Global Breast Cancer Treatment Market By Therapy (Targeted Therapy (Trastuzumab, Ribociclib, Pertuzumab, Palbociclib, Olaparib, Everolimus, Ado-Trastuzumab Emtansine, Abemaciclib, and Others), Hormonal Therapy (Selective Estrogen Receptor Modulators (SERMs), Estrogen Receptor Down Regulators (ERDs), and Aromatase Inhibitors), Chemotherapy, and Immunotherapy), By Cancer Type (Hormone Receptor and HER2+), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 49084

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

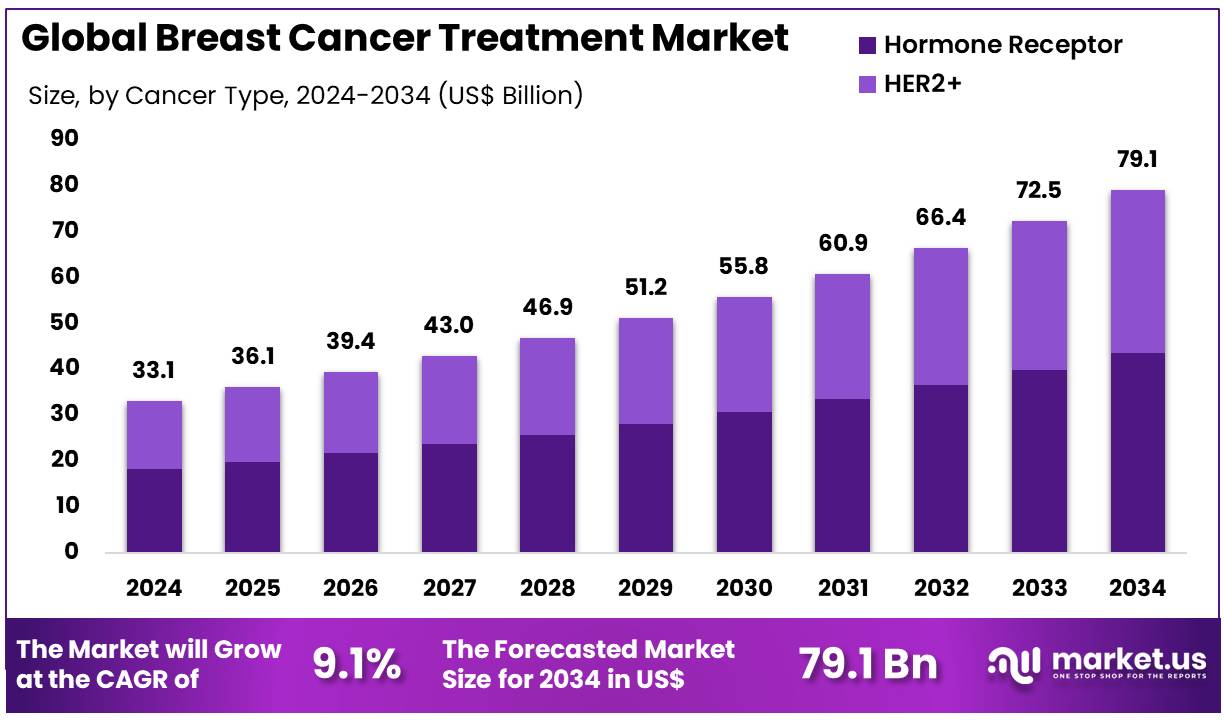

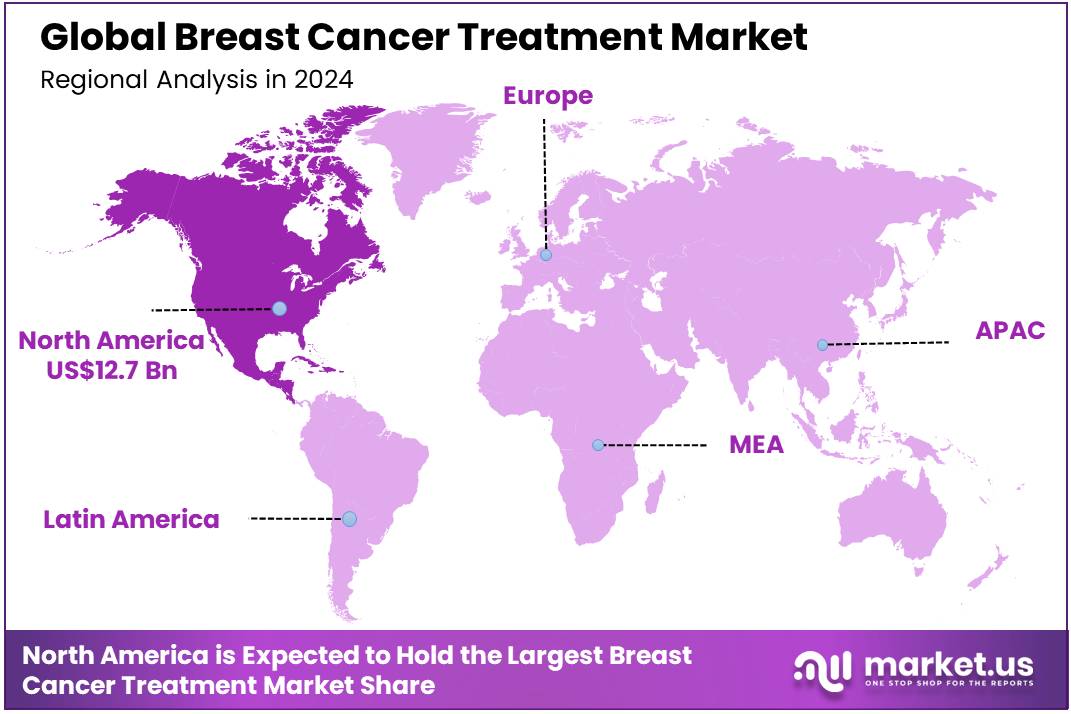

Global Breast Cancer Treatment Market size is expected to be worth around US$ 79.1 Billion by 2034 from US$ 33.1 Billion in 2024, growing at a CAGR of 9.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 12.7 Billion.

Increasing global awareness of breast cancer and the rising prevalence of the disease are driving the growth of the breast cancer treatment market. In 2022, the World Health Organization (WHO) reported approximately 20 million new cancer cases, with breast cancer accounting for 2.3 million new diagnoses, making it the second most common cancer worldwide. As one of the leading causes of cancer-related deaths, with 670,000 fatalities in 2022, breast cancer presents a significant burden on healthcare systems globally.

This has prompted ongoing advancements in treatment modalities, from traditional chemotherapy and radiation to more targeted therapies, including hormonal therapies, HER2-targeted therapies, and immunotherapy. The market benefits from innovations in personalized medicine, where genetic testing and molecular profiling guide the selection of the most effective treatment options, improving patient outcomes.

The growing trend of combination therapies, which pair traditional treatments with newer, more targeted approaches, enhances the overall efficacy of breast cancer treatment. Additionally, the rise of novel drugs and therapies, such as CDK4/6 inhibitors and immune checkpoint inhibitors, presents new opportunities in managing aggressive breast cancer subtypes like triple-negative breast cancer (TNBC).

In response to the increasing number of breast cancer cases and the demand for more effective and less invasive treatments, the market is also witnessing growth in precision medicine, offering tailored solutions based on genetic and molecular characteristics of the cancer.

With ongoing research and the development of new therapies, the breast cancer treatment market is poised for continued evolution, offering hope for improved survival rates and better quality of life for patients.

Key Takeaways

- In 2024, the market for breast cancer treatment generated a revenue of US$ 33.1 billion, with a CAGR of 9.1%, and is expected to reach US$ 79.1 billion by the year 2034.

