Global Bromobenzene Market Size, Share, And Business Benefits By Type (Pharmaceutical Grade, Industrial Grade, Reagent Grade), By Purity (Less Than 99%, Greater Than Equal To 99%), By Application (Solvent, Chemical Intermediate, Grignard Reagent, Others), By End-Use (Pharmaceuticals, Agrochemicals, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151121

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

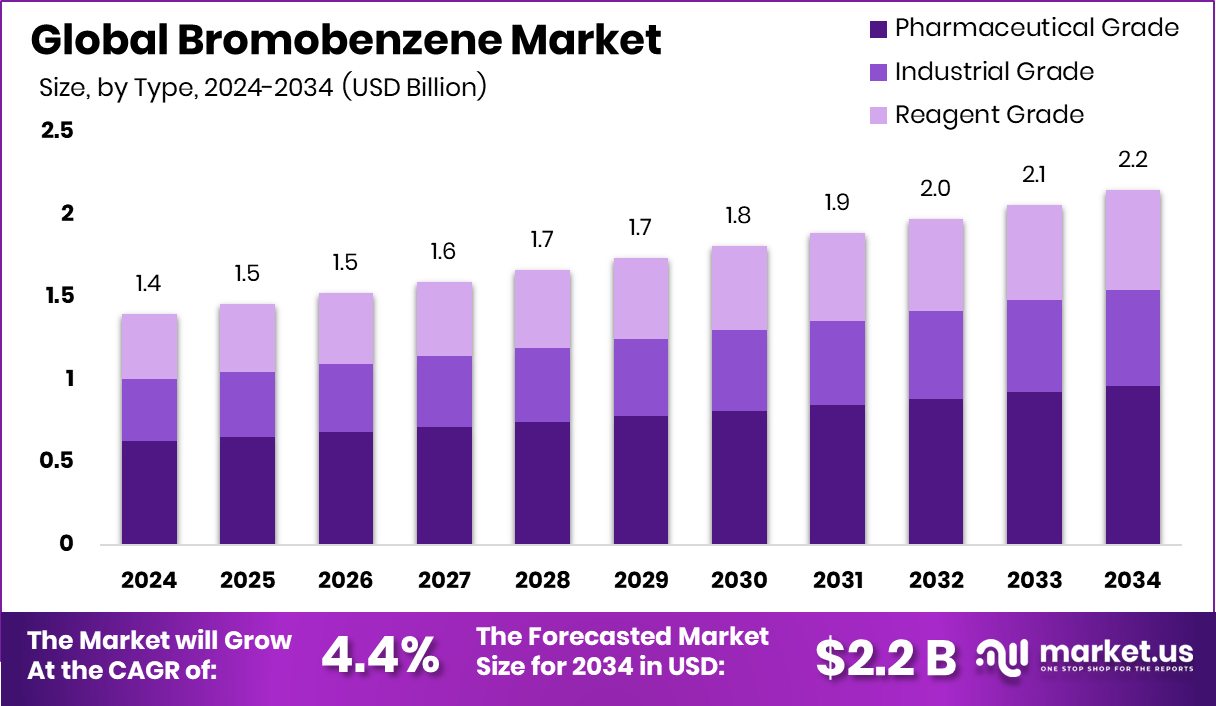

Global Bromobenzene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034. Strong industrial growth in Asia-Pacific supports its 56.9% market dominance globally.

Bromobenzene is an aromatic organic compound with the formula C₆H₅Br. It consists of a benzene ring bonded to a single bromine atom. This colorless liquid is widely used as an intermediate in organic synthesis, particularly for making Grignard reagents, which are essential in forming carbon-carbon bonds in various chemical reactions.

The bromobenzene market encompasses the global production, distribution, and consumption of bromobenzene across various industries. This market includes suppliers of raw materials, chemical manufacturers, and end users in sectors like pharmaceuticals, agrochemicals, and electronics. The market is shaped by demand trends, technological advancements, environmental regulations, and the availability of raw materials such as bromine and benzene.

The growth of the bromobenzene market is primarily driven by the increasing demand for pharmaceutical intermediates and fine chemicals. As the pharmaceutical sector expands, especially in developing regions, the need for brominated compounds in drug synthesis is rising steadily. Additionally, technological improvements in chemical manufacturing are making bromobenzene production more efficient and environmentally sustainable, encouraging wider adoption.

Demand for bromobenzene remains stable due to its versatile applications in laboratory and industrial processes. Its use in creating Grignard reagents ensures continued demand from research institutions and chemical producers. The expanding chemical and material science sectors further strengthen the demand base, especially as more customized organic compounds are being developed.

Key Takeaways

- Global Bromobenzene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034.

- Bromobenzene market sees 44.8% share in pharmaceutical grade, driven by growing drug synthesis demand.

- High-purity bromobenzene (≥99%) dominates with a 67.3% share, ensuring quality for sensitive chemical processes.

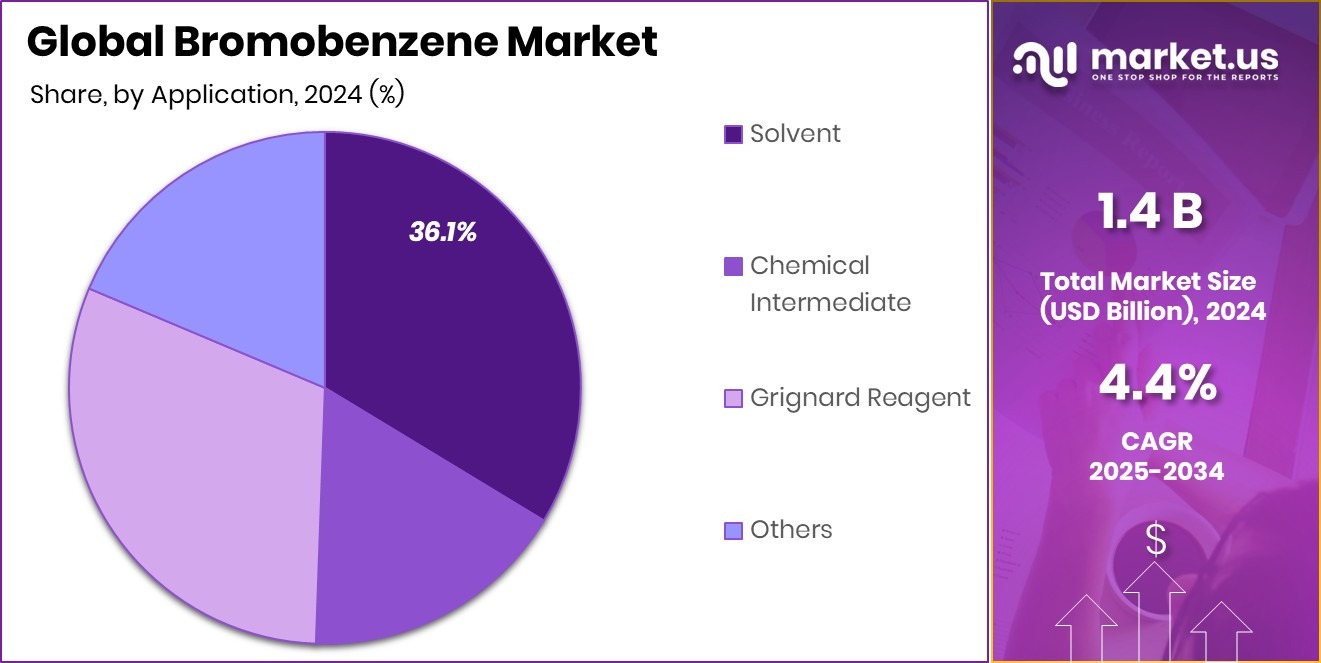

- As a solvent, bromobenzene holds 36.1% market share, supporting various organic and lab-based reactions.

- Pharmaceuticals lead end-use at 48.5%, showcasing bromobenzene’s importance in active ingredient manufacturing.

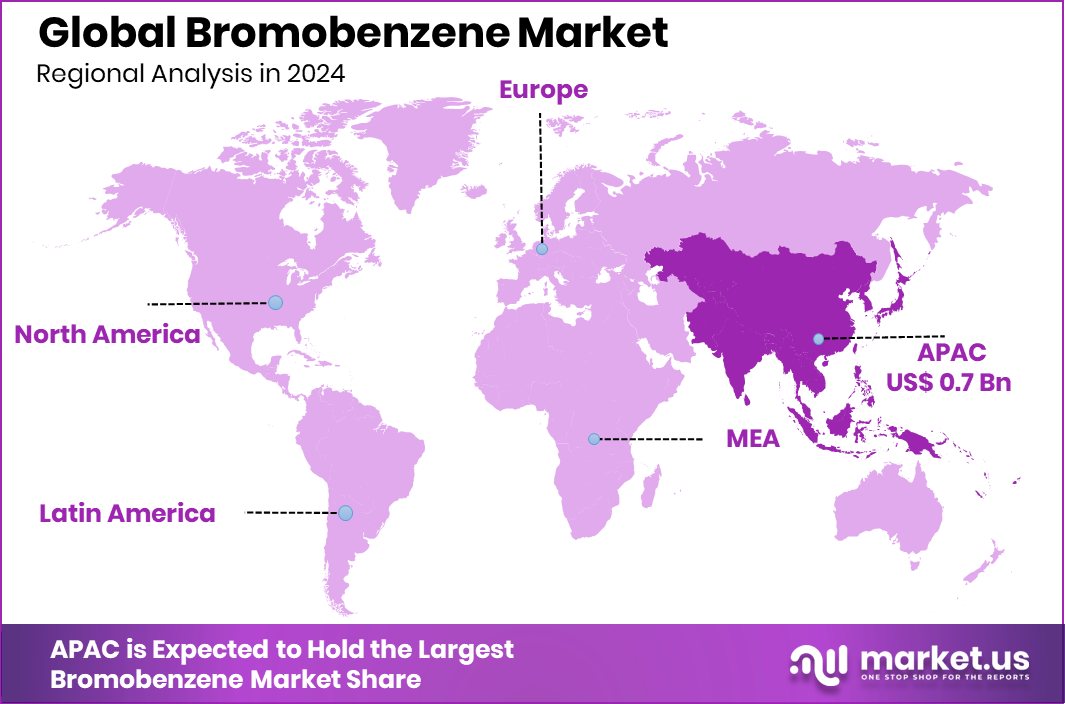

- The Asia-Pacific bromobenzene market reached a value of USD 0.7 billion.

By Type Analysis

Pharmaceutical grade bromobenzene dominates the market with a 44.8% strong share presence.

In 2024, Pharmaceutical Grade held a dominant market position in the By Type segment of the Bromobenzene Market, with a 44.8% share. This significant market share highlights the strong demand for high-purity bromobenzene, particularly driven by its critical role in pharmaceutical manufacturing. The pharmaceutical industry relies on bromobenzene as an essential intermediate in the synthesis of various active pharmaceutical ingredients (APIs), especially in processes requiring high-quality and consistent chemical performance.

The dominance of the Pharmaceutical Grade type is attributed to the increasing global emphasis on drug development, rising healthcare needs, and stringent quality requirements in pharmaceutical production. Manufacturers in this segment prioritize consistent supply, purity levels, and regulatory compliance, which supports the high preference for pharmaceutical-grade bromobenzene over other types.

With its significant share in 2024, the pharmaceutical-grade segment reflects not only current industrial demand but also the broader market trend towards precision chemistry and safe drug formulation.

By Purity Analysis

High-purity bromobenzene (≥99%) leads demand, accounting for 67.3% of overall usage.

In 2024, ≥99% held a dominant market position in the By Purity segment of the Bromobenzene Market, with a 67.3% share. This dominance indicates a strong market preference for high-purity bromobenzene, primarily due to its essential role in applications that demand consistent quality and reliability. Industries such as pharmaceuticals and specialty chemicals require bromobenzene with ≥99% purity to ensure precise chemical reactions, high yield, and compliance with safety and regulatory standards.

The 67.3% market share reflects the increasing importance of purity in end-use sectors where even slight impurities can impact product efficacy or performance. High-purity bromobenzene is particularly valued for its stability and effectiveness in sensitive chemical syntheses, making it the preferred choice for manufacturers and research institutions alike. This segment’s leadership also suggests a shift toward more refined chemical processes that align with global quality benchmarks and clean production requirements.

As demand for premium-grade intermediates continues to rise, the ≥99% purity segment is expected to sustain its leading position. Its large market share in 2024 underscores not only its existing importance but also the confidence of industries in adopting purer, more reliable chemical inputs for critical applications.

By Application Analysis

Solvent applications drive 36.1% of the bromobenzene market, showing steady industrial reliance.

In 2024, Solvent held a dominant market position in the By Application segment of the Bromobenzene Market, with a 36.1% share. This leading position reflects the widespread use of bromobenzene as a solvent in various chemical and industrial processes. Its chemical stability, compatibility with organic compounds, and effectiveness in facilitating reactions make it a preferred choice in environments that require reliable solvent performance.

The 36.1% market share illustrates the strong demand for bromobenzene in laboratory and industrial applications where solvents are essential for synthesis, purification, and extraction processes. Its role as a solvent is particularly critical in procedures that require high-purity reaction media, which aligns with the industry’s increasing focus on precision and efficiency. The consistent performance of bromobenzene in this function supports its strong foothold in the application segment.

The dominance of the Solvent segment also points to its versatility and established utility in a wide range of chemical practices. With this substantial share in 2024, the segment continues to benefit from stable industrial usage patterns and ongoing demand from sectors that rely heavily on solvent-based processes.

By End-Use Analysis

The pharmaceutical industry remains the top end-user, consuming 48.5% of the total bromobenzene output.

In 2024, Pharmaceuticals held a dominant market position in the By End-Use segment of the Bromobenzene Market, with a 48.5% share. This significant share highlights the critical role bromobenzene plays in pharmaceutical manufacturing, particularly as an intermediate in the synthesis of various drug compounds. Its chemical structure and reactivity make it highly suitable for forming complex organic molecules required in modern therapeutics.

The 48.5% market share underscores the strong and consistent demand from pharmaceutical companies that rely on bromobenzene for high-precision chemical reactions. Its use in creating intermediates and reagents essential for drug development has made it a foundational component in pharmaceutical supply chains. The sector’s adherence to quality and safety standards also aligns with the need for reliable chemical inputs like bromobenzene, reinforcing its value.

This dominant position also reflects the broader trend of expanding pharmaceutical activities, particularly with increased investments in research, development, and production across global markets. As companies focus on innovation and efficiency in drug synthesis, bromobenzene continues to be an indispensable part of the process.

Key Market Segments

By Type

- Pharmaceutical Grade

- Industrial Grade

- Reagent Grade

By Purity

- <99%

- ≥99%

By Application

- Solvent

- Chemical Intermediate

- Grignard Reagent

- Others

By End-Use

- Pharmaceuticals

- Agrochemicals

- Chemicals

- Others

Driving Factors

Rising Demand from Pharmaceutical Manufacturing Industry

One of the top driving factors for the bromobenzene market is the growing demand from the pharmaceutical manufacturing sector. Bromobenzene is widely used as an intermediate in the production of active pharmaceutical ingredients (APIs). As the need for medicines continues to increase globally—driven by population growth, aging demographics, and rising healthcare awareness—pharmaceutical companies are expanding their production capacities.

This directly boosts the need for reliable and high-purity chemical inputs like bromobenzene. Its chemical properties make it ideal for creating complex compounds used in drug formulations. With consistent use in various drug synthesis processes, the pharmaceutical industry plays a major role in supporting the overall growth and stability of the bromobenzene market across key regions.

Restraining Factors

Health and Environmental Concerns Limit Market Growth

A major restraining factor for the bromobenzene market is the increasing concern over its impact on health and the environment. Bromobenzene is classified as a hazardous chemical, and prolonged exposure can lead to health issues such as skin irritation, respiratory problems, and organ toxicity. Additionally, improper handling or disposal may cause environmental pollution, especially to soil and water bodies.

These risks have led to stricter regulations by environmental and safety authorities in many countries. Companies are required to follow strict handling, storage, and disposal guidelines, which increases operational costs and limits broader use.

Growth Opportunity

Eco-Friendly Production Methods Offer New Opportunities

One of the biggest growth opportunities in the bromobenzene market lies in developing eco-friendly and low-waste production processes. Traditional manufacturing methods often generate harmful by-products and require significant energy inputs. Producers can reduce environmental impact and meet stricter global regulations by investing in cleaner technologies, such as solvent-free reactions, catalytic processes, or waste recycling.

These greener approaches not only improve sustainability but also lower long-term costs and enhance brand reputation. As end users—particularly in pharmaceuticals and specialty chemicals—place greater emphasis on responsible sourcing, companies offering sustainable-grade bromobenzene can gain a competitive edge.

Latest Trends

Shift Toward Green and Sustainable Chemical Practices

A notable trend in the bromobenzene market is the gradual shift toward green and sustainable chemical practices. Companies are actively exploring cleaner ways to produce bromobenzene, including using fewer solvents, recycling waste, and adopting newer catalytic methods that reduce energy use. These efforts are driven by tighter environmental regulations and growing customer demand for environmentally responsible ingredients.

By reducing harmful by‑products and improving process efficiencies, manufacturers can minimize costs and environmental impact simultaneously. Additionally, businesses that publicly embrace sustainability often strengthen their reputation and build trust with eco-conscious buyers.

Regional Analysis

In 2024, Asia-Pacific led the bromobenzene market with a 56.9% regional share.

In 2024, the Bromobenzene Market showed varied performance across regions, with Asia-Pacific emerging as the dominant region, accounting for 56.9% of the global market share, valued at USD 0.7 billion.

This significant regional leadership is driven by strong demand from the pharmaceutical and chemical sectors in countries such as China, India, and Japan, where industrial manufacturing is rapidly expanding. The availability of raw materials, lower production costs, and increasing chemical exports continue to position Asia-Pacific at the forefront of market growth.

North America and Europe also represent important regions for the bromobenzene market, supported by ongoing pharmaceutical research and stable demand for high-purity solvents. However, their market shares remain lower compared to Asia-Pacific.

Latin America and the Middle East & Africa maintain a smaller presence in the global market, with gradual adoption driven by developing industrial infrastructure and growing interest in chemical production capabilities. While these regions show potential, their contribution remains limited at this stage.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global bromobenzene market reflects the strategic presence of key players such as Aarti Industries, Chemcon Speciality Chemicals Limited, and Haihang Industry Co., Ltd. Each of these companies brings unique strengths and plays a vital role in shaping the competitive landscape of the market.

Aarti Industries, known for its strong backward integration and diversified chemical portfolio, continues to maintain a stable position in the bromobenzene segment. With its focus on high-purity production and a robust manufacturing infrastructure, the company supports consistent supply to both domestic and international pharmaceutical and agrochemical sectors.

Chemcon Specialty Chemicals Limited remains a significant contributor, with a specialized focus on niche chemical intermediates, including brominated compounds. In 2024, its performance is supported by growing demand from pharmaceutical companies, especially within India. The company’s agility in scaling production and its emphasis on quality compliance make it a reliable supplier in regulated markets.

Haihang Industry Co., Ltd, based in China, continues to be a strong player in terms of bulk production and global export. With access to low-cost raw materials and large-scale manufacturing capabilities, the company plays a key role in supporting Asia-Pacific’s dominance in the market.

Top Key Players in the Market

- Aarnee International

- Aarti Industries

- Chemcon Speciality Chemicals Limited

- Haihang Industry Co., Ltd

- Heranba Industries Ltd.

- Lanxess

- Merck KGaA

- Pragna Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Yancheng Longshen Chemical Co., Ltd.

- Yogi Intermediates PVT. LTD.

- Yurui (shanghai) chemical Co., Ltd

Recent Developments

- In April 2025, LANXESS completed the sale of its Urethane Systems polymer business to UBE Corporation (Japan) for about €460 million enterprise value, generating ~€500 million in gross cash .

- In July 2024, Merck KGaA bought Mirus Bio, which makes reagents for introducing genetic material into cells (used in cell and gene therapies), for roughly US$ 617 million (€ 570 million) in cash.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pharmaceutical Grade, Industrial Grade, Reagent Grade), By Purity (<99%, ≥99%), By Application (Solvent, Chemical Intermediate, Grignard Reagent, Others), By End-Use (Pharmaceuticals, Agrochemicals, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aarnee International, Aarti Industries, Chemcon Specialty Chemicals Limited, Haihang Industry Co., Ltd, Heranba Industries Ltd., Lanxess, Merck KGaA, Pragna Group, Sandoo Pharmaceuticals and Chemicals Co., Ltd., Yancheng Longshen Chemical Co., Ltd., Yogi Intermediates PVT. LTD., Yurui (shanghai) chemical Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aarnee International

- Aarti Industries

- Chemcon Speciality Chemicals Limited

- Haihang Industry Co., Ltd

- Heranba Industries Ltd.

- Lanxess

- Merck KGaA

- Pragna Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Yancheng Longshen Chemical Co., Ltd.

- Yogi Intermediates PVT. LTD.

- Yurui (shanghai) chemical Co., Ltd