Global Bridge Management Software Market Size, Share, Growth Analysis By Deployment Mode (Cloud-based, On-premises), By Application (Inspection & Condition Assessment, Maintenance & Repair Planning, Asset Inventory & Documentation, Performance & Risk Analysis, Others), By End-User (Government Transportation Agencies, Private Infrastructure Owners/Operators, Engineering & Consulting Firms, Others), By Bridge Type (Highway Bridges, Railway Bridges, Pedestrian & Cycling Bridges, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170193

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Software

- Industry Adoption

- Emerging Trends

- US Market Size

- By Deployment Mode

- By Application

- By End-User

- By Bridge Type

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint factors

- Growth opportunities

- Trending factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

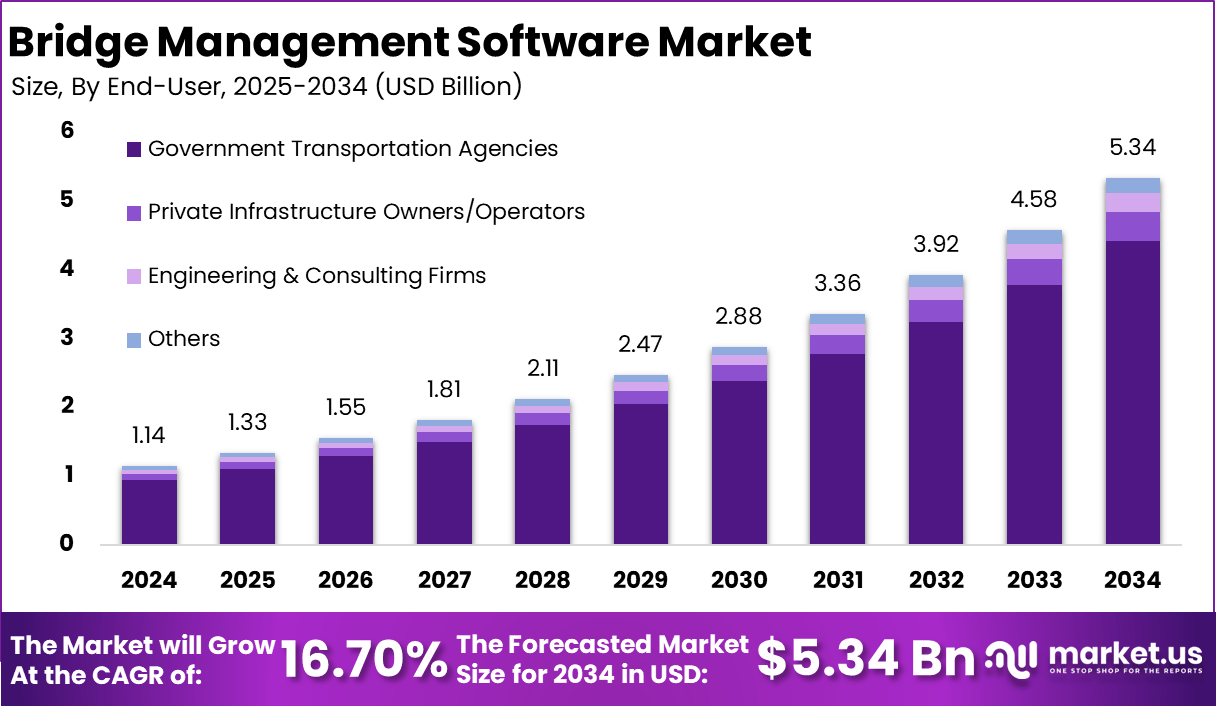

The Bridge Management Software Market is gaining strong momentum as transportation agencies and infrastructure owners accelerate the digital modernization of bridge assets. In 2024, the market value stands at USD 1.14 billion, supported by rising investments in smart infrastructure, asset lifecycle management, and data-driven maintenance planning.

