Global Butter Market By Butter Type(Cultured Butter, Uncultured Butter, Salted Butter, Whipped Butter, Others), By Processing(Processed Butter, Unprocessed Butter), By Usage(Spreadable, Non-spreadable), By End Use(Food Processing, Bakery, Dairy and Frozen Desserts, Dressings and Spreads, Others), By Distribution Channel(Hypermarket / Supermarket, Convenience Store, Specialty Store, Online), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 15933

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

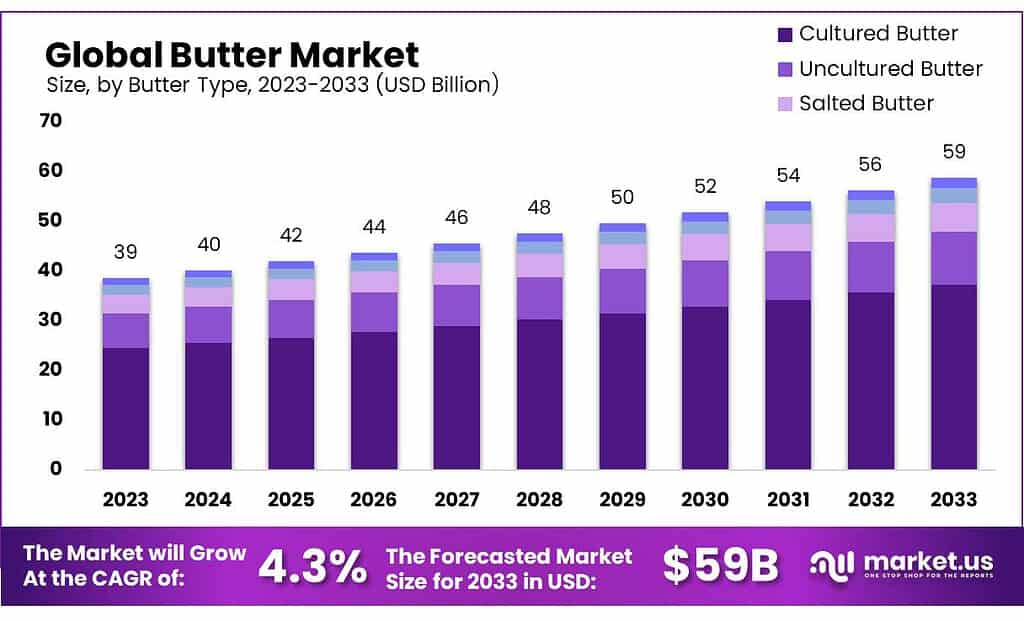

The global Butter Market size is expected to be worth around USD 59 billion by 2033, from USD 39 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Butter Market refers to the global or regional industry and commerce surrounding the production, distribution, and sale of butter. Butter, a dairy product made from churning milk or cream, is a staple in various cuisines worldwide, used in cooking, baking, and as a spread. The market encompasses different types of butter, including unsalted, salted, cultured, and clarified butter, catering to diverse consumer preferences and dietary requirements.

Key factors influencing the Butter Market include dairy farming practices, milk production levels, consumer demand trends, dietary habits, health considerations, and regulatory standards related to food safety and quality. The market is also affected by global trade dynamics, including tariffs and trade agreements, which can impact the availability and prices of butter in different regions.

The Butter Market involves a wide range of stakeholders, from dairy farmers and butter manufacturers to wholesalers, retailers, and consumers. Advances in dairy technology, shifts in consumer preferences towards organic and grass-fed butter products, and the use of butter in processed foods and the culinary industry also play significant roles in shaping market trends.

In addition to traditional butter, the market has seen the emergence of plant-based alternatives catering to vegan, lactose-intolerant, and health-conscious consumers, expanding the scope of the market. The Butter Market is a dynamic segment of the broader dairy industry, continually evolving in response to changes in consumer behavior, technological advancements, and global economic conditions.

Key Takeaways

- Market Growth: USD 39 billion in 2023 to USD 59 billion by 2033, with a 4.3% CAGR.

- Butter Types: Cultured Butter led with 63.5% share, favored for its tangy flavor.