- The therapy segment is divided into targeted therapy, hormonal therapy, chemotherapy, and immunotherapy, with targeted therapy taking the lead in 2024 with a market share of 39.5%.

- Considering cancer type, the market is divided into hormone receptor and HER2+. Among these, hormone receptor held a significant share of 55.0%.

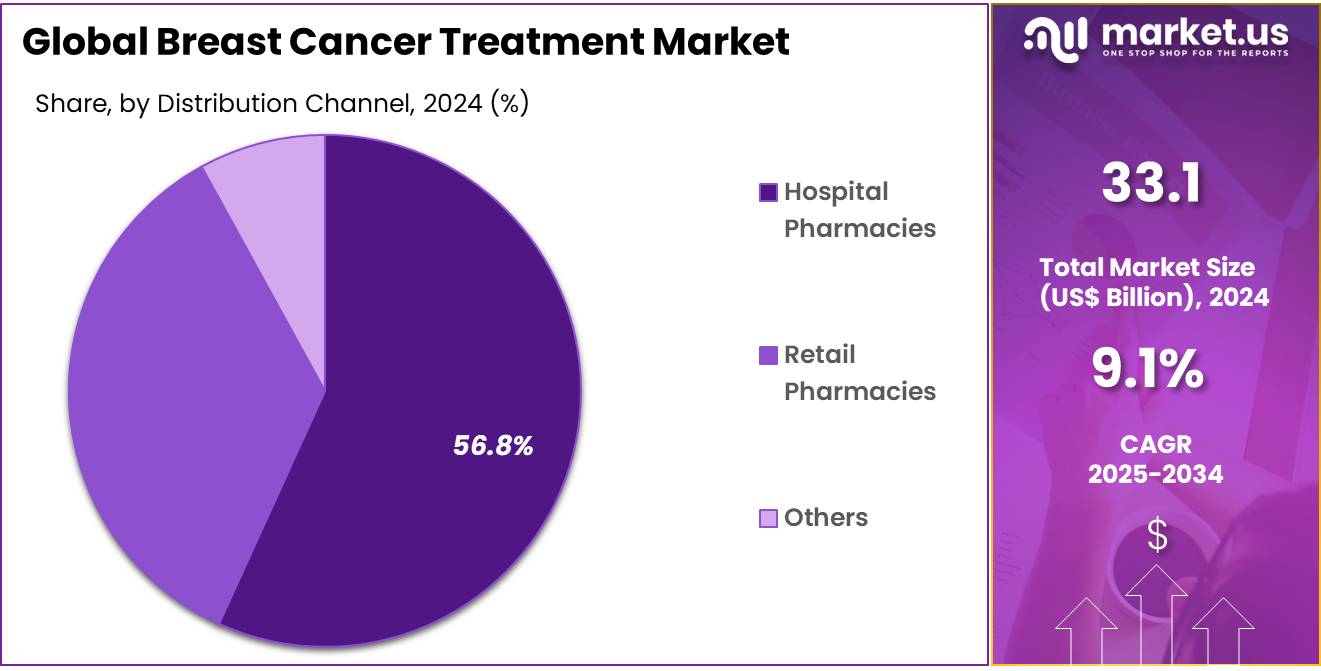

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 56.8% in the breast cancer treatment market.

- North America led the market by securing a market share of 38.4% in 2024.

Therapy Analysis

Targeted therapy is expected to dominate the breast cancer treatment market, comprising 39.5% of the market share. Targeted therapies work by targeting specific molecules involved in the growth and spread of cancer cells, minimizing damage to normal, healthy cells. The growing preference for targeted therapies in the treatment of breast cancer is driven by their ability to provide more personalized treatment with fewer side effects compared to traditional therapies like chemotherapy.