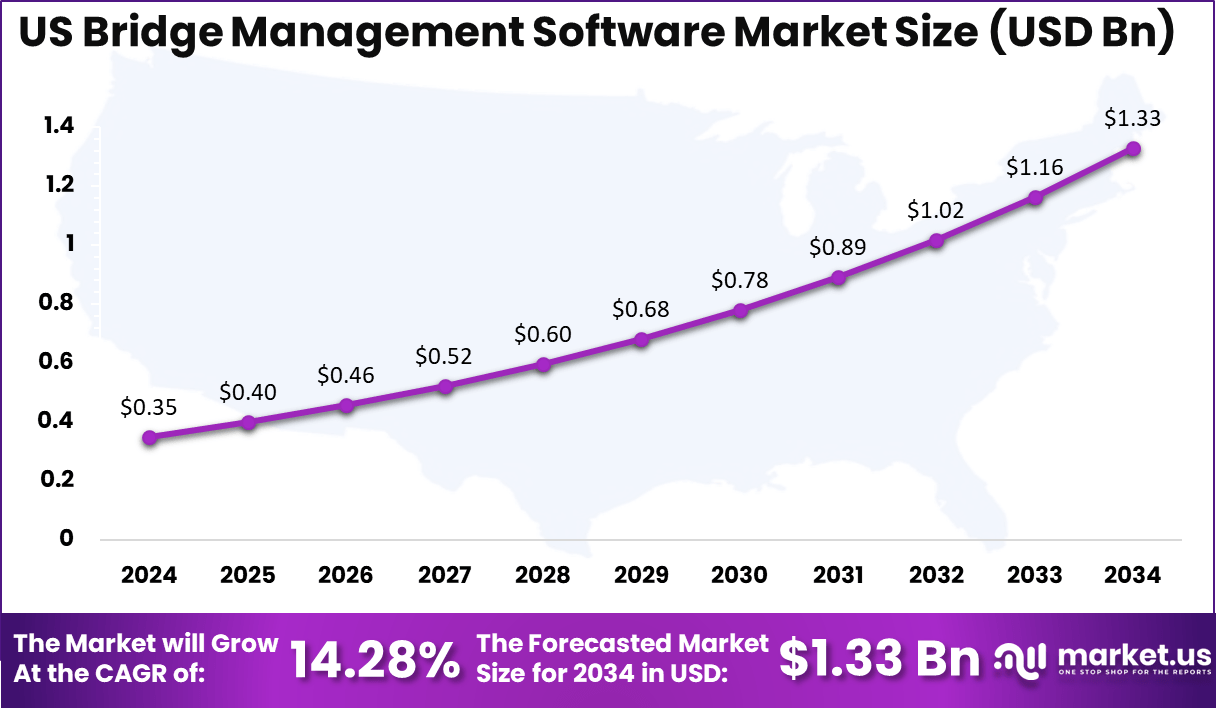

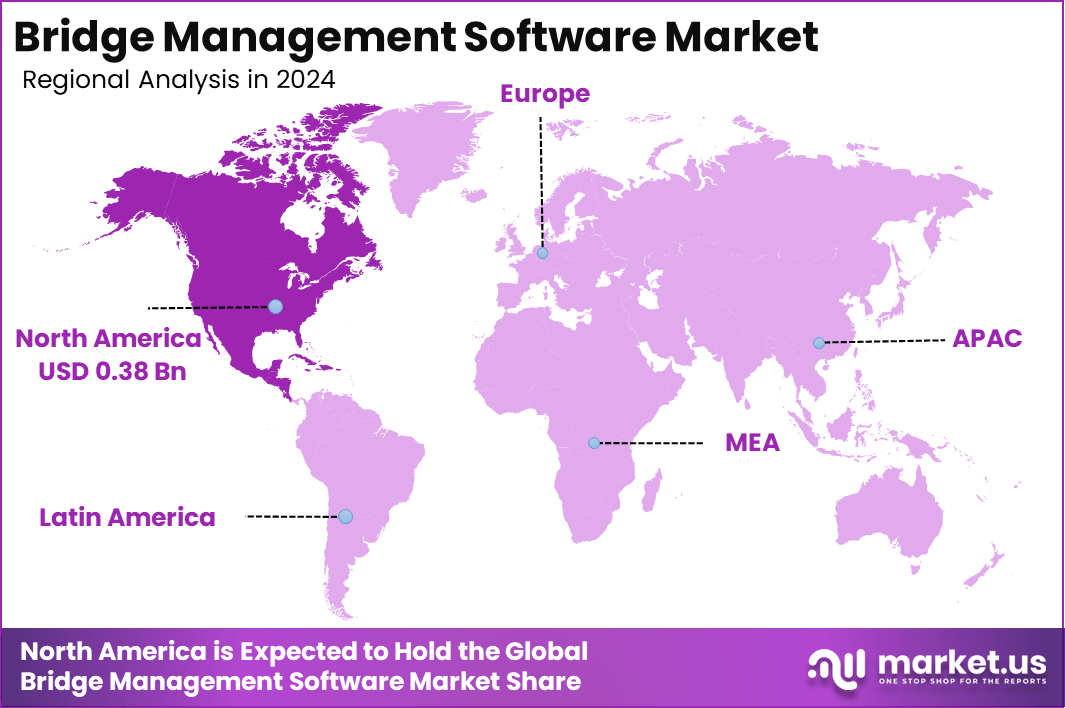

The market is projected to expand at a CAGR of 16.70%, reaching USD 5.34 billion by 2034, reflecting widespread adoption across developed and emerging economies. North America dominates with a 34.2% share, valued at USD 0.38 billion in 2024, driven by extensive bridge inventories and strong federal and state-level infrastructure programs. The US alone accounts for USD 0.35 billion in 2024 and is anticipated to reach USD 1.33 billion by 2034, supported by a CAGR of 14.28% and sustained investment in digital infrastructure management.

Bridge management software platforms enable authorities to monitor structural conditions, schedule inspections, prioritize repairs, and optimize budgets through centralized digital systems, replacing fragmented and manual processes. Growing concerns around aging bridge networks, public safety, and regulatory compliance are encouraging the adoption of predictive analytics, cloud-based platforms, and integrated inspection databases.

These solutions support long term planning by combining inspection data, load ratings, deterioration models, and risk assessment tools, helping agencies extend asset life while reducing unplanned failures. With increasing emphasis on resilience and sustainability, software-driven decision-making is becoming a core component of bridge asset management strategies.

Bridge management software is a digital solution designed to support the inspection, monitoring, maintenance, and lifecycle planning of bridge infrastructure. These platforms centralize structural data such as inspection records, material conditions, load ratings, and maintenance histories into a single system, enabling infrastructure owners to make informed and timely decisions.

Modern systems often align with national bridge inspection standards and support condition rating scales ranging from 0 to 9, which are widely used by transportation authorities to assess structural health. The software integrates advanced analytics to evaluate deterioration trends, estimate remaining service life, and prioritize maintenance activities based on risk and performance indicators.

Many platforms support inspection cycles of 12 to 24 months and can manage data for thousands of bridge assets simultaneously. Geographic information system integration allows spatial visualization of bridge networks, while mobile inspection tools enable real-time data capture in the field, improving accuracy and reducing reporting delays.

With increasing adoption of sensors and structural health monitoring technologies, bridge management software can process large volumes of data, such as vibration frequency, strain levels, and displacement thresholds, to detect early signs of structural stress.

