Global Bubble Wrap Machine Market Size, Share, Industry Analysis Report By Product By Machine Type(Automatic, Manual), By Orientation(Horizontal, Vertical), By End-Use(Manufacturing & Warehousing, Pharmaceuticals, Electronics & Electricals, Automotive & Allied Industries, Food & Beverage, Cosmetics & Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165985

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

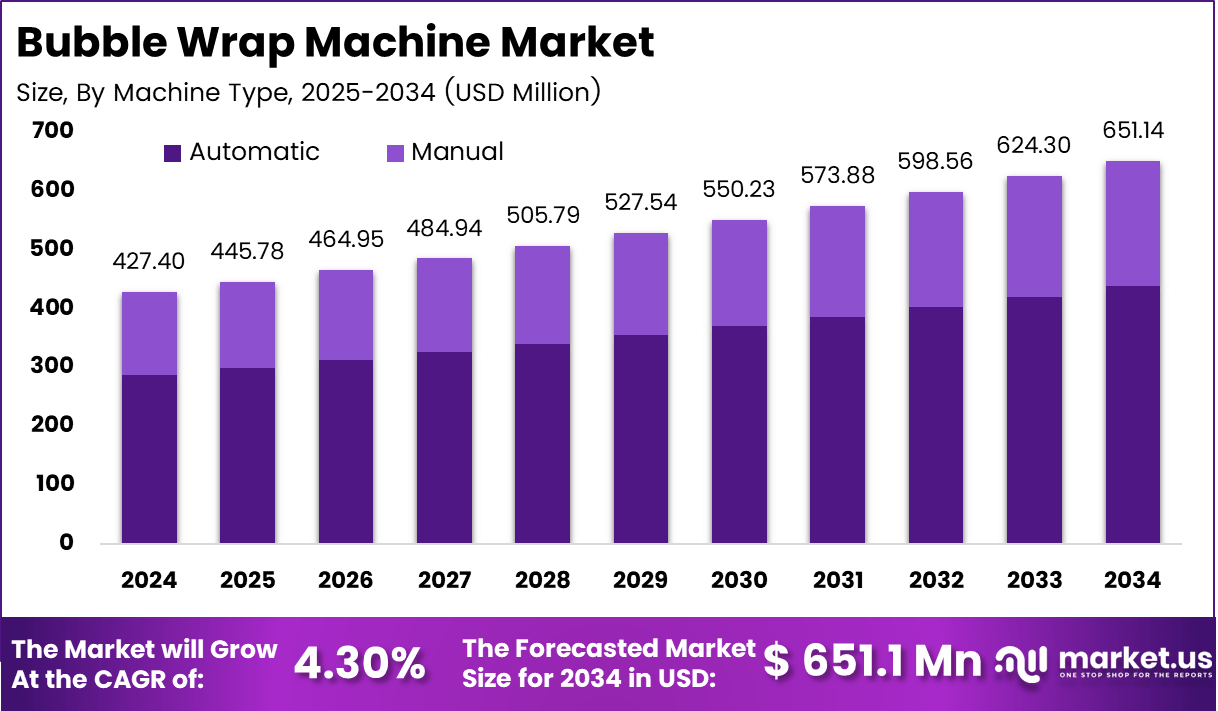

The Global Bubble Wrap Machine market is poised for significant growth, driven by increasing demand for protective packaging across diverse industries. The Bubble Wrap Machine market size is valued at USD 427.4 Million in 2024 and is forecasted to reach USD 651.1 Million by 2034, expanding at a robust Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2034.