The increasing number of FDA-approved targeted therapies for breast cancer, especially for HER2+ and hormone receptor-positive subtypes, is expected to continue fueling market growth. As precision medicine advances, the ability to tailor treatments based on genetic and molecular profiling will drive the adoption of targeted therapies.

Additionally, the rising prevalence of breast cancer and the increasing demand for effective treatments are likely to further boost the growth of this segment. Research and development in novel targeted therapies, including those for triple-negative breast cancer, are expected to contribute to the continued expansion of this market segment.

Cancer Type Analysis

Hormone receptor-positive breast cancer is expected to remain the largest cancer type in the breast cancer treatment market, holding 55.0% of the share. This subtype of breast cancer, which is fueled by hormones such as estrogen and progesterone, is particularly treatable with hormonal therapies. The growth of this segment is anticipated to be driven by the widespread use of hormonal therapies such as tamoxifen and aromatase inhibitors, which block or lower the levels of hormones that promote tumor growth.

As the diagnosis rate for hormone receptor-positive breast cancer increases, more patients will benefit from these therapies, driving their demand. Additionally, as the focus on personalized medicine expands, more tailored treatments targeting hormone receptors will likely be developed, which will further fuel growth in this segment. The long-term nature of treatment for hormone receptor-positive breast cancer, combined with the increasing availability of newer, more effective hormonal therapies, will continue to drive the demand for treatments in this segment.

Distribution Channel Analysis

Hospital pharmacies are projected to remain the dominant distribution channel in the breast cancer treatment market, comprising 56.8% of the market share. Hospitals are key providers of cancer treatment, offering a wide range of services, including the administration of chemotherapy, targeted therapies, and immunotherapies. The increasing number of breast cancer patients requiring complex and personalized treatment regimens will likely drive the demand for hospital-based treatments.

Hospitals are also expected to play a major role in clinical trials and the adoption of novel treatments, particularly as new therapies are introduced into the market. The growing prevalence of breast cancer globally and the increasing emphasis on providing comprehensive care will further support the demand for hospital pharmacies.

As cancer care becomes more specialized, hospital pharmacies are expected to continue providing the infrastructure and expertise necessary to deliver cutting-edge treatments to patients. As a result, hospital pharmacies will maintain their position as the primary distribution channel in the breast cancer treatment market.

Key Market Segments

By Therapy

- Targeted Therapy

- Trastuzumab

- Ribociclib

- Pertuzumab

- Palbociclib

- Olaparib

- Everolimus

- Ado-Trastuzumab Emtansine

- Abemaciclib

- Others

- Hormonal Therapy

- Selective Estrogen Receptor Modulators (SERMs)

- Estrogen Receptor Down Regulators (ERDs)

- Aromatase Inhibitors

- Chemotherapy

- Immunotherapy

By Cancer Type

- Hormone Receptor

- HER2+

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Drivers

Increasing Global Incidence of Breast Cancer is Driving the Market

The rising global incidence of breast cancer is a fundamental driver for the breast cancer treatment market, directly fueling the demand for advanced therapies and diagnostics. As more individuals are diagnosed, there is a continuous and escalating need for a broad spectrum of treatment modalities, including surgery, radiation, chemotherapy, hormonal therapy, targeted therapy, and increasingly, immunotherapies.

Early detection and improved screening methods also contribute to the identification of more cases, necessitating comprehensive treatment plans. According to the International Agency for Research on Cancer (IARC) and the World Health Organization (WHO), breast cancer remains the most common cancer among women and was the second most common cancer type overall globally in 2022, with an estimated 2.31 million new cases worldwide.

The sheer volume of new diagnoses year-over-year places immense pressure on healthcare systems to develop and adopt more effective, less toxic, and personalized treatments, thereby sustaining the growth and innovation within this vital medical sector. This persistent and increasing disease burden ensures a strong and continuous demand for therapeutic solutions.