- Processing Preference: Processed Butter dominated with a 71.5% share in 2023.

- Usage Trends: Spreadable Butter captured over 59.3% share due to its convenience.

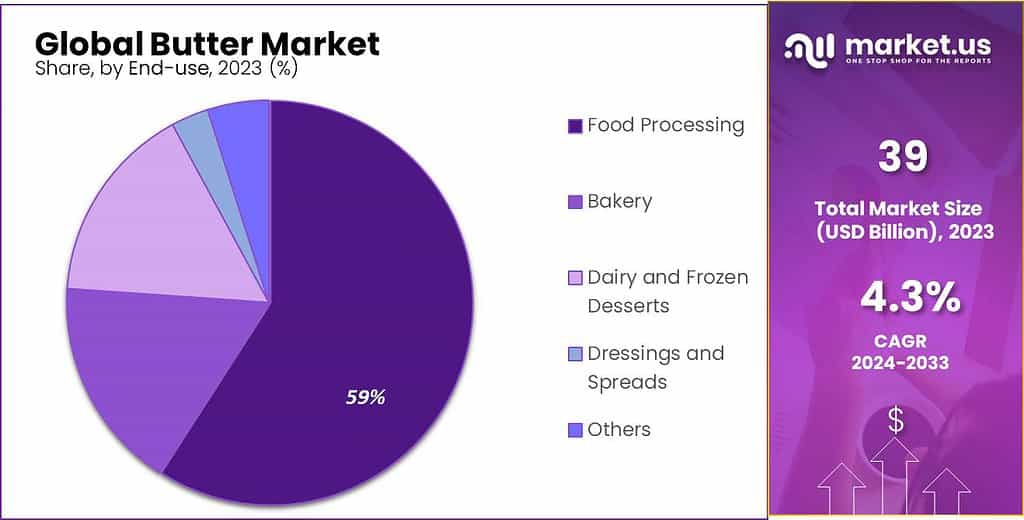

- End Use Segments: Food Processing held over 59.1% share, emphasizing butter’s versatility.

- Distribution Channels: Hypermarkets/Supermarkets led with 43.6% share, offering diverse options.

- Regional Analysis: Asia Pacific Dominance is Poised to lead, capturing 54.2% market share in the Butter Market.

By Butter Type

In 2023, Cultured Butter led the Butter Market, seizing more than a 63.5% share. Its popularity stems from its rich, tangy flavor, which is favored in both cooking and as a spread. This type of butter is made by adding live bacteria to cream before churning, a process that not only enhances its taste but also may offer digestive benefits, appealing to health-conscious consumers.

Following closely, Salted Butter also held a significant portion of the market. Appreciated for its versatility and flavor-enhancing properties, salted butter is a kitchen staple, suitable for both baking and cooking, making it a preferred choice for many households.

Whipped Butter, known for its light, airy texture and ease of spreading, carved out its niche. Its lower calorie content, due to air incorporation, appeals to those seeking a lighter alternative without compromising on taste.

Uncultured Butter, although simpler in flavor compared to its cultured counterpart, remains a fundamental choice for basic cooking and baking needs. Its straightforward production process and traditional appeal ensure its steady demand within the market.

The Others category, which includes varieties like clarified butter (ghee) and plant-based alternatives, caters to specific dietary needs and preferences, from lactose intolerance to vegan diets. This segment’s growth reflects the market’s evolving diversity and consumers’ increasing desire for specialized products.

By Processing

In 2023, Processed Butter held a dominant market position, capturing more than a 71.5% share. This segment’s lead is attributed to its convenience and wide availability in various forms, including sticks, tubs, and spreads, catering to the diverse needs of consumers. Processed butter often undergoes additional steps to extend shelf life, enhance flavor, or modify texture, making it a versatile choice for both cooking and direct consumption.

On the other hand, Unprocessed Butter, representing a smaller market share, appeals to those seeking natural and minimally processed food options. This type of butter is valued for its pure flavor and the perception of being a healthier choice due to the absence of added preservatives or artificial ingredients. Despite its smaller market footprint, unprocessed butter has gained traction among health-conscious consumers and those prioritizing organic and artisanal food products.