Cloud-based deployments are also expanding, offering scalability, multi-user access, and data availability rates exceeding 99%. Overall, bridge management software plays a critical role in improving safety, optimizing maintenance budgets, and supporting long term infrastructure resilience through data-driven asset management.

Recent developments in bridge management software continue to emphasize funding, product enhancements, and strategic partnerships amid rising infrastructure demands worldwide. In October 2025, Bridge, an AI-powered operating system tailored for private markets, including bridge asset management, secured a $5.1 million seed round led by Thicket Ventures, with participation from key fintech backers to fuel AI integrations and expand its engineering team from 10 to over 25 members within the year.

This infusion supports rapid scaling of features like automated compliance tracking and real-time portfolio analytics, positioning Bridge to handle the complexities of a $30 trillion alternative investments ecosystem.

Beyond funding, the sector shows growing interest in collaborative tools, with recent integrations of IoT sensors for live bridge monitoring gaining traction through vendor partnerships announced in early 2025, enabling predictive alerts that cut maintenance costs by up to 20% in pilot programs.

No blockbuster mergers surfaced in late 2025, but smaller acquisitions of niche AI startups by established players like Bentley Systems hint at consolidation, as firms aim to bundle structural analysis with full lifecycle management software. Product launches remain active, including cloud-native updates from multiple providers that boost mobile access for field engineers, rolled out progressively through Q3 2025 to streamline inspections and reporting.

Looking at partnerships, collaborations between software firms and government agencies have accelerated, such as a November 2025 deal between a leading bridge software provider and the U.S. DOT for pilot deployments on 500+ aging structures, incorporating drone data feeds for enhanced accuracy.

These initiatives reflect a broader industry shift toward sustainability-focused features, like carbon footprint trackers in new modules, driven by regulatory pressures in Europe and North America. Overall, the pace of innovation signals strong momentum, with expectations for more seed rounds and AI-centric releases heading into 2026.

Key Takeaways

- The Bridge Management Software Market reached a value of USD 1.14 billion in 2024 and is projected to grow at a CAGR of 16.70%, reaching USD 5.34 billion by 2034.

