinenbau AG

- Faber Leisure

- Conveyor & Ropeway Services Pvt. Ltd.

- Doppelmayr Seilbahnen GmbH

- Leitner – Poma of America, Inc.

- LEITNER Ropeways

- MND Group

- Nippon Cable Co., Ltd.

- POMA

- Ropeway & Cablecar Systems Pvt. Ltd.

Recent Developments

- December 2025, TÜV SÜD America announced the appointment of Curt Panter as Chief Ropeway Engineer within its Amusement Rides, Water Parks, and Ropeways Division, where he is responsible for overseeing the technical delivery of TÜV SÜD’s internationally accredited ropeway services portfolio across the Americas and reporting directly to senior divisional leadership.

- April 2024, North America recorded an all-time high number of skiers, highlighting strong growth in mountain tourism across the US and Canada and driving increased investments by ski areas in new cable cars and expanded ropeway infrastructure to enhance visitor capacity and experience.

Report Scope

Report Features Description Market Value (2025) USD 4.5 billion Forecast Revenue (2035) USD 13.0 billion CAGR (2026-2035) 11.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion (Electric, Diesel, Hybrid), By Product Type (Aerial Tramways, Funicular Ropeways, Surface Lifts, Material Ropeways), By End-use (Tourism, Public Transport, Material Handling) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bartholet Maschinenbau AG, Faber Leisure, Conveyor & Ropeway Services Pvt. Ltd., Doppelmayr Seilbahnen GmbH, Leitner – Poma of America, Inc., LEITNER Ropeways, MND Group, Nippon Cable Co., Ltd., POMA, Ropeway & Cablecar Systems Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cable Car And Ropeway MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cable Car And Ropeway MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bartholet Maschinenbau AG

- Faber Leisure

- Conveyor & Ropeway Services Pvt. Ltd.

- Doppelmayr Seilbahnen GmbH

- Leitner - Poma of America, Inc.

- LEITNER Ropeways

- MND Group

- Nippon Cable Co., Ltd.

- POMA

- Ropeway & Cablecar Systems Pvt. Ltd.