The contrasting preferences for processed and unprocessed butter reflect broader consumer trends toward convenience and a desire for authentic, wholesome foods. With processed butter leading the market due to its adaptability and ease of use, unprocessed butter continues to carve out a significant niche, driven by growing interest in natural and organic products.

By Usage

In 2023, Spreadable Butter held a dominant market position, capturing more than a 59.3% share. Its popularity is rooted in its convenience and ease of use, making it a preferred choice for everyday consumption of bread, toast, and other bakery products. The demand for spreadable butter has been driven by its creamy texture and ability to blend smoothly at a range of temperatures, enhancing its appeal for consumers seeking both flavor and functionality in their butter choice.

Non-spreadable butter, while holding a smaller share of the market, is favored for specific culinary applications, including baking and cooking. Its firmer texture and rich flavor profile make it an essential ingredient for those looking to impart depth and richness to their dishes. Despite its lesser market share compared to spreadable butter, non-spreadable butter remains a staple in kitchens where culinary precision and traditional recipes are valued.

The distinction between spreadable and non-spreadable butter underscores the diverse usage scenarios and consumer preferences within the Butter Market. With spreadable butter leading due to its convenience and versatility, non-spreadable butter maintains its importance for culinary enthusiasts and professionals who prioritize flavor and quality in their cooking and baking endeavors.

By End Use

In 2023, Food Processing held a dominant market position in the Butter Market, capturing more than a 59.1% share. This segment’s lead is attributed to butter’s essential role in numerous food production processes, where it adds flavor, texture, and richness to a wide array of products. Its versatility makes it a key ingredient in everything from sauces to confectionery, underlining its importance in the food industry.

The Bakery segment follows closely, where butter’s unparalleled taste and ability to create flaky pastries and rich baked goods have cemented its use. Bakeries rely on butter for its ability to provide moisture and aerate dough, resulting in soft, delicious bread and pastries that appeal to consumers’ palates.

In Dairy and Frozen Desserts, butter enhances the creamy texture and flavor of products like ice cream and frozen yogurts. Its fat content is crucial for achieving the smooth, indulgent mouthfeel that consumers expect from their frozen treats.

Dressings and Spreads also form a significant segment, with butter serving as a base for many dressings and spreads, adding a depth of flavor that elevates simple dishes to gourmet standards.

The Others category encompasses a variety of uses, including home cooking and emerging food innovations, where butter’s unique properties are leveraged to enhance taste and texture.

By Distribution Channel

In 2023, Hypermarkets/Supermarket held a dominant market position in the Butter Market, capturing more than a 43.6% share. Their wide reach and the convenience of offering a variety of butter types under one roof have made them the preferred shopping destination for most consumers. These outlets cater to the everyday needs of customers, providing accessibility to a range of brands and products at competitive prices.

Convenience Stores also play a significant role, serving those in need of quick purchases. Though smaller in market share, their strategic locations and extended hours appeal to consumers seeking immediate or last-minute butter buys.

Specialty Stores have carved out their niche by offering premium and artisanal butter varieties, attracting customers looking for unique flavors or organic options. Their expertise and focused product selection cater to discerning consumers who prioritize quality and specialty products over price.

The Online segment has seen substantial growth, offering unparalleled convenience and access to a wide array of butter products, including hard-to-find and specialty items. This channel appeals to tech-savvy consumers and those with busy lifestyles, providing easy comparison shopping and home delivery options.

Each distribution channel caters to different consumer needs and preferences, with Hypermarkets and Supermarkets leading due to their widespread availability and diverse product range, while Convenience Stores, Specialty Stores, and Online platforms offer specialized services and products to meet the evolving demands of the Butter Market.