- North America leads the global market with a 34.2% share, accounting for a market size of USD 0.38 billion in 2024 due to strong infrastructure digitization initiatives.

- The US represents a major contributor with a market size of USD 0.35 billion in 2024 and is expected to reach USD 1.33 billion by 2034, expanding at a CAGR of 14.28%.

- On-premises deployment dominates by deployment mode with a share of 58.3%, reflecting preferences for data control and compliance among public agencies.

- Inspection and condition assessment is the leading application segment, holding a 41.8% share driven by regulatory inspection requirements and aging bridge inventories.

- Government transportation agencies are the primary end users, accounting for 82.7% of total demand due to large-scale public bridge networks.

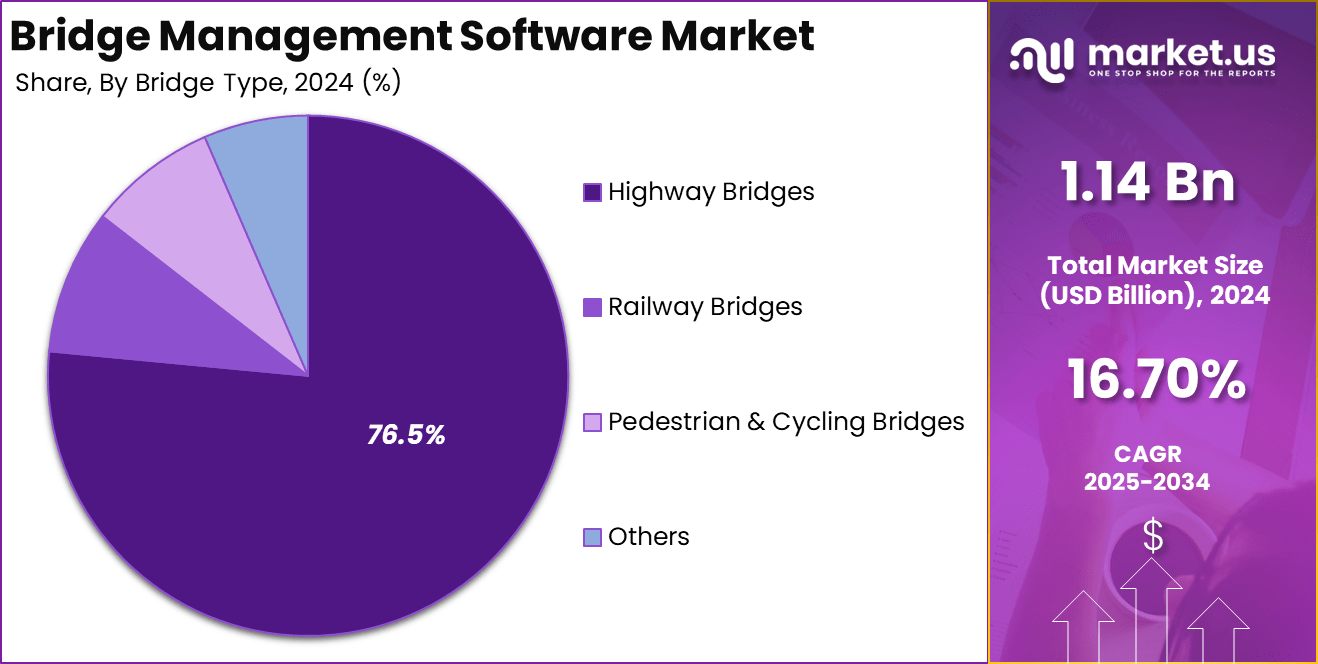

- Highway bridges dominate by bridge type with a 76.5% share, supported by high traffic volumes and critical safety considerations.

Role of Software

Software plays a critical role in improving the efficiency, accuracy, and reliability of bridge management activities across transportation networks. Digital platforms enable agencies to shift from reactive maintenance to proactive planning by consolidating inspection records, maintenance logs, and structural documentation into a single, searchable system.

This centralized approach significantly improves data consistency and reduces manual errors associated with paper-based workflows. Bridge management software supports advanced decision-making through condition trend analysis and performance-based planning. Engineers can compare historical inspection results, identify recurring defect patterns, and align maintenance actions with safety and operational priorities.

Scenario modeling tools allow agencies to evaluate multiple maintenance strategies and understand long term impacts on asset condition, funding utilization, and service continuity. The software also enhances coordination between field inspectors, engineers, and policymakers by enabling real-time data sharing and standardized reporting formats.

