Global Butyraldehyde Market By Product Type(N-butanol, 2-ethylhexanol, Polyvinyl Butyral, Others), By Application(Chemical Intermediate, Rubber Accelerator, Synthetic Resins, Plasticizers, Others), By End-Use Industry(Medical, Agriculture, Cosmetic and Personal Care, Food and Beverages, Apparel and Textile, Chemical, Pulp and Paper, Automotive, Construction, Others), By Sales Channel(Direct Sale, Indirect Sale) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Sep 2024

- Report ID: 129641

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

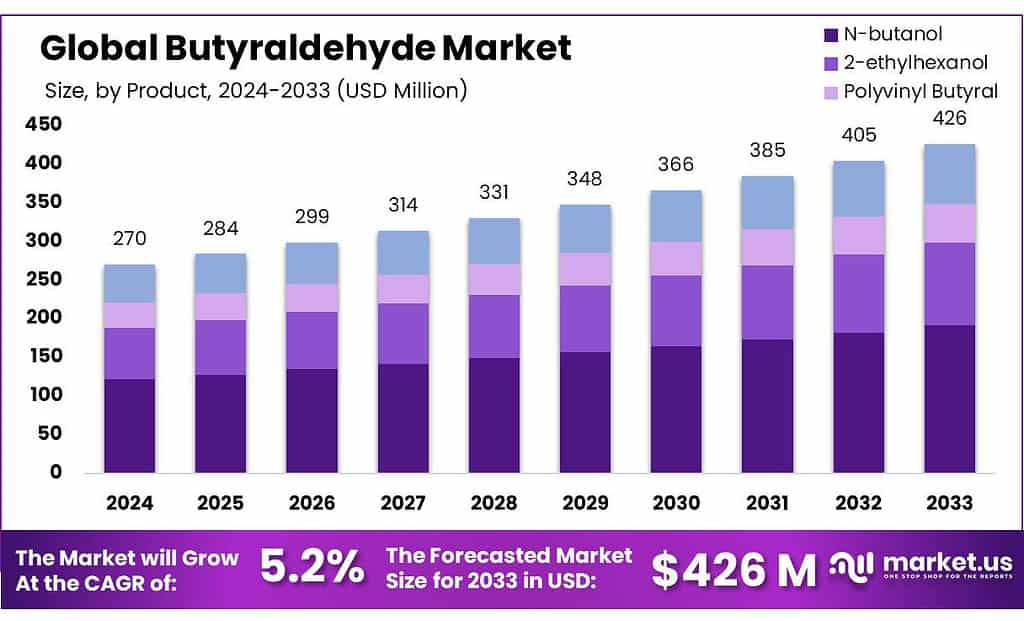

The global Butyraldehyde Market size is expected to be worth around USD 426 Million by 2033, from USD 270 Million in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The butyraldehyde market encompasses the production, distribution, and consumption of butyraldehyde, a versatile chemical primarily used as an intermediate in manufacturing products such as plastics, resins, and synthetic rubber. The growth is driven by rising demand from key industries like automotive, construction, and consumer goods, where butyraldehyde is essential for producing adhesives, coatings, and solvents.

Government regulations significantly influence the butyraldehyde market. For instance, in Europe, REACH regulations compel manufacturers to enhance the safety and environmental sustainability of chemicals, including butyraldehyde. This push for safer practices is leading to the development of greener alternatives.

Additionally, the Asia Pacific region plays a crucial role, accounting for over 45% of global butyraldehyde production and consumption. Countries such as China and India have seen increased imports, with China importing around 120,000 metric tons in 2022, reflecting its growing industrial sector.

Furthermore, government initiatives in regions like the U.S. are promoting the use of bio-based chemicals. Programs such as BioPreferred encourage the adoption of renewable materials, including butyraldehyde derived from biomass, which aligns with sustainability goals. Innovation remains a key factor in this market, with companies developing more efficient production processes to reduce waste and energy usage.

Strategic mergers and acquisitions are also prevalent; for example, in 2023, a major chemical manufacturer acquired a butyraldehyde production facility in Europe to strengthen its market position. Overall, the butyraldehyde market is characterized by strong growth potential, evolving regulations, and a shift towards sustainability.

Key Takeaways

- Butyraldehyde Market size is expected to be worth around USD 426 Million by 2033, from USD 270 Million in 2023, growing at a CAGR of 5.2%.

- N-butanol held a dominant market position, capturing more than a 45.6% share.

- Chemical Intermediate held a dominant market position.

- Construction held a dominant market position, capturing more than a 13% share.