Restraints

High Cost of Novel Therapies and Treatment Regimens is Restraining the Market

A significant restraint on the breast cancer treatment market is the substantial and often escalating cost associated with novel, targeted, and highly personalized therapies. While these advanced treatments offer improved outcomes for many patients, their high price tags can create significant financial burdens for individuals, healthcare systems, and national economies. This “financial toxicity” can lead to patients delaying or forgoing necessary care, impacting overall treatment adherence and outcomes.

For instance, a longitudinal study conducted in China from November 2022 to March 2024 on financial toxicity in breast cancer patients found that 24% of participants experienced “Severe Financial Toxicity with Gradual Relief,” and 26% were in the “Moderate Financial Toxicity with Gradual Worsening” group.

While this specific study is from China, the issue of financial toxicity is globally recognized, as highlighted by a February 2025 systematic review which noted that 56.1% of cancer patients globally experience catastrophic health expenditures. The economic strain imposed by these therapies, combined with the often long duration of treatment, presents a formidable barrier to equitable access and widespread adoption, particularly in health systems with limited resources or high out-of-pocket patient costs.

Opportunities

Growing Focus on Precision Medicine and Biomarker-Driven Therapies Creates Growth Opportunities

The accelerating focus on precision medicine, which involves tailoring treatment strategies based on the specific genetic and molecular characteristics of a patient’s tumor, presents a significant growth opportunity in the breast cancer treatment market. Advances in genomic sequencing and biomarker discovery allow for the identification of specific mutations or protein expressions (e.g., HER2, HR, PIK3CA) that can be targeted by highly effective drugs, leading to more favorable patient outcomes and reduced side effects compared to broad-spectrum chemotherapy.

The U.S. Food and Drug Administration (FDA) has demonstrated strong support for this approach through its approvals. For example, in October 2024, the FDA approved inavolisib in combination with palbociclib and fulvestrant for endocrine-resistant, PIK3CA-mutated, HR-positive, HER2-negative advanced breast cancer, as reported by Onclive based on FDA announcements.

Similarly, the FDA accepted a biologics license application in February 2025 for HLX11, a pertuzumab biosimilar for HER2-positive breast cancer, further expanding options for targeted therapy. This continuous development and regulatory approval of targeted therapies and their companion diagnostics, driven by a deeper understanding of breast cancer biology, allows for increasingly personalized and effective treatment regimens, propelling market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the breast cancer treatment market, primarily through their direct impact on national healthcare budgets, public and private insurance coverage, and the purchasing power of healthcare providers and patients. During periods of global economic growth and stability, governments often allocate more funds to public health initiatives and research, potentially leading to broader coverage for advanced and expensive therapies, including innovative breast cancer treatments.

Conversely, economic downturns, periods of high inflation, or austerity measures can lead to tightened healthcare budgets, potentially delaying the adoption of new, costly treatments or placing greater out-of-pocket burdens on patients, which can hinder access to optimal care. The International Monetary Fund (IMF) indicated in its April 2025 “World Economic Outlook” that while global economic growth is stable, persistent geopolitical fragmentation and higher interest rates pose risks, which could indirectly impact healthcare spending and investment.

Geopolitical factors, such as international trade policies affecting the import and export of pharmaceutical ingredients and complex manufacturing equipment, and the stability of global supply chains for crucial drug components, also play a vital role. Political instability or trade disputes can disrupt supply chains, increase manufacturing costs for pharmaceutical companies, and create uncertainty for global distribution, impacting the timely availability and pricing of essential breast cancer medications.

However, the universally recognized urgency of effectively treating breast cancer, given its high incidence and significant health burden, ensures sustained political and financial commitment to research, development, and equitable access, allowing the market to navigate and overcome these challenges.

Current US tariff policies can indirectly impact the breast cancer treatment market by influencing the cost of imported active pharmaceutical ingredients (APIs), specialized manufacturing equipment, and other essential components required for drug production. The US relies significantly on global supply chains for its pharmaceutical needs. The U.S. Census Bureau’s “U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES, DECEMBER AND ANNUAL 2024” report (released in February 2025) indicated that US imports of pharmaceutical preparations in 2024 totaled US$ 247.2 billion, highlighting the substantial volume of imported drugs and their components.