Key Market Segments

By Butter Type

- Cultured Butter

- Uncultured Butter

- Salted Butter

- Whipped Butter

- Others

By Processing

- Processed Butter

- Unprocessed Butter

By Usage

- Spreadable

- Non-spreadable

By End Use

- Food Processing

- Bakery

- Dairy and Frozen Desserts

- Dressings and Spreads

- Others

By Distribution Channel

- Hypermarket / Supermarket

- Convenience Store

- Specialty Store

- Online

Drivers

Rising Demand for Natural and Organic Products Drives the Butter Market

A significant driver propelling the growth of the Butter Market is the escalating consumer demand for natural and organic food products. In recent years, there has been a marked shift in consumer preferences towards foods perceived as healthier and more natural, with butter standing out as a beneficiary of this trend.

Once vilified due to misconceptions about fat content, butter is now celebrated for its natural composition and absence of artificial additives, aligning with the growing wellness and clean eating movements. This renewed interest is partly driven by an increased awareness of the health implications associated with processed foods and artificial ingredients, leading consumers to seek out products with simpler, more recognizable ingredient lists.

Butter, especially varieties that are organic or come from grass-fed cows, is prized for its nutritional benefits, including higher levels of Omega-3 fatty acids, Vitamin K2, and butyrate. These products cater to health-conscious consumers looking to incorporate fats that support a balanced diet into their meals. Furthermore, the push for organic products reflects a broader concern for animal welfare and environmental sustainability, with organic farming practices generally viewed as more ethical and less harmful to the environment than conventional methods.

The demand for natural and organic butter has also been bolstered by the culinary world, where chefs and home cooks alike value the flavor and quality that these butter can bring to dishes. As a key ingredient in baking and cooking, the type of butter used can significantly affect the taste and texture of food, choosing butter more critical than ever.

Moreover, the growth of specialty food stores and online platforms has made these premium butters more accessible to the average consumer, further fueling market growth. As availability increases, so does consumer experimentation with and loyalty to brands that align with their values and taste preferences.

In response to this demand, producers are expanding their offerings of organic, grass-fed, and artisanal butter, often highlighting the provenance of their products and the traditional methods used in their production. This not only caters to the demand for natural and organic products but also taps into the consumer desire for authenticity and transparency in food sourcing.

Restraints

Health Concerns and Dietary Shifts: A Major Restraint for the Butter Market

A significant restraint facing the Butter Market is the ongoing health concerns and dietary shifts towards lower-fat and plant-based alternatives. Despite butter’s resurgence as a preferred natural and organic option among health-conscious consumers, its high saturated fat content continues to raise health concerns.

Many consumers, particularly those at risk of or managing cardiovascular diseases, are advised to limit their saturated fat intake, leading to a cautious approach towards butter consumption. This health-based restraint is compounded by a growing awareness and understanding of nutrition and wellness, where balanced diets and heart-healthy fats are emphasized over traditional dairy fats.

The rise of veganism and lactose intolerance has further fueled the demand for non-dairy alternatives, such as margarine and plant-based spreads made from oils like olive, coconut, and avocado. These products appeal not only to those following strict vegan diets but also to consumers looking for lactose-free or lower-cholesterol options. The availability and improving quality of these alternatives have made them viable substitutes for butter in cooking, baking, and as spreads, challenging butter’s market dominance.

Furthermore, the dietary trends towards plant-based eating are supported by environmental and ethical considerations. The dairy industry’s environmental impact, including its contribution to greenhouse gas emissions and water usage, has led environmentally conscious consumers to explore more sustainable options. This shift is part of a broader consumer movement towards foods with a lower environmental footprint, aligning with global sustainability goals and personal ethics.

Moreover, the global health narrative around fats is complex and evolving. While butter has benefited from the backlash against trans fats found in some margarine and processed foods, the dialogue around healthy fats and cholesterol levels remains a topic of debate among nutritionists and health professionals. This ongoing discourse influences consumer perceptions and choices, presenting a challenge for the butter industry to navigate.

In response to these restraints, the butter industry is innovating with new product formulations that address health concerns, such as reduced-fat or fortified butter. There is also an emphasis on marketing the culinary benefits of butter, positioning it as a premium ingredient for discerning consumers who prioritize taste and quality.

As dietary preferences continue to evolve, the Butter Market faces the challenge of adapting to changing consumer health perceptions and competing with a growing array of alternative products. Balancing tradition with innovation and addressing health concerns without compromising on taste will be crucial for maintaining butter’s relevance in the modern dietary landscape.

Opportunity

The Global Culinary Renaissance: An Opportunity for the Butter Market

A major opportunity for the Butter Market lies in the ongoing global culinary renaissance, where there’s a renewed appreciation for quality ingredients, traditional cooking methods, and authentic flavors. This movement is not just confined to professional kitchens but has also taken root among home cooks and food enthusiasts worldwide, driven by a desire to recreate gourmet experiences at home.

Butter, with its rich flavor and versatility, stands at the heart of this culinary revival. Its ability to enhance taste, texture, and aroma makes it an indispensable ingredient in a wide range of dishes, from simple home-cooked meals to complex restaurant-quality creations.

The rise of cooking shows, online food content, and culinary influencers has played a pivotal role in educating consumers about the importance of using high-quality ingredients, including butter, to achieve the best results in cooking and baking. This exposure has cultivated a more discerning consumer base that values the nuanced differences high-quality butter can bring to their food. As a result, demand for premium butter varieties, such as grass-fed, organic, or cultured butter, is on the rise, presenting a significant growth opportunity for producers in the Butter Market.

Furthermore, the global nature of this culinary renaissance has sparked an interest in international cuisines, opening up new avenues for butter consumption. For instance, the popularity of French pastries and Italian sauces, both of which rely heavily on butter, has encouraged consumers to experiment with these dishes at home, thereby increasing the demand for butter. Similarly, the fusion cuisine trend, which blends culinary traditions from different cultures, often incorporates butter as a key ingredient to add richness and depth of flavor.

This burgeoning interest in cooking and baking, combined with a willingness to invest in quality ingredients, presents a lucrative opportunity for the Butter Market. Producers can capitalize on this trend by offering a range of butter products tailored to different cooking needs and preferences, from unsalted butter for baking to flavored varieties for finishing dishes. Additionally, engaging with consumers through recipes, cooking tips, and partnerships with chefs and food influencers can help brands position themselves as essential components of the culinary experience.

As the global culinary landscape continues to evolve, the Butter Market has the opportunity to grow and diversify. By tapping into the consumer desire for quality, authenticity, and culinary exploration, butter producers can expand their reach and reinforce the indispensable role of butter in the kitchen.

Trends

The Surge in Plant-Based Alternatives: A Transformative Trend in the Butter Market

A transformative trend shaping the Butter Market is the surge in demand for plant-based alternatives. This shift is largely fueled by a growing consumer consciousness around health, environmental sustainability, and ethical concerns related to animal welfare. As more individuals adopt vegetarian, vegan, or flexitarian diets, the demand for dairy-free alternatives to traditional butter has skyrocketed, presenting both a challenge and a significant opportunity within the butter industry.

Plant-based butter, made from a variety of oils such as coconut, almond, and olive, has emerged as popular alternatives that cater to this changing consumer preference. These products not only appeal to those looking to reduce their dairy intake but also for lactose-intolerant consumers and those with dairy allergies.

The development of these alternatives has been driven by advances in food technology, which have enabled manufacturers to replicate the taste, texture, and melting properties of dairy butter, making plant-based butters suitable for a wide range of culinary applications, from baking to cooking and spreading.

Moreover, the environmental argument for plant-based butter is compelling. The production of plant-based alternatives is generally associated with lower greenhouse gas emissions, reduced water usage, and a smaller ecological footprint compared to traditional dairy farming. This aligns with the increasing consumer demand for sustainable food products and the broader societal push towards more environmentally friendly consumption patterns.

The health aspect also plays a significant role in the popularity of plant-based butters. Many consumers perceive plant-based diets as healthier, and plant-based butters often contain beneficial fats, fewer calories, and no cholesterol, making them an attractive option for health-conscious individuals.

However, the trend towards plant-based alternatives is not without its challenges. The butter market must navigate issues related to taste, texture, and cooking performance to meet consumer expectations. Additionally, the higher price point of some plant-based butters can be a barrier to widespread adoption.

Geopolitical Impact Analysis

Due to geopolitical tensions, supply chain activities have been disrupted, impacting the global butter market. This market is a vital component across various sectors such as food production, hospitality, and culinary arts, and is increasingly influenced by geopolitical complexities. Current geopolitical events and tensions exert a significant influence on the butter market, influencing supply chains, regulatory landscapes, energy costs, and investment patterns. These factors collectively mold market trends, demand dynamics, and strategic choices made by stakeholders within this sector.

The most immediate impact of geopolitical tensions is felt within the butter supply chain. The butter market relies on a global network of suppliers for ingredients and raw materials. Geopolitical conflicts or trade disputes can disrupt these supply chains, leading to shortages of essential ingredients or raw materials, elevated expenses, and prolonged production schedules. For instance, tariffs implemented due to trade conflicts can escalate the costs of imported ingredients, tightening profit margins for butter producers and necessitating a reevaluation of procurement strategies.

Geopolitical transformations often precipitate regulatory adjustments that resonate throughout the butter market. Emerging trade agreements, sanctions, and environmental policies can reshape market dynamics, influencing how companies operate and compete on a global scale. Sanctions imposed on specific regions can impede market access, compelling companies to explore alternative markets or suppliers. Conversely, new trade agreements can unlock fresh market opportunities, offering growth prospects for butter producers seeking to expand their reach.

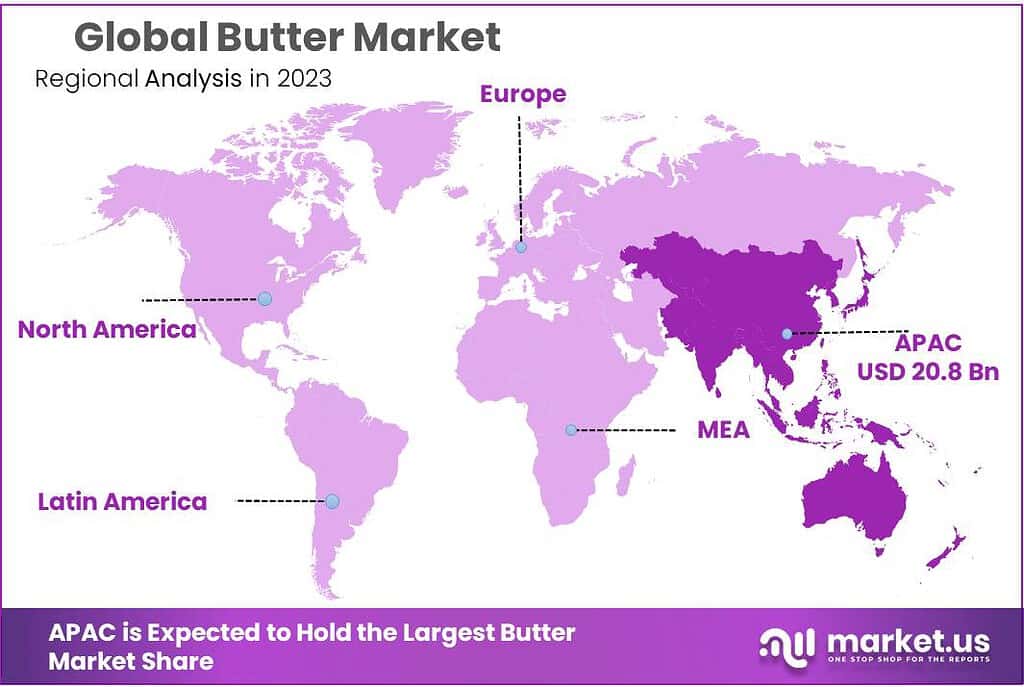

Regional Analysis

As of 2023, the Asia Pacific region emerged as the most profitable market for butter globally.

The Asia Pacific region is poised to lead the Butter Market, capturing a significant market share of 54.2%. This remarkable growth is driven by a surge in demand for butter across diverse applications, from culinary uses in households to industrial applications in the food processing sector, across countries like China, India, Korea, Thailand, Malaysia, and Vietnam. The expansion in this region is supported by the burgeoning food industry, rising household incomes, and an increasing consumer penchant for rich, flavorful, and high-quality culinary ingredients.

In North America, the flourishing food industry and a growing trend towards artisanal and gourmet food products are expected to boost the demand for butter significantly. The region’s focus on innovation in dairy products, coupled with a rising preference for natural and organic foods, further propels this demand, positioning North America as an essential market for butter.

Europe is also set to see substantial growth in the Butter Market. This growth is driven by the increasing consumer demand for high-quality dairy products in culinary, commercial, and residential sectors. Europe’s rigorous standards for food quality and sustainability are critical in enhancing the use of butter in various culinary practices and food products, ensuring that butter remains a staple ingredient in European kitchens and industries.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Butter Market is a dynamic sector characterized by a blend of traditional dairy giants and innovative newcomers, each contributing to the market’s growth and diversity. Key players in the market have strategically positioned themselves through product innovation, quality enhancement, and global expansion efforts. Here’s an analysis of some key players shaping the Butter Market

Market Key Players

- Amul Dairy

- Anand

- Arla Foods amba

- Cabot Creamery Co-operative Inc.

- Dairy Farmers of America, Inc.

- Fonterra Co-operative Group Limited

- Gujarat Co-Operative Milk Marketing Federation Limited

- Lactalis International

- Land O’Lakes Inc.

- Meadow Foods Ltd.

- MS Iceland Dairies

- Muller

- Organic Dairy LLC

- Organic Valley Co-operative

- Ornua Co-Operative Limited

Recent Development

In 2024, Amul Dairy further solidified its position as a leading player in the butter market, capitalizing on growing consumer demand for premium dairy products.

In 2024, MS Iceland Dairies continued to thrive in the butter sector, leveraging its strong brand identity and innovative product offerings to maintain a competitive edge. The company’s commitment to ethical sourcing and product integrity remained key drivers of its success, as it solidified its position as a trusted provider of butter in the market.

Report Scope

Report Features Description Market Value (2023) USD 39 Bn Forecast Revenue (2033) USD 59 Bn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Butter Type(Cultured Butter, Uncultured Butter, Salted Butter, Whipped Butter, Others), By Processing(Processed Butter, Unprocessed Butter), By Usage(Spreadable, Non-spreadable), By End Use(Food Processing, Bakery, Dairy and Frozen Desserts, Dressings and Spreads, Others), By Distribution Channel(Hypermarket / Supermarket, Convenience Store, Specialty Store, Online) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Amul Dairy, Anand, Arla Foods amba, Cabot Creamery Co-operative Inc., Dairy Farmers of America, Inc., Fonterra Co-operative Group Limited, Gujarat Co-Operative Milk Marketing Federation Limited, Lactalis International, Land O’Lakes Inc., Meadow Foods Ltd., MS Iceland Dairies, Muller, Organic Dairy LLC, Organic Valley Co-operative, Ornua Co-Operative Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is hte size of Butter Market?Butter Market size is expected to be worth around USD 59 billion by 2033, from USD 39 billion in 2023

What CAGR is projected for the Butter Market?The Butter Market is expected to grow at 4.3% CAGR (2023-2033).

Name the major industry players in the Butter Market?Amul Dairy, Anand, Arla Foods amba, Cabot Creamery Co-operative Inc., Dairy Farmers of America, Inc., Fonterra Co-operative Group Limited, Gujarat Co-Operative Milk Marketing Federation Limited, Lactalis International, Land O’Lakes Inc., Meadow Foods Ltd., MS Iceland Dairies, Muller, Organic Dairy LLC, Organic Valley Co-operative, Ornua Co-Operative Limited

-

-

- Amul Dairy

- Anand

- Arla Foods amba

- Cabot Creamery Co-operative Inc.

- Dairy Farmers of America, Inc.

- Fonterra Co-operative Group Limited

- Gujarat Co-Operative Milk Marketing Federation Limited

- Lactalis International

- Land O’Lakes Inc.

- Meadow Foods Ltd.

- MS Iceland Dairies

- Muller

- Organic Dairy LLC

- Organic Valley Co-operative

- Ornua Co-Operative Limited