- Direct Sales held a dominant market position, capturing more than a 76.5% share of the butyraldehyde market.

By Product Type

In 2023, N-butanol held a dominant market position, capturing more than a 45.6% share of the butyraldehyde market. This product is widely used in the production of solvents, plastics, and paints, making it essential for various industries, including automotive and construction. Its versatility and effectiveness as a solvent contribute significantly to its strong demand.

Following N-butanol, 2-ethylhexanol accounted. This product is primarily used in the production of plasticizers and synthetic lubricants. Its ability to enhance flexibility and durability in plastics makes it a preferred choice in the manufacturing sector.

Polyvinyl butyral (PVB) also plays a significant role in the market. PVB is widely utilized in the production of safety glass and coatings, especially in the automotive industry. Its excellent adhesive properties and transparency make it highly valuable for applications requiring durability and safety.

By Application

In 2023, Chemical Intermediate held a dominant market position. This application is crucial as butyraldehyde serves as a key building block for various chemicals used in numerous industries, including plastics, paints, and adhesives. Its versatility in chemical synthesis underpins much of its demand.

Rubber Accelerator accounted. Butyraldehyde is essential in producing rubber accelerators that enhance the performance and durability of rubber products. This application is particularly important in the automotive and manufacturing sectors, where high-quality rubber components are required.

Synthetic Resins captured. Butyraldehyde is widely used in the production of synthetic resins, which are vital in coatings, adhesives, and various construction materials. The increasing demand for durable and high-performance materials in the construction industry drives this segment’s growth.

By End-Use Industry

In 2023, Construction held a dominant market position, capturing more than a 13% share of the butyraldehyde market. This sector utilizes butyraldehyde primarily for producing high-performance adhesives and coatings, essential for various building materials. The ongoing growth in construction activities globally is driving this demand.

In the Chemical industry butyraldehyde serves as a key intermediate in the manufacture of resins, solvents, and other chemicals, making it crucial for many industrial applications. This segment benefits from consistent industrial growth and innovation.

The Automotive industry followed closely. Butyraldehyde is vital for producing rubber components and coatings, enhancing vehicle performance and safety. As automotive manufacturing expands, particularly with the rise of electric vehicles, demand in this segment is expected to increase.

Food and Beverages made up about 8% of the market. Butyraldehyde is utilized in food packaging and preservation, reflecting the growing focus on food safety and quality. The demand for sustainable packaging solutions is further supporting this segment’s growth.

By Sales Channel

In 2023, Direct Sales held a dominant market position, capturing more than a 76.5% share of the butyraldehyde market. This channel is preferred by manufacturers due to the efficiency it offers in terms of logistics and cost management. Direct sales allow producers to engage closely with their customers, ensuring timely delivery and tailored solutions.

Indirect Sales, while smaller, accounted for the remaining share of the market. This channel includes distributors and retailers who act as intermediaries between manufacturers and end-users. Indirect sales are beneficial for reaching a broader customer base, especially in regions where manufacturers may not have a strong presence. However, it often comes with higher costs and longer lead times compared to direct sales.

The dominance of direct sales reflects a trend toward streamlined operations and better customer relations in the butyraldehyde market. As demand continues to grow, companies are likely to invest more in optimizing their direct sales strategies to maintain competitive advantages.

Key Market Segments

By Product Type

- N-butanol

- 2-ethylhexanol

- Polyvinyl Butyral

- Others

By Application

- Chemical Intermediate

- Rubber Accelerator

- Synthetic Resins

- Plasticizers

- Others

By End-Use Industry

- Medical

- Agriculture

- Cosmetic and Personal Care

- Food and Beverages

- Apparel and Textile

- Chemical

- Pulp and Paper

- Automotive

- Construction

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Driving Factors

Increasing Demand from End-Use Industries

The butyraldehyde market is significantly driven by the rising demand from various end-use industries. As of 2023, the global demand for butyraldehyde is expected to reach approximately 2.6 million metric tons, with the automotive and construction sectors being the largest consumers.

In the automotive industry, butyraldehyde is essential for producing rubber components and coatings. The global automotive market is projected to grow at a CAGR of 4.3%, reaching around USD 4.6 trillion by 2027, thereby increasing the demand for butyraldehyde.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainable practices are also influencing the market. For instance, in the European Union, the REACH regulation emphasizes reducing harmful substances in chemicals, including butyraldehyde.

These regulations are encouraging manufacturers to adopt safer, more environmentally friendly production methods. In the United States, the BioPreferred program is promoting bio-based alternatives to traditional chemicals, which include butyraldehyde produced from renewable sources. This initiative is expected to boost market growth as industries strive to meet regulatory compliance.