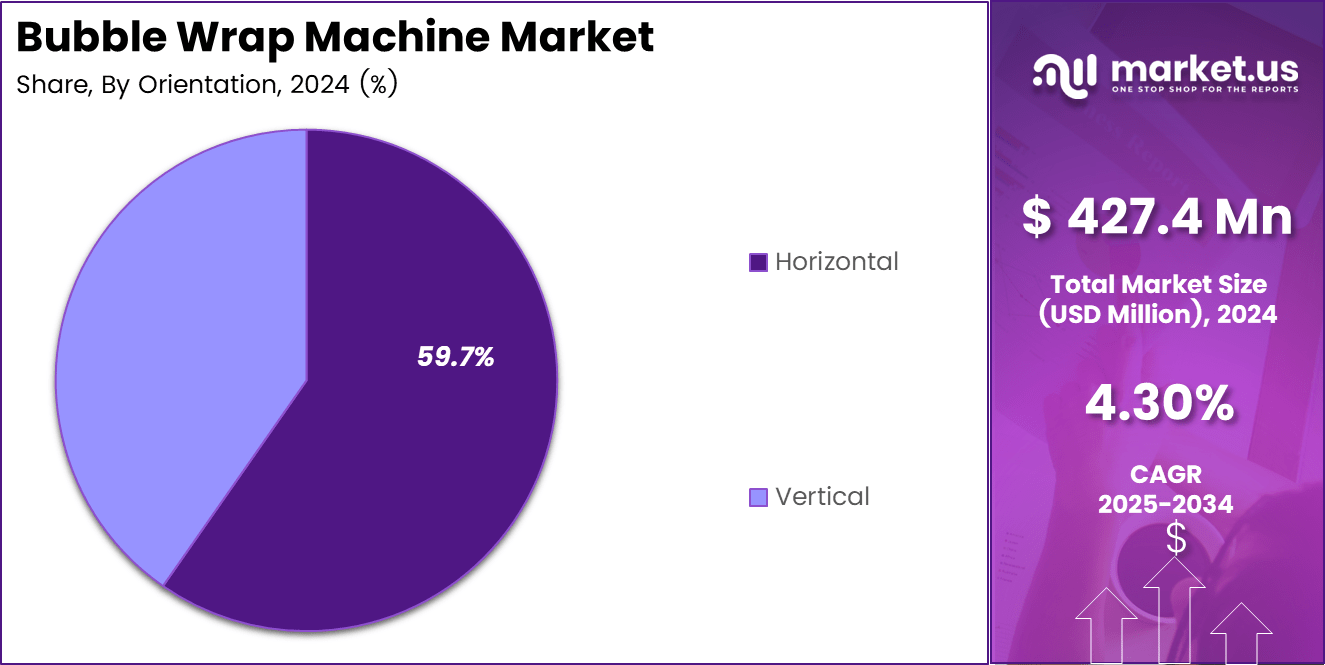

Analysis by orientation shows that the Horizontal machine type currently dominates the market, capturing a significant 59.7% share in 2024. While the market is segmented into Automatic and Manual machine types, both are contributing to the overall expansion.