Additionally, imports of optical, medical, and surgical instruments, which include devices used in treatment administration or diagnostics, amounted to US$124 billion in 2024. Any new tariffs imposed on these specific imported raw materials or finished pharmaceutical products could incrementally increase manufacturing costs for companies operating in or importing into the US. This might translate to higher drug prices for patients and healthcare systems or potentially constrain research and development budgets if companies absorb these increased costs, thereby affecting patient access to innovative therapies.

Conversely, these tariff policies can act as a powerful incentive for pharmaceutical and medical device manufacturers to invest in expanding or establishing domestic production capabilities for breast cancer treatments and their components within the US. This strategic shift towards localized manufacturing aims to create a more secure and resilient supply chain for essential therapies, reducing dependence on potentially volatile international sources and enhancing national medical security, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increasing Adoption of Antibody-Drug Conjugates (ADCs) is a Recent Trend

A prominent recent trend in the breast cancer treatment market is the increasing adoption and development of Antibody-Drug Conjugates (ADCs). ADCs are highly innovative targeted therapies that combine a monoclonal antibody (which specifically binds to a target on cancer cells) with a potent cytotoxic chemotherapy drug via a stable linker. This design allows for the precise delivery of chemotherapy directly to cancer cells, minimizing systemic toxicity and improving efficacy compared to conventional chemotherapy.

Several ADCs have recently gained significant traction and approval for various breast cancer subtypes. For instance, the FDA granted accelerated approval to fam-trastuzumab deruxtecan-nxki (Enhertu) in April 2024 for adult patients with unresectable or metastatic HER2-positive (IHC 3+) solid tumors, including breast cancer, who have received prior systemic therapy and have no satisfactory alternative treatment options. This particular approval highlights the broader applicability of ADCs.

Furthermore, the American Society of Clinical Oncology (ASCO) Annual Meeting in 2025 showcased numerous presentations on the expanding role of ADCs in breast cancer, including those targeting novel antigens, reinforcing their growing importance. This strategic approach to drug delivery is revolutionizing treatment paradigms by offering potent anti-cancer activity with a more favorable safety profile, driving intense research and clinical integration.

Regional Analysis

North America is leading the Breast Cancer Treatment Market

North America dominated the market with the highest revenue share of 38.4% owing to the persistent and high incidence of the disease, significant advancements in targeted therapies and immunotherapies, and well-established screening programs. In the United States, an estimated 316,950 women were diagnosed with invasive breast cancer in 2025, with an additional 59,080 new cases of non-invasive breast cancer, according to recent figures, highlighting the pervasive need for ongoing treatment innovations.

Canada also faces a substantial burden, with an estimated 30,500 women projected to be diagnosed with breast cancer in 2024, representing 25.4% of all new female cancer diagnoses (excluding non-melanotic skin cancers). The U.S. Food and Drug Administration (FDA) has actively approved novel therapies, including new indications for existing drugs.

For example, in September 2024, the FDA approved Novartis’s Kisqali (ribociclib) to reduce the risk of recurrence in HR-positive, HER2-negative early breast cancer. Similarly, in October 2024, the FDA approved inavolisib in combination with palbociclib and fulvestrant for endocrine-resistant, PIK3CA-mutated HR-positive, HER2-negative advanced breast cancer, offering new hope for patients.

Major pharmaceutical companies with strong breast cancer portfolios have reported impressive financial results reflecting this growth. Roche’s Pharmaceuticals Division, which includes several key breast cancer medicines like Phesgo and Kadcyla, reported an 8% sales increase in 2024, with newer medicines being top growth drivers. Pfizer’s IBRANCE, a CDK4/6 inhibitor widely used in breast cancer, recorded global revenues of US$4.5 billion in 2023. These factors collectively illustrate a dynamic and expanding treatment landscape across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing incidence of the disease across the region, improving healthcare access, rising awareness about early detection, and the growing adoption of advanced treatment modalities. In China, breast cancer is a significant concern, with its estimated incidence contributing to the country’s overall cancer burden, which saw approximately 3,246,625 new cancer cases in 2024.

The World Health Organization (WHO) reported nearly 1 million new breast cancer cases in Asia in 2022, underscoring the scale of the challenge. Governments in key Asian nations are increasingly investing in cancer control programs and infrastructure development to enhance patient outcomes. For instance, in Japan, public health initiatives continue to promote breast cancer screening, and while specific 2024 screening rates are pending, the government’s commitment to early detection remains strong.

India’s National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD), which includes breast cancer screening as part of its population-based screening for common non-communicable diseases, aims to improve early diagnosis and management at primary healthcare levels. Leading pharmaceutical companies are also focusing on increasing access to their innovative therapies across Asia Pacific.

Roche’s Pharmaceuticals Division reported a 19% sales growth in its “International” segment (which encompasses the Asia-Pacific region) in the first nine months of 2024, indicating robust demand for its advanced treatments, including those for breast cancer. This confluence of factors ensures a strong upward trajectory for breast cancer management in the Asian Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the breast cancer treatment market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting breast cancer treatment. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for breast cancer treatment solutions.

Roche Holding AG is a prominent player in the breast cancer treatment market. Headquartered in Basel, Switzerland, Roche specializes in developing and delivering innovative therapies for various types of cancer. The company’s oncology portfolio includes medications like Kadcyla, Perjeta, and Herceptin, which are specifically designed to treat HER2-positive breast cancer.

Roche emphasizes research and development to discover new treatment options and improve patient outcomes. Through strategic acquisitions and collaborations, Roche continues to expand its capabilities and maintain a leadership position in the oncology market. The company’s commitment to innovation and patient care drives its growth in the competitive breast cancer treatment landscape.

Top Key Players

- Pfizer Inc

- Novartis AG

- Merck KGaA

- Janssen Pharmaceuticals, Inc

- Gilead Sciences

- Celldex Therapeutics

- Celgene Corporation, Inc

- AstraZeneca

Recent Developments

- In February 2023, major pharmaceutical companies such as Novartis AG, Pfizer Inc., and Eli Lilly & Co. raised the list prices of 983 prescription drugs used for cancer, arthritis, and other conditions. The average price increase across these drugs was 5.6%, highlighting the ongoing trend of rising drug costs.

- In February 2023, Gilead Sciences announced that its drug Trodelvy received U.S. FDA approval for a third indication, providing an additional treatment option for patients with the most common form of breast cancer, expanding its therapeutic applications and offering hope for improved patient outcomes

Report Scope

Report Features Description Market Value (2024) US$ 33.1 Billion Forecast Revenue (2034) US$ 79.1 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy (Targeted Therapy (Trastuzumab, Ribociclib, Pertuzumab, Palbociclib, Olaparib, Everolimus, Ado-Trastuzumab Emtansine, Abemaciclib, and Others), Hormonal Therapy (Selective Estrogen Receptor Modulators (SERMs), Estrogen Receptor Down Regulators (ERDs), and Aromatase Inhibitors), Chemotherapy, and Immunotherapy), By Cancer Type (Hormone Receptor and HER2+), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc, Novartis AG, Merck KGaA, Janssen Pharmaceuticals, Inc , Gilead Sciences, Celldex Therapeutics, Celgene Corporation, Inc , AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Breast Cancer Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Breast Cancer Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc

- Novartis AG

- Merck KGaA

- Janssen Pharmaceuticals, Inc

- Gilead Sciences

- Celldex Therapeutics

- Celgene Corporation, Inc

- AstraZeneca