Growth in the Construction Sector

The construction industry is experiencing robust growth, further driving the demand for butyraldehyde. The global construction market is projected to reach USD 15 trillion by 2025, growing at a CAGR of 4.2%. Butyraldehyde is widely used in adhesives and coatings that enhance the performance and durability of construction materials. As more countries focus on infrastructure development, the consumption of butyraldehyde in this sector is expected to increase significantly.

Technological Advancements

Technological advancements in production processes are another key driving factor. Recent innovations have led to more efficient and cost-effective methods for producing butyraldehyde.

For example, advancements in catalytic processes have increased production efficiency by up to 30%. Such improvements not only reduce costs but also minimize environmental impact, making butyraldehyde a more attractive option for manufacturers.

Rising Focus on Bio-Based Chemicals

There is a growing focus on bio-based chemicals across industries, which is expected to create new opportunities for butyraldehyde. The market for bio-based chemicals is projected to reach USD 3.8 trillion by 2027, growing at a CAGR of 12%.

This shift is driven by consumer preferences for sustainable products and government incentives aimed at reducing reliance on fossil fuels. Manufacturers are increasingly exploring bio-based feedstocks for butyraldehyde production, aligning with market trends.

Expansion in Emerging Markets

Emerging markets are presenting significant growth opportunities for the butyraldehyde market. Regions such as Asia-Pacific, particularly India and China, are witnessing rapid industrialization and urbanization.

The Asia-Pacific region is expected to account for over 45% of the global butyraldehyde market by 2025. As these countries continue to develop their infrastructure and manufacturing capabilities, the demand for butyraldehyde is anticipated to rise.

Restraining Factors

Health and Environmental Concerns

One of the primary restraining factors for the butyraldehyde market is the increasing scrutiny over its health and environmental impacts. Butyraldehyde is classified as a volatile organic compound (VOC), which can contribute to air pollution and pose health risks upon exposure.

According to the U.S. Environmental Protection Agency (EPA), VOCs are responsible for various respiratory issues and have been linked to serious health conditions, leading to stricter regulations. In 2021, the EPA reported that butyraldehyde concentrations in certain urban areas exceeded safety thresholds, prompting calls for reduced emissions from industrial processes.

Regulatory Challenges

The stringent regulatory landscape also poses challenges for the butyraldehyde market. In regions like Europe, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires manufacturers to provide extensive safety data, which can be costly and time-consuming.

Compliance with these regulations can lead to increased operational costs, potentially limiting the market’s growth. Additionally, the European Chemicals Agency (ECHA) has flagged butyraldehyde for further evaluation, creating uncertainty among manufacturers about future regulations and compliance costs.

Competition from Alternative Chemicals

The rise of bio-based and eco-friendly alternatives is another significant challenge for the butyraldehyde market. With growing consumer awareness regarding sustainability, many industries are shifting towards greener options.

For instance, bio-based solvents and adhesives are gaining traction as safer alternatives to traditional chemicals, including butyraldehyde. The global market for bio-based chemicals is projected to reach USD 3.8 trillion by 2027, growing at a CAGR of 12%, which poses a competitive threat to conventional chemicals.

Price Volatility of Raw Materials

Fluctuations in the prices of raw materials used in the production of butyraldehyde can also restrain market growth. For example, the prices of propylene and other feedstocks have seen significant volatility, influenced by geopolitical tensions and supply chain disruptions.

In 2022, the price of propylene rose by approximately 45% due to supply chain issues and rising energy costs. Such price volatility can impact production costs and profit margins, making it challenging for manufacturers to maintain competitive pricing.

Market Maturity in Developed Regions

In developed regions like North America and Europe, the butyraldehyde market is becoming increasingly mature, resulting in slower growth rates. As of 2023, the market growth in these regions is projected to be around 3%, primarily due to saturation and limited new applications. Companies operating in these regions may find it difficult to expand their market share without innovative product offerings or diversification strategies.

Global Economic Conditions

Lastly, global economic conditions can significantly impact the butyraldehyde market. Economic downturns can lead to reduced demand in key end-use industries, such as automotive and construction. For instance, during the COVID-19 pandemic, the global economy contracted by approximately 3.5%, leading to decreased industrial activity and lower demand for butyraldehyde. While recovery is underway, economic uncertainties still pose a risk to the market.

Growth Opportunities

Increasing Demand from the Automotive Industry

One of the significant growth opportunities for the butyraldehyde market lies in the automotive industry. As vehicles become more complex and manufacturers focus on lightweight materials, the demand for advanced adhesives and coatings is rising.

