Global Business Interruption Insurance Market Size, Share, Growth Analysis By Coverage Type (Gross Earnings Coverage, Extra Expense Coverage, Contingent Business Interruption, Specialized Coverage), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End User (Retail Stores, Restaurants, Professional Services, Manufacturing Plants, Hospitality Chains, Technology Companies, Healthcare Facilities, Educational Institutions, Transportation & Logistics, Others), By Distribution Channel (Insurance Brokers, Direct Writers, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168732

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Finance

- Industry Adoption

- Emerging Trends

- US Market Size

- By Coverage Type

- By Enterprise Size

- By End User

- By Distribution Channel

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

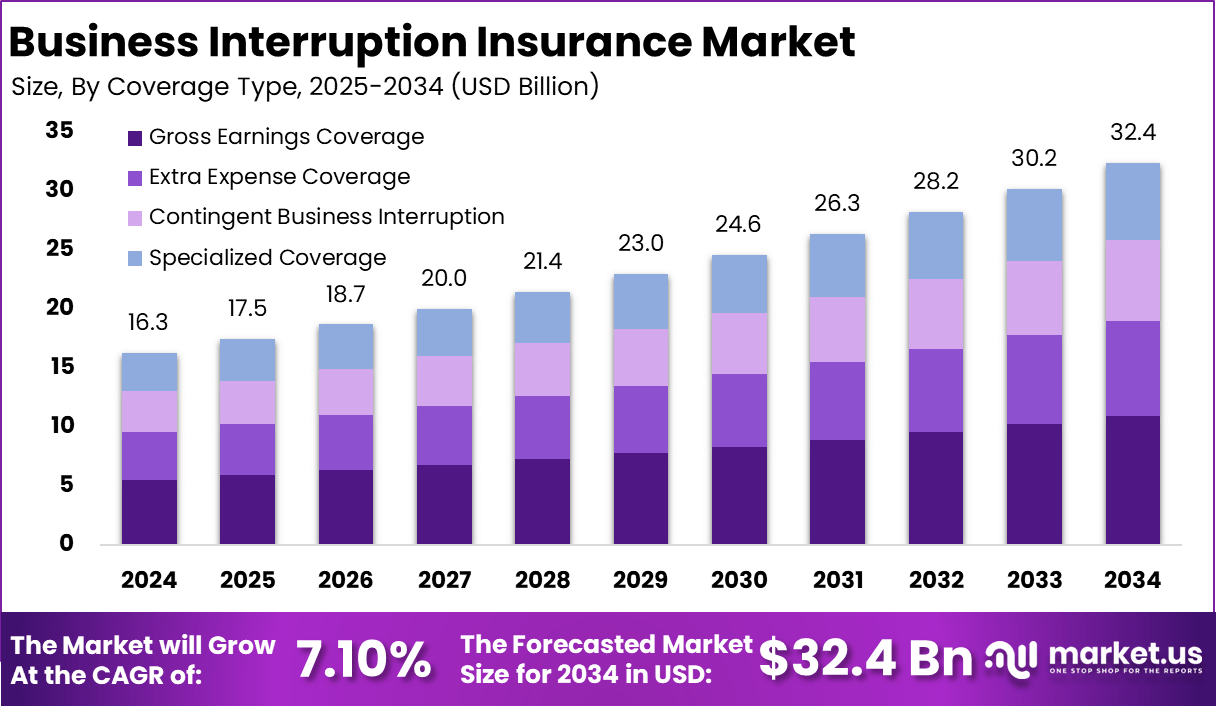

The global Business Interruption Insurance Market is expected to grow steadily as companies prioritize financial protection against operational disruptions. Valued at USD 16.3 billion in 2024, the market is projected to reach USD 32.4 billion by 2034, expanding at a CAGR of 7.10%.

This growth is driven by rising exposure to natural disasters, cyberattacks, supply-chain vulnerabilities, and regulatory pressures that compel enterprises to adopt comprehensive risk-mitigation frameworks. Organizations across manufacturing, retail, BFSI, healthcare, and logistics increasingly recognize business interruption coverage as a core component of enterprise resilience strategies.

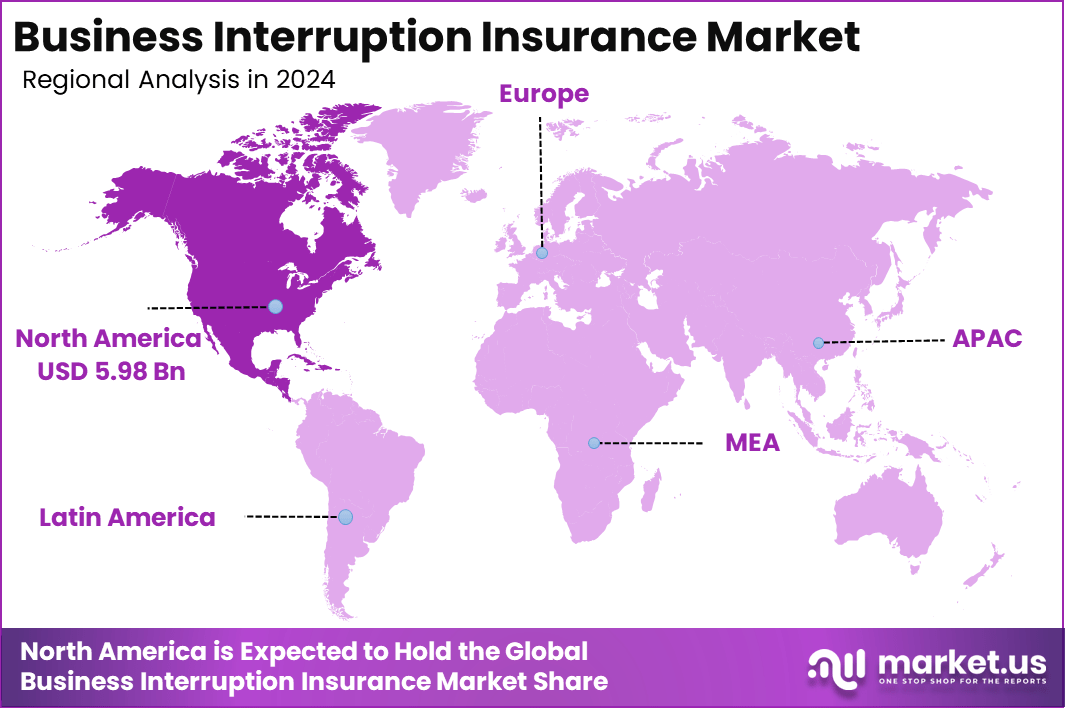

North America dominates the global landscape with a 36.7% market share, reflecting strong insurance penetration, higher risk awareness, and strict business continuity requirements. The region’s market size reached USD 5.98 billion in 2024, supported by growing claims related to weather-related catastrophes, wildfire-induced shutdowns, and prolonged cyber incidents.

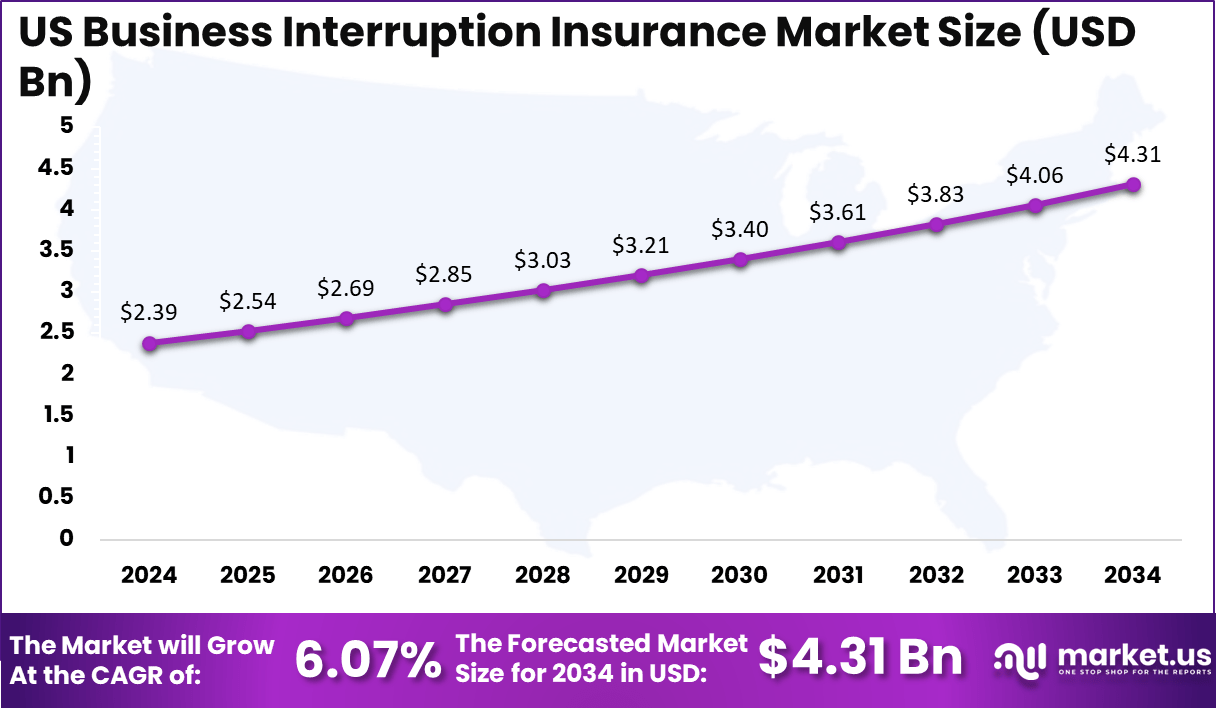

The US remains the most influential contributor, with a market value of USD 2.39 billion in 2024, projected to rise to USD 4.31 billion by 2034 at a CAGR of 6.07%. Corporate investments in digital infrastructure, coupled with the increasing financial impact of operational downtime, are expected to further accelerate adoption over the coming decade.

The Business Interruption Insurance Market is emerging as a critical pillar of corporate risk management as companies face escalating threats that disrupt operational continuity. Global economic losses from natural disasters alone exceeded USD 275 billion in 2023 (Swiss Re), while cyber incidents accounted for more than USD 10.5 trillion in projected annual damage by 2025 (Cybersecurity Ventures).

Such disruptions directly impact revenue streams, making financial protection essential across manufacturing, retail, energy, healthcare, logistics, and IT services. As a result, demand for comprehensive business interruption coverage is accelerating, supported by increasing supply chain complexities, rising climate-linked shutdowns, and stricter regulatory frameworks for business continuity planning.

The insurance market is expected to gain significant traction as downtime costs surge globally. Industry assessments indicate that the average cost of a one-hour critical systems outage can exceed USD 300,000, while long-term closures following extreme weather events can push losses into multi-million-dollar ranges for mid-sized enterprises.

These rising economic exposures are encouraging organizations to adopt policies that cover lost income, fixed operating expenses, employee wages, and temporary relocation costs. With climate volatility increasing the frequency of catastrophic events and digital dependency heightening vulnerability to cyber disruptions, business interruption insurance continues to transition from an optional safeguard to a strategic necessity for operational resilience.

In 2025, business interruption insurance has seen notable activity driven by mergers, acquisitions, and product innovation. Major mergers include Arthur J. Gallagher & Co.’s $13.5 billion acquisition of AssuredPartners and Brown & Brown’s $9.8 billion purchase of Accession Risk Management Group, which includes Risk Strategies and One80 Intermediaries.

These large brokerage consolidations highlight a trend toward strengthening market presence and expanding service capabilities. Florida remains a hotspot for brokerage M&A due to its risk profile and growing property market.

Besides M&A, insurers have launched new products incorporating AI and digital automation to improve risk assessment and claims processing, particularly for cyber-related business interruptions. Partnerships between insurance firms and technology companies are increasing to offer more precise risk pricing and faster payouts. Private equity continues to be active despite a slight slowdown in overall transaction numbers.

Market players are also adapting to regulatory and tax changes affecting cross-border transactions and capital reserves. Overall, the landscape is marked by strategic acquisitions aiming to integrate innovative insurance solutions and enhance geographic risk diversification, supported by robust deal flow with over 200 transactions reported in insurance services so far in 2025.

This dynamic environment reflects insurers’ push to address rising risks from climate change, cyber threats, and complex supply chains by leveraging technology and consolidating expertise through acquisitions. These moves aim to provide enhanced business interruption coverage and operational resilience for clients.

Key Takeaways

- The Business Interruption Insurance Market reached USD 16.3 billion in 2024 and is projected to hit USD 32.4 billion by 2034 at a 7.10% CAGR.

- North America accounted for 36.7% of the global market, with a USD 5.98 billion valuation in 2024.

- The US market stood at USD 2.39 billion in 2024, expected to rise to USD 4.31 billion by 2034 at a 6.07% CAGR.

- By Coverage Type, Gross Earnings Coverage dominated with a 33.8% share.

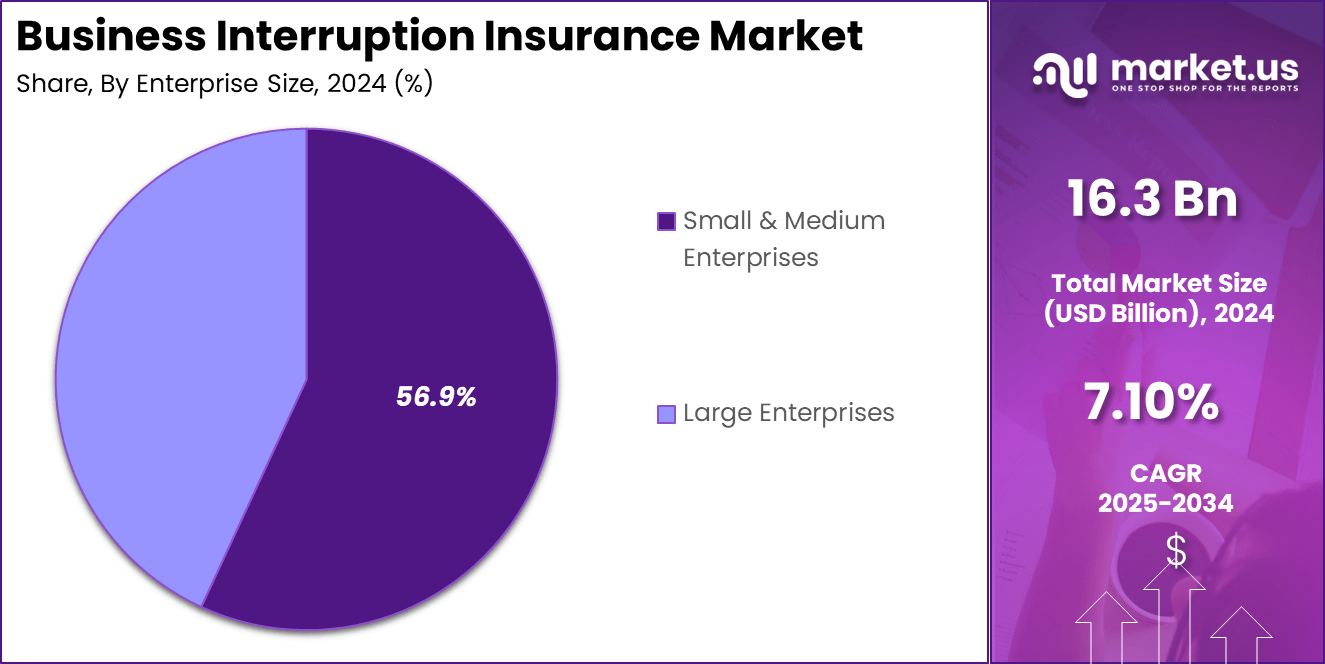

- By Enterprise Size, Small & Medium Enterprises led the market with a 56.9% share.

- Within the End-User category, Retail Stores accounted for 12.9% of total demand.

- By Distribution Channel, Insurance Brokers captured the largest share at 53.4%.

Role of Finance

Finance plays a fundamental role in driving economic growth, business expansion, and individual financial security. It ensures the efficient flow of capital across markets, linking savers, investors, and businesses, and enabling productive investments. According to the World Bank, global capital flows surpassed USD 23 trillion in 2023, reflecting the scale at which financial systems support global development.

For businesses, finance guides budgeting, forecasting, and cost control, helping organizations allocate resources effectively and maintain operational stability. Corporate studies show that companies with strong financial planning systems are 30–40% more likely to achieve long-term growth targets.

Finance also supports innovation and infrastructure creation. The IMF reports that countries investing over 4% of GDP in financial-sector development experience significantly higher economic resilience and innovation capacity. In the business environment, financial tools such as credit, working capital loans, insurance, and investment planning help companies navigate uncertainties, including market volatility, supply chain disruptions, and inflationary pressures.

At the personal level, finance empowers individuals to manage savings, credit, retirement planning, and wealth building. Global household wealth reached USD 463 trillion in 2023 (Credit Suisse), highlighting the importance of financial literacy and access to financial services. Overall, finance remains the backbone of modern economies by enabling stability, supporting innovation, and ensuring sustainable development.

Industry Adoption

Industry adoption of advanced financial practices and technologies is accelerating as organizations seek greater efficiency, transparency, and resilience. According to McKinsey, nearly 70% of global enterprises have increased investment in financial digitization, driven by the need for real-time insights, automated workflows, and improved risk management.

Industries such as manufacturing, healthcare, retail, logistics, and BFSI are integrating financial analytics, cloud-based accounting, and digital payment systems to enhance decision-making and operational performance. This shift is supported by rising compliance requirements and the need to reduce manual errors, which account for nearly 25% of annual financial reporting issues globally.

Technology adoption further strengthens financial resilience. Research reports that embedded finance solutions are growing at 30% annually, enabling businesses to offer financial services directly within their platforms. Meanwhile, automated expense and cash-flow tools reduce operational costs by up to 20%, helping industries optimize working capital and maintain liquidity. Supply chain-heavy sectors increasingly rely on financial forecasting and risk models to navigate price fluctuations, disruptions, and global uncertainties.

Additionally, industries are turning to ESG-linked financial practices as global sustainable investment has surpassed USD 30 trillion, encouraging companies to align financial decisions with environmental and social goals. Overall, industry adoption reflects a strategic shift toward data-driven, technology-enabled financial ecosystems.

Emerging Trends

Emerging trends in the financial and business landscape are reshaping how organizations operate, manage risks, and pursue growth. One key trend is the rapid acceleration of digital finance adoption, with Deloitte reporting that over 75% of enterprises are integrating AI-driven analytics, automation, and cloud finance platforms to enhance accuracy and reduce operational costs.

Real-time financial visibility is becoming standard, enabling faster decision-making and improved forecasting accuracy across industries. Another strong trend is the expansion of embedded finance, projected by Statista to exceed USD 7 trillion in transaction value by 2030, as businesses increasingly integrate payments, lending, and insurance services directly into their digital ecosystems.

Sustainability-linked finance continues to gain momentum, driven by global ESG investments surpassing USD 30 trillion. Organizations are adopting green bonds, climate-risk modeling, and ESG-aligned capital allocation to meet regulatory expectations and investor priorities.

Cyber-risk financing is also emerging as a critical trend as cyberattacks cost the global economy more than USD 10.5 trillion annually (Cybersecurity Ventures), prompting companies to invest in specialized cybersecurity insurance and resilience strategies.

Additionally, Blockchain and tokenization are transforming transaction security and asset management, with tokenized assets expected to reach USD 16 trillion by 2030 (BCG). Collectively, these trends highlight a global shift toward smarter, more resilient, and technology-driven financial ecosystems.

US Market Size

The US Business Interruption Insurance market continues to strengthen as companies face rising operational risks, climate-related disruptions, and cyber threats that impact business continuity. Valued at USD 2.39 billion in 2024, the market reflects growing awareness among enterprises about the financial impact of downtime.

The frequency of extreme weather events in the US has increased significantly, with NOAA reporting 28 separate billion-dollar disasters in 2023, driving higher demand for insurance protection. Businesses across manufacturing, retail, logistics, healthcare, IT services, and hospitality increasingly seek policies that cover income loss, equipment damage, supply chain interruptions, and extended recovery periods.

Looking ahead, the US market is projected to reach USD 4.31 billion by 2034, expanding at a steady 6.07% CAGR. This growth is supported by expanding digitalization across industries, which heightens exposure to cyber incidents and operational outages. According to IBM, the average cost of a US data breach reached USD 9.48 million in 2023, encouraging companies to enhance their insurance portfolios with interruption coverage.

Small and medium enterprises (SMEs) form a substantial demand segment, as they often lack the capital reserves to withstand prolonged shutdowns. With increasing regulatory scrutiny, rising natural catastrophe losses, and a growing focus on resilience planning, the US Business Interruption Insurance market is positioned for sustained long-term expansion.

By Coverage Type

Gross Earnings Coverage holds a 33.8% share and remains the leading coverage type as businesses prioritize protection against lost income during operational disruptions. This segment is widely adopted across manufacturing, retail, logistics, and service-based industries because it covers revenue loss from events such as fire, equipment failure, cyber incidents, and natural disasters.

Companies choose this coverage to safeguard earnings during downtime, ensuring financial stability and uninterrupted payroll obligations. With rising climate-related events, causing over USD 165 billion in economic losses in the US alone in 2022 (NOAA), gross earnings protection has become a fundamental part of corporate risk planning.

Extra Expense Coverage continues to gain traction as organizations focus on maintaining operations during unexpected shutdowns. This includes costs for temporary relocation, renting equipment, or outsourcing production to minimize revenue loss. Industries with high operational dependencies, such as healthcare and financial services, increasingly rely on this coverage to support rapid recovery and continuity.

Contingent Business Interruption Coverage addresses supply chain vulnerabilities, covering losses caused by disruptions at suppliers, distributors, or key partners. This is particularly important as global supply-chain delays surged by 22–25% during recent geopolitical tensions, prompting firms to strengthen insurance protection. Specialized Coverage caters to niche risks such as cyber-induced downtime, utility service interruptions, or pandemic-related closures, reflecting evolving business risk profiles across digital-first industries.

By Enterprise Size

Small and Medium Enterprises hold a 56.9% share, making them the dominant segment in the Business Interruption Insurance Market. This strong adoption is driven by increasing awareness of financial vulnerability during operational disruptions. SMEs often operate with limited cash reserves, making them more susceptible to revenue loss when faced with equipment failures, fire incidents, cyberattacks, or supply chain delays.

According to the US SBA, nearly 40% of small businesses fail to reopen after a major disaster, emphasizing the importance of robust insurance protection. Business interruption coverage helps SMEs manage ongoing expenses such as rent, utilities, and employee salaries while providing financial support during recovery.

The rise in climate-related events and localized disruptions has further accelerated the adoption of income protection solutions among small manufacturers, retailers, restaurants, logistics providers, and service-based companies.

Large Enterprises also maintain a significant presence in the market due to their extensive operational footprint, global supply chain dependencies, and higher exposure to catastrophic losses. These organizations invest in comprehensive business interruption policies that include contingent coverage, cyber-related downtime protection, and specialized risk extensions.

With many large corporations operating across multiple sites and regions, even brief periods of downtime can result in millions of dollars in losses. This compels them to prioritize advanced risk mitigation strategies supported by high-value insurance coverage.

By End User

Retail Stores account for 12.9% of the Business Interruption Insurance Market, reflecting their strong need to protect revenue against unexpected closures, property damage, and supply delays. This segment relies heavily on daily foot traffic and inventory turnover, making even short disruptions financially challenging. Factors such as theft, weather-related shutdowns, and utility outages continue to influence adoption.

With increasing digital integration and omnichannel operations, retail stores also seek protection against IT failures and cyber incidents that affect sales systems and payment networks. Restaurants show rising adoption due to their high dependence on perishable inventory, steady customer flow, and strict health regulations. Losses from equipment breakdowns, fire incidents, or contamination events make interruption coverage essential for stability.

Professional Services, including consulting firms, legal practices, and accounting agencies, require protection against office closures, IT failures, and cybersecurity risks that impact client operations. Manufacturing Plants rely on coverage to manage lost production time, machinery breakdowns, and supply chain disruptions that impact output.

Hospitality Chains increasingly use interruption insurance to manage risks tied to seasonal demand, property damage, and unexpected guest cancellations. Technology Companies focus on safeguarding revenue from outages, cyberattacks, and system downtime.

Healthcare Facilities adopt coverage to handle service disruptions, equipment issues, and emergency-related closures. Educational Institutions and Transportation and Logistics providers also invest in these policies to ensure revenue continuity during operational delays, infrastructure failures, or external disruptions.

By Distribution Channel

Insurance Brokers hold a 53.4% share and remain the dominant distribution channel in the Business Interruption Insurance Market. Their strong position is supported by their ability to provide personalized guidance, negotiate competitive policies, and match businesses with coverage that fits industry-specific risks.

Companies rely on brokers to navigate complex policy structures, evaluate exclusions, and customize coverage for interruptions caused by equipment breakdowns, cyber events, natural disasters, or supply chain failures. Brokers also assist organizations in understanding premium structures, claim documentation, and recovery timelines, which strengthens their influence across small businesses and large enterprises. Their advisory role becomes even more critical as climate-related incidents and cyberattacks continue to increase.

Direct Writers maintains a steady presence, particularly among established companies with long-term insurance relationships. These providers offer streamlined processes and bundled policy options that appeal to organizations seeking comprehensive coverage from a single insurer. Direct writers are preferred by businesses looking for faster policy issuance, integrated support services, and consistent claim-handling experiences.

Online Platforms are expanding rapidly as digital transformation accelerates across the insurance industry. Companies are adopting online tools for policy comparison, real-time premium calculation, and simplified underwriting. The convenience, transparency, and lower administrative costs of digital channels continue to attract small businesses and tech-driven firms looking for quick and accessible coverage solutions.

Key Market Segments

By Coverage Type

- Gross Earnings Coverage

- Extra Expense Coverage

- Contingent Business Interruption

- Specialized Coverage

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End User

- Retail Stores

- Restaurants

- Professional Services

- Manufacturing Plants

- Hospitality Chains

- Technology Companies

- Healthcare Facilities

- Educational Institutions

- Transportation & Logistics

- Others

By Distribution Channel

- Insurance Brokers

- Direct Writers

- Online Platforms

Regional Analysis

North America holds a 36.7% share of the global Business Interruption Insurance Market, making it the leading region driven by high insurance penetration, advanced risk management practices, and growing exposure to climate-related events. The regional market reached USD 5.98 billion in 2024, supported by widespread adoption across industries such as manufacturing, retail, logistics, healthcare, technology, and financial services.

The increasing frequency of extreme weather disruptions, including hurricanes, wildfires, and winter storms, has significantly strengthened corporate demand for income protection and operational recovery solutions. According to NOAA, the US recorded more than 28 billion-dollar disaster events in 2023, which heightened awareness of downtime-related financial losses.

The region also faces rising cyber risks, supply chain interruptions, and labor shortages, compelling businesses to prioritize comprehensive business continuity planning. Strong regulatory frameworks and strict disclosure requirements encourage organizations to integrate business interruption coverage into enterprise risk strategies. Small and medium enterprises across North America show growing interest due to their financial vulnerability and limited reserve capacity during unexpected closures.

Additionally, the expansion of digital infrastructure, cloud-based operations, and e-commerce platforms increases reliance on uninterrupted service delivery, further supporting the region’s market growth. With ongoing investments in resilience planning and evolving risk landscapes, North America is expected to maintain its leadership throughout the forecast period.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Driving factors for the Business Interruption Insurance Market include rising climate-related disruptions, growing cyber threats, and increased supply chain vulnerabilities. NOAA recorded 28 billion-dollar disasters in the US in 2023, significantly driving demand for income protection. The surge in ransomware attacks, costing businesses over USD 20 billion annually, pushes companies to adopt comprehensive coverage for downtime and recovery.

Global supply chain delays increased by nearly 22% during recent geopolitical tensions, prompting organizations to secure policies that protect against losses from supplier failures. Additionally, regulatory pressure on business continuity planning and increasing digital dependency across industries strengthen market adoption.

Restraint Factors

The market faces restraints due to high premium costs, complex policy structures, and lengthy claims processes. Insurance premiums for business interruption coverage have risen by 15 to 25% in high-risk regions due to climate volatility. Many small enterprises avoid coverage because they perceive policies as difficult to interpret, especially regarding exclusions related to pandemics, cyber events, and utility failures.

Long settlement timelines also act as a barrier, with some claims taking 6 to 12 months to resolve, depending on loss documentation and insurer assessments. Limited awareness among SMEs, especially in emerging markets, further restricts adoption. Insurers’ reliance on historical data also poses challenges as modern risks evolve rapidly, often outpacing available actuarial models.

Growth Opportunities

Growth opportunities are emerging from rising digitalization, expanding SME participation, and increasing focus on cyber resilience. The global cyber insurance segment is forecast to surpass USD 60 billion by 2030, creating opportunities for integrated business interruption policies covering cyber-induced downtime.

The growing number of SMEs, which account for 90% of businesses worldwide (World Bank), represents a large untapped market with high vulnerability to disruptions. Climate-resilience initiatives and government disaster recovery programs are encouraging companies to adopt proactive financial protection. Insurtech innovations such as automated claims, parametric insurance, and AI-driven risk assessments are improving customer experience and reducing processing time by up to 40%, supporting wider adoption.

Trending Factors

Key trending factors include the rise of parametric insurance, the expansion of embedded insurance, and increasing reliance on advanced risk analytics. Parametric policies, which trigger payouts based on pre-set conditions like wind speed or earthquake intensity, are growing at 20% annually due to faster settlement times. Embedded insurance is gaining traction, with global embedded premiums projected to reach USD 700 billion by 2030, enabling coverage to be offered directly through digital platforms.

AI-driven financial modeling and digital twins are helping companies simulate disruption scenarios, enhancing risk preparedness. The integration of environmental, social, and governance (ESG) factors into insurance planning is also increasing, with global ESG investments exceeding USD 30 trillion. The rise of remote work and digital operations has further heightened demand for coverage addressing IT failures, cloud outages, and communication breakdowns.

Competitive Analysis

The competitive landscape of the Business Interruption Insurance Market is shaped by global insurers expanding their portfolios, strengthening digital capabilities, and tailoring industry-specific coverage solutions. Leading companies such as Allianz, AXA, Zurich, Chubb, Travelers, and AIG collectively serve millions of commercial clients worldwide, with several reporting annual gross written premiums exceeding USD 40 to 60 billion across property and casualty lines.

Their scale enables them to offer complex business interruption policies, advanced risk-engineering services, and faster claims support. Insurers are investing heavily in digital platforms, with the global insurtech market surpassing USD 5.5 billion in 2023, improving underwriting accuracy and customer experience.

Competition is also intensifying as insurers integrate cyber-related business interruption coverage. Cyber incidents cost global businesses more than USD 10.5 trillion annually (Cybersecurity Ventures), prompting top insurers to launch combined property-cyber interruption products. Mid-sized and regional carriers are differentiating themselves through specialized offerings for SMEs, parametric insurance options, and faster claims processing using automation.

Collaborations between insurers and technology firms are increasing, with AI-driven claim analytics reducing settlement times by up to 40%. With rising climate risks, insurers are also expanding catastrophe modeling capabilities, investing more than USD 2 billion annually in climate analytics to enhance policy pricing and reduce exposure.

Top Key Players in the Market

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- Nationwide

- The Hartford

- Berkshire Hathaway

- FM Global

- Swiss Re

- Munich Re

- Hiscox

- Markel

- Others

Recent Developments

- October 21, 2025: Allianz announced the expansion of its global commercial insurance platform, integrating advanced climate-risk modeling tools that improve business interruption loss prediction accuracy by over 35% for high-exposure sectors such as manufacturing and logistics.

- October 10, 2025: Zurich Insurance Group launched its unified Business Resilience Suite, a digital platform that combines real-time supply chain monitoring, cyber-risk alerts, and automated claims initiation, reducing business interruption claim processing time by nearly 30% across early adopters.

- September 28, 2025: Chubb introduced a new parametric business interruption product for mid-market enterprises, offering instant payouts triggered by predefined natural disaster thresholds, with pilot programs showing settlement completion in under 48 hours.

Report Scope

Report Features Description Market Value (2024) USD 16.3 Billion Forecast Revenue (2034) USD 32.4 Billion CAGR(2025-2034) 7.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Coverage Type (Gross Earnings Coverage, Extra Expense Coverage, Contingent Business Interruption, Specialized Coverage), By End-User (Small & Medium Enterprises, Large Enterprises), By End User (Retail Stores, Restaurants, Professional Services, Manufacturing Plants, Hospitality Chains, Technology Companies, Healthcare Facilities, Educational Institutions, Transportation & Logistics, Others), By Distribution Channel (Insurance Brokers, Direct Writers, Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, Zurich Insurance Group, Chubb, AXA XL, AIG, Liberty Mutual, Travelers, Nationwide, The Hartford, Berkshire Hathaway, FM Global, Swiss Re, Munich Re, Hiscox, Markel, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Business Interruption Insurance MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Business Interruption Insurance MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- Nationwide

- The Hartford

- Berkshire Hathaway

- FM Global

- Swiss Re

- Munich Re

- Hiscox

- Markel

- Others