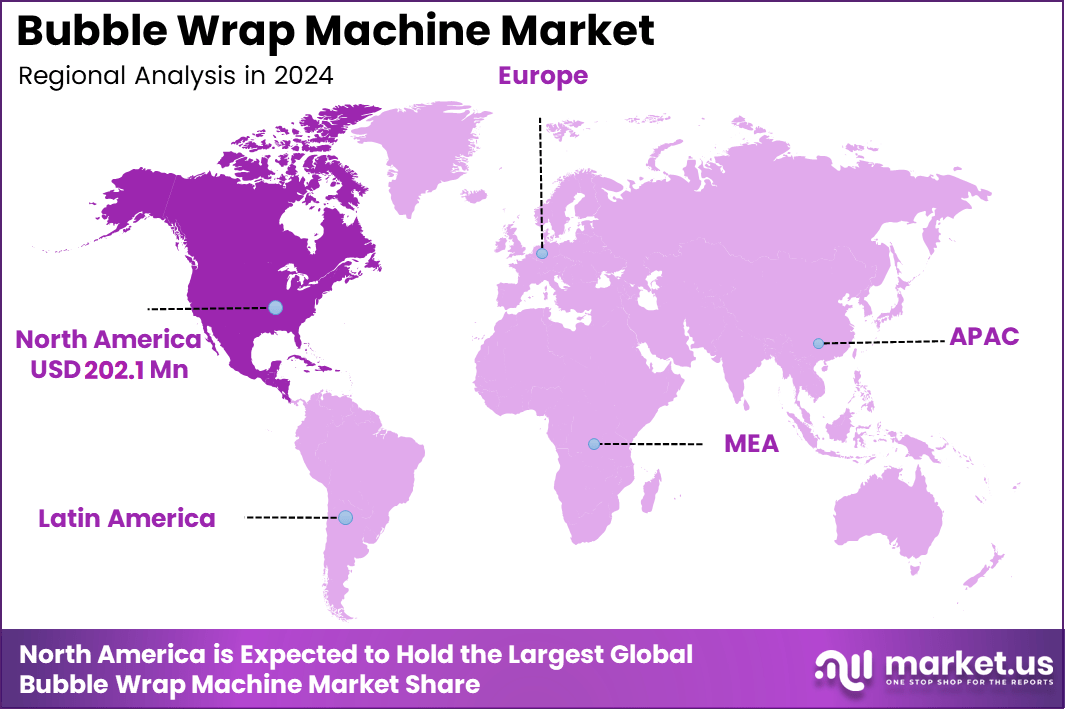

Geographically, North America is a key region, holding a substantial market share 47.30% valued at USD 202.1 Million and is expected to retain its position as the largest global Bubble Wrap Machine market contributor, followed by regions like Europe, APAC, Latin America, and MEA.

The expanding end-use industries, including Manufacturing & Warehousing, Pharmaceuticals, and E-commerce, are the primary catalysts for this steady market progression.

A Bubble Wrap Machine, or air bubble film machine, is industrial equipment designed to manufacture continuous rolls of bubble a crucial protective packaging material. These machines operate by extruding and laminating two layers of polyethylene film. The core process involves forming air-filled domes on one film layer using a specialized vacuum roller, and then sealing a second, flat film layer over the top to trap the air and create the signature cushioning bubbles.

The primary benefit for businesses is the ability to produce protective packaging material on demand, which reduces the cost of purchasing pre-made bubble wrap and minimizes storage space. Modern machines are highly automated, offering features like adjustable bubble sizes, multi-layer film production for enhanced protection, and compatibility with eco-friendly, recyclable, or biodegradable plastic films. They are essential across logistics, e-commerce, electronics, and manufacturing industries to prevent product damage during transit.

Key Takeaways

- The global Bubble Wrap Machine market demonstrates steady expansion, rising from USD 427.4 million in 2024 to an estimated USD 651.1 million by 2034, supported by automation upgrades and packaging volume growth.

- Automatic bubble wrap machines remain the dominant machine-type segment, holding 67.2% share, driven by higher speed, labor savings, and adoption in large production environments.

- Horizontal orientation systems account for the largest orientation share at 59.7%, supported by their suitability for high-throughput packaging workflows.

- Manufacturing & Warehousing emerges as the top end-use category with 32.8% market contribution, reflecting rising industrial packaging needs across electronics, automotive components, and bulk goods.

- North America leads the global demand with a 47.30% share, valued at USD 202.1 Million in 2024, benefiting from strong e-commerce penetration, mature logistics operations, and ongoing automation investments.

- Leading companies such as Sealed Air and Pregis continue prioritizing automation-focused designs, faster inflation technology, and energy-efficient machine innovations to strengthen competitiveness.

Analysts Viewpoint

The Bubble Wrap Machine Market is expected to expand steadily as industries shift toward faster, automated, and cost-efficient protective packaging solutions. Analysts observe that rising e-commerce shipments, rapid fulfillment expectations, and global manufacturing expansion continue to shape demand. Companies are investing in compact, energy-efficient, and high-output machines to manage the increasing volume of fragile goods transported across borders.

The market also benefits from the global rise in contract packaging facilities and the need for consistent, customizable cushioning materials. North America and Europe remain strong adoption regions, but emerging APAC economies offer the fastest growth potential due to industrialization and export-oriented manufacturing.

Automatic machines and horizontal systems show strong dominance, reflecting the operational push for higher productivity. Overall, the market is anticipated to maintain stable double-digit growth potential over the long term, supported by packaging automation, sustainability considerations, and advancements in bubble inflation efficiency and material use.

Emerging Trends

Emerging trends in the Bubble Wrap Machine Market are shaped by automation, sustainability, and smart packaging technologies. One of the strongest shifts is the demand for eco-friendly bubble films, including recyclable, biodegradable, and reduced-plastic formulations, pushing manufacturers to redesign machines for better material compatibility. Another key trend is the adoption of IoT-enabled systems that track machine performance, film usage, and maintenance needs in real time, helping large warehouses avoid downtime.

E-commerce expansion continues to influence machine design, leading to compact, high-output models that support on-demand bubble production directly at fulfillment stations. Integration with conveyor systems and automated packing lines is becoming a standard requirement as companies aim for faster throughput.

There is also a growing trend toward energy-efficient heating elements, lowering operational costs. Additionally, customizable bubble sizes and multi-layer cushioning capabilities are gaining importance as industries seek packaging tailored to fragile and high-value goods.

Growth Factors

Growth in the Bubble Wrap Machine Market is strongly influenced by the rapid expansion of global e-commerce, which contributes to nearly 38–42% of new machine installations each year as fulfillment centers automate packaging lines.

Industrial manufacturing accounts for another 30–34% of overall demand, driven by rising shipments of electronics, automotive components, and fragile goods requiring consistent cushioning. Sustainability-focused upgrades are shaping about 25–28% of purchasing decisions, with companies shifting toward recyclable and reduced-plastic films.

Automation adoption is accelerating fast—nearly 45–50% of medium and large warehouses now prefer fully automatic systems to reduce labor expenses and improve output quality. Demand from APAC’s manufacturing sector is rising at 12–15% annually as exports grow. Additionally, the shift toward on-demand packaging at warehouses reduces storage volume by 20–25%, encouraging more businesses to invest in bubble wrap machines. These combined factors create a strong foundation for long-term market expansion.

Regional Analysis

The North America region dominates with a share of 47.30%, Valued at USD 202.1 million, driven by large fulfillment centers and industrial packaging operations. Europe follows with steady demand from automotive, electronics, and pharmaceutical sectors that require consistent protective packaging standards. Asia-Pacific (APAC) emerges as the fastest-growing region, supported by rapid industrialization in China, India, Vietnam, and Indonesia, where export-oriented manufacturing boosts machine installations.

The regional outlook for the Bubble Wrap Machine Market in 2024 shows clear dominance from North America, supported by strong e-commerce penetration, mature logistics networks, and high adoption of automated packaging systems.

Latin America shows rising adoption as retail and cross-border e-commerce expand gradually, while local manufacturers upgrade to cost-efficient automation. Middle East & Africa (MEA) experiences moderate growth, driven by increasing warehousing activity and the expansion of logistics hubs in Gulf countries. Overall, North America remains the global leader, while APAC offers the strongest long-term growth potential.

Machine Type Analysis

Automatic leads 67.2% dominate this market as manufacturers across sectors are expected to prefer equipment that improves throughput, lowers human error, and maintains consistent packaging quality. Automated systems are anticipated to remain essential in high-volume environments where demand for faster cycle times continues to rise. Their integration with sensors, servo controls, and PLC-based architecture is projected to support real-time adjustments, ensuring uniform bubble-wrap output even under fluctuating material conditions.

The drive toward minimizing operational costs is likely to push companies to invest in machines that reduce labor dependence and manual rework. In sectors such as e-commerce, electronics, and pharmaceuticals, the pressure for precise product cushioning is expected to elevate preference for advanced automation.

Additionally, governments emphasizing industrial modernization and workplace safety are expected to encourage factories to upgrade legacy systems with safer enclosed automatic units. These capabilities collectively position automatic machines as the priority choice for operational reliability and long-term cost efficiency.

Orientation Analysis

Horizontal leads 59.7% leads due to its expected advantage in handling continuous sheet production with fewer interruptions. The horizontal layout is anticipated to optimize roll feeding, air-injection uniformity, and sealing stability, making it suitable for producing large volumes of standard bubble-wrap material. Manufacturers relying on packaging consistency for fragile goods likely to prefer this orientation because it reduces wrinkling, uneven bubble formation, and sheet distortion.

The design is also projected to support easier inspection and maintenance, resulting in reduced downtime across production cycles. As expanding online retail and warehouse operations require bulk protective packaging, the demand for stable horizontal machines is expected to increase. Their ability to operate at higher speeds without compromising bubble integrity is likely to remain a competitive differentiator. Additionally, manufacturers focusing on space-optimized layouts are expected to choose horizontal models that fit into linear production lines, supporting smooth material flow and efficient labor allocation.

End-Use Analysis

Manufacturing & Warehousing leads 32.8% emerges as the leading end-use segment due to increasing needs for safe transport, bulk movement, and efficient storage of sensitive goods. This segment is expected to strengthen as factories optimize packaging to prevent damage during internal handling and long-distance logistics. The rising movement of semi-finished components between facilities is anticipated to fuel greater use of bubble-wrap machinery for in-house protective packaging.

Warehousing operations are projected to adopt higher volumes of bubble wrap to safeguard inventory stored for extended durations, particularly within electronics, spare parts, and pharmaceuticals. Growing supply-chain modernization, encouraging warehouses to maintain standardized cushioning materials also likely to contribute to this share.

With manufacturers increasingly prioritizing quality assurance and damage-reduction metrics, protective packaging consumption is expected to rise steadily. This environment positions manufacturing and warehousing users as consistent buyers of bubble-wrap machines to maintain disruption-free product flow and minimize replacement losses.

Key Market Segments

By Machine Type

- Automatic

- Manual

By Orientation

- Horizontal

- Vertical

By End-Use

- Manufacturing & Warehousing

- Pharmaceuticals

- Electronics & Electricals

- Automotive & Allied Industries

- Food & Beverage

- Cosmetics & Personal Care

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

A major driver for the Bubble Wrap Machine Market is the rapid acceleration of global e-commerce and third-party logistics networks. With millions of parcels shipped daily, manufacturers and warehouses need high-speed cushioning solutions to protect goods in transit.

Automatic bubble wrap machines help reduce labor dependency, ensure consistent quality, and support round-the-clock operations. Growth in electronics, automotive components, pharmaceuticals, and consumer goods manufacturing further boosts machine installations, as these sectors require high-precision protective packaging to prevent product damage.

Increasing pressure to reduce breakage costs and returns is prompting companies to adopt on-site bubble wrap production instead of buying bulky rolls. Additionally, sustainability efforts are encouraging lightweight packaging with improved recyclability.

Many machines now support thinner yet stronger bubble films, reducing material consumption. The ongoing expansion of export-oriented industries in APAC and Latin America also contributes significantly to machine demand, driven by global shipping and cross-border trade volumes.

Restraints

Despite strong growth, the market faces restraints linked to sustainability regulations and rising scrutiny of plastic packaging materials. Many countries are introducing restrictions on single-use plastics, prompting businesses to reconsider bubble wrap usage or shift toward eco-friendly alternatives. While recyclable and biodegradable films exist, they are costlier and limit machine compatibility, slowing adoption. High initial investment costs also present a restraint, particularly for small manufacturing units and warehouses that rely on manual packaging.

Maintenance and operational expenses, including energy consumption and spare parts, add further burden. Fluctuations in polymer prices impact production costs, which may reduce purchasing willingness in cost-sensitive industries. Additionally, the presence of low-cost manual inflation systems in emerging markets reduces the penetration of advanced machines. A limited skilled workforce for operating and maintaining high-speed systems also delays expansion, especially in developing regions where automation adoption remains slower compared to North America and Europe.

Opportunities

Significant opportunities exist in developing sustainable bubble wrap machines capable of producing recyclable, biodegradable, or compostable cushioning materials. Manufacturers investing in greener films and compatible machine upgrades can capture rising demand from environmentally conscious brands. Another opportunity lies in the growing shift toward on-demand packaging in e-commerce fulfillment centers and hyperlocal delivery hubs.

Machines that produce bubble cushioning directly at the point of packing reduce storage volume, transport costs, and waste. Rapid expansion of APAC manufacturing presents large-scale installation opportunities, notably in electronics, textiles, and industrial components. Technological upgrades such as IoT-enabled monitoring, predictive maintenance, and energy-efficient heating systems create new product differentiation avenues.

Contract packaging firms are increasing their capacities, offering machine suppliers steady, recurring demand. Additionally, small and mid-sized businesses adopting compact tabletop bubble wrap systems represent an expanding customer base for lower-cost machine models with high operational value.

Challenges

One of the major challenges is aligning bubble wrap machine technology with evolving sustainability requirements without increasing operational cost. Manufacturers must develop systems compatible with recycled or biodegradable films, which often behave differently from conventional plastics, requiring design upgrades that raise production costs. Another challenge is the intense competition from alternative protective packaging formats such as molded pulp, paper cushioning, and air pillow systems, which appeal to brands seeking eco-friendly branding.

Machine downtime, maintenance complexity, and the need for skilled technicians impact operational efficiency, especially in high-volume warehouses. In developing regions, low awareness and limited automation budgets restrict market penetration. Supply chain disruptions due to polymer shortages also challenge production planning.

Additionally, the growing demand for custom-sized protective packaging requires more advanced machines capable of variable bubble dimensions, putting pressure on manufacturers to innovate quickly while keeping equipment affordable and energy-efficient for end-users.

SWOT Analysis

Strengths

- Strong demand from e-commerce and global logistics networks

- High efficiency and cost savings from automated machines

- On-demand production reduces storage and transportation overhead

Weaknesses

- High initial investment for small and medium businesses

- Dependence on polymer-based films is facing regulatory pressure

- Skilled technicians are required for maintenance and operation

Opportunities

- Rising interest in recyclable and biodegradable cushioning films

- Fast growth of APAC manufacturing industries

- IoT-enabled smart machines and predictive maintenance features

Threats

- Competition from paper cushioning, molded pulp, and air pillows

- Increasing global restrictions on plastic-based packaging

- Price competition from low-cost regional manufacturers

Key Players Analysis

Competition in the Bubble Wrap Machine Market is shaped by continuous innovation, automation upgrades, and the shift toward sustainable packaging. Key players such as Sealed Air, Pregis, FROMM Packaging Systems, Sealed Air, and Storopack focus on high-output, energy-efficient machines that allow on-demand production of inflatable cushioning. Their strategies include integrating IoT monitoring, reducing film waste, and developing equipment compatible with recyclable materials.

Asian manufacturers, especially from China, are expanding rapidly with cost-competitive machines, increasing pressure on global brands to differentiate through advanced features and longer service life. Companies are also entering partnerships with logistics hubs and contract packaging centers to strengthen market reach.

R&D efforts increasingly revolve around compact designs suitable for smaller warehouses, which expands customer penetration. As automation adoption grows across manufacturing and e-commerce, established players continue gaining traction through dependable performance, strong service networks, and sustainability-focused machine upgrades.

Top Key Players in the Market

- Veritiv Corporation

- Sealed Air Corporation

- Jiffy Packaging Co.

- Pregis Corporation

- Smurfit Kappa

- Barton Jones Packaging Ltd.

- Others

Recent Developments

- June 2024, Pregis expanded its European production line, adding a new smart-inflation technology aimed at optimizing bubble strength while reducing material usage.

- March 2025, Storopack launched a biodegradable bubble film designed for high-speed horizontal machines, addressing growing sustainability demand from retail and industrial customers. These developments emphasize the industry’s shift toward eco-friendly materials, higher output speed, and digitally monitored machine performance—core factors influencing future purchasing decisions across the global bubble wrap machine market.

- In November 2025, Sealed Air agreed to be acquired by CD&R in a transaction valued at $10.3 billion, aiming to strengthen long-term growth through private equity ownership and operational transformation across protective and food packaging segments.

- In July 2024, ATS Corporation completed the acquisition of Paxiom, expanding its packaging automation portfolio and reinforcing its presence in end-of-line packaging solutions for food, beverage, and consumer goods manufacturers.

Report Scope

Report Features Description Market Value (2024) USD 427.4 Million Forecast Revenue (2034) USD 651.1 Million CAGR(2025-2034) 4.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Machine Type(Automatic, Manual), By Orientation(Horizontal, Vertical), By End-Use(Manufacturing & Warehousing, Pharmaceuticals, Electronics & Electricals, Automotive & Allied Industries, Food & Beverage, Cosmetics & Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Veritiv Corporation, Sealed Air Corporation, Jiffy Packaging Co., Pregis Corporation, Smurfit Kappa, Barton Jones Packaging Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Veritiv Corporation

- Sealed Air Corporation

- Jiffy Packaging Co.

- Pregis Corporation

- Smurfit Kappa

- Barton Jones Packaging Ltd.

- Others