In 2022, the global automotive adhesives market was valued at approximately USD 6.2 billion and is projected to grow at a CAGR of 6.3% from 2023 to 2030. Butyraldehyde serves as a critical intermediate in producing these adhesives, indicating strong potential for market expansion in this sector.

Growth in the Construction Sector

The construction industry is another vital area where butyraldehyde can thrive. With global infrastructure development projected to reach USD 4.2 trillion by 2025, the demand for paints, coatings, and sealants, which often utilize butyraldehyde, is expected to increase.

In 2023, the global construction chemicals market was valued at around USD 56.3 billion, with a projected growth rate of 5.1% annually. This growth will drive the need for butyraldehyde-based products, particularly in exterior applications where durability and weather resistance are crucial.

Sustainable Product Development

There is a growing trend toward sustainability in the chemical industry. Government initiatives promoting bio-based chemicals are creating new opportunities for butyraldehyde derived from renewable sources. For example, the U.S. Department of Agriculture (USDA) has launched the BioPreferred program, which encourages the use of renewable materials in various applications, including chemicals. This program is expected to expand the market for bio-based butyraldehyde, aligning with the increasing consumer preference for environmentally friendly products.

Rising Demand in the Consumer Goods Sector

The consumer goods sector is another area experiencing growth, particularly in personal care and cosmetics. The global cosmetics market is anticipated to reach USD 429.8 billion by 2025, with a significant portion relying on butyraldehyde as a key ingredient in various formulations. This increasing demand highlights a lucrative opportunity for manufacturers to develop innovative butyraldehyde-based products tailored for the cosmetic industry.

Technological Advancements in Production

Advancements in production technologies are also set to enhance the butyraldehyde market. Innovations aimed at reducing production costs and increasing efficiency can make butyraldehyde more attractive to manufacturers. For instance, new catalytic processes can significantly lower energy consumption during production, making it more cost-effective. Such advancements can facilitate greater adoption of butyraldehyde in various applications.

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific, present a substantial growth opportunity. The Asia-Pacific region accounted for over 45% of the global butyraldehyde market share in 2023. Rapid industrialization, urbanization, and increasing consumer spending are driving demand for chemicals in sectors such as automotive, construction, and consumer goods. Countries like India and China are expected to see substantial growth in manufacturing activities, further boosting the demand for butyraldehyde.

Latest Trends

Shift Toward Bio-Based Alternatives

One of the most significant trends in the butyraldehyde market is the shift towards bio-based alternatives. As sustainability becomes increasingly important, many manufacturers are exploring renewable sources for producing butyraldehyde.

For instance, the USDA’s BioPreferred program has identified a growing consumer preference for bio-based chemicals, encouraging investments in technologies that derive butyraldehyde from biomass. This trend aligns with a broader market shift, where bio-based chemicals are projected to reach USD 50 billion by 2025, reflecting a compound annual growth rate (CAGR) of 9.2%.

Technological Advancements in Production

Innovations in production processes are transforming how butyraldehyde is manufactured. Recent advancements, such as the use of advanced catalysts and more efficient production methods, can lower energy consumption and reduce waste. In 2023, new catalytic processes have been reported to improve yield by 15%, significantly enhancing cost-effectiveness. These technological improvements are crucial for meeting the increasing demand while adhering to environmental regulations.

Rising Demand in the Automotive Sector

The automotive industry is increasingly relying on butyraldehyde as a vital component in the formulation of adhesives and coatings. With the global automotive market expected to reach USD 8.4 trillion by 2028, the demand for high-performance materials, including butyraldehyde-based adhesives, is projected to grow. In particular, butyraldehyde’s role as a chemical intermediate in producing various automotive components is driving its consumption in this sector.

Focus on Sustainable Practices

Regulatory frameworks are increasingly promoting sustainable practices within the chemical industry. The European Union’s REACH regulation requires manufacturers to ensure the safety of chemicals like butyraldehyde, leading to the development of safer formulations. These regulations are pushing companies to invest in R&D for eco-friendly production methods. As a result, manufacturers are focusing on producing lower-emission and safer chemical alternatives, which is reshaping the competitive landscape.

Increased Use of Personal Care Products

Another emerging trend is the rising application of butyraldehyde in personal care and cosmetic products. The global cosmetics market, valued at USD 429.8 billion in 2022, is anticipated to grow significantly, with butyraldehyde being used in various formulations due to its properties as a fixative and solvent. This increasing demand for butyraldehyde in the cosmetics industry highlights a lucrative opportunity for manufacturers, especially those targeting eco-friendly product lines.

