Global Building and Construction Plastics Market By Product Type (Polyvinyl Chloride, Polystyrene, and Other Product Types), By Application (Roofing, Insulation, Pipes & Ducts, Wall Coverings, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2024

- Report ID: 13055

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

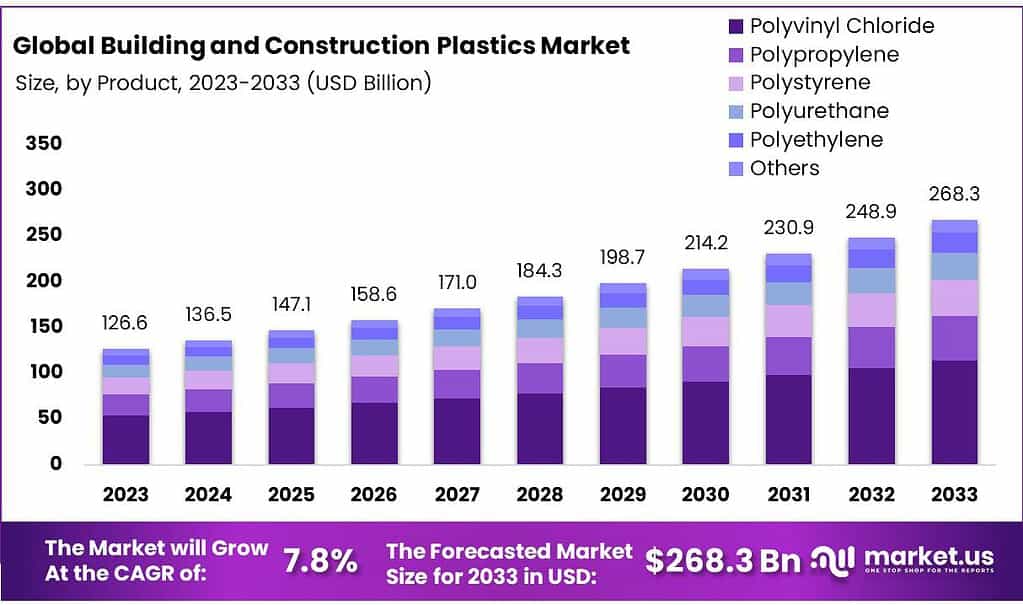

The Building and Construction Plastics Market size is expected to be worth around USD 268.3 billion by 2033, from USD 126.6 Bn in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2033.

The market has been boosted by increasing population and urbanization around the world. The market will also benefit from government initiatives to improve its building structure.

There are significant technological and material improvements in the market to lower production costs and improve infrastructure. The government’s integrated initiatives to encourage foreign investment and introduce green building projects are expected to boost the growth of Asia Pacific’s market.

Key Takeaways

- Projected Growth: The market is set to grow from USD 126.6 billion in 2023 to USD 268.3 billion by 2033, with a CAGR of 7.8%.

- PVC Leadership: Dominating the market, PVC holds a 42.6% share in 2023, valued for its versatility and durability in the construction industry.

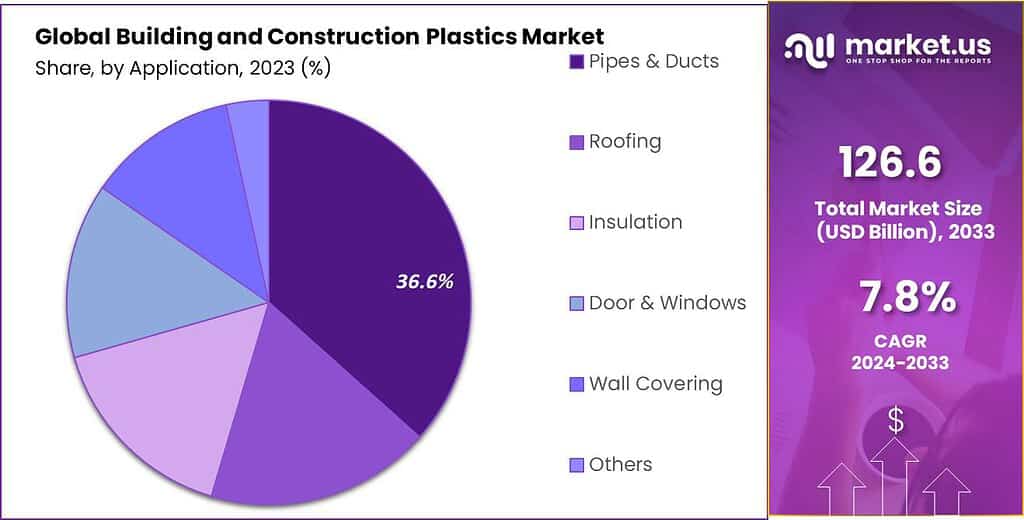

- Main Application: Pipes & Ducts lead with a 36.4% share in 2023, showcasing the preference for plastic in essential construction infrastructure.

- Residential Focus: Over 58.7% of the market is driven by the Residential sector, highlighting the significant demand for plastics in home construction.

- Asia Pacific Dominance: Leading the market with a 41.2% share in 2023, APAC’s rapid urbanization and infrastructure investment drive significant demand.

Product Type Analysis

Various product segments play distinctive roles in the dynamic landscape of the Building and Construction Plastics Market. In 2023, Polyvinyl Chloride (PVC) emerged as a frontrunner, securing a dominant market position by capturing more than a 42.6% share.

This signifies a robust presence in the industry, underscoring PVC’s widespread use and preference within the construction sector. Polyvinyl Chloride, known for its versatility and durability, continues to be a go-to choice for construction applications.

Its excellent properties, including resistance to chemicals, weatherability, and cost-effectiveness, contribute to its substantial market share. PVC finds extensive utilization in various construction components such as pipes, window profiles, flooring, and cables, making it a cornerstone in the building and construction plastics segment.

This market dominance of Polyvinyl Chloride indicates the industry’s reliance on this material for fulfilling diverse construction needs. However, the market dynamics may evolve, influenced by factors such as technological advancements, regulatory changes, and shifting preferences within the construction sector.

Understanding the market landscape is crucial for stakeholders to navigate challenges and capitalize on emerging opportunities in the dynamic Building and Construction Plastics Market.

Application Analysis

In the Building and Construction Plastics Market, different applications play pivotal roles in shaping the industry landscape. As of 2023, Pipes & Ducts emerged as a dominant force, securing a substantial market position by capturing more than a 36.4% share. This indicates a significant preference for plastic materials in the construction of pipes and ducts, showcasing their vital role in the sector.

The dominance of Pipes & Ducts is reflective of the versatility and efficiency that plastic materials bring to these applications.

Plastic pipes, renowned for their durability, corrosion resistance, and cost-effectiveness, have become integral components in various construction projects. Whether used for plumbing, drainage, or HVAC systems, plastic pipes offer advantages that contribute to their widespread adoption and market leadership.

The market dynamics within the Building and Construction Plastics sector are subject to changes influenced by factors such as technological innovations, evolving construction practices, and regulatory considerations.

While Pipes & Ducts currently hold a prominent position, the industry’s landscape may witness shifts over time as other applications gain traction based on emerging trends and demands within the construction market. Staying attuned to these dynamics is crucial for industry participants to adapt to changing preferences and seize opportunities in this dynamic market.

By End-Use

In 2023, the Residential segment took center stage in the Building and Construction Plastics Market, securing a dominant market position by capturing more than an impressive 58.7% share. This indicates that residential construction activities played a pivotal role in driving the demand for plastic materials within the industry during that period.

The significant market share held by the Residential segment underscores the widespread use of plastics in various aspects of home construction and improvement. From pipes and ducts to insulation, doors, windows, and other essential components, plastics have become integral to residential construction projects. The versatility, durability, and cost-effectiveness of plastics make them a preferred choice for addressing diverse needs in residential buildings.

In the Residential segment, plastics find application in a range of areas, contributing to the construction of modern and energy-efficient homes. The use of plastic materials in residential projects aligns with the evolving trends in construction practices, emphasizing sustainability, innovation, and affordability.

As the demand for housing continues to grow globally, the dominance of the Residential segment in the Building and Construction Plastics Market reflects the crucial role that plastics play in shaping the landscape of residential construction. The industry’s reliance on plastics in this segment is a testament to the material’s adaptability and suitability for meeting the evolving needs of homeowners and builders alike.

Kеу Маrkеt Ѕеgmеntѕ

By Product Type

- Polyvinyl Chloride

- Polystyrene

- Polyethylene

- Polyurethanes

- Other Product Types

By Application

- Pipes & Ducts

- Roofing

- Wall Coverings

- Insulation

- Other Applications

By End-Use

- Residential

- Commercial

- Industrial

Drivers

The Building and Construction Plastics Market is propelled by several robust drivers that underscore the indispensability of plastics in the construction sector. One pivotal factor is the inherent versatility of plastic materials, allowing them to be molded into diverse forms, thereby providing flexibility in design and construction. This adaptability is evident across applications, from pipes and roofing to insulation and windows, showcasing the multifaceted nature of plastics in addressing construction needs.

Another driving force is the durability and longevity exhibited by plastics. Their resistance to corrosion, weathering, and decay makes them enduring solutions for various applications, ensuring their sustained use over extended periods. This durability contributes to the reliability and longevity of construction projects, reinforcing the prominence of plastics in the industry.

Cost-effectiveness remains a compelling driver for the adoption of plastics in construction. Offering economical solutions without compromising performance, plastics present a competitive advantage, appealing to builders, contractors, and project developers seeking efficient and budget-friendly alternatives to traditional materials. Plastics contribute significantly to the trend of lightweight construction materials.

Their relatively low weight simplifies transportation, handling, and installation processes, resulting in reduced overall construction costs. This characteristic aligns with the growing preference for efficient and sustainable construction practices.

The energy efficiency and insulation properties of certain plastic materials, such as polyurethane and polystyrene, drive their use in insulation applications. As the construction industry increasingly emphasizes energy-efficient buildings, plastics play a pivotal role in meeting sustainability goals and regulatory requirements.

Ongoing innovation in plastic technologies stands out as a driving force, with advances in polymer science and manufacturing processes contributing to the development of high-performance plastics. These innovations yield materials with enhanced properties, meeting the evolving demands of the construction sector for modern, resilient, and sustainable solutions.

The ease of installation and maintenance offered by plastics is another key driver. Their simplicity in working with these materials translates into faster construction timelines and lower labor costs, appealing to both builders and project owners seeking efficient and cost-effective construction solutions.

Regulatory support for sustainable construction practices enhances the adoption of plastics. Many plastic materials align with green building standards, and regulatory incentives for sustainable construction contribute to their increased use in eco-friendly building projects.

Plastics’ customization and design flexibility also drive their incorporation into architectural elements. These materials enable innovative designs and aesthetic flexibility, empowering architects and designers to explore creative solutions in building construction.

Global trends in urbanization and construction activity significantly influence the demand for building and construction plastics. As urban populations continue to grow, the need for efficient, cost-effective, and sustainable construction materials becomes increasingly crucial, positioning plastics as key contributors to meeting these evolving demands.

Understanding these drivers is essential for stakeholders to navigate the market effectively and harness the growth opportunities within the Building and Construction Plastics Market.

Restraints

The Building and Construction Plastics Market has challenges that need careful attention for sustainable growth. One big challenge is about the environment and being sustainable. Some plastics have limited recycling, and this raises concerns about their impact on the environment. Strict rules and regulations about plastic waste and the environment make it hard for the industry to adopt sustainable practices.

Following rules and meeting standards is another challenge. There are always new rules about how materials should be made, how safe they are, and how they affect the environment. This can make production more expensive and put limits on the market. Finding a balance between following rules and keeping costs down is crucial. Fire resistance is a worry, especially for certain plastics used in construction.

Meeting high safety standards for fire is difficult for these materials, making it challenging to use them in important building parts where fire safety is crucial. Public opinion is a big challenge too. Many people worry about how plastics harm the environment and don’t break down. This can influence the choices of people who decide what materials to use, affecting the market.

Questions about how long certain plastics last and how well they perform are challenges. People want to know if these materials will stay strong, especially in tough conditions or bad weather. Building confidence in the reliability of plastic applications is important. The industry relying on petrochemicals is a problem. Prices of these materials can change a lot, affecting how much it costs to make plastic.

Finding ways to deal with these changes is important for keeping things stable. Other materials competing with plastics is a big challenge. Some materials are more eco-friendly, like sustainable composites or bio-based materials. This competition may take customers away from plastic, so the industry needs to be ready to adapt and come up with new ideas.

Recycling plastics can be complicated. Some plastics are hard to recycle, making it challenging to achieve goals for reusing materials and being more environmentally friendly. Simplifying recycling and making plastics easier to recycle are important for managing waste better and being more sustainable.

Aesthetic limitations in certain plastic materials represent a restraint, particularly in applications where visual appeal is critical. The restricted range of textures and finishes compared to traditional materials may limit the use of plastics in specific architectural and design-oriented projects. Concerns about potential material devaluation due to market saturation and oversupply add a layer of uncertainty.

A careful balance between production and demand growth is necessary to prevent a decrease in material value, ensuring the continued profitability of businesses within the Building and Construction Plastics Market. Addressing these restraints requires a collaborative effort from industry stakeholders, including manufacturers, regulators, and consumers, to foster sustainable practices, innovation, and adaptability in the evolving landscape of building and construction plastics.

Opportunities

The Building and Construction Plastics Market has great chances to grow. One big opportunity is creating new and better materials that are good for the environment. Making plastics that can be recycled more easily and break down naturally aligns with the industry’s goal to be more eco-friendly. Dealing with the challenge of fire resistance is also a chance for progress.

If the industry invests in new technologies to make plastics better at resisting fire, it opens up more uses for them in important parts of buildings where safety is crucial. Educational campaigns are a smart way to change how people think.

By telling the public about the good things happening with plastics, like being more eco-friendly and used responsibly, these campaigns can help people see plastics in a positive light. This can make a big difference in how people choose materials for proje Emphasizing the long-term durability and performance of plastics provides another opportunity.

Research initiatives aimed at addressing concerns about the lifespan of plastic components in challenging conditions can instill confidence in their reliability. This, in turn, fosters greater acceptance of plastics in construction projects where longevity is a critical consideration. Diversifying raw material sources beyond petrochemicals is a resilience opportunity for the industry.

Exploring alternative raw materials, such as bio-based sources, can reduce dependency on fluctuating petrochemical prices and enhance adaptability to economic uncertainties. This diversification contributes to the industry’s sustainability and stability.

Collaborative efforts for circular economy practices offer significant opportunities. Establishing partnerships within the industry and with recycling facilities can lead to effective waste management solutions. This not only aligns with sustainability goals but also contributes to the realization of a circular economy, where plastics are recycled and reused efficiently.

Innovations in design solutions present opportunities to enhance the aesthetic appeal of plastics. Investing in research and development to expand the range of textures, finishes, and visual options for plastic materials can increase their suitability for architectural and design-oriented projects. This enhances the market appeal of plastics in diverse construction applications.

The integration of smart technologies into plastic materials is a forward-looking opportunity. Smart plastics equipped with sensors and monitoring capabilities can add functionality to building components. This innovation contributes to the creation of intelligent and responsive structures, aligning with the trend of smart and sustainable construction practices.

The adoption of modular construction practices represents an opportunity for plastics. Designing plastic components that align with modular construction can streamline processes, reduce costs, and enhance efficiency. This opportunity allows plastics to play a crucial role in the growing trend of modular construction.

Exploring emerging markets globally presents opportunities for market expansion. As construction activities rise in emerging economies, tapping into these markets can open new avenues for the use of plastic materials in diverse construction projects.

This geographical diversification contributes to the industry’s growth and resilience. By seizing these opportunities, the Building and Construction Plastics Market can navigate challenges, foster innovation, and contribute to the evolution of sustainable and resilient practices within the industry.

Challenges

The Building and Construction Plastics Market faces a spectrum of challenges that necessitate careful consideration for sustainable growth. A pivotal concern is the industry’s environmental footprint and its commitment to sustainability. The limited recyclability of certain plastics raises questions about their long-term impact on the environment, urging the industry to adopt more eco-friendly practices and explore sustainable alternatives.

Regulatory compliance stands as a formidable challenge, with the industry grappling to keep pace with ever-evolving standards. Adapting to changing regulations, particularly those related to material specifications, safety standards, and environmental considerations, requires a delicate balance between compliance and cost-effectiveness. The industry’s ability to navigate this regulatory landscape will shape its future trajectory.

Fire resistance limitations pose a critical challenge, especially when considering the stringent safety standards for construction materials. Innovations in technologies that enhance the fire resistance of plastics are essential to broaden their applications and overcome this hurdle. Overcoming negative public perceptions is another challenge, with concerns about plastic pollution influencing public opinion.

Educational campaigns that highlight responsible plastic use and showcase industry initiatives are vital for changing these perceptions. Questions surrounding the long-term durability and performance of plastics in diverse conditions present challenges that demand innovative solutions.

Building trust in the reliability of plastic components, particularly in challenging environments, is crucial for wider acceptance in construction projects. The industry’s dependency on petrochemicals adds a layer of vulnerability, requiring strategies to mitigate the impact of fluctuating petrochemical prices and exploring alternative raw material sources.

Competition from alternative materials, such as sustainable composites and bio-based options, introduces a competitive dynamic that necessitates adaptation and innovation. Striking a balance between maintaining the appeal of plastics and addressing aesthetic limitations is crucial for certain applications, particularly in architectural and design-oriented projects.

Streamlining recycling processes to achieve circular economy goals and simplifying the recyclability of plastics are practical challenges that require industry-wide collaboration. The potential for material devaluation due to market saturation and oversupply underscores the importance of strategic planning and market demand forecasting.

Sustainable growth will depend on the industry’s ability to address these challenges proactively, fostering innovation, and embracing environmentally responsible practices. By navigating these complexities, the Building and Construction Plastics Market can position itself for resilient and sustainable development in the construction industry.

Regional Analysis

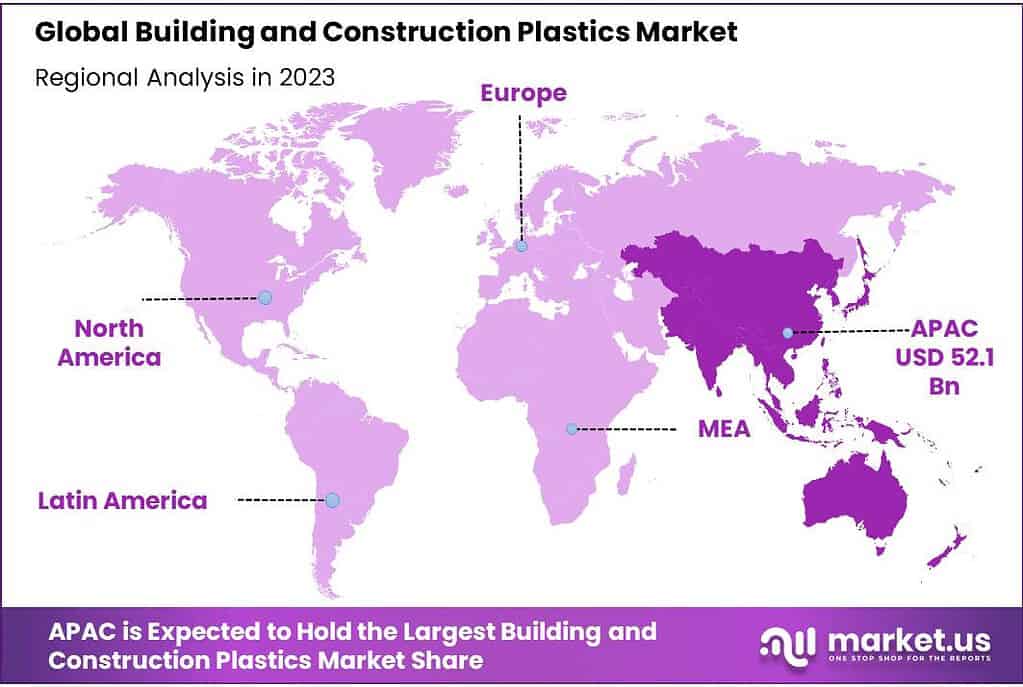

Asia Pacific (APAC) had the largest revenue share at over 41.2% in 2023. Due to rapid urbanization and increasing population, it is expected that infrastructure spending will increase over the next few years.

North America is a key market for construction and plastics. The market will be driven by the expansion of the construction industry in the U.S. and Canada. The forecast period will see a rise in the demand for old buildings being renovated. This is expected to boost the market’s growth. In North America, trade associations such as the Plastics Industry Association and the National Association of Plastic Industries are launching initiatives to promote the development and growth of plastics and their end applications.

Rising demand from Brazil, Chile, and other countries in South America drives the growth of Central and South America. With the increasing population, the demand for construction is on the rise. The product will be in high demand due to government investments in infrastructure and the rising demand for commercial buildings.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Global markets are highly competitive due to the presence of many multinationals as well as local manufacturers. To meet the rising demand in emerging markets, companies invest significant amounts of capital. They also participate in acquisitions and mergers of top manufacturers from emerging countries. Companies are also involved with extensive research and development.

The market’s key players include Borealis AG and BASF SE. These companies have established manufacturing facilities worldwide and have an extensive distribution channel to expand their global reach.

Маrkеt Kеу Рlауеrѕ

- BASF SE

- Chevron Phillips Chemical Company, LLC

- DowDuPont Inc.

- Koninklijke DSM N.V

- INEOS Group Holdings S.A.

- Lanxess Aktiengesellschaft

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- SABIC

- Solvay S.A.

- Other Key Players

Recent Development

- 2023 LyondellBasell: Partnered with Borealis to launch Circuler™ PP Black, a recycled polypropylene specifically designed for construction applications.

- 2023 BASF: Introduced its first CO2-reduced polyurethanes, aiming to achieve net-zero emissions by 2050.

- 2023 DuPont de Nemours: Launched Zytel® HTN22G, a high-performance nylon resin for demanding construction components.

- 2023 Honeywell Performance Materials: Unveiled Solstice® Z, a bio-based polyamide offering a lower carbon footprint for building materials.

Report Scope

Report Features Description Market Value (2022) USD 100 Mn Forecast Revenue (2032) USD 341 Mn CAGR (2023-2032) 13.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type(Polyvinyl Chloride, Polystyrene, Polyethylene, Polyurethanes, Other Product Types), By Application(Pipes & Ducts, Roofing, Wall Coverings, Insulation, Other Applications), By End-Use(Residential, Commercial, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape BASF SE, Dow Inc., SABIC , ExxonMobil Corporation, LyondellBasell Industries, Ineos Group, Solvay SA, Lanxess AG, Arkema Group, Borealis AG, Covestro AG, Formosa Plastics Corporation, TotalEnergies, Mitsubishi Chemical Corporation, Reliance Industries Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is the size of Building and Construction Plastics Market?Building and Construction Plastics Market size is expected to be worth around USD 268.3 billion by 2033, from USD 126.6 Bn in 2023

What is the CAGR for the Building and Construction Plastics Market?The Building and Construction Plastics Market is expected to grow at a CAGR of 7.8% during 2023-2033.

Who are the key companies/players in the Building and Construction Plastics Market?BASF SE, Dow Inc., SABIC , ExxonMobil Corporation, LyondellBasell Industries, Ineos Group, Solvay SA, Lanxess AG, Arkema Group, Borealis AG, Covestro AG, Formosa Plastics Corporation, TotalEnergies, Mitsubishi Chemical Corporation, Reliance Industries Limited

Building and Construction Plastics MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Building and Construction Plastics MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Chevron Phillips Chemical Company, LLC

- DowDuPont Inc.

- Koninklijke DSM N.V

- INEOS Group Holdings S.A.

- Lanxess Aktiengesellschaft

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- SABIC

- Solvay S.A.

- Other Key Players