Automated alerts and compliance tracking help ensure that inspection schedules and regulatory requirements are met without delays. Integration with traffic, environmental, and structural monitoring systems further strengthens risk assessment by linking structural data with external stress factors such as load intensity and climate exposure.

Overall, bridge management software serves as a strategic backbone for infrastructure governance, supporting transparency, accountability, and informed investment decisions while extending the functional life of bridge assets and improving public safety outcomes.

Industry Adoption

Industry adoption of bridge management software is expanding steadily as infrastructure owners prioritize digital asset management and long-term resilience planning. Transportation authorities, engineering consultants, and infrastructure operators are increasingly integrating software platforms into daily workflows to improve coordination across inspection, maintenance, and planning teams. Adoption is particularly strong among organizations managing large and geographically dispersed bridge portfolios, where manual tracking systems create operational inefficiencies.

Engineering and construction firms use bridge management software to support condition assessments, rehabilitation planning, and performance reporting throughout project lifecycles. These platforms enable standardized data collection and consistent evaluation methodologies, improving collaboration between public agencies and private contractors. Software adoption is also accelerating in public-private partnership projects, where transparent reporting and measurable performance indicators are critical for contractual compliance.

Municipal and regional authorities are adopting these solutions to support compliance with evolving safety regulations and reporting requirements. Digital platforms simplify audit processes by maintaining structured records and historical performance data, reducing administrative burden. Cloud-enabled systems are further encouraging adoption by lowering infrastructure costs and enabling remote access for distributed teams.

Additionally, the growing integration of inspection tools, digital twins, and structural monitoring systems is strengthening software adoption across the industry. As infrastructure modernization programs expand globally, bridge management software is increasingly viewed as an essential tool for maintaining asset integrity, optimizing maintenance planning, and supporting data-driven infrastructure investment decisions.

Emerging Trends

Emerging trends in bridge management software are centered on advanced analytics, automation, and deeper integration with smart infrastructure technologies. One of the most significant trends is the growing use of artificial intelligence and machine learning to analyze inspection images and detect defects such as cracks, corrosion, and spalling. Image recognition tools are achieving accuracy levels above 90%, reducing dependence on manual visual assessments and improving consistency across inspections.

The adoption of structural health monitoring integration is also increasing. Software platforms are now designed to process continuous data streams from sensors measuring vibration, strain, and displacement, enabling near real time condition tracking. Some bridge networks deploy hundreds of sensors per structure, allowing early detection of abnormal behavior and reducing unexpected maintenance events.

Digital twin technology is gaining traction as agencies model bridge performance over 20 to 40 year lifecycles. These virtual replicas allow engineers to simulate load scenarios, environmental impacts, and maintenance strategies before physical interventions. Mobile first inspection tools are another growing trend, with field teams using tablets and smartphones to capture data, images, and geotagged notes, cutting inspection documentation time by nearly one third.

Cybersecurity-focused software architectures are also emerging as critical priorities, with multi-factor authentication and encrypted data storage becoming standard features. Overall, these trends highlight a shift toward predictive, connected, and intelligence-driven bridge management ecosystems.

US Market Size

The US Bridge Management Software Market reflects strong momentum as federal, state, and local agencies accelerate the digital transformation of transportation infrastructure. In 2024, the market size stands at USD 0.35 billion, supported by the country’s extensive bridge inventory and the growing need for structured asset management systems.

With a large proportion of bridges operating beyond their original design life, software-based management tools are increasingly used to support inspection planning, maintenance prioritization, and long-term capital allocation. The market is anticipated to expand steadily, reaching USD 1.33 billion by 2034 at a CAGR of 14.28%.

This growth is closely linked to national infrastructure modernization programs and stricter performance reporting requirements. Bridge management software enables agencies to align maintenance strategies with funding cycles, improve transparency in asset condition reporting, and support risk-based decision making across multi-year planning horizons.

Adoption is also driven by the need to manage complex datasets generated from inspections, monitoring systems, and rehabilitation projects. Software platforms help standardize evaluation methods across states, improving comparability and regulatory compliance. Increased use of cloud-based architectures and mobile inspection tools further supports scalability and interagency collaboration.

Overall, the US market demonstrates strong fundamentals, with sustained investments in digital infrastructure management positioning bridge management software as a critical component of long term transportation asset stewardship.

By Deployment Mode

On-premises deployment dominates the Bridge Management Software Market with a 58.3% share, reflecting strong preferences among public infrastructure owners for direct control over data, systems, and security protocols. Transportation agencies managing critical bridge assets often favor on-premises solutions to meet internal IT governance policies, comply with data sovereignty requirements, and ensure uninterrupted system availability.

These deployments allow tighter integration with legacy databases, inspection archives, and customized analytics tools that have been developed over many years. On-premises platforms are also perceived as more suitable for handling sensitive structural and safety-related information, especially in environments where cybersecurity oversight is handled internally by government IT departments.

Cloud-based deployment is gaining traction as agencies seek greater scalability, flexibility, and collaboration capabilities. Cloud platforms support remote access for inspectors, engineers, and decision makers, enabling faster data sharing and streamlined coordination across regions.

These solutions reduce the need for heavy upfront infrastructure investments and simplify software updates, system maintenance, and user management. Cloud-based models are particularly attractive for smaller agencies and consulting firms that manage multiple bridge portfolios and require rapid deployment.

While on-premises systems continue to lead due to established trust and control advantages, the growing emphasis on interoperability, mobile access, and real-time analytics is gradually increasing acceptance of cloud-based bridge management software across the industry.

By Application

Inspection and condition assessment lead the Bridge Management Software Market with a 41.8% share, as regular structural evaluation remains the foundation of bridge safety and regulatory compliance. Software platforms are widely used to schedule inspections, record defect observations, manage photographic evidence, and apply standardized rating methodologies.

Digital tools improve consistency across inspection teams and enable faster consolidation of field data into actionable reports, supporting timely decision-making and compliance with mandated inspection programs. Maintenance and repair planning represents a critical application area, where software supports prioritization of interventions based on condition trends, usage intensity, and budget constraints.

These systems help agencies compare repair scenarios, plan rehabilitation timelines, and optimize resource allocation to reduce unplanned closures. Asset inventory and documentation applications focus on maintaining accurate records of bridge components, materials, design attributes, and historical modifications. Centralized inventories improve data accessibility and reduce duplication across departments.

Performance and risk analysis is gaining importance as agencies adopt risk-based asset management approaches. Software tools evaluate vulnerability by combining structural condition data with external factors such as traffic loading and environmental exposure.

This supports more informed investment decisions and long-term resilience planning. Other applications include reporting, regulatory audits, and integration with external infrastructure systems, reinforcing the role of bridge management software as a comprehensive decision support platform across the asset lifecycle.

By End-User

Government transportation agencies dominate the Bridge Management Software Market with an 82.7% share, as they are responsible for the majority of bridge assets and public safety oversight. These agencies manage extensive bridge networks across national, state, and municipal levels, requiring structured digital systems to coordinate inspections, maintenance planning, and long-term investment strategies.

Bridge management software supports regulatory compliance, standardized reporting, and transparent decision making, all of which are essential for public accountability and efficient use of infrastructure budgets. Public agencies rely on these platforms to align maintenance priorities with policy objectives, funding programs, and safety mandates.

Centralized software systems help streamline coordination between inspectors, engineers, planners, and policymakers, reducing information silos and improving operational efficiency. The ability to track historical condition data and evaluate performance trends strengthens evidence-based planning and supports proactive asset stewardship.

Private infrastructure owners and operators represent a growing user group, particularly in toll roads, concessions, and public-private partnership projects. These entities use bridge management software to meet contractual performance requirements and manage asset risks.

Engineering and consulting firms adopt these platforms to deliver inspection, assessment, and advisory services for multiple clients, ensuring consistent methodologies and documentation. Other end users include research institutions and specialized service providers supporting infrastructure analysis and monitoring activities.

By Bridge Type

Highway bridges account for the largest share of the Bridge Management Software Market at 76.5%, reflecting their critical role in national and regional transportation networks. These structures support high traffic volumes and heavy load conditions, making regular inspection, condition monitoring, and maintenance planning essential for safety and mobility.

Bridge management software is widely used by authorities to manage large highway bridge inventories, track structural performance, and prioritize interventions that minimize traffic disruption and economic impact. Software platforms help highway agencies analyze deterioration patterns, schedule maintenance activities, and align rehabilitation programs with long term transportation plans.

The ability to integrate traffic data, load information, and inspection histories enhances decision-making for bridges that experience continuous operational stress. Digital systems also support coordinated planning for lane closures, detours, and phased repairs, reducing the impact on commuters and freight movement.

Railway bridges represent another important application area, where software supports structural reliability under dynamic loading conditions and strict operational tolerances. Pedestrian and cycling bridges are increasingly included in digital asset management programs as cities expand active transportation infrastructure.

These bridges require tailored inspection and safety management approaches due to different usage patterns. Other bridge types, including movable and special-purpose bridges, also benefit from software-driven monitoring and documentation, reinforcing the importance of digital management across diverse bridge categories.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Application

- Inspection & Condition Assessment

- Maintenance & Repair Planning

- Asset Inventory & Documentation

- Performance & Risk Analysis

- Others

By End-User

- Government Transportation Agencies

- Private Infrastructure Owners/Operators

- Engineering & Consulting Firms

- Others

By Bridge Type

- Highway Bridges

- Railway Bridges

- Pedestrian & Cycling Bridges

- Others

Regional Analysis

North America leads the Bridge Management Software Market with a 34.2% share, reflecting early adoption of digital infrastructure management practices and strong institutional focus on asset preservation. In 2024, the regional market size reached USD 0.38 billion, supported by extensive bridge inventories and structured inspection programs across federal, state, and municipal levels.

Transportation agencies across the region increasingly rely on software platforms to standardize inspections, manage historical condition data, and support long-term maintenance planning. The region benefits from well-established regulatory frameworks that emphasize regular inspection cycles, performance-based planning, and transparent reporting.

Bridge management software helps agencies meet these requirements by enabling consistent evaluation methodologies and centralized data storage. The integration of mobile inspection tools and analytics platforms further enhances operational efficiency and data accuracy across large geographic networks.

Investment in infrastructure modernization and digital transformation continues to drive regional adoption. Agencies are increasingly linking bridge management software with geographic information systems and structural monitoring technologies to improve network-level visibility and risk assessment. Collaboration between public authorities, engineering firms, and technology providers also supports continuous innovation and system refinement.

Overall, North America’s leadership in bridge management software adoption is driven by strong governance structures, mature infrastructure management practices, and sustained commitment to improving safety, reliability, and long term performance of bridge assets across the region.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The adoption of bridge management software is primarily driven by the increasing focus on infrastructure safety and asset performance optimization. Aging bridge networks require more frequent inspections, condition tracking, and preventive maintenance, pushing agencies toward digital solutions. Many transportation authorities manage thousands of bridge assets, making manual data handling inefficient and error-prone.

Software platforms enable centralized data management, faster reporting cycles, and improved coordination across departments. The growing use of performance-based infrastructure management frameworks also supports adoption, as agencies are required to demonstrate measurable improvements in asset condition and service reliability.

Integration with inspection tools, geographic information systems, and monitoring technologies further strengthens software value by enabling data-driven decision-making. In addition, workforce constraints and limited availability of experienced inspectors are encouraging automation and analytics-driven assessments.

Rising public expectations for road safety, reduced closures, and transparent infrastructure reporting continue to reinforce the role of bridge management software as a core tool in modern transportation asset management.

Restraint factors

Despite strong demand, several factors restrain the adoption of bridge management software. High implementation complexity remains a key challenge, particularly for agencies with legacy databases and fragmented record systems. Data migration, system customization, and staff training can extend deployment timelines and increase operational burden.

Budget limitations also restrict adoption, especially for smaller municipalities that prioritize immediate maintenance over digital investments. Resistance to change among personnel accustomed to traditional inspection workflows can slow software utilization and limit value realization. Cybersecurity concerns further restrain adoption, as infrastructure data is considered sensitive and critical.

Agencies often require extensive internal approvals before transitioning to digital platforms. In addition, inconsistent data quality from historical inspection records can limit the effectiveness of analytics and predictive tools. These barriers highlight the need for structured change management, phased deployment strategies, and stronger technical support to ensure successful implementation and sustained usage.

Growth opportunities

Significant growth opportunities exist as infrastructure owners expand digital transformation initiatives across transportation networks. The increasing adoption of cloud-based platforms opens opportunities for scalable, cost-efficient deployments and improved collaboration across regions. Integration with structural health monitoring systems, unmanned inspection tools, and digital twin models is creating new use cases beyond traditional inspection management.

Software providers can expand offerings by supporting risk-based planning, resilience modeling, and climate impact assessment, which are gaining importance in infrastructure policy discussions. Emerging economies investing in road and bridge expansion represent additional opportunities, as digital asset management can be embedded early in project lifecycles.

Consulting firms and technology vendors can also leverage software platforms to offer value-added services such as predictive maintenance planning and lifecycle optimization. As agencies seek better return on infrastructure spending, bridge management software is well positioned to support smarter investment decisions and long term asset sustainability.

Trending factors

Several trends are reshaping the bridge management software landscape. Artificial intelligence is increasingly used to automate defect detection and condition scoring from inspection images, improving consistency and reducing manual workload. Mobile first inspection workflows are becoming standard, enabling real-time data capture and faster reporting from the field.

Integration of software platforms with digital twins is gaining momentum, allowing agencies to simulate deterioration, traffic loading, and maintenance scenarios over extended planning horizons. Interoperability is another key trend, with agencies seeking systems that integrate seamlessly with traffic, environmental, and asset management platforms.

Cybersecurity-focused system design is also emerging as a priority, with stronger access controls and encrypted data storage becoming standard requirements. Overall, these trends indicate a shift toward intelligent, connected, and predictive bridge management ecosystems that support proactive infrastructure governance.

Competitive Analysis

The competitive landscape of the Bridge Management Software Market is shaped by a blend of established infrastructure technology vendors and specialized solution providers, each striving to differentiate through advanced features, integration capabilities, and geographic reach.

Bentley Systems, Inc. stands out with its comprehensive infrastructure management suite, including the widely used OpenBridge platform, which integrates inspection, modeling, and asset lifecycle tools for large bridge portfolios. Trimble Inc. is another key player, offering software with strong GIS and BIM integration that supports detailed spatial analysis and field data workflows.

Autodesk, Inc., leverages its global leadership in design and engineering software to enhance bridge lifecycle management through seamless integration with design and digital twin environments. Hexagon AB and Siemens AG focus on combining structural health monitoring and asset management functionalities, appealing to clients managing complex infrastructure networks.

Aurigo Software specializes in cloud-based capital and asset planning tools widely adopted by public transportation departments. Other notable competitors include ESRI, WSP Global, and specialized research-driven platforms like the Bridge Software Institute that emphasize technical depth and industry research alignment.

Competitive strategies across these firms emphasize product innovation, strategic partnerships, and expanding services to address predictive analytics, mobile inspection, and cloud interoperability requirements.

Top Key Players in the Market

- Bentley Systems, Incorporated

- Autodesk, Inc.

- Trimble, Inc.

- AECOM

- WSP Global, Inc.

- SAP SE

- Oracle Corporation

- IBM Corporation

- AssetIntel, LLC

- AgileAssets, Inc.

- GISGRO Oy

- Innovyze, Inc. (an Autodesk company)

- Roadware, Inc.

- Deighton Associates, Ltd. (dTIMS)

- mPower, Inc.

- Others

Recent Developments

- March 2025: Transportation agencies across North America reported accelerated adoption of bridge management software integrated with mobile inspection tools, driven by workforce shortages and the need to reduce manual inspection documentation time while maintaining regulatory compliance.

- July 2025: Industry updates indicate growing implementation of artificial intelligence-based image analysis within bridge management platforms, enabling automated crack detection and condition scoring as agencies seek higher consistency in inspection outcomes.

- September 2025: Public infrastructure programs emphasized tighter integration between bridge management software and structural health monitoring systems, reflecting increased reliance on sensor-generated data for continuous condition tracking and early risk identification.

Report Scope

Report Features Description Market Value (2024) USD 1.14 Billion Forecast Revenue (2034) USD 5.34 Billion CAGR(2025-2034) 16.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Application (Inspection & Condition Assessment, Maintenance & Repair Planning, Asset Inventory & Documentation, Performance & Risk Analysis, Others), By End-User (Government Transportation Agencies, Private Infrastructure Owners/Operators, Engineering & Consulting Firms, Others), By Bridge Type (Highway Bridges, Railway Bridges, Pedestrian & Cycling Bridges, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bentley Systems, Incorporated, Autodesk, Inc., Trimble, Inc., AECOM, WSP Global, Inc., SAP SE, Oracle Corporation, IBM Corporation, AssetIntel, LLC, AgileAssets, Inc., GISGRO Oy, Innovyze, Inc. (an Autodesk company), Roadware, Inc., Deighton Associates, Ltd. (dTIMS), mPower, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Bridge Management Software MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bridge Management Software MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bentley Systems, Incorporated

- Autodesk, Inc.

- Trimble, Inc.

- AECOM

- WSP Global, Inc.

- SAP SE

- Oracle Corporation

- IBM Corporation

- AssetIntel, LLC

- AgileAssets, Inc.

- GISGRO Oy

- Innovyze, Inc. (an Autodesk company)

- Roadware, Inc.

- Deighton Associates, Ltd. (dTIMS)

- mPower, Inc.

- Others