Regional Analysis

The butyraldehyde market is witnessing notable growth across various regions, with North America leading the charge. In 2023, North America captured approximately 35% of the global market share, valued at USD 95.3 million. This dominance can be attributed to the robust presence of key end-use industries, including automotive, construction, and chemicals, which significantly drive demand for butyraldehyde as a critical intermediate.

Europe follows closely the region’s strict regulatory environment, particularly under REACH, which encourages the adoption of safer and more sustainable chemical practices, thereby influencing butyraldehyde consumption patterns. The ongoing shift towards eco-friendly products is further propelling growth in this region.

In the Asia-Pacific region, rapid industrialization and urbanization are key growth drivers. Countries such as China and India are increasing their production capacities and consumption of butyraldehyde, primarily due to the expanding automotive and construction sectors. The region’s market is projected to grow at a CAGR of 7.5% through 2028.

The Middle East and Africa, while still emerging, are expected to contribute around 7% to the global market, supported by ongoing infrastructure projects. Latin America holds a smaller share, approximately 3%, but shows potential for growth as regional industries evolve. Overall, the global butyraldehyde market is characterized by diverse regional dynamics, each contributing to its expansion and development.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The butyraldehyde market is characterized by the presence of several key players, each contributing significantly to the industry’s growth and innovation. BASF SE stands out as a major player, leveraging its extensive research and development capabilities to produce high-quality butyraldehyde products. Similarly, DuPont and Eastman Chemical Company are recognized for their strong portfolios, focusing on sustainable production methods and advanced applications of butyraldehyde in various sectors.

Other notable companies include Mitsubishi Chemical Corporation and OXEA Corporation, both of which have established themselves as reliable suppliers in the market. These firms are investing in expanding their production capacities and enhancing their technological capabilities to meet rising demand. Additionally, companies like Merck KGaA and GELEST, INC. focus on specialty chemicals and high-purity butyraldehyde applications, catering to niche markets such as pharmaceuticals and high-end materials.

Emerging players like Aurochemicals and KH Neochem Co., Ltd. are also gaining traction by offering competitive products and innovative solutions. This dynamic competitive landscape is further shaped by strategic partnerships, acquisitions, and a growing emphasis on sustainability, positioning the butyraldehyde market for continued growth and development in the coming years.

Market Key Players

- Advanced Biotech

- Alfa Aesar

- Aurochemicals

- BASF SE

- DuPont

- Eastman Chemical Company

- GELEST, INC.

- Grupa Azoty ZAK S.A

- KH Neochem Co., Ltd.

- LobaChemie Pvt Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- OXEA Corporation

- Perstorp Holding AB

- The Dow Chemical Company

- Thermo Fisher Scientific

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals

Recent Development

In 2023 Advanced Biotech, the company expanded its production capacity to meet the growing demand for bio-based chemicals, positioning itself as a key supplier in the market.

In 2023 Alfa Aesar, company expanded its portfolio to include various grades of butyraldehyde, catering to the increasing demand from sectors like pharmaceuticals, chemicals, and food processing.

Report Scope

Report Features Description Market Value (2023) US$ 270 Mn Forecast Revenue (2033) US$ 426 Mn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(N-butanol, 2-ethylhexanol, Polyvinyl Butyral, Others), By Application(Chemical Intermediate, Rubber Accelerator, Synthetic Resins, Plasticizers, Others), By End-Use Industry(Medical, Agriculture, Cosmetic and Personal Care, Food and Beverages, Apparel and Textile, Chemical, Pulp and Paper, Automotive, Construction, Others), By Sales Channel(Direct Sale, Indirect Sale) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Advanced Biotech, Alfa Aesar, Aurochemicals, BASF SE, DuPont, Eastman Chemical Company, GELEST, INC., Grupa Azoty ZAK S.A, KH Neochem Co., Ltd., LobaChemie Pvt Ltd, Merck KGaA, Mitsubishi Chemical Corporation, OXEA Corporation, Perstorp Holding AB, The Dow Chemical Company, Thermo Fisher Scientific, Tokyo Chemical Industry Co., Ltd., Toronto Research Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Biotech

- Alfa Aesar

- Aurochemicals

- BASF SE

- DuPont

- Eastman Chemical Company

- GELEST, INC.

- Grupa Azoty ZAK S.A

- KH Neochem Co., Ltd.

- LobaChemie Pvt Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- OXEA Corporation

- Perstorp Holding AB

- The Dow Chemical Company

- Thermo Fisher